Stock investors always have a unique capital allocation problem.

- Their default posture is mainly to invest their capital in stocks or securities that give them a good reward for the risk taken.

- The cash that they have needs to be liquid enough to deploy.

- They want to have access to the capital hassle-free. This means that locking their capital in some fixed deposits and pulling it out earlier than moving it over is quite a hassle.

That is why some brokerages like iFAST develop a cash sweep account, which is a managed cash solution that offers higher interest rates, yet it gives you access to your monies within T+1. In my latest post, moomoo addressed this with their moomoo Cash Plus, which gives T+1 as well.

Investing in money market funds or cash management solutions with Robo-advisers is slower because of the time it takes to process and settle the sale. Using accounts such as DBS Multiplier and UOB ONE is useful because transferring to a brokerage platform is pretty fast.

If you invest using Interactive Brokers, how do Interactive Brokers address this problem?

By simply giving you a higher interest rate.

How Interactive Brokers Higher Interest Rate Work

One of the primary revenue sources of Interactive Brokers (ticker: IBKR) is taking the excess you keep on the platform and investing the cash in safe Treasury bills.

They thus earn the spread between the interest they give you versus what they can earn from Treasury Bills. Yet, at the same time, they have to remain liquid and not lose money despite the movement of the Treasury yield curve.

The interest rate you earn at Interactive Brokers depends on

- How much money did you invest in securities on the Interactive Brokers platform

- How much cash do you have on the platform itself

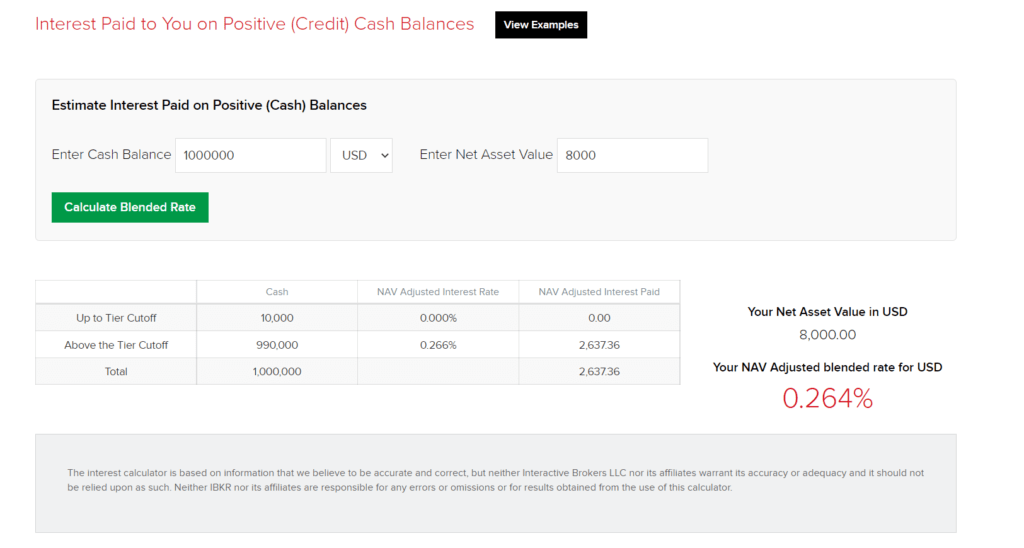

Interactive Brokers has a calculator to help you with that. Here’s Interactive Brokers interest rate page:

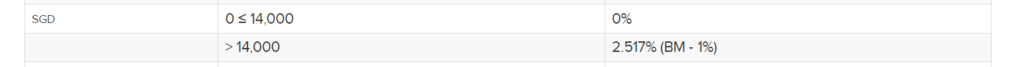

You earn different interest rates based on the different benchmark rates of the currency you keep in.

The interest rate does not stay constant.

This means that if the interest rate generally heads south, the interest you earn will go down. That would mean that the account automatically scales up and down your interest earned.

If you compare the rate to your Singapore savings bond or treasury bills, the rates given by Interactive Brokers are not the highest, but they are decent.

Currently, you can earn 2.5% p.a. on your SGD cash, 3.33% on your USD cash and 2.55% on your HKD.

You have to commit capital to invest in securities to earn that rate.

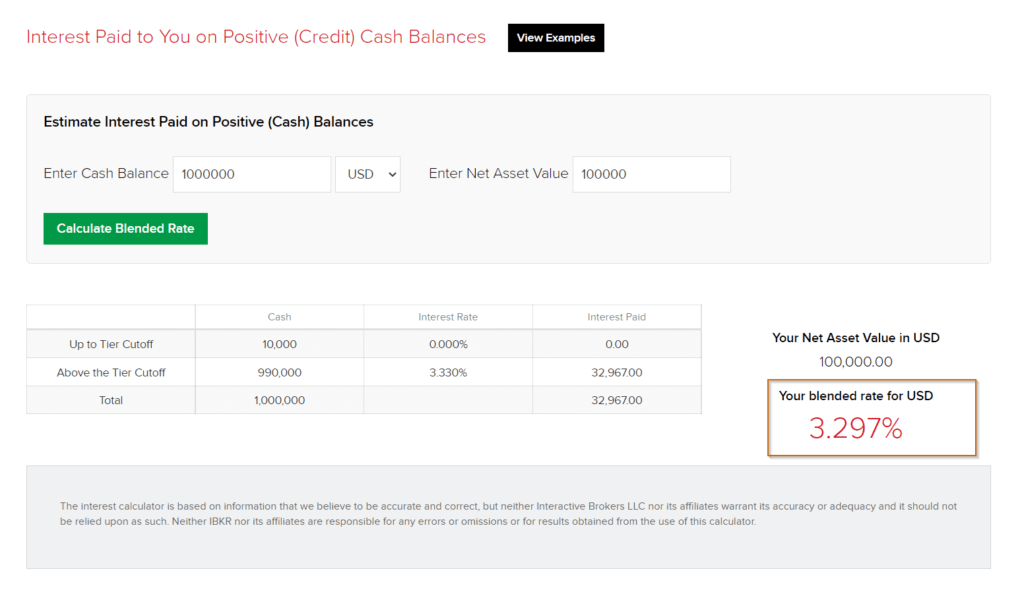

If you have USD 1 million in cash, the amount above $10,000 earns a higher interest of 3.297% if the net asset value of your invested securities is USD 100,000.

This is the maximum blended rate that you can earn, which means that if you wish to optimize and earn at the highest blended rate, you will need to commit with a capital of USD 100,000.

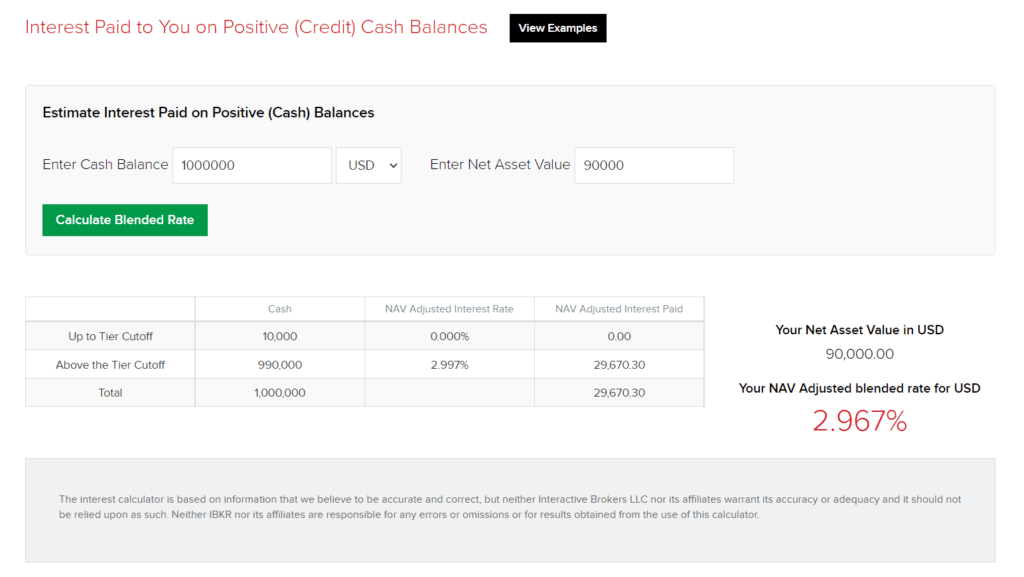

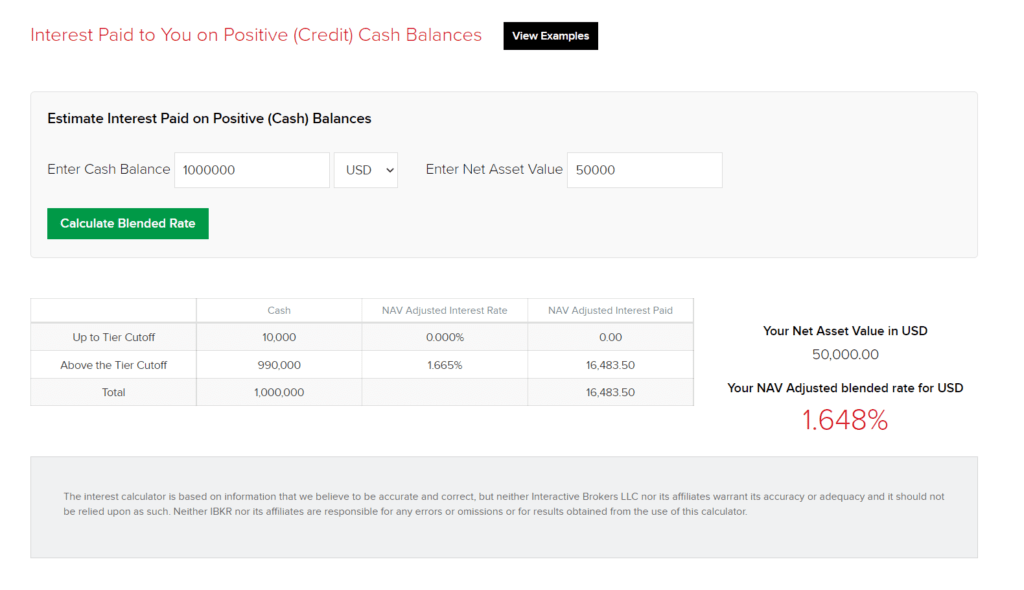

If you reduce your invested securities to US90,000, then the blended rate reduces.

And reduces.

And reduces.

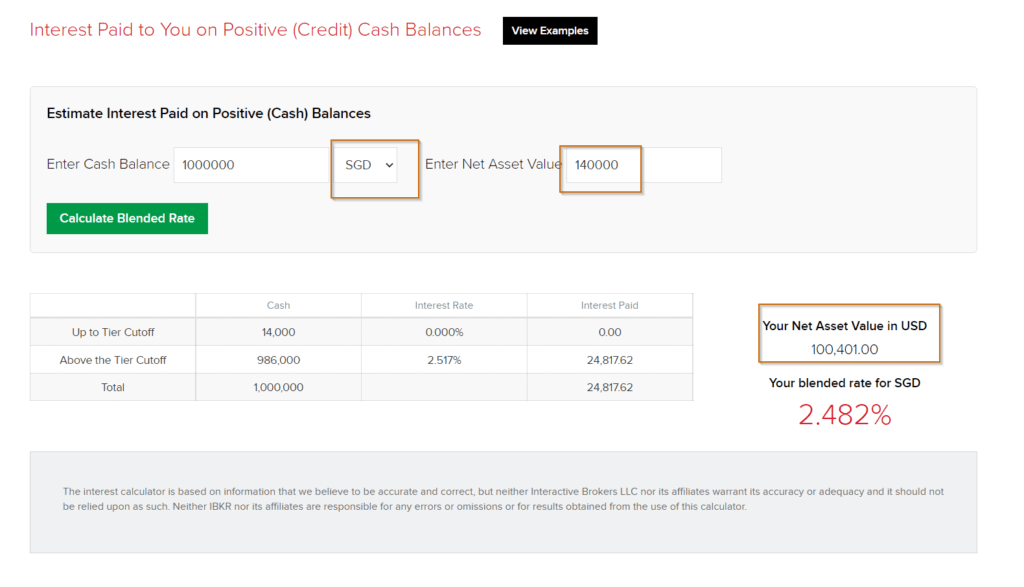

If you put S$1 million and S$140,000 into the calculator, you get a blended rate of 2.48%.

Thus, the maximum blended rate hurdle is based on US 100,000.

Easily Switch Currency and Continue to Earn Good Interest

One of the main issues with cash that you may have is the currency you keep it in.

If you keep it in USD because you invest in USD-denominated ETF, you may not want to see your currency depreciate if the USD weakens.

You might wish to be more tactical with your cash, and Interactive Brokers make it quite simple because:

- Currency conversion is cheap, and currency conversion is at a spot rate (read my IBKR Currency Conversion guide)

- Your cash in IB automatically earns a higher interest if you have invested enough.

With other platforms you have to think about the spread between your currency conversion and the cost, and the chore of deploying the cash and withdrawing the cash.

Interest Earned and Potential Interest Easily Reviewed in IBKR Portfolio Analyst Reports

IBKR make it easy for you to review how much interest you earn, potentially can earn in their PortfolioAnalyst report (read more about Portfolio Analyst report here)

This section at the bottom shows the estimated annual income of your dividends and interest and specifically shows the estimated SGD income.

They will also show the actual income you managed to receive.

Conclusion

In some of your head, you might fear that you are missing out on high opportunity costs if your cash sits idle, yet in a dilemma should you make a move to switch out of your brokerage platform and then switch back in days later.

With IBKR’s higher interest, you don’t have such a big problem or your opportunity cost can be dramatically reduced.

Besides this, there are other advantages as well.

Like many satisfied Singaporeans and International Investors, sign up and try Interactive Brokers today.

My Comprehensive Interactive Brokers How-to Guides

Interactive Brokers is a great low-cost, financially strong brokerage platform that can be the standard broker for holding your long-term investments. You can access 150 global exchanges, including exchanges such as Singapore, the US, Hong Kong, London, European and Canada.

You will enjoy cheap commissions and zero minimum recurring platform fees or maintenance fees. Convert your funds to different currencies at near-spot rates, paying a flat US$2 fee.

To get started or become familiar with Interactive Brokers, check out my past articles on how to invest with Interactive Brokers. I hope the guides make your life and investing experience easier and brighter.

An Easy Step-By-Step Guide to Setup Interactive Brokers (IBKR)

How to Fund & Withdraw Funds from Your Interactive Brokers Account

How to Convert Currencies in Interactive Brokers

How to Buy and Sell Stocks and Securities on Interactive Brokers

How Competitive are Interactive Brokers Commissions Pricing?

How Safe is it to Custodized Your Money at Interactive Brokers? The things they do better than other brokers.

How Safe is it to Custodized Your Money at Interactive Brokers (2)? Financial strength of IB during recent banking crisis and during Great Financial Crisis

Interactive Brokers have Eliminated the US$10 monthly inactivity fee. More details here.

How to Transfer your shares from Standard Chartered Online Trading to Interactive Brokers

How to trade after-hours and premarket

Create Customized Reports and automatically send them to your email

What is the PortfolioAnalyst Report and Automatically Send the PortfolioAnalyst Report to Your Email

Send Money from TransferWise to Interactive Brokers

Interactive Brokers’ Fluid Interest Income on Cash

Introducing IMPACT by Interactive Brokers

Here are your other Higher Return, Safe and Short-Term Savings & Investment Options for Singaporeans in 2023

You may be wondering whether other savings & investment options give you higher returns but are still relatively safe and liquid enough.

Here are different other categories of securities to consider:

| Security Type | Range of Returns | Lock-in | Minimum | Remarks |

|---|---|---|---|---|

| Fixed & Time Deposits on Promotional Rates | 4% | 12M -24M | > $20,000 | |

| Singapore Savings Bonds (SSB) | 2.9% - 3.4% | 1M | > $1,000 | Max $200k per person. When in demand, it can be challenging to get an allocation. A good SSB Example. |

| SGS 6-month Treasury Bills | 2.5% - 4.19% | 6M | > $1,000 | Suitable if you have a lot of money to deploy. How to buy T-bills guide. |

| SGS 1-Year Bond | 3.72% | 12M | > $1,000 | Suitable if you have a lot of money to deploy. How to buy T-bills guide. |

| Short-term Insurance Endowment | 1.8-4.3% | 2Y - 3Y | > $10,000 | Make sure they are capital guaranteed. Usually, there is a maximum amount you can buy. A good example Gro Capital Ease |

| Money-Market Funds | 4.2% | 1W | > $100 | Suitable if you have a lot of money to deploy. A fund that invests in fixed deposits will actively help you capture the highest prevailing interest rates. Do read up the factsheet or prospectus to ensure the fund only invests in fixed deposits & equivalents. |

This table is updated as of 17th November 2022.

There are other securities or products that may fail to meet the criteria to give back your principal, high liquidity and good returns. Structured deposits contain derivatives that increase the degree of risk. Many cash management portfolios of Robo-advisers and banks contain short-duration bond funds. Their values may fluctuate in the short term and may not be ideal if you require a 100% return of your principal amount.

The returns provided are not cast in stone and will fluctuate based on the current short-term interest rates. You should adopt more goal-based planning and use the most suitable instruments/securities to help you accumulate or spend down your wealth instead of having all your money in short-term savings & investment options.

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

Daniel

Saturday 1st of April 2023

Interesting article thanks. If you have cash in multiple currencies e.g. $50K USD and $50K SGD, do you know how the interest is calculated?

Does the interest 'tier cut off' apply to both currencies separately (i.e. you earn 0% on the first $10K USD and first $14K SGD), or is it blended and you earn 0% only on around $10K USD above both currencies combined?

Kyith

Sunday 2nd of April 2023

this i am not sure.