A question on many investors mind is that we always say that we invest because we want to make our money work harder. Working harder here is to make use of the power of compounding over time.

However, how do we relate this to dividend income investing? What are the things we need to watch out for? Today we will fit this into our action plan to compound dividends.

Power of compounding

Power of compounding over time in layman terms is to earn on an investment, put that earnings back into the investment or another investment to earn more and continue to do that.

If you invest $1000 in Singapore Press Holdings (SPH) and you invest in SPH knowing it will earn you $60 for a 6% yield per year.

If you take the $60 out of your portfolio to buy some other things you want, in 20 years you will earn:

$60 x 20 = $1200

Compare this to if you take all these dividend cash earned from SPH back into SPH, your returns will be $2399.56 (computations below)

| End of Year | Accumulated Value | Returns | Return difference from principal |

| 0 | $1000.00 | $1000.00 x 1.06 = $1060.00 | $60 |

| 1 | $1060.00 | $1060.00 x 1.06 = $1123.60 | $123.60 |

| 2 | $1123.60 | $1123.60 x 1.06 = $1191.06 | $191.06 |

| 3 | $1191.06 | $1191.06 x 1.06 = $1262.48 | $262.48 |

| 4 | $1262.48 | $1262.48 x 1.06 = $1338.23 | $338.23 |

| 5 | $1338.23 | $1338.23 x 1.06 = $1418.52 | $418.52 |

| 6 | $1418.52 | $1418.52 x 1.06 = $1503.63 | $503.63 |

| 7 | $1503.63 | $1503.63 x 1.06 = $1593.85 | $593.85 |

| 8 | $1593.85 | $1593.85 x 1.06 = $1689.48 | $689.48 |

| 9 | $1689.48 | $1689.48 x 1.06 = $1790.85 | $790.85 |

| 10 | $1790.85 | $1790.85 x 1.06 = $1898.30 | $898.30 |

| 11 | $1898.30 | $1898.30 x 1.06 = $2012.20 | $1012.20 |

| 12 | $2012.20 | $2012.20 x 1.06 = $2132.93 | $1132.93 |

| 13 | $2132.93 | $2132.93 x 1.06 = $2260.90 | $1260.90 |

| 14 | $2260.90 | $2260.90 x 1.06 = $2396.58 | $1396.58 |

| 15 | $2396.58 | $2396.58 x 1.06 = $2540.35 | $1540.35 |

| 16 | $2540.35 | $2540.35 x 1.06 = $2692.77 | $1692.77 |

| 17 | $2692.77 | $2692.77 x 1.06 = $2854.34 | $1854.34 |

| 18 | $2854.34 | $2854.34 x 1.06 = $3025.60 | $2025.60 |

| 19 | $3025.60 | $3025.60 x 1.06 = $3207.13 | $2207.13 |

| 20 | $3207.13 | $3207.13 x 1.06 = $3399.56 | $2399.56 |

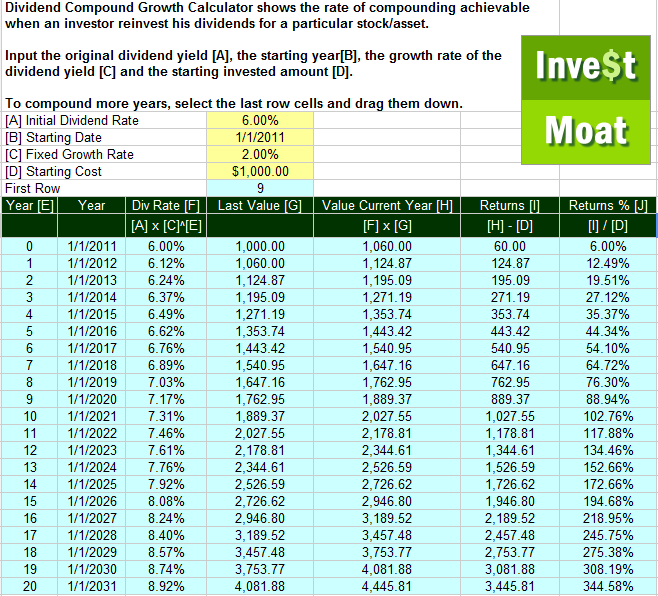

However, it is even more crazy if you can consider that the 6% dividend grows at a conservative 2% per year. Instead of returning $2399 the return now is $3445 from the original capital. Your original yield on cost increases from 6% to 8.92%.

The lesson here: To make more money do not take your money out of your portfolio. Re-invest in it.

The important aspects of compounding in dividend income stock

Based on the compounding example above it is easy to see where are the flaws of this when we realistically talk about compounding of a dividend stock like SPH

Growth rate is important. Stock’s dividend yield do not grow consistently at 6%. Some bad years it may be 2%, some years it will give special dividend, thus your yield will be 12%.

Do not underestimate the importance of special dividends. This article shows you that special dividends, bonus shares and spin offs can determine a lot of the astronomical returns.

In some years they do not pay at all. In some years you may even lose money if the growth rate is negative!

Failure for stock to maintain or grow their dividend payout at the required growth rate could ultimately make this stock less appealing then another stock on the market.

Dividends are pay out of profits and cash flow. Many look at dividends at the be all end all but to pay out a sustainable dividends, the stock needs to be not just profitable but earning enough to pay for it.

At Investment Moats, we define a sustainable dividend payout either as a dividend payout less than free cash flow or net profit. [Explaining free cash flow and net profit >>]

A sustainable and growing free cash flow and net profit is important to the sustainability of a 6% dividend yield.

Choosing the right dividend stock is important. Many a time we buy a stock for its dividend only that it turns out to be a dud

- Unable to continue paying 6%. Some companies business model gets eroded by competition, substitutes that what used to enable them to be lucrative just ain’t that good anymore

- Take on more debts to pay dividends, which will eventually proof to be unsustainable. (Think Willas Array)

- Cook their books by using dividends to entice investors only the cash to pay dividends is not there at all (Think fraudulent S-Chips)

It is important to evaluate the business of a dividend stock to see whether it can continue to pay the dividends that you require. To guard against fraudulent risks or imperfect knowledge holding a portfolio of dividend stocks is important rather than concentrate on 1 or 2 stocks.

Your Action Plan to Compounding Dividends

Taking into considerations the important aspects mentioned, how should you go about compounding through dividend investing?

To put it simply, put the following widgets into your action plan:

- Identify a list of reliable dividend paying stocks. Know their economic moat, strength and weakness, their risks and their profit and cash flow sustainability and growth capability.

- From this list, evaluate which of them are beaten down or presents a good value proposition.

- Invest a comfortable amount of your “Investment Warchest” into them.

- Collect your dividends, capital returns and together with your additional savings set aside for investments, put it into an “Investment Warchest”.

- Periodically review Step 1 and 2 and invest your “Investment Warchest” or prune your existing holdings.

1. Identify a list of reliable dividend paying stocks

To reinforce and to guard against what was outlined in the importance aspects of compounding in dividend income stock, always treat it as an exercise to understand the companies you currently invest in, do want to invest in, or do not want to invest in.

Understand their

- Economic moat. What makes this business a better business then the rest. What is the edge of this business model.

- Strength and Weakness. How it measures up versus its competition or why this business is not good to invest in.

- Sustainability of profit and cash flow. Is the cash flow growing? Can it sustain the dividend payout? Is this huge cash flow a one time event? Is this loss a one time event?

- Risks to operability and going concern. Can this company pay off its debts? Is it holding too much debts? Does the company have a law-suit or major impairment that would impede profitability currently or in the long term. Can it get its loans refinance?

2. Evaluate the value proposition

Its important to know how the business or how the stock generates the dividends. However, it doesn’t mean a good company is a good investment.

Total access communication which I identified in June this year was paying a dividend yield of 9% in March 2011. Buying the stock then would be a great proposition.

Since I identified it late and was waiting for it to come down it has ran up almost 50%. The current yield now is only 5%.

9% versus the average REITs listed on my Dividend Stock Tracker is great, but 5%? I think we can spot many better stocks with higher yields.

Of course dividend yield versus the prevailing market dividend yield is only 1 metric. It is a long topic which we will discuss more in the future and this goes hand in hand with Step 1, which is very important for this step.

Ultimately we hope to uncover fifty-cent dollar. This means that you get to buy 1 dollar for only fifty-cent.

3. Invest a comfortable amount of your “Investment Warchest”

I like to term my cash holdings set aside for investing as my “Investment Warchest”. To guard against things you cannot control, it is advisable to not concentrate your initial buying all at once and in only 1 or 2 stocks.

While step 1 and 2 when done right can weed out the duds, ultimately there are certain businesses that cook their books so well that even the pro analyst who are in constant contact with management cannot see it.

In some other cases, they are not fruadulent, their models are just breaking down. When you review it, your portfolio is already down a lot. Diversification ensures that it is not a sizeable chunk.

The key here is also not to over-diversify, such that it takes too much effort to monitor them. You are not a full time investor with the time to do that. I suggest not more than 20 stocks. Use Step 5 to prune when you have to.

4. Collect dividends, savings and add to “Investment Warchest”

The problem with starting small is that your dividends might not allow you to re-invest readily. Imagine your dividends from SPH being only $120. What can you buy with that?

The key is to pool your dividends together. That way you can invest in a stock that enables you to put your money back to work.

Now, most likely as part of a sound financial plan you will pay yourself first and set aside money for wealth accumulation and preservation. Collect them in this “Investment Warchest” as well.

5. Review Step 1 and 2. Continue to invest and prune your portfolio

Step 5 is the recurring step. It is also the one that demands you to be discipline and industrious. You are not going to collect dividends only for 1 month but through out the year and for many years.

Every month you will add savings to your “Investment Warchest”, you will need to put it to work as well.

To re-invest that, and the rest of the cash in your “Investment Warchest”, you will have to consistently take a look at prospective stocks and the stocks you own.

- Most of your holdings may hum along nicely.

- Some of them may have grown well.

- Some of them may be in trouble for a while or for a foreseeable future.

- There may be great stocks that suddenly appear to be at great prices

The important thing is to weed out those that are in (3). If they have fallen but you know their business is strong and it’s a short term problem, your next investment prospect could be this.

Those in (1) may still look very valuable even if they had grown with the general market. Some checkmarks here is compare to other stocks on your prospective list, they appear to be of higher value then the others.

In contrast, there could be those bargain dividend stocks in recession or sharp corrections that you want to buy but they were at $1. Now you get to buy them at $0.80 or $0.50.

The key is to develop investing, valuation and portfolio management as a lifelong hobby.

Conclusion

I hope that I have highlight to you folks how compounding in dividend investing comes into play. There are some caveats to it compare to what we normally know like bank interest rate and bond interest rate. This happens because stocks do fall or rise in value. Compounding is not so visible.

As such the key is for cash flow of the stocks to grow and re-investment. I hope that through my five step plan it makes it simple for you guys.

Do let me know if you have any questions.

I run a free Singapore Dividend Stock Tracker . It contains Singapore’s top dividend stocks both blue chip and high yield stock that are great for high yield investing. Do follow my Dividend Stock Tracker which is updated nightly here.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Kh

Friday 6th of December 2019

Hi Kyith, I came across your blog while reading up on passive investing, and enjoy your articles. I went for a free talk recently that advocated REITS strategy with some gentle leverage - you probably already know which course I am alluding to, haha. I have read some of your articles on REITS investing and was tempted to sign up for the course but am hesitant due to the course fees. Given your many years of experience, I would like to tap your views and wisdom on whether it is worth paying for this course, given the type of strategy it is advocating (the high returns come with the use of leveraging, which can be risky for the novices). Thank you.

Kyith

Friday 6th of December 2019

Hi Kh, I cannot speak for my friend Chris. Nor can I am in the position to advocate the course. Here is what I wrote about the subject: https://investmentmoats.com/money/leverage-your-portfolio/

Sometimes if the course is too expensive, maybe you are not ready for it yet. Not a lot of things end up being the holy grail that we searched for. Try to do it small and see whether you can do it. I would only say his sample size is damn small.

Simon Lang

Saturday 8th of June 2019

Hi I was trying to collate a list of Singapore listed Companies offering Dividend Re-investment plsns. Has anyone msnsged to identify them?

Ace

Tuesday 8th of September 2015

Sorry for commenting on an old post. But I wish to better understand the pros/cons in dividend investing over investing in ETFS. From what I know, ETFS give out or reinvest dividends.

Kyith

Saturday 19th of September 2015

Hi Ace,

usually ETFs have a theme to them, whether they invest in a particular country index, or a segment of a country industry. Because it is a basket of stocks, there is diversification of risk over buying a portfolio of dividend stocks.

when you invest in ETF it is more of getting the asset allocation right, and then rebalance along the way. when you do investing with a portfolio of dividend stocks, it is essentially active investing, which entails watching the development of the businesses that you have purchase.

thus ETF investing is a little bit more hands off versus dividend investing. this might suit certain people's lifestyle.

Kyith

Sean

Wednesday 12th of December 2012

Insight analysis. Wil follow this from now

Drizzt

Thursday 13th of December 2012

thanks sean, hope you can read some of the other resources.

peter

Sunday 28th of October 2012

Very useful and informative. Thanks for all this. God blessed.

peter