Many Singaporeans think retirement is far away, so they only care about building wealth and not so much about taking a distribution.

I think it is important to think about your retirement if that is your destination. How does your retirement look like compared to mine?

If your retirement differs from mine, what would you need to do differently from me?

I collated in this article all that I have to learn about retirement planning and financial independence so that you can optimise your retirement journey, get there faster and live the ideal life you want.

Before going into some of my content, I would like you to listen to Ali Abdaal’s clear explanation of financial independence and retirement:

I agree with most of Ali’s points, but to effectively plan towards financial independence, be ready for financial independence, we will need to know more.

Let us get started.

The Origins of Retirement and What it Means to You

You came to read this topic because you want to know

- How to retire comfortably

- If you have missed anything out

- What you can do to speed to get to retirement

I believe one question on your mind is: Should you retire at all?

To answer this question, we go into history to take a look at how retirement first came about and how it changed over time.

Once you understand the origins, your beliefs about retirement might change.

Read the Origins of Retirement and How it Shapes Our Beliefs >>

Visualizing Retirement as Cash Flow instead of Pool of money

The retirement apocalypse that isn’t coming

- Instead of thinking about retirement savings as this dreary thing that “will sustain you until you die,” he suggests focusing on specific things you’re saving for. How many times a week do you want to eat out when you retire? How about a summer in Paris, or a world tour?

- Think of your spending in terms of opportunity cost. Forgo new swimsuits this summer, book the savings, and you’re that much closer to adding a pool to your retirement dream house.

- Setting those kinds of goals makes saving much more enjoyable. “You’re rewarding yourself when you retire,” Norton says, “rather than just taking from yourself now.” Financial Finesse’s Carter says early retirement is a particularly motivating goal. He insists retiring early is often an eminently achievable goal as long as workers make small, gradual adjustments to savings rates now.

How to Think About Saving Up for Financial Independence

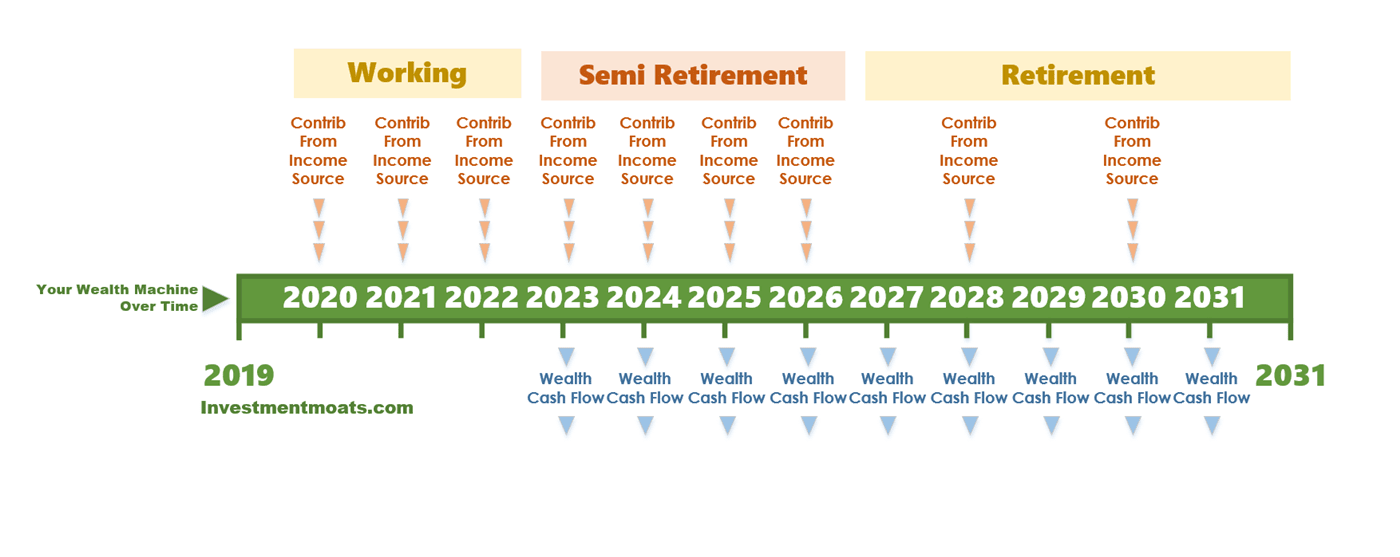

Many of you will think planning for financial independence is putting an initial sum of money into your investment portfolio and then periodically adding to it. At a planned date and year, you will reach financial independence.

The truth is that as a starting point, that plan is sound.

The reality is that you are not sure whether you will be lucky or unlucky in your journey. If you are lucky, your journey will be faster. If not, your journey will be slower.

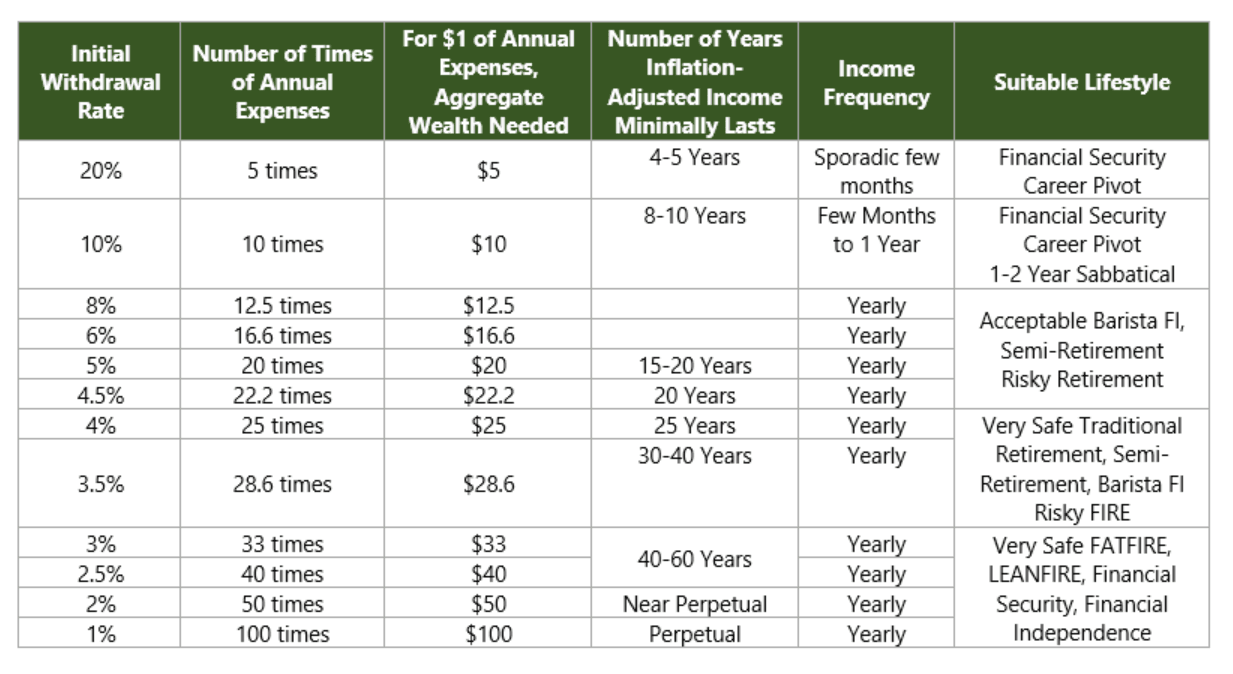

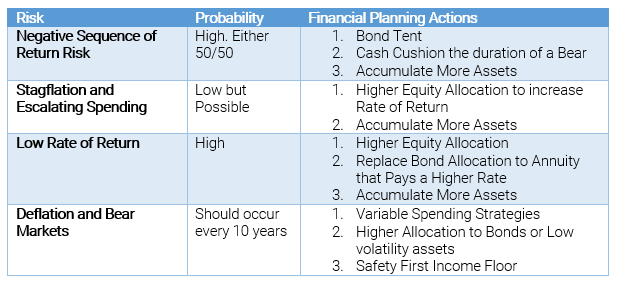

I shared the table above in an article about how much you need to achieve financial independence.

Your journey will involve passing the milestones in this table. Your wealth, relative to your income, will reach a 20% initial withdrawal rate. While you may not be fully financially independent, the amount of wealth can be rather useful.

As you grow your wealth more, you go deeper down the table.

At some point, you unlock Barista FI, Semi-Retirement, very conservative Financial Security, and finally, very conservative Financial Independence.

At any point, your wealth can be rather useful to you.

This is how reality is in your accumulation journey. There may be a few steps back, then a few steps forward.

The goal is to go deeper down the table; the deeper you go, the more conservative your plan is.

What is the Safe Withdrawal Rate or the 4% Rule, and Why is it Important to Your Financial Independence?

When you are researching financial independence, you might come across this thing called the 4% Rule or safe withdrawal rate.

What is this rule, and what is the safe withdrawal rate?

In my opinion, the safe withdrawal rate is a very nifty rule of thumb that determines how ready you are for financial independence. It also tells us how conservative is your financial independence plan.

For example, suppose you have accumulated $2 million in investable assets. Your investable assets are cash, bonds, unit trust or ETFs and add up to $2 million.

Your family reckon you have spent $50,000 a year for the past 3 or 4 years.

Your initial withdrawal rate is equal to $50,000 / $2,000,000 = 0.025 or 2.5%.

If you look up the table above, you realize that you can unlock a very safe FAT FIRE, LEAN FIRE, financial security and financial independence. Your wealth would last at least 40-60 years despite extracting inflation-adjusted income from your portfolio yearly.

Conversely, suppose you want to create a wealth machine that provides inflation-adjusted, passive income that lasts perpetually to pay for your food expenses; how much do you need?

You spend $5,400 a year on food this year.

You will need $5,400/0.02 = $270,000. (Refer to the table above)

This safe withdrawal rate framework is very nifty!

But how does it work, and what is the research behind it? I can tell you that there is a lot of misconception about it in the media, which will throw you off.

That is why I wrote a very comprehensive article explaining the inner working of the safe withdrawal rate and also answer a bunch of questions people have about it over the years.

Read Why the Safe Withdrawal Rate (SWR) is Important for Your Financial Independence >>

You should read this article because if not, a lot of the retirement and financial independence content will not make sense.

The Big Problem of Negative Sequence of Return Risk Explained

Spending wealth down requires a very different strategy from building wealth. Failure to understand this could subject your retirement fund to going down faster than you anticipate.

In this article, we explain what is the sequence of return risk and some possible solutions to address it.

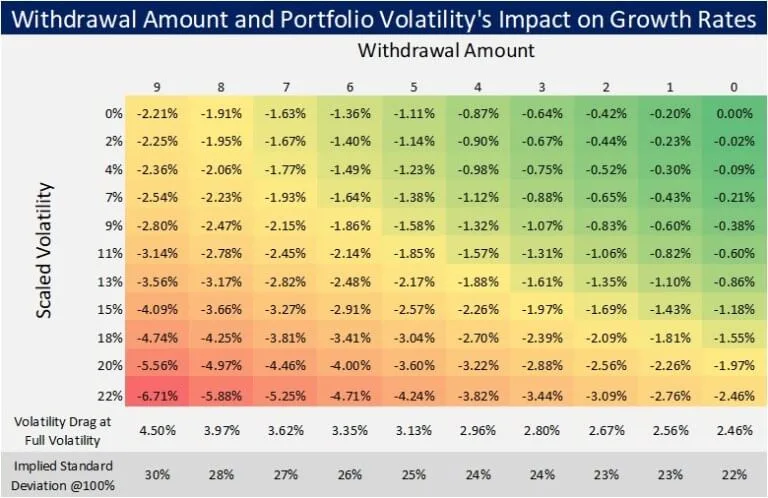

How Volatility is a Drag on Your Income Portfolio in Financial Independence

It is easy to think that if we have a high return portfolio solution, the amount of income we extract from the portfolio can be high.

The problem is, higher returns are usually accompanied by higher volatility.

And volatility, together with income extraction puts stress on the portfolio.

In this article, we explain How Volatility Drags Your Income Portfolio in Financial Independence.

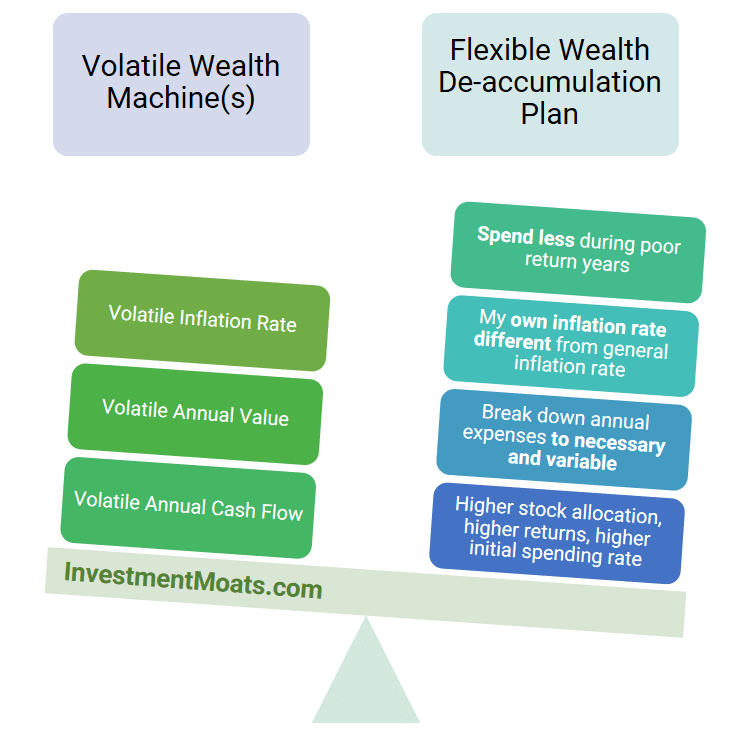

When your Portfolio is Volatile, Your Cash Flow and Spending will become Volatile

What is seldom explained by financial advisers who are not specialized in planning how you spend down your money is that the traditional financial assets we put our money in are volatile in their value and cash flow.

It does not mean that if you have a portfolio that provides a 4% return, you can spend all 4% of it.

Likewise, if you have rental properties, you cannot just assume your rental income is always consistent.

The world we lived in is volatile. However, you can equip yourself with knowledge, and then build in rules to navigate this volatile environment.

In this material, I will explain:

- what are the financial assets that are volatile

- what are the financial assets that are safety first

- why do we need volatile assets

- why we cannot just make use of safety first assets

- what are some of these rules of thumb to be flexible

Read the material here >>

Exploring Various Systems of Flexible Retirement Spending to Increase the Longevity of Your Wealth in Retirement

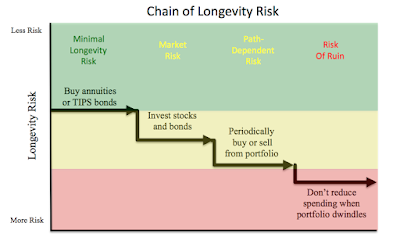

There are a few paths to Rome when it comes to planning how to spend down your money in retirement or financial independence. How would we ensure that our money would last for as long as we live?

There are many ways, such as purchasing annuities, building a bond ladder, and having a stocks and bonds portfolio.

However, each of these instruments has its level of riskiness when we are solely focused on longevity risk. That is, to increase the longevity of your wealth.

The Case to Have More Equities Allocation in Retirement to Increase Longevity of your Wealth

The traditional retirement portfolio allocation is to have a high equity allocation and slowly reduce it and increase your bond allocation during retirement.

Ed Rempel looked through 145 years of data and came up with evidence that to increase the longevity of your wealth, to have enough for your retirement spending, you need to have a high equity allocation.

How to Reliably Maximize Your Retirement Income – Is the “4% Rule” Safe?

A summary of the spending decisions that you need to make

Dirk Cotton’s article here attempts to let you understand some of the spending down decisions you have to make in order for you to not have a high risk of running out of money.

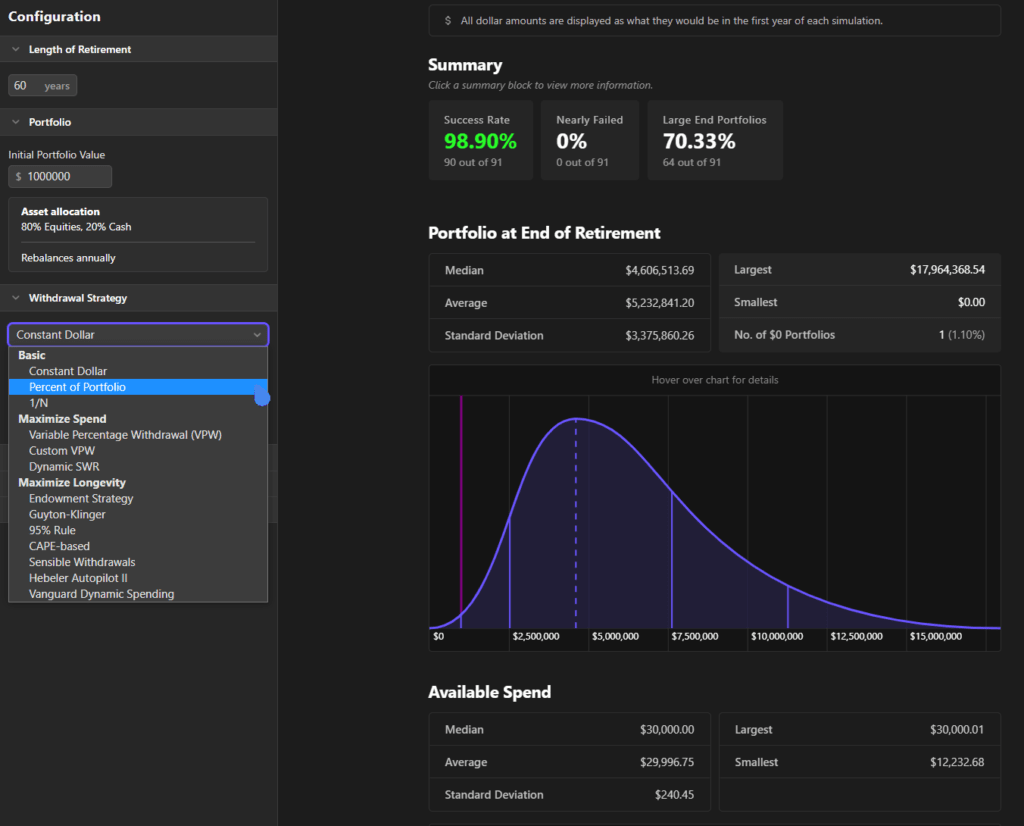

Different Dynamic Wealth Spending Plans consolidated by Investment Moats

The 4% safe withdrawal rate has been talked about a lot as the holy grail of retirement planning but it has some flaws. It is more important to understand the variable decisions that we can make during bear markets that can help boost our withdrawal rates.

In this article, I will introduce and compare the various variable withdrawal methods so that you can compare and contrast them.

Variable Withdrawal Strategies for Financial Independence- The Definitive Guide

In this follow up article, I use Timeline App to backtest some of these variable withdrawal strategies to see, based on actual historical sequences, whether they improve the success of your money lasting, and provide you decent cash flow to pay for your annual expenses.

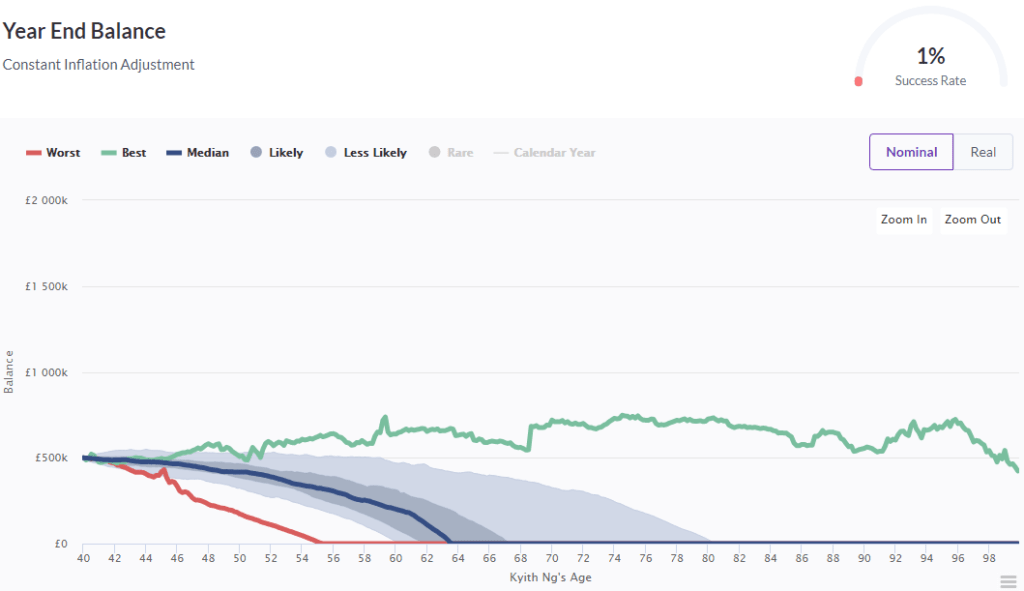

Making a Portfolio of $500,000 last 60 years on a 5% Initial Withdrawal Rate

Explaining the Target Percentage Adjustment – a Variable Wealth Withdrawal Scheme

In a further post, financial planner David Zolt explains his flexible variable withdrawal method and brings us through some worst-case scenarios and how we can increase our withdrawal rate and increase the duration our money lasts.

WSJ – A Summary of Some Variable Withdrawal Scheme

Wall Street Journal Explores why Dynamic withdrawals are the way to go for realistic retirement spend-down instead of the 4% rule. Here, they briefly go through T Rowe Price’s 4% adjusted, Bengen’s Floor and Ceiling Rule, Guyton’s Guardrail Rule.

A Better Way to Spend your Retirement Savings >>

In Real Life, You would Moderate Your Spending If You Realize Something Isn’t Right

You would Moderate Your Spending if the World Collapsed >>

4% Withdrawal Rate Might be Overly Conservative in Some Regimes. You might need to Ratchet up Your Spending In Case of Leaving too Much

Micheal Kitces wrote up this piece sharing that in the case of an average economic situation, the withdrawal rate should be 6% instead of 4%. Bill Sharpe highlights that the 4% is highly inefficient as it is likely 2/3 of the time, the folks end up with double their wealth even after spending in a lifetime.

He proposes a cautious way to ratchet up the spending if the current portfolio exceeds 50% of the initial portfolio amount

The Ratcheting Safe Withdrawal Rate – A more dominant version of the safe withdrawal rule >>

Could we Spend Money like the Charity Foundations and University Endowment?

Charity foundations and university endowments have a very unique requirement:

- They need to preserve the money possibly infinitely

- They need to take care of current spending

- They have to worry about future spending needs

- They invest in volatile markets

Does that sound like a lot of us? I think so!

So this article is my exploration of what do they do differently.

Could we Model Our Retirement Spending like Endowment Funds >>

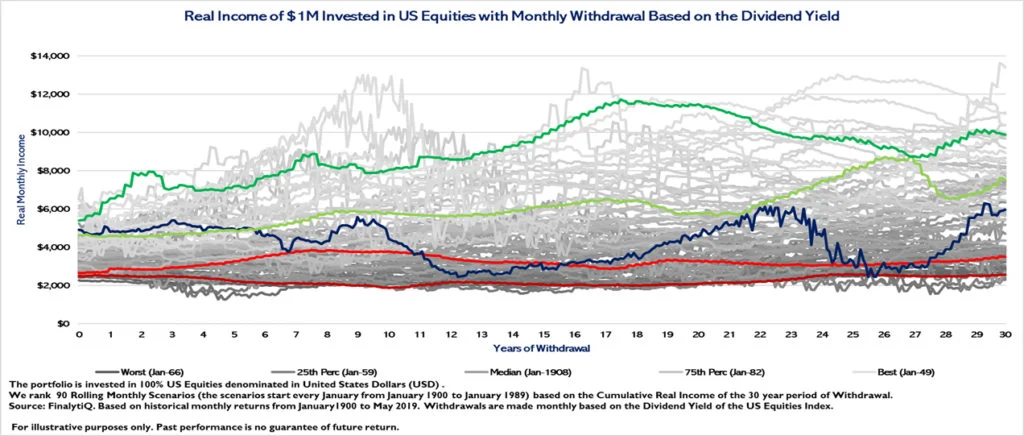

Why Living Off Dividend Income in Retirement is Not Perfect

Many investors wished to have passive income in retirement, that are inflation-adjusted. They also wish to preserve their capital so that their next generation can have it.

Thus, by spending only the natural dividend income from their portfolio of stocks, they think they have a good model for achieving this.

In this article, we show you some studies that your income may not be so inflation-adjusting and not so stable. This could affect your ability to spend and the kind of retirement you would like to have.

The Permanent Portfolio Might Do Worse in Retirement than the Traditional Equity Bond Portfolio

While playing with the Timeline App, backtesting through historical Global Equity, Bond, Gold portfolio, I realize that the Permanent Portfolio might not work so well to make the traditional 30-year retirement last.

Timing Your Retirement after a Financial Meltdown Increases the Robustness of your Retirement Plan

You still have your job. And now you are planning the time you retire.

The stock market has gone up for a while already. Should you retire now, or should you wait for after the market meltdown, then you retire?

This article explores the advantages of retiring during or after a market downturn.

Learning about Safe Withdrawal Rates

A financial adviser by the name of William Bengen did research to find out whether there is a magical figure that can be a good rule of thumb to let advisers (and yourself) know

- How much you will need to save in retirement

- How much you can safely spend in retirement so that you will not run out of money

- How do you structure your portfolio in retirement

He came up with this 4% withdrawal rate.

This means that if you have a portfolio of $1 million, you can take out $40,000 a year in the first year to spend. In subsequent years, your portfolio will grow, will decline but you can get inflation-adjusted income for the next 25 to 30 years.

His work is the basis of many retirement planning models today. There are flaws and critiques to his research but generally, we should thank him for it.

What I realize is that many did not fully understand withdrawal rates. Because they do not understand well, they could not understand how safe or unsafe their plan is.

So this section will provide some of my past write-ups in these areas.

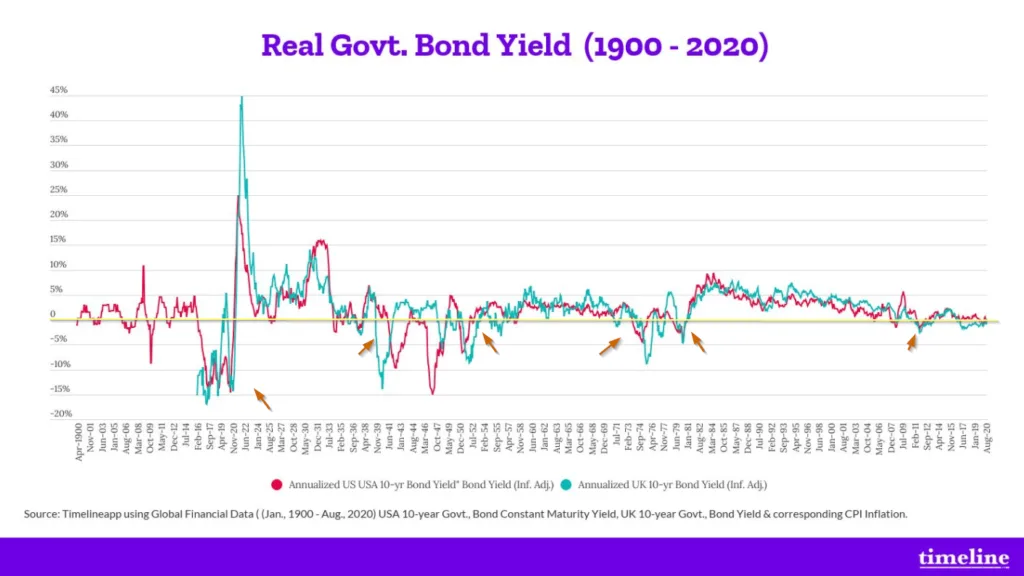

The Safe Withdrawal Rate Study Factors in Negative Bond Interest Rates

At the time of writing (2020), a lot of countries have really low bond yields and many felt that what should be considered safe rates should be brought down further because, in the past, we have not seen low bond rates.

Abraham from Timeline did the research and show that this is not the case.

Safe withdrawal rate research encompasses the study of equity, bond returns, inflation rates in a region or country in the past. Abraham has 100 years of data and during this period there are many periods where the real bond yields went negative.

While he always says for the UK the safe withdrawal rate should be 2.5% instead of 4%, it means that this 2.5% encompass the work of 106 years of equity, bond returns and inflation data.

2.5% factors in the period of negative bond yields and poor bond returns.

Read Negative Real Bond Yields Impact on the 4% Safe Withdrawal Rate >>

Action Script – To systematically spend your wealth in Retirement or Financial Independence

Now that you understand that balancing the objectives of making your wealth last for the period you and your spouse is around, and meeting your total annual expenses need, in a situation where your wealth will be volatile, how should you go about spending down your money?

I created a high-level action script for the people that DIY, to plan how much they can spend the next year, and do this exercise on an annual basis. It provides the majority of the things to think about.

Having a Cash Buffer Does not Guard Against a Large Market Decline and Make your Wealth Stay Longer for Your Retirement

The common advice given is to have a cash buffer of 2-5 years so that you avoid spending down the portfolio during a large equities drawdown.

The research done by others show that cash has an opportunity cost of low growth, and if we have too many low growth financial assets over time, it affects how long our wealth will last.

Re-balancing seems to matters less.

This is done for a passive Global Equities and Global Bonds portfolio, if you are an active investor, it means that your growth rate needs to be as high as equities for the major portion of your wealth to ensure longevity.

You need to allocate more to equities over time in your retirement.

If not, you need to have more money.

Why having a Cash Buffer Does Not Increase the Longevity of Wealth in Financial Independence

A Cash Buffer Zone, where you Consistently Tap and Replenish from Equities, May Not be Better

Would a Cash Buffer Improve Your Retirement Income Success?

Annuities and Retirement

Here is a good video on planning for retirement using annuities to supplement your various income-producing assets.

- 03:58 – The three-legged stool of retirement planning have become inadequate. Must shift the thinking to a pyramid of Social security, then 401k, then liquidating real estate, followed by part-time work and lastly income-producing asset

- 05:40 – The challenge: How to translate 401k to income that will last a lifetime. How long will you live

- 07:35 – Many don’t realize that they get an increase to their social security at 8% per year from 66 -70 years old if you wait a little longer to get your social security. That is 33% larger

- 08:30 – When you retire and when you start collecting your benefits are essentially 2 separate things

- 08:50 – Secured income for life through insurance. There should be a gap after the social security and assets income. People will look into annuities. The key is to NOT invest too much into it but to fill that gap. The rest you will still continue to invest it

- 10:44 – Ladder bonds do not provide enough income in a low-interest rate environment

- 11:05 – How do annuities work? Why are they able to provide more income than bonds (pooling of risks, immediate annuity)

- 12:19 – 4% withdrawal rate problem

- 13:30 – The key difference in mindset between accumulation and distribution

- 14:10 – Immediate Annuity in detail

- 14:57 – Variable Annuity

- 16:55 – Deferred Income Annuity

- 18:00 – The rising interest rate will solve many retiree problems (Fixed D and Annuities)

- 19:00 – Longevity Insurance – Pays only at 85 years old. You can modify your plan so that you can aim for your money to last till 85 years old.Long-tail risk that you will live longer than more. Like deferred annuity. A hard sale. Its pure insurance

7 Annuity Mistakes to Avoid

Annuities are complex products and I believe the insurance company want it that way so that they can earn from you and make it hard to compare.

Kiplinger have an article that talks about common annuity mistakes

- Investing too much money

- Picking the wrong kind of payout

- Picking the wrong payout guarantees

- Switching to another annuity

- Withdrawing too much money

- Not making the most of the guarantee

- Jumping at an annuity buyback offer

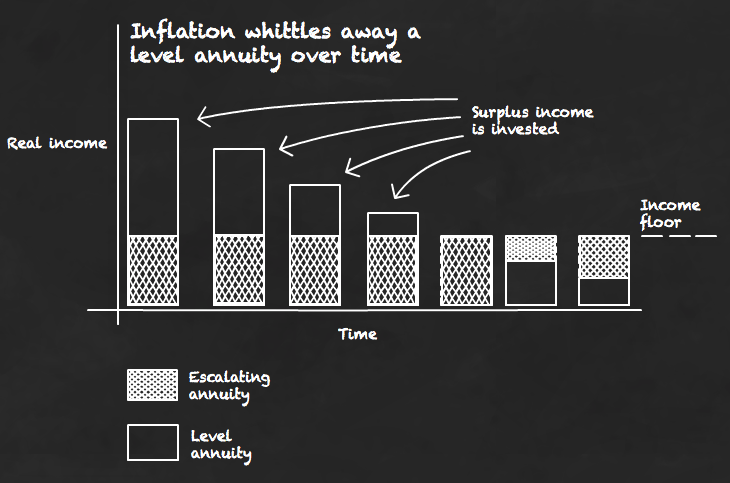

Level versus Escalating Annuities

Monevator breaks down the trials and tribulations of 2 contrasting annuity scheme and how it affects your retirement.

Ultimately, a level annuity offers more flexibility, growth, and value for money, but it does not offer certainty, security, or safety.

An escalating annuity is the superior product if those are your retirement goals, and frankly who doesn’t want some of that in their retirement?

Focus: Spending and Cash Flow Needs in Retirement

To plan for your retirement, you need to know the annual expenses that you will need rather well.

To know that:

- imagine how you would spend your days in retirement on a typical week

- what are the one-time expenses you will need to spend on

- what are some of the outstanding liabilities still?

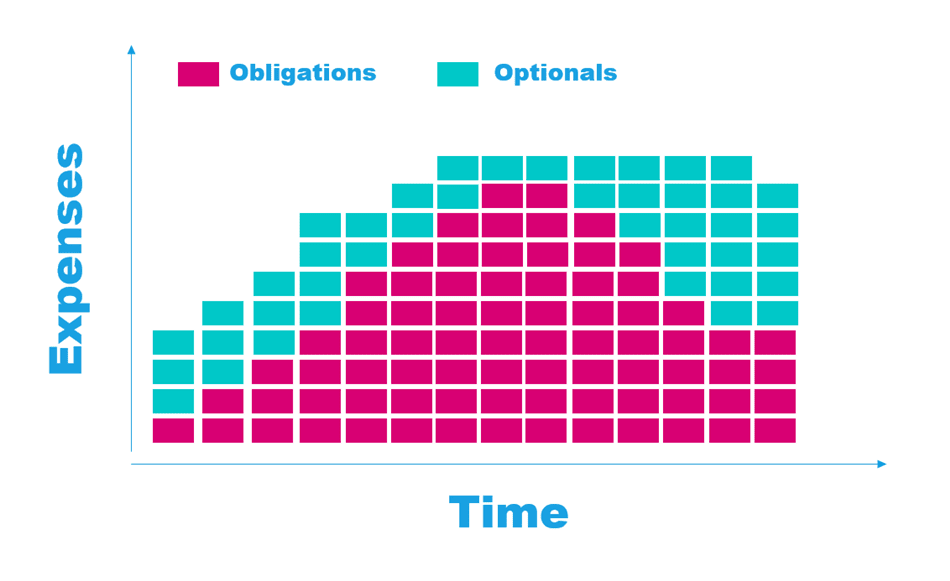

What you need to come up with, is to break your annual expenses into:

- Essential Recurring Expenses

- Essential Non-Recurring Expenses

- Non-Essential Recurring Expenses

- Non-Essential Non-Recurring Expenses

Here are some articles that elaborate on this area.

Retirement Spending could actually be Lower

David M Blanchett researched shows that what we know about expenditures in retirement may be rather different:

- Expenditures tend to go down

- Even after factoring in inflation

- Even factoring in higher medical costs

Exploring the Retirement Consumption Puzzle and also Saving for Bucket List

Research shows that Retirees Do Not Dare to Spend During Retirement

Blanchett and Micheal Finke shared a few pieces of research showing that retirees still accumulate assets in retirement.

They cannot spend optimally because they are worried about running out of money.

This is why annuity income is very appealing for the same amount of money.

Just like our Work Income, Annuity Income is Addictive

Would it be possible we need to Save Much Less for Retirement?

NYT ran an article providing insights about the subject of a 4% withdrawal rate from an experienced planner. Based on his experience, he seldom sees people spend in a straight line. Research has shown that spending over time resembles more of a smile.

Thus, they felt that what you need can be less. However, somehow I felt that they are planning for people who are not super optimizers during their working years. You might not have many things to cut down on if you are.

Optimizing Your Expenses is More Efficient than Earning Higher Wealth Returns

There is always a big fight among the proponents who advocate optimizing expenses versus trying to earn more.

However, it is very difficult to “earn more” by increasing your financial assets’ returns over the average in retirement.

And thus, for many retirees, it might make more sense for you to optimize your view of retirement and the expenses for that kind of retirement.

Optimizing your expenses will make your plans safer, with a greater margin for error, than if the amount of wealth you have just about produces the optimum income required for your retirement.

Think of your Expenses in terms of Obligations – You Need to Optimize them to Make the Numbers Work

As we live our lives, we start to stack up a lot of obligations. You may not have realised that these obligations often involve spending more time and money.

Sometimes it is something that you are not very comfortable with.

If your life is filled with obligations, many of your expenses are essential.

Then you realize that you need a lot of money to feel safe to retire.

Which might be rather demoralizing.

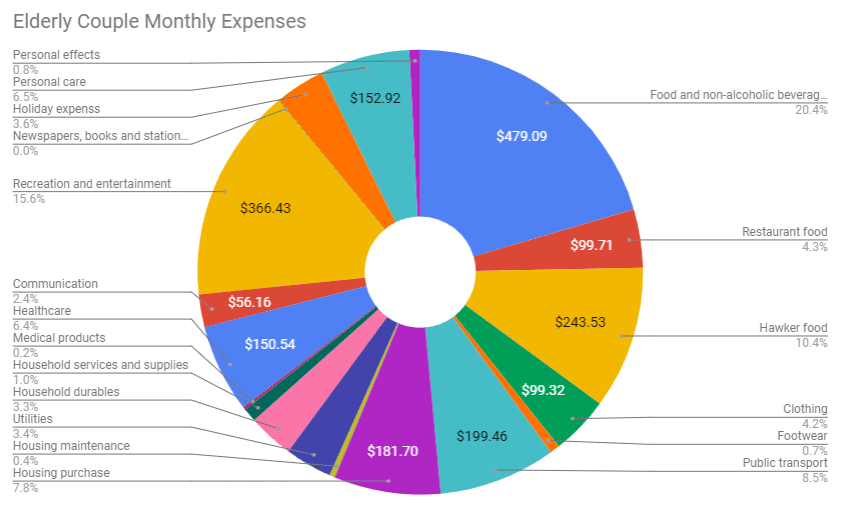

For Singaporeans – A Reference Template of Items when Planning How Much You Need in Retirement

The Lee Kuan Yew School of Public Policy came up with a report in 2019 to find out what our basic living standards are based on their MIS method.

It is not one based on only essential expenses. It includes the non-essentials and essentials because they ask a group of Singaporeans and sought to construct it based on their lifestyle.

This report is good because:

- It lets you and I have an idea of what is a higher priority in older folks

- What they deem as a satisfying retirement

- Gives a trigger list for you to work your retirement budget, based on how you will live your life in retirement, and not when you are working

- It gives you numbers so as to estimate what is the floor in your spending

If we know that Essential + some Non-Essential Expenses come up to $26,000/yr without housing, we can imagine your CPF Life with Full Retirement Sum (FRS) giving you $13,000/yr.

You will thus need to fulfil $13,000/yr with your non-CPF retirement funds.

For a 30 year retirement, a good estimate of a stock/bond portfolio will be $13,000/0.035 = $371,000.

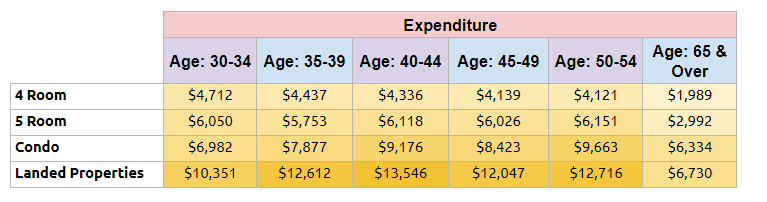

For Singaporeans – What you can Learn about Expenses from the Singapore Statistic Survey

Every five years, the Singapore Statistic Department will compile an annual expenditure survey.

We can tell a lot from this survey:

- Monthly expenditure by income level, by the home we live in, by profession, by how many children we have

- Monthly expenditure by age group

- Our Income level

For those planning for financial independence, you can use these data and see how your spending will change as you move to not working. You can also use the savings rate to estimate how likely is it for you to early retire.

Financial Independence and Retirement Calculators

- FI Calc – Very good FI calculator. Able to simulate constant percentage, constant inflation adjusting, flexible spending, and PMT spending. Data goes back to the 1800s.

- Coast FI Google Spreadsheet. In the middle of this post, I have included a Google spreadsheet that allows you to compute how much you need to be Coast FI.

Good General Articles on Retirement

- The Safe Retirement Spending Rate can be as high as 5% in Today’s Low-Inflation Environment: Bill Bengen

- How does a retired actuary, who served on the boards of the pension system, plan for his own retirement spending? What are the important questions we should ask ourselves to see if we are ready for retirement?

- Having Passive Income to Prevent a Life Deprivation is a Better Feeling than Having Lots of Wealth But Not Feeling You Have Enough

More Case Studies

- Making a Portfolio of $500,000 last 60 years on a 5% Initial Withdrawal Rate: I use a quantitative retirement planning app Timeline to show you how to turn a low success retirement to a higher success one through tactical shifts in spending from year to year

- Doug Nordman: Early retired US military man in an interview at Wealth Mentor on a simple lifestyle, passive investing and mistakes made during the dot-com boom

- An “Extreme” Early Retirement Life is Not so Extreme. It looks Pretty Good: What Jacob Lund Fisker, who popularized extreme early retirement, did during his retirement

More to continue….

Do you have other great retirement resources? Do share with me so that I can add to this great resource!

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Kenneth

Saturday 30th of May 2020

Dear Kyith, I came across your website and read it with great interest. It is very informative and easy to understand, with good illustrations. I am in my late forties and married, and also invest in SG and HK markets but not very active.

Appreciate your work and look forward to share more and learn from you.

Have a Great Weekend

Best regards Kenneth

Kyith

Sunday 31st of May 2020

Hey Kenneth! You are the first person to comment here so I really appreciate it! Do let me know if you have a question on your mind that you are searching for a solution. I may be able to point you to the right resource!