Once you have setup your Interactive Brokers account through an entirely online sequence, you need to fund your account to start trading.

You can fund your Interactive Brokers account from banks and financial institutions from all over the globe. The transfer is free and you are entitled to one free withdrawal per calendar month.

I will show you how to

- Deposit money to fund your Interactive Brokers account in SGD

- Withdraw money from your Interactive Brokers account to your Bank account

- Deposit money to fund your Interactive Brokers account in USD via online remittance

- Some other possible cool ways to fund, withdraw money that I came across

- Some other fun things you could do with the account

How to Setup Transfer Instructions in Interactive Brokers

Login to your Interactive Brokers account on your desktop (I have always transferred on my desktop.

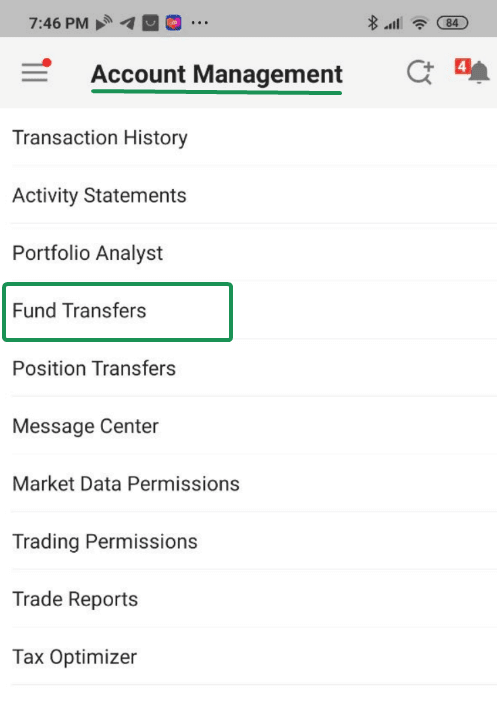

You can also initial this fund transfer through the mobile app. Go to Account Management then Fund Transfers. However, you can only deposit funds and not withdraw funds on the mobile app.

Let us continue on the desktop app.

Go to the top left corner to bring out the menu. Under Transfer & Pay, select Transfer Funds.

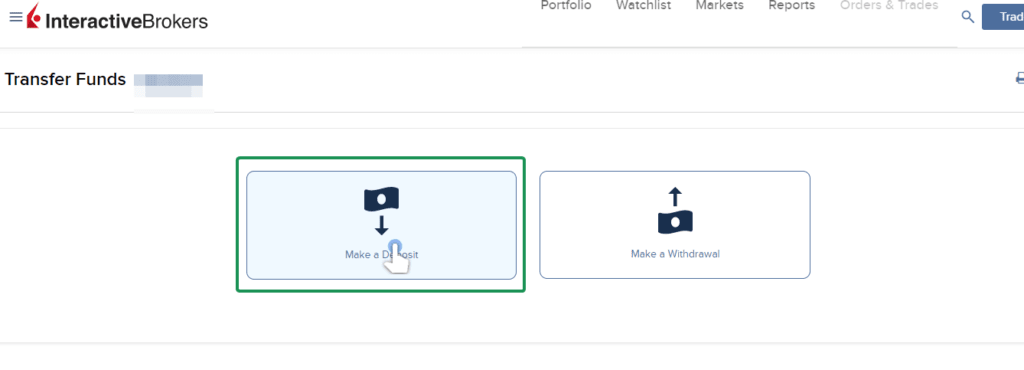

Select Make a Deposit, because that is what you wish to do.

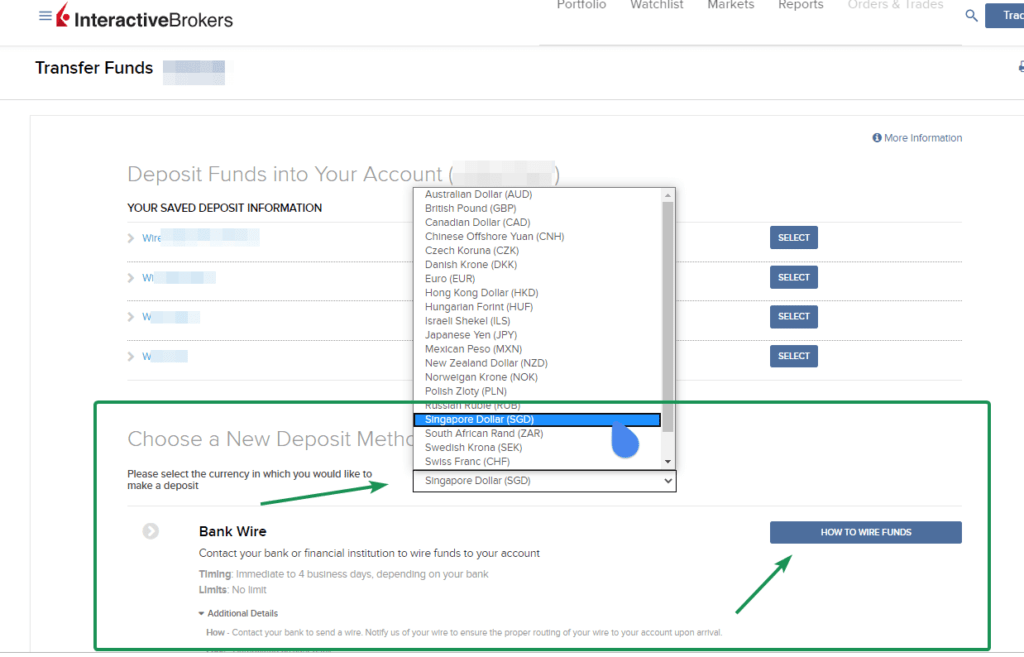

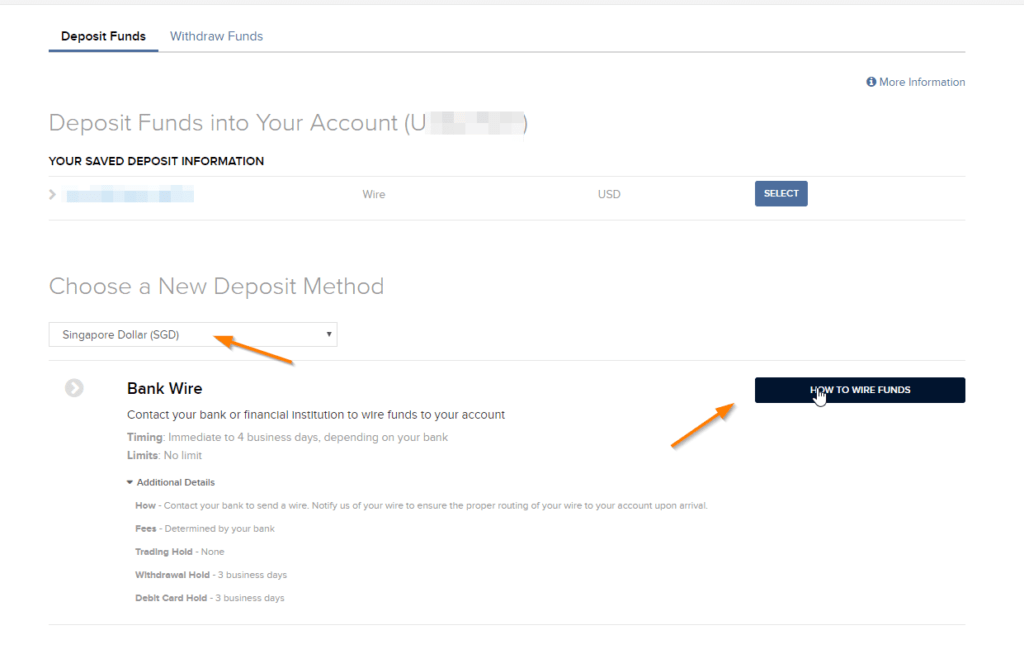

In this screen you will see two sections. The top section is shown to be populated if you have created and save transfer instructions.

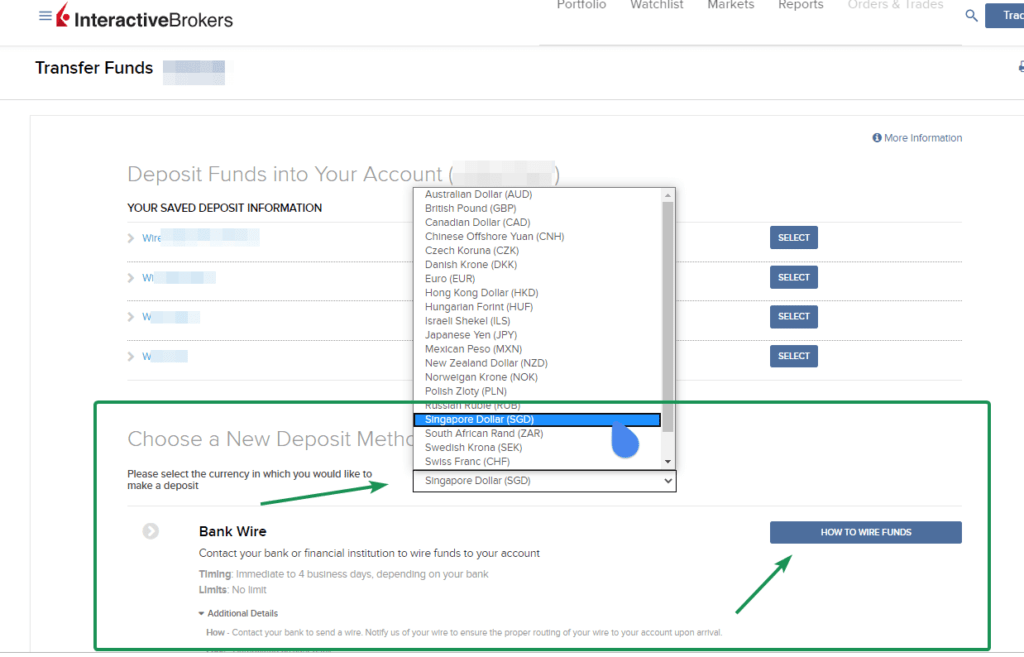

If this is your first transaction (which I assume you are), go to the section Choose a New Deposit Method.

This allows you to setup a standing instruction to transfer the funds from your account to Interactive Brokers’ account.

We will want to do a Bank Wire transaction which is to wire funds from your bank account to Interactive Brokers account.

Notice that you can select different currency to fund. This means if you move to another country, say Australia, and you have a local Australia bank, you can Bank Wire AUD into the Interactive Brokers account.

Today we will go through how to bank wire your base currency (in my case SGD) and USD through a local bank.

How to Fund SGD from Your DBS Bank to Your Interactive Brokers Account via FAST Transfer

The simplest funding method is to do a bank transfer to IBKR or IBSG.

For transfer to IBKR, you will be using FAST transfer.

For transfer to IBSG, you will be using a Transfer to Other DBS or POSB acccount.

I will go through the transfer to IBKR method first. The transfer to IBSG is largely similar except for certain parts.

Transfer from DBS Bank to IBKR via FAST Transfer

With a FAST transfer, the transaction can take place on the same day. You can transfer and a few hours later, your money will be in your Interactive Brokers account and you can use it.

FAST Transfer to Interactive Brokers (for retail folks and to other places) is FREE currently, regardless of how many times you do it.

Here is a tip.

I am not sure about you, but I am rather fearful of transferring a large sum of money around, making a mistake, and losing the money.

Since transfer is free, perhaps test it out with $10 or a smaller sum of money. Ensure the money gets to Interactive Brokers safely at least the first time, before you transfer a larger sum.

The high level idea of the transfer:

- Set up a standing instruction in Interactive Brokers, letting them know a sum of money in a certain currency is coming from a certain bank

- Go to your bank and create a FAST transfer instruction to Interactive Brokers

- At your bank, submit the FAST transfer

- Check Interactive Brokers a few hours later to see if it is funded

Ok let us go through this.

Select Singapore Dollar. Click on how to Wire Funds.

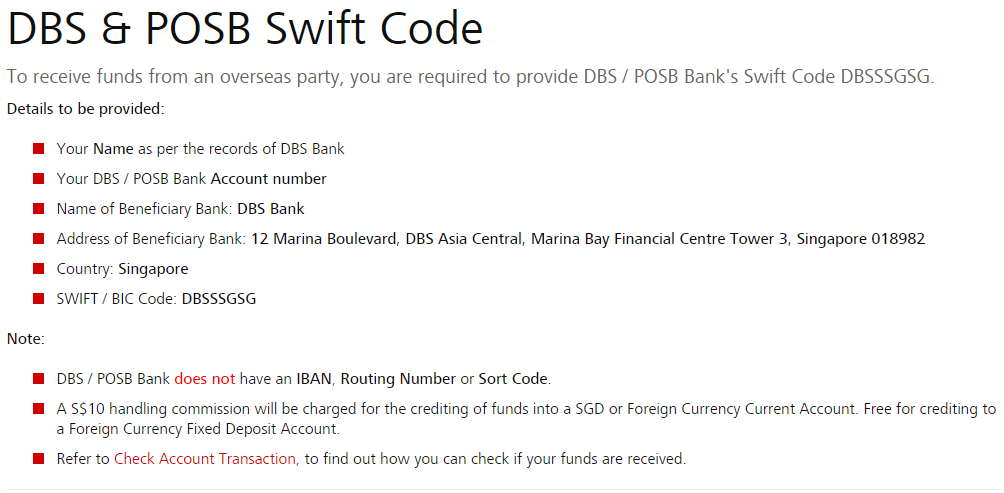

You may need to take note of your DBS SWIFT Code and relevant information. (Do not trust the information in this screen capture. Banks change their codes from time to time.)

You can find them in this link here: https://www.dbs.com.sg/personal/support/bank-general-swift-code-details.html

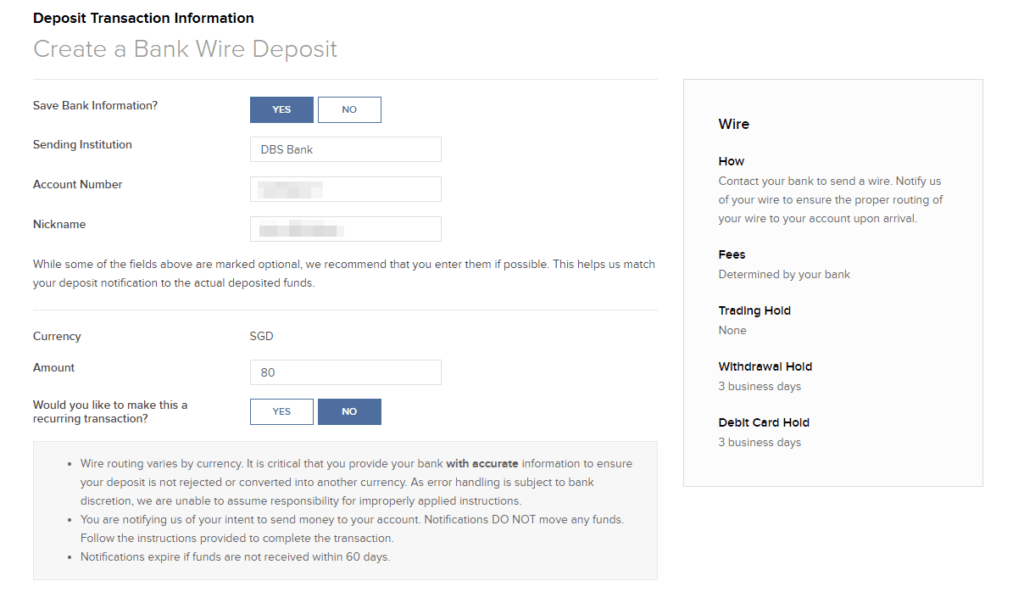

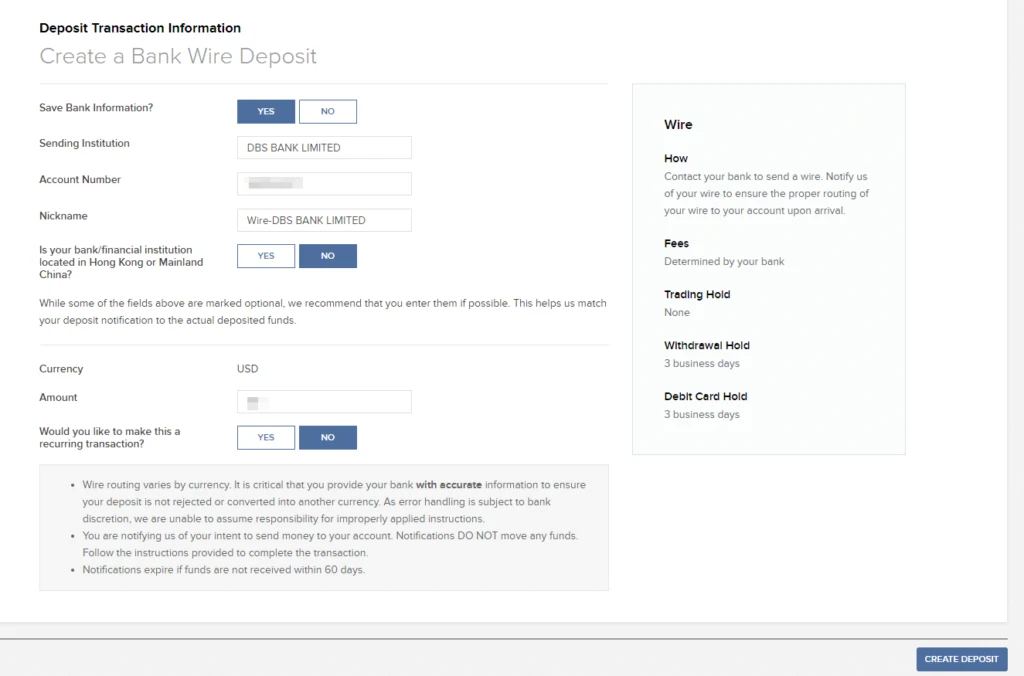

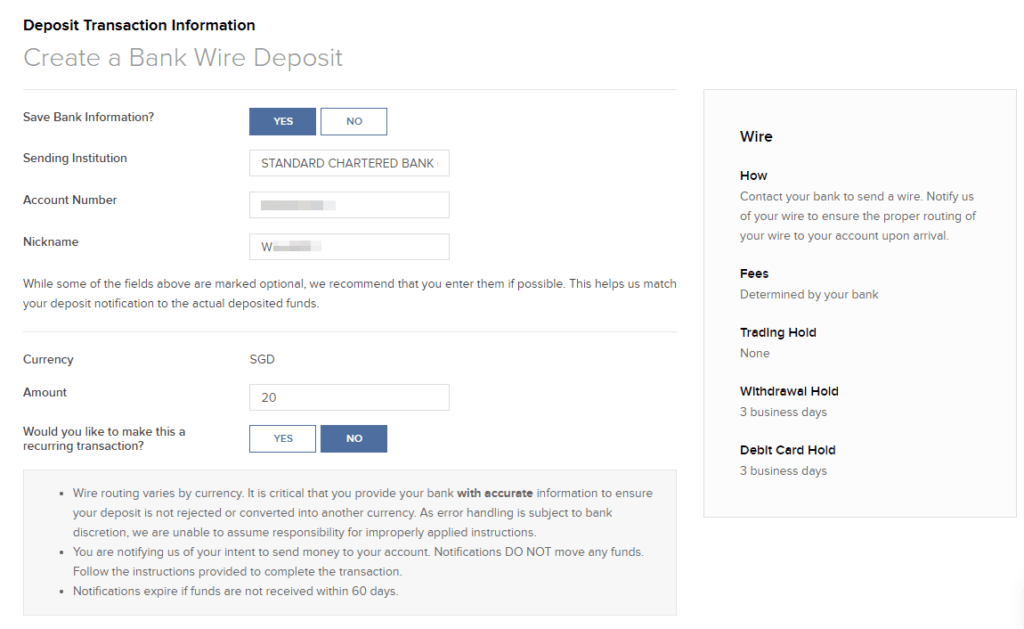

If you wish to save this information in the future, toggle Yes for the first option. Give your sending institution a name. I called this DBS Bank.

Type in the account number of your DBS Bank in Account Number. The nickname will be the name that appear in your IBKR’s Saved Deposit Information section.

Specify the amount you wish to fund.

You have the option to make this a recurring transaction.

Once that is done click on Create Deposit.

Interactive Brokers is now waiting for your money to come.

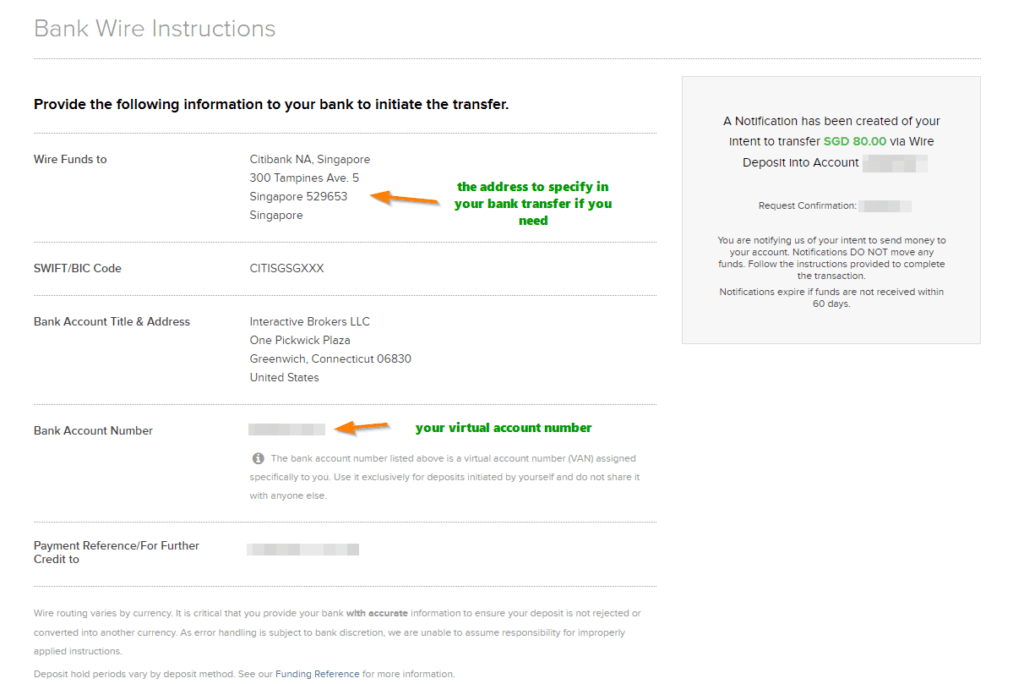

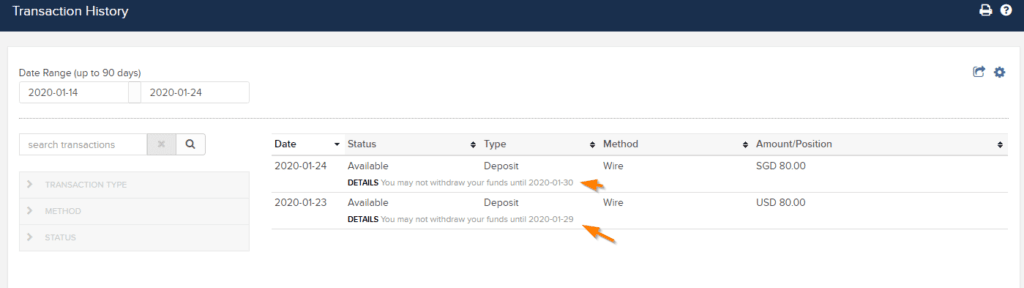

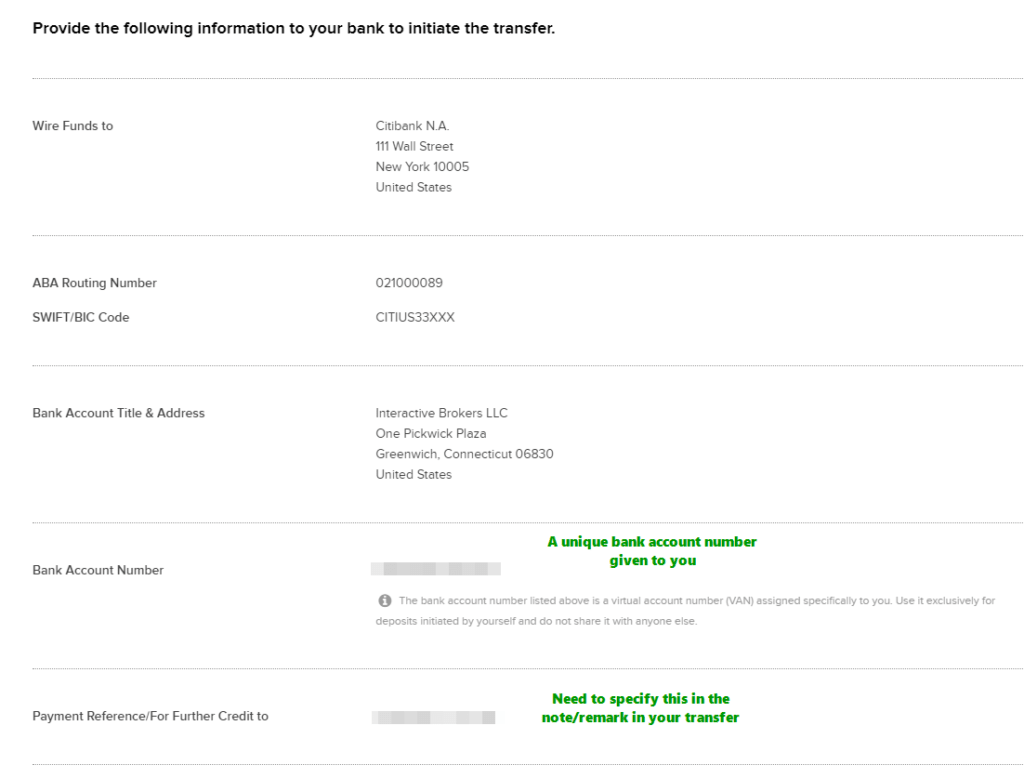

Interactive Brokers will provide you with the information to specify at DBS bank. The address to wire to is the Singapore Tampines address.

Interactive Brokers will also give you a Bank Account Number that you will specify in your DBS FAST Instruction.

At the bottom is a payment reference that you will have to put in your DBS FAST Instruction. This basically puts your {Interactive Brokers Account No} {Your name}.

This is so that when Interactive Brokers receive the money, they know who this $80 belongs to. If you do not specify this, it will lead to some unnecessary complications.

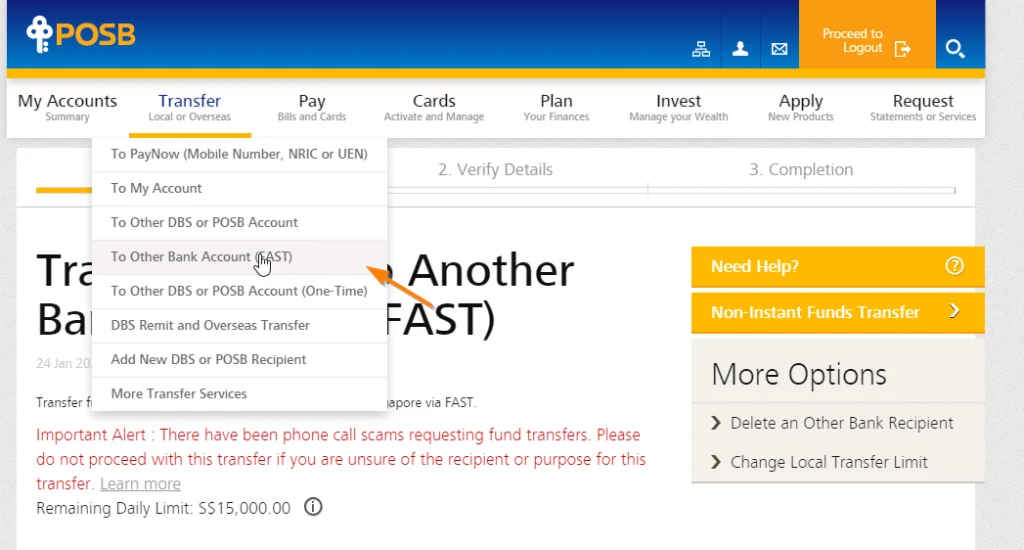

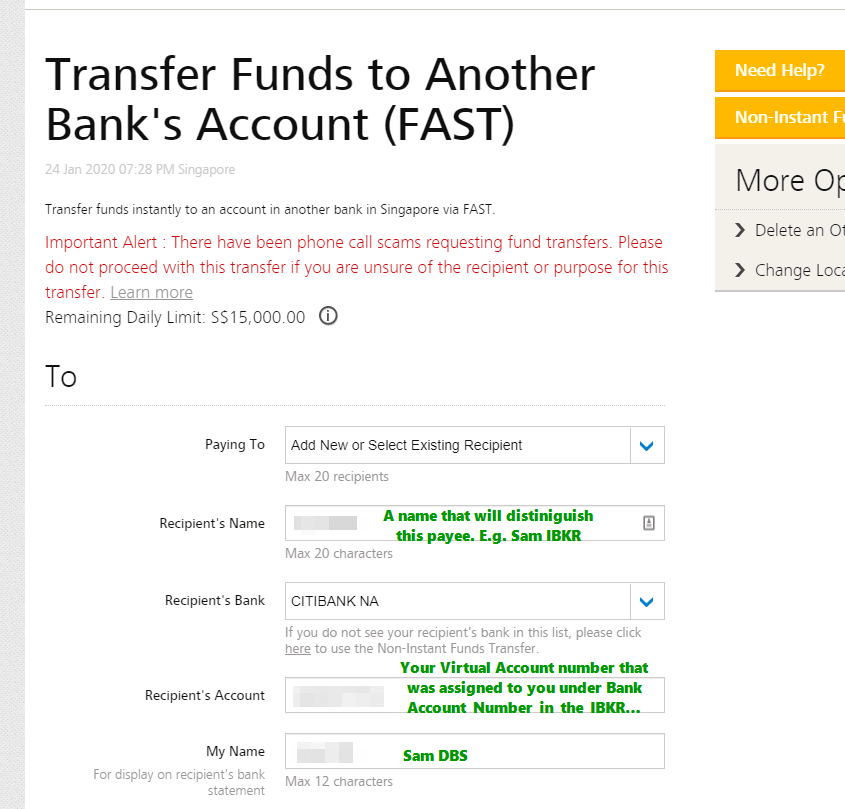

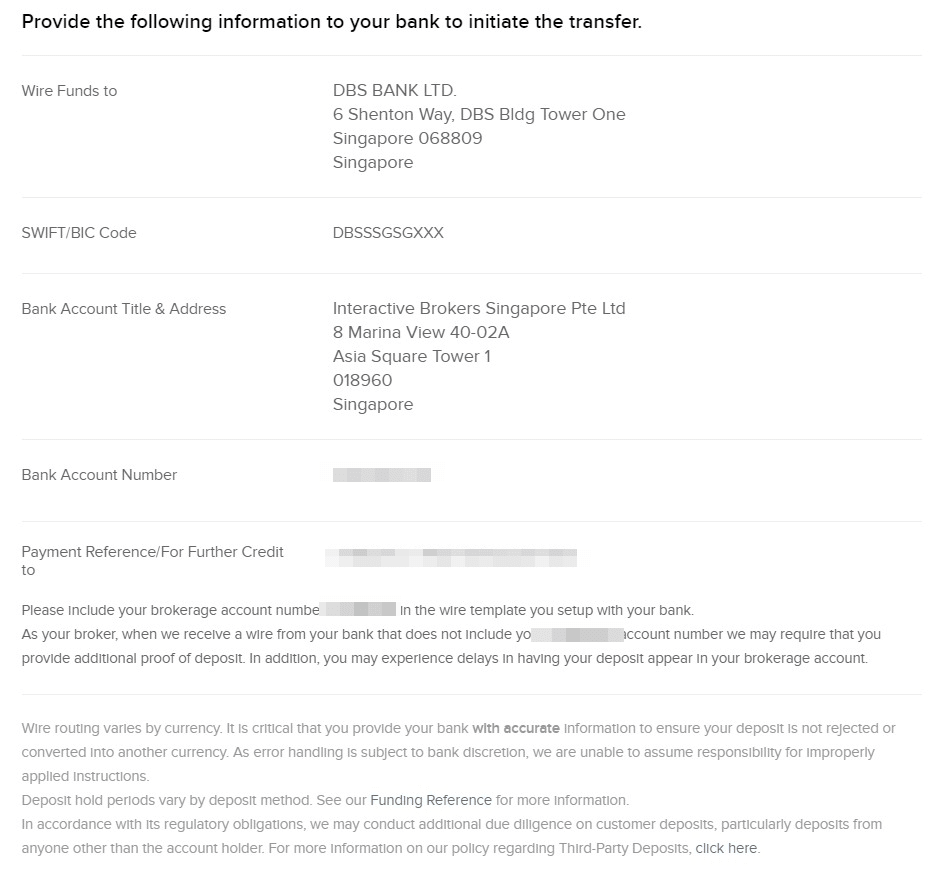

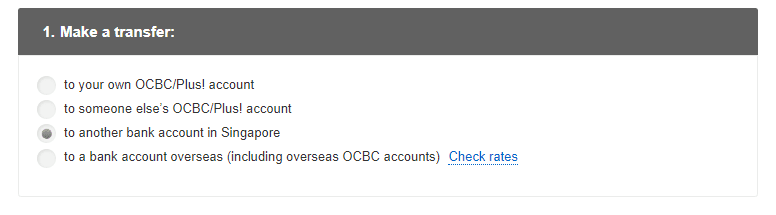

Now go to your DBS online banking account.

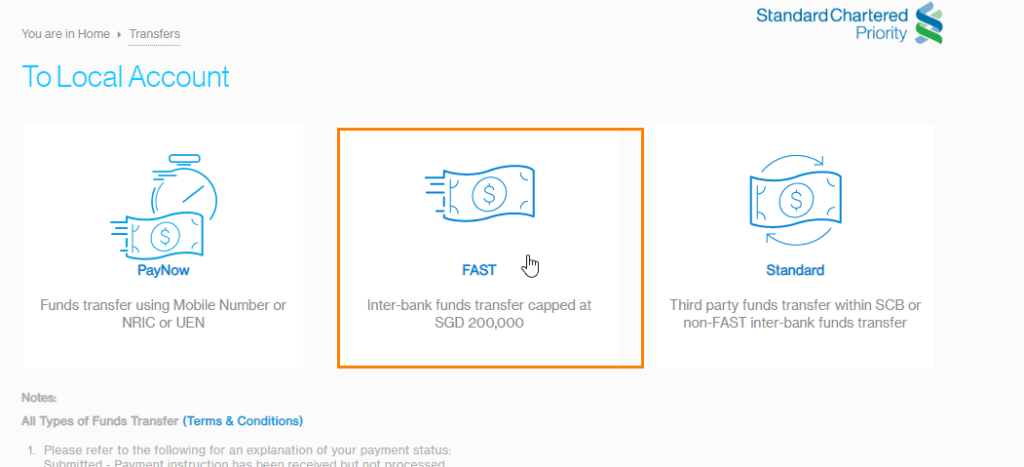

Go to Transfer > To Other Bank Account (FAST).

This is where you key in the instructions provided by Interactive Brokers.

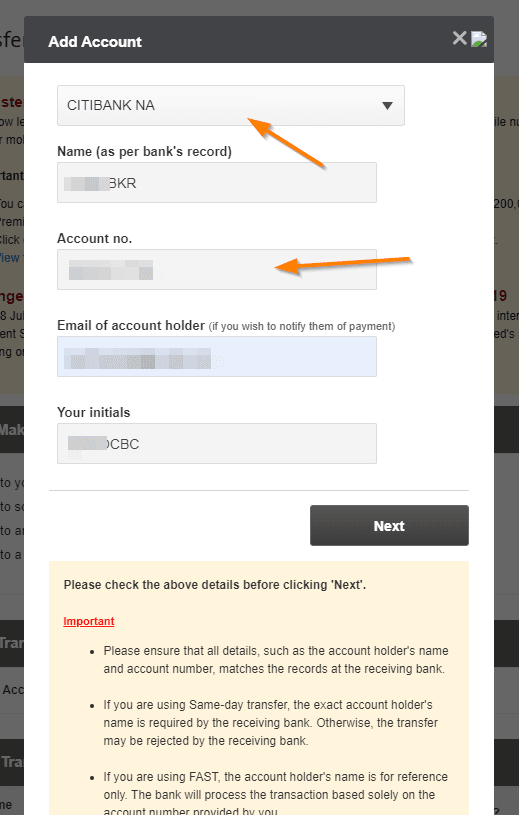

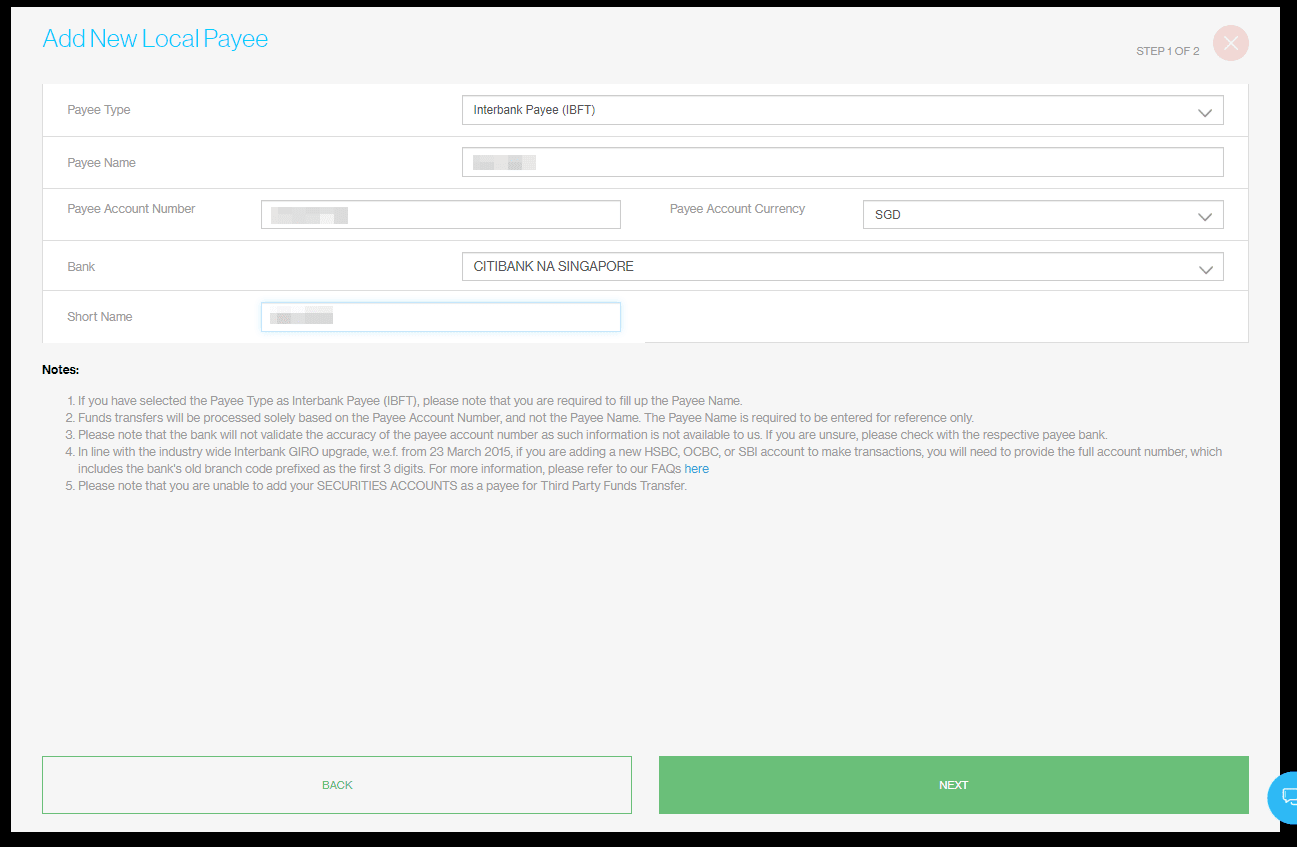

Put in a name that you can identify this transaction next time in DBS.

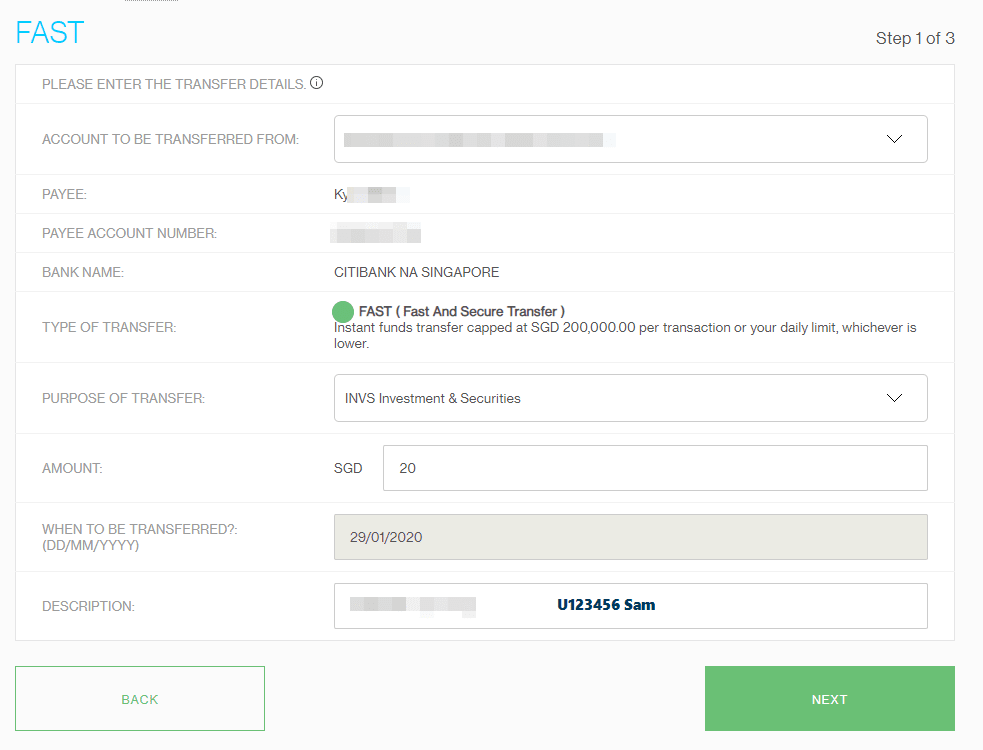

Select the Recipient Bank to be Citibank NA if you are on IBKR.

In the Recipient’s Account, put in the Bank Account Number that Interactive Brokers provided. Lastly, at My Name, put something that the other side will identify you with.

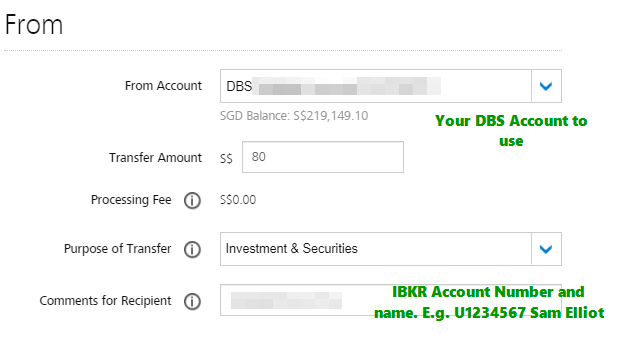

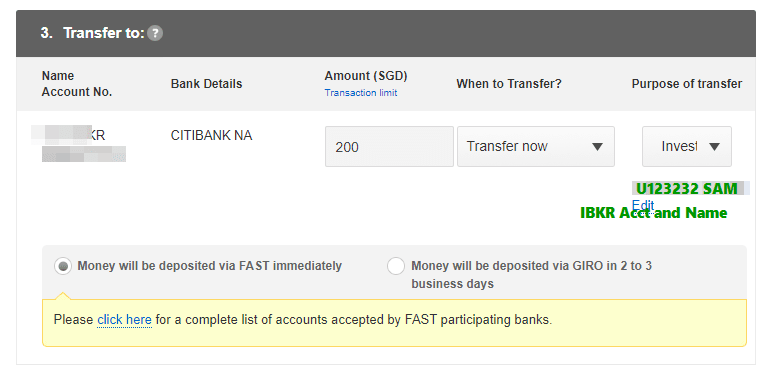

Select which bank account to transfer from, and the amount to transfer. Specify the purpose of transfer.

The most important part is in the Comments for Recipient, put the {Interactive Brokers Account No} {Your name} that was provided in Payment Reference.

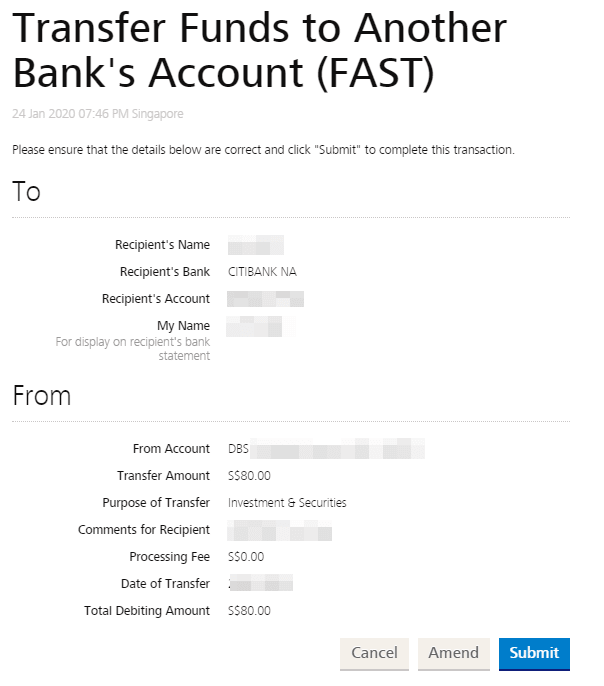

Check then Submit.

You might not be able to transfer a lot. Sometimes you are limited by your bank transfer limit. For each bank, you can change the bank transfer limit to a larger amount. Do it with care because these limits are there to protect you.

If you have save the FAST pay standing order, you can make use of this instruction to transfer money next time, provided the details stayed the same.

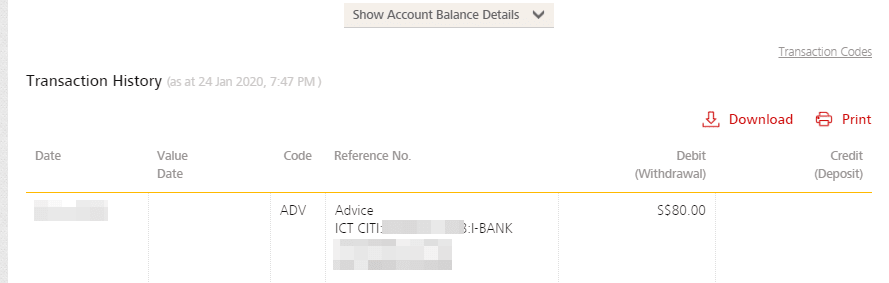

In your DBS account, you would see the transaction out immediately.

Now you wait for your money to come in.

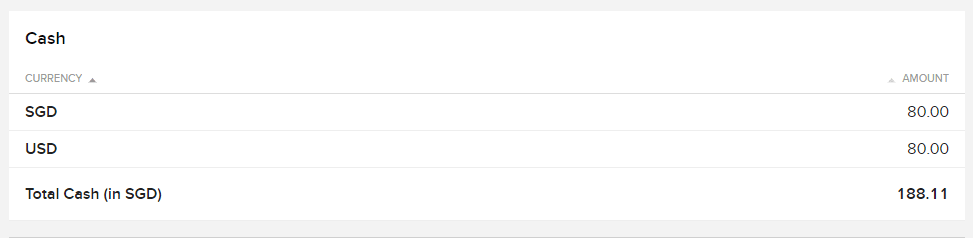

My experience is that within 1 to 2 hours, I see the above in my Interactive Brokers portfolio, which indicates the money is in (screen capture shows 2 deposited sum).

Withdrawal Limit

If I go to the Transaction History, I can review each of these transfer transactions. What I observe is that there seem to be a limit to when I can transfer each sum I just deposited out of the account.

Perhaps something to take note.

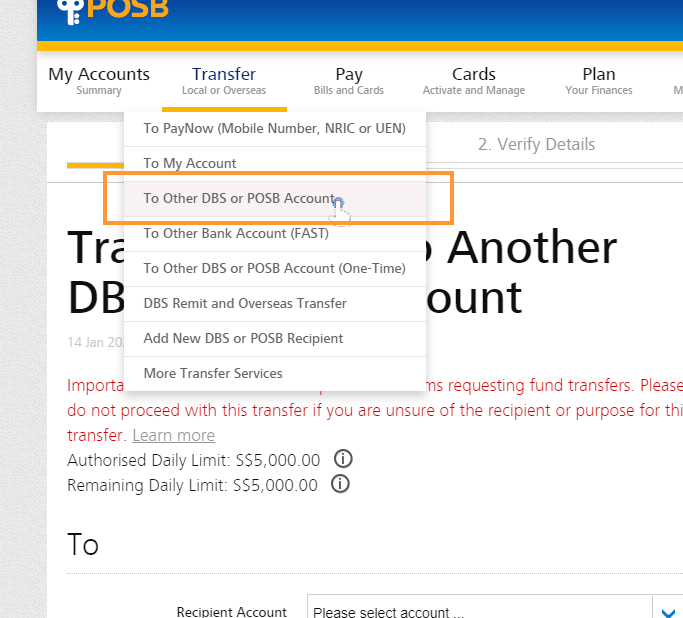

Transfer from DBS Bank to IBSG

Those Singaporeans who have created their Interactive Brokers account recently will be on IBSG or the Singapore version of Interactive Brokers.

Instead of the screen above, you would see the following:

The main difference is the Wire Funds to and Bank Account Title & Address is different. This is okay.

If you see the above information, use this instead.

Instead of FAST transfer, you will be transftering to another DBS or POSB account. This is because, the destination account IBSG uses is a DBS account.

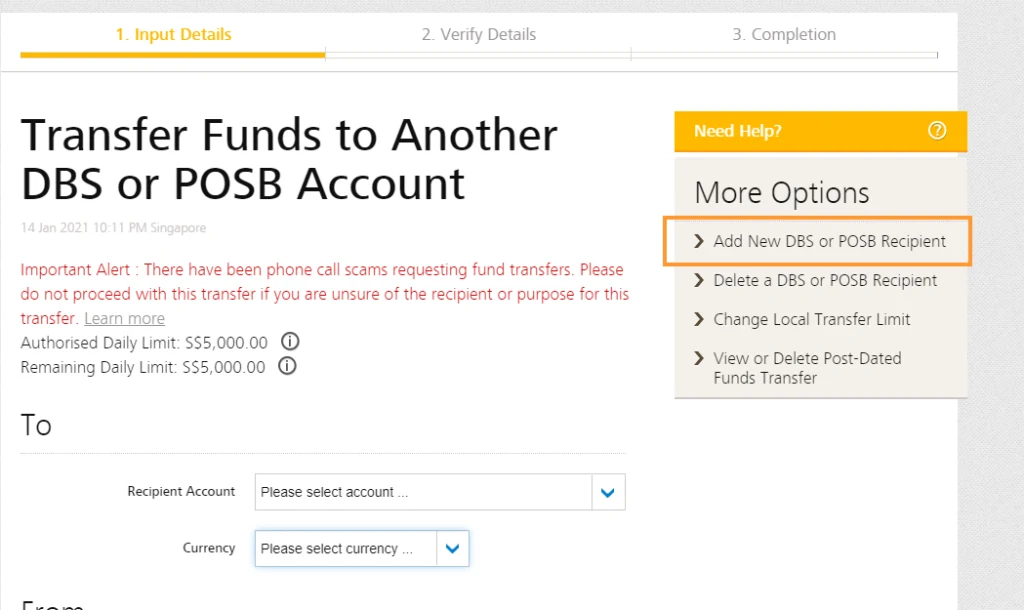

If you have not create a receipient, click on Add New DBS or POSB Recipient to create a recipient called IBSG.

Once that is done, specify that IBSG recipient in the To section.

The rest of the steps should be pretty similar to Transfer from DBS to IBKR.

For transfer from other banks to IBSG or IBKR you can take a look at the process below after the conclusion.

How to Fund USD from Your DBS Bank to Your Interactive Brokers Account via DBS Overseas Remit

Now, what if you have different currency in your DBS Multi-currency account?

You can transfer them via the DBS Overseas Remit function to Interactive Brokers account.

Transferring via DBS Overseas Remit is free. There are other similar functions by other banks such as Standard Chartered’s SCRemit.

If I were to believe, this remittance function is also how we can make use of third-party platform such as TransferWise to transfer money into Interactive Brokers.

What is the downside of remitting the money in other currencies?

The downside is that the conversion rates between currencies at a bank are not good. Banks earn a healthy spread from you. This is why you have services like TransferWise, Instarem popping up.

I am showing you how to do it. It does not mean I encourage it. You might have money that you need to transfer this way.

Ok same thing but this time, we choose USD.

Do the same thing. Give a nickname that reflects this transaction.

Click Create a Deposit.

Interactive Brokers is now waiting for your money to come.

Interactive Brokers will provide you with the standing instructions as the SGD FAST Transfer.

The main difference here is that the address for Wire Funds To, is a United States bank address. Take note of the Bank Account Number and Payment Reference.

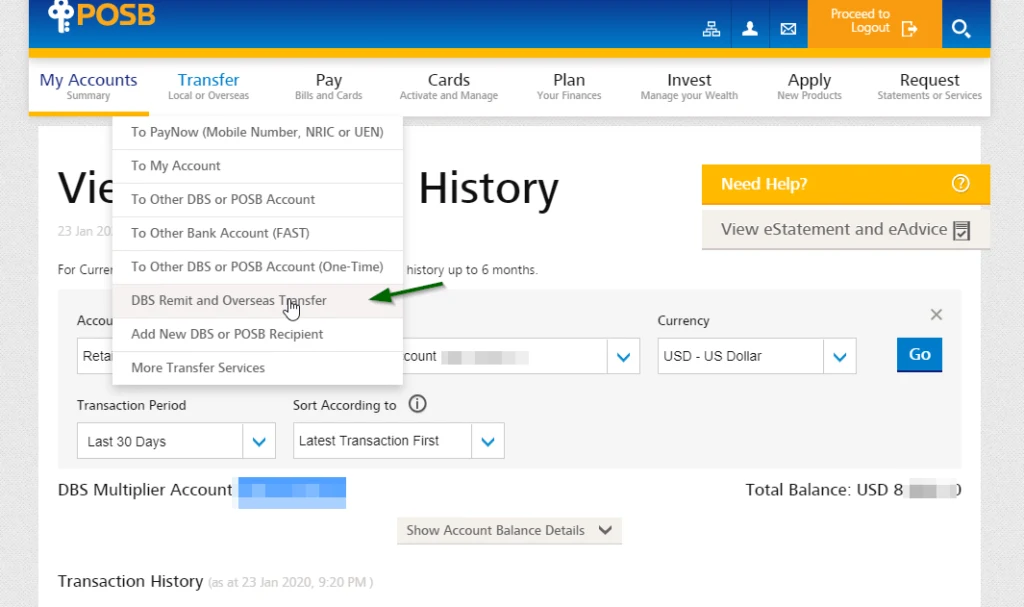

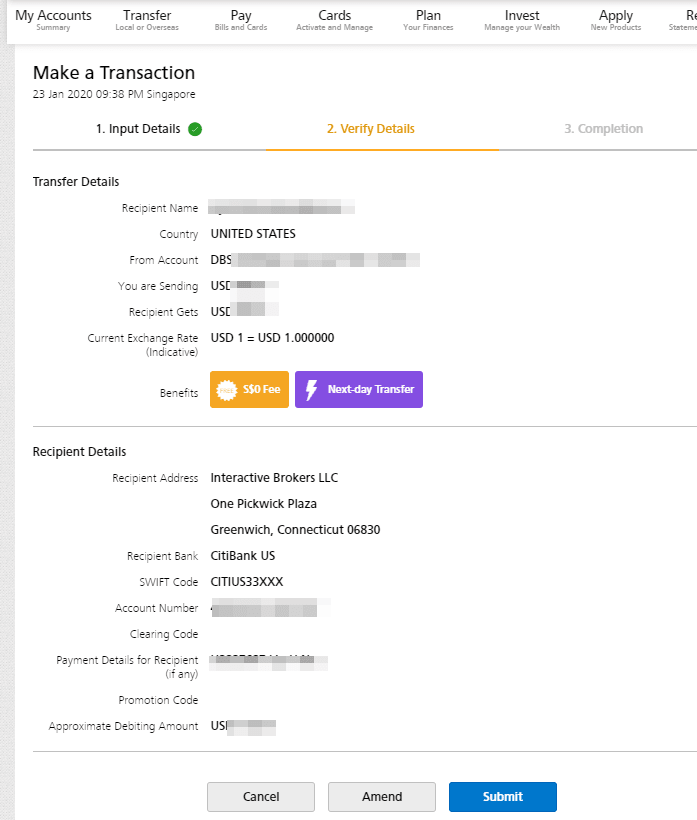

Now let us go to DBS bank.

Go to Transfer > DBS Remit and Overseas Transfer.

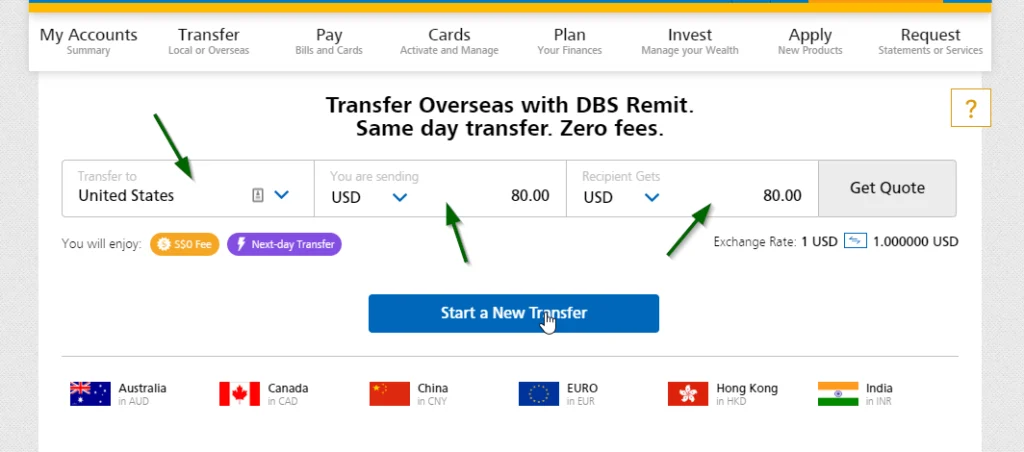

Select Transfer to the United States and you will be sending USD of a particular amount to USD of a particular amount.

The click Start a New Transfer.

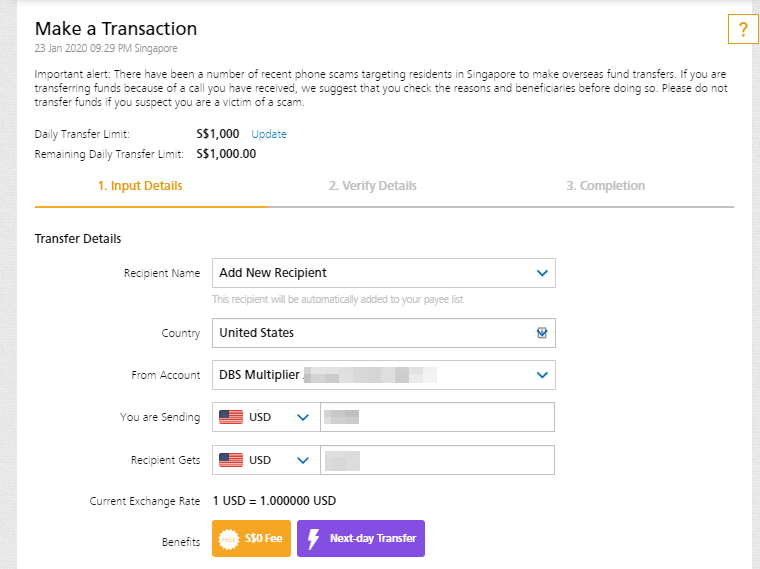

In the next screen, select which account you will be sending from and the amount to send.

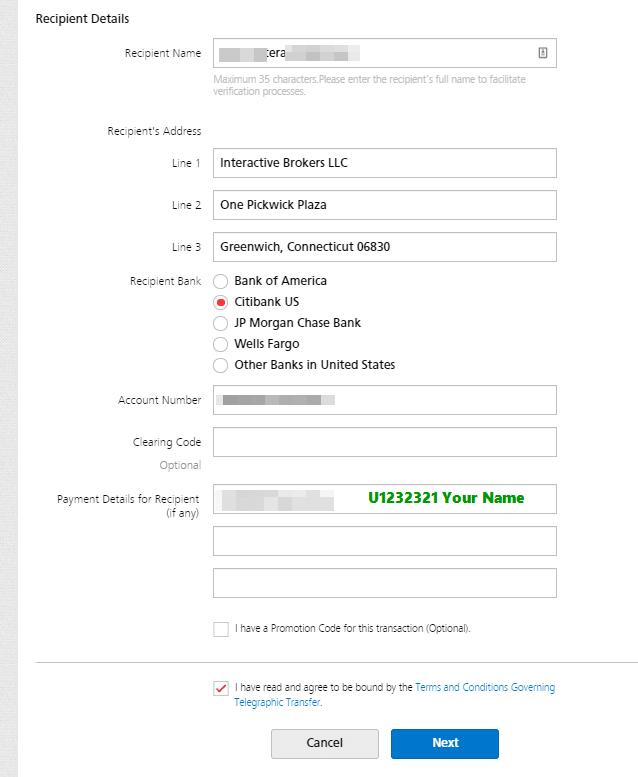

In the next screen, this is where you specify the information from Interactive Brokers’ standing instruction.

The thing to note is that in the address, you specify Interactive Brokers’ address and not Citibank’s address.

Choose also Citibank US.

Put the Bank Account number that Interactive Brokers provided you.

Lastly, attach your {Interactive Brokers Account No} {Your name} in Payment Details for Receipent.

Once you do a last check, you can submit.

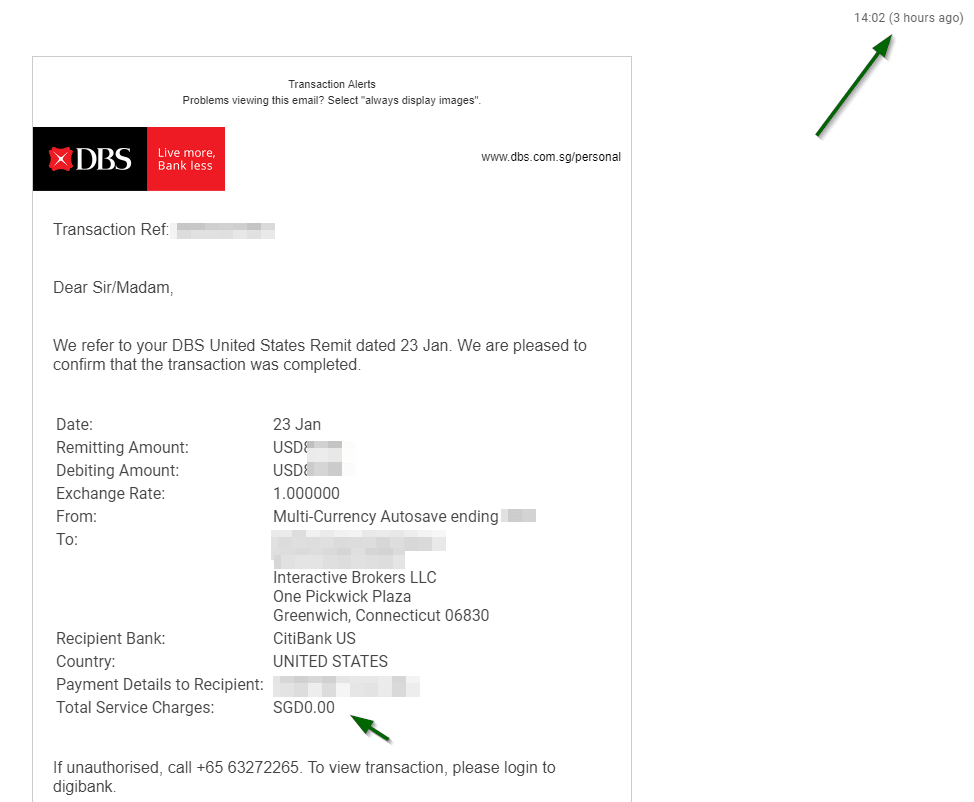

Now you wait for the transaction to go through.

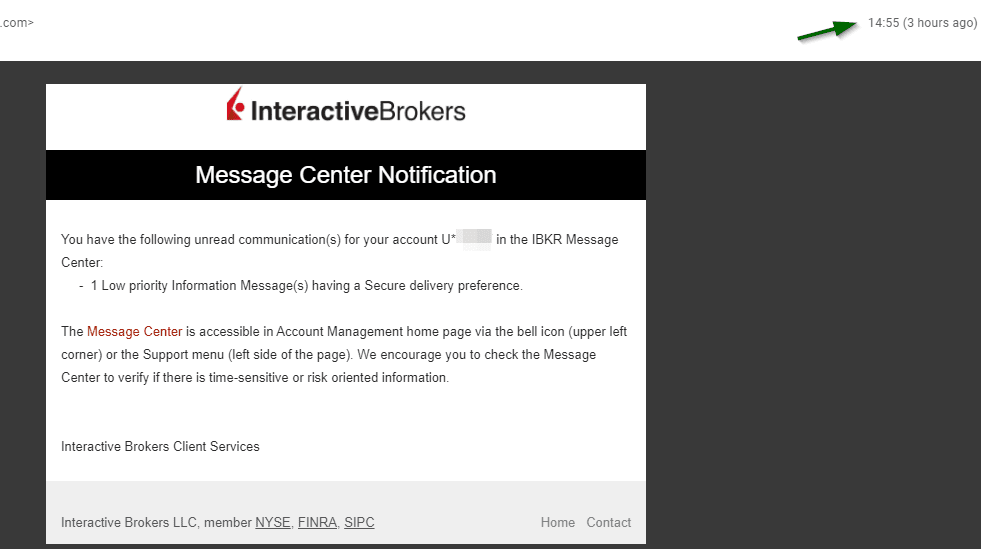

I got a message notification in my email in 3 hours.

I carried out the remit transaction in the middle of the night. The next day at 2 pm, I received an email, and an SMS from DBS informing me that the transaction was successful.

We can also observe that the total service charges is zero.

How to Withdraw Money from Interactive Brokers to Your Bank Account

Now that you are familiar with how to fund, you may be wondering about how to withdraw money.

There are 2 withdrawal method: ACH and Wire Transfer.

The most common one is Wire Transfer.

You will set up a wire transfer instruction in Interactive Brokers letting them know which bank or financial institution you wish to transfer money to.

Then you will transfer the money. Then, you will wait and validate the money is received.

Typical, depending on your institution, your transactions would take place in 2 to 4 days (let me know if your experience is different).

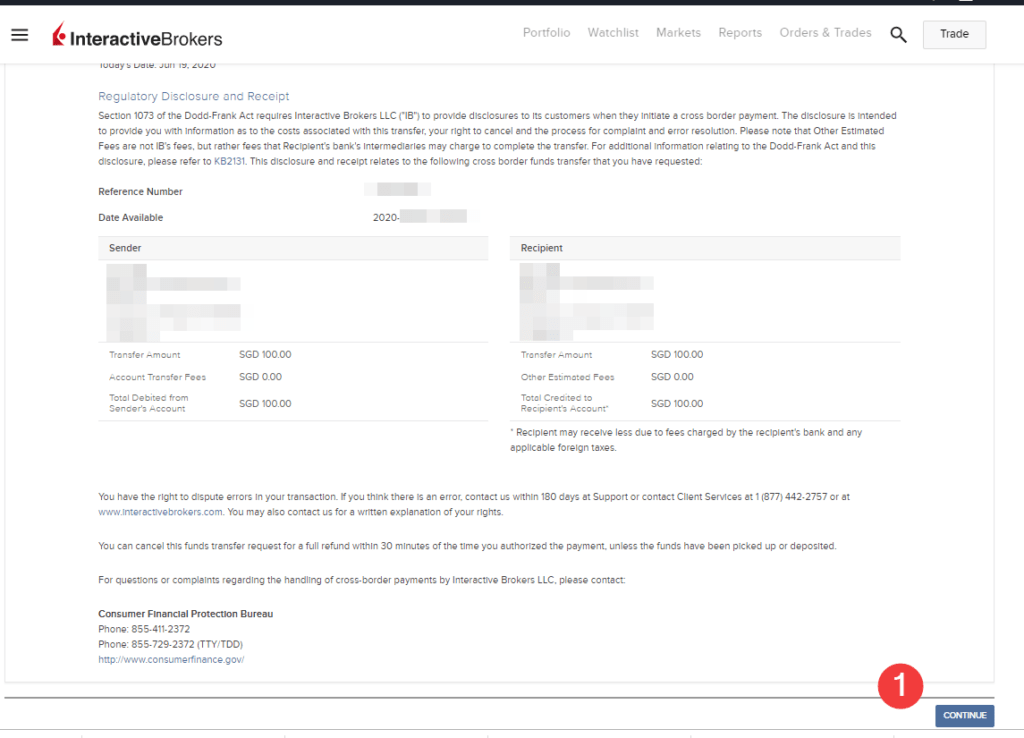

Are there any withdrawal costs?

You can make one withdrawal per calendar month for free. If you wish to make more than 1, it will cost you SG$15 per transaction.

If you ask me, SG$15 is 50% cheaper than a bank wire transfer rate in the past. If it is urgent for you to make a transaction, just pay the $15. It is not a deal breaker.

Withdrawal can be done over the InteractiveBrokers Web Interface or through the Mobile Application.

The follow is how to withdraw illustrated using the web interface.

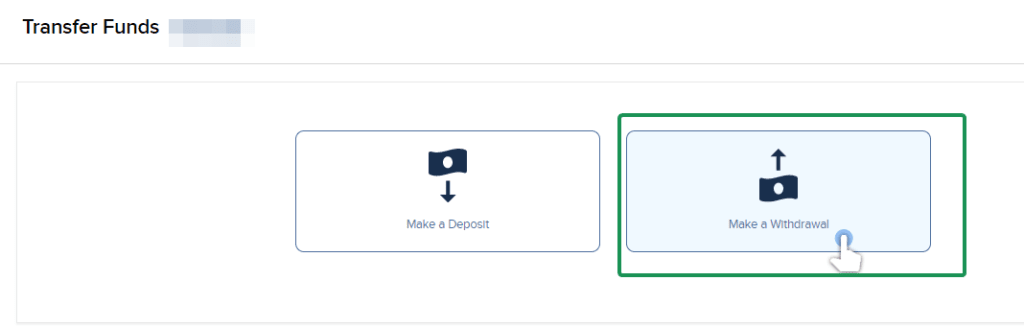

Go to Transfer & Pay > Transfer Funds.

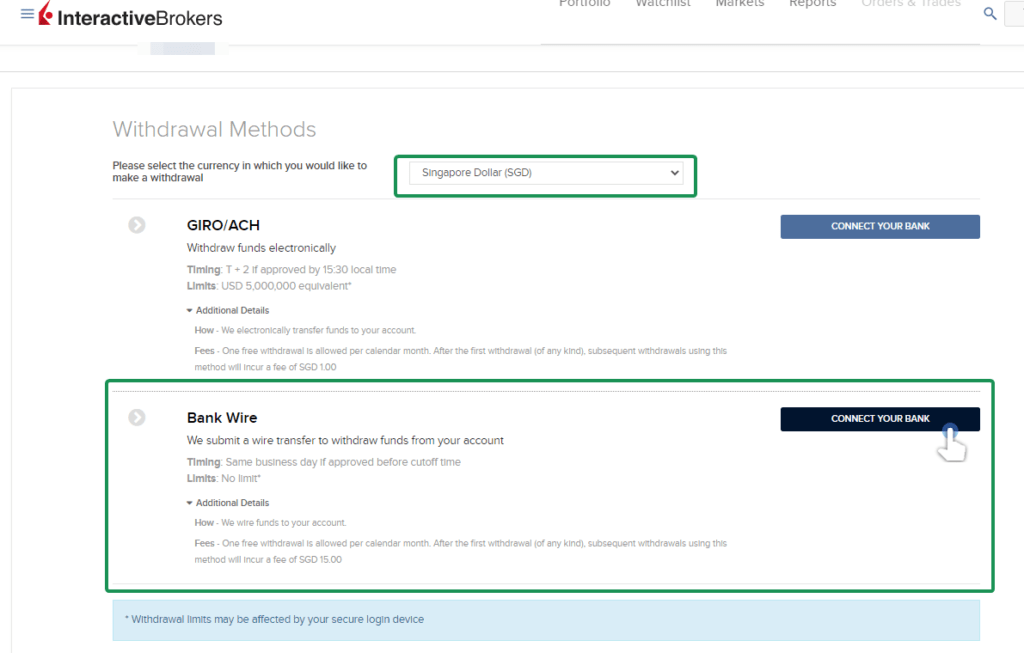

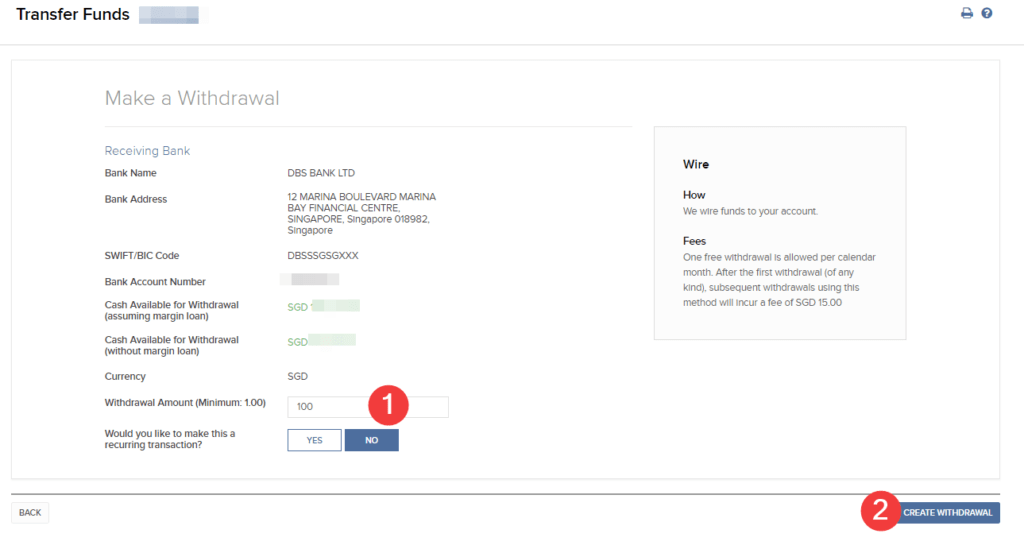

Select Make a Withdrawal.

Note: If you are on mobile, go to Transfer & Pay and select Withdraw Funds.

Select Singapore Dollar.

However, if you are overseas and have an AUD, GBP, or USD bank account to withdraw to, select accordingly.

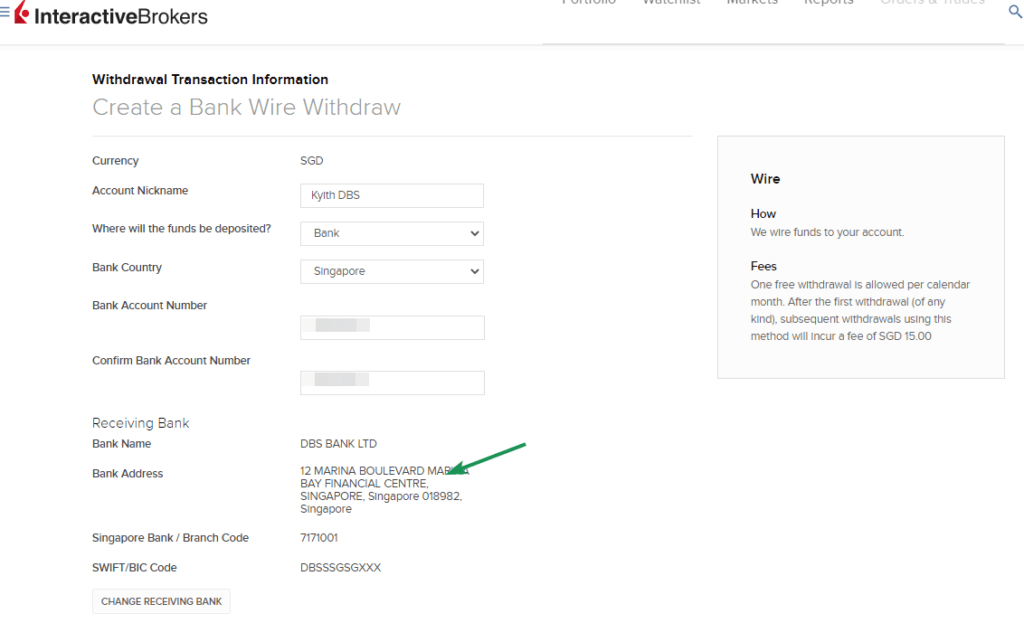

Then select Bank Wire > Connect Your Bank.

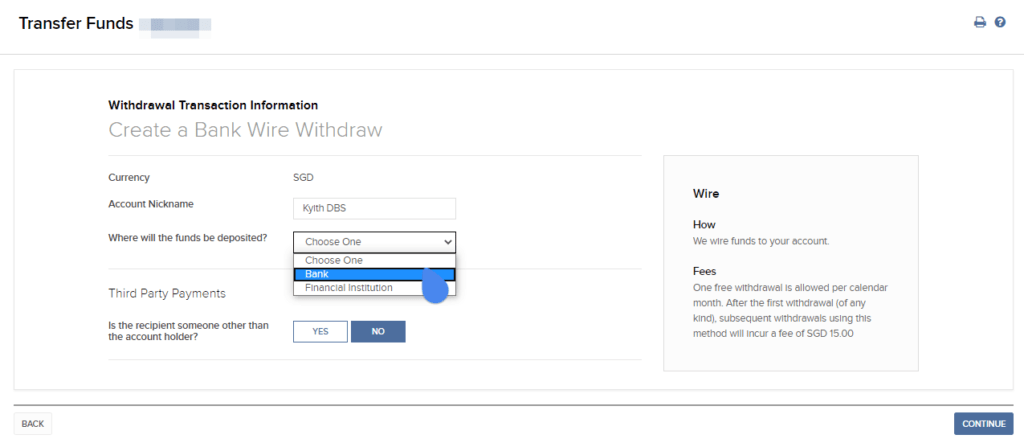

Give the account a nickname.

If you are depositing to a bank like DBS, choose Bank. If it is a third party platform select, financial institution.

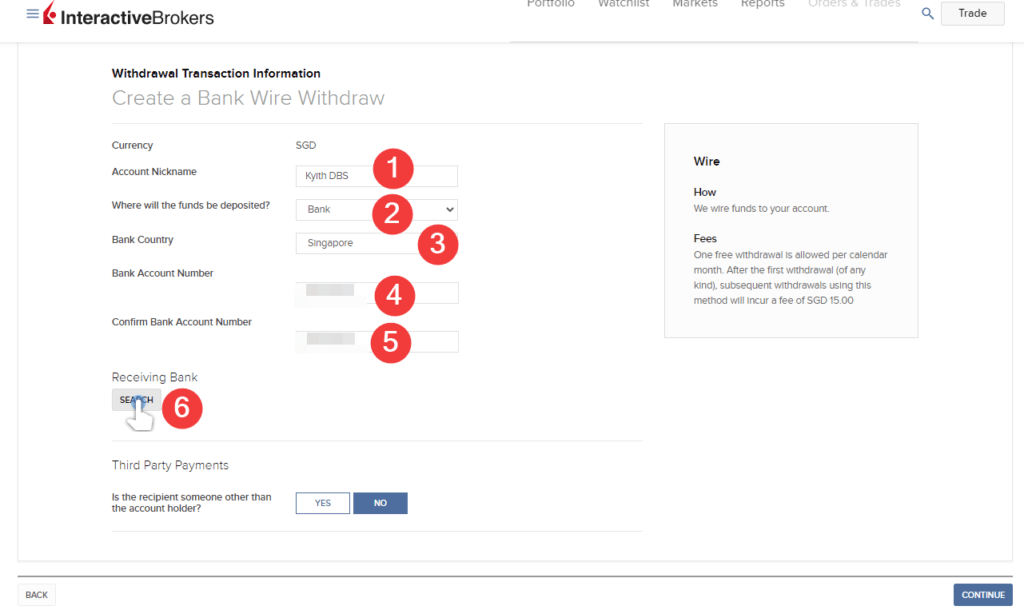

More options will be made available to you (starting from #3).

Select Singapore as your Bank Country.

Key in the account number of your Singapore bank account, then confrim the bank account number again.

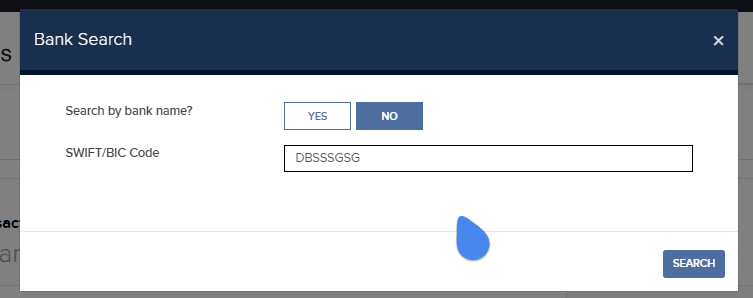

Next click on the SEARCH button at Receiving Bank.

You can find the bank based on the SWIFT code. That can be provided by your bank.

If you are successful, the Receiving bank infor is filled.

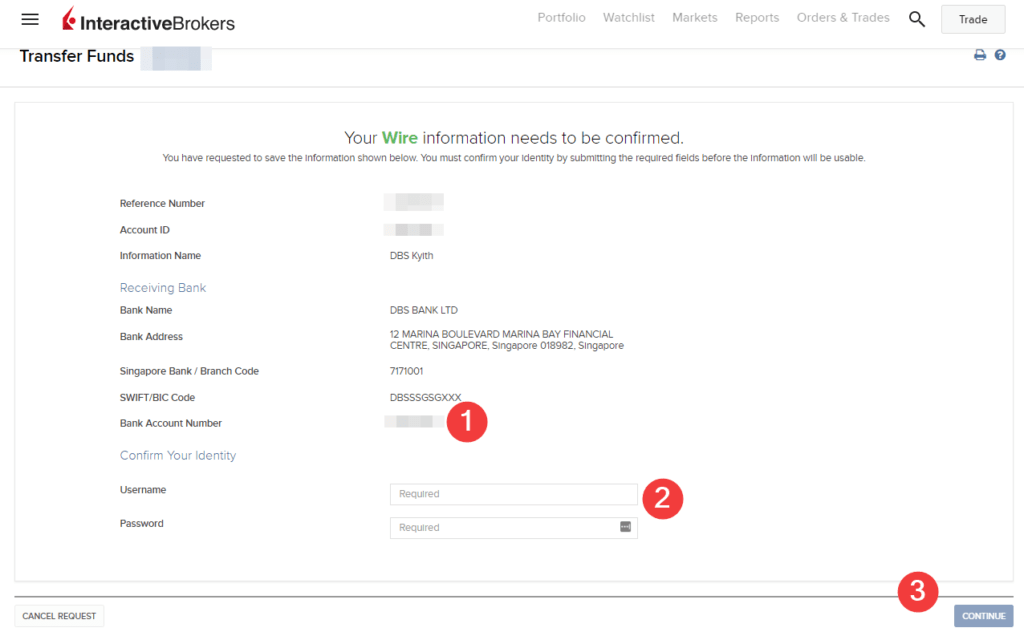

At the next screen, check that the details are correct. Enter your Interactive Brokers username and password and then click continue.

You will be prompted to validate the transaction with your mobile phone.

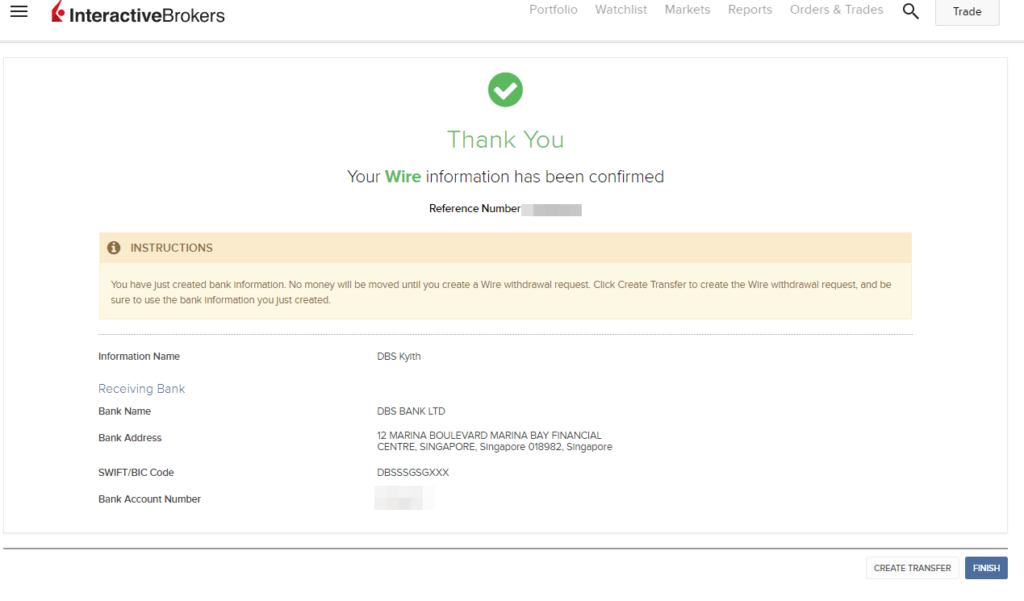

Your Withdrawal standing instructions is completed.

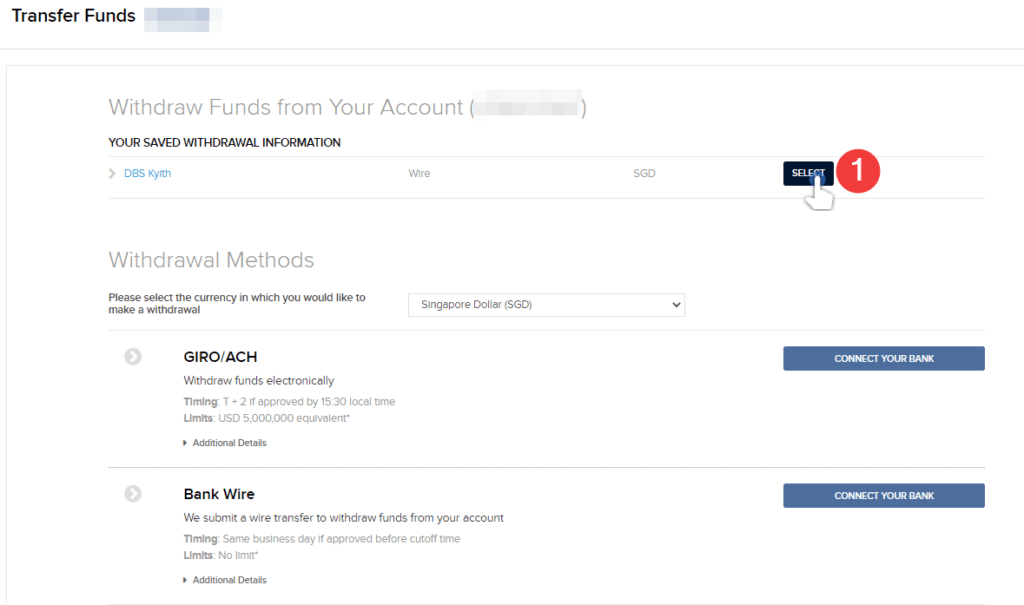

If you go back to the Make a Withdrawal page, you can see this new saved withdrawal information.

Click SELECT.

Interactive brokers will let you know the cash balance in SGD available for withdrawal.

They will also let you know the cash available that includes a margin loan. It would seem that you can borrow money from Interactive Brokers through margin and get the money out to spend HAHA!

Since you have specified that you would withdraw in SGD, you can only withdraw from your SGD balance. If you have cash in other currencies, you would have to convert them to SGD and then withdraw.

Or you could withdraw them in other currencies.

Key in the amount you wish to withdraw, then click Create Withdrawal.

Read through the regulatory disclosure. Note that no fees are charged.

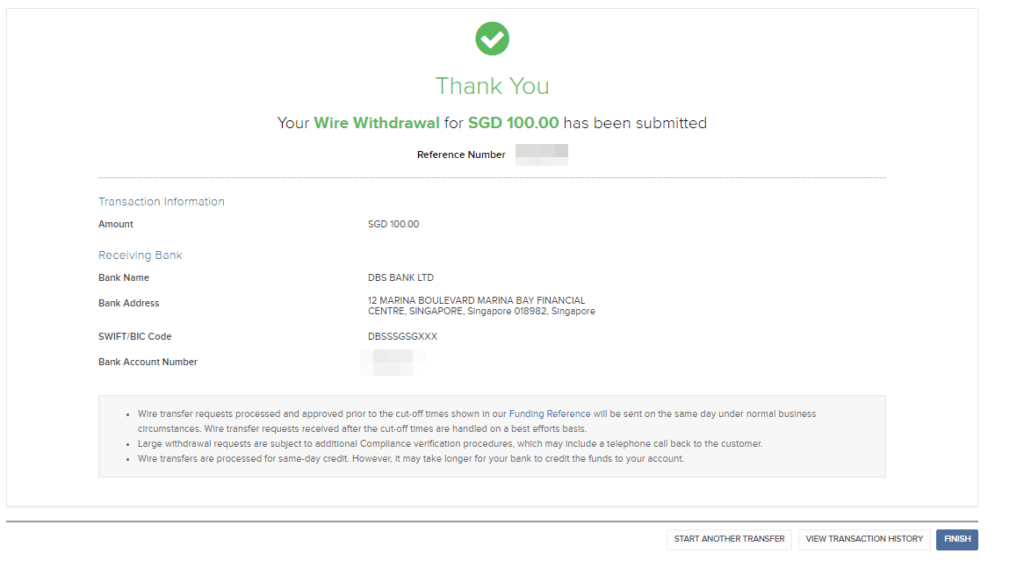

Completed. Now wait for money.

Typically, I would get the money on the same day.

I have also tried this for different bank.

How to Transfering Money to Other Countries at Good Exchange Rates with Interactive Brokers

The problem that many people faced is that exchange rates charged by financial institutions for money transfers are high.

Imagine that you are going over to Australia.

You need to buy a home there and you need to convert a large sum of money from SGD to AUD.

You will be charge a high rate if you do the transfer through the traditional bank.

Interactive Brokers has the unique advantage that their currency conversion is almost at spot rates.

If you pair this together with the transfer and withdraw lesson here today, you can see that there may be some useful use-cases.

Videos to Help with Learning About Funding Your Interactive Brokers Account

My Comprehensive Interactive Brokers How-to Guides

Interactive Brokers is a great low-cost, financially strong brokerage platform that can be the standard broker for holding your long-term investments. You can access 150 global exchanges, including exchanges such as Singapore, the US, Hong Kong, London, European and Canada.

You will enjoy cheap commissions and zero minimum recurring platform fees or maintenance fees. Convert your funds to different currencies at near-spot rates, paying a flat US$2 fee.

To get started or become familiar with Interactive Brokers, check out my past articles on how to invest with Interactive Brokers. I hope the guides make your life and investing experience easier and brighter.

An Easy Step-By-Step Guide to Setup Interactive Brokers (IBKR)

How to Fund & Withdraw Funds from Your Interactive Brokers Account

How to Convert Currencies in Interactive Brokers

How to Buy and Sell Stocks and Securities on Interactive Brokers

How Competitive are Interactive Brokers Commissions Pricing?

How Safe is it to Custodized Your Money at Interactive Brokers? The things they do better than other brokers.

How Safe is it to Custodized Your Money at Interactive Brokers (2)? Financial strength of IB during recent banking crisis and during Great Financial Crisis

Interactive Brokers have Eliminated the US$10 monthly inactivity fee. More details here.

How to Transfer your shares from Standard Chartered Online Trading to Interactive Brokers

How to trade after-hours and premarket

Create Customized Reports and automatically send them to your email

What is the PortfolioAnalyst Report and Automatically Send the PortfolioAnalyst Report to Your Email

Send Money from TransferWise to Interactive Brokers

Interactive Brokers’ Fluid Interest Income on Cash

Introducing IMPACT by Interactive Brokers

Other Guides

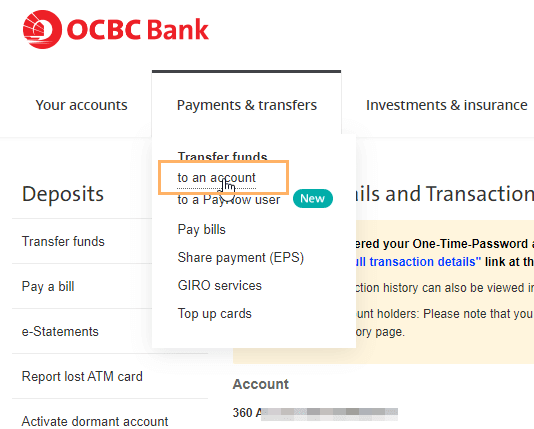

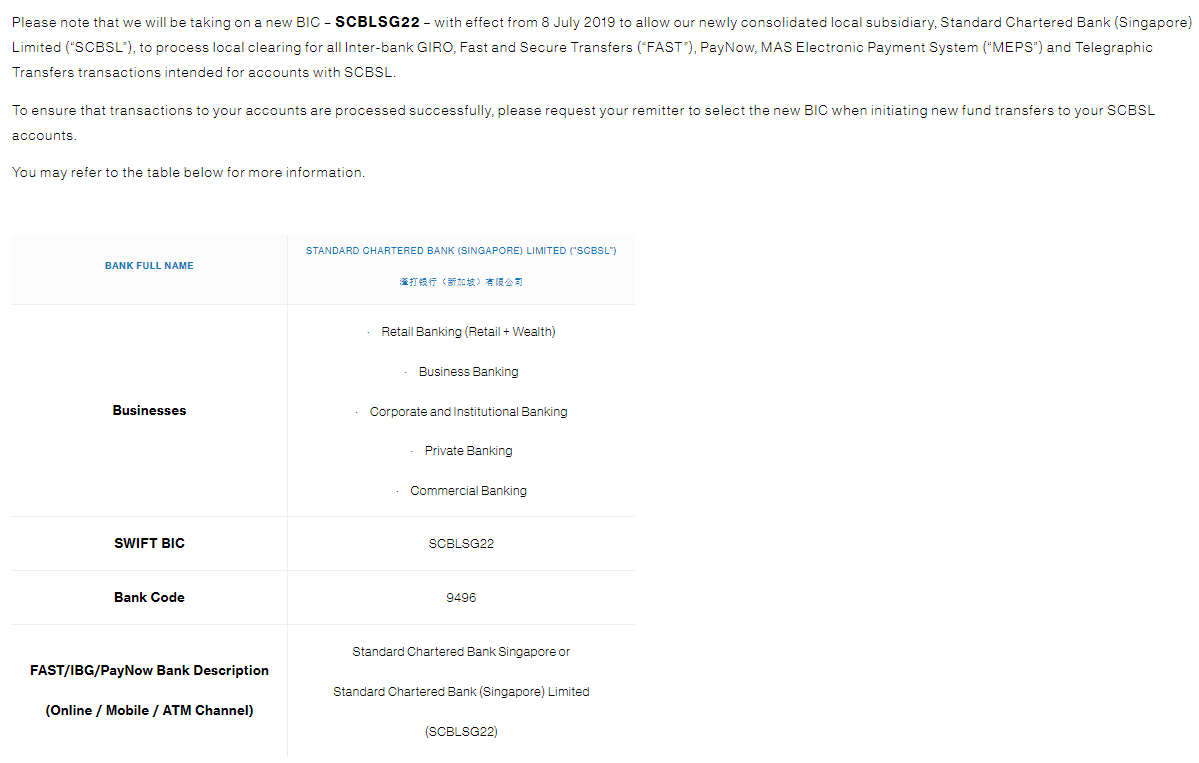

Aside from DBS, here are some of the transfer instructions for OCBC and Standard Chartered Online Banking.

Deposit SGD from OCBC to Interactive Brokers

Deposit SGD from Standard Chartered to Interactive Brokers

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Joy

Saturday 4th of June 2022

Hi Keith, Nice article. Seeing many people mentioned IBSG bank account is now becoming DBS Singapore and can accept SGD and USD. I'm looking to setup a corporate IBSG account for currency exchange. Is it possible for user to deposit USD cheque to IBSG's DBS bank USD account as this will save the TT transfer cost? Thanks

Kyith

Wednesday 8th of June 2022

Hi Joy, we will have to check. This is not something that I am personally acquainted with so I have to find out.

Elbert

Monday 16th of May 2022

Hi Kyith, I have some HKD in DBS Bank earning no interest. Would like to fund the HKD to my account with Interactive Brokers LLC to buy some shares from HKEx. Is the process the same as funding SGD? Any fees and charges by IB for funding HKD

E

Sunday 24th of October 2021

Hi I requested a withdrawal of my cash balance on IBKR and was requested to give IBKR a verbal call to confirm that request. Have you experienced this before, what is the purpose of this call and is it required each time i make a withdrawal? T

Kyith

Tuesday 26th of October 2021

Hi E, we did not experience this before. Is there something different about your transaction? Maybe that is the reason for that.

Mich Tan

Tuesday 5th of October 2021

Hi Kyith,

Thanks for your great post.

I am not aware that there is a IBSG version until I read your article; my recently opened account is IBKR (i.e. Citibank SA one). May I know what are the differences between IBKR vs IBSG (apart from different banks they used) ?

Kyith

Tuesday 5th of October 2021

Hi Mich, IBSG allows you to trade on the SGX. Also, IBSG is registered under MAS. It does not have SIPC protection like the protection for a typical US Brokerage.

Elbert

Wednesday 18th of August 2021

Hi Kyith, I have accounts with IBKR LLC and TDA SG. Is it possible to transfer USD in IBKR LLC to TDA SG? If yes, how do I do it? Any charges or fees payable for the transfer?

Kyith

Wednesday 18th of August 2021

Hi Elbert, i am not sure about TDA. I think it should allow you to transfer and there might be charges. As to the procedures, I have to do it to know.