In some of the articles on Smart Beta in the past, I shared that with the additional risk that you take by investing in the value, momentum, quality or size factors, you may be rewarded in the long run by higher returns above the market risk premiums.

If you invest in a Smart Beta fund that screens and invests in stocks that exhibit multiple factors, you may be able to systematically capture the premiums with much smoother returns that do not underperform the index too much.

You might also do better when the main index, such as the MSCI World did not do that well. You can read Would Smart Beta ETF Improve Your Returns If the Market Indices are Not Performing Well?

Over the weekend, I chanced upon the index data behind the JPMorgan ETFs (Ireland) ICAV – Global Equity Multi-Factor UCITS ETF (Ticker: JPGL on Interactive Brokers) and decide to see whether I could also get my hands on the index data for the index data behind iShares Edge MSCI World Multifactor UCITS ETF (Ticker: IFSW on Interactive Brokers).

Since I have the index data behind Dimensional’s Global Core Equity Fund, I could probably do a comparison of how the 3 multi-factor indexes behind the ETF perform against the MSCI World index. All 3 multi-factor indexes target the global developed large-cap and mid-cap space that is pretty close to the MSCI World.

We only have the returns data (other than Dimensionals data) from March 2001 to April 2022, so that gives us roughly 22 years of data. During this period we start off at a low in the midst of the 1999 to 2002 bear, the GFC, the boom after that, COVID, and the recent downturn.

So the 4 indexes are:

- JP Morgan Diversified Factor Global Developed (Region Aware) Equity Index (JPM Div Fact Glb in the charts later) – Factors: Value, Momentum, Quality

- MSCI World Diversified Multiple-Factor Index (MSCI Div MultiFact) – Factors: Value, Momentum, Quality, Size

- Dimensional Global Core Equity Index (DFA Global Core) – Factors: Value, Size, Profitability

- MSCI World Net Total Return Index – Factors: Market Risk

Here are the 5-Year Rolling Returns:

There are 194 rolling 5-year periods and even in these 5-year periods, you can observe the MSCI World doing -5% for 5 years (2004 to 2009). What we notice is that the JP Morgan Diversified Factor Global Developed (Region Aware) Equity Index did relatively well in the past to help cushion the poor results.

Average 5-year Rolling Return

| Index | Average 5-Year Annualized Return |

| JPM Div Fact Glb | 10.4% |

| DFA Global Core | 9.2% |

| MSCI Div MultiFac | 10.2% |

| MSCI World | 7.6% |

Despite some differences in implementation (notably size and momentum), we probably get a mixed bag. After 2008, the difference in implementation is less (probably due to quantitative easing) and the index did better.

In my data study, 2008 till the top recently was the only period where the main index (MSCI World) did better than a composite multi-factor index.

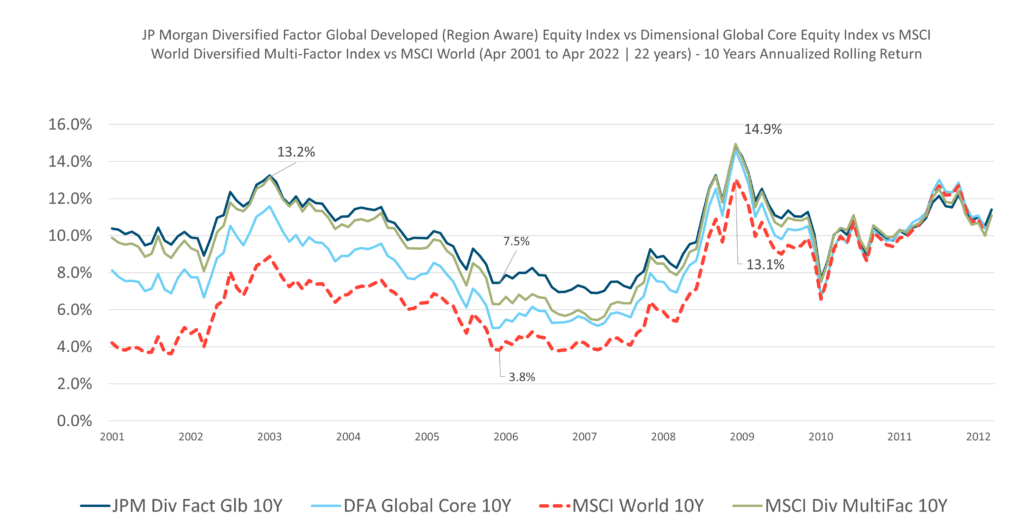

Here are the 10-year Rolling Returns:

We have 134 rolling 10-year periods. Now you can see a bigger difference.

There are years where the MSCI World would do 3.8% a year for 10 years and the JP Morgan Diversified Factor Global Developed (Region Aware) Equity Index would do 7.5% a year for 10 years. That is a big difference.

In recent years, the difference is less as if the premiums did not show up. I would like to think that the quality and momentum premiums offset the underperformance of the value premium in recent years.

Average 10-year Rolling Return

| Index | Average 10-Year Annualized Return |

| JPM Div Fact Glb | 10.2% |

| DFA Global Core | 8.7% |

| MSCI Div MultiFac | 9.7% |

| MSCI World | 7.2% |

Past 22-year performance does show the presence of premiums but more in the first decade. Now, we wonder if we are going to see the return of that period with less quantitative easing.

Again, past performance is not indicative of future return.

You can gain exposure or invest in two of these factors and market index through my default low-cost global broker Interactive Brokers:

- JPMorgan ETFs (Ireland) ICAV – Global Equity Multi-Factor UCITS ETF – JPGL

- iShares Edge MSCI World Multifactor UCITS ETF – IFSW

- iShares Core MSCI World UCITS ETF – SWDA

And you can invest in the Dimensional Global Core Index through the portfolios of advisers that are able to recommend Dimensional Funds such as MoneyOwl, Endowus and of course my firm Providend.

I do have a few other data-driven Index ETF articles. These are suitable if you are interested in constructing a low-cost, well-diversified, passive portfolio.

You can check them out here:

- IWDA vs VWRA – Are Significant Performance Differences Between the Two Low-Cost ETFs?

- The Beauty of High Yield Bond Funds – What the Data Tells Us

- Searching for Higher Yield in Emerging Market Bonds

- The performance of investing in stocks that can Grow their Dividends for 7/10 years

- Should We Add MSCI World Small-Cap ETF (WSML) to Our Passive Portfolio?

- Review of the LionGlobal Infinity Global – A MSCI World Unit Trust Available for CPF OA Investment

- 222 Years of 60/40 Portfolio Shows Us Balanced Portfolio Corrections are Pretty Mild

- Actively managed funds versus Passive Peers Over the Longer Run – Data

- International Stocks vs the USA before 2010 – Data

- S&P 500 Index vs MSCI World Index Performance Differences Over One and Ten Year Periods – Data

Here are some supplements to sharpen your edge on low-cost, passive ETF investing:

Those who wish to set up their portfolio to capture better returns believe that certain factors such as value, size, quality, momentum and low volatility would do well over time and are willing to harvest these factors through ETFs and funds over time, here are some articles to get you started on factor investing passively:

- Introduction to factor investing / Smart Beta investing.

- IFSW – The iShares MSCI World Multi-factor ETF

- IWMO – The iShares MSCI World Momentum ETF

- GGRA – The WisdomTree Global Quality Dividend Growth UCITS ETF

- Investing in companies with strong economic moats through MOAT and GOAT.

- Robeco’s research into 151 years of Low Volatility Factor – Market returns with lower volatility that did well in different market regimes

- JPGL vs IFSW vs Dimensional Global Core vs SWDA – 22 years of 5-year and 10-year Rolling Returns Performance Comparison

- 98 Years of Data Shows the US Small Cap Value Premium over S&P 500

- 42 Years of data shows that Europe Small Cap Value premium over MSCI Europe

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

- The LionGlobal APAC Financials Dividend Plus ETF Won’t Give Singapore Investors 5% Dividend Yield Always. Further personal thoughts (with some data). - April 13, 2024