On 23rd July, Singapore-listed financial services platform iFAST announced its 2nd quarter results.

It has been a while since I looked at their results, so I decided to collect some of my thoughts.

At the current price of $3.99, iFAST trades at a market capitalisation of $1.17 billion. Based on the historical net profit of $17.5 million, iFAST currently trades at a price-earnings of 66.8 times.

iFAST is not trading at a cheap valuation. However, if the company sets itself up nicely, future profit growth might justify such a lofty valuation.

iFAST Goes into Negative Profit Territory

The group’s assets under administration (AUA) dropped 5.1% if we measure quarter by quarter but increased year on year by 0.8%. Net profit edged into negative territory due to a one-off $5.2 mil impairment at their India associate.

The securities and exchange board of India (SEBI) has released a circular to disallow the usage of pool accounts for mutual funds transactions. The effective date of implementation of this latest rule is 1 July 2022. With this change, management assessed that the India onshore platform service business has significantly been impaired as the ban of pool accounts has undermined the ability of iFAST India to provide an efficient online platform service to onshore clients and business partners.

They have decided to exit from the onshore platform service business, given the restrictive landscape in India.

Aside from that, we observe that commission and fee expenses edge despite the rise in revenue.

There was also a steep climb in staff costs and other expenses, equivalent to 90% of last year’s quarterly net profit.

Small Signs of iFAST’s Operating Leverage that Eventually Fizzled Out

The appeal of iFAST is that the cost of running the financial business will not be as fast as the revenue they can earn. To put it in another way, many of the costs are fixed.

They will enjoy great operating leverage if they have made suitable investments early to support the consumers and the financial advisory firms.

So 66 times price-earnings can shrink to 16.5 times if their 3-year annual growth is 44% yearly.

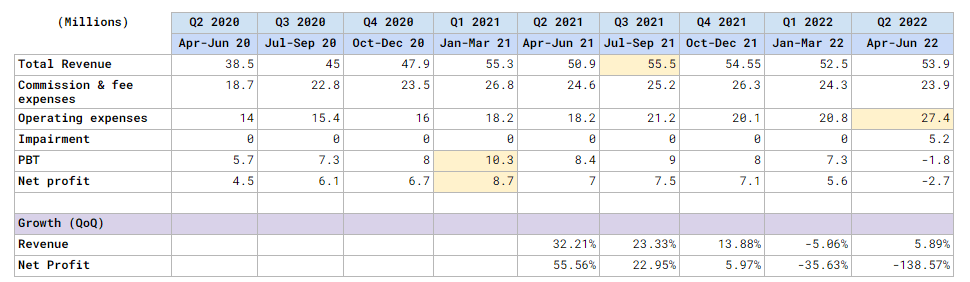

Here is part of iFAST quarterly financials for the past nine quarters:

The yellow boxes denote the peak for each category.

Total revenue peaked from Jul to Sep 2021, which is about right because the general financial market started correcting after that. This could be due to falling AUA or general cautious sentiments.

Despite the stalling of revenue, management continues to invest in various marketing and staff expenses.

The peak profit happens to be in Jan to Mar 2021 period. Ever since then, profits have gone down.

We have seen great revenue growth since the post-COVID period, which directly funnels to the net profit.

However, net profit growth has been in line with revenue growth.

However, we see more negative operating leverage where falling revenue has a greater impact on net profit.

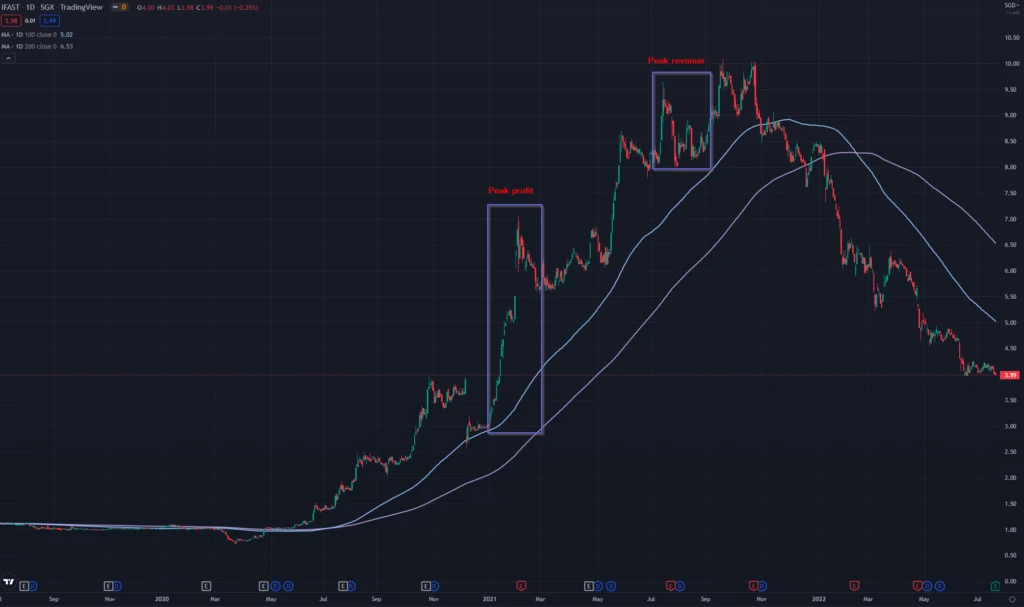

Here is iFAST corresponding share price performance:

Their share performance follows the revenue expectations, which gives investors an idea about the net profit potential.

There are a lot of future profit expectations baked into the share price.

And when the profit expectations start to disappoint, so does the share price.

Retail Investors Were Holding the Most Popular Fads

Here is a Vanguard FTSE All-World UCITS ETF chart, which can be a proxy for the developed and emerging markets.

We can see that as the market peaks, so does the revenue.

Suppose the retail crowd is less affected by the markets and continues to invest through the brokerages, and the advisory firms continue to bring in more AUA despite the shift in the market. In that case, we should see the revenue less affected.

However, that is not the case.

It will be interesting to see which FA firm is putting up a strong front, saying that they are not haemorrhaging assets during this period.

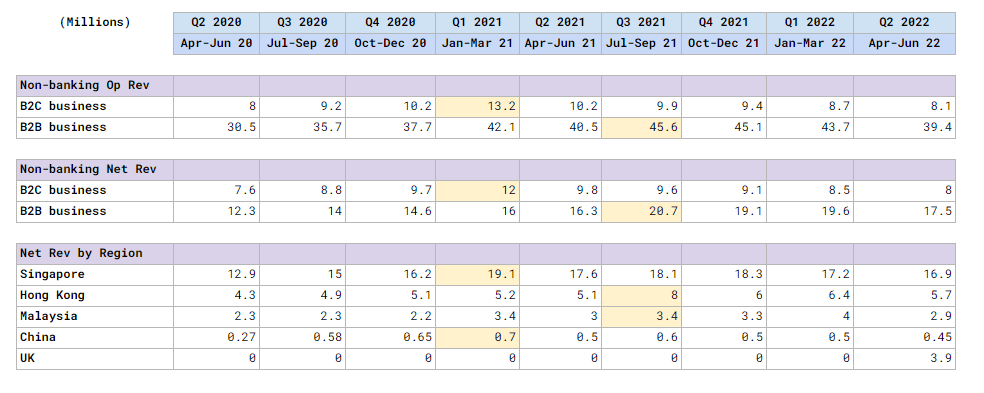

The following table shows the segmental performance:

The B2C business peaked so much earlier in Jan to Mar 2021 period.

There was a surge in revenue from Oct-Dec 2020 to Jan-Mar 2021.

As we see in the previous chart, the general developed and emerging markets were still climbing.

The retail crowd either are pulling money out… or they continue to stay invested and are bleeding badly.

After seeing the run-up, the retail crowd started getting into the latest fad, such as Ark Innovation and China tech.

This is my guess.

In contrast, the B2B money peaked the quarter before the general market turned down.

But the advisory business should be more resilient if:

- The adviser can risk coaching the clients to stay in the game

- Bring in more new monies

iFAST financial results seem to show that the advisory firms are struggling to do a combination.

Regional performance indicates that most of Singapore’s revenue peaked with the B2C business and then struggled to bring in more assets before succumbing to the negative market sentiments at the start of this year.

More or less, Singapore investors are weak hands and fewer contrarian investors.

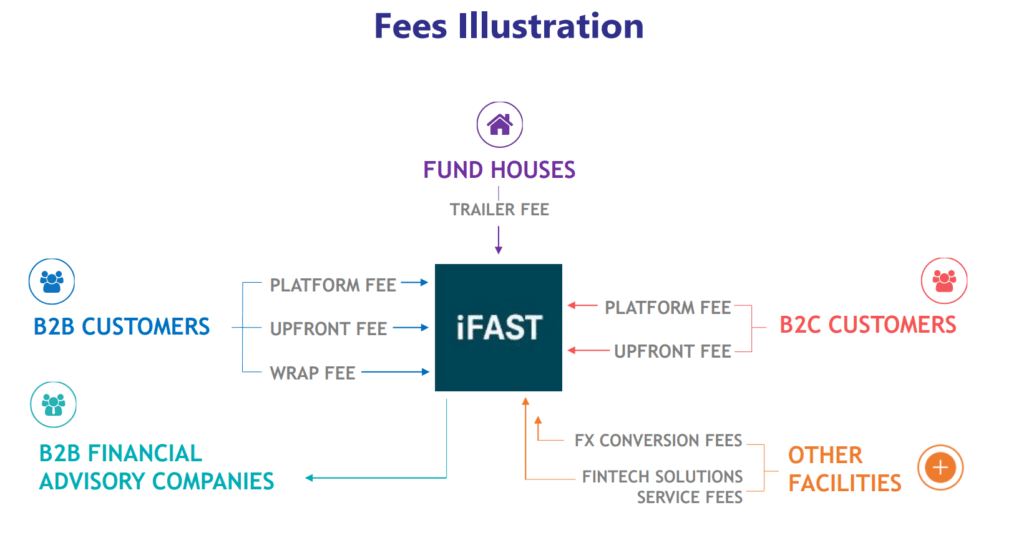

iFAST is Very Dependent on Trailer Fees

I always remember what the CEO, Mr Lim Chung Chun, said during a session at a Fifth Person event years ago. Mr Lim downplayed the impact of an outright ban on trailer fees, like in other countries, on iFAST’s business.

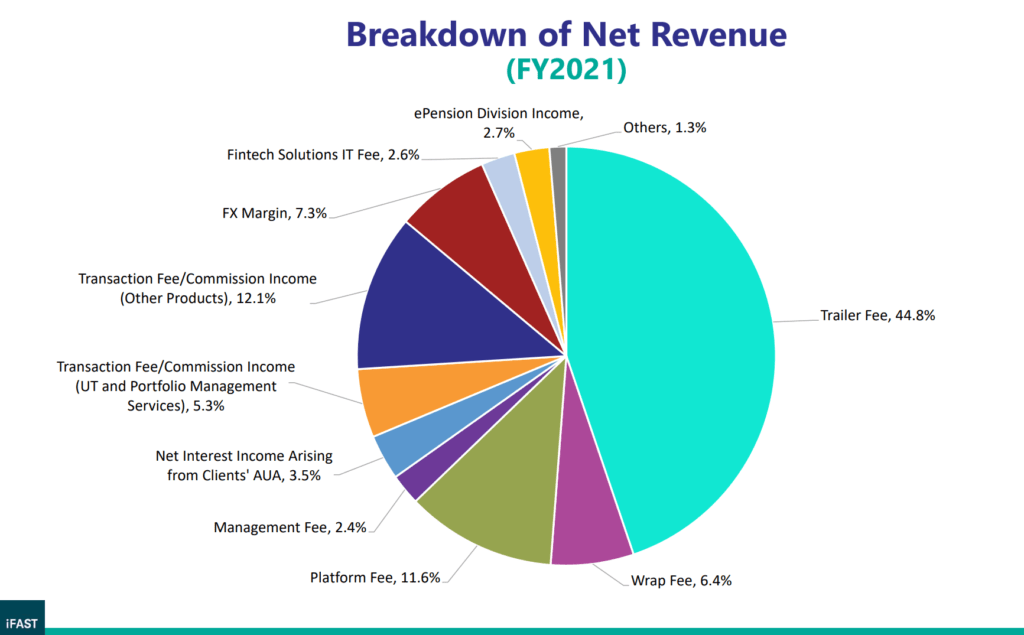

Here is a slide provided about iFAST’s revenue breakdown:

Given how big of a chunk the trailer fees make up the net revenue, I refuse to believe they won’t be impacted if trailer fees were banned. In that event, they could raise other fees, but that would make their B2C and B2B platforms less competitive versus the competition.

The FX Margin is also damn fat.

What Would Drive iFAST’s Share Price Recovery

Unlike banks, iFAST has been trying to find innovative ways to value-add to retail investors since it started in 2002-2003.

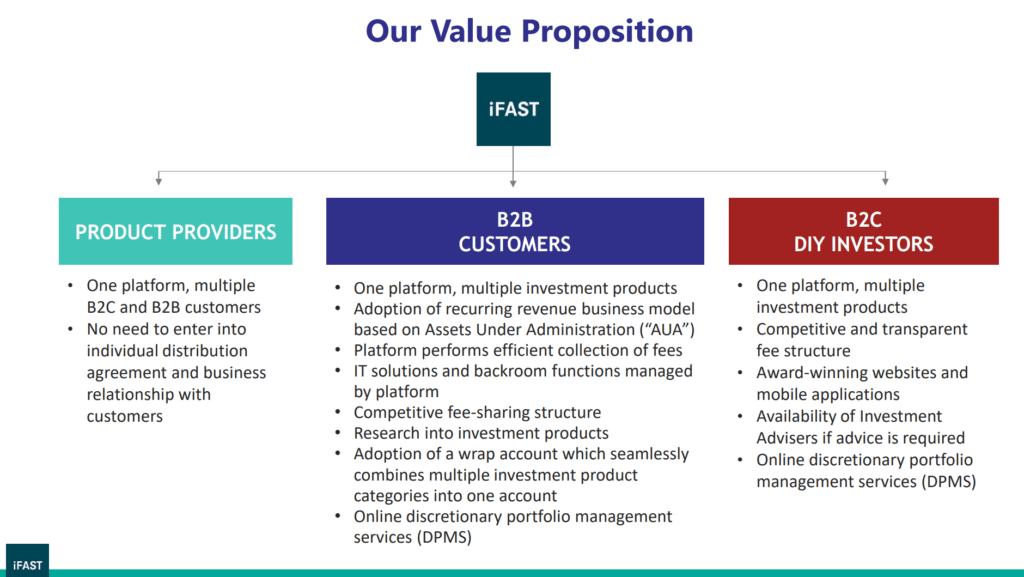

The competition in the retail B2C business is getting more intense as more and more fintech firms start rolling out their solutions. With the recent acquisition of a UK digital bank, iFAST may have dreams of leveraging on the digital bank to provide a unique breadth of banking and investment solutions for retail investors.

The competition in the B2B area is less intense.

The customers are more sticky because it is challenging to find a platform that offers the breadth of investment products and reliable enough back-end operations to get them started to go out and gather assets.

Even if there are, advisory firms have less incentive to move. Advisory firms are less sensitive to fees because their clients are less sensitive to fees unless the clients wise up.

Looking at the revenue and net revenue, we can perhaps understand why iFAST is willing to make all these investments to grow the B2C business:

- B2C: Higher margin but fickle clients. They will bank with you because having your money all over the place is tiring.

- B2B: Margins are lower, but direct clients are more sticky. The direct clients help you to go out and gather assets.

Eventually, what will restore the share price would still be the same dynamics:

- Improve breadth, advisory firms have an easier time bringing in more AUA, and retail investors bank with you

- Optimise their fixed cost after stabilisation

- The market goes up in the long run, which gives a constant tailwind to revenue

The combination of all three will restart iFAST’s engine again.

At today’s prices, a lot of optimism is still baked in. #1 and #2 don’t seem to be stabilising soon.

So this will take some time.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

Revhappy

Saturday 30th of July 2022

Have you read any of fundsupermarts recommendations? They have been bullish China and Hong Kong since 2010 and bearish on US and have been so wrong until now. Their managed portfolio in the website, they haven't updated the performance since 2017. It just feels a very dodgy company, I would stay away from them. I am surprised their stock did well when there so much better competition

Kyith

Wednesday 3rd of August 2022

Think they have updated their recommendations. Their actual recommendations is a little different.