This page lists the articles which are mainly noted to me. They mainly contain the philosophies on why I do things in specific ways and some of the struggles I faced with the things I implemented.

Some of these notes will not be coherent with an excellent introduction or take care of novice and advanced users.

The writing mainly serves me, and some of you may find it helpful.

Much of the content will revolve around how I have or will personally manage my money. As a person entering middle age, I have built up some wealth, but the question I often ask (and you may be asking as well) is:

What does my wealth buy me?

And so much of the content will be about that.

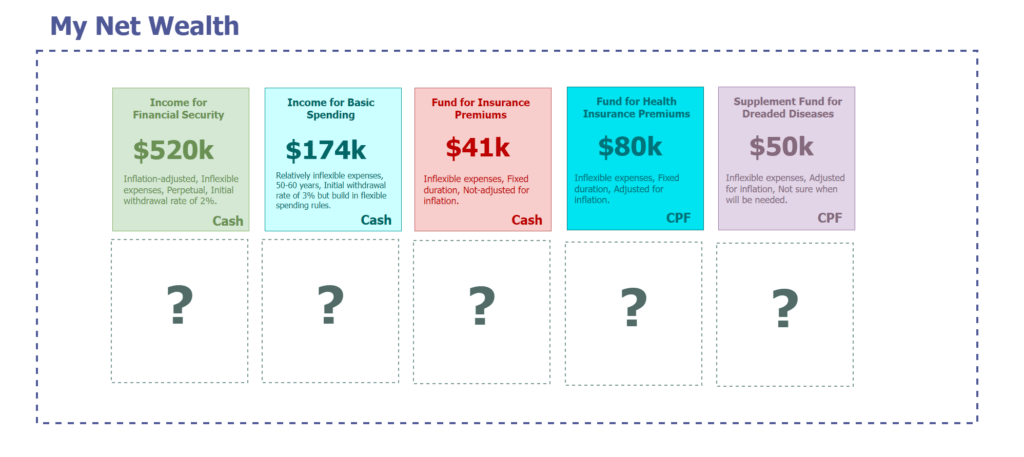

The diagram below illustrates things:

Net wealth represents my total assets minus total liabilities. What will I do with my net wealth? How do I frame my net wealth? Money should be able to buy some stuff, but what will I buy?

My Number 1 Financial Priority – Setting Aside Enough to Ensure Financial Security

A. The Wealth Management Decisions

- What kind of lifestyle would I need to buy for myself?

- How much do I need to provide a perpetual income to fund that lifestyle?

B. The Investment Decisions

- How do I look at what drives returns in my portfolio?

- This explains my philosophy and why I set the portfolio the way it is.

- Deconstructing Daedalus – My Investment Portfolio that will provide the income for my most essential and basic spending.

- Why did I move away from the Dividend Income Strategy for Financial Independence Planning

How I Think about Other Areas of My Current Recurring Expenses

- Aside from my most essential spending needs, I need $5,160 yearly for my basic needs. I would set aside $174,000 to provide income for it.

- Most insurance premiums do not need to adjust for inflation. Think about how much to set aside

- Setting aside $80,000 at age 43 to fund my future health insurance premiums from age 43 to 100 years old

- Setting aside $50,000 at age 43 to supplement my critical illness coverage to cover major dreaded disease event