There are enough people asking me how I achieved my low trading commissions. Well, I do not think they are that low. So maybe I can share more.

Early this year, I decided to add Interactive Brokers to the brokers at my disposal.

There are a few reasons I decide to add Interactive Brokers or IBKR for short to my wealth management platforms.

Here is a short list:

- Through IBKR, I can buy and sell stocks in a lot of markets. Much more than most brokers out there. (Currently, as a Singaporean, you cannot use IBKR to trade the stocks listed on SGX in Singapore but foreigners can. This will change with the launch of IBSG or Interactive Brokers Singapore later this year)

- IBKR’s commissions for most markets are low. Based on my trading size of $3000 to $10,000 the commissions for the US is US$1 per trade, US$5 if I were to purchase low-cost exchange-traded funds like IWDA or VWRA on the London Stock Exchange and 0.19% for Hong Kong Stocks in general.

- IBKR has been around for a long time and is seen as the default trading platform for international investors

- Currency conversion between different currencies is at near spot rates (like 0.00001-0.00002% or 0.10-0.20 basis points ) with a minimum conversion cost of US$2.

- Can transfer via FAST transfer to fund accounts easily

- They have an office in Singapore at Asia Square Tower 1

- Sophisticated enough in terms of their reporting and consolidating. This does not seem like much but if you have used the iFAST platform for advisers, you will know what I mean.

I might elaborate my reasons in a later post.

I am comfortable with IBKR, Standard Chartered Online Trading, and Lim and Tan as my broker platforms.

Some will find that the account application process to be a stumbling block but the Interactive Brokers account opening and approval process is very easy.

The whole application approval was done online, my approval took 3 working days. So there were no trips to Asia Square Tower 1 or snail mail.

In this post, I bring you through the whole process step-by-step.

1. Start Trading with Interactive Brokers by Opening an Account Application

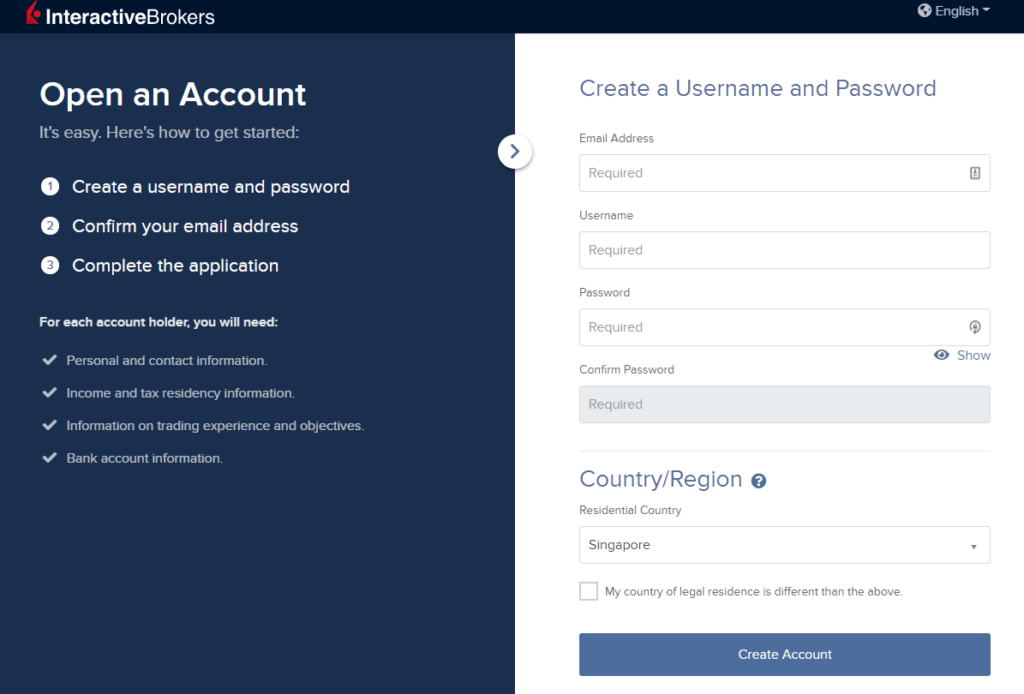

You start the process by clicking on the Open Application button. Then Start the Application.

If you require additional professional or more specific account types such as managing Trust Accounts and managing for friends and family, the process would look different.

Then you will need to create an online account. You need an unique email, username and password.

The username will be what you use to access to your Interactive Brokers account the most frequently. So do think about what you set for it.

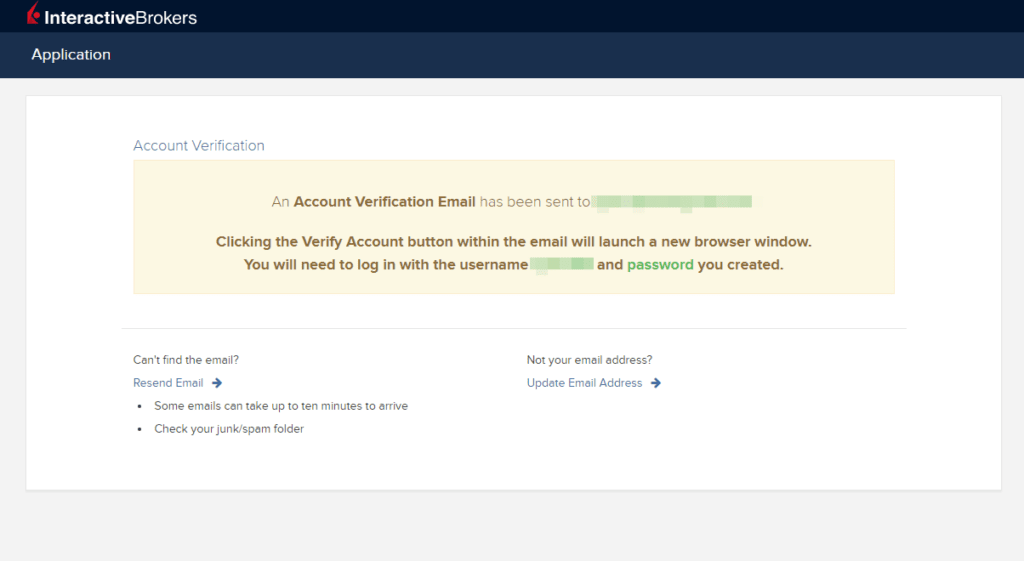

Once you have finished that part of the process, an account verification email will be sent to your email address.

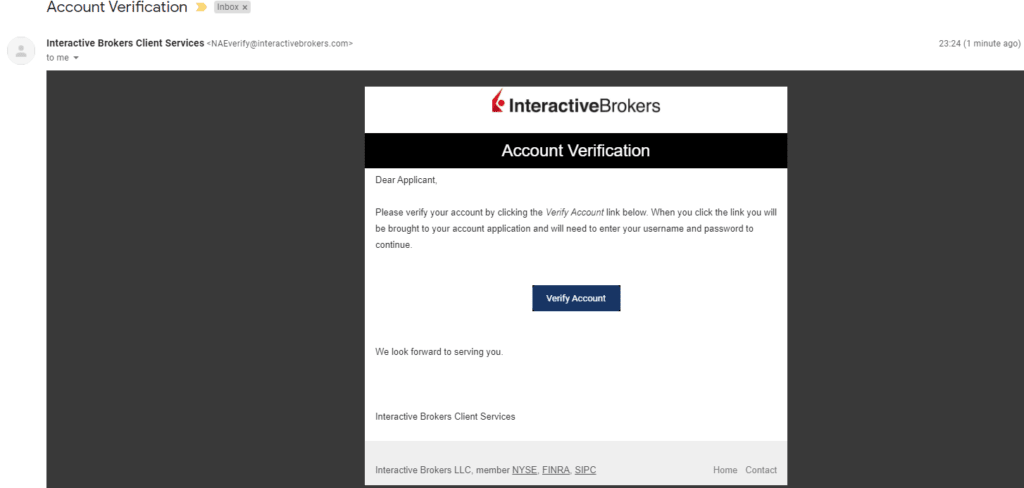

You will need to go to your email address to click on the link in the email.

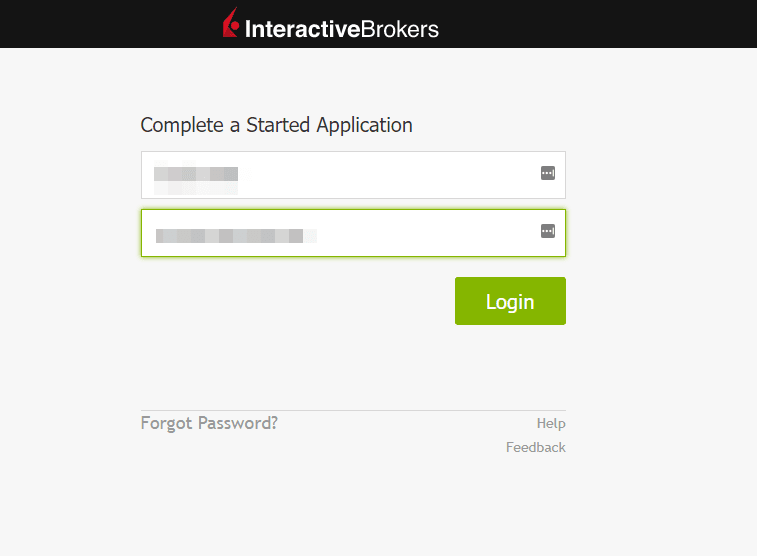

You will then be prompt to log in to your Interactive Brokers account to continue with the account opening process.

2. Filling in Your Particulars

I selected Individual account type under Customer Type.

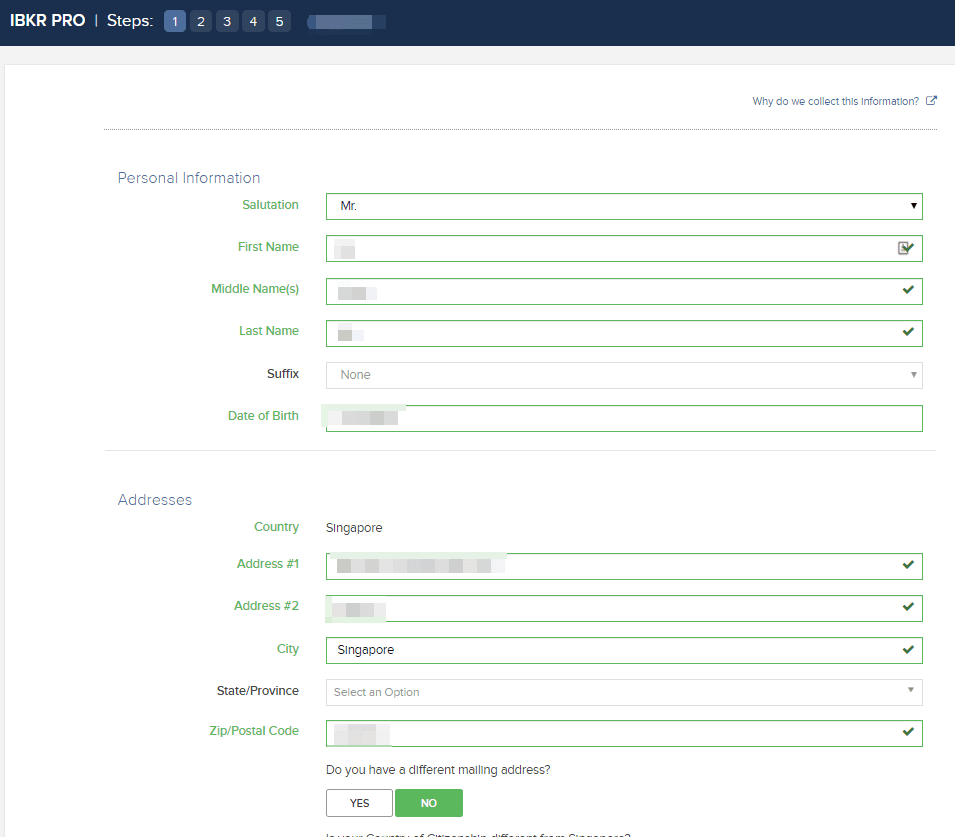

The personal information and addresses are pretty straight forward.

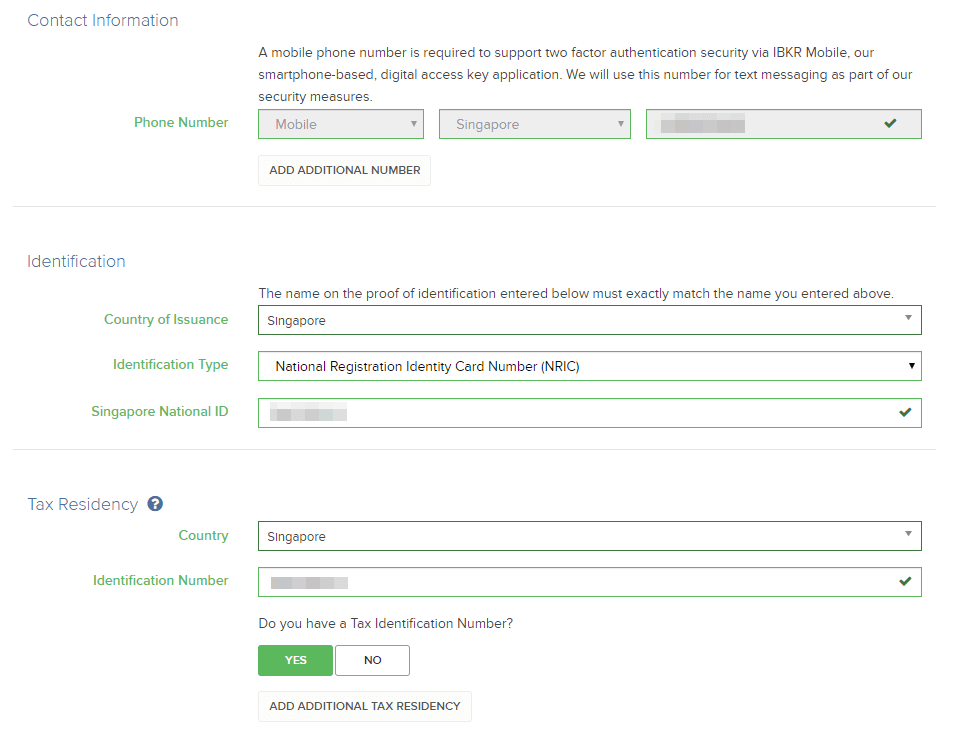

You will need to specify a phone number. This is to be used for your two-factor authentication in the future. Then you will also need to specify the identification that you wish to use to identify yourself as well as your tax residency.

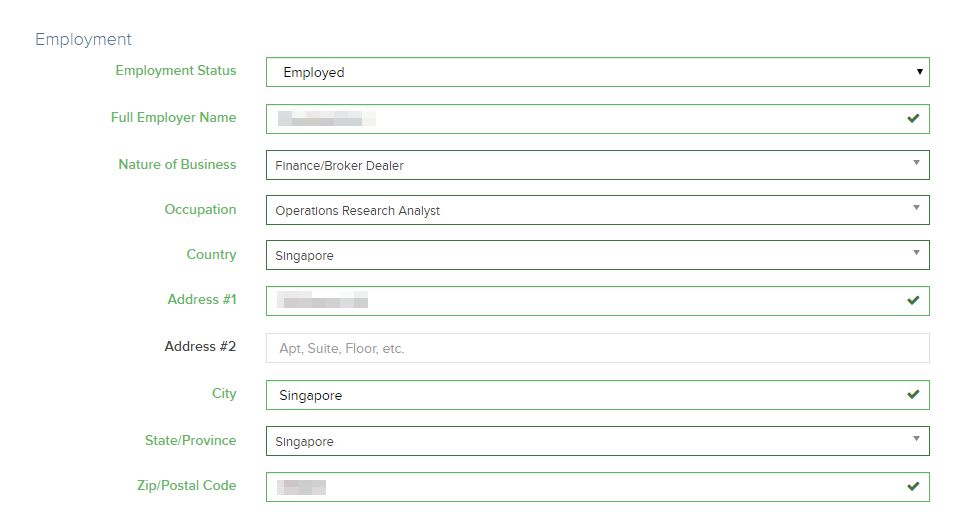

Then your employment details.

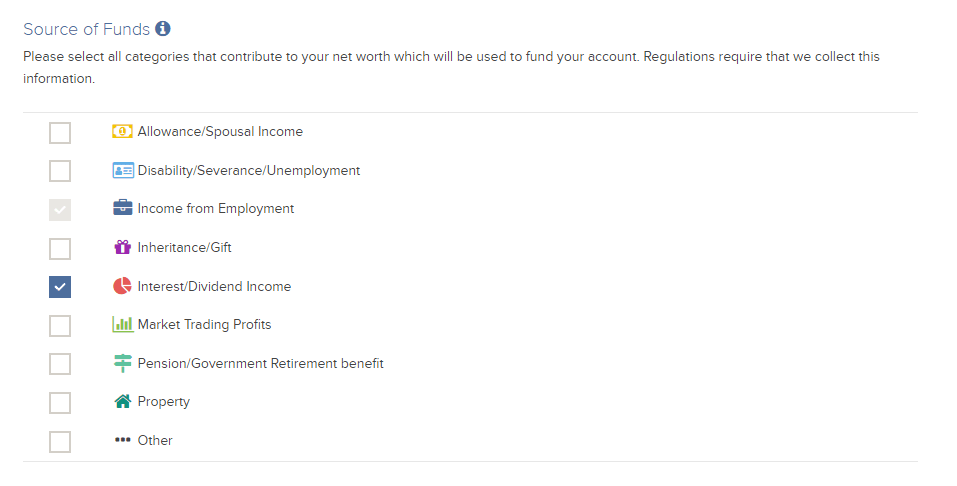

Specify your source of funds for compliance reasons.

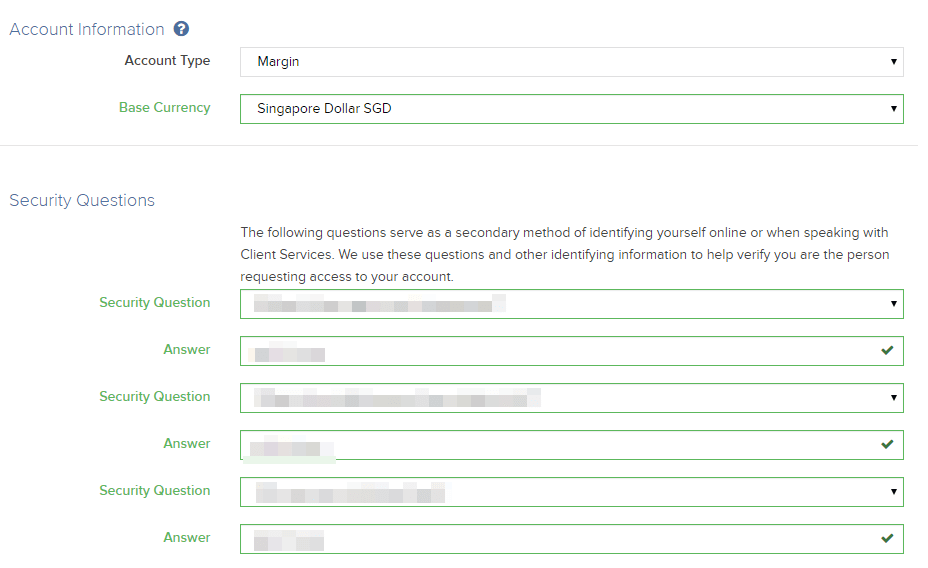

3. Choosing Your Interactive Brokers Account Type and Your Base Currency

Interactive Brokers will then ask you what kind of account type you wish and what is your base currency.

There are 3 kind of account type:

- Cash

- Requires account holder to have enough cash to cover the cost of transaction plus commissions. You cannot borrow to support trading in a cash account.

- Margin

- US regulatory-based margin account. Allows borrowing to support equities trading, stock shorting, full options trading, full futures/futures options trading, currency conversions, and securities/commodities trading in multiple currencies.

- Portfolio Margin

- Allows borrowing to support equities trading, stock shorting, full options trading, full futures/futures options trading, currency conversions, and securities/commodities trading on multiple currencies.

If you are a passive, low-cost exchange-traded fund investor, a cash account might just be enough. However, I chose the Margin account which allows me to borrow money if needed.

The base currency is the currency you use to maintain the book of accounts. This affects the translation of currency for your statements and uses to determining your margin requirements.

I choose to set my base currency to be SGD.

I can hold stocks in a lot of different currencies be it Euro, USD, AUD. When I review the statements, the portfolio and accounts are translated into my base currency SGD.

You can change your base currency after this process easier in your account settings so don’t sweat over this.

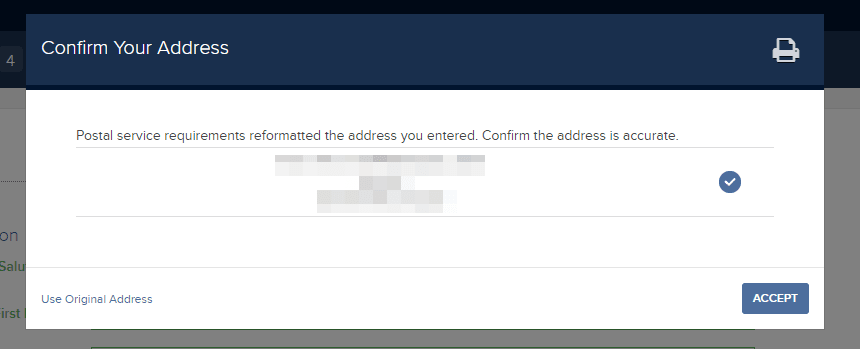

InteractiveBrokers will then need you to confirm your postal address is correct.

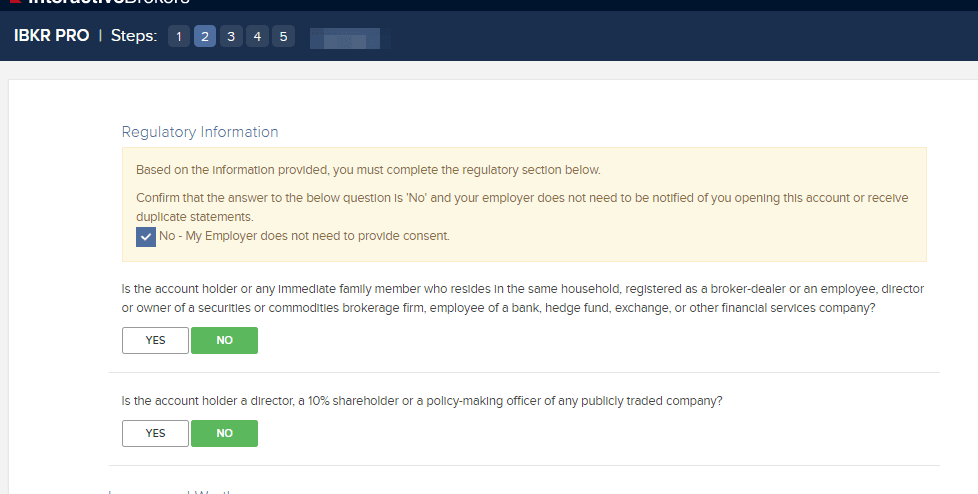

Then you have to answer some compliance questions.

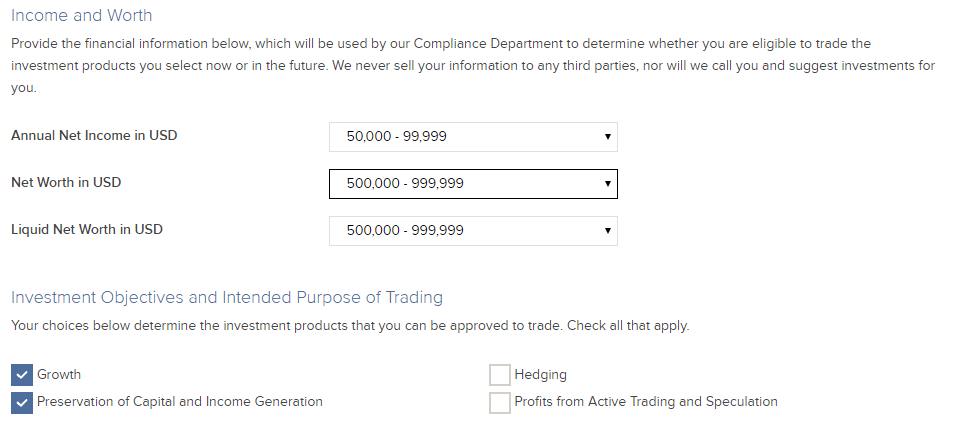

Specify your net worth and objectives you intend to achieve by trading.

4. Choosing What Financial Instruments to Trade and Where You Can Trade on Interactive Brokers

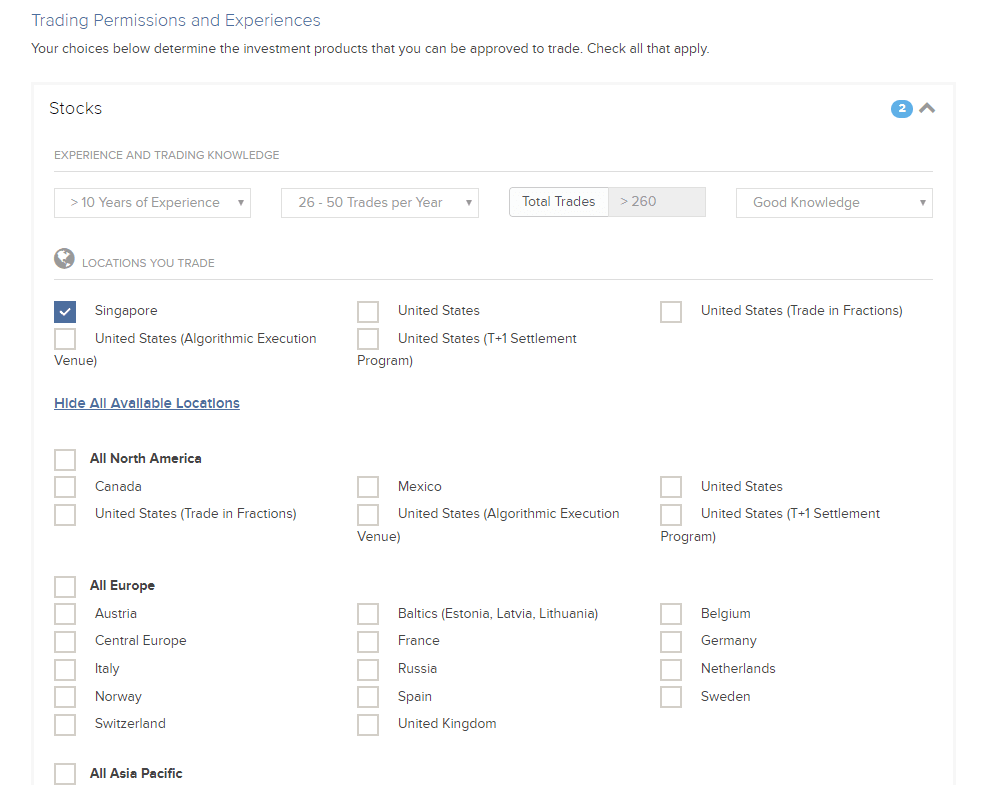

This section is important in that Interactive Brokers find out your experience with different instruments. If you do not have the requisite experience, you cannot manage certain instruments.

If you are a passive ETF investor and would like to purchase ETF in the United States or United Kingdom (London Stock Exchange), be sure to choose United States and United Kingdom.

I did not specify United Kingdom previously and it is only later did I realize I could not purchase ETF on the London Stock Exchange.

If you wish to trade options, also specify accordingly.

Again, if you get it wrong, you can change this in the account settings. However, changing this will take 1 day of approval before you can trade in the new markets or instruments specified.

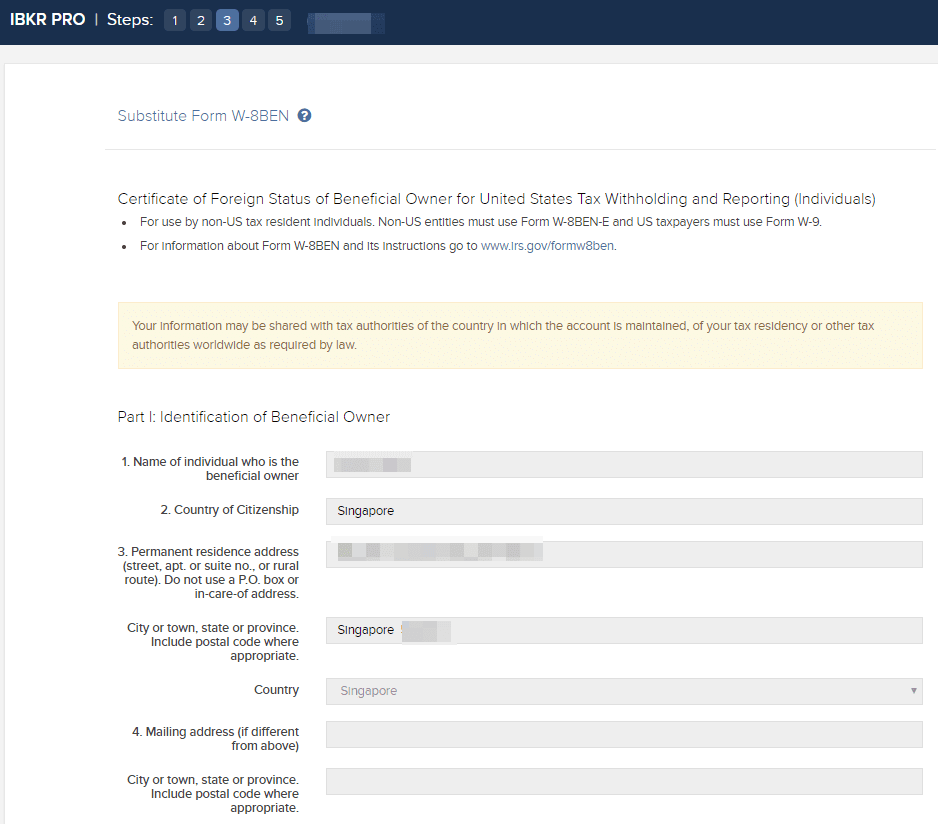

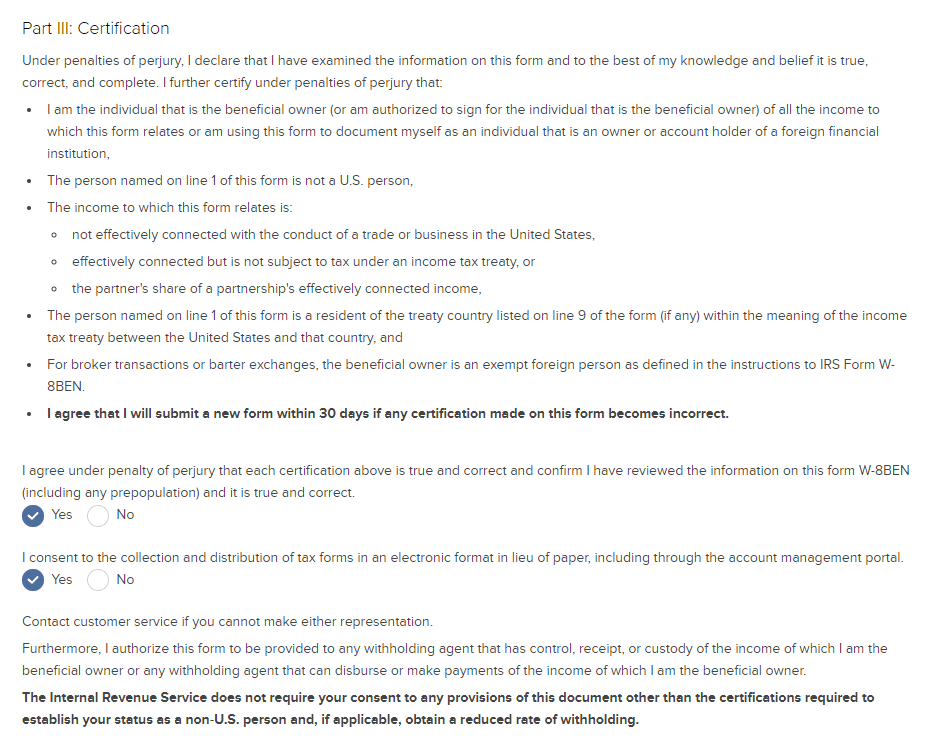

5. Submitting Your W8-BEN Withholding Tax Status

Usually, if you open a trading account that allows you to trade in the United States, you will need to submit a W-8BEN form for reporting of your tax withholding status.

This is pretty seamless with IBKR.

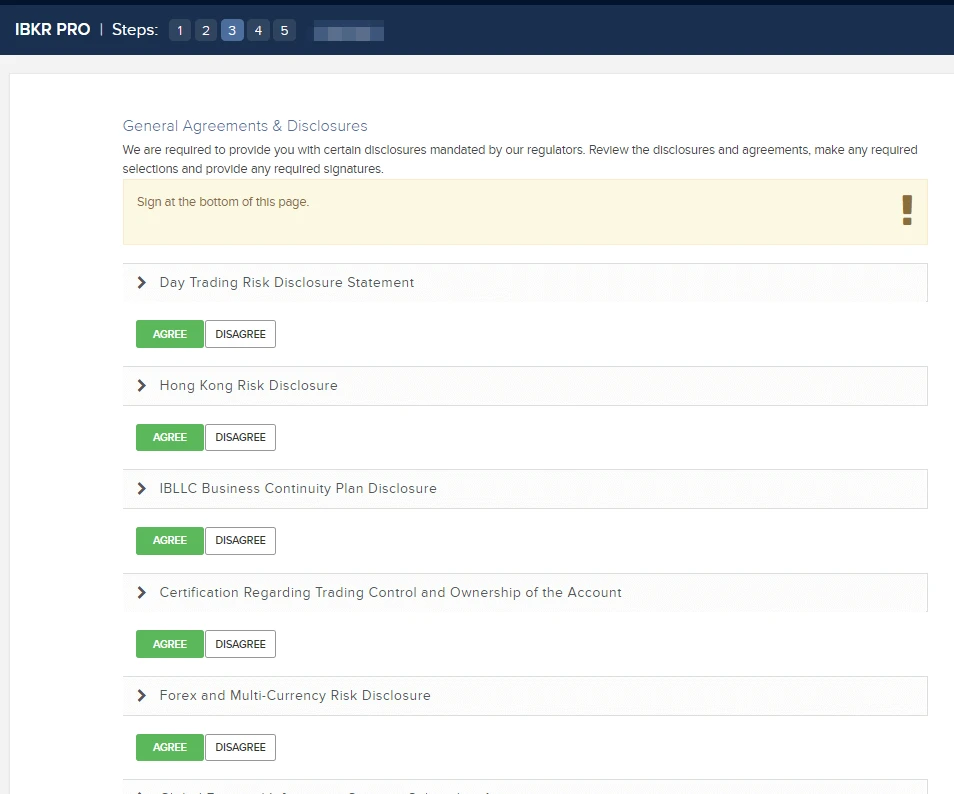

There are some compliance agreements and disclosures. Please take your time to read through them and choose to AGREE or DISAGREE where appropriate (if you DISAGREE then it is likely you would not sign up for the account).

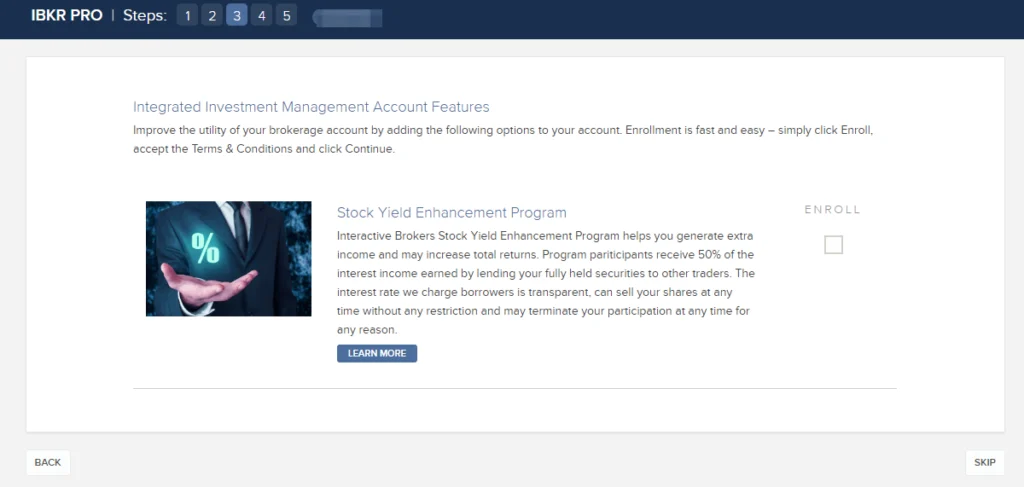

IBKR then ask if you would like to participate in their program to earn extra income by lending out your shares.

I did not choose to do so.

You can change this later in the account settings.

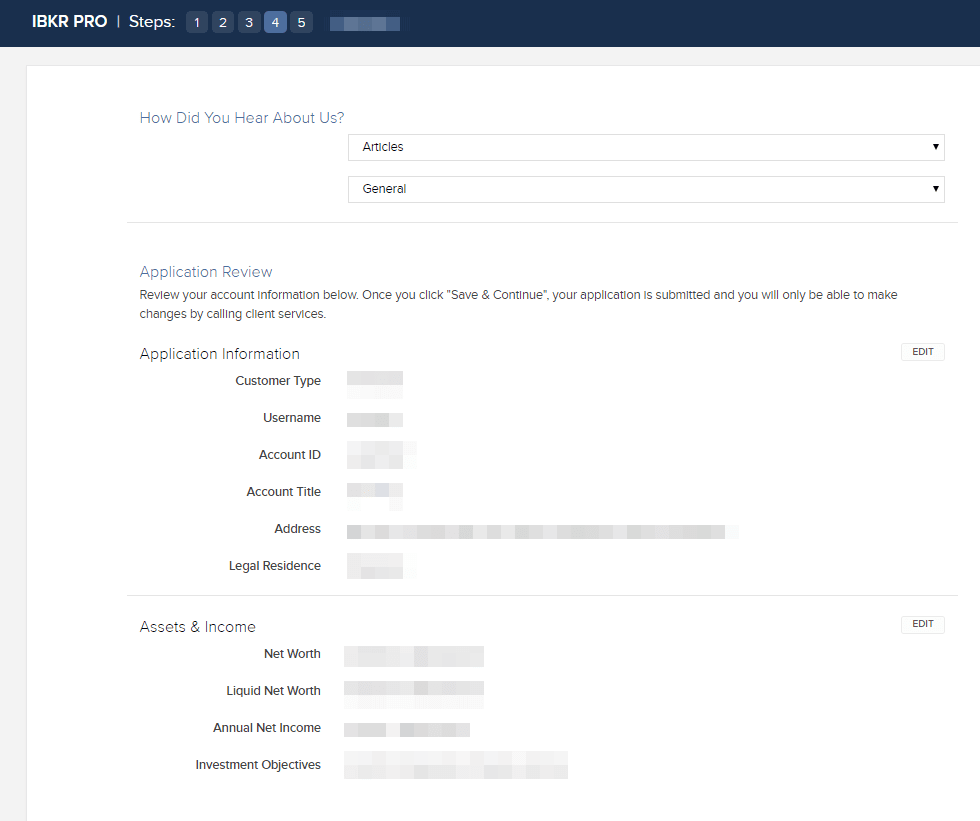

IBKR then ask how do you know about them follow by a review of your application.

If you click next, IBKR will continue with the actual processing of your application.

6. Submitting Your Identity and Address Verification Online to Interactive Brokers.

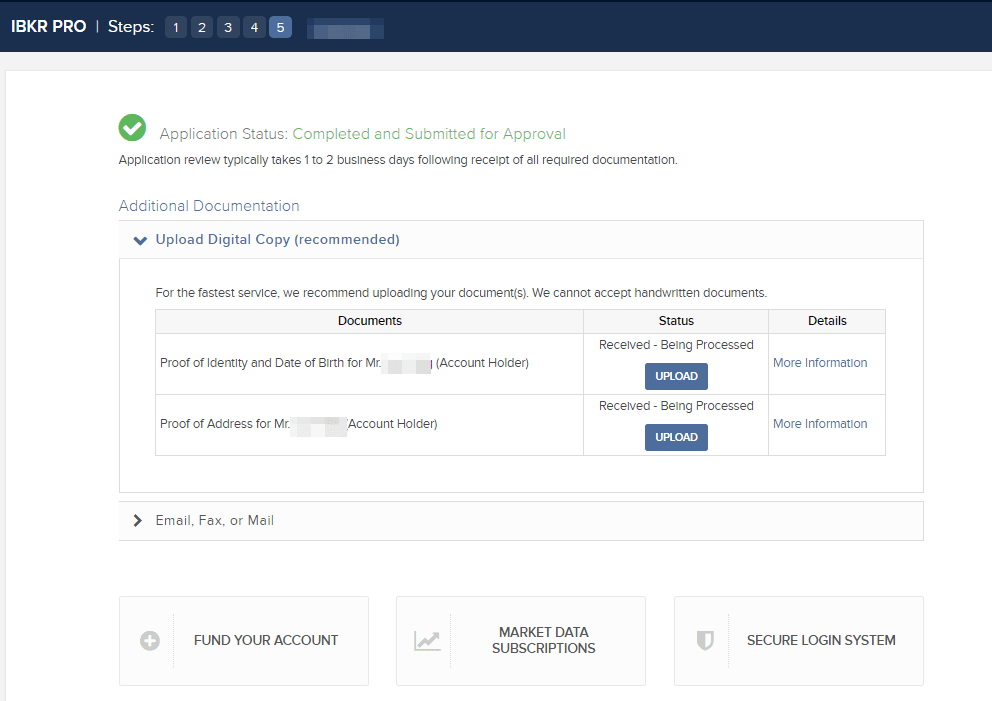

IBKR will then inform you that the process submission is done.

Like many application that involves money, the financial institution will need to verify your identity.

IBKR will need you to submit digital copy of some documents to prove your identity. You can also choose to email, fax and snail mail to them.

On the screen capture you can see that i have submited my identity card and another document for proof of address and they have been received.

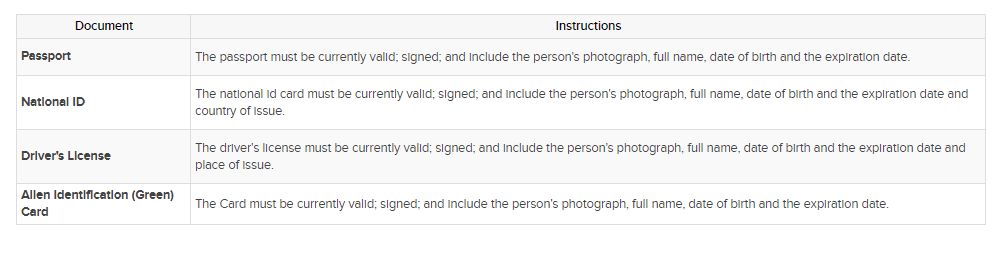

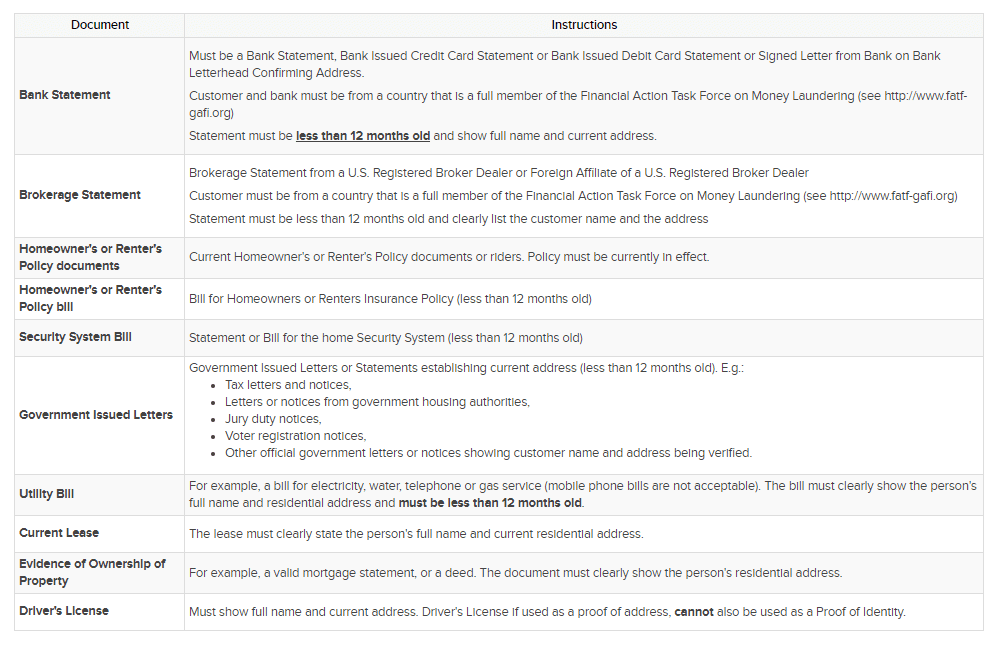

Here are the documents that you can submit.

7. Wait for Interactive Brokers Update

All that you have to do next is to wait.

Wait for IBKR to inform you about the status of application.

10 minutes after the application process, I was informed that the identity application has been received and have been processed.

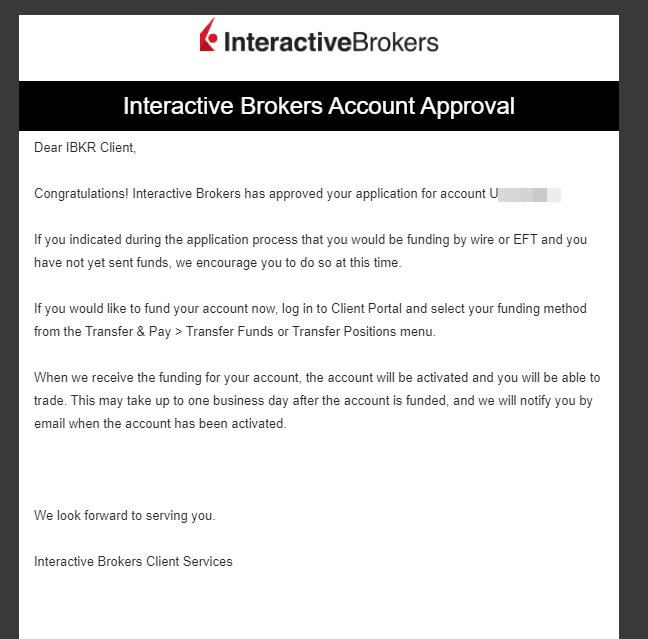

8. Interactive Brokers Account Approval in Email

If everything goes well then you should receive an email informing you that your account have been approved.

My approval came within 3 workings days or 5 calendar days in total.

IBKR will then inform you to fund your account so that you can get started trading.

The funding part is another topic altogether and I will share more in some upcoming posts.

The whole process is very seamless and fuss-free.

My Comprehensive Interactive Brokers How-to Guides

Interactive Brokers is a great low-cost, financially strong brokerage platform that can be the standard broker for holding your long-term investments. You can access 150 global exchanges, including exchanges such as Singapore, the US, Hong Kong, London, European and Canada.

You will enjoy cheap commissions and zero minimum recurring platform fees or maintenance fees. Convert your funds to different currencies at near-spot rates, paying a flat US$2 fee.

To get started or become familiar with Interactive Brokers, check out my past articles on how to invest with Interactive Brokers. I hope the guides make your life and investing experience easier and brighter.

An Easy Step-By-Step Guide to Setup Interactive Brokers (IBKR)

How to Fund & Withdraw Funds from Your Interactive Brokers Account

How to Convert Currencies in Interactive Brokers

How to Buy and Sell Stocks and Securities on Interactive Brokers

How Competitive are Interactive Brokers Commissions Pricing?

How Safe is it to Custodized Your Money at Interactive Brokers? The things they do better than other brokers.

How Safe is it to Custodized Your Money at Interactive Brokers (2)? Financial strength of IB during recent banking crisis and during Great Financial Crisis

Interactive Brokers have Eliminated the US$10 monthly inactivity fee. More details here.

How to Transfer your shares from Standard Chartered Online Trading to Interactive Brokers

How to trade after-hours and premarket

Create Customized Reports and automatically send them to your email

What is the PortfolioAnalyst Report and Automatically Send the PortfolioAnalyst Report to Your Email

Send Money from TransferWise to Interactive Brokers

Interactive Brokers’ Fluid Interest Income on Cash

Introducing IMPACT by Interactive Brokers

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Ng Ann

Monday 11th of December 2023

Hi Kyith, thank you so much for your kind sharings.

Albert Foo

Wednesday 13th of October 2021

Hi Keith,

Since I started using IB to do all my trading for both Singapore and overseas shares, I plan to transfer all my existing shares held in my CDP account to my IB account since I no longer use other local brokers.

Doing so also allows me to monitor/buy/sell all my shares using just IB moving forward.

IB has a Basic Free-of-Payment (FOP) Transfer but I am not too confident in filling in the details, and unsure whether CDP would charge a fee for the transfer. Appreciate if you can share an article or tutorial on this?

Thanks much!

Kyith

Friday 15th of October 2021

HI Albert, every of these process is stressful haha. Some of my readers or peers have provided some guides to how to do the process. Unfortunately, no one updated me on the CDP one.

You can take a look at this article here for the SCB to IBKR or SCB to TD Ameritrade process: https://investmentmoats.com/money/transfer-shares-standard-chartered-online-trading-interactive-brokers/

Jamier

Saturday 4th of September 2021

Hi Kyith,

Many thanks for the detailed steps. It really helped a lot.

I've read somewhere that IBKR offers a good set of APIs to code with. Is that true?

Jamier

Cal

Wednesday 21st of July 2021

Hi Kyith,

I intend to open IBKR. Just wondering what is the difference between IBKR and IBKR-SG?

Which to open? Many thanks for the good read.

Kyith

Saturday 24th of July 2021

HI Cal, if you are a Singaporean and you open it now, you would be opening by default an IBSG account. that will allow you to trade SG stocks which you cannot on IBKR. IBSG is a MAS regulated entity and therefore compare to IBKR, it does not have the $500,000 SIPC insurance enjoyed by IBKR which is a US entity. IBSG does not have the estate tax complication faced by IBKR due to its US brokerage entity status.

Tan

Wednesday 7th of April 2021

Hi Kyith, I saw IBKR has a referral program: https://www.interactivebrokers.com.sg/en/index.php?f=45764

Do you have a referral link? Thanks!

Kyith

Wednesday 7th of April 2021

HI Tan, if you would like to use my referral link here it is: https://ibkr.com/referral/lip893