After you have funded your Interactive Brokers account with money, then it is time to start trading.

But first, you may have to convert your money in your Interactive Brokers account into another currency.

The purpose you have a trading account is to buy securities and majority of the securities that you are interested in tends to be overseas in

- United States

- United Kingdom

- Australia

- Hong Kong

- A lot of other countries

The currencies that the securities trade in tends to be USD, Euro, HKD, AUD.

Without the currencies the security trades in you cannot buy. If you do not have the money in that currency and you have a margin account, Interactive Brokers will by default take it that you wish to borrow on margin to purchase the securities.

So in this article, we discussed all things about FX conversion

IBKR Allows You to Convert Currencies at Near Spot Rates

The spot rate is the price quoted for immediate settlement on a currency.

If you have experience with currency conversion with your local banks, or brokerages, or money changer, you will realize that there is a difference in rates that you were quoted and the rates that you see on certain website.

My experience with local brokerages is that the conversion between SGD and USD or HKD for example is about 0.50% or 50 basis points.

My most frequent broker is Standard Chartered Online Trading and in my post here, we see that they have improved the spread between their rates and another website from 0.80% to 0.30-0.40%.

These are cost to you and if you are investing passively in a portfolio of low cost, diversified ETFs in UK or USA, cost matters.

With IBKR, the usual currency spread I get is soooo low that it is almost like there isn’t a currency spread (as small as 0.1 PIP).

However, there is a small commission charge on the conversion. Usually, it comes up to SGD$2.80.

The above line item is one of my currency conversion. I been a bit trigger happy by converting a small amount, but since the conversion is almost at spot rates and factoring the SG$2.80, the commission cost is 0.09%, which is much lower.

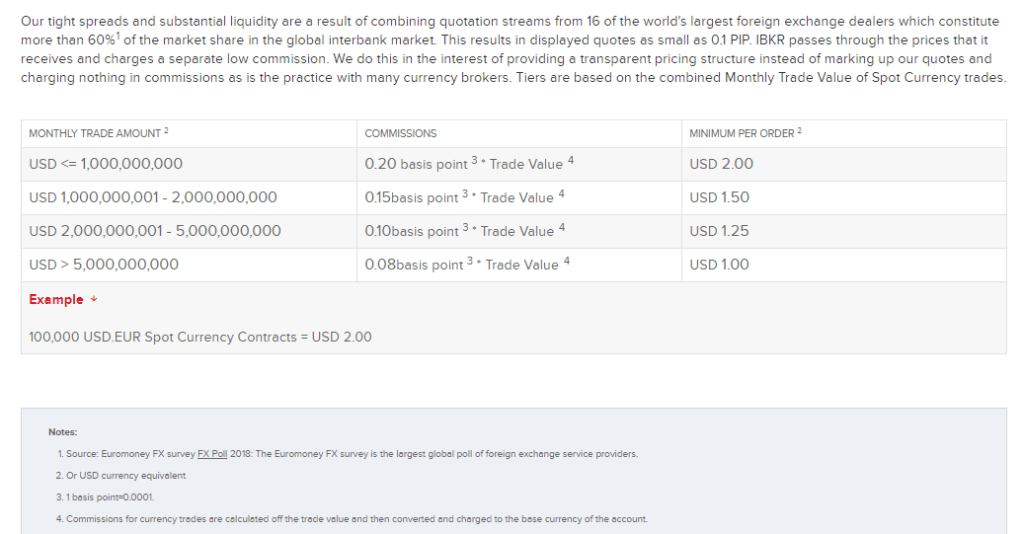

The table above shows how the commmission rates are structured. Think for most of us, it will fall under the first band.

Setting Your Base Currency

I mentioned in the first article on setting up your IBKR account that you can change your base currency rates later.

Your base currency

- Determines the currency of translation for your statements and the currency used for the determination of margin requirements.

- In addition, charges related to market data and research, inactivity fees, and commission on Forex trades are also charged in your base currency.

I have set mine to Singapore dollars. You may set yours to USD.

Setting your base currency does not affect how you transfer money into Interactive Brokers.

If you set your currency like USD, you can still transfer SGD into IBKR.

If you transfer SGD from your bank account, it will just go into the SGD Cash Balances. If you transfer EUR it will go to your EUR Cash Balances.

If you sell your securities in EUR at a loss, it will still be deposited in your EUR Cash Balances.

Majority of what Base Currency is for… is for reporting and updating purpose.

You can change your base currency under Settings > Account Settings > Base Currency. Base currency changes will not take effect until the next trading day.

In the IB mobile application, it is very convenient to toggle your view from base currency, to the currencies the securities are traded in.

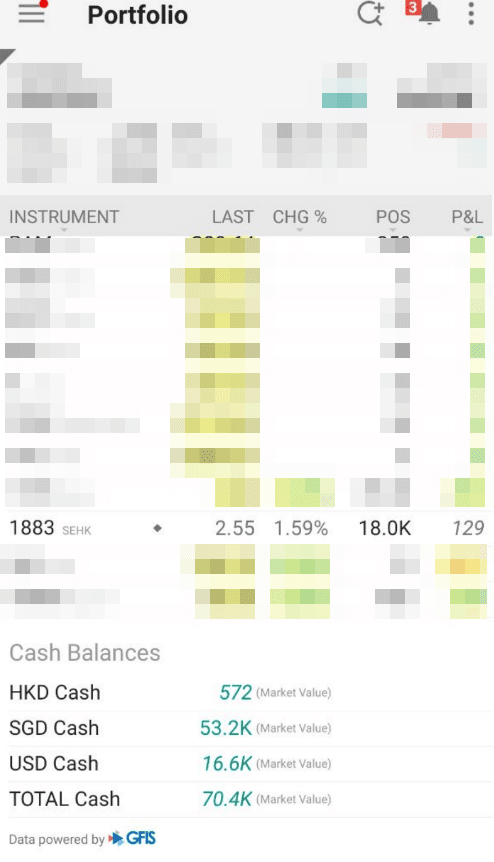

For example, the above view is in base currency. So that is SG$572 in HKD cash balances. For 1883 (Citic Telecom), the P&L of $129 is in SGD.

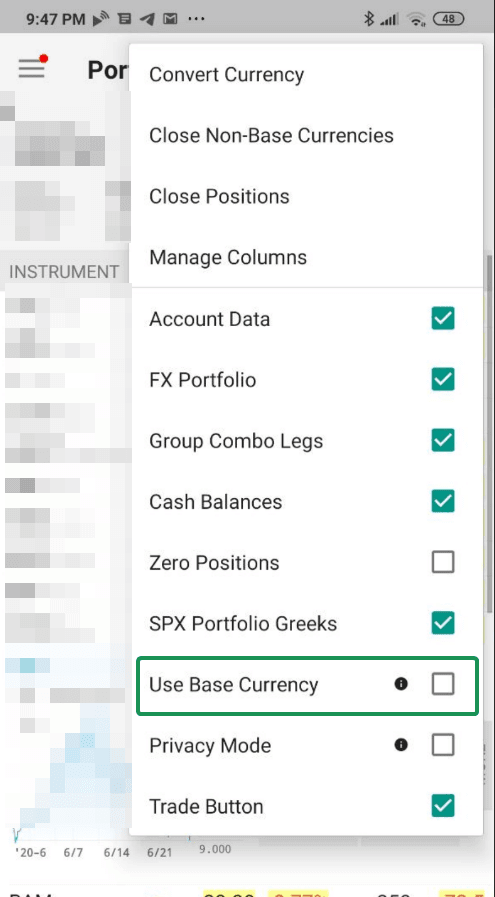

At the top right corner of your app, bring out this menu and you can toggle Use Base Currency, to switch around.

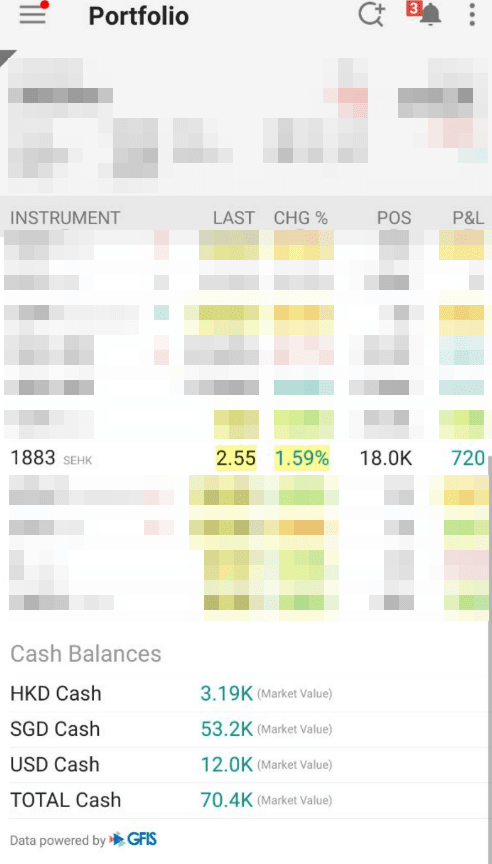

In HKD, the cash balances is shown as HK$3190 instead of SG$572. The P&L is shown as HK$720.

Base currencies in the app is identified as italic numbers instead of normal numbers.

Converting From One Currency to Another

Currency conversion in Interactive Brokers used to be more complex.

And that option is still around.

Suppose I wish to buy a Hong Kong stock, so I need to convert my SGD to HKD.

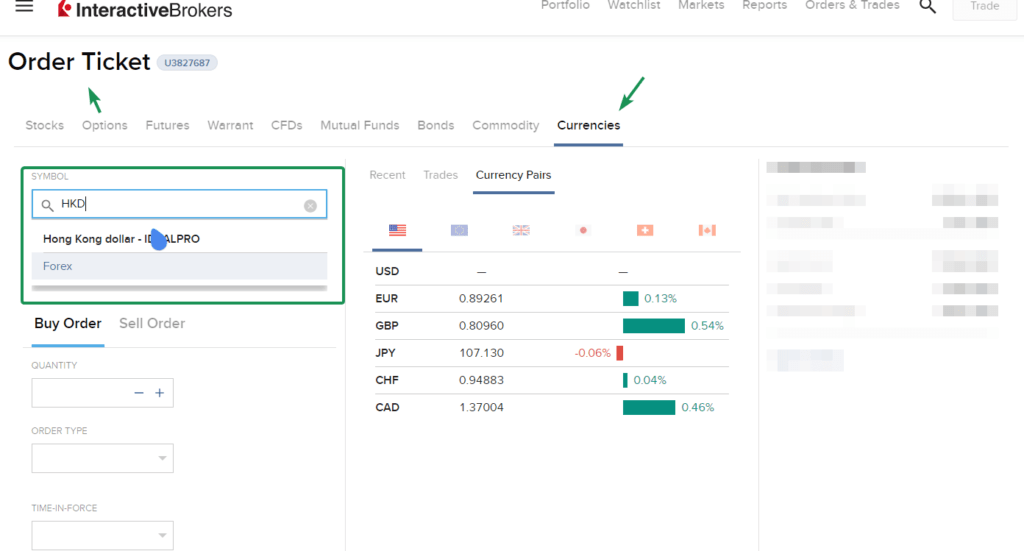

On my IB web app, I will go to Order Ticket > then go to Currencies tab.

If I type in SGD, IB will auto search and find the forex pairs involving SGD (the screenshot above is wrong, I was searching for “HKD” instead. think of that as me typing “SGD”)

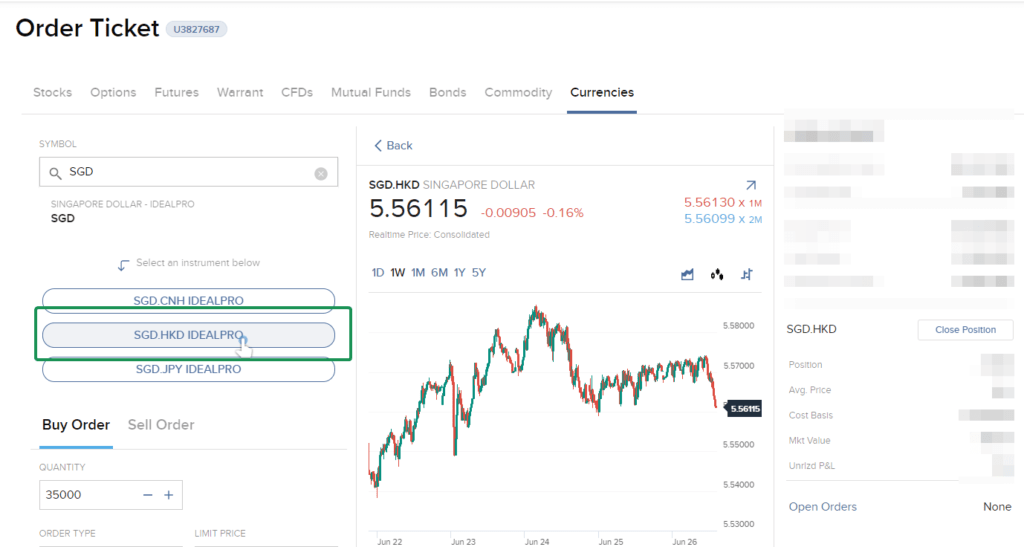

You will find the SGD/HKD currency pair that you wish to buy or sell (depending on whether you are converting from SGD to HKD or the other way round)

Now, then you get to the tough part.

You need to know how to read a currency pair.

The illustration above may help you understand how to read a currency pair. Going by the above a SGD/HKD pair means Singapore dollar is the base currency and quoted in Hong Kong dollar.

- If I buy or bid for a SGD/HKD, it means I am converting from HKD to SGD (buying SGD through selling HKD)

- If I sell or ask for a SGD/HKD, it means I am converting from SGD to HKD (selling SGD to get HKD)

So if I need SGD I will sell the equivalent of SGD 5,000 to get HKD.

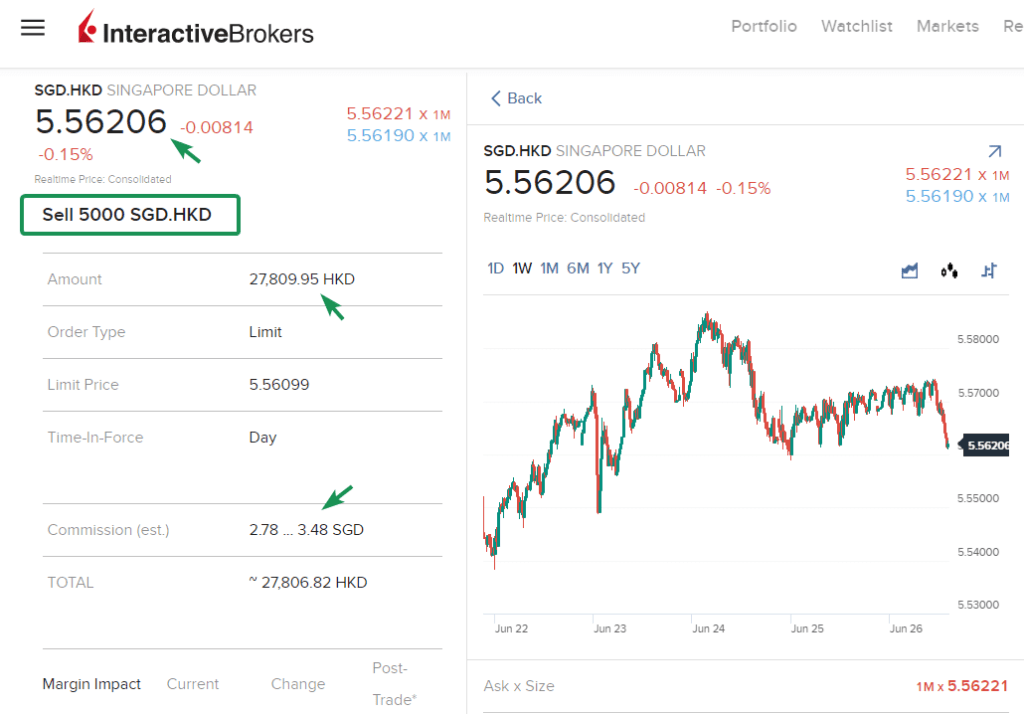

I key in that I will sell 5000 SGD.HKD. In the order preview above, based on a prevailing rate of $5.56206, I will get HK$27,809. The commission for the transaction is between SG$2.78 to SG$3.48.

If you are ok with this, once you submit the trade, the broker will put your order in queue. If a buyer comes along, he or she will buy your SGD.HKD and will pay you in HKD.

Then the HKD will go into your IB HKD Cash balances.

An Easier Way to Convert Currency

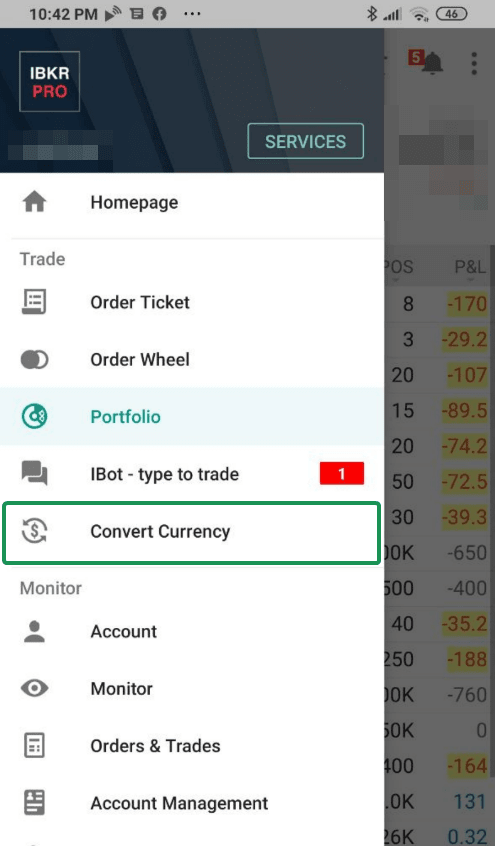

If the above currency conversion sounds cheem to you, then here is the simple way.

Go to your Interactive Brokers mobile app.

Click the Convert Currency.

You will be presented with a rather clean interface. You can start off with putting in how much of the currency you have or the currency you want.

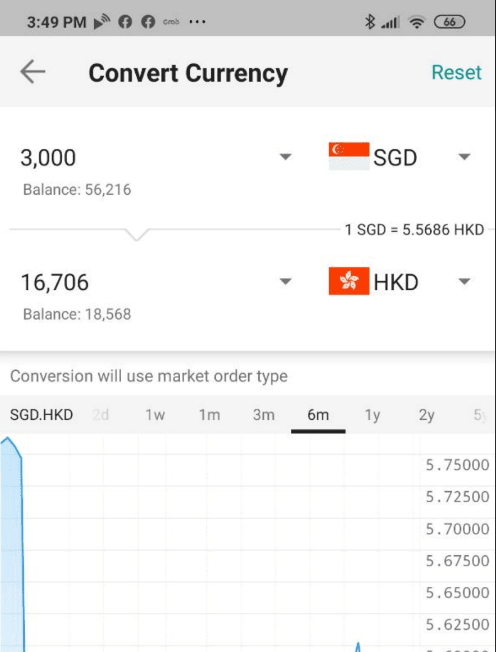

In this example, I specified that I wish to convert $3,000 SGD into HKD.

Once I confirm this conversion, this order will be sent to the exchange (which is the same as the previous example.)

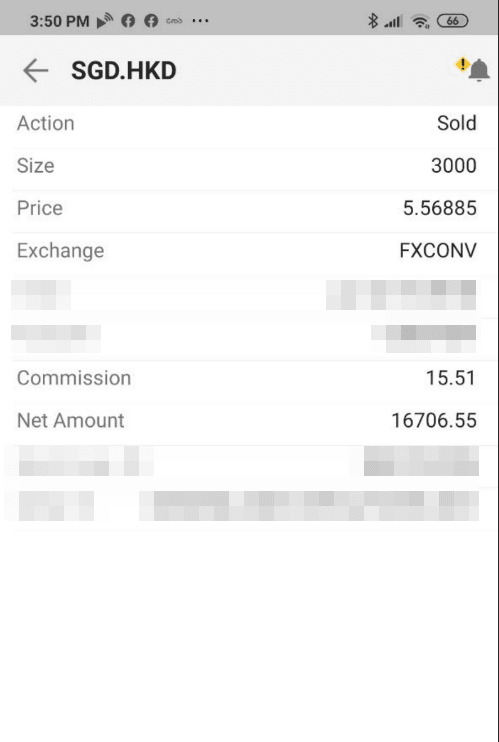

When your trade is confirmed, you can go to Order & Trades > Trades, and if you click on the SGD.HKD trade, you can see the details above.

You can see the commission charged as well (which is in HKD)

Go to Portfolio and you should see your money converted under Cash Balances.

Now you will be wondering why Kyith didn’t showed this in the first place. I want you to feel the pain of what some of the early adopters felt to understand the improvement the team made.

Now that you have the right currency, maybe it is time to talk about making your trade.

My Comprehensive Interactive Brokers How-to Guides

Interactive Brokers is a great low-cost, financially strong brokerage platform that can be the standard broker for holding your long-term investments. You can access 150 global exchanges, including exchanges such as Singapore, the US, Hong Kong, London, European and Canada.

You will enjoy cheap commissions and zero minimum recurring platform fees or maintenance fees. Convert your funds to different currencies at near-spot rates, paying a flat US$2 fee.

To get started or become familiar with Interactive Brokers, check out my past articles on how to invest with Interactive Brokers. I hope the guides make your life and investing experience easier and brighter.

An Easy Step-By-Step Guide to Setup Interactive Brokers (IBKR)

How to Fund & Withdraw Funds from Your Interactive Brokers Account

How to Convert Currencies in Interactive Brokers

How to Buy and Sell Stocks and Securities on Interactive Brokers

How Competitive are Interactive Brokers Commissions Pricing?

How Safe is it to Custodized Your Money at Interactive Brokers? The things they do better than other brokers.

How Safe is it to Custodized Your Money at Interactive Brokers (2)? Financial strength of IB during recent banking crisis and during Great Financial Crisis

Interactive Brokers have Eliminated the US$10 monthly inactivity fee. More details here.

How to Transfer your shares from Standard Chartered Online Trading to Interactive Brokers

How to trade after-hours and premarket

Create Customized Reports and automatically send them to your email

What is the PortfolioAnalyst Report and Automatically Send the PortfolioAnalyst Report to Your Email

Send Money from TransferWise to Interactive Brokers

Interactive Brokers’ Fluid Interest Income on Cash

Introducing IMPACT by Interactive Brokers

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Soon Hui

Thursday 25th of November 2021

Hi Kyith

I am currently on Margin and my base currency is SGD. So all along if I buy stocks on Hong Kong market, there will be a negative HKD on my balance. So after the purchase then I will use the convert currency on my HKD balance to SGD (SGD margin rate being better than HKD on IBKR). Previously this is all ok even if I already have a negative SGD balance. But past few weeks, I see that this option is no longer valid unless I have a positive SGD balance for the conversion (from HKD to SGD).

On the other hand, I do not want to have the FOREX (SGD.HKD) in my position to balance my negative HKD balance thus seeking your advice if there is any way I can use back the old method as I feel it is more cleaner and clear cut.

Thank you.

Kyith

Friday 26th of November 2021

Hi Soon Hui, I do not have a good answer to the first part of the question. By right with margin you will run into less problems. There are two systems for handling forex on IB. One is IdealPro and the other is FXConv. IdealPro is the one that creates those forex pairs you see FXConv do not. If i am right the only way to trigger FXconv is through their Trade Station platform.

Valerie

Thursday 11th of November 2021

I would like to ask, somehow I only get a limited number of currencies I can convert to, I can't find CAD on the list for example. Do I need to convert SGD to USD to CAD? Or is there something I have to configure in my settings? Thanks so much!

Kyith

Friday 12th of November 2021

Hi Valerie! This is strange. It should not be a problem. Here is what I see on my Android phone: I don't think you need to set something but perhaps in the available products, choose that you want to trade currency and see if it helps.

Jay

Thursday 19th of August 2021

Hi Kyith, I've got an error message when converting currency about $500 "SGD to USD" in Interactive Brokers. "We are unable to submit this cash quantity order with currently available market data". I can't seems to find a solution. Thanks

Kyith

Tuesday 24th of August 2021

Hi Jay, I suppose you are using a cash account. Did you leave like 2-3 dollars for the currency conversion cost?

Low

Monday 24th of May 2021

Hi I bought US option and I forget to convert my S$ to US$. As my account is margin, I understand it will use my margin account. I quickly converted my S$ to US$ after 2 days. Will my option cost be deducted from my available funds? Or it will still be utilising my margin? Thanks.

Kyith

Tuesday 25th of May 2021

Hi Low, as long as you convert your SGD to USD after that it should be ok

ML

Saturday 2nd of January 2021

Hi Kyith, if we don't have enough currency for the stock that we want to trade in, is it a good idea to borrow on margin first? Then, after the trade value is known, then I convert the currency. That way, I don't end up with an excess / deficit foreign currencies. Is there any minimum interest on margin borrowing?

Kyith

Saturday 2nd of January 2021

Hi ML, I think having a little currency is ok la. I did it both ways before. Most of the time, I can calculate how much i need and just convert the needed amount.