In the last few articles, we have covered how to open your account with Interactive Brokers, funding your account, and converting to different currencies. Now, you are ready to buy and sell or trade stocks on Interactive Brokers.

This includes stocks and options on different stock exchanges.

Let us try to get down to it.

How Stock Exchanges Work

Before you trade on these stock exchanges, you would need to know the mechanics behind how they work.

By understanding the mechanics, you will not find what you have to do weird.

Intreactive Brokers is a broker that allows you to trade on a stock exchange.

The illustration above roughly the role they play in this system. They allow you to

- Buy and sell

- Get information about the stocks, including prices, volume and more information

- Holds the records of what you own (official term is they are the one that custodize your stocks and option holdings)

At the background, Interactive Brokers help you place your order and handle the backend processing.

Some years ago, I wrote a comprehensive article explaining how to Buy and Sell Stocks, Bonds, REITs, and ETFs in Singapore.

It is very comprehensive and I urge you to read it before you get started with this.

Be Clear What You Wish to Buy and sell

After you understand the general trading process, it is time to start trading.

You need to have a certain understanding about what you are trying to do. Are you buying a company with a 3 day or 2 years time frame. Or are you selling a company whose fundamentals have broken down.

Interactive Brokers is the broker and the stock exchange is just a place that lists the prevailing market price of the companies you wish to buy and sell.

For some of my readers out there, you are passive, index investors who prefer to do-it-yourself.

You wish to periodically buy exchange-traded funds (ETF) listed on the London Stock Exchange. These ETFs allow you to own a basket of stocks at a low cost. Owning an ETF is a very simple way to be diversified, capture the returns and prevent a handful of stocks from permanently impairing your capital.

Some popular ETFs are:

- iShares Core MSCI World UCITS ETF – Ticker: IWDA

- Vanguard FTSE All-World UCITS ETF – Ticker: VWRA

I wrote an article not long ago exploring whether there are differences in the historical performances of these two ETFs. It provides more information about these two ETFs.

For others, you are interested in owning great businesses around the world such as Tencent listed on the Hong Kong Stock Exchange, Adyen listed in the Netherlands, or PayPal listed in the United States.

Whichever, you need to know the ticker/quote of the stock/ETF that you are buying/selling.

You will also need to know the price that you wish to buy/sell.

For the demonstration, I will use the iShares Core MSCI World UCITS ETF or IWDA as an example.

Finding the security IWDA on Interactive Brokers

Suppose I wish to add IWDA to my existing holdings.

I wish to purchase 10 shares of IWDA.

For most of us, we would trade through the Interactive Brokers mobile application (which is available on Apple App Store or Google Play). However, if you wish to use Interactive Brokers on the desktop, you could do it the same way as well.

If you have an ETF or stock that you wish to buy, first you got to search for the stock.

At most screens on the mobile app, there is a magnifying glass icon. If you click on it, it allows you to search for the securities.

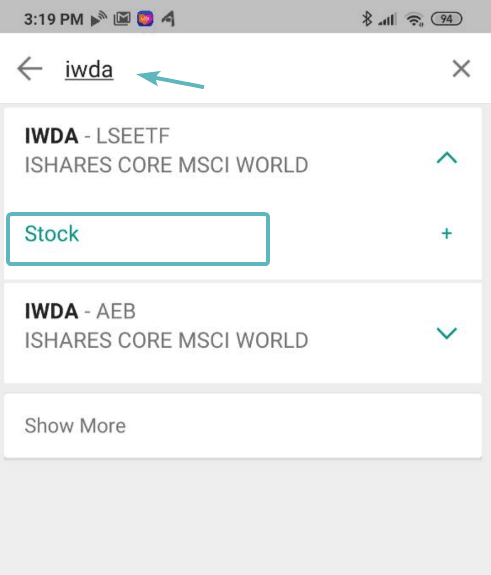

In this case, we are interested in IWDA, so we search using the ticker IWDA. We came up with two entries. The one that we wish to purchase is the IWDA that is listed in the London Stock Exchange or LSE.

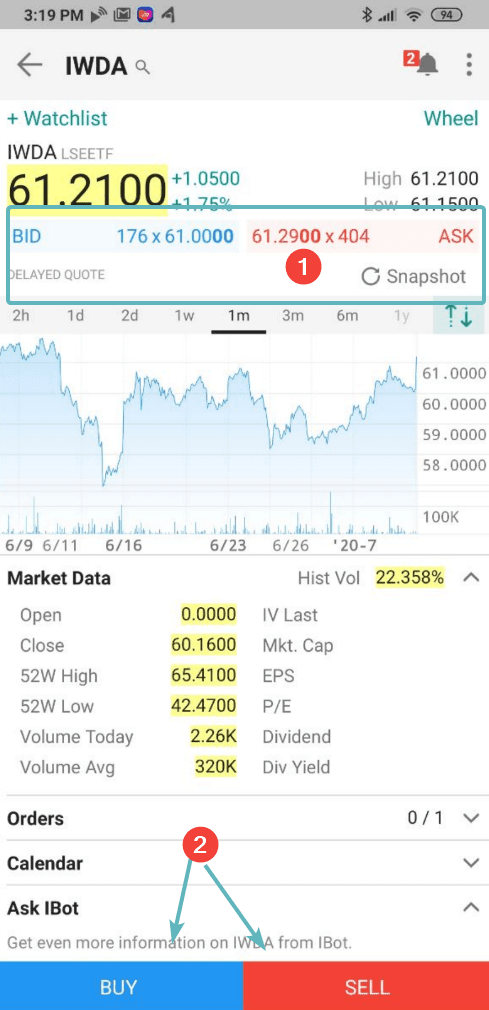

Interactive Brokers will show you some details about the securities that you wish to purchase. You can scroll through to take a look.

Understanding the BID and ASK Queue system

If the market is open, you can see the BID and ASK prices and the amount of stocks in the BID queue and ASK queue.

The BID queue are the people queuing to buy IWDA. The ASK queue are the people queuing to sell IWDA.

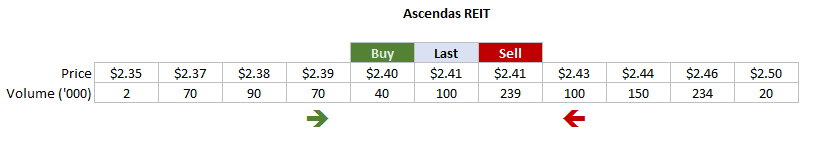

The best way to think about the Bid and Ask queue is to use the Ascendas REIT illustration in my previous article. Currently, Ascendas REIT trades at $2.41. You can choose to buy at $2.41, but there are a lot of people who are only willing to buy at $2.39, $2.38, $2.35.

So they will queue and wait.

Similarily, there are people who wish to sell at $2.41, $2.43, $2.46, $2.50.

So they will queue and wait.

At some point, someone will grow impatient and decide to sell at $2.40 instead of where they are currently queuing.

So the transacted price became $2.40 instead of $2.41.

This is how the stock exchange work.

What this means is that if you wish to purchase IWDA, you could choose to buy at $61.00 or $61.29 or any price.

But if no one wishes to sell to you, at that very moment, you will not get the 10 shares of IWDA.

If you are impatient, you will just BID at $61.29 and you will get it.

BID and ASK Prices May Not Be Real Time

One thing to note is that the prevailing price $61, 21, BID and ASK price of $61.00 and $61.29 is not the real time prices.

By default Interactive Brokers shows the delayed prices.

In order to get the real-time price, you have to pay a monthly subscription to get the real-time prices for certain exchanges.

This may sound like a deal breaker but this is seldom a problem for a lot of us.

The reason is that:

- There are other website that you can reference the real-time prices. For example AAStocks.com gives real-time Hong Kong prices. Investing.com has real time prices for US stock prices

- You can purchase the latest price when you wish to purchase at a very small fee (more on this later)

Filling in the Buy Order

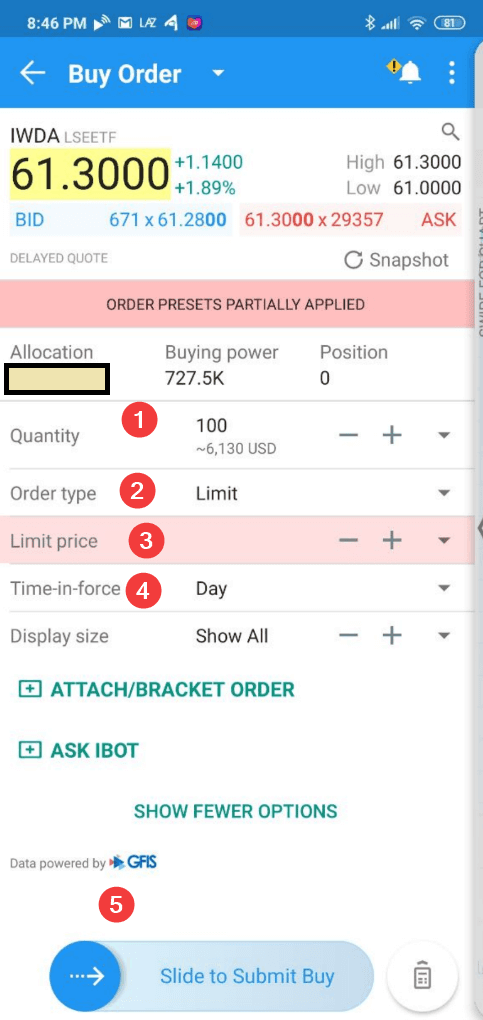

There is a Buy and Sell button at the bottom of the IWDA information screen.

Click on the Buy button.

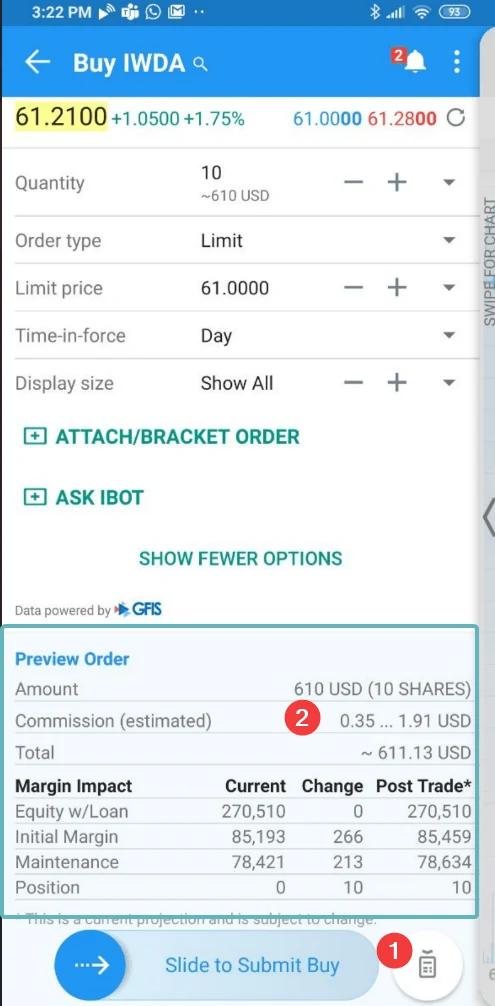

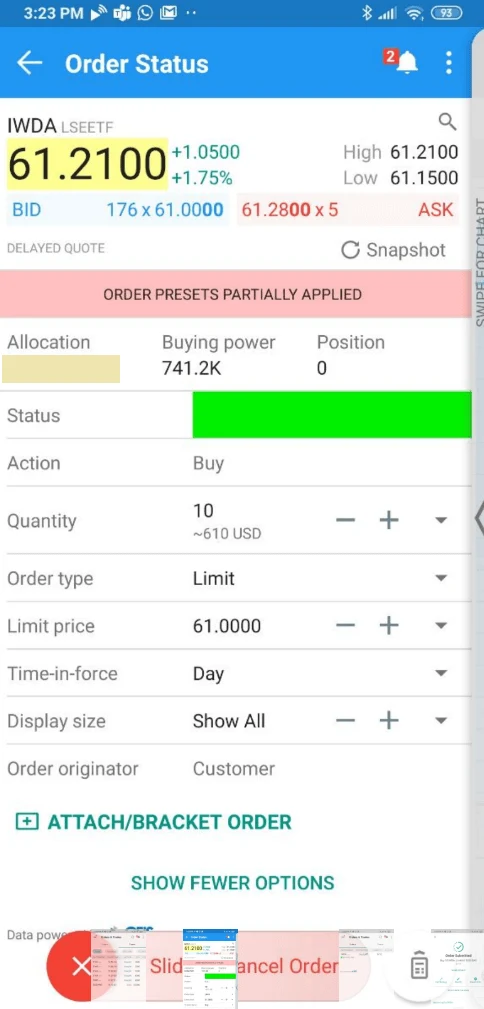

You would need to fill in #1 the quantity, #2 the order type, #3 the price, #4 time-in-force.

And then you will slide #5 to buy.

Interactive Brokers by default set your order to order type Limit, and Time-in-force Day. At the grey area in the quantity, it shows you roughly how much this order will cost (6,130 USD)

A. Filling in the Price

In order to know what price to queue your BID at, you need to know roughly what is the price IWDA is traded at.

For that, you could check the price at another platform like Investing.com.

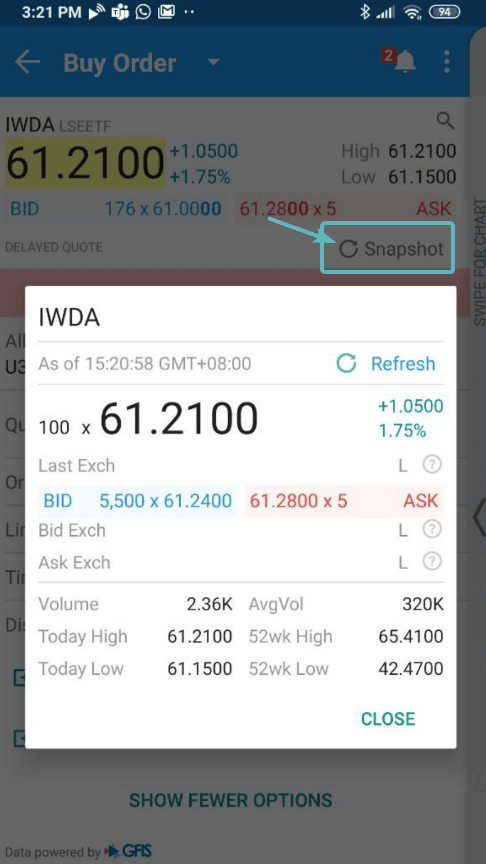

Or you can use the Snapshot function in Interactive Brokers.

IBKR offers eligible clients the option of receiving a real-time price quote for a single instrument on a request basis. This service, referred to as “Snapshot Quotes” differs from the traditional quote services which offer continuous streaming and updates of real-time prices. Snapshot Quotes are offered as a low-cost alternative to clients who do not trade regularly and do not want to rely upon delayed quotes1 when submitting an order. Additional details regarding this quote service is provided below.

You can check out the snapshot cost for various exchanges here. For most exchange it is USD0.03 and for United States Exchange it is USD0.01.

I think it is not too expensive.

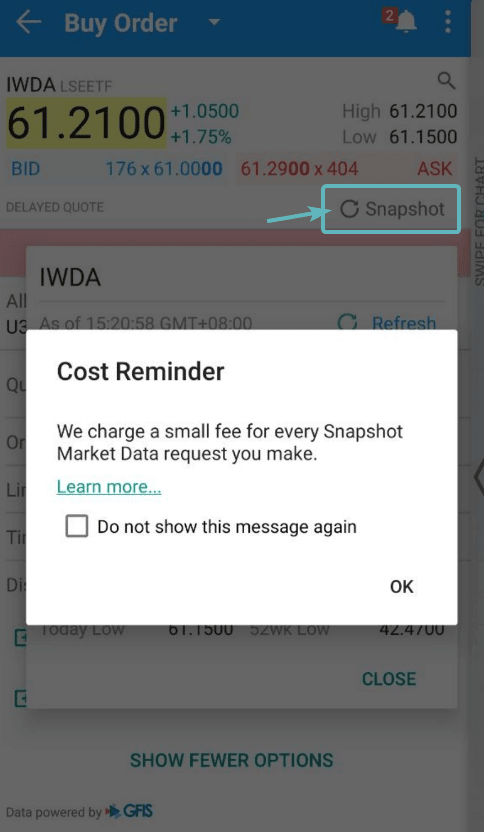

If you click on the Snapshot word under ASK, IB will remind you that they charge a small fee for every Snapshot request.

So instead of $61.00 and $61.29, the real time BID and ASK is $61.24 and $61.28. The current traded price is $61.21. This allows you to make better decision.

You can then fill in the price.

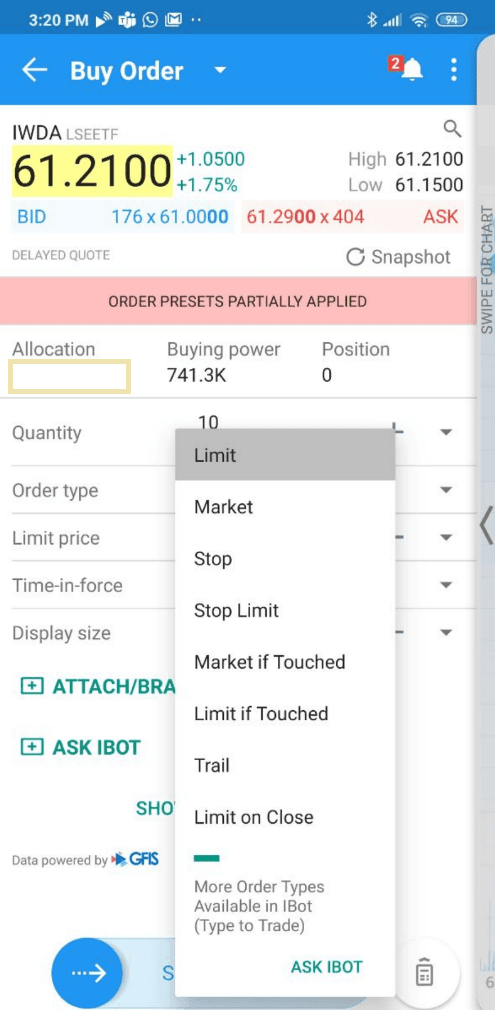

B. Order Type

There are a few order type.

- Limit – Your buy or sell order will only be executed if it hits your price. For example, if the current price is 61.21 and you queued at 61.11, your order will not execute unless the price gets down to 61.11. Limit Order is the default option and what I use most of the time.

- Market – Instead of specifying the price you want to buy or sell at, you take the latest price IWDA is traded at. For example, if currently, IWDA trades at 61.20, it will execute at this price. Market orders are pretty dangerous if there is a liquidity vacuum in the stock you are trading in or sudden price spike and fall. Generally, do be careful of market order

- There are other order types that I have not tried. Some are stop-loss orders or trailing stop-loss orders. (You can let me know if you find that some are significant enough for me to mention)

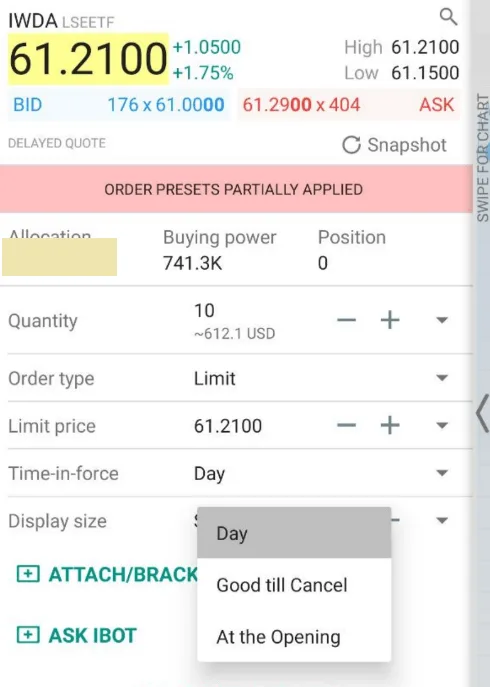

C. Time-in-force

Time-in-force determines the length of time over which an order will continue working before it is canceled.

There are three types:

- Day – Order will work throughout the trading day during regular trading hours until it is filled, is canceled by the user, or expires at the end of the trading day. Default option and what I used most of the time

- Good Till Cancel – Order will continue to work within the system and in the marketplace until it executes or is canceled. Good till Cancel orders will be canceled in some conditions

- If you do log into IB to more than 90 days

- At the next calendar quarter after the current

- At the Opening – The Order will try and execute at the opening. If it does not, then it will expire

For most of us, a Day order would be adequate.

D. Preview Order

There is a calculator-like button at the bottom. If you click on the button, it will show you a preview of the order. You can see the estimated commission range and how much the total transaction will come up to.

If you have a margin account, it will also show you the margin impact.

E. Submitting Your Order

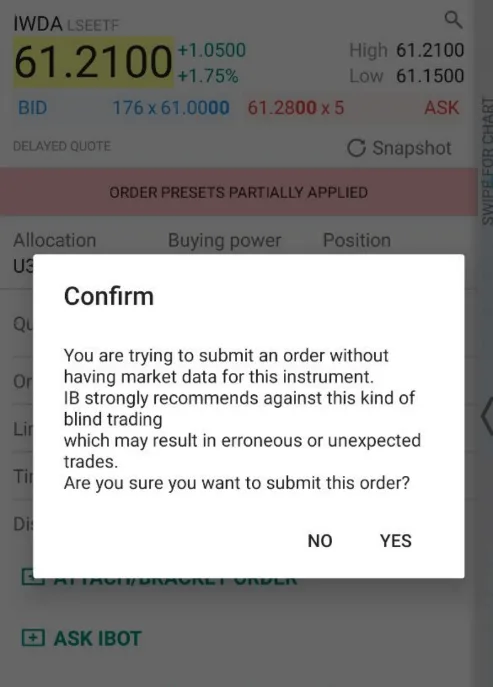

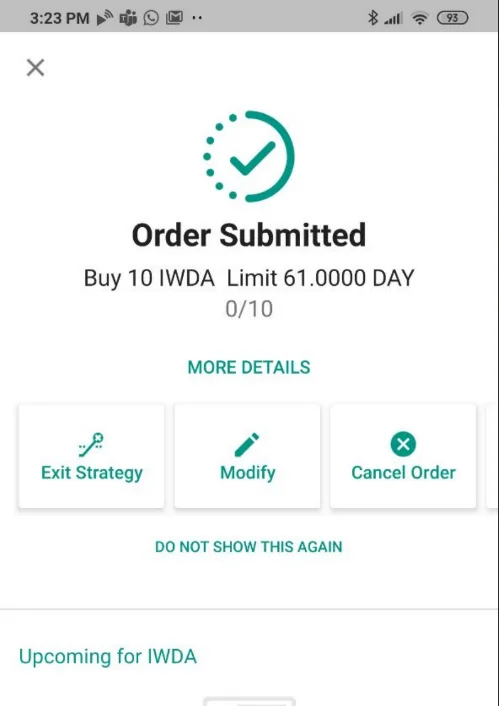

When you Slide to Submit Buy, you will encounter the following screen.

It is a compliance message letting you know that you are submitting an order without having market data on this instrument.

Just be sure that you know that you have keyed in the price you intend to buy at.

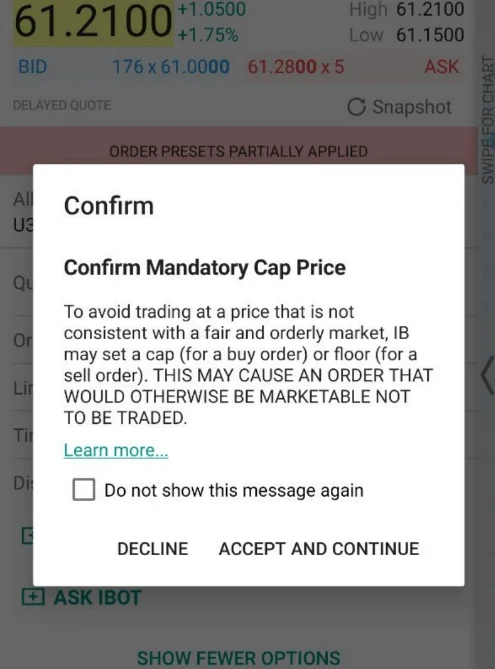

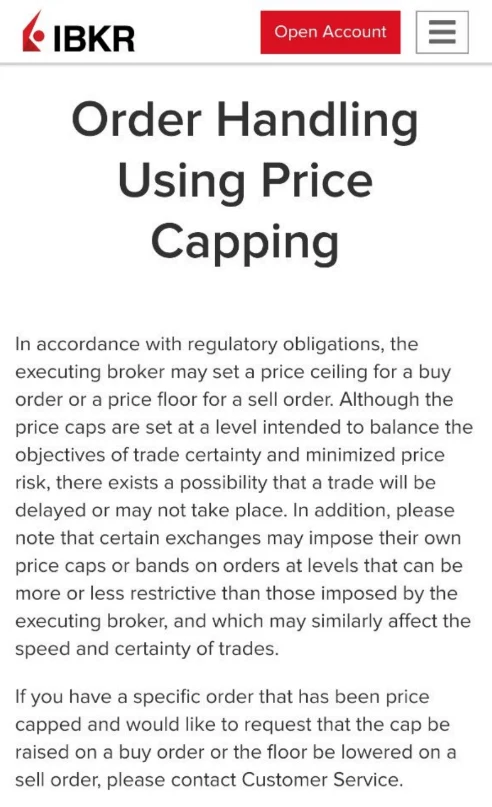

There is another compliance message to inform you that IB have placed a ceiling and floor on orders due to regulatory obligations. The explanation is below:

After you are aware, click Accept and Continue.

Your Order is Submitted.

Checking on Your Outstanding Order

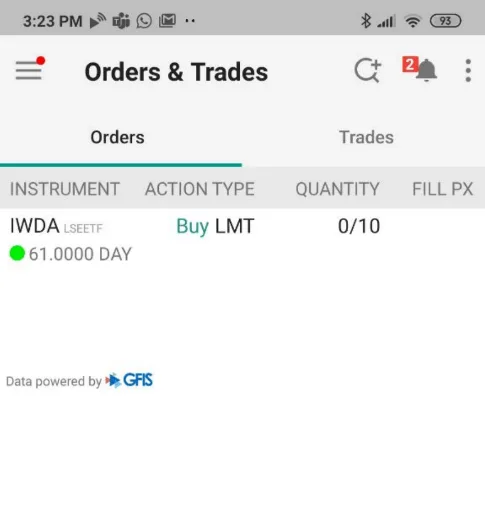

If you go to your Menu (the Button on the top left with three lines), then Order & Trades, you can check up on how your order is doing.

In this screen capture, you can see my limit order is still not executed. 0 out of 10 quantity are filled.

If you would like to modify your order, click on the IWDA.

You can amend the quantity, order type, price and time-in-force.

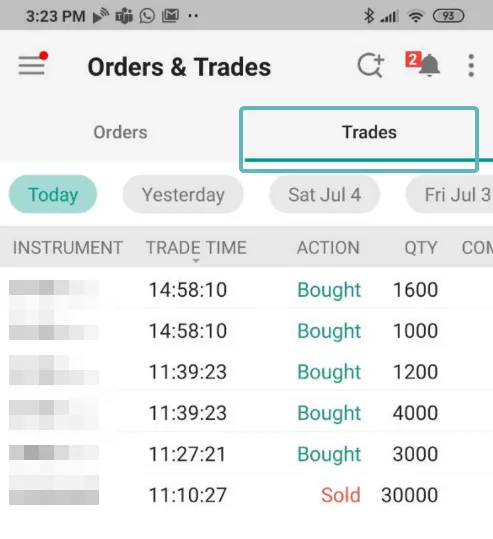

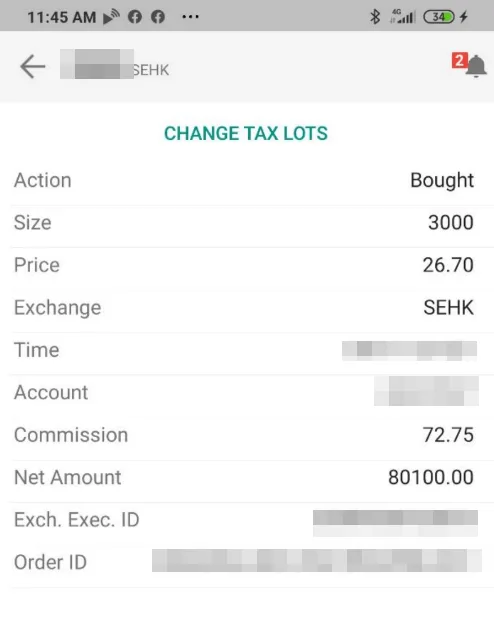

If you click over to the Trades tab, you could review those trades that have been executed on different days.

Clicking on each trade log will allow you to see more details of the trade.

You can see roughly the commission and what price the trade was executed at.

Selling a Security

I will not go through the sell process as it will be similar to the buy, except you click on the Sell button and put in the quantity and price you wish to sell.

Then you submit the order and see whether it gets executed.

Summary

I do find the trade execution on the web application to be rather user friendly.

On their desktop application TWS, that is another matter altogether.

Let me know if you have further questions.

My Comprehensive Interactive Brokers How-to Guides

Interactive Brokers is a great low-cost, financially strong brokerage platform that can be the standard broker for holding your long-term investments. You can access 150 global exchanges, including exchanges such as Singapore, the US, Hong Kong, London, European and Canada.

You will enjoy cheap commissions and zero minimum recurring platform fees or maintenance fees. Convert your funds to different currencies at near-spot rates, paying a flat US$2 fee.

To get started or become familiar with Interactive Brokers, check out my past articles on how to invest with Interactive Brokers. I hope the guides make your life and investing experience easier and brighter.

An Easy Step-By-Step Guide to Setup Interactive Brokers (IBKR)

How to Fund & Withdraw Funds from Your Interactive Brokers Account

How to Convert Currencies in Interactive Brokers

How to Buy and Sell Stocks and Securities on Interactive Brokers

How Competitive are Interactive Brokers Commissions Pricing?

How Safe is it to Custodized Your Money at Interactive Brokers? The things they do better than other brokers.

How Safe is it to Custodized Your Money at Interactive Brokers (2)? Financial strength of IB during recent banking crisis and during Great Financial Crisis

Interactive Brokers have Eliminated the US$10 monthly inactivity fee. More details here.

How to Transfer your shares from Standard Chartered Online Trading to Interactive Brokers

How to trade after-hours and premarket

Create Customized Reports and automatically send them to your email

What is the PortfolioAnalyst Report and Automatically Send the PortfolioAnalyst Report to Your Email

Send Money from TransferWise to Interactive Brokers

Interactive Brokers’ Fluid Interest Income on Cash

Introducing IMPACT by Interactive Brokers

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

MichaelJZ

Sunday 26th of September 2021

Hi Kyith, how is the execution speed for buying and selling US stock in Singapore? Im an active Day trader from Italy, and was wondering if IB is good for my purposes. Thanks!

MichaelJZ

Tuesday 28th of September 2021

@Kyith, Thank you for your reply, just checked IB and for my purposes of day trading NYSE-NASDAQ-AMEX stocks I need market depth (level 2) and it comes at 60$ a month. And since its direct access route the fill speed should be fast. If the order is routed right I can also get exchange rebates and the commissions are even lower.

Kyith

Sunday 26th of September 2021

Hi Michael, I am not so sure what are the demands that you need for IB. I feel like in terms of execution it is like any broker. but as a day trader you might need the price to be real time. If that is the case there might be additional cost as real time price data comes at additional costs. There is a function whereby we can get the latest price on demand at a very, very , very cheap cost but I feel that for day traders, this might not be sufficient. However, there are boutique funds running their business on IB platform. In a way they feel that is sufficient for them.

Adrian

Saturday 6th of February 2021

Hi, MAS has regulations to transact in listed Specified Investment Products (SIPs); e.g. SGX SIPs ETFs, overseas exchanges ETFs, etc. Does IBKR (Singapore) requires the Customer Account Review (CAR), to deemed if customer possess the knowledge to transact in SIPs? Thanks.

Hex

Sunday 17th of January 2021

Thanks for the detailed guide. To share, now we can use "MyInfo" to sign up for an account. (with Singpass) All the particulars filled in, no need send photocopy of NRIC or Utility bills. Amazingly, I didnt even send any specimen signature of myself.

Question: 1) IBKR cannot do "Sell from CDP" right? and SRS and CPFIS is also a No-no. So we would still need maintain another local broker for that.

2) Wonder if I can transfer securities Singapore stocks from CDP to IBKR.

Kyith

Sunday 17th of January 2021

#1 is right. #2 i have to find out.

Kk

Wednesday 13th of January 2021

Hi

Will the commission charges incurred from SG and Hongkong market trade to be used to offset the IKBr monthly fees 10usd?

KK

Thursday 14th of January 2021

@Kyith,i just received the email notification saying going to charge me $10 monthly fee. let me monitor for coming months and update here if there is any changes..

Kyith

Wednesday 13th of January 2021

HI KK yes. Are you observing otherwise?

DQ

Tuesday 5th of January 2021

Hi Kyith

Thanks for the very detailed guide on Interactive Brokers, it is very helpful.

Pardon my novice question, but I recently opened an account following your detailed instructions in September 2020.

I've been reading the comments on your IB related posts and have seen people mentioned IBKR and IBSG.

What is the difference between the 2, and how do I know which I have signed up for when I opened my account?

Thanks!

DQ

Thursday 7th of January 2021

@Kyith, thanks a lot for your reply, much appreciated!

Kyith

Wednesday 6th of January 2021

Hi DQ, i think if you have signed up recently, you have signed up for IBSG. If you look at your URL it should reflect as .SG. IBSG allows you to trade Singapore shares, while a customer on IBKR would not be allowed to do that if they are Singaporean.