By default, you can only trade stocks, shares and options during the hours where the stock exchange is open.

But on some platforms, they allow you to trade during after-hours.

The pre-valent market that allows you to do that is the stock exchange in the United States.

And with Interactive Brokers and some other exchanges, you as a retail investor will be able to trade after-hours.

Why would you want to trade after-hours?

There can be a number of reasons why you would want to do that.

You can trade after normal markets close so that you can react quickly to breaking news or fresh information before the next day’s market open.

You may find that the prices during after hours, for some stocks to be more appealing.

In a way, with after-hours trading, it is as if you have a longer period of time to trade and execute, and you won’t be afraid to miss opportunities to load or unload stocks or put in option chains.

When does after-hours trading typically take place?

The standard trading hours on the US market is from Monday through Friday, from 9.30 am to 4.00 pm in United States time. That is 9.30 p.m to 4 a.m Singapore time. If there is daylight saving, the market will open and close 1 hour later.

Nasdaq

Nasdaq has early trading from 4 a.m. to 9.30 a.m US eastern time. That is 4 p.m to 9.30 p.m Singapore time.

Late trading from 4 p.m to 8 p.m US eastern time. That is 4 a.m to 8 a.m Singapore time.

NYSE American equities, Chicago and National

Pre-opening trading starts at 6.30 am US eastern time.

Early trading goes from 7 am to 9.30 am US eastern time.

Late trading goes from 4 pm to 8 pm US eastern time.

Here is how to trade the Pre-Market, Post-Market Hours on the US Market with Interactive Brokers

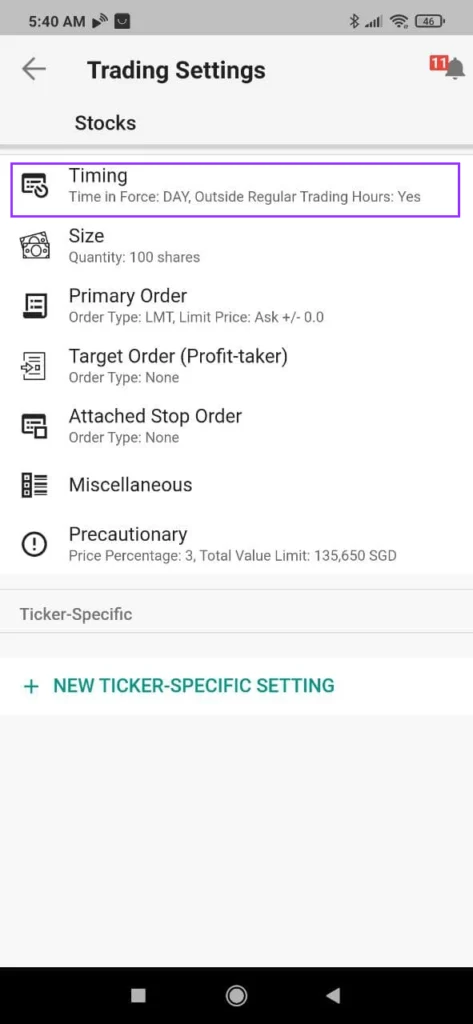

You will need to go to your Configuration in your Interactive Brokers app to toggle the setting that allow you to trade after-hours. You can also find the same setting under the Trade expanded menu.

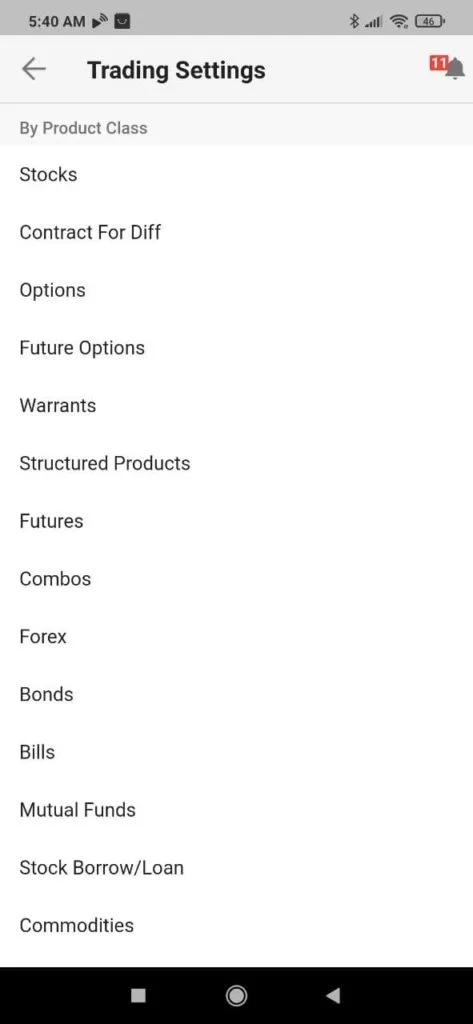

Under both sections, you will see Trading Settings.

There are a few different product classes. You can go into different ones to enable after-hours trading.

I think almost all of them in some ways allow you to trade after-hours.

But let us centre on Stocks for now.

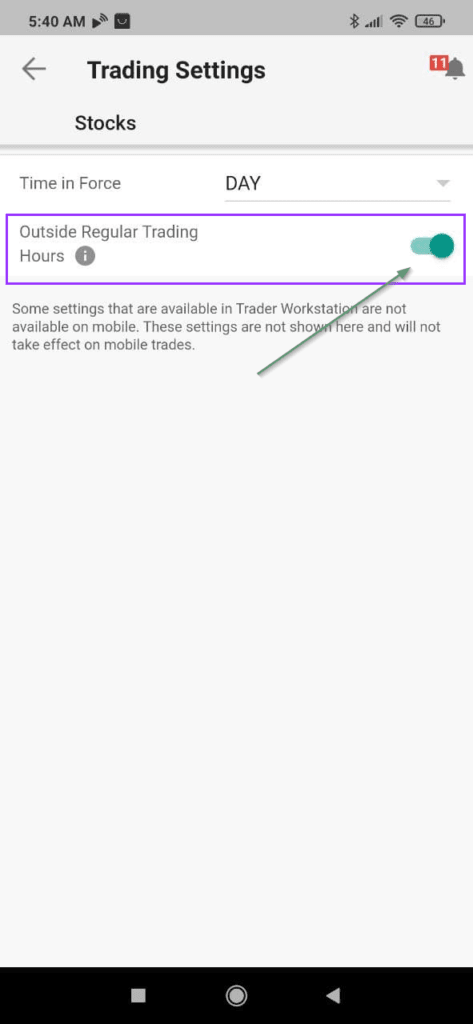

Select Timing.

There is an Outside Regular Trading Hours switch. Toggle that.

Now you have configured successfully.

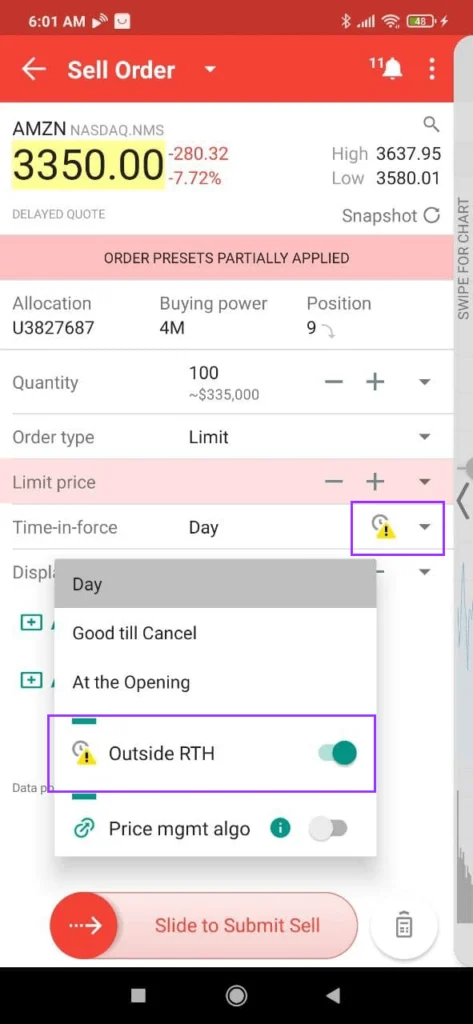

When you go into the trade screen, under Time-in-force, you will see when your order can be filled. The clock with an exclamation tells you that you can fulfil the transaction after regular trading hours (RTH).

You can toggle that off as well.

In a sense, the clock with exclamation tells you that you are trading after office hours.

The Risks to Take Note of When Trading After Regular Trading Hours

There are things to take note of when trading after regular hours.

Less liquidity. During normal trading hours, there are more buyers and sellers. During after-hours, there is less trading volume for some of your stocks so it may be harder.

Wider spreads. Due to the first point, what you may face is that the spread between the bid and ask is also wider.

Volatility. Due to the first point, the volatility in the stock and options movement might be wider as well.

After-regular trading hours give you a tool but you would also need to know how to use it.

My Comprehensive Interactive Brokers How-to Guides

Interactive Brokers is a great low-cost, financially strong brokerage platform that can be the standard broker for holding your long-term investments. You can access 150 global exchanges, including exchanges such as Singapore, the US, Hong Kong, London, European and Canada.

You will enjoy cheap commissions and zero minimum recurring platform fees or maintenance fees. Convert your funds to different currencies at near-spot rates, paying a flat US$2 fee.

To get started or become familiar with Interactive Brokers, check out my past articles on how to invest with Interactive Brokers. I hope the guides make your life and investing experience easier and brighter.

An Easy Step-By-Step Guide to Setup Interactive Brokers (IBKR)

How to Fund & Withdraw Funds from Your Interactive Brokers Account

How to Convert Currencies in Interactive Brokers

How to Buy and Sell Stocks and Securities on Interactive Brokers

How Competitive are Interactive Brokers Commissions Pricing?

How Safe is it to Custodized Your Money at Interactive Brokers? The things they do better than other brokers.

How Safe is it to Custodized Your Money at Interactive Brokers (2)? Financial strength of IB during recent banking crisis and during Great Financial Crisis

Interactive Brokers have Eliminated the US$10 monthly inactivity fee. More details here.

How to Transfer your shares from Standard Chartered Online Trading to Interactive Brokers

How to trade after-hours and premarket

Create Customized Reports and automatically send them to your email

What is the PortfolioAnalyst Report and Automatically Send the PortfolioAnalyst Report to Your Email

Send Money from TransferWise to Interactive Brokers

Interactive Brokers’ Fluid Interest Income on Cash

Introducing IMPACT by Interactive Brokers

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024