This post explores how competitive Interactive Brokers is when it comes to commissions for trading stocks.

Specifically, my focus will be on the trading cost if you wish to do it yourself to create a low-cost, passive portfolio with exchange-traded funds.

If you are less interested in exploring Interactive Brokers as a platform for that but to trade or invest in a portfolio of individual stocks, I am sure there are some useful takeaways as well.

This post will not explore the trading cost for options, futures, forex, spot currencies, fixed income, fixed income (which should be just as competitive)

Interactive Brokers have eliminated its $10 a month Inactivity Fee

Interactive Brokers used to have a US$10 monthly inactivity fee if the amount in your Interactive Brokers account is less than US$100,000.

This US$10 fee has been a source of distress for young investors who wish to get on the platform but are not sure if it is a good idea. There are also investors who wish to get on the platform but are not willing to commit such a sum of money.

The good news is as of 1st July 2021, Interactive Brokers have eliminated this monthly inactivity fee.

You can read my post on this announcement here.

What this means that a major negative consideration for some investors has been eliminated.

It also drastically changes the comparison we will have subsequently.

The original comparison with Standard Chartered Online trading factors in a scenario where your amount is less than US$100,000.

With this change, some of the comparisons will change, to the advantage of Interactive Brokers over its competitors.

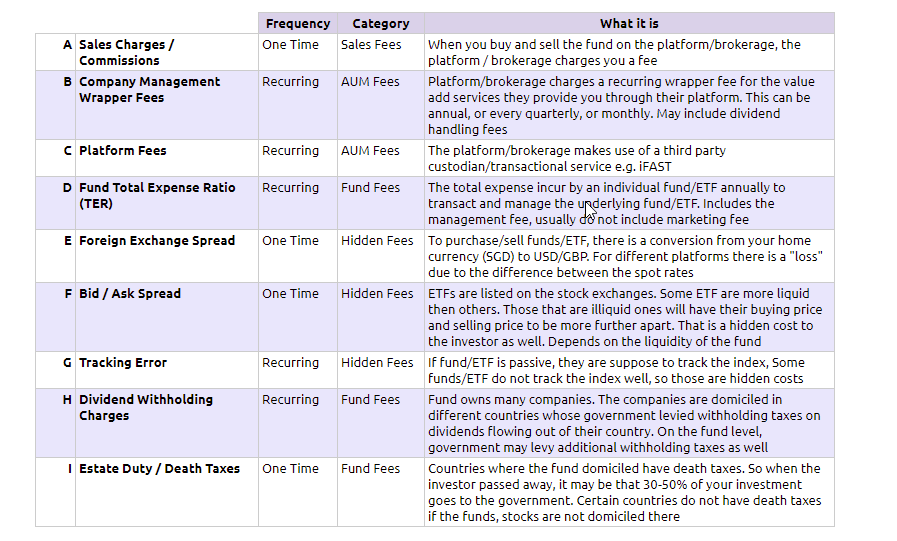

Understand the Cost Stack

If you would like to compare the cost between different brokers, it can be very daunting because you do not know what are the costs to consider.

Just like in my comprehensive guide to investing in Dimensional Fund Advisors, you should look at what you need to pay as a “cost stack”. This is a set of costs that you would have to pay.

In general, the cost stack would look like this:

- Broker commission. What your broker charges you to make the transaction

- Exchange and Clearing fees. The exchange where the shares are listed would typically charge a clearing fee. Some exchanges such as Hong Kong will have stamp duty fees. Some exchanges will have exchange fees.

- Forex conversion cost. if you are purchasing shares in a currency different from your home currency, someone would have to help you convert the money in your home currency to that of the foreign currency. This can be done by your bank, a third party agent like Transferwise, or your broker

This does not include a few other costs that you should think about if you are a fund investor such as bid/ask spread, tracking error, dividend withholding charges.

As an investor, you are trying to find a cost-efficient platform to execute your strategy.

And so you cannot just base your decision only on the broker commission or adviser/access fee. The cost stack showed us that your decisions would have to include which stocks and ETFs are more efficient to execute your strategy.

But for this article to be more general, I will not go too deep and factor in every aspect of this cost stack.

Total Cost Comparison Between Interactive Brokers and Standard Chartered Online Trading

We decide to compare Interactive Brokers to Standard Chartered Online Trading (SCB) because there are many readers who are trying to identify a platform that is the most cost-effective for them to buy-and-hold low-cost, broadly diversified, tax-efficient UCITS ETFs listed on the London Stock Exchange.

There are other platforms like:

- DBS Vickers

- Saxo

That will give you access to UCITS ETFs

There are other brokers now that are cheaper than SCB. Two that you can consider is FSMOne and the new Tiger Broker (which ironically Interactive Brokers have a stake in it)

SCB’s overseas commission rate is 0.25% with a minimum commission of $10.70 with GST. With FSMOne and Tiger Brokers, they can reach 0.08% with a minimum commission of roughly SG$10.

So clearly FSMOne and Tiger Brokers can be as competitive as Interactive Brokers. The issue is that both Tiger Brokers and FSMOne currently do not allow you to trade on the London Stock Exchange (where the UCTIS ETF is listed) but if you wish to have low-cost general trading options, those two platforms are worth considering.

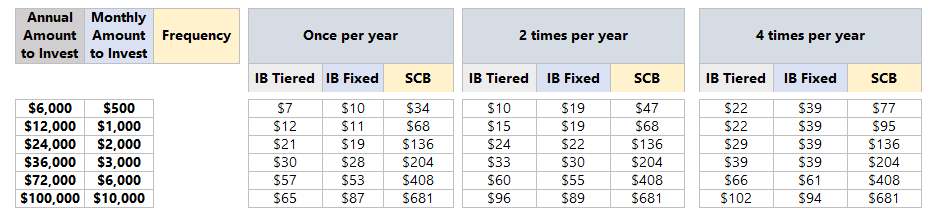

I decided to put in some capital balance at a different frequency to evaluate the difference in cost:

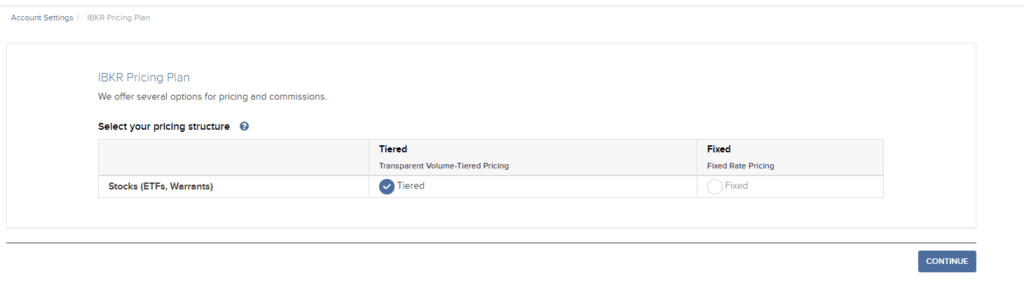

There are two sets of commission structures for Interactive Brokers:

- Tiered – The commission charged depends on your trade size. If the size is smaller the commission is lower and as it goes up the commission is higher. Clearing and Exchange fees are separated from the commission. For some who starts off smaller, this one would be more ideal.

- Fixed – Interactive brokers charged a fixed commission. This commission factors in clearing and exchange fees.

Whether it is Tiered or Fixed, Interactive Brokers has a much cheaper commission per trade compared to SCB.

IB Tiered commission is better if the invested amount is smaller while IB Fixed may be better if you are executing a larger transaction size.

As an Interactive Brokers client, you can go to the account setting and switch between these two modes. They will need one day to be activated.

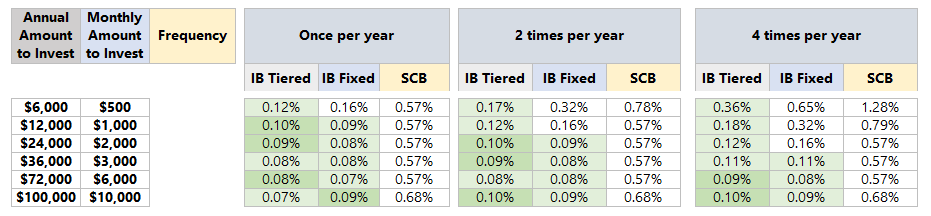

To allow you to compare against other prospective brokers, I have compiled the annual investment cost as a percentage of the annual amount to invest.

In this way, I think it is clearer.

With this annual investment cost, you can compare against other brokers.

Interactive Broker’s Near Spot Currency Conversion Gives the Broker a Big Advantage over Competitors.

The biggest advantage of IBKR or IBSG is their currency conversion rate.

If you wish to invest overseas, it is likely you will need to convert your SGD to USD, EUR, HKD or GBP.

There is a one-time or many-time currency conversion fee levied.

- Local brokers typically will have a spread of 0.30 – 0.60% over the rates you see if you check the forex rates at an independent site.

- For SCB, their Live FX allows me to get a spread closer to 0.20 – 0.30%. (See my experience here)

Interactive Brokers have a currency advantage in that the conversion cost is about S$2.80 flat plus a rate of 0.2 basis points (this reads 0.002% vs the 0.30% of SCB and 0.50% of some traditional brokers)

The currency conversion advantage helps extend IBSG and IBKR’s lead in their overall cost stack over other competitors.

Interactive Brokers Tiered Commission Structure

In the tier commission structure, you are charged based on your trade size. Different markets have different tiers.

You can review the commission pricing here. You can also find the exchange and clearing fees there.

Let me highlight some common ones:

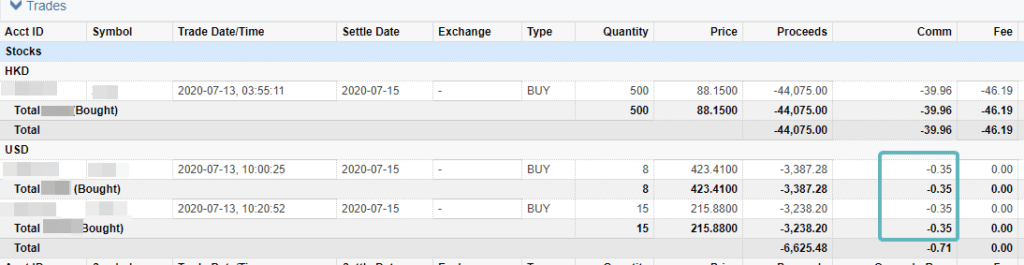

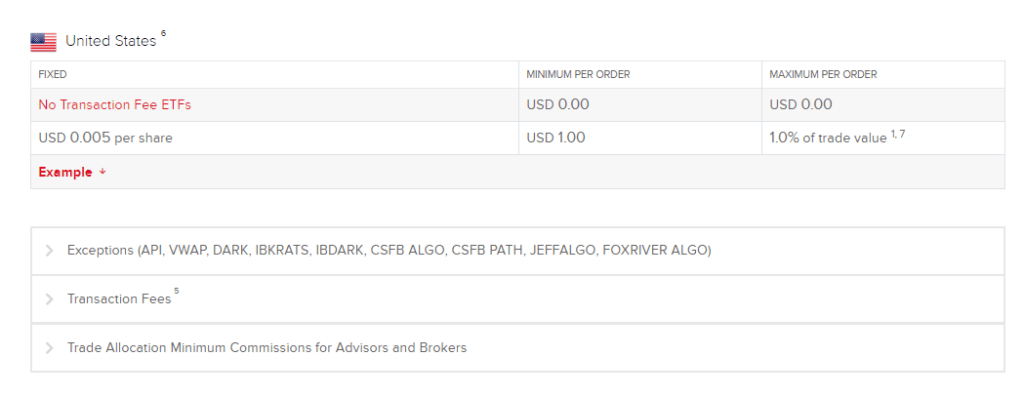

Most of us should trade with a volume of fewer than 300k shares. The minimum commission is US$0.35 which is very cheap.

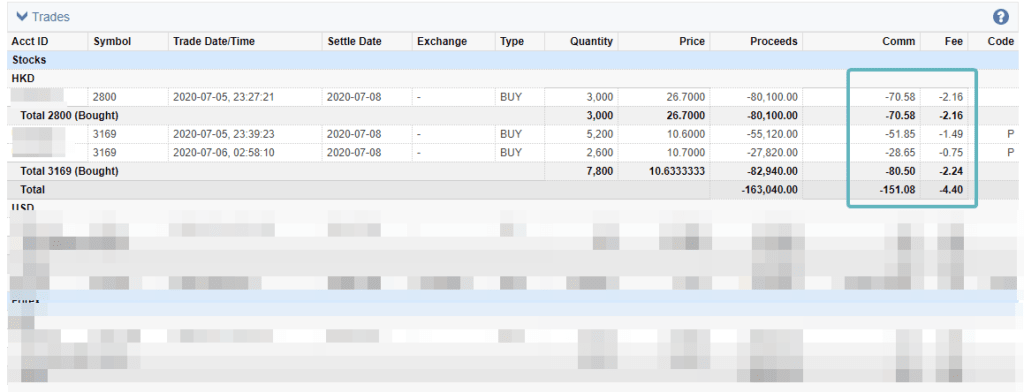

The report above shows the tiered commission. The report typically separates exchange and clearing fees from commissions. In this case, there aren’t any fees.

US$0.35 is less than the US$1 fixed commission if you choose the tiered pricing.

Based on my trade size the commission rate is 0.01%. If you include a $2 currency conversion charge, this becomes 0.07%.

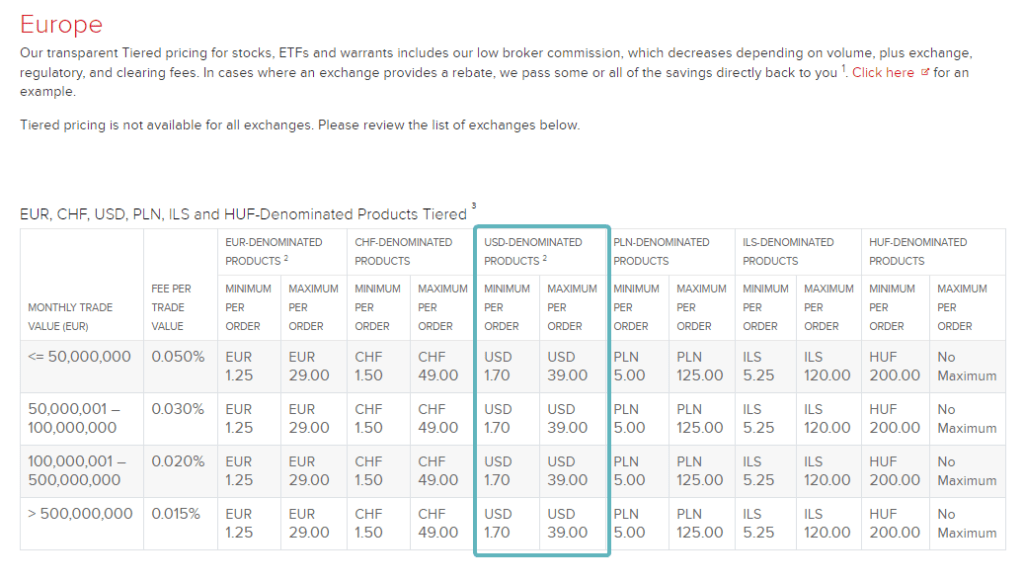

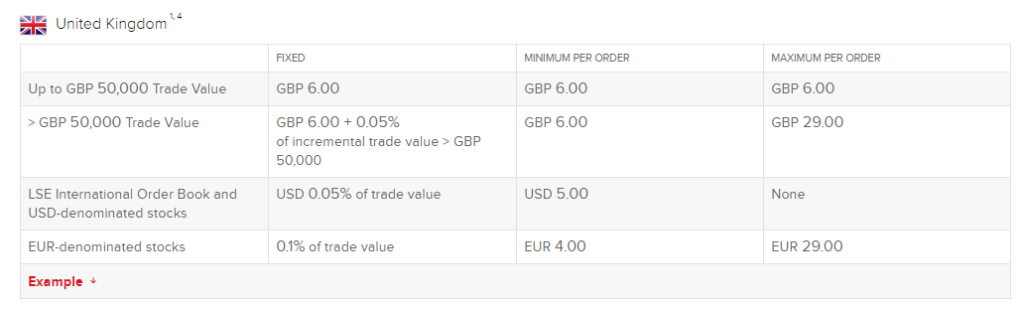

If you invest in low-cost UCITS ETF listed in the London Stock Exchange, and they are denominated in USD, then your cost would be between US$1.70 to US$39.0. The fee works out to be 0.05%.

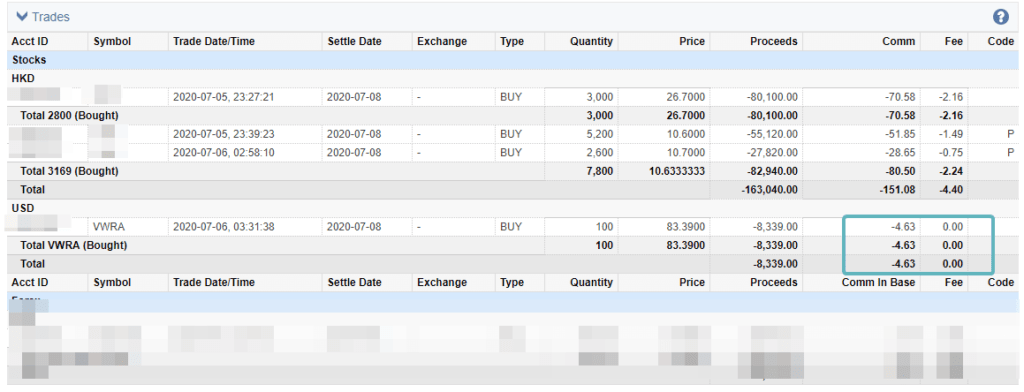

In the above transaction, the tiered commission works out to be US$4.63. This is lower than the US$5.00 fixed commission but barely.

This works out to be 0.055%. If you include a $2 currency conversion, this becomes 0.08%.

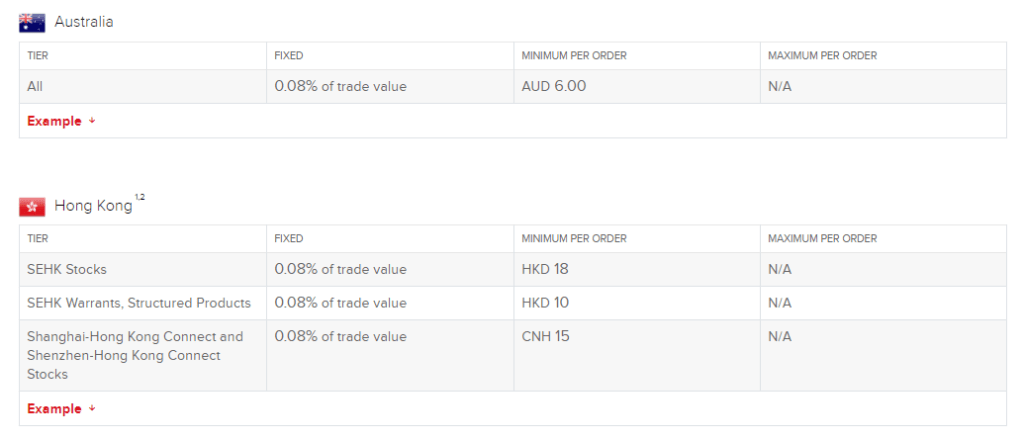

Here is the Australian tiered fees.

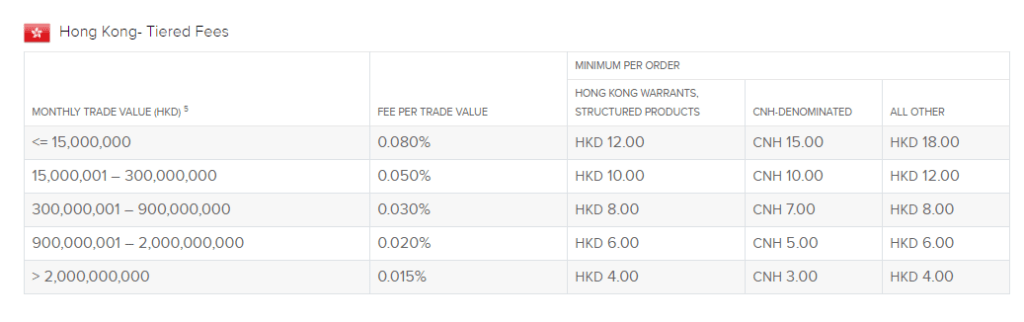

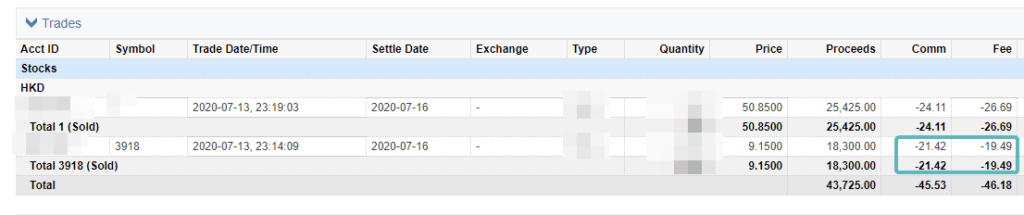

Finally here is the tiered fee structure if you trade the Hong Kong markets. In general, the fee is 0.08%.

In general, my commission will hit 0.09%. However, with the exchange fees (under the fee), my average cost comes up to 0.19%.

I realize we cannot reduce this.

The bulk of the cost is a 0.10% stamp duty.

However, if we are purchasing ETF listed on the Hong Kong stock exchange, the 0.10% stamp duty goes away. This becomes much cheaper.

Interactive Brokers Fixed Commission Structure

Here is the various commission pricing under the fixed commission structure:

I find that if your account balance is more than US$100,000 and your trade size is more than $1000, the difference between Tiered and Fixed is not a lot.

How to Switch from Fixed Pricing Structure to Tiered Pricing Structure

You are not tied to one standard commission structure. You can switch between the two when your needs change.

The change should take 1 day.

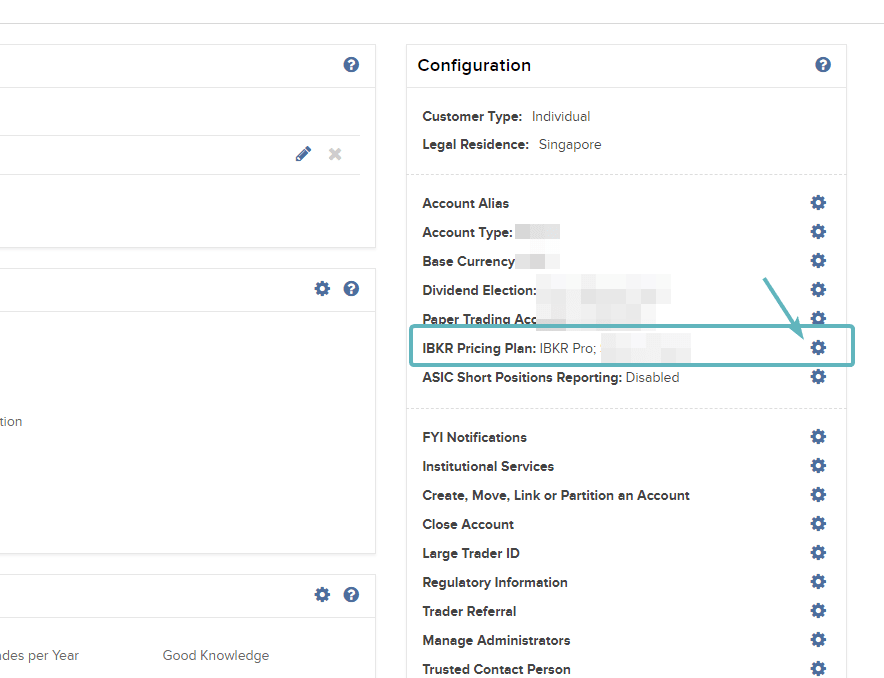

Login to your Interactive Brokers on your Desktop.

Go to Account Settings > IBKR Pricing Plan.

The interface is a bit of a problem. It does not tell you this is where you change the pricing structure.

It just reads IBKR Pro!

If you manage to get in, then you can change accordingly.

Conclusion

In general, I feel that if we considered all the forex, exchange, and clearing, broker commission fees, Interactive Brokers is very compelling.

The cost should be an important part of the consideration but other aspects matter as well. You would want a platform that you know has been around for a long time, more consistent than not, have a breath of markets to trade, and a breath of products available to you.

Interactive brokers are very cost-competitive to trade other financial instruments as well (that I have failed to explain here)

At the end of the day, don’t spend all the time saving on commission, focusing on the trees and not see the forest.

Eventually, your asset allocation, stock selection, and execution may outweigh the importance of cost.

Try your best to get an acceptable overall cost, then focus on investing.

My Comprehensive Interactive Brokers How-to Guides

Interactive Brokers is a great low-cost, financially strong brokerage platform that can be the standard broker for holding your long-term investments. You can access 150 global exchanges, including exchanges such as Singapore, the US, Hong Kong, London, European and Canada.

You will enjoy cheap commissions and zero minimum recurring platform fees or maintenance fees. Convert your funds to different currencies at near-spot rates, paying a flat US$2 fee.

To get started or become familiar with Interactive Brokers, check out my past articles on how to invest with Interactive Brokers. I hope the guides make your life and investing experience easier and brighter.

An Easy Step-By-Step Guide to Setup Interactive Brokers (IBKR)

How to Fund & Withdraw Funds from Your Interactive Brokers Account

How to Convert Currencies in Interactive Brokers

How to Buy and Sell Stocks and Securities on Interactive Brokers

How Competitive are Interactive Brokers Commissions Pricing?

How Safe is it to Custodized Your Money at Interactive Brokers? The things they do better than other brokers.

How Safe is it to Custodized Your Money at Interactive Brokers (2)? Financial strength of IB during recent banking crisis and during Great Financial Crisis

Interactive Brokers have Eliminated the US$10 monthly inactivity fee. More details here.

How to Transfer your shares from Standard Chartered Online Trading to Interactive Brokers

How to trade after-hours and premarket

Create Customized Reports and automatically send them to your email

What is the PortfolioAnalyst Report and Automatically Send the PortfolioAnalyst Report to Your Email

Send Money from TransferWise to Interactive Brokers

Interactive Brokers’ Fluid Interest Income on Cash

Introducing IMPACT by Interactive Brokers

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Albertu Gu

Sunday 25th of February 2024

Interactive Brokers have a currency advantage in that the conversion cost is about S$2.80 flat plus a rate of 0.2 basis points (this reads 0.00002% vs the 0.30% of SCB and 0.50% of some traditional brokers)

Keith 0.00002% = 0.2 bps points is wrong

0.2 bps is 0.002%

1bps is 0.01% 100bps is 1.00%

Kyith

Friday 1st of March 2024

Hi Albertu, thanks for the heads up.

Ben

Monday 16th of May 2022

Hi Kyith,

*** Problem statement: *** I just started investing into UCITS ETFs listed in the London Stock Exchange like the VWRA & CSPX using IBKR after much research on the internet. However after 3 months into the DCA, I realised that we cannot buy fractional shares for UCITS ETFs which is quite a big problem given that I can only allocate SGD 300 & 400 per month for VWRA & CSPX respectively at the moment.

Additionally, buying UCITS ETF via IBKR also comes at a higher total commissions & fees as compared to that of US listed ETF such as QQQM (USD 2.02 per trade for VWRA/CSPX vs USD 0.37 per trade for QQQM).

*** Questions: *** 1a) Does the lesser withholding tax (15%) on UCITS ETF like VWRA/CSPX really outweigh its cons of higher total commissions & fees (5.45x that of US listed ETF per trade) for investors with long investment horizon >15 years & who seek to do monthly DCA via IBKR?

1b) Where exactly does this withholding tax apply to the ETF that we buy? Issit applied to the dividend that we suppose to receive from the ETF? Or issit applied to the capital gain/loss that we suppose to receive once we sell the ETF in the future?

1c) If the answer to Q1b is the former (i.e., withholding tax applies to the dividend that we suppose to receive from the ETF), I also received the information from IBKR representative (excerpt provided as below) that ETFs bought via IBKR aren't eligible for Dividend Reinvestment Program (DRIP). And if this is indeed true, don't you think that the withholding tax concern between US listed and UCITS ETFs actually doesn't really matter anymore & therefore, we are probably better off buying the US listed ETFs owing to their lower total commissions + fees?

" Please note that ETFs are not eligible for the Dividend Reinvestment Program. Only U.S. and Canada-listed common and preferred stocks paying cash dividends are eligible for reinvestment. For more information on Dividend Reinvestment Program, you may refer to the following webpage: LINK../2730"

2) Do you have any recommendations for low cost US listed ETFs which are equivalent to VWRA & CSPX please?

Thank you!

- Ben -

Kyith

Monday 20th of June 2022

I think you can read this on dividend withholding tax: https://investmentmoats.com/money-management/guide-dividend-withholding-tax-interest/ And this on estate tax duty: https://investmentmoats.com/money/4-potential-ways-to-estate-tax-proof-your-investments/

The issue with going for US ETF is the potential estate tax when the investor passes away. It could come up to 18-40% of the investors portfolio value.

I think if your invested sum is small, just go for one ETF. it is ok not to have fractional shares. just save up and invest in a quarter.

CH

Saturday 30th of January 2021

Hi Kyith, thank you so much for the guide. It is really well-explained and this is one of the few guide that I found really helpful!

Question regarding the Standard Activity Fee = USD10 - Commissions, does the commission include the USD2 Forex fee? I.e. If I made convert SGD to USD (incurring a USD2 forex fee) and buy a stock (incurring a USD1 transaction fee), is the activity fee USD8 or USD7?

Kyith

Saturday 30th of January 2021

The USD 2 is a commission, so it should be counted in the computation. You can refer to this page here: https://www.interactivebrokers.com/en/index.php?f=1590&p=fx

IW

Wednesday 20th of January 2021

Great article, thank you! Very useful info.

I started using IBKR and realized a number of LSE ETFs are not available - I'd have to buy through other exchanges such as in Switzerland. e.g. for iShares Core S&P 500 UCITS ETF, 'CSPX' on the LSE is not available, but there is 'CSSPX' which is in Switzerland. e.g. for iShares NASDAQ 100 UCITS ETF, 'CNDX' on the LSE is not available, but there is 'CSNDX' which is in Switzerland. Did you come across this issue (you mentioned investing in LSE ETF)? I would think there might be a differences in costs / liquidity / bid-ask spreads when having to go through a non-London exchange.

Thanks!

Kyith

Thursday 21st of January 2021

HI IW, the symbols are called different names on the LSE. You can refer to this IBKR LSE List here. CSPX is CSSPX and CNDX is CSNDX.Bot seem to be listed on LSE leh

J

Monday 4th of January 2021

how about the market data subscriptions? do u use a free version of trading view for eg? IBKR charges quite alot for market data

Kyith

Monday 4th of January 2021

Hi J,

I make use of the Snapshot functionality to get the most up-to-date prices before I place an order. I do not trade so much so I make use of Trading View or other platforms to look at the prices.