It was around 2012 or 2013 that I first encounter this thing called financial independence. What I learn to open my eyes to the possibility that maybe I have an option to spending the next 30 years of my life working.

One of the first things was to figure out: How much is enough? How much do we need to be financially independent?

I realize that even if I have worked out the amount I needed to be financially independent, I am not entirely sure if I have understood all the assumptions and have not missed out on anything big.

I wrote a post explaining to people how to derive the amount of wealth they need to be financially independent.

It was very much based on a dividend investing model.

Today, I deleted that entire 4,000-word post and re-wrote it.

Don’t get me wrong, it is not that the dividend investing model does not work. I just find that you can invest in different ways to reach the wealth needed. Even when you spend down the money, it does not need to be just based on dividend income.

After looking at this space for the 6 years since I first wrote the article, I have some deeper perspectives about this topic.

It probably also helped that I worked in a firm whose specialization is to help people with wealth plan their financial independence.

The main purpose of this article is to help you derive how much you need to be financially independent.

But we all have different interpretations of what is the kind of financial independence that you are looking for, so it is not a straight forward answer.

To cut the long story short, if you know your annual expense, if your aggregate wealth is more than 30 times your annual expenses, you are probably very close to being financially independent.

If your aggregate wealth is less than 10 times your annual expenses, you are very far off.

If your aggregate wealth is between 10 to 30 times, then I think better read on, because it is not so straight forward.

We Will Just Cover the Math Aspect of Financial Independence

To limit the scope of discussion, what I will explain today is the financial aspect of financial independence.

The lifestyle aspect is a very important component, but I would prefer to leave it to another article.

What We Will Cover in This Article

I will sought to address the main question on how to determine a financial independence number.

However, from what I learn over time, being financially independent is not a situation where you hit a certain aggregate wealth, you are ready and you could pull the plug on your job.

It is also very de-motivating for many that they will not hit the aggregate wealth needed.

A large part of how much you need is determined by the life that you wish to build. So we will spend a little bit of time discussing the lifestyle and what is an appropriate close aggregate wealth estimation that you need to work towards.

Your decision to pull the plug invariably depends on how comfortable you are with your financial situation. Comfortable is both determine by number but also psychological, so we will spend some time looking at balancing knowing that you have enough mathematically and feeling you have enough.

I feel your conviction depends on knowing that you have covered most of the things you need to know. One area is the financial math behind financial independence. So I will explain enough but not too detail.

Lastly, over the years, there were a few questions asked about financial independence so I will seek to address them in a question and answer format. (After you have read it, if you still have unanswered questions, let me know. I will try my best to answer them and put it up here)

This article is kinda long, so you can scroll to the section that interest you, or just bookmark and read over a week.

Let us get down to this discussion.

Why Should We Pursue Financial Independence at All?

I really like this quote about financial independence:

Live a financial independent life before financially you are independent.

What it means is that we should all find a job that we

- Are intellectually, technically or professionally challenged

- There is progression

- Feeds the family and yourself well

- That we would not want to quit

At the same time, we lead a fulfilling life with our family.

In this way, we do not need to think about being financially independent. If you live a life that is so good, so balanced, why would you wish to stop?

Unfortunately, this is not the case:

- Some of us work in jobs that are a bit bullshit

- We can be good at what we do but we don’t find meaning in them. Long term wise we don’t see ourselves being in these job

- Our jobs take up so much of our time that we do not have time for our family or pursue our own endeavours

What is likely to happen is that we will transit our lives from one phase to another phase.

We often do not handle transition well because there are a lot of uncertainty involve. We do not know whether the changes are going to work out for the better or worse.

A large part of the anxiety has to deal with whether our family and ourselves will be Ok. Do we have food on the table, our utilities can still run, we can still take public transport?

Basically, will we be able to maintain our current quality of life?

In Financial Independence, we try our best to build up our wealth so that our wealth can enable us to transit from one phase of life to another.

When we have wealth, we can cash flow our wealth to give income, which we can spend for our expenses.

Your wealth act as a form of unemployment insurance, or as an airbag if your career transition did not go according to plan.

A final progression of financial independence is when you decide that you are not going to get regular income from your daily living.

In this case, you need to have a recurring income stream and you will need to build up wealth for that.

This final phase would be retirement.

In this article, I will provide examples of why some of my friends pursue financial independence and the kind of financial independence they chose to pursue.

You Need Wealth to Facilitate Financial Independence

So we have established that we need to build up wealth for our financial independence.

If you have built up your wealth, you can find a way to cash flow your wealth to provide the income you need in financial independence.

I will not cover the wealth building aspect, but in a previous article, I have written about a simple wealth blueprint. Most of the people who manage to build wealth well would do most of the things in this article.

What is considered wealth?

Let us define wealth a bit. Wealth is quite a broad term but in essence to me are assets that retains and grow value over time.

The following is a simple but not exhaustive list:

- Cash & equivalents

- Individual stocks and bonds

- Different kind of managed funds (unit trusts, hedge funds, boutique funds)

- Investment properties

- Manual/automatic trading strategies (if they work)

- Alternative investments (Art, Gold and Silver, Wine)

Most of you would have a mixture of these.

Each of these assets have a specific profile of long term growth rate, volatility and the effort needed to generate the long term growth.

How do I cash flow to provide income?

I like to use the phrase “cash flow” better than income but I think the industry out there prefers to tout income.

It gives people the idea that you need some managed fund that deliberately provides an income to have income for financial independence.

There are many ways to cash flow:

- You have $10 million in cash and equivalent and then you just spend it. Redeem your fixed deposits and you can spend it

- Some stocks provide dividend income, bonds provide coupon interest income

- You can sell some of the shares you own to cash flow. You can also sell some of your bonds to cash flow it. Usually we do this when the dividend and interest income do not cover it enough

- Some managed funds provide income. For others, you can sell some of the units and it provides a cash flow.

- Investment properties provide net rental income

- You can also cash flow your properties by selling one out of 10 properties

- When you trade, you have gains, which is deposit in your trading account. Transfer them out and you have cash flow

- Sell some silver coins or artwork

When you cash flow, you have income.

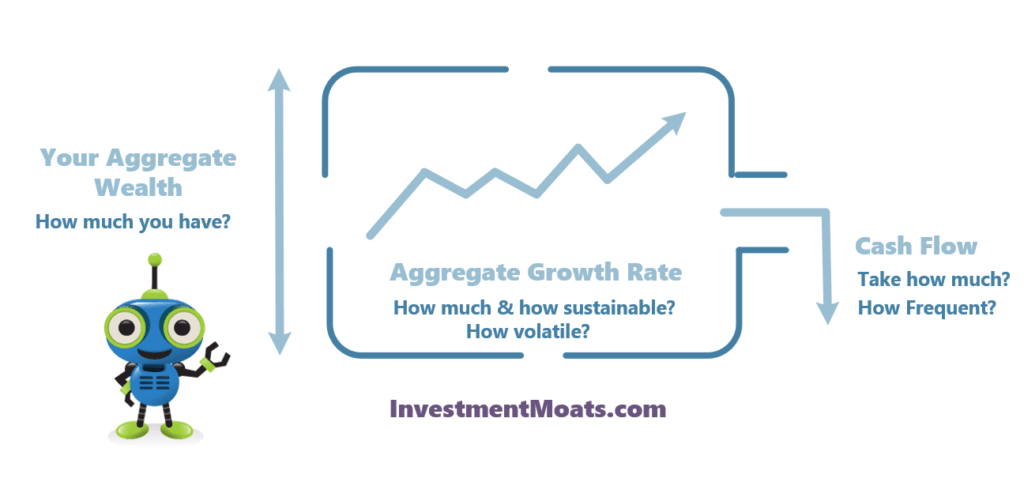

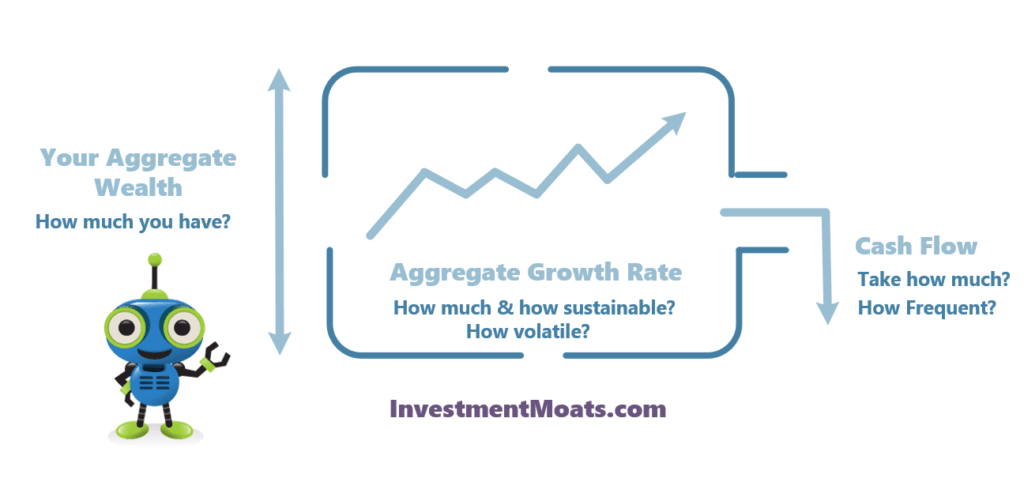

Wealth x Cash Flow x Rate of Return Determines How Long Your Stream of Cash Flow Is

We all want income and we all want our wealth to last.

So how do we have both? You need to take care of the interplay between 3 factors:

- The amount of wealth in aggregate you have

- How much and how frequent you cash flow your wealth

- The ability to generate a decent, sustainable, long term rate of return

A large part of the money-side of financial independence is the management of these 3 factors.

If you want a secure stream of cash flow that last for a long time that takes care of all your expenses, you need to

- Have as much aggregate wealth

- A sustainably high and low volatile growth rate

- Withdraw less

If you don’t manage it well, your stream of cash flow ends prematurely.

Our problem is that… we don’t live in a perfect world. We may not have unlimited financial assets; our expenses may be high and it is challenging to find financial assets that give a good rate of return.

So we have to do our best.

Usually, you need to do two of the three well.

Here are some examples:

- You have $15 million in fixed deposits and withdraw $50,000 every year. High aggregate wealth, low rate of return, low withdrawal.

- You have your own quant model that generates 15% rate of return a year on $500,000 with low volatility. You withdraw $30,000 a year. Low aggregate wealth, high rate of return, average withdrawal.

- You have $1 million in a managed portfolio generating a low volatile 4% a year in the long run. You withdraw $15,000 a year. High aggregate wealth, low rate of return, low withdrawal.

We all have our own circumstances, different access to different financial assets, and need different amount of income for our needs.

Recognise that there are constrains and find your sweet spot.

Many folks have the idea that once they reach retirement, they will sell off all their assets and put them in cash. It might work for someone very rich, but for a lot of us, we still need our wealth to grow.

If not, we will run out of money faster.

I do observe that if the rate of return is very volatile, we tend to run out of money faster as well.

It is a dream of everyone to have a financial asset that generates high yet low volatile returns. Let us hope someone creates something like this next time.

Roughly How Much Do I Need to Be Financially Independent?

I am going to give you a quick and dirty way to determine how much you need to be financially independent.

You will need to work out 2 figures:

- Your Aggregate Wealth. In the previous section, I have shown you what are considered wealth assets. Add them up.

- Deduct any mortgages or debts on the financial assets. We want to know the equity value

- Don’t include your residential property. You need somewhere to live.

- If you are willing to rent instead, then include the equity of your residential property.

- If your home is both a home and investment, then you got to freaking think what is your long term plan. What I would do is think of where you would live today instead of this place. Find out how much it cost today. Calculate how much you will get from selling off this home and then buying the other to live in and how much residual amount you have left

- Your Annual Expense. In order to know how much, you need to withdraw from your wealth, you need to know how much you need. Each of you need different amounts

- Your family’s annual expense

- Your most essential expense or your survival expense. You may just want to be assured that you can cover your family or your most essential needs

- A portion of your spending. You may just want to cover some aspect of your life. E.g. twice a year vacation.

- Your expense may be just once every few years. In this case, do an estimation. If you think you need $30,000 every 3 years, then take annual expense to be $10,000 a year

Okay, once you work your aggregate wealth and annual expense out, take your annual expense divide by your aggregate wealth.

You will get this initial withdrawal rate. As the name suggest, this is the initial amount of cash flow you will withdraw from your wealth to provide the income to spend.

If your withdrawal rate is:

Greater than 10%

You are probably still not there yet. You still need to work on getting this initial withdrawal rate down to a lower number.

A lot of folks will start off here and languish here for a long time. I will give you some example.

You are 5 years into your job and have a small family. Your annual expense is $40,000 a year. Your aggregate wealth is $70,000.

The initial withdrawal rate will be 57%. Still very far off.

Between 10% and 3%

You may be financially independent but to a different degree.

For some of you, you may have reached your goals.

For others, your wealth can provide you real utility to augment your life. But you need to have a deeper conversation with someone who can enlighten you the possibility of financial independence and lifestyle redesign.

This may involve

- Being more focus on wealth accumulation

- Know your family and your philosophy to life, values and spending better

- Re-allocating your wealth assets into a better asset allocation

Being in the financial blogging space, I do have fair bit of friends here. One of them has an annual expense of $48,000 for the family of 3 and their aggregate wealth is $1.1 mil.

The initial withdrawal rate is 4.3%.

He could be financially independent but a lot will have to depend on his family’s circumstances.

Less than 3%

Based on your spending and the amount of aggregate wealth, you may have enough to last a long time.

Like 40 to 60 years or even perpetuity.

However, this may involve re-allocating your wealth assets to a better asset allocation.

A lot of the bosses of small, medium enterprises end up over here.

Their annual expenses maybe $240,000 a year but their aggregate wealth is $24 million. On a smaller scale, there are also folks who just wish to ensure that they cover their food, transport, and household utilities for their family which comes up to $14,000 a year and they have an aggregate wealth of $700,000.

A Different and More Easy Way of Determining How Much You Need to Accumulate to Be Financially Independent

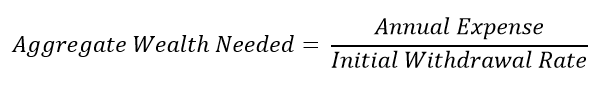

The initial withdrawal rate can give us a rough estimation whether we are closer or further from the goal.

However, we would usually wish to know the amount that we need to accumulate to. By re-arranging the formula we can identify a better representation:

So if my annual expense is $30,000 a year and I wish to reach a 10% initial withdrawal rate, then the aggregate amount of wealth needed is $30,000/0.10 = $300,000.

If I aim for a 3% initial withdrawal rate, then it is $30,000/0.03 = $900,000.

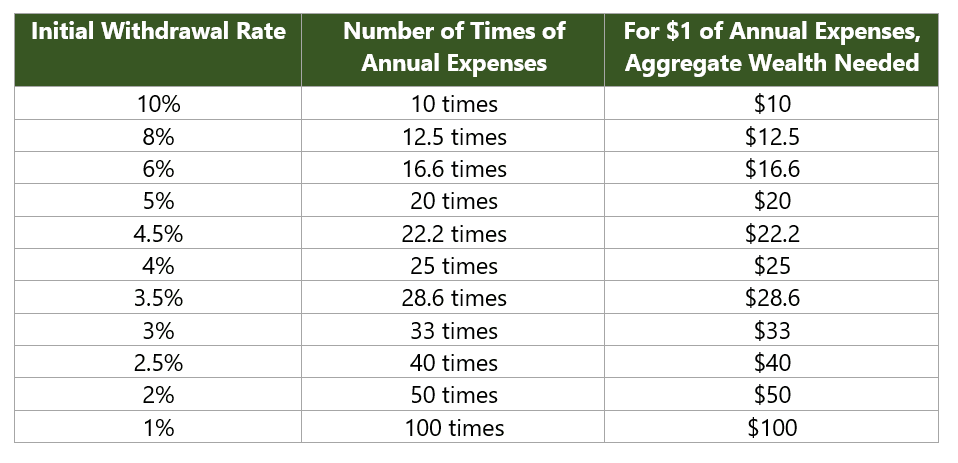

If we treat our annual expense needed as $1, then we will need:

- 10% initial withdrawal rate: $1/0.10 = 10 times our annual expenses

- 3% initial withdrawal rate: $1/0.03 = 30 times our annual expenses

I think it is pretty easy to look at things as the number of times your annual expenses. You can focus the conversation on how much is your annual expenses, then determine whether you have 10 times, 20 times, 30 times that.

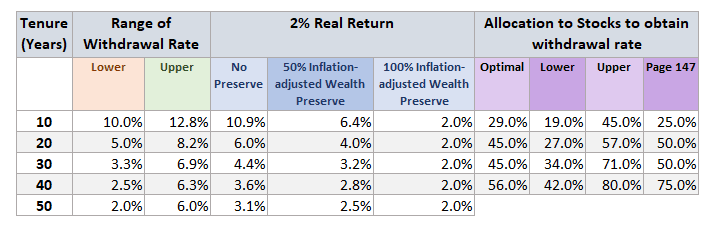

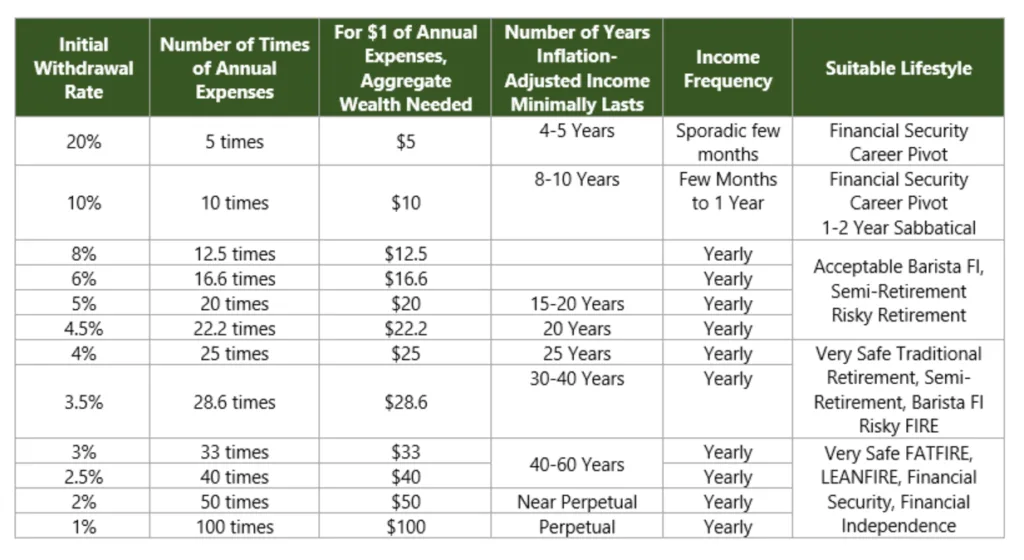

Here is an easy lookup table:

Let me know in the comments section which way do you think it is easier.

Personally, I really like the idea that I can track how much my family spends on food, I got a figure of $5,000 a year and in order for me to have an inflation-adjusted stream of cash flow, I would need $5,000 x 33 = $165,000.

Why Would Some Be Financially Independent but Others Not Be Financially Independent at the Same Initial Withdrawal Rate?

If you have computed your initial withdrawal rate and it lies between 3% and 10%, you might have enough or maybe not enough.

This answer may sound very unsatisfactory but the reality is that each of our financial situations are different, what we need is also different, and what we are aiming for is different.

You have to figure out what kind of lifestyle you want ideally.

Then, you will have a better idea whether you have enough to be financially independent or not.

In general, whether you have enough depends on:

- Your desired financial independent lifestyle

- How fool proof or secure you want the plan to be

There are a Few Types of Financial Independent Lifestyle. The Aggregate Wealth Needed is Different.

Retirement gets a very bad connotation because more and more people could not resolve why we need to stop work when we enjoyed our work.

In modern times, we have more options, some have greater salary than olden days that we want to live a life very different from the traditional path.

What has been the rage in the past years are people coming up with all sorts of different names for different kind of financially independent lifestyle they designed.

You may have heard of F.I.R.E. It stands for financially independent retire early. This topic got so hot that MarketWatch devoted a section for the topic.

Some of your wealth would be enough for certain types of financial independence while for other types, you need to accumulate more.

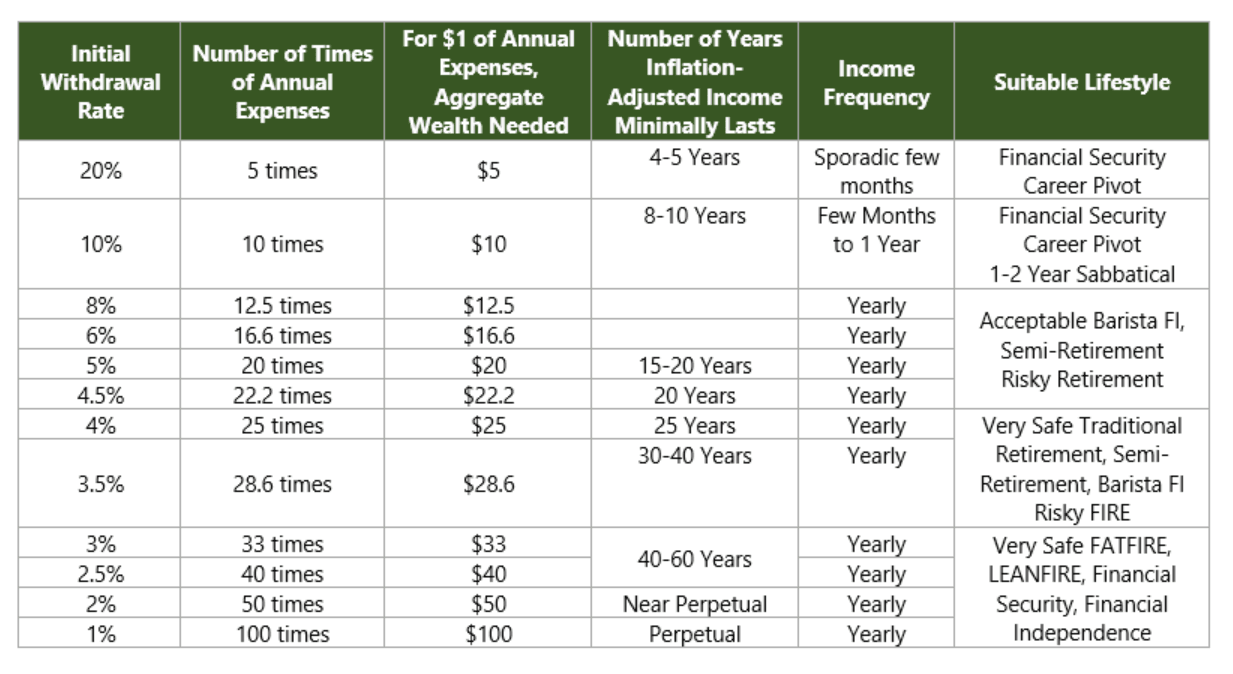

I have expanded the table before to let you see roughly how long of an inflation-adjusted income stream you could draw if you hit a certain initial withdrawal rate and how useful is this withdrawal rate for the desired lifestyle you wish to pivot to:

You will notice is that at certain initial withdrawal rate, the wealth can’t last for a long time. However, accumulating this amount unlocks certain desired lifestyle choices.

Many are aiming for a full financial independence, but if you go down this path, even if you do not get there, other desired lifestyle might be very useful for your family.

I will go through some popular ones here today but this list is not exhaustive.

In general, each of these type of financial independence differs on the following parameters:

- The frequency of cash flows you need

- How flexible you can tolerate your cash flow to be

- Frequency of work

- Duration of income you need from your portfolio

1. Traditional Retirement. The traditional path is to work for 40 years and retire at 65 years old. You will stop working, enjoy a leisure lifestyle then passed away. You will not work.

Depending on your life expectancy, you may need your wealth to last from 25 to 35 years.

An appropriate initial withdrawal rate will be between 3% to 4%.

2. Early Retirement (F.I.R.E). Same as traditional retirement but for some with greater earnings potential or investing prowess, they have accumulated their wealth in a shorter time and would like to stop working.

How Early?

Some did it in their 30s, some 40s, some 50s. The benchmark is to compare to the traditional 65 years old.

They need an annual cash flow and usually they cannot tolerate variability in their income.

The duration they need the income may be 30 to 60 years.

An appropriate initial withdrawal rate will be between 2.5% to 4%, mainly depending on the duration of your retirement. The longer the duration, the lower the initial withdrawal rate needed.

3. FATFIRE. This is a modification of #2 early retirement. There are some that was able to have very strong cash inflow from work or business at an early age. It allows them to accumulate a lot of money.

Yet, they wish to be very comfortable with their lifestyle and that means a comfortably larger annual expense. Because of their strong earning power, many felt that if they leave their job, they might not get that earning power again, so they would rather err on the safe side and have a low initial withdrawal rate.

So large expenses x low initial withdrawal rate (usually 2-3% initial withdrawal rate) means they need a large sum of money.

Due to their earning power they are able to.

4. LEANFIRE. This is a modification of #2 early retirement. Compared to FATFIRE, LEANFIRE is at the opposite end of the spectrum in early retirement.

Some have a very frugal lifestyle. They do not need to spend a lot for their family.

The official cut off is that they spend less than US$40,000 a year. For some in the states in mid-America, they can survive on US$15,000 a year. Thus based on 4% initial withdrawal rate, they would need US$375,000.

LEANFIRE is characterised more for people who are frugal, can be more flexible with their spending, willing to do seasonal or odd jobs to supplement their income.

What they want in life is much less costly than a lot of other people.

An appropriate initial withdrawal rate is between 3% to 4%. As they do not have much leeway in their expenses (being intentional, they do not have much to cut for their expenses if times are hard), it would be better to be more conservative on the initial withdrawal rate.

5. Coasting or Barista FI. Coasting is a surfing or skating technic that after you put in initial effort, the system and momentum makes use of the effort put in to glide effortlessly over a period.

In financial independence, there are some who would like to amassed their wealth early. Then their wealth will grow on its own till their eventual retirement (which is much later.)

They can then find a job they connect with better.

Some like a less stressful job that pays for the expenses. Hence the name Barista FI (if there are baristas or those in the same field please do not feel offended. I did not come up with this term but it is to show the disparity between annual income earned and stress level)

Usually, this is characterised by people who is able to earn a relatively good income to very generous income at the start of their careers. However, to earn that good income, it comes with the expense of their personal time, lives. Some of these folks spend more time in hotels, meetings, and on the plane.

They probably cannot last long and a lot of them know it.

For others, their job pays well. Could be relatively stable, but for the amount of work the pay is generous. Some the pay is the top 5% of Singapore but over time it is soul sucking. A few of my banking friends belong to this category. Civil servant friends as well. Those that are on the plane more are doing regional sales or McKinsey, Bain consultants.

For those who can control their lifestyle and amass their surplus from income well, they might reach a magical number that the aggregate wealth they have can grow on its own without much additional contribution from work income.

The path for coasting:

- Be a good performer at work. Earn above average salary with generous bonus

- Have a controlled lifestyle. Don’t expand your expenses proportionately as your income grows

- Start investing early and do it wisely

- Pay attention to what other kind of work you are interested in, you can contribute, you see growth and better align to your values

- When you reach the level of wealth close to the coasting sum, do more detail planning

- Switch to the new career

- Save less. You have already build up enough so that your wealth will grow on its own.

I have written more about Coasting or Barista FI in this article here.

The computation for how much we need for coasting is more complex.

- You need to figure out your lifestyle when you officially retire X years from now (like really stop working). When is that, how much you need in today’s dollars.

- Then you adjust this annual expense requirement by inflation

- Using a 3-4% initial withdrawal rate (depending on how long you need the money for) find out how much you need at retirement age

- Work backwards based on the long term rate of return today what is the wealth needed.

So suppose

- I need $1 today and I am 35 years old.

- My official retirement age is 70 years old.

- At 3% inflation, $1 will be $2.8 in 35 years’ time.

- Using a 3.5% initial withdrawal rate, I would need $80 at age 70

- Assuming a 5% long term rate of return, I would need $14.50 today or 14.5 times the annual expense of that lifestyle

You will notice inflation, rate of return of your wealth, when you retire, your longevity becomes a factor here.

The appeal of coasting Is you work a fulfilling life and you stop work at a much older age, so you need less money. You need to save less money today.

So a person with generous salary may reach this stage pretty fast.

6. Semi-Retirement. Similar to the traditional retirement but instead of not working, you work seasonally, or in a reduced capacity. You do not earn as high of an income as before but it covers your annual expenses to a different degree.

The usual transition is

- Work

- Semi-Retire

- Full Retirement

I think for a lot of people they would phase their retirement like this.

In terms of the amount of wealth needed, it will depend on case by case basis.

There are some friends who are tuition teachers. They can have reduced the number of students they take in by 25%, 50% or 75%. This gives a better work life balance. For some even with the reduction, they can cover almost all their expense. For some, if they take on a more mundane job it covers maybe 50% of their expenses.

So if you need $0.50 out of $1 of expenses, at a 3% initial withdrawal rate, you will need 16.6 times your current expenses. Or you could just use the amount that you need to cover.

I think it is recommended to use closer to a 3% initial withdrawal rate because for many, they are transiting from a better paying job to one that is riskier. By using a lower initial withdrawal rate, you sought to ensure that your wealth last.

For many they could be in semi-retirement for a longer period (maybe 40 to 60 years) and if the duration you need the money is longer, a lower initial withdrawal rate is better.

Your mileage may vary.

7. Financial Security. For some folks they didn’t think so much about life. If you ask them what they want, they will struggle to tell you. Their main impetus to save money is to feel secure.

I have friends who grew up in poorer conditions and they can look back and see they did well in their career. However, they do not want to go back to that situation again.

The difficult thing to tackle about financial security is that this is very psychological.

I written a more comprehensive article on financial security here.

I would recommend for financial security:

- Figure out your essential expenses from your non-essential expenses (this article might be helpful)

- Take a small portion of your non-essential expenses, add to your essential expenses. This forms your baseline survival expenses or what we call core expenses.

- Have like 1 year, 5 years or 10 years that amount.

The idea is that this is like your own unemployment insurance. The more you have the more runway you have to work itself out. Can you imagine that you cannot find work after 10 years?

You can also look upon this as an enlarged emergency fund, one that is a cross between your emergency fund and investment portfolio. Instead of keeping it in cash, you need to ensure that it grows.

I think that is quite a conservative estimate.

For some that is really fearful, I think if you want, you can use a 4-5% initial withdrawal rate. The idea is that based on frequency you are not going to always draw upon it, so you can have a higher initial withdrawal rate.

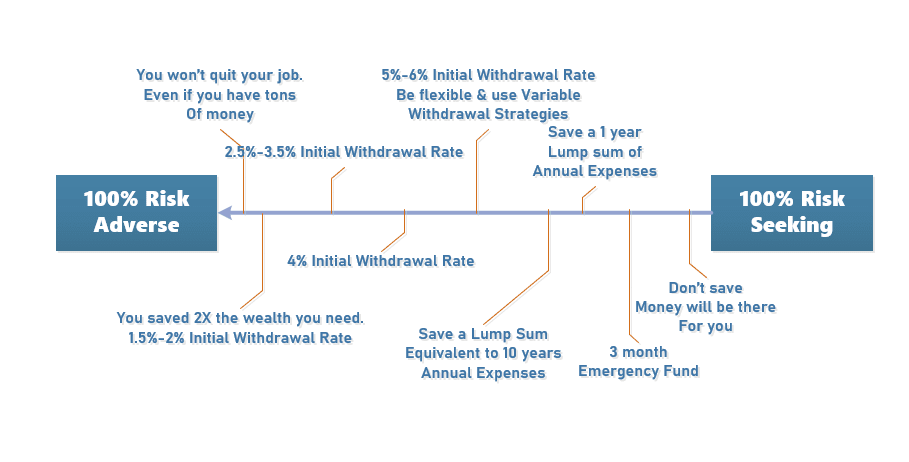

How Fool Proof or Secure You Want Your Financial Independence Plan to Be?

Talking about financial security is a nice transition to why for most lifestyle, I use a range of initial withdrawal rate.

The reason is that over time, I realize that some folks can be more risk seeking in terms of their circumstances while others are more risk adverse.

I know of two people who both worked in investment banking. They controlled their lifestyle very well. Since they are financially literate they also know how to invest.

Potent combination. Out of my wealthy formula, they probably did well in 2 and moderately above average in the last one.

One would be retiring early while another probably is thinking of coasting.

In order to survive, you got to be good at your job, likeable and rather smart. So for folks like this, even if they step out of this hard environment, they should do pretty ok. This means that they might not need such a conservative initial withdrawal rate of below 3%.

However, we always get the feeling that if you leave your job, any job cannot match a pay of $450,000 a year.

So your sum needs to be “confirmed”.

And so they aimed to have an aggregate wealth that they are able to spend 3% of it in the first year so that it provides them a recurring, inflation adjusted income stream.

Another person works in banking but he felt that he has this idea that he got to take chances with. Of course, he is rather prudent as well.

So he ensured that he build up his capital plus 10 years of survival expenses and got started.

There is no right or wrong.

At the start of this article, I asked everyone to look at look at financial independence as a volume knob instead of a light switch.

One of the main reason is that how ready we are is a function of how secured we wish our financial independence to be.

There is a spectrum from very risk averse to very risk seeking.

Two of them would not feel safe until they have like less than 3%. One of them felt the opportunity cost of not starting the business and regretting was too much.

And that is just the way it is.

We can move back and forward on this spectrum

- With more knowledge of what we know is mathematically conservative or risky

- Gain more experience in life about opportunity costs, time that can never earned back

My general observation is that every wants FATFIRE because it is the safest financial independence, but not everyone has the resources for it.

The Theory Behind the Safe Withdrawal Rate Concept

We now know that your desired lifestyle and how fool proof you wish your plan to be influences how much you need.

However, these percentages are just a number if you do not know what it encompasses.

If you are serious about why I would rely on this methodology, perhaps it is best to read up on it.

When you know the assumptions, how robust or not robust it is, it affects how you look at how much you need.

The theory of safe withdrawal rate is that if you withdraw a certain amount of money from your aggregate wealth, it will last for X number of years.

Imagine that you put all your money into a unit trust.

- This unit trust on average grows at a certain long term rate of return

- But the actual value of this unit trust goes up and goes down. We believe that it goes up over time that coincides to the long term rate of return

- Now we need income from this unit trust. So you sell some units of this unit trust. The amount gives you income for your expenses

- However, how much can you safely take out from this unit trust?

- If you take out too much, you may run out of money too soon

- If you take out too little, you didn’t get to enjoy the money you have built up

So this is the problem that the safe withdrawal rate tries to solve. How much do you need to accumulate to? And how much can I spend so that I do not run out of money.

William Bengen kickstarted a lot of the work on this safe withdrawal rate in 1994. There was support for his work.

Right now, the FIRE community was able to grow so well because his work on the 4% safe withdrawal rate make deriving what is the amount you need and when you can retire to be so easy.

However, there were also enough people that poke holes into his work.

I think you can or not agree on what is the rate, but it did trigger a meaningful group of study that benefit us greatly.

Here are some of the things you could read:

- William Bengen’s original retirement research article

- The Trinity Study done by three professors on safe withdrawal rates

- An International Perspective on Safe Withdrawal Rates from Retirement Savings: The Demise of the 4 Percent Rule? – 2010

- The 4% Rule is Not Safe in a Low Yield World (2013)

- The Ultimate Guide to Safe Withdrawal Rates (a lot of parts)

There are also some articles you can read on the financial math behind creating long-term stream of inflation-adjusted cash flow:

- The Fecundity of Endowment and Long Duration Trusts

- Could we Model Our Retirement Spending like Endowment Funds? | Investment Moats

- Perpetual Distribution Rates for Foundations, Endowments and Charitable Trusts

I will go through some features of the withdrawal method, some pros, and some cons.

But before I start let me tell you upfront some features:

- It provides a stream of consistent cash flow

- This cash flow adjusts based on the prevailing inflation rate (so this means this cash flow is inflation adjusted)

- Depending on how much you withdraw and the performance of your assets you may or may not run out of money

Ok now let’s get down to it.

How does Spending Money Look Like in the Withdrawal Method?

The original body of work that Bengen did is based on a portfolio of 50% USA equities and 50% US government bonds.

This is a portfolio that is half positioned to try its best to capture the returns in a risky asset class and 50% geared to reduce the overall volatility of the portfolio.

We are going to use a portfolio like this for our explanation.

Your mileage may vary because you would have properties and cash. Each have their own long term rate of return and volatility characteristics.

In most of my illustration I would use 50% S&P 500 and 50% 1-month US Treasury.

I decided to use 1-month treasury because the rate of return is the lowest, so that I can try to reduce the expectations as much as possible. From 1928 to 2018 (91 years) the compounded average growth of the S&P 500 is 9.5% a year and the 1-month US Treasury is 3.3% a year.

I will bake in a fee of 0.50% a year.

Suppose you have $1 million dollars and you put in this fund that makes up of 50% S&P 500 and 50% 1-month US Treasury.

You decide to spend $40,000 in the first year.

We all this a 4% initial withdrawal rate.

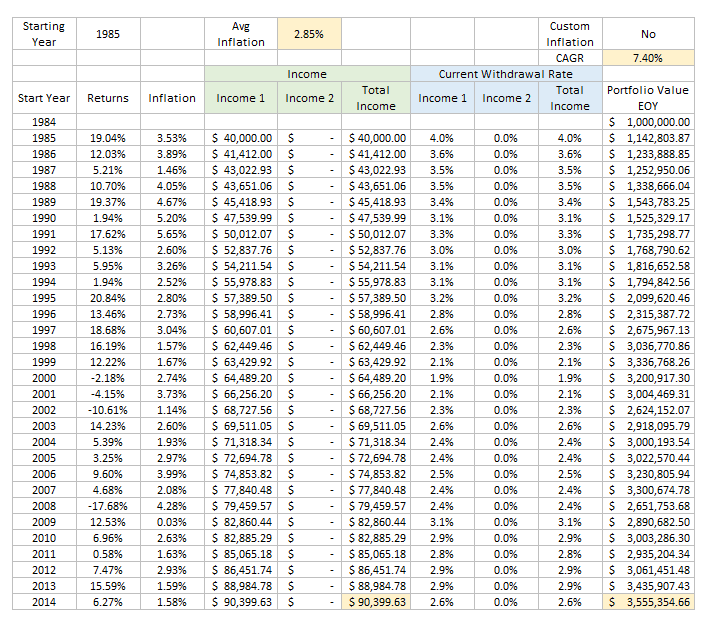

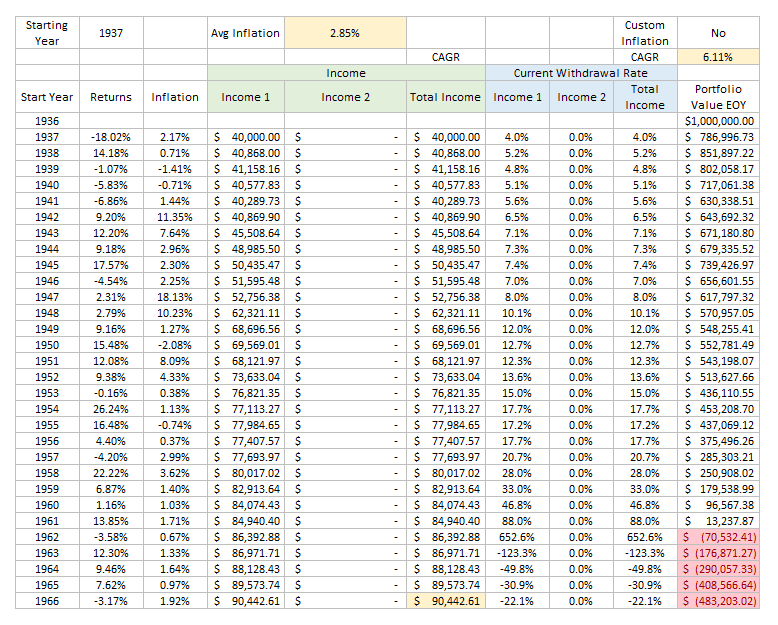

The table below shows the progression of the inflation-adjusted stream you withdraw from your $1 million and how much you are left with at the end of 30 years:

At the start of every year, you will withdraw an inflation adjusted amount from the previous year. This thirty-year sequence is from 1985 to 2014.

You will withdraw $40,000 in the first year, then $41,412 in the second year and $43,022 in the third year.

At the end of thirty years, your income would be $90,399.

You will also be left with $3.55 million at the end of thirty years. While the markets are volatile, your retirement have been pretty good.

What I like about the withdrawal method is that you can frame your asset as an aggregate fund. Regardless of whether it is investment property, bonds, stocks, funds, you can view them as an aggregate.

Individually, all these assets need to grow and each have their own volatility.

If you have too much cash, then your rate of return is lower, and your money do not last.

If you have dividend stocks or investment property, part of your withdrawal will be from the dividend and rental income, then some will come from cash on hand.

Not all Sequences Are Positive

While the year of 1985 to 2014 worked out very well the same can’t be said of some other sequences.

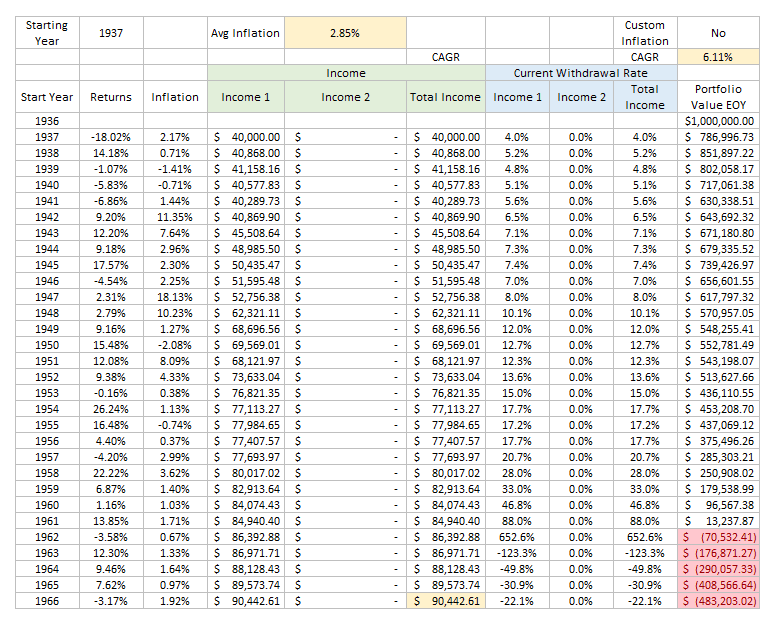

Suppose you start your retirement in 1937 to 1966:

If you start spending the same $40,000, your wealth will run out in 1961. The inflation rate is the same as the previous (2.85%), the returns are lower but instead of $3.55 mil, you run out of money.

The sequence of the returns and inflation matters a lot.

1937 is said to be one of the toughest 30-year sequence.

Would you get a 1937 sequence or a 1985 sequence?

I have no idea.

Financial planners like to use a fixed 6-8% returns and tell you if you build up this amount you should be ok.

The truth is that…. The world can be a little uncertain.

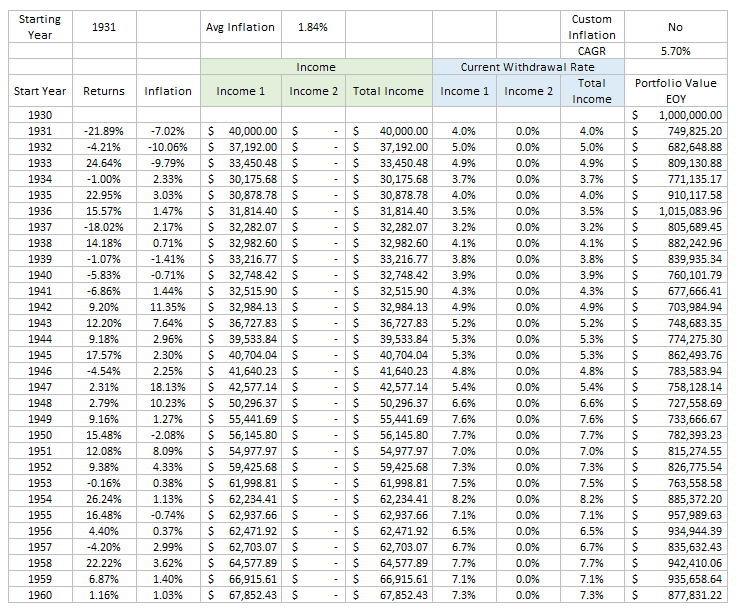

Sometimes it is not just the rate of return. In the period starting in 1931, the rate of return is lower… yet you can have a decent retirement:

While the retirement started off with a -21% fall, inflation is lower as well. Eventually, you are left with $877 at the end of thirty years.

Bengen’s Work on the 4% Withdrawal Rate

So in some years if you spend the same amount, you can have a good retirement.

Yet in some years, you will run out of money.

What Bengen did was to slowly test the withdrawal rate starting with 1%, and then see for the years starting in each year how long it lasts.

He found that if the withdrawal rate is 1%, the money will last for at least 50 years in all situations. So he raised that 1% slowly until he reached a point where they don’t last so long.

His “so long” back then was 25 years.

So he found that at 4% that is the max you can go.

The trinity study eventually called this the SAFEMAX, or the safest, maximum amount that you can withdraw such that regardless of the economic situation, the wealth can last.

The Study Factors in a History of Economic Uncertainties and Prosperity

Some question whether this 4% safe withdrawal factor in this bear that bear. That it is not tested.

This body of work went through

- The hyperinflation of the 70s where the average 30-year inflation reached 5.5% a year

- Great depression

- Oil crisis

- 1987 crash

- Dot-com crash

- One world war

- 2008

Whatever happen in the past 90 years is probably encapsulated in this one percentage.

Early Retirement – If you Need a Longer Duration

If the duration is longer than a traditional retirement, then you would have to reduce the initial withdrawal rate.

If not the amount won’t last.

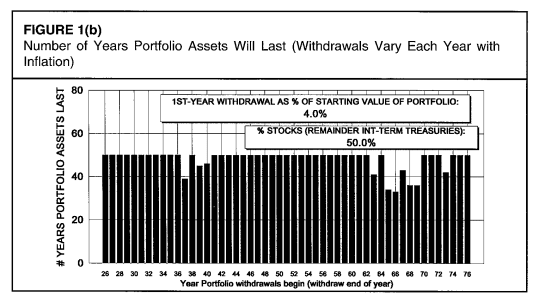

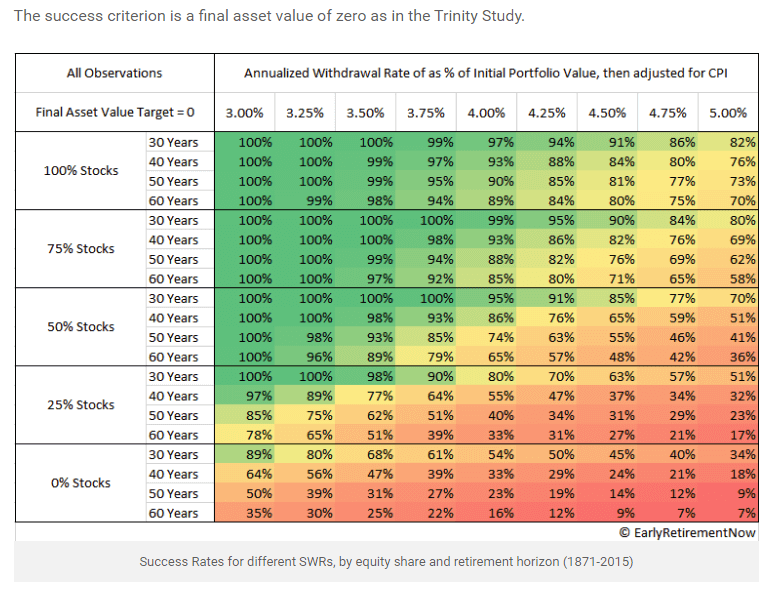

Early Retirement Now has a pretty good table that shows the relationship between your equity and bonds allocation, how many years you need, and different withdrawal rate success:

A 100% success means that for all the rolling 30, 40, 50, 60-year tested, the portfolio lasts for those years. If the success is 70%, it means your money failed to last in 30% of those rolling periods.

There are some things you notice:

- If you only have bonds, they do not last very long. It will be worse if it is in cash

- 4% is very borderline

- If you would like your wealth to last 50-60 years, the max you can go to is about 3.25%

- If you have 100% in equities, it does not mean you can increase the initial withdrawal rate

There are still a few body of research work that shows how much you can withdraw:

Generally, if you need the money more for security, having 5-10% withdrawal rate is pretty OK. You need to know that you won’t be drawing down on it so often and it is more for security purpose.

If you need it for 40 to 50 years some safe initial withdrawal rate can go as low as 2 to 2.5%.

Not all Situation is So Gloomy

At this stage, a lot of you will be focused on a really small and safe number. You might still ask whether 3% is safe enough or should we go to 2%.

And what I will say is that it is better to go to an initial withdrawal rate of 2.5%.

However, I do question whether you want to save such a large sum of money for the absolute worst case scenario.

Consider an initial withdrawal rate of 3% for a 60-year period.

Out of the 32 rolling 60-year period, there are 3 rolling 60-year period where the money does not last. So that is 10%.

For those other 29 year periods, only 1 period you are left with $1 mil at the end of 60-years.

- 27 periods you end up with $5 million or more

- 14 periods you end up with $20 million or more

We want to feel safe, but remember that putting in more to building wealth might just take away your time for spending it on life.

Being Flexible with Your Spending gives you a Greater Security in your Financial Independence Plan… But up to a certain point.

If we can be more flexible, we can make some withdrawal rates work.

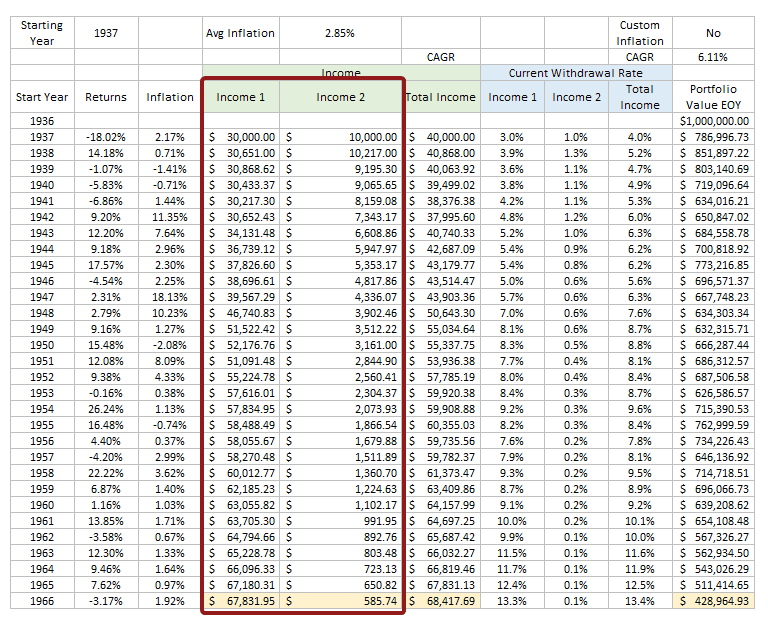

The table above shows the 1937 to 1966 sequence where we ran out of money.

Now what if we determine that out of the $40,000, in challenging times we can just spend $30,000 and in better times we spend more?

We can build in some flexibility in spending.

If we break the $40,000 into our core expenses and good-to-have expenses, it can navigate a challenging 30-year period better.

You are left with $429,000 instead of running out of money. Your income is lower than the original $90,000. You lose purchasing power.

But you preserve the purchasing power of your core expenses.

You realize that this way of spending makes more sense. When times are not good, we conserve a bit, when times are better we go a little bit more crazy.

The Initial withdrawal method can be rather rigid. There is a reason for it to be this way because it is after all a study.

The best way I would characterise it is to look at withdrawal rate as your endowment plan that provides a cash back.

- An endowment plan needs to provide you that cash back

- It invests in a mixture of properties, stocks but mainly bonds

- They don’t want to run out of money

- So they need to give a very conservative estimate how much to pay you so that you do not run out of money

A 4-5% initial withdrawal plan is like an endowment but instead of conserving money, it’s focus is to provide you with an inflation-adjusted income.

So it will run out of money. The focus of an endowment plan is to make sure the plan is still in force.

An endowment focus on controlling your income to preserve capital and in the withdrawal method you focus on preserving an inflation-adjusted income while not worrying so much about the capital.

The idea way is both to have an eye on:

- Preserving your capital

- Varying your spending

What Can You Do to Embarked On the Path of Financial Independence?

I think we went through a fair bit of stuff today and you might be a little confused what you can do at this point.

So here is a list of things you could do.

1. Find Out Why You Should Embark on This Path

I see a lot of benefit of pursuing financial independence because having that financial grounding allows you to re-aligned your life.

Our life can be a tale of two halves:

- The first half is where you give yourself financial security or stability

- The second half is ______________________________________

You need to fill in the blank there.

I have provided a few different types of financial independence and they exist because different groups of people have different priorities that they adhere to.

If you do not know the why, it might not be motivating to keep you on the path.

Those who stuck to the path, they tend to find their why.

Here are some of the things people tell me why they felt so strongly about this:

- I don’t want a situation where my family will lose their current quality of life because I didn’t accumulate enough

- I have an opportunity to earn a generous income but this career is damn volatile. If they don’t need you, they will just make you redundant. I have been made redundant before so I know the feeling. I don’t want Golden Handcuffs

- There are signs that my industry is going to be severely disrupted. I got to make sure that I have enough because I may not earn as well for the things that I would do next.

- I wasted enough of my time and money in the past. Luckily, my pay is still high. I don’t want to end up like some of my peers who spend their money and time womanizing and spending money like nobody’s business.

- Becoming a general manager is great and provides for my family, but I see my calling in some other areas. It is time to explore something else.

Sometimes if you don’t have a why, I am not sure whether that is a problem in itself.

2. Work Out Your Current Withdrawal Rate

In order to know how well you are doing, you have to work out your withdrawal rate.

Here is the formula again.

With this you will know whether you fall into which of the 3 bands.

To work out this figure you would have to work out your current annual expense and aggregate wealth.

If you have no idea about your annual expense, the bad news is that whether you are closer to the desired lifestyle would depend on your awareness of your expenses.

For those who are more aware, you can play around with different sets of expenses.

What is your current withdrawal rate based on:

- Your future desired lifestyle. The lifestyle you are looking for might be different from current.

- Your core expenses. This is if you are more geared towards financial security, semi-retirement or LEANFIRE

- A particular expense. This is if you wish to create a sinking fund that will provide for a unique hobby

Of course, you got to know what are your current wealth assets, which is covered in the earlier section.

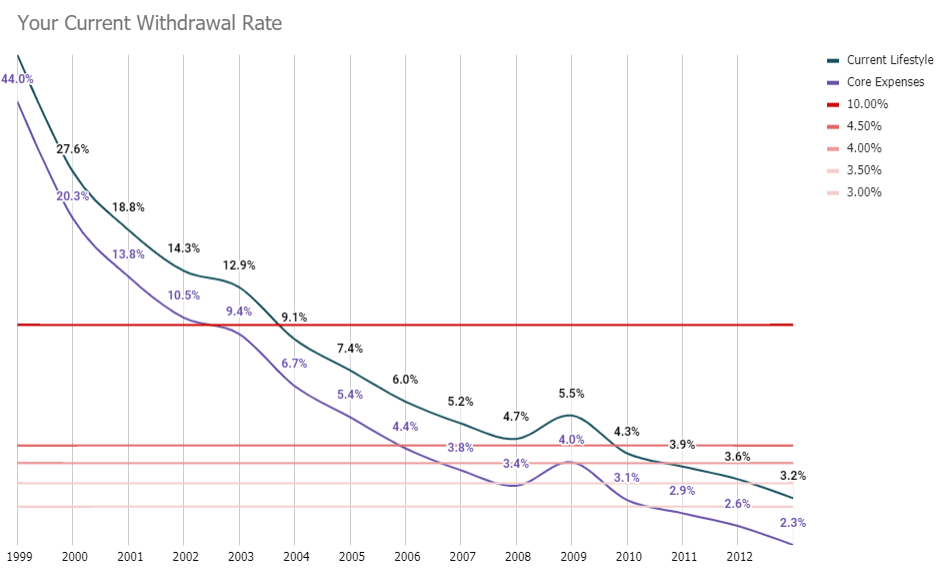

3. Track Your Current Withdrawal Rate Over Time

If you can, track your current withdrawal rate every year.

Perhaps at the start or end of the year.

There are two figures here:

- Annual Expense for that year

- Aggregate wealth for that year

To get these figures, you would at least need to keep track of your spending pattern for the year and find all your various accounts to tally them up.

I am of the opinion that if you have a problem getting this two figure, it will be a struggle to embark on this path. What I observe is that a lot that emerge somewhat more successful in this tend to be intentional in some aspect of their lives.

If it is high enough in the priority, then we should be able to find a way to get it done.

To track this, you can use an excel to track. Every year, a new line item with the aggregate wealth and expenses can be entered.

You will have a chart that looks something like this:

When you start this, the current withdrawal rate will look absurdly high. If you do everything well, this should come down over time.

This person lived through a 15-year period from 1998 to 2012. The compounded rate of return is just 2.4% a year in this 15-year period. When the performance is poor (2009 and 2003) the current withdrawal rate went up instead of going down. This is to be expected.

A disciplined approach to accumulation have allowed them to build wealth despite the market conditions.

One suggestion is that you can add a few different expenses to see whether in some smaller expense goal, your wealth have allowed you afford a different kind of lifestyle. In this case, this person tracked both his current lifestyle and core expenses.

4. Live Life but Do Your Best in Your Pursuit of Financial Independence

Probably the most important thing is the last step.

It would be healthier to live a good life and not think about the numbers part. At work, we often say time passes faster if we have things to do. Sometimes the work day can feel long if we do not have much to do.

To gain wealth, most people would be better off honing their human capital, increase their income. Ensure your lifestyle do not inflate at the pace of your income.

Learn to invest well.

Be aware what will make the biggest impact to your wealth building. You can read this article.

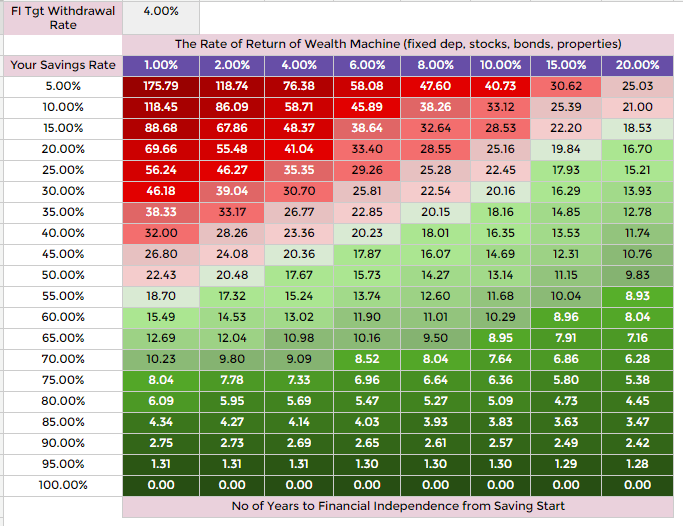

For example, probably the single factor that makes the most impact is your savings or surplus rate:

In the table above it shows your savings rate (take home pay minus your expenses) versus the rate of return of your wealth machine (investments). Each cell in the table shows the number of years it takes for you to be financially independent.

If your savings rate is greater than 50%, the number of years to be financially independent narrows significantly. The difference is 10 years.

You might or might not be a good investor, but if you are privileged to have a good income and minimize your expenses you can do well.

You would need to pick up some books on investing, or work with a planner that you can trust, who carries low-cost, diversified funds.

One or two broad based, low-cost, diversified equity and bond fund is probably the most sensible way to build wealth.

You can also read my guides on active investing, REIT investing, wealth foundations and retirement planning.

5. Try Your Best to Reduce Your Current Withdrawal Rate

While you are doing #4, try your best to work on controlling your expenses and increasing the wealth assets.

We do find that more people tend to be more conservative and would like their financial independence to be more secured.

Some of us might reach hit the threshold that I talked about for the lifestyle we want, but at this point, we may feel pretty comfortable working in our job.

If you continue to accumulate, and your current withdrawal rate becomes smaller, the wealth side of your financial independence becomes more secured.

So just go down from 5% to 4% to 3%.

If you still enjoy your job, keep accumulating until you have a little more buffer.

However, at a certain point, you would need to recognize that you have more than enough.

It might become a tad unhealthy if, by this withdrawal rate measure, you have a lot but still feel you do not have enough.

Let’s Clear Up a Few Things About Financial Independence

In this section, let me address some common questions or worries people have on certain aspects of this topic.

If you see that there are questions that I have not addressed do put them here.

What About Your Government Pension System or in Our Case the CPF?

I have deliberately leave this out if not this article will extend by 5000 words.

I think the CPF is important to a certain extend.

There are a group of people whose initial withdrawal rate would always be above 10%. This means that they struggle to accumulate enough till 65 years old.

They have to rely on the government pension system.

The system sought to address the needs of the 2nd quartile of Singapore.

For those pursuing early retirement, at some point, their CPF Life income will aid their retirement. If they have excess CPF OA and SA that will contribute to the sustainability of their overall income stream as well.

My research did show that if we add the government pension income or lump sum to our wealth later on, the impact to the safe withdrawal rate that we can withdraw today (if you retire early) is not much.

I think it may be that by then, your total wealth might be so large in comparison to the pension lump sum or that your annual expense has been inflation so much that CPF Life does not alleviate your expenses much.

But if it is a traditional retirement of course it helps. The degree of impact will depend on your expense needs. For some their combined CPF Life is $3600 a month but their annual expense is $20,000 a year.

Do You Expect Your Expenses to Change Compared to 30 Years Later?

30 years is a long time.

I wrote an article about the End of History Illusion. Basically, it explains that we are pretty bad in estimating what our future self would like. This affects our values, beliefs and a host of other stuff.

It means that it is a risk for Kyith to be sure that his lifestyle today will persist till 30 years later.

So how then do we plan for financial independence if the expenses are hard to pin down?

At our workplace, for those who are in their accumulating phase, we look at their future desired lifestyle as an evolving process. We expect things to change.

So every year, when they come in, we have a conversation with them to find out what’s change? Is there a change in philosophy to things?

And so this would involve reworking the target 20 to 30 years from now.

When the expense need changes, the amount you need changes.

This is why I prefer just tracking the current withdrawal rate. I expect your annual expense to fluctuate and not kept constant, as do your aggregate wealth.

Try to meaningfully see if you can have a very habitual lifestyle. You cannot get a lot of the expenses right but as a person reaches their 40s and 50s, your life might fall into a routine and with that, you might be able to estimate your expenses better.

What Do You Need to Prepare Before You Can Retire?

This is not an exhaustive list but in general:

- Ensure you have taken care of your health insurance (in Singapore we tend to be quite OK there). Ensure that in your expense, you can cover the insurance

- Pay off your mortgage. Having less debt gives you peace of mind. Secure financial independence is one where you have not too many negative surprises

- Be comfortable about the way you build wealth. You should have enough experience managing your own money or comfortable with the external manager you delegate the wealth management to. I like to tell people you are likely to get a fair bit of anxiety if for decades your wealth is in cash and suddenly you decide to put all into equities and retire. Experience may have soothed out some of the anxiety, increases the conviction and result in a less stressful financial independence

If I Accumulate Wealth Until I Hit a 3% and Below Initial Withdrawal Rate, Does that Mean it Will Always Work Out?

I would not venture so far to safe it is 100% + confirm chop guaranteed you won’t run out of money. If you read some of the articles I have posted in the financial math section of this article, you would realize it is better to go down to an initial withdrawal rate of 2.1%.

Why the math figures below 3% work is because, you are spending a small amount. Spending a small amount, relative to what you have allows the aggregate wealth to re-adjust in volatile return environments.

We need to dance between the balance for spending enough but not too much that it will put stress on the portfolio.

Based on the returns expectations, 3.0% is quite OK. Dr Wade Pfau, a researcher in this field, recently came out to say that based on the returns projections of bonds and equities the 4% safe withdrawal rate is closer to 2.4%.

If you want to feel really safe, then you can work towards a 2% withdrawal rate.

However, I do feel that at some point, a lot of people will buffer so much that either they have some very generous earnings or that a lot of will spend a bulk of their effort building up towards it.

For some, they might live through a period where 4% actually worked out well and there is an opportunity cost for that.

You want to spend your time earning and creating a perpetual legacy or do you want to balance it by doing the things you want?

Some of These Desired Lifestyle’s Look the Same isn’t it?

They definitely look the same.

Most of them played around the different level of composition of live, work and living off your aggregate wealth.

You can look at the intention of that kind of lifestyle. You wish to coast because you really want to work. Someone chose semi-retirement because they prefer a balance between work and living. While they may look similar, what differentiates between these two are their outlook towards their commitment to work.

But I agree a lot of these looked the same. I do think the benefit of packaging things differently is so that you can Google and find communities that are like-minded. That will benefit more people.

Which Desired Lifestyles are the Low Hanging Fruits?

I think the lowest is probably those that wish to feel financially secure. So having 5 to 10 years of expenses can give you a lot of options in life.

Depending on your personal situation, I do think that semi-retirement and creating a perpetual income fund for financial security is the next low hanging fruit.

If we assume that out of your family’s current expenses, your core expenses are 50% of it or that your semi-retirement job covers 50% of your current expenses, the demands are roughly the same.

If you are aiming for a 3% initial withdrawal rate, that will be like 15 years of your total annual expenses. I think 15 is easier to do after you conquered 10 times.

In that time frame, it should be enough for you to accumulate the sum of money needed for Coasting or Barista FI. It is a bit subjective, but my estimation is that the sum needed for the aggregate wealth to grow on its own is about 15 years.

Why Not Measure the Financial Independence Amount by The Income That You Get?

This is damn subjective.

I started this journey in the dividend investing (and probably still am). I observe this really, really, unhealthy scavenging for income products mentality.

I think people missed the fact that dividends can be variable. One of the important aspect that you need to take care of is how consistent you need the income to be.

If you plan to only spend your income only, so that you preserve the capital, but your income drops due to poor business conditions (like now in 2020) then what do you do?

If you really, really do not have a job, you got to sell some of your capital because you really need to feed your kid as he or she is hungry.

Some will tell me so plan to spend only a smaller, conservative yield. When you do that… it is no different from looking at things through the withdrawal methodology.

Ultimately, your capital will need to grow during financial independence. Some folks will just keep pushing for some seemingly higher yielding, but safe dividend stocks. The growth rate of these stocks might be lower than the market average.

To me, just look at your returns as a total return (income + capital appreciation). If you don’t have dividend income but your assets grow at 15% a year on average, I think it is a better situation than just harping on dividend income.

I wrote a deeper article on why living off dividend income in retirement is not perfect.

I don’t think living on a shoestring like those on LEANFIRE is sustainable. This is especially so in this bear market (2020)

I think we got to hold our horses. We haven’t even finish the year yet. For all you know we hit new highs come December.

The other things are that, you got to ask those people who live that way to know if their retirement is failing. It might not be.

The thing that a lot of people don’t realize is that just because you start your retirement in a down year doesn’t mean your money will not last 30 years. And just because you have 3 good years doesn’t mean your money will last 30 years.

The thing that make living without work income hard is the uncertainty. Longevity is uncertain, health is uncertain, inflation is uncertain, market returns are uncertain.

Withdrawal rate study is a collation of all these uncertainties (not the longevity and health part) and telling us that based on the data, if you spend only this initial withdrawal rate, your wealth will last. Not much math simulation can simulate these sequence of uncertainties to perfection.

Also, you can find people living in LEANFIRE. It is just spending less than $40,000. I am sure there are family spending less than $40,000. To make it safe, just have $2 million dollars. There should be enough buffer there.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Revhappy

Thursday 5th of August 2021

Hi Kyith,

Excellent post, you have done really nice and comprehensive research on this topic of FIRE. I can quite relate to you. I work in banking IT and I have accumulated 1.2m SGD but I am a foreigner working in Singapore but didnt get PR inspite of applying several times, so no choice lah, even though we love Singapore, we will have to go back and retire in India. But the plus side is that I can make use of this geographical arbitrage. I am also quite frugal like like you, I read your annual expenses in 2020 was 22.5k(quite shocking to me). As foreigners our major expense is house rent, unfortunately right now rents are shooting up in Singapore, due to the Malaysia border closure, all those who travelling across the causeway are now staying in Singapore and renting, sudden huge spike up. But as foreigners, no choice need to just take the increased rental into our stride. So my income is like 10k but rent is like 2.5k for a 5 room HDB flat. It is nice spaceous and has helped us during the last 1 yr WFH and HBL for daughter we love the space. Next big expense is daughter's international school fees, again we are not allowed entry into the local schools, the cheapest is an Indian international school and costs like $800 a month. So you see my rent and school fees is like already 3.2k and my total monthly expense including the iras giro of around $600 is like less than 5k. So I match you pretty much in frugality. In India my expenses should be around 20k SGD per year, I am actually still surprised how my India expense is same as your SG expense. But in India, this is considered like a equivalent of the $40,000 expense you were talking about in the article. So my networth is about 60 times my annual expenses. So to me I am quite ready to retire early. I dont really like IT job, hence the "why" part of early retirement. I actually dont like to do anything. Just while away my time. I like finance so I dont mind being involved with finance in some way, but I am not talented like you to be able to invest or write about investment. My investment experience until now has been quite haphazard, trying to time the markets badly and mostly missed out on the entire bull market. Now I am planning to gradually increase my allocation to equities index ETFs, from my current 32% to target 50%. I dont really think I should go above 50% given my low risk tolerance.

You mentioned you work in financial planning company as a senior solution specialist. Did you change your field from IT to finance? I would be quite curious to know and it would be inspiring for people who want to get out of IT.

Revhappy

Sunday 8th of August 2021

Thanks a lot Kyith, really appreciate your response! I really like your blog, it is not only full of knowledge but it also comes across as very honest and open. Wish you all the best!

Kyith

Saturday 7th of August 2021

Hi Revhappy, thanks for sharing your journey. It is remarkable that you are able to accumulate that amount while having more stuff to spend upon than me. Rent is a big thing. I would say I paid rent in a way like servicing my mortgage but my mortgage is rather low. If you are a PR and have access to public school, the fees for your daughter might be lower. Your expense today divided by your networth is closer to 5%. It is not the most conservative to stop work but if push comes to shove, you could work in something that covers your expenses that is less stressful. in IT, less stress can mean a lot of things. You should be able to navigate that better than the advise that I can give.

But that amount will be great when you go back to India because I think it is more than enough.

Don't worry, I also missed out on the bull market. We should just focus on understanding how to invest in index ETF, reining in our behavioural issues, build up our conviction investing this way through understand the history of returns, market bulls and bears and money management.

I was fortunate to go into finance because my friend ask if I would like to work for him. Not everyone has that opportunity but I think as a person gets older and if they have a larger group of friends, these opportunities may come about.

RN

Thursday 3rd of July 2014

Kyith, in theory I agree with your methodology to generate income as well as increase the principle over time. However, in practice, we will not be able to obtain constant rate of return (said 6.33%). Market goes in cycle.

The historical long term return stock market may not repeat by itself. For example, Singapore GDP has "peak" and PM Lee said that he will be happy if the GDP growth is ~3%. With ~3% growth, it is thus not realistic to say 6% return is conservative.

Hence, the tough part is to grow the wealth with CAGR of 6.33%.

lim

Sunday 26th of April 2020

you shouldn't be depending entirely on Singapore stock market to fund your retirement. especially now when so many brokers make it easy to own foreign ETFs.

you are also right that market goes in cycle, thats why you can look at asset allocation strategy and rebalancing to maximise risk adjusted return. If you find asset allocation too complicated, that's where an investment advisor steps in I suppose.

Kyith

Thursday 3rd of July 2014

Hi rn,

I beg to differ. I am not the best person to ask but what I remember is that the yield that you should get is gdp + inflation + current dividend yield. I remember that from gmo, who are the ones very well verse in this. Having said that, I am not referring to one asset but it could be a Vanguard world stock market etf, a portfolio of dividends stock, a rental property.

They key is understand the idea and think of the way to implement it

Derek Chamberlain

Friday 28th of February 2014

I've always heard to just multiply your annual expenses by 20... this is an easy quick way to get in the ball park...

Kyith

Friday 28th of February 2014

Hi Derek,

perhaps that is roughly you can, but the problem is whether that is a true north or something we can work with. I always go through this exercise so that we arrive at something realistic and applicable.

thanks.

Jomel Ng

Thursday 27th of February 2014

Hi Kyith

Good post. Sets people thinking about balancing work and personal life based on one's actual needs and wants. I am also thinking about financial independence over the past few years. I think I am heading in that direction, but something needs to be factored into account, which is healthcare costs, especially inflated healthcare costs as the years pass. We may be able to predict the amount of money we need for FI e.g. $2000 a month, but we cannot predict the amount of money we need when we fall sick one day, when we need to be hospitalised, when we need to consume medication amounting to $50 a day. We can have hospitalisation and critical illness insurance, but hardly would they cover subsequent claims e.g. relapse of cancer. Do you have any insight to this?

Jomel

Kyith

Saturday 1st of March 2014

Hi Jomel, great that you are on your way. What you asked is difficult and perhaps you would have to run through your simulation. whether disabiltiy income insurance covers that, what is the plan after 65 years old. We have no choice, we have to read more and piece the plan together.

did something happen close to heart that cause you to evaluate this?

Ray

Monday 24th of February 2014

nice

Kyith

Monday 24th of February 2014

Thanks