This used to be a hobby.

If you feel like writing then you write. If you feel strongly enough, you write.

It hit me especially hard when I was about to watch Dr Stone. “Kyith, could you provide a summary of the National Day Rally for the advisers?”

Guess this is life now.

So since I already read it, why not provide it here. The version that I wrote internally is more for a different base. This one is more….

Let me give a summary that is closer to the readers. They are ranked in terms of importance.

No Impact to CPF Withdrawal

The biggest talking point have been about raising of the retirement age and re-employment age.

This will be raised gradually.

We know it is coming. KNN, if you read enough of the papers this 2 years, you would have caught the narrative.

What the Prime Minister did was to kill a lot of the arguments the opposition will have on retirement. It is something the opposition know is close to the people’s heart.

He repeated twice. There will be no changes to the withdrawal.

He basically said “I will raise the retirement age, I will give you more official protection on working longer, yet you can still withdraw your CPF as same as the current plan. It is your choice whether you want to delay to 70 years old or not. It is up to you. Opposition, what do you wish to attack me on?”

The re-employment age will be beneficial to clients who are still working. It provides policy security that makes it compulsory that their employers must offer them re-employment from 62 years old onwards, up to the age of 70.

This allows them to work longer, and accumulate more wealth.

Continual employment is beneficial to a retiree:

- It adds to their retirement funds. This increases what they can spend in the future

- By spending their earnings, it prevents early draw down of retirement funds. What they originally should spend will be reserve to spend in the future

For those with good savings rate, by working each year, they may lengthen their retirement by 2 years.

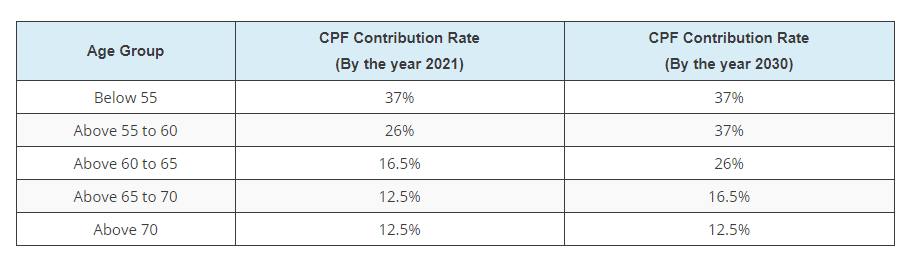

Changes to the CPF Contribution Rates

While there are no changes to the CPF Life withdrawal, the government will be gradually raising the CPF Contribution rate.

Refer to the following table taken from Seedly:

Employers and employees will still continue to contribute the full 37% from 55 to 60 years old, then step down to 26% and so on. The government have delay the contribution rate reduction.

The impact to you is that, for those who are still working, employers are contributing more to their CPF. As do themselves.

I would think that those that delay their CPF Life pay out beyond the typical 65 years old may be able to take out more. This helps a lot for those that needed more time to reach the full retirement sum, or even basic retirement sum.

Potential Impact to SRS

If you withdraw early from the Supplementary Retirement Scheme (SRS) account, there is an early penalty of 5% and the withdrawal amount is taxable as ordinary income tax.

The Penalty Free withdrawal age was 62 years old. This is tied to the statutory retirement age. Since this is moved, this may change.

That is why I explain how I open and fund my SRS account with $1 dollar a year ago. After you hear so much narrative, you got to do something.

I think the impact will depend on how dependent on your SRS for cash flow.

If you really and I mean really need it, then just withdraw early and take the penalty and be taxed. You need the money!

But for most, they should be able to delay for 1 to 3 years in cash flow. I find the impact of this is down to planning.

More Pre-school Subsidies

Pre-school education spending to be double over the next few years. Government will raise the income ceiling of households eligible from $7,500 a month to $12,000 a month. An additional 30,000 household stands to benefit. Government supported pre-school to be increased from 50% to 80%.

This one is a big one because it has been something the middle income have been trying to tackle. It is one of the concerns on their mind when they think about having more children.

Pre-school is necessary especially for single child to open them up faster, to interact with people. I find it helps them develop faster.

But the cost is rather substantial for parents. The example given by Channel News Asia puts the cost reduction from $560 a month to $370 a month.

It is not just about subsidies but also creating an ecosystem that supports it. And this plan helps.

It also creates job opportunities.

Reduced University, Polytechnic Fees for Lower Income Students

The Prime Minister also announced a few measures aimed at helping lower income students:

- Bursaries for university courses to increase from up to 50 per cent of fees, to up to 75 per cent

- Bursaries for polytechnic diploma programmes to increase from up to 80 per cent of fees, to up to 95 per cent

- Increased bursaries for students at the Institute of Technical Education (ITE), Nanyang Academy of Fine Arts and LASALLE College of the Art

- Reducing the cost of tuition for low income but eligible students to study medicine from $29k – $35k a year to $5k a year

This is a push of what meritocracy is about. Those who are bright, should be not limited by their economic background to be able to get up-skilled. It may allow them to earn higher wages.

What may not be addressed is that a lot of bright kids fell on the way side because the ranking system is still based on a bell shaped curve. The kid may be bright but there are many bright kids. So they end up with less than stellar grades. And that affects their qualification.

It is a bit sad there.

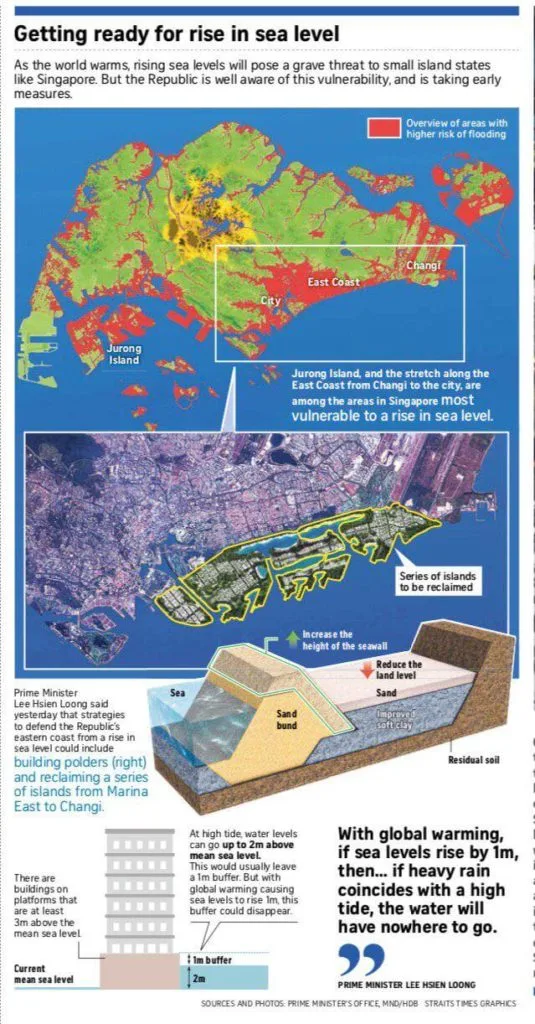

Protecting against Climate Change

This is a big one for me.

I been wondering about this and it is good the government has thought about this.

The sum of this, as highlighted by the Prime Minister is huge. But if you divide it up, it is big but at least more manageable.

The repercussions is real if the government have not seriously considered and implement this.

And many of you have majority of your net wealth in properties. Our properties are attractive because Singapore is land scarce and we have a sort of stability, and are well connected. Advanced enough if you want to call it.

Imagine the prospect of those properties being affected by flooding.

I could probably relocate. But if your net wealth is so concentrated and tie to a single sector, single location, good luck to you.

Development of Greater Southern Waterfront

More plans were put out how they are going to shape the Greater Southern Waterfront.

Those of you who are staying in Redhill and Telok Blangah will welcome this. It should add or stabilize your property value. The value is high but some of your flats are old.

This will also be welcome developments for investors holding Mapletree Commercial Trust. Mapletree Commercial Trust primarily owns a lot of properties that resides in the Greater Southern Waterfront. The increase importance will bring welcome footfalls from office as well as city dwellers for its main asset Vivo City.

While more office buildings may increase the competition for the REIT’s properties in the region, I do see it as complementary. Businesses tend to congregate together.

These developments will be welcomed by investors who holds existing construction, engineering and cement suppliers listed in the Singapore stock exchanges. These stocks have been in a slump with a lack of developments. I do caution that while there is a plan in place, these listed firms still have to compete against keen and intense competitors in the industry. There is also a timing of when these projects will be released and the company’s cost control.

Stocks in these industry tend to be cyclical in nature. The investor will have to be vigilant in his or her assessment of the business.

Raising of the Official Retirement Age and Re-Employment Age

I put this last because as a person who have been writing about financial independence, I do not know why people are so concerned about it:

- If you don’t like your job and have the wealth, even if the official age is 80, you will still retire at 57 years old

- If you like your job and have the wealth, you will work till you drop dead a lot of times

My dad “retired” nearly 19 years ago at 54 years old when there was no more contracting business. At that time Yong Nam’s share price was near $0.01 if I remember. I do not know if “retrenched” is the right word here.

What scares people is that all their money is tied to CPF.

There is so much talk about the government can always “shift the goal post”.

If that is the case, don’t keep topping up so much CPF lah!

The returns may look good but you got to think of your overall plan. Learn to earn as good of a return outside of the CPF!

Who knows the returns of 2.5% and 4% may be unsustainable.

I will say this:

- the re-employment age may be important As explained before

- there is very little comparable annuity out there from my point of view versus the CPF Life

If you keep asking the question of whether the goal post will shift again, or whether the rate of return is sustainable or not, it may be the proportion of your CPF in your overall net wealth is large.

According to standard risk management:

- Mitigate the risk. Don’t have so much so concentrated in a policy tied instrument

- Avoid the risk. Plan like you are not going to see this “CPF Tax” at all

- Transfer the risk. Not really applicable here.

Conclusion

There are lots of good in this National Day Rally.

Perhaps more goodies means the Singapore Election is around the corner. Humans have short memories and these good initiatives will stick to them.

In any case, I think the whole narrative we see for the past 2 to 3 years point to a clean sweep for the PAP. The main idea: “There is no more monster meaningful enough to slay.”

This may be a topic for another day.

More so, the big projects such as Greater Southern Waterfront and these climate change stuff will create enough projects for local companies. They have not been doing well.

When the private markets are in the dumps, the government spending have to ramp up. This is one way. IT projects is another.

How will all these be funded.

I think its not an issue for this Prime Minister. It may not be his problem for long. Just like how the VERS will be carried out.

No one knows. It is the next generations hot potato.

If you are wondering what is Dr Stone, its the show below:

I welcome any thoughts that is not too politically volatile.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

Sinkie

Monday 19th of August 2019

LOL! If you had to do the reading & writing outside of office hours, you could chalk up the time & watch Dr Stone during office hours today!

Lawyers are really good at clock watching :)

Mickey J

Monday 19th of August 2019

To be fair, if the opposition parties didn't drill in the retirement issue long enough, our ruling government wouldn't have done what they announced yesterday. So I would give this win to our opposition parties. :)

Tai Lai Kwan

Monday 19th of August 2019

Thank you so much for your take on PM’s address especially the part re climate change and the govt’s plans to safe guard Spore. I felt a great sigh of relief that a think tank has put together an initial blue print for current & next generation to work on & improve. This is Hugh for Spore as a low lying island with no hinterland for escape. Actually I went to bed a little upset, as reaction on this subject from all the investment Chat groups I’m in were almost non existent, and the only immediate comments on the issue from one chat group were really frivolous and only concern about having to foot the bill! Hopefully more thoughtful heads prevail especially our younger generation! Once again, thank you for your analysis, as always, a joy to read, and very edifying.