I first introduce the Infinity Global Stock Index to readers in 2014. 5 years later, I think it makes sense to do an update since the landscape for passive investing has changed.

I have decided to update the performance of Infinity Global versus the iShares Core MSCI World UCITS ETF (IWDA) in both SGD and USD over the past 11.5% to show the impact of cost in Oct 2020.

One way to build wealth, but don’t want to actively manage it, treating investing as a form of accumulation is to passively invest in a diversified portfolio.

And one of the best way is to invest in a diversified portfolio across the world as if you are purchasing a group of the stalwarts around the world.

If we know that it is hard to pick the right active manager, the best way is to invest in a low cost fund that tracks a World Global Index.

Most investors did not know that there are 3 feeder index funds that enables you to invest in Vanguard in Singapore. They were brought over in early 2000 by then OCBC Asset management, now Lion Global Investors.

These funds are:

- Infinity Global Stock Index Fund: A feeder fund into Vanguard Global Stock Index Fund, which tracks the MSCI World Free Index, a basket of 1600 global stocks

- Infinity US 500 Stock Index Fund: A feeder fund into Vanguard US 500 Stock Index Fund, which tracks the S&P 500 index

- Infinity European Stock Index Fund: A feeder fund into Vanguard European Stock Index Fund, which tracks the MSCI European index

They are distributed by many platforms like your normal unit trust and one distributor is Fundsupermart.com

If you want to keep things simple, and own majority of the corporates in the world passively, Infinity Global Stock Index Fund fits the needs.

How you can build wealth with the Infinity Global Stock Index fund – The Strategy

The Infinity Global Stock Index fund has an advantage because a lot of Singaporeans are familiar and know how to purchase it.

- Sign up with a distributor like Fundsupermart so that you can start purchasing the Infinity Global Stock Index Fund

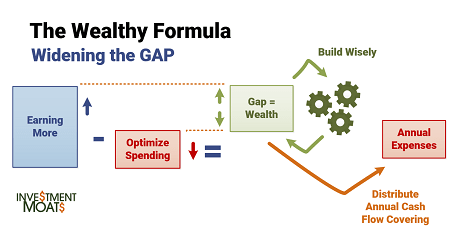

- Decide X amount or Y% of your disposable income per month to funnel into Wealth Building

- Start a regular savings plan (RSP) to monthly funnel X amount to Fundsupermart to purchase Infinity Global Stock Index Fund using GIRO (minimum amount is $100, which is low)

- Regularly contribute to the Infinity Global fund. You try to earn more, then optimize your expenses, so that you have greater personal free cash flow to channel to your wealth building

Benefits of Investing Passively in a basket of Global Stocks

There are some benefits of investing in a single fund this way:

- It enables you to participate in the global growth of the corporates in the world. If your time horizon is 20 years or more, and a firm believer of optimism that the world will be a better place 20 years from now, this is a passive way to do that

- The basket of stocks is diversified. There are 1600 stocks, sampling based on the composition of the largest companies in the world. If a few company blows up, it will cause a minor dent in your portfolio

- It removes a single country risk. You can always invest passively in a Singapore STI Index ETF, but what if Singapore languish for 20++ years the way Japan did? A global index portfolio minimizes that risk

- You can worry less about underperformance. Because you are essentially buying the benchmark where all global unit trusts, or active managers measures against, there is no worry that choosing the wrong fund, 20 years down the road, results in abysmal performance versus the benchmark

- You are removed from the execution. Note the process above. You set it and forget it. Human’s tend to make irrational decisions due to our genetic behavioral makeup. We become our worst enemy by buying high or selling low. Fixing a GIRO plan is a form of pre-commitment and protection against yourself, compare to if you need to monthly manually purchase a fixed amount yourself (You might decide then and there when the MSCI Index is down 4% in 2 days to ‘wait until the coast is clear’ before investing)

- It lets you get on with what you value most: Life

Some negatives about this plan

- If you have an ‘edge’ to perform better, you may be missing out on an opportunity. There are folks that do have a certain edge that when they actively managed, they do better than the average performance of the market. And they have the time to actively manage. This might not be for them. The question is whether they have the ‘edge’ (Or most of the time its their ego that thinks they have the edge)

- In the short term, the value of your holdings can be very volatile. Your value at the worse case in the depths of 2008 can go down by 50%. Can you bear with that?

- Global growth of corporates in the world can stagnate or deflate in 20 years. There are always pessimists in the world. If you firmly believe we are in such a scenario, this is not for you.

- The Infinity Global Index Fund is not as low cost as the original US Index Fund. Ultimately cost matters and the Achilles heel of the Infinity Global is that the expense ratio is 0.95%. The original index fund’s expense ratio is close to 0.25%. That means you lose out 0.7% return just to fund management and by virtue of it being in Singapore. (See below why this cost matters)

Summary of Costs Associated with Investing in Infinity Global Stock Fund

The Infinity Global Stock Fund is a unit trust. And with it there is a bunch of costs associated with owning the fund.

Later in the article we will talk about why costs matter in investing.

As Singaporeans, you have various ways now, compared to in the past to invest in a low cost global equity product. You do not always need to invest through the Lion Global Infinity Series.

You could:

- Purchase as part of a portfolio through the Robo platforms Stashaway, AutoWealth and Smartly

- Purchase viable passive index exchange traded funds (ETF) through a good platforms such as Standard Chartered Online Trading, Interactive Brokers

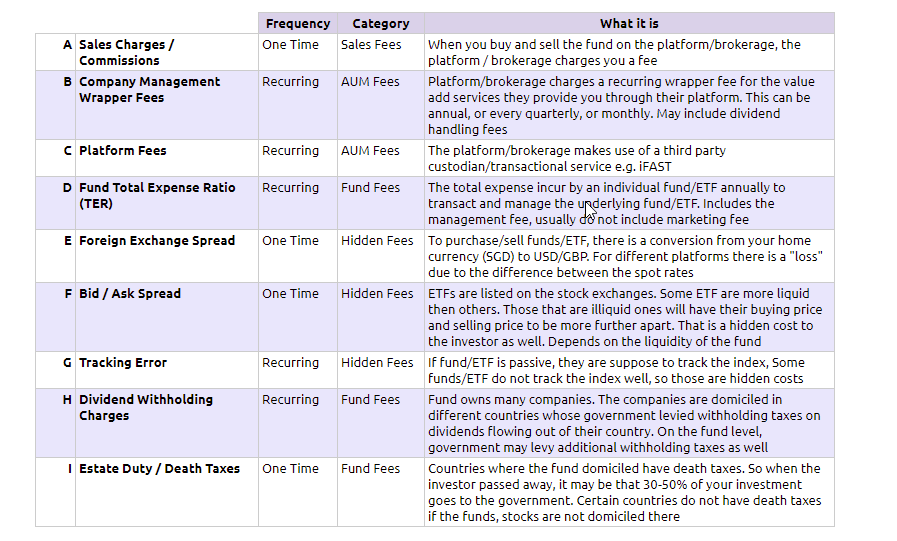

There are however, different costs, some visible some hidden.

Infinity Global have certain advantages over #1 and #2. In other areas #1 and #2 have advantages over Infinity Global.

The table below summarizes the “Cost Stack” that passive investors could use to evaluate:

Some of the costs are recurring. Those are the costs you should take note of more, than the one time one because they are going to compound over time.

One cost that you should take note of is I Estate Duty/Death Taxes. Certain funds/ETF domiciled in certain countries such as USA, UK levy a 30%-50% tax on the amount of money you have within the country after a certain minimum amount. This gets very murky because non of the platforms want to help you on this. They will ask you to consult your tax advisers.

Some options available to Singaporeans thankfully, do not have this problem. The Infinity Series of Funds is one of them.

So while you may not feel this cost now, your descendants might feel it.

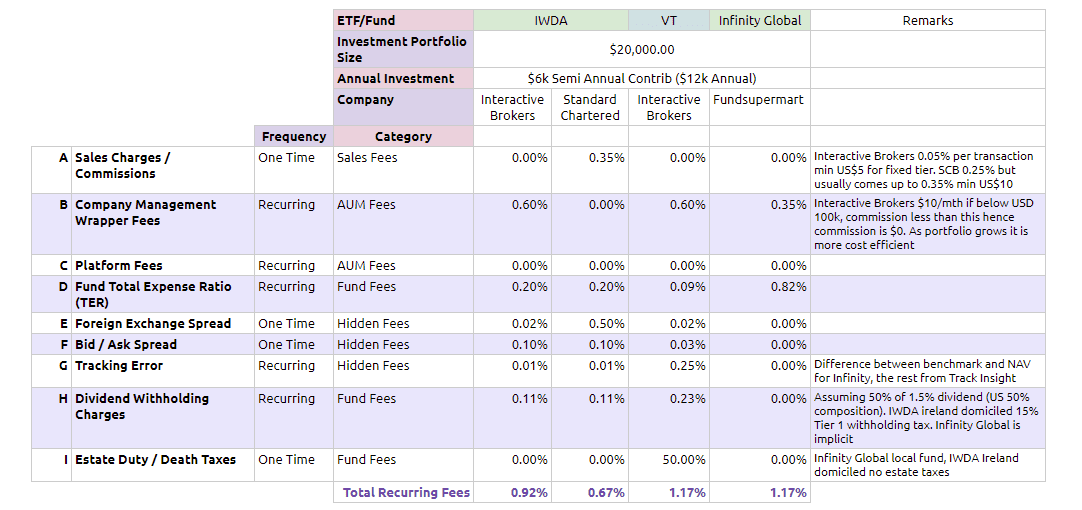

In the table below, I compared the total cost of investing in Infinity Global Stock Fund versus some of its peers such as

- iShares Core MSCI World UCITS ETF (IWDA) listed on the London Stock Exchange through their broker

- The Vanguard Total World Stock ETF (VT) listed on the New York Stock Exchange through their broker

Some of these costs are based on discussions that I have with people investing with Interactive Brokers, IWDA, and VT. By no means are they always accurate?

Some hidden fees such as foreign exchange spread, bid/ask spread, and tracking error change over time.

The total recurring fees at the end do not consider foreign exchange spread, bid/ask spread, and estate duty among the cost. They are one-time cost, but cost like foreign exchange spread do matter. Then again currency do fluctuate over the next 20 years (Specifically your home currency, versus the foreign-denominated currency, how different it is from the most efficient rate)

Stacked together, Infinity Global does not look too expensive versus the most cost-efficient solution, which is purchasing IWDA through an Interactive broker (perhaps it is an article for another day).

Then again my assumption is that your portfolio size is $20,000 currently. You will add $1000/mth to IWDA/VT or Infinity Global, and you would accumulate every half year then invest once.

With Infinity Global, the platform is much easier. There is a long topic in Hardwarezone that acts as a support group on how to invest with Interactive Brokers. They discuss how to fund the account, whether there are any hidden costs to get the money from the platform back into your account, and how to change to a different currency, how to read the performance report.

With Infinity Global, you can have an automated regular savings plan, where the money from your bank account funds the passive fund automatically without you doing anything. The minimum amount is SGD $100.

The complexity of the DIY manner and the ability for you to invest in small amounts with less human intervention help people to start more easily and prevent behavioral issues from destroying your portfolio.

A Profile of Infinity Global’s Return versus MSCI World or IWDA Return

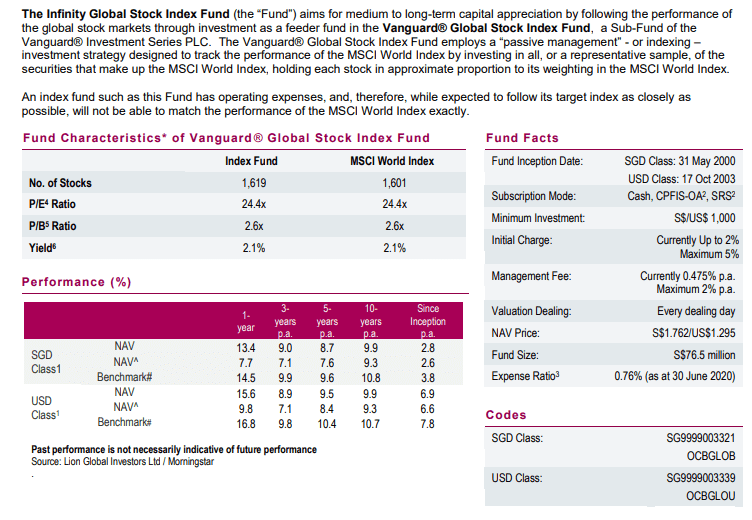

A recent factsheet of the Infinity Global Fund can be seen here. Here is Fundsupermart’s sheet.

The SGD Class fund was incepted in May 2000 which is almost 20 years ago. The USD Class fund was incepted in Oct 2003 which is around 17 years ago.

You will observe that there are 2 columns of NAV: NAV and NAV^. NAV stands for the returns in % of Net Asset Value of the basket of stocks, while NAV^ is the returns after preliminary charge.

Observe that the charge (the difference between NAV and NAV^) can result in a difference as high as 1%. This indicates the effect of higher costs on your investing results.

But you cannot really see the difference so well.

So I decided to consult the Bloomberg god how was the return of Infinity Global in USD and SGD, versus the IWDA and the MSCI World Index.

The hope is so that you can get a better appreciation of the returns profile.

Infinity Global, due to the higher total expense ratio of 1% to 0.7%, should do worse than a lower cost ETF or unit trust like IWDA.

So let us see whether that is the case.

IWDA has the shortest history. It was incepted in 2009.

Thus, the best we could do to measure the returns of MSCI World Total Return Index vs IWDA vs Infinity Global USD vs Infinity Global SGD from 2009 to 2020 to date. That is about 11.5 years.

Over this period, the MSCI World Index gave the best total return of 156%. The IWDA, with its 0.25% expense ratio for the longest time, gave a total return of 152%. The difference is probably due to tracking error and the expense.

Infinity Global USD, represented by the yellow dotted line, returned 134% or 22% less.

Infinity Global SGD, represented by the solid red line, returned 126%.

The difference between Infinity Global USD and SGD can be attributed to stronger SGD versus the USD during this period.

Bloomberg has a way for me to convert the Infinity Global SGD to USD. The result is below:

Notice now the return for both OCBGLOU and OCBGLOB is almost the same.

If you are spending your money in SGD, the result would roughly be the same.

If you invest in the Infinity Global USD and you got better performance, at some point, you have to sell your Infinity Global USD and spend it in SGD.

There will be a conversion from USD to SGD, and the result would be that your proceeds will be lesser due to the strengthening currency (USD that is worthless… is converted to SGD which is relatively more valuable).

Net net, the result would roughly be the same.

Comparing the MSCI World and Infinity Global Over a Longer Period

If we take out IWDA, we can study Infinity Global’s return profile over a longer period. We could study the return from 2003 to 2020 or about 17 years.

Now before we continue, note that based on the previous Bloomberg screen the annualized return over the 11.5 years was:

- IWDA: 8.7% a year

- MSCI World: 8.9% a year

- Infinity Global: 7.97% a year

Let us take a look at the performance over a longer period:

The returns profile is :

- MSCI World: 7.4% a year

- Infinity Global USD: 6.5% a year

- Infinity Global SGD: 5.0% a year

Over a longer period, SGD is much weaker versus USD compared to the past 10 years. The weaker annualized return showed that MSCI World had a weaker performance in the first 10 years versus the past 10 years.

The Infinity Global vs Index Comparison shows Cost Matters in Investing

You have seen me mentioned cost a few times in this post. Something about the expense ratio, the sales charge, withholding taxes.

Why is cost important? Because we think that it has a large impact on your returns.

If we revisit Infinity Global’s factsheet, a fund that tries to mimic the index should achieve close to the performance of the index.

However, over the long term, the performance of Infinity Global is about 60% of what the benchmark index achieved.

The likely reason for the loss is if we account for costs.

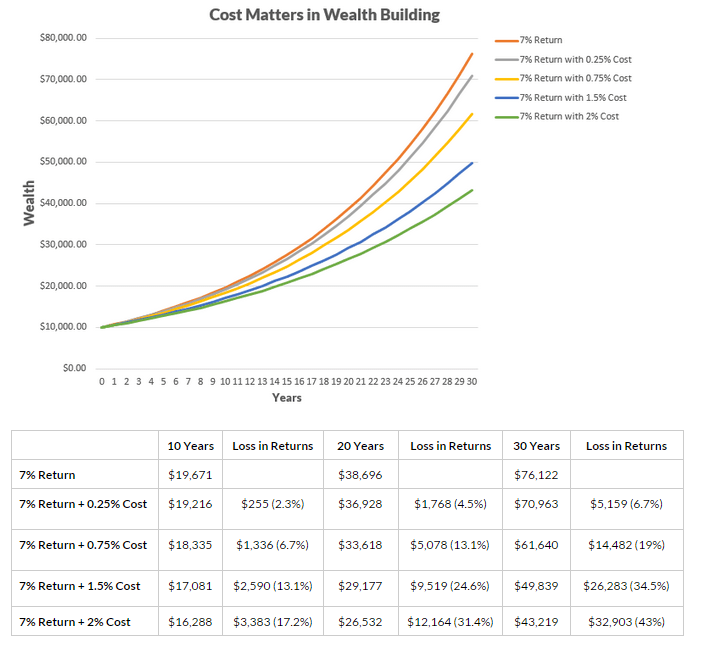

The illustration above shows how much $10,000 will grow to in 10 years, 20 years, and 30 years, if the compounded average rate of return is 7%.

If you add a little cost of 0.25% to it, we start losing some returns. If we add 0.75% cost to it, we start losing more returns.

The longer the horizon, the greater the cost compounds.

You would not know whether you will get 4% to 10% over the long run, but you know your costs will always be there, and the cost is compounding.

Infinity Global’s NAV versus the benchmark returns has a 1% difference.

The overall expense ratio of the fund has come down from 0.95% 5 years ago to 0.81% in 2019 and now 0.70% in 2018. This is a very good thing if the cost is important.

Infinity Global Fund’s Ranking among the Active Funds

I have tabulated the rankings of Infinity Global versus the active funds, with the smallest position being the highest return for the time period:

YTD: 17th out of 58 funds (71% position)

1 Week: 20/58 (65%)

1 Month: 15/58 (72%)

3 Month: 28/58 (51%)

6 Month: 37/54 (31%)

1 Year: 15/52 (71%)

2 Year: 9/49 (81%)

3 Year: 7/42 (83%)

5 Year: 3/30 (90%)

10 Year: 1/16 (100%)

In truth, instead of 58 funds, there were 95 funds in total, but I decided to narrow down to only SGD funds.

Doing this would allow us to compare its performance as a mechanical passive benchmark index against those with active managers.

Its results to me are pretty stellar. Infinity Global ranks top among the 16 funds that have a 10-year history. On a 5 year basis, it ranks third among 30 funds and 7th & 9th on a 3-year, 2-year basis.

In the short run, a market is a voting machine. In the long run, it is a weighing machine.

The longer-term results especially 10 years are important because that is usually how long you should be looking at holding a fund like this. Short-term-wise they can gyrate up and down, but longer-term you should expect the Infinity Global to be above 50%.

Why did Infinity Global do well in the long term?

My guess is due to:

- It is difficult for active managers to consistently stock pick and outperform the benchmark

- The higher cost of active funds starts to impede the fund’s returns.

Since I updated this in April 2019, Let us contrast this to the data in Jan 2014 or 5.4 years ago.

YTD: 10th out of 35 funds (71% position)

1 Week: 20/35 (42%)

1 Month: 15/35 (57%)

3 Month: 11/35 (68%)

6 Month: 9/35 (74%)

1 Year: 6/32 (81%)

2 Year: 3/28 (89%)

3 Year: 3/27 (88%)

5 Year: 6/25 (76%)

10 Year: 3/6 (50%)

You will realize the following:

- There were fewer funds in 2014. 6 versus 16 for 10 years, 25 versus 30 for 5 years. The 2014 result includes SGD and USD funds

- The funds were mostly above 50%, which shows that they seldom underperform

- More so, it shows that not every active manager can outperform a “dumb” index fund

- The rankings are rather similar. Between 1 Week to 6 months, the results pale against the longer term

Did the Top funds 5.4 Years ago Remain as Top Funds?

Since I am updating this post in 2019, I thought let us look at how the top funds did 5 years ago now.

Why is this important?

You think you can pick the top fund, managed by the top manager, or the best fund recommended by Fundsupermart, or your financial adviser.

The ranking of the 6 funds in 2014 (there are not many of them):

- Aberdeen Global Opportunities

- Nikko AM Shenton Glb Opportunities

- Infinity Global Stock Index

- Fidelity FPS Global Growth USD

- United International Growth Fund

- First State Global Opportunities Fund

The top 16 Funds in Ranking in 2019:

- Infinity Global Stock Index

- Nikko AM Shenton Glb Opportunities

- AB SICAV I Sustainable Global Thematic A SGD

- Stewart Investors Worldwide Leaders Sustainability A Acc SGD

- HGIF-Economic Scale Global Equity AD SGD

- United International Growth Fund

- DWS Global Themes Equity A SGD

- Nikko AM Global Dividend Equity Acc SGD-H

- FTIF- Templeton Global A Acc SGD

- AB FCP I Global Equity Blend A SGD

- Schroder ISF Global Dividend Maximiser A Acc SGD

- Aberdeen Global Opportunities

- Schroder ISF Global Dividend Maximiser A Dis SGD

- United Global Dividend Equity Fund A SGD Dist

- Eastspring Investments Unit Trusts – Global Themes SGD

- FTIF – Templeton Global Equity Income A MDIS SGD

Somehow out of the 6 funds, I cannot find 2 of them:

- Fidelity FPS Global Growth USD

- First State Global Opportunities Fund

Since I only included those funds with SGD, I tried searching for Fidelity FPS Global Growth USD but cannot find it. I also failed to find the First State fund.

The top-performing fund is now at the other end of the spectrum. The second position fund remains in second position (kudos to Shenton Glb Opportunities, it has been around for a long long long time)

UOB’s United International Growth did better 5 years later.

How would the 16 funds do in the future? Take your pick. Aberdeen is a strong manager, but even then, picking it as your choice 5 years ago would have been great, but if you are always expecting a top-class performance, then I think it is not so easy to discern ( it should be noted that the 10 years annualized return of 7.23%/yr for Aberdeen Global Opp isn’t too shabby and not bad for you the investor)

If you know what happened to the Fidelity and First State fund, do let me know.

I wonder if it’s a case of poor performance or strategic review, resulting in them closing down the funds. I would not surprise some of the 16 funds with a 10-year track record close down 5 years later. This is the reality of the fund management business.

Picking the Best Fund on a Forward-Looking Basis

One thing you will notice is that at different time periods, there is no best performing funds throughout the different time periods. At different time frames, it’s difficult to pick the best fund.

In 2014 I wrote this:

3 Active funds stands out

- Templeton Global

- Fidelity FPS Global Growth

- Aberdeen Global Opp

To pick the best fund going forward, you have to look at their past track records.

Given this data, you would probably pick Fidelity FPS, but 10 years in, it turns out that Aberdeen Global performed best.

Yet Aberdeen Global hasn’t been performing the best for these 5 years.

So how do you resolve that?

In 2019, We know that Aberdeen Global didn’t turn out the best. I cannot find Fidelity FPS Global Growth. In hindsight, we should all choose Nikko Shenton Glb Opportunities.

And therein lies the difficulty to pick good managers that last for 20-30 years.

Investors have Limited Choices if their Distributors/Advisers/ Investment-Linked Policy have Limited Choices

If you are advised by your investment advisor or insurance agent to purchase an investment-linked policy, you will realize the choices are limited.

What if the best funds available are not within the choices? You may have to endure mediocre results.

Summary

For those who understand passive, low cost investing, the Infinity Global Stock Index fund is a unit trust that allows you to start small and save up your money.

It allows you to de-accumulate in retirement as well.

The landscape has changed a fair bit since 2014. We have many Robo platforms that offer competing solutions. So they might make the Infinity Global Index fund less unique.

It is pretty nice to see how well the fund performance did against its actively managed peers. However, the difference between the fund’s NAV and its benchmark might make the ETF solutions through your brokers more appealing.

Still, my friend Gregory from Endowus will say that at this cost, it is still too expensive for the retail investors. We will see if we can see products that are either better in performance with lower volatility, or that it is cheaper.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

- The LionGlobal APAC Financials Dividend Plus ETF Won’t Give Singapore Investors 5% Dividend Yield Always. Further personal thoughts (with some data). - April 13, 2024

S

Sunday 11th of February 2024

Hi there, I bought the LionGlobal VWRA wrapper fund a few years back in part due to the advice on this post, but I am wondering if you know of a low-cost "bond index fund wrapped by a unit trust" equivalent? Mainly wanting to stick with unit trusts as they have as simpler cost structure and might cheaper if when investing smaller amounts. Thanks in advance!

Kyith

Monday 12th of February 2024

There is the Amundi Global Aggregate Bond Hedged to SGD that i think you can buy from Endowus.

CY

Monday 3rd of April 2023

Hi

Is it confirmed that Infinity fund does not have US estate tax?

I thought all stocks/bonds/funds domiciled in US has estate tax?

Thanks.

CY

Tuesday 4th of April 2023

@Kyith, Thanks for the reply.

Do you mean the fund is domicile in the US for the wrapper is domiciled in Singapore and hence there is no US estate tax for us?

Do you happen to know about Amundi Prime USA fund, domiciled in Luxembourg? Are we exposed to US estate tax for this fund?

Thanks.

Kyith

Tuesday 4th of April 2023

The fund is domicile not in the US. but the wrapper is domiciled in Singapore.

Alton

Tuesday 2nd of August 2022

Not sure if anyone will reply lol. But I don't understand why SGD denominated Infinity fund will perform worse than USD demomined infinity fund when SGD strengthens. If anything, shouldn't the SGD fund perform better with a strengthened SGD? Don't quite understand the inner wrapping workings of SGD denominated US funds, if anyone can explain that'd be much appreciated (=

Kyith

Sunday 21st of August 2022

When SGD strengthens, the SGD denominated fund will show less USD gains, so in terms of pure return numbers it will look weaker.

Gilbert

Tuesday 29th of December 2020

Hello Kyith, thanks for the breakdown – it’s really helpful.

One question that I have – under “A Profile of Infinity Global’s Return versus MSCI World or IWDA Return”, for performance in the first year SGD Class, the NAV and NAV^ are 13.4 and 7.7 percent respectively. This is quite a huge difference – would this imply that the charges are close to 7%? (The same is also observed in the USD Class).

Or am I reading the chart wrongly?

It appears that the return converge (starting from the 3rd year) but I’m just wondering if you know why there is such a huge difference in the first year.

Kyith

Friday 1st of January 2021

hi Gilbert, the difference is due to the initial charge, which usually is stated as 5%. in all honesty, distributors today will not have such a high commission.

Julia Ng

Saturday 31st of October 2020

Hi Kyith

How did you achieve financial freedom at 38? What were your strategies?

Thanks.

Kyith

Saturday 31st of October 2020

Hi Julia, It would be a long tale which I think I speak in a few interviews but I didn't put it out. If you go under my wealth foundation, those are roughly what I used to achieve financial independence, without talking about the investing part so much.

In short, I executed the wealthy formula to a very above average manner. I did not earn above average, I optimize my expenses very well, and I think I invested better than the average (but not spectacularly). So I just repeat doing this for 14 years and I got this sum of money. Somewhere along the way, I got into figuring out how much do I need to be financially independent and realize more or less my annual expenses can be covered by an initial 3% of my portfolio, so I am able to plastered this message out there. The sum is about 830,000.

Hope this helps.