There are a bunch of investors who are always searching for a cost-effective broker platform. Through this platform they wish to handle the majority of their transactions.

I think cost is one aspect but there are other considerations

- Think in terms of whether the broker will continue to be in business

- If you have a problem with the platform or your trade, are they responsive

- The variety of products they allow you to trade

- How easy will it be for you to transfer your money in to start and transfer the money out

- How intuitive is the interface

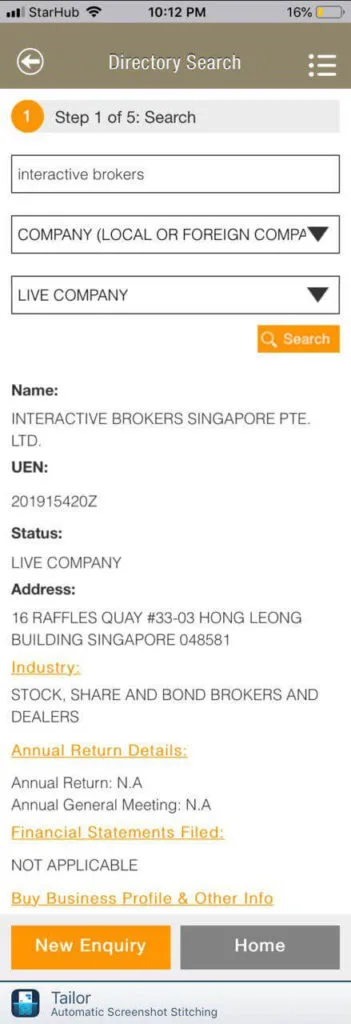

One of my friends told me that Interactive Brokers (IBKR) are in the midst of setting up their Singapore office. They are probably in the process of getting the necessary license through MAS to operate in Singapore.

My friend did a check-in ACRA (that is diligent of him) and it seems they really did set up this year.

Subsequently, a reader from Telegram group informed me that Interactive Brokers have posted an ad on LinkedIn looking for a role in Singapore:

Interactive Brokers was in Singapore but this time around, maybe they are looking for something more.

Update 29 Oct 2019: Interactive Brokers to Get Capital Markets Service License to Operate in Singapore

Interactive brokers have announced that they received in-principal approval from Monetary Authority of Singapore (MAS) for a Capital Markets Service license in September.

Its Asia-Pacific managing director David Friedland told The Business Times he hopes the Nasdaq-listed broker will be given the go-ahead to commence operations in Singapore from January 2020.

Update 28 Feb 2020: Interactive Brokers have Obtain their Capital Markets Service License to Operate in Singapore

A check on MAS website will show that Interactive Brokers have successfully obtained their MAS License.

With this, they can finally start their advertising campaign and tell Singaporeans about what they have to offer.

The Benefits of Interactive Brokers

The biggest deal about having an overseas broker having a local office is perhaps that it gives both sides an opportunity to build trust with each other.

The older investors would feel uneasy having their net worth in anything other than CDP, or the traditional brokers such as Vickers, Kay Hian and GK Goh.

The younger investors do not know what the big deal about this. They probably assume some of worries of the older investors would not happen to them. They are more accepting about this.

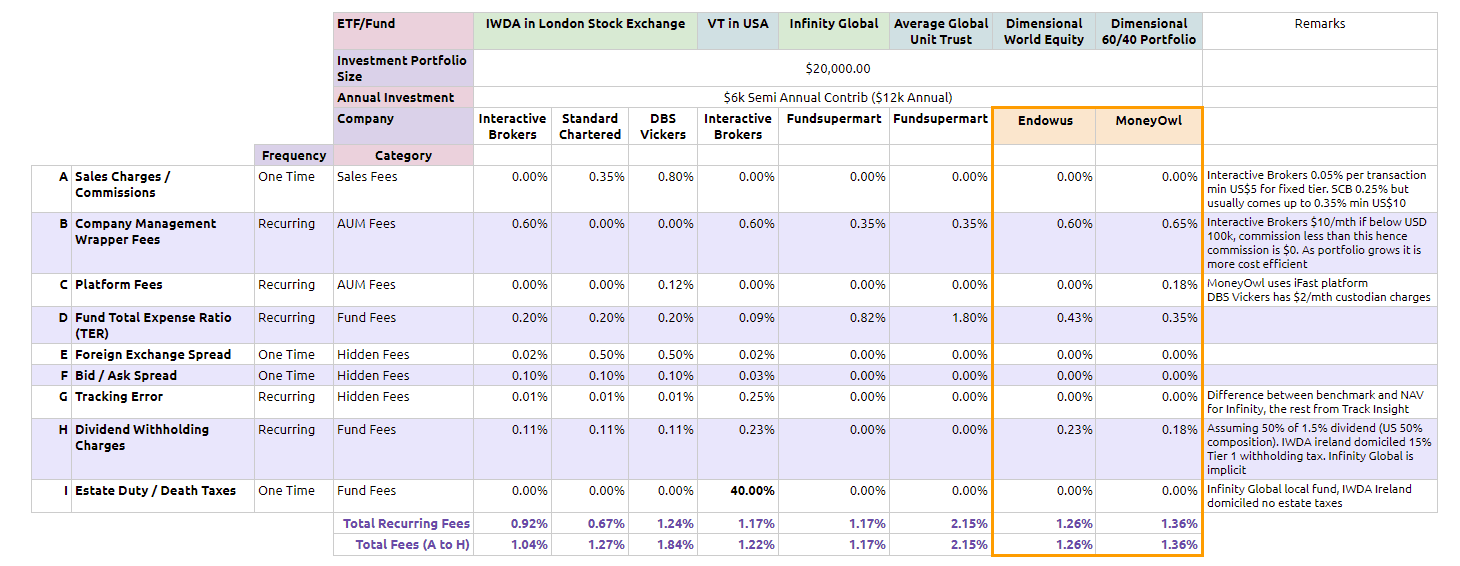

The more savvy local investors are familiar or at least have heard of IBKR. In my Dimensional Fund Advisers article, I pitted the cost for the Roboadvisers, the banks and my current company against do it yourself investing with a IBKR broker.

Their commission for the fixed tier, which is 0.05% subject to the minimum of US$5 is pretty hard to beat.

In recent years, the local brokers such as iFAST, POEMS, Kim Eng, and like, have started to offer pre-paid accounts. These are accounts where you keep your shares with the broker. They become your custodian. You are able to get 0.08% to 0.12% per transaction commissions.

We should not be comparing against transaction cost of 0.25%, which is what offer by traditional brokers (full disclosure: I am still paying at such obscenely not cheap charges)

The appeal of IBKR is the whole package:

- It is a listed US Company. Actually, it may be a company you wish to invest in

- The way I think about it, people outside of US are looking for a platform that is cost effective enough to invest through. Turns out the savvy folks out of US, whether is Europe, Hong Kong or Singapore uses IBKR

- If your account size is US$100,000, there are no custodian charges. If you have less it is $10 per month unless you make certain trades. As you make some trades, it gets deducted from this $10. To me this is not a problem even if your amount is small. Eventually, if you follow my wealthy formula, it is likely you will have US$100,000. Your $120/yr is just going to spread over the future years

- The commission is low as previously stated

- They allow you to invest in a lot of markets

- Thus those who wishes to buy UCITS Exchange Traded Funds (ETF) that is relatively low cost, listed in London Stock Exchange are able to do so at very low cost

- With different broker platforms, you tend to incur some cost when you convert between SGD to USD, GBP or HKD. This is typically in the 0.50% range more or less. What I understand is the slippage in this is very very low

- Many have complained that their platform is not intuitive. To me this is perhaps just trying to get used to. I heard they are able to compute your portfolio overall return and let you review these numbers. I think that is a benefit of housing all your net wealth in one platform

- Currently, Singaporeans can FAST transfer their money in. You can Google around to see the process

A lot of advantages, very little disadvantages. The main one from what I understand, as Singaporeans, you cannot trade Singapore stocks through IBKR. Overseas investors can (very ironic)

My friend have list out some of the advantages he sees as a private investor:

- It is easier to manage your account through a local office in Raffles Place area

- It gives greater confidence in Singapore based users

- May be easier for Independent Financial Advisers to set up and manage B2B enterprise accounts with IB

- Put pressure on local brokers. So this may result in things cheaper for everyone

I like the B2B angle. A lot of the current B2B business is undertaken by IFAST. IBKR have their institutional side of the business.

It remains to be seen whether they prefer to focus on the B2B or B2C portion of things. I think there might be very little alternative to IFAST. The rest of the B2B platform, from what I heard, were not able to deliver as good of a service than IFAST.

With some competition, we might be able to enjoy better rates. Of course, we may benefit when local brokers scramble to try and offer what IBKR is able to.

My Comprehensive Interactive Brokers How-to Guides

Interactive Brokers is a great low-cost, financially strong brokerage platform that can be the standard broker for holding your long-term investments. You can access 150 global exchanges, including exchanges such as Singapore, the US, Hong Kong, London, European and Canada.

You will enjoy cheap commissions and zero minimum recurring platform fees or maintenance fees. Convert your funds to different currencies at near-spot rates, paying a flat US$2 fee.

To get started or become familiar with Interactive Brokers, check out my past articles on how to invest with Interactive Brokers. I hope the guides make your life and investing experience easier and brighter.

An Easy Step-By-Step Guide to Setup Interactive Brokers (IBKR)

How to Fund & Withdraw Funds from Your Interactive Brokers Account

How to Convert Currencies in Interactive Brokers

How to Buy and Sell Stocks and Securities on Interactive Brokers

How Competitive are Interactive Brokers Commissions Pricing?

How Safe is it to Custodized Your Money at Interactive Brokers? The things they do better than other brokers.

How Safe is it to Custodized Your Money at Interactive Brokers (2)? Financial strength of IB during recent banking crisis and during Great Financial Crisis

Interactive Brokers have Eliminated the US$10 monthly inactivity fee. More details here.

How to Transfer your shares from Standard Chartered Online Trading to Interactive Brokers

How to trade after-hours and premarket

Create Customized Reports and automatically send them to your email

What is the PortfolioAnalyst Report and Automatically Send the PortfolioAnalyst Report to Your Email

Send Money from TransferWise to Interactive Brokers

Interactive Brokers’ Fluid Interest Income on Cash

Introducing IMPACT by Interactive Brokers

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Alfonso HH

Saturday 28th of November 2020

Hey Kyith, thanks for the good writeups on IBKR. I am wondering if you have tried their transfer-in? I am thinking of moving out from SC.

Kyith

Saturday 28th of November 2020

Hi Alfonso, unfortunately, someone commented in one of my series of Interactive post tried to transfer in from SC and was unable to do so. You can refer to my series of post starting over here.

divvy

Tuesday 1st of September 2020

Thanks fc for sharing and confirming this fact. I am still thinking if it's worth it doing this just to buy sgx shares:)))

divvy

Sunday 30th of August 2020

Hi Kyith did you have a US Interactive brokers account already when you opened the Interactive Brokers singapore account? I am having problems opening the singapore account. When I start the application process it directs me to the US site to open a " new" account and I can't seem to find the correct link on US site to do this. I tried emailing the Singapore website but no reply. I also messaged for help through the US wensite and they have been quite unable to understand my problem:(( Any advice would be appreciated. Thanks!

Kyith

Sunday 30th of August 2020

Hi Divvy, try calling this number 800 101 3456. This comes straight from the horse's mouth. I had that before IBSG started. Which part of the process were you stuck in? I had a friend who recently applied and it seem to be ok.

Ying Qin

Saturday 8th of August 2020

Hi,

Do you appreciate the key differences between having interactive broker (USA) account versus interactive broker (Singapore) account, beyond the latter can buy from SGX (i.e estate law, fees, etc)?

Thanks.

Kyith

Sunday 9th of August 2020

HI Ying Qin, I do not see much difference. The main difference is that it seems the USA SIPC protection is quite appealing. But then a MAS approved entity is pretty strong as well.

Lee

Monday 6th of July 2020

I understand that if we buy US stock using local broker such as Vicker, the shares are held by Vicker's custodian account. What about if we buy US stock using interactive broker? It is held by DTCC or IB's custodian account?

Kyith

Monday 6th of July 2020

it will be held in custodian account in USA. if IBKR comes to Singapore the stocks will still be in United States but the cash will be local.