In light of what is happening with the US Banks, if you are a client of Interactive Brokers LLC (IBKR) or Interactive Brokers Singapore (IBSG), you might wonder about your brokers when compared to the situations of these US Banks.

I hold my securities and cash mainly in both IBKR and IBSG.

Interactive Brokers Group has over $11.6 billion in equity (12/31/22 equity), comprised of highly liquid assets, primarily cash in banks and reverse-repos collateralized by US Treasury securities.

Here is the other information regarding their financial health and incentives.

Interactive Brokers’ Exposure to Distressed Banks

Interactive Brokers do not have exposure to:

- Silicon Valley Bank

- First Republic Bank

- Signature Bank

IBKR also updated that they did not have material margin loan losses due to the client’s holdings in SVB or other banks’ failing values.

How IBKR Manages Client’s Money

IBKR earns the majority of their revenue from:

- Margin loans from trading.

- Investing your excess cash in the accounts at a spread above the cash.

Under IBKR’s Financial Strength, they give us an idea of how they house the money.

Our money is in three places:

The majority is invested in U.S Treasury Securities.

These are direct investments in:

- Treasury bills

- Treasury notes

- Reverse repurchase agreements, where collateral received is in the form of U.S Treasury securities. Transactions are conducted with third parties and guaranteed through a central counterparty clearing house. The collateral is held by IBKR at a custody bank in a segregated Reserve Safekeeping Account for the exclusive benefit of clients

As of 10 March 2023, this is about 78% of clients’ funds.

Interactive Brokers LLC’s $32 billion (segregated customer securities on 12/31/22) portfolio duration is 30-40 days. When rates rise, IBKR’s portfolio re-investments will adjust for a higher rate in about a month.

This way, they can avoid mismatching the maturities between their on-demand obligations to their clients and their investments. This practice also allows IBKR to avoid excessive price volatility and the risks of large losses stemming from declines in investment values that longer-term securities may exhibit.

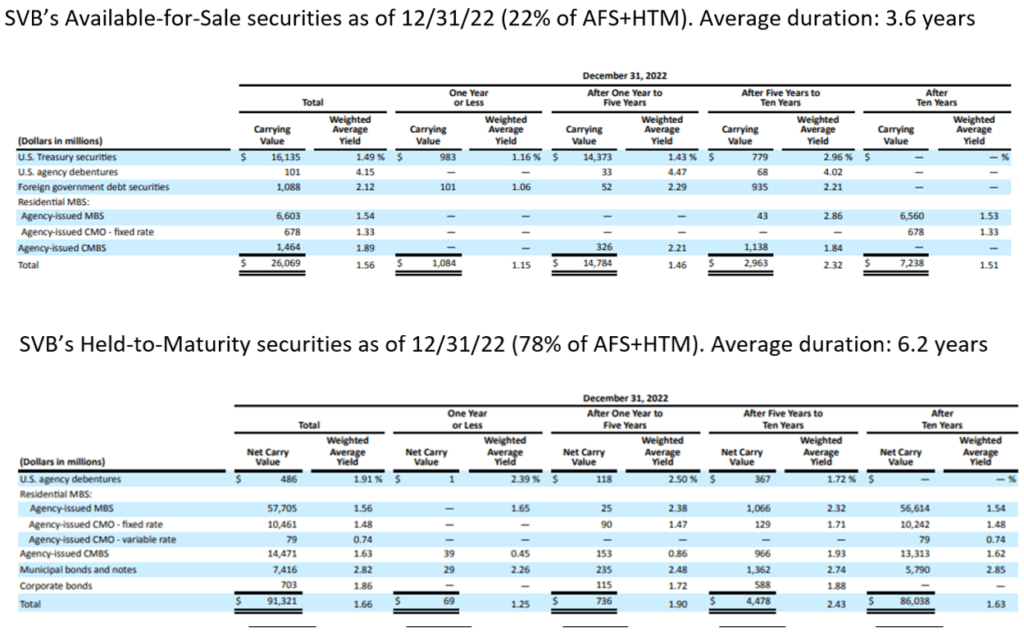

In contrast, SVB’s portfolio duration was 5.7 years (as of 12/31/22), with an average interest rate of 1.6%.

As interest rates rose, the value of their long-maturity securities fell; when SVB was then forced to sell them at a loss to meet customer withdrawals, that previously unrealized loss became realized and reportable.

Some are Maintained due to Client’s Margin Lending

Client cash is maintained on a net basis in the reserve accounts, which reflects the long balances of some clients and loans to others.

To the extent any one client maintains a margin loan with IBKR, that loan will be fully secured by stock valued at up to 140% of the loan.

The security of the loan is enhanced by IBKR’s conservative margin policies, which do not allow the borrower to correct a margin deficiency within days, as permitted by regulation. Instead, IBKR monitors and acts on a real-time basis to automatically liquidate positions and repay the loan. This brings the borrower back into margin compliance without putting IBKR and other clients at risk.

Special Reserve Accounts

These is the special accounts that was previously talked about.

A portion (9% of clients’ funds as of March 10, 2023) is deposited primarily with large U.S banks in special reserve accounts for the exclusive benefit of IBKR’s clients. These deposits are distributed across several banks with investment-grade ratings to avoid concentration risks.

No single bank holds more than 5% of total client funds held by IBKR.

As of March 2023, the following banks held deposits from IBKR (this list is subject to change over time at IBKR’s discretion):

- Bank of the West (part of the BMO family)

- BMO Harris Bank, N.A.

- CIBC USA

- Citizens Bank

- Standard Chartered Bank

- Truist Bank

- US Bank, N.A.

- Valley National Bank

Certain banks, which are affiliates or branches of foreign financial institutions, are subjected to regulatory oversight by the Federal Reserve and the Office of the Comptroller of the Currency.

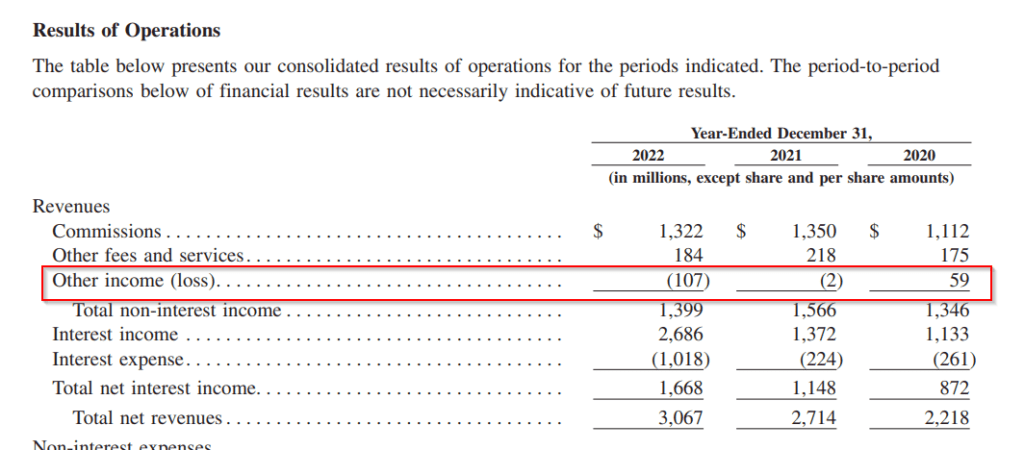

IBKR Marks to Mark Their Portfolio – Their Losses

As of Dec 2022, the investment portfolios of the client is $32 billion (under segregated customer securities in the financial statements).

IBKR as a broker, must mark to market its portfolio and they do so on a daily basis. The market value is reported to regulators. This is also published in IBKR’s quarterly financial statements.

You can review their monthly report to regulators here at FOCUS.

The losses on the portfolio are reported transparently under other income and is a tiny portion of $32 billion.

In contrast, the banks are not required to mark their investment portfolios to market if they are classified as “held to maturity” but can keep their securities on their books at their carrying value. This results in hidden losses unless they are forced to sell to generate liquidity.

Here is how long Silicon Valley Bank’s available-for-sale and held-to-maturity duration was:

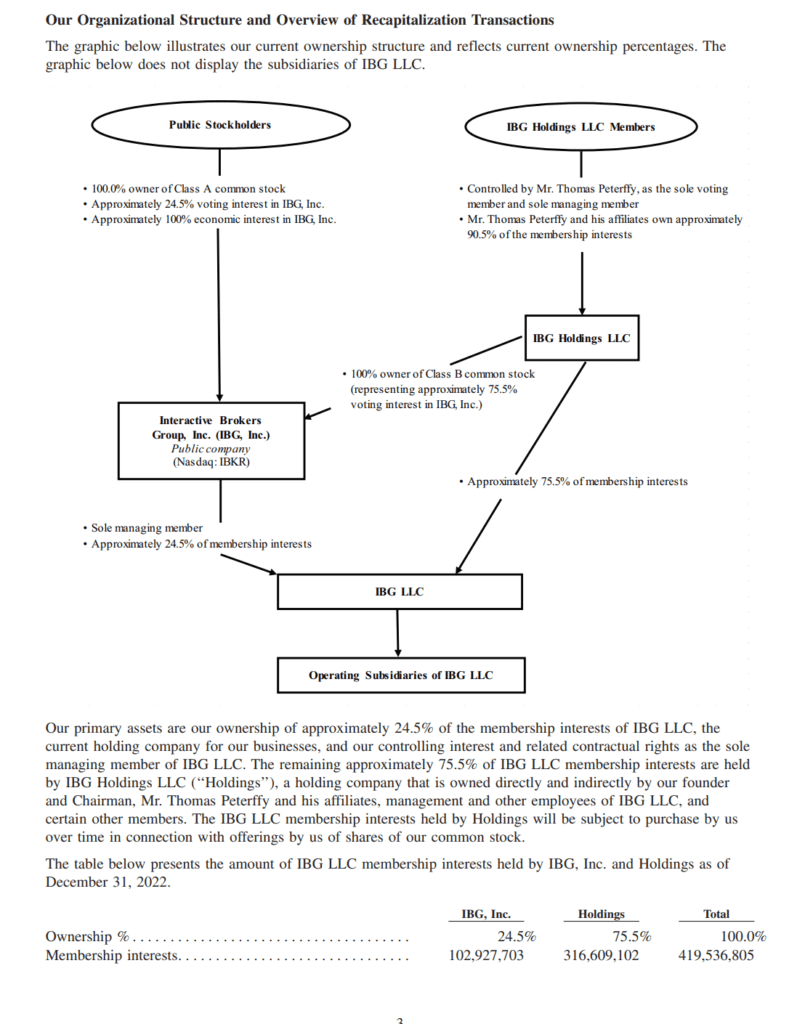

IBKR’s Owners Have A Lot of Skin in the Game

If there is doubt about incentives, public investors are really the minority interest in IBKR. Thomas Peterffy, the chairman and owner of IBKR, owns 75.5% of IBKR.

If this melts down, he melts down harder.

Further Information

Currently, IBKR has no long term debts and held no CDOs, MBS or CDS.

I will update more information as I know more.

You can find more information about the strength and security of both IBKR and IBSG here:

- IBKR: https://www.interactivebrokers.com/en/general/financial-strength.php

- IBSG: https://www.interactivebrokers.com.sg/en/general/financial-strength.php

- IBKR’s 2022 10K: https://investors.interactivebrokers.com/en/index.php

My Comprehensive Interactive Brokers How-to Guides

Interactive Brokers is a great low-cost, financially strong brokerage platform that can be the standard broker for holding your long-term investments. You can access 150 global exchanges, including exchanges such as Singapore, the US, Hong Kong, London, European and Canada.

You will enjoy cheap commissions and zero minimum recurring platform fees or maintenance fees. Convert your funds to different currencies at near-spot rates, paying a flat US$2 fee.

To get started or become familiar with Interactive Brokers, check out my past articles on how to invest with Interactive Brokers. I hope the guides make your life and investing experience easier and brighter.

An Easy Step-By-Step Guide to Setup Interactive Brokers (IBKR)

How to Fund & Withdraw Funds from Your Interactive Brokers Account

How to Convert Currencies in Interactive Brokers

How to Buy and Sell Stocks and Securities on Interactive Brokers

How Competitive are Interactive Brokers Commissions Pricing?

How Safe is it to Custodized Your Money at Interactive Brokers? The things they do better than other brokers.

How Safe is it to Custodized Your Money at Interactive Brokers (2)? Financial strength of IB during recent banking crisis and during Great Financial Crisis

Interactive Brokers have Eliminated the US$10 monthly inactivity fee. More details here.

How to Transfer your shares from Standard Chartered Online Trading to Interactive Brokers

How to trade after-hours and premarket

Create Customized Reports and automatically send them to your email

What is the PortfolioAnalyst Report and Automatically Send the PortfolioAnalyst Report to Your Email

Send Money from TransferWise to Interactive Brokers

Interactive Brokers’ Fluid Interest Income on Cash

Introducing IMPACT by Interactive Brokers

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Chong

Wednesday 9th of August 2023

Hi Kyith,

With the latest downgrade of credit ratings for the 10 midsized US banks and assigning of negative outlook for another 6 top-tier lenders by Moody yesterday, we saw Truist Financial Corp (TFC, listed entity of Truist Bank) and U.S. Bancorp (USB, parent company of U.S. Bank National Association) appeared in the list of banks that IBKR is putting their deposits in.

Maybe its time to update this post?

Kyith

Sunday 13th of August 2023

Hi Chong, good spot. I remember that recent news (although I try not to pay attention to more financial news these days). Giving negative outlook is quite a normal thing given downturns in business cycle. The question is also how much would credit ratings need to downgrade before we worry that they are a going concern? The price of the fall may have recently show the rerating.

Ming

Saturday 18th of March 2023

Though unlikely, it would be good to know what happens to the share/stock/securities purchased using IBKR, IBSG platform, in the event where Interactive Brokers collapses.

Kyith

Saturday 18th of March 2023

Hi Ming, likely a broker custodian is someone who maintains a ledger book on a continual basis. they maintain the buy, sells and all those sort of stuff. when these stuff happens, those paper assets should be ok because it is under your name, unless it is otherwise in a different relationship