One of my friends asked me how MSCI World performed against the S&P 500 in the past.

He was deciding whether there is a solid reason to own a global large-cap and mid-cap index rather than a pure US index ETF.

MSCI only has the data for various developed worlds starting from 1970, so we can only compare the performance for the past 52.5 years.

We can compare the performance by taking the returns of the S&P 500 index minus the returns of the MSCI World index. If the returns are positive, the S&P 500 outperforms the MSCI World. If the returns are negative, the S&P 500 underperforms the MSCI World.

Since the US forms between 40% and more of the MSCI World at various past junctures, we can see how different the international developed stocks (does not include emerging markets) perform against the US.

How the S&P 500 did over one year versus the MSCI World if we roll month by month:

There are periods where the S&P 500 performs better than the MSCI World and also vice-versa.

Most of us tend to have a recency bias and would be quite influenced that MSCI World always did poorly compare to the S&P 500.

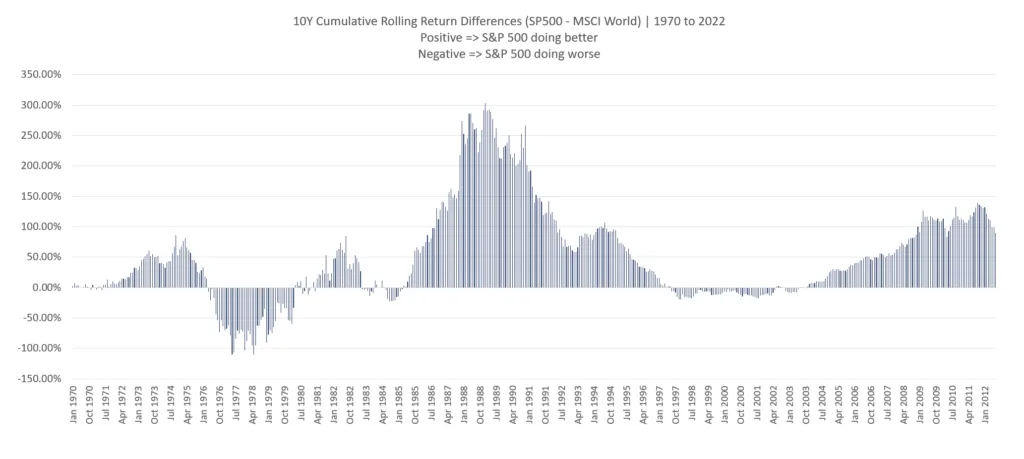

Now, let us take a look at the ten-year cumulative returns (as opposed to annualised returns) if we roll month by month:

The S&P 500 have some astounding ten-year outperformance.

Given this data, most people might conclude that they should just invest in the S&P 500.

But if I get the data right, the data show the periods where S&P 500 underperform for ten years. I wonder how many people can endure ten years of underperformance.

There are also periods where the MSCI World underperforms by ten years.

Whichever way, my firm conclusion is that most investors cannot endure ten years of underperforming unless they wise up and realise they can’t just evaluate based on this comparison.

You can purchase an ETF that tracks both the S&P 500 and MSCI World that is domiciled in Ireland through Interactive Brokers in a very low-cost manner. The preferred ticker for S&P 500 is the CSPX and the MSCI World is SWDA.

I do have a few other data-driven Index ETF articles. These are suitable if you are interested in constructing a low-cost, well-diversified, passive portfolio.

You can check them out here:

- IWDA vs VWRA – Are Significant Performance Differences Between the Two Low-Cost ETFs?

- The Beauty of High Yield Bond Funds – What the Data Tells Us

- Searching for Higher Yield in Emerging Market Bonds

- The performance of investing in stocks that can Grow their Dividends for 7/10 years

- Should We Add MSCI World Small-Cap ETF (WSML) to Our Passive Portfolio?

- Review of the LionGlobal Infinity Global – A MSCI World Unit Trust Available for CPF OA Investment

- 222 Years of 60/40 Portfolio Shows Us Balanced Portfolio Corrections are Pretty Mild

- Actively managed funds versus Passive Peers Over the Longer Run – Data

- International Stocks vs the USA before 2010 – Data

- S&P 500 Index vs MSCI World Index Performance Differences Over One and Ten Year Periods – Data

Here are some supplements to sharpen your edge on low-cost, passive ETF investing:

Those who wish to set up their portfolio to capture better returns believe that certain factors such as value, size, quality, momentum and low volatility would do well over time and are willing to harvest these factors through ETFs and funds over time, here are some articles to get you started on factor investing passively:

- Introduction to factor investing / Smart Beta investing.

- IFSW – The iShares MSCI World Multi-factor ETF

- IWMO – The iShares MSCI World Momentum ETF

- GGRA – The WisdomTree Global Quality Dividend Growth UCITS ETF

- Investing in companies with strong economic moats through MOAT and GOAT.

- Robeco’s research into 151 years of Low Volatility Factor – Market returns with lower volatility that did well in different market regimes

- JPGL vs IFSW vs Dimensional Global Core vs SWDA – 22 years of 5-year and 10-year Rolling Returns Performance Comparison

- 98 Years of Data Shows the US Small Cap Value Premium over S&P 500

- 42 Years of data shows that Europe Small Cap Value premium over MSCI Europe

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Craig Verdi

Saturday 16th of December 2023

"Who can endure 10 years of underperformance?" The real question is, how many people can endure 30-40 years of underperformance by international stocks? I would take (and did endure, along with my clients,) staying in US stocks if that was my only choice vs the MSCI.

Wholesalers, ads, and talking heads have sheep like bleatings of "we should all be in international funds for more diversification and possible returns." Vanguard says that you should have at least 20% in international. Morningstar says "We consider foreign large-blend funds to be core holdings that could make up as much as 40% to 80% of a portfolio's assets, although most ..."

I am writing an article on this and would like to know if you have some examples of a long term portfolio 30-40 years that clearly benefited with a 30% allocation to international stocks. I can't find one.

Why 40 years? Our average client is about 55. They should be weighted in stocks to gain on inflation forever and be living on the dividends and 1-3 percent on principle. And if they live to 95, that's the 40.

Kyith

Saturday 16th of December 2023

hi Craig, if we don't have data going back so long, it doesn't mean that international diversification doesn't work. taking the data before 2010, a portfolio of international stocks have the same average returns compare to the US. More so, my point of choosing to be globally diversified is to have the humility to admit that we don't know what is goign to happen in the future regarding which country will emerge stronger.

David

Tuesday 15th of August 2023

Hi Kyith

Is there any benefit in holding both SWDA & CSPX together - or do they essentially cancel one another out - as I realise that USA market is covered within SWDA……

Many thanks

Kyith

Saturday 19th of August 2023

Hi David, there is... if you reallly wish to overweight the US in your allocation but have some very little developed markets too (not sure why).

Paulo

Tuesday 20th of December 2022

Hello Kyith,

Great post mate! It has been a question in my head and you explored very well.

I have a tendency to decide to invest in USA + Emerging markets because I think it gives a better hedge against the potencial chances of American markets going lateral for 10 years.

I know that in 2000 - 2013 period the Emerging markets worked very well as a hedge against it but I don't know for past periods.

Have you thought about doing this comparison but using EIMI instead. It would be great!

For sure S&P500 will be one of the best investment on the long term that's why I want to stick to it plus using a kind of protection against lateral periods adding the Emerging markets but not lowering my expected returns adding developed countries that have not being growing for decades

Thanks

Paulo

Kyith

Monday 26th of December 2022

HI Paulo, thanks I will do that if I can. Should not be a problem.

Felicia

Saturday 30th of July 2022

Hi Kyith

Can you further elaborate on the significance of using one-year (roughly equal performance) vs ten-year returns (major overperformance by S&P 500) when comparing against MSCI World vs S&P 500?

By changing this comparison timeframe, the case seems to have swung in favor of S&P 500.

What is the takeaway for us as investors? Does it mean that over the long run it is still better for me to invest in S&P 500 assuming I have a long-term horizon (given the 10 year chart)? Or you mean to show that it doesn't matter between even if I chose MSCI World (given the one-year chart)?

Thanks!

Craig Verdi

Saturday 16th of December 2023

If you go back over the past decades, the further you go the fewer companies there were. Lately performance is worse, maybe, because of too many shaky companies in countries with shaky governments.

Felicia

Friday 5th of August 2022

@Kyith, much thanks for sharing your perspective and shedding more light on how to go about "interpreting" the graphs.

Personally I lean towards investing towards investing globally as well hence the recent outperformance of S&P 500 shown made me do a double-take.

PS: Love your reference on the source nation of vibranium :)

Kyith

Wednesday 3rd of August 2022

Hi Felicia, we look at different time frame to gain different perspectives about how the market performs. A longer timeframe gives us an idea how the index did over a timeframe that is more important to many of us. Time is something that we cannot go back and change our investment decision. Each bar in the longer timeframe is ten years. Now you got to ask yourself if you investing S&P 500, there are so many chances after ten years you would do worse than Europe and Japan, what is the likelihood you will stick with the index. The data basically tell us that relative underperformance is to be expected, whether you invest in S&P 500 or expand into MSCI World. The more important thing is whether psychologically you can live through underperformance and stick with the investments.

My preference has always been to invest globally because while there are underperformance against S&P 500 like recently, it doesn't mean i earn poor returns. But if there is a country like China or Wakanda that became rather significant in contribution, then I want exposure to it. MSCI World is acceptance to have more humility that we do not know what is going to happen and try to hedge our bets better.