Many investors wish to build their wealth through investing in a diversified portfolio of low-cost exchange-traded funds (ETFs).

One of the key criteria is to use a platform that allows them to optimize their overall costs and keep that cost low.

Roughly how Passive Investors Structure their Passive Portfolio

After reading some books on index investing, or factor investing, they would decide on an appropriate asset allocation between stocks and bonds.

Then, they will decide the appropriate allocation in their stock pie and bond pie.

Since most of these investors are rather young, their portfolios are allocated 100% to equities.

Most of their portfolios are geographically diversified to capture the returns.

To be tax-efficient so as to minimize dividend withholding taxes and not subject to future estate tax risks, they prefer to invest in ETFs domiciled in Ireland, which is traded on the London Stock Exchange (LSE).

Ireland have a dual-taxation treaty with the United States, do not have withholding tax and estate taxes for retail funds created in the country.

A simple portfolio will contain less than 10 funds. Here is a possible example:

| Fund | Ticker | Allocation |

| iShares Core MSCI World UCITS ETF | IWDA | 85% |

| iShares Core MSCI EM IMI UCITS ETF | EIMI | 10% |

| SPDR® MSCI USA Small Cap Value Weighted UCITS ETF | USSC | 5% |

This is not the most optimized portfolio, nor is this a recommendation.

Selecting the Right Broker to Implement a Low-Cost, Passive ETF Portfolio

These investors chose to create their own portfolio instead of going for a Robo Adviser such as Endowus, Stashaway or MoneyOwl mainly for two reasons:

- They can optimize this portfolio and have the flexibility to infuse their own flavour into the portfolio

- They believed the costs are lower since they do not need to pay a percentage of asset under management fee

The lowest-cost broker that allows them to invest in these ETFs listed on the London Stock Exchange in a cost-effective manner is using Interactive Brokers.

With tiered or fixed pricing, your average commission per trade should be about 0.05-0.06%.

This is probably the lowest local cost you can find among all the brokers here. And if that is not good enough, converting your SGD to USD or GBP or EUR in Interactive Brokers cost you a flat USD$2 and lets you convert at near spot rates.

If you wish to get started, you can read my series of articles about Interactive Brokers at the end of this article.

The problem some investors have with Interactive Brokers is that there is a monthly $10 inactivity fee if your account is less than USD$100,000. If you are below 25 years old, this inactivity fee is lower at $3 a month. If your account is less than USD$100,000, any commissions paid goes to offset this $10 monthly inactivity fee.

If you are one of these young investors starting out, it might take you about 4-10 years to build up your investment account to US$100,000.

In the meantime, what would be a suitable broker to start off that is low cost enough?

There are not many brokers that allows you to trade on the LSE.

The second-lowest-cost one is Standard Chartered Online Trading (SCB). SCB was my second most frequently used broker.

Here is how the fee schedule looks like:

Based on my experience, on average your commission would be about 0.35% with a minimum commission of US$10. There are no custody fee or dividend handling charges. There is no UK stamp duty as well, although in your order it will initially put the UK stamp duty. (I have verified it myself.)

If you would with to keep your average commission below 0.35%, and you are just starting off, you should accumulate your capital until you have $10/0.0035 = US$2,857 or SG$3,800.

What is Your Game Plan?

If you are just getting started with investing, and can only put away $6000 a year into your portfolio, you might wonder if you could hit US$100,000 in 4 to 8 years.

Thus, you are likely unwilling to sign up for Interactive Brokers.

So what you can do is:

- Sign up and use Standard Chartered Online Trading for the time being.

- When you have accumulate past US$100,000, either do a share transfer to Interactive Brokers or sell the shares on Standard Chartered Online and buy it in Interactive Brokers.

This is an elegant progression from a platform with reasonable commission to a lower-cost one.

How to Transfer Your Stocks from Standard Chartered Online Trading to Interactive Brokers.

If you tried search online, you would have found entries that say this transfer was not possible. Some of the reasons given is that SCB can only transfer to brokers on certain platform and Interactive Brokers was not one of them.

Well, one of the members of my Financial Independence Telegram group managed to successfully transferred from SCB to IBKR.

What you need to do is to fill up forms on both SCB and IBKR.

Once you submit the forms, both SCB and IBKR will link up and do the work for you.

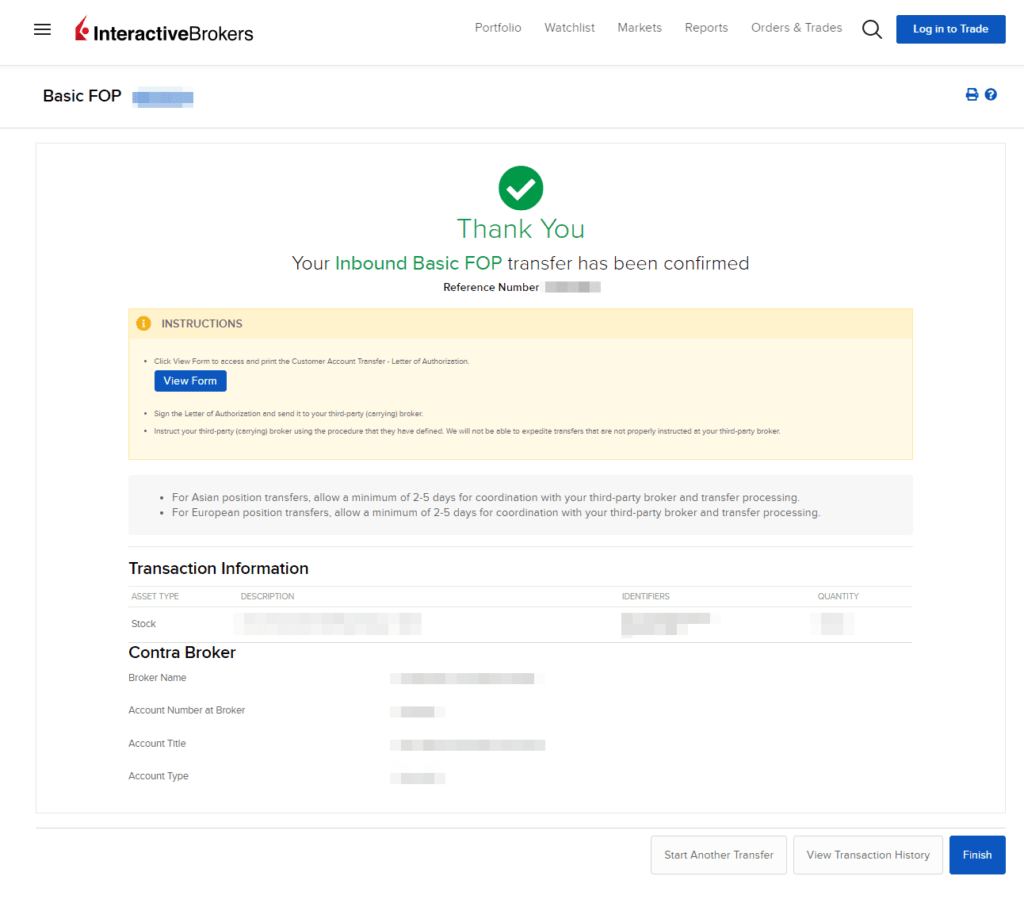

The process took our member about 4 working days from request submission to seeing his position in IBKR.

In the following section, I will show you how I transferred one of my stock holding under SCB to Interactive Brokers. It took me roughly 7 calendar days.

The stock actually appeared in the Interactive Brokers statement on a Sunday!

Filling in the Standard Chartered Share Transfer Form

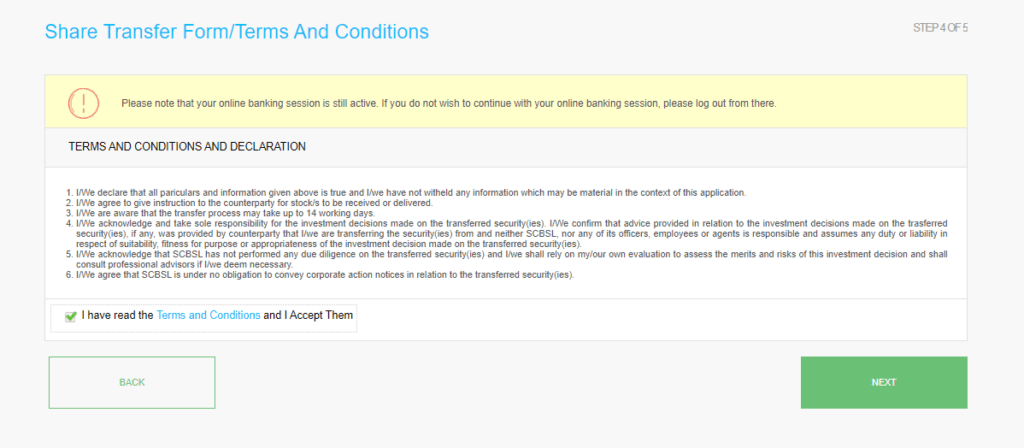

SCB provided an online form for you to submit your share transfer.

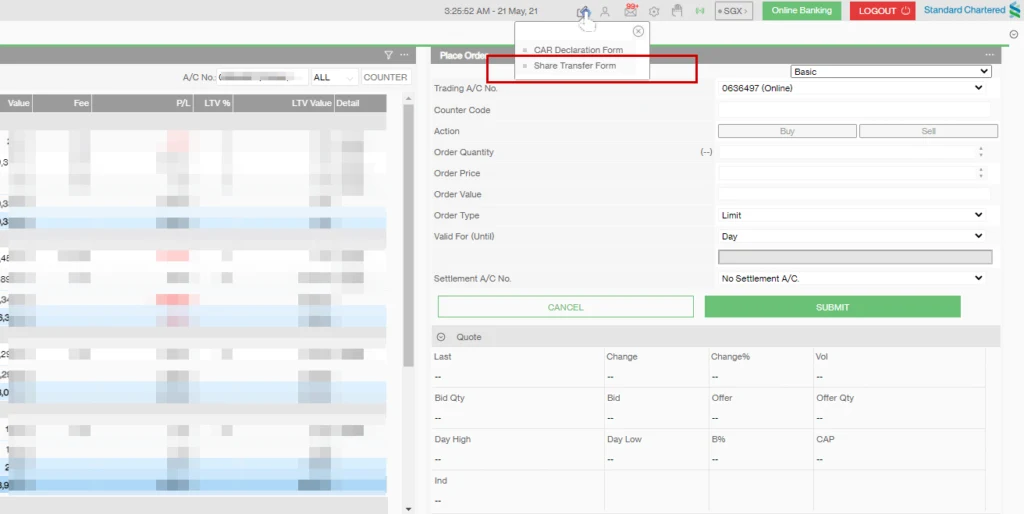

You may access the share transfer form by clicking that small button in the graphic and select Share Transfer Form.

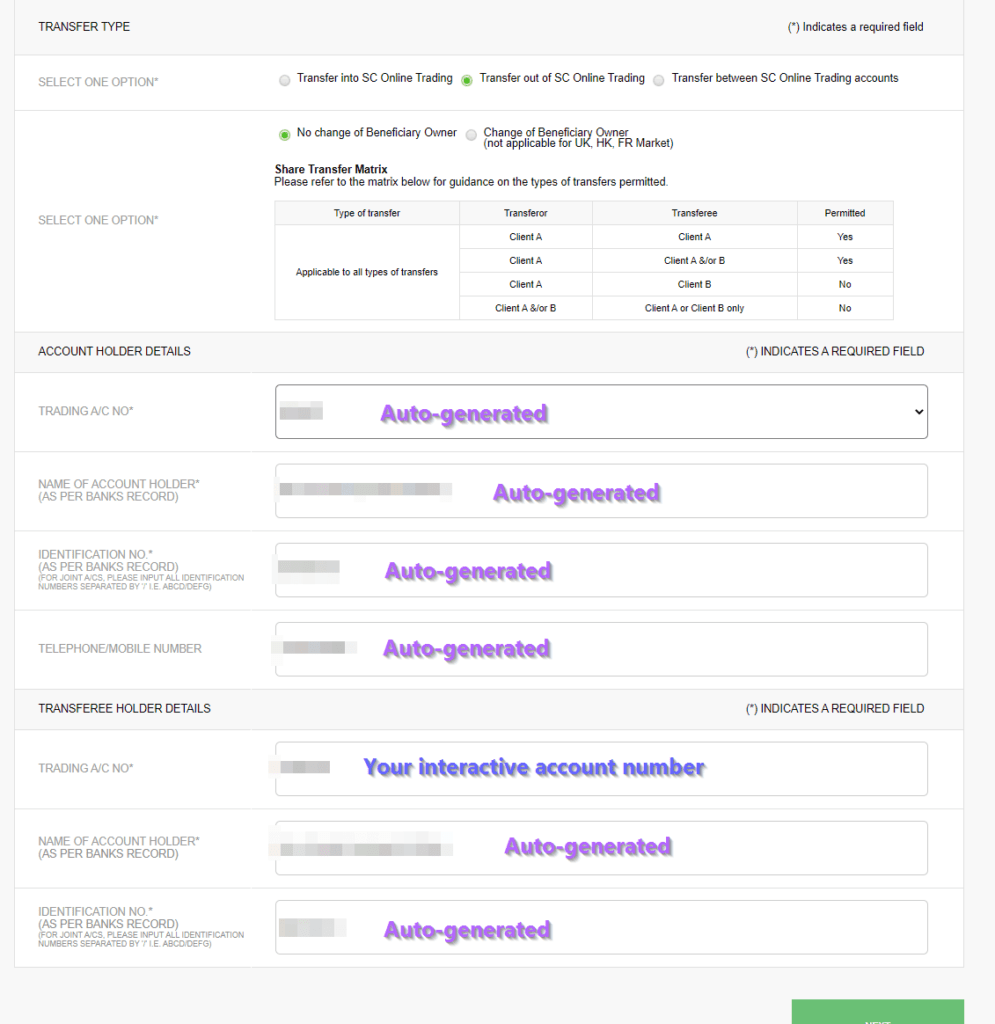

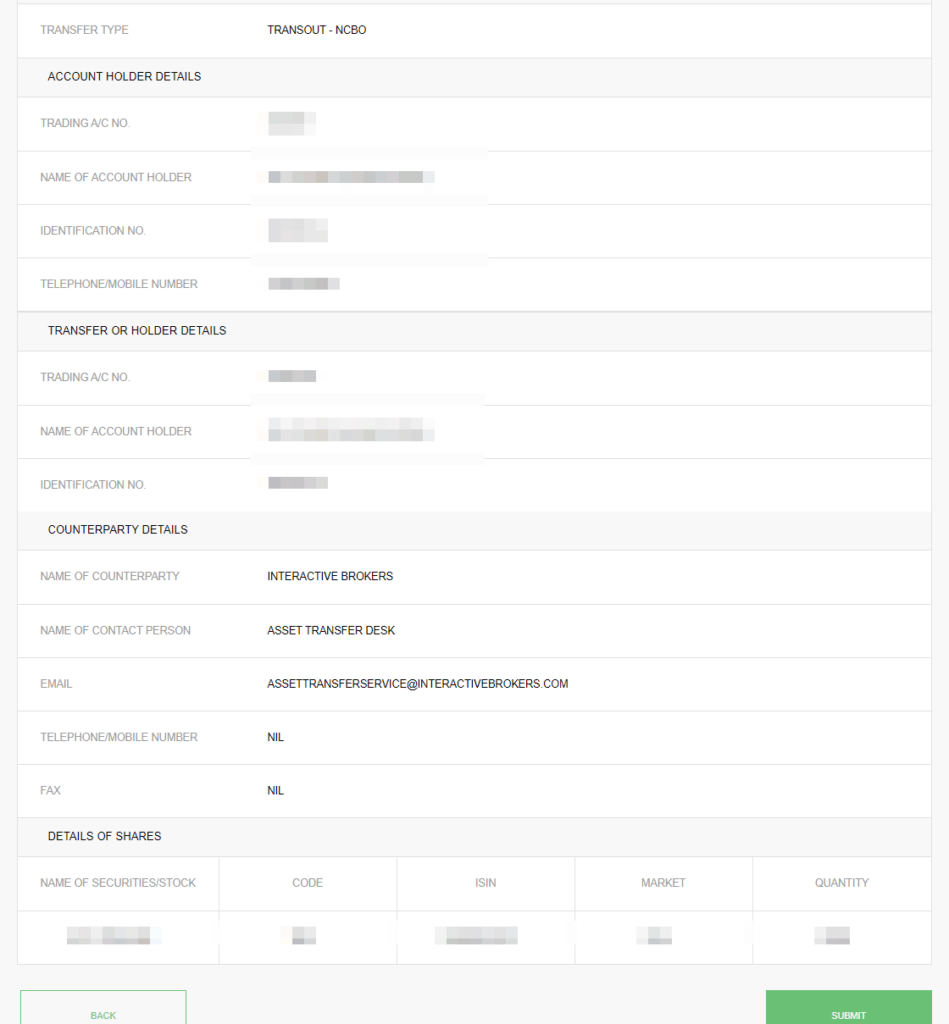

You will come to this page wher eyou will need to specify the account you wish to transfer from and where it is going.

I select the option Transfer out of SC Online Trading. Also select No Change of Beneficiary Owner.

After selecting my trading account from the dropdown, most of the information is auto-generated.

The only portion I had to manually fill up is under the trading account number.

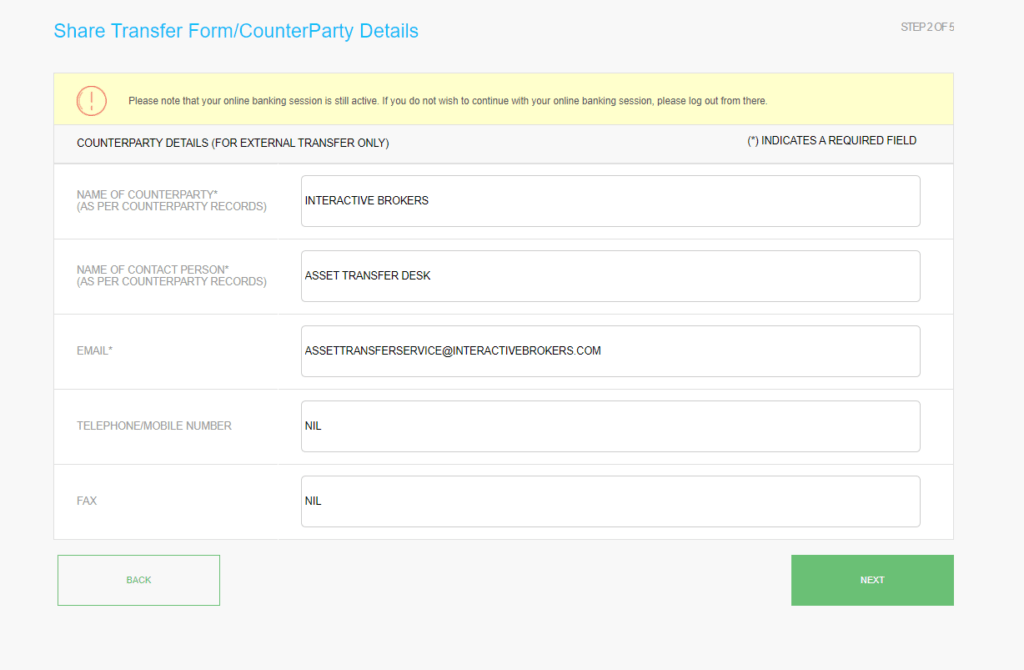

When you click Next, you will come to a page where you would need to fill in Interactive Brokers details. I managed to obtain this information from a reader (hat tip to you know who). If not, I am not sure where we are going to get the information.

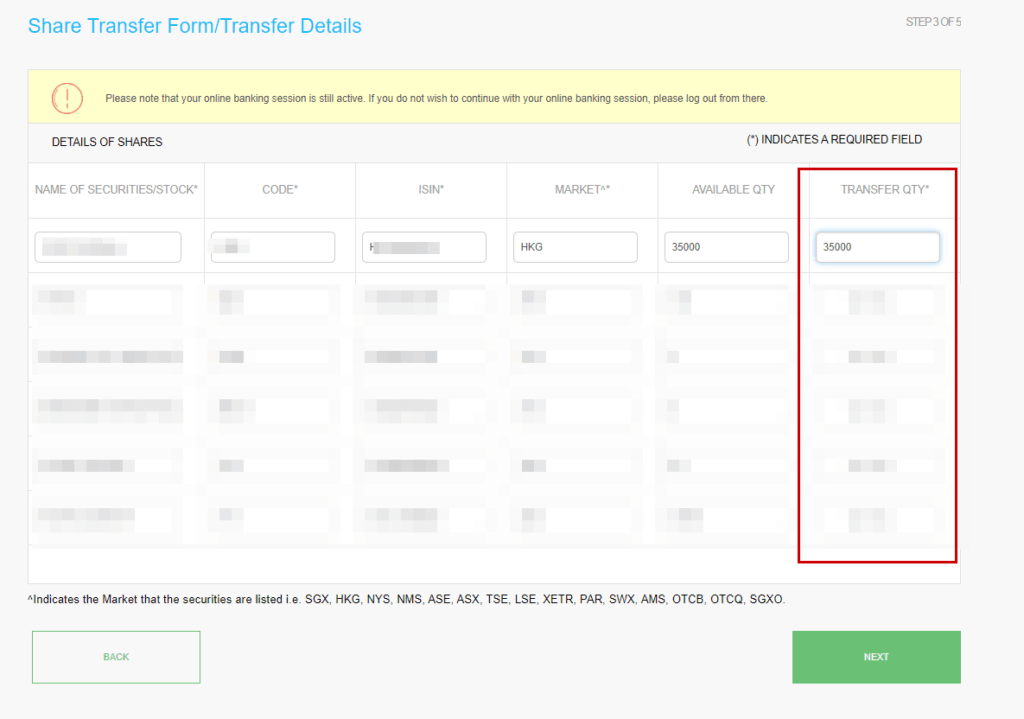

In the next screen, you will select the number of shares you would like to transfer.

In this case I have selected all the shares of a particular Hong Kong stock of mine.

Click Next.

Once you have reviewed, then you can submit.

Filling in the Basic Transfer Form at Interactive Brokers

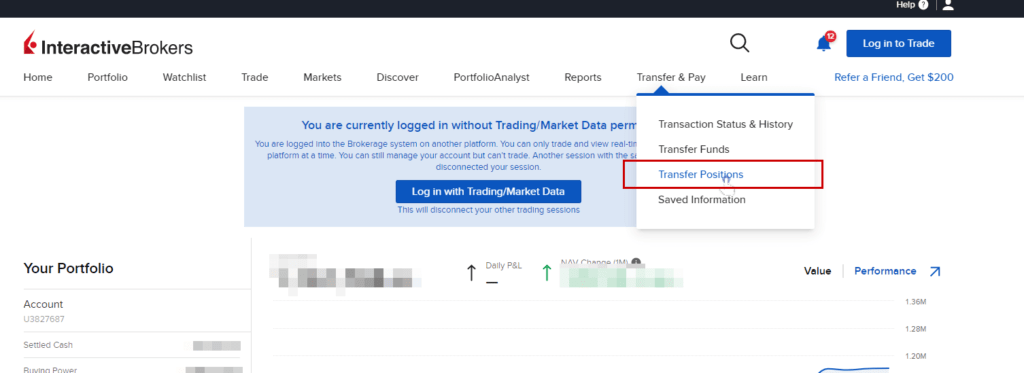

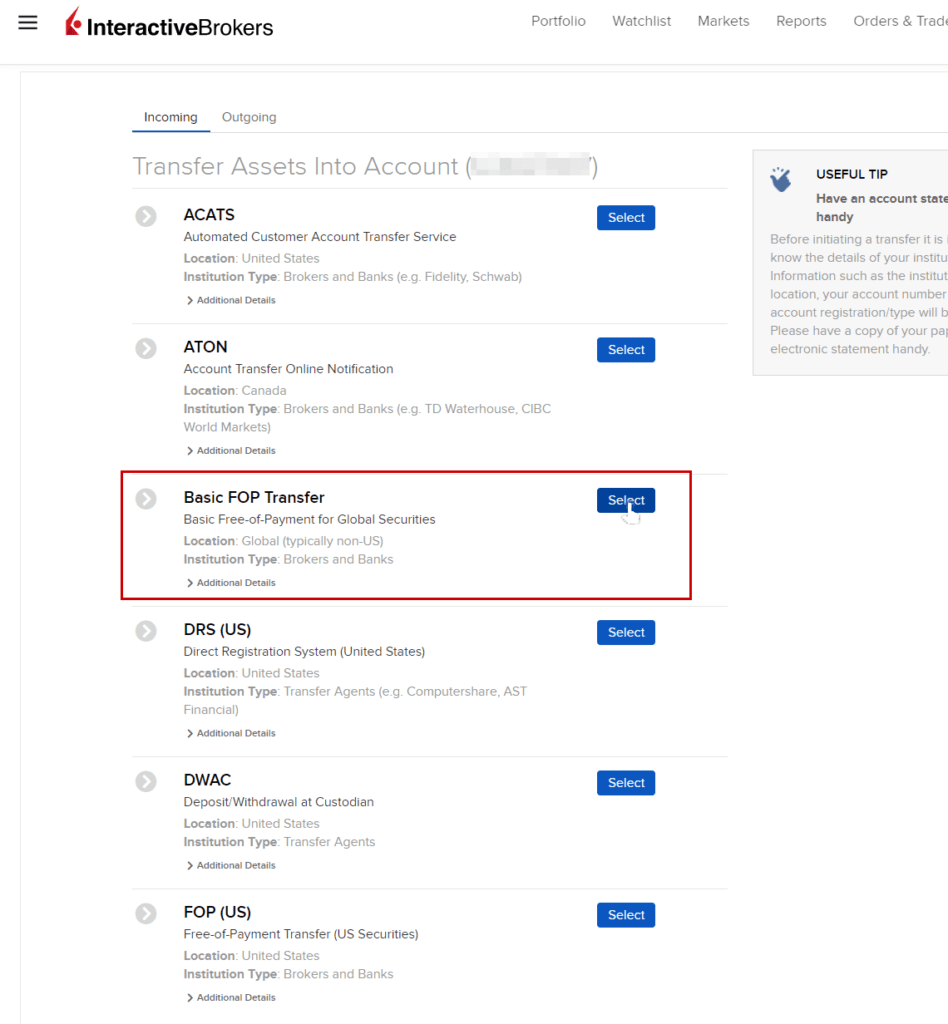

Once we have settled with the Standard Chartered Side, its time to fill in the form at Interactive Brokers to let them know some shares are coming.

Go to Transfer & Pay > Transfer Positions.

Select Basic FOP Transfer.

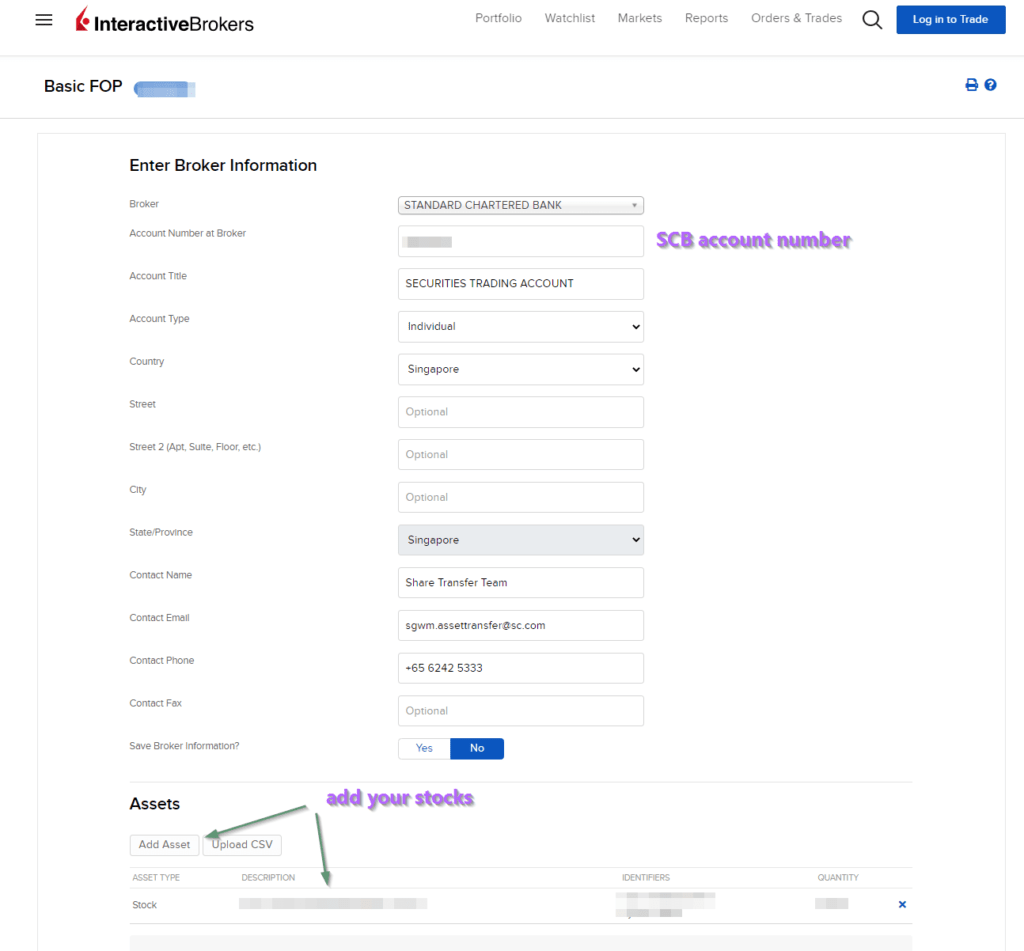

From the drop down, select Standard Chartered Bank. Fill in your SCB account number.

You will also need to fill in the Contact Name, Contact Email and phone number. You can fill in what is in the screen above (Got it from the reader as well)

At the bottom part, add the asset that you are transferring in. Interactive Brokers have an intuitive search function to aid you to easily add the share.

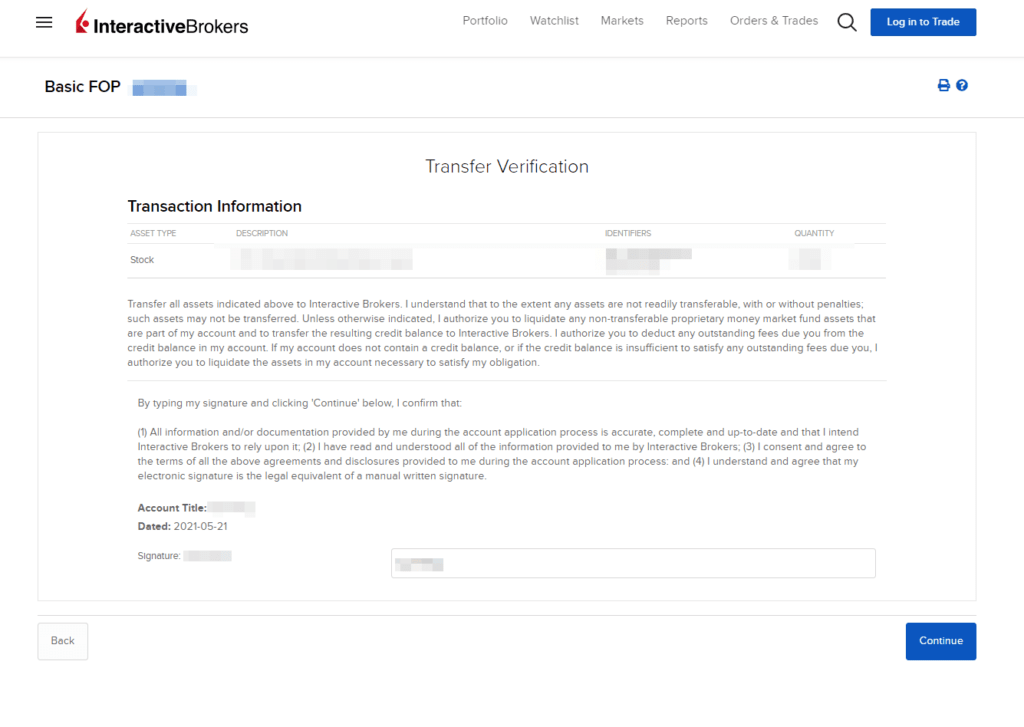

Next page you need to sign.

You are done.

Waiting for Your Transfer Request to Be Processed

The next part would be waiting.

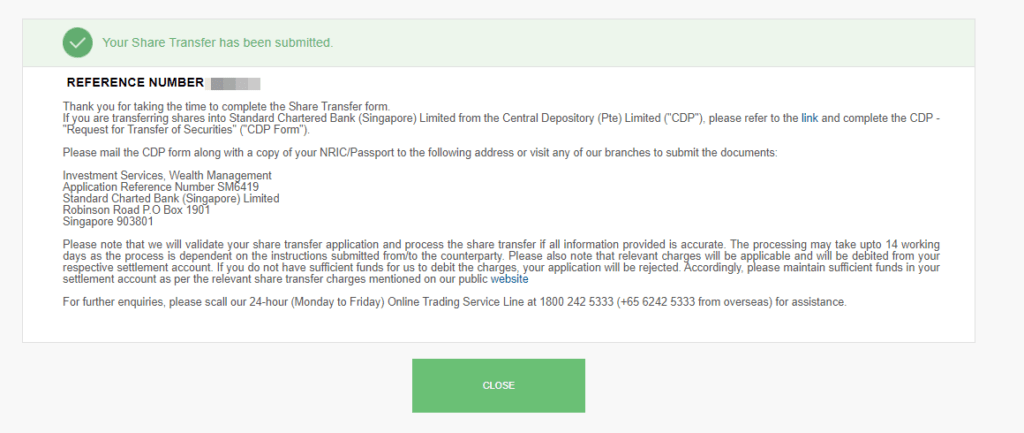

I managed to receive this email indicating the application was submitted.

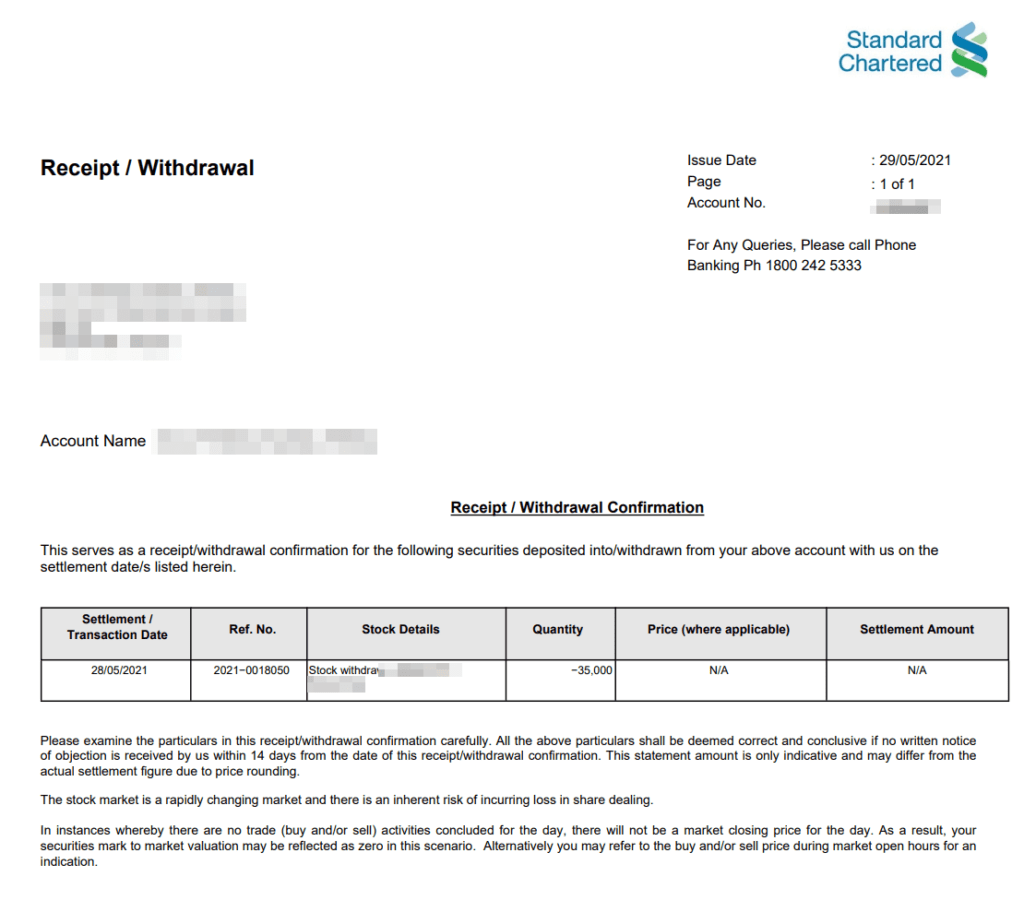

I checked my SCB account and saw this receipt.

But I think one day prior to this receipt, my shares have been credited into the IBKR Account.

Should We Transfer or Sell The Shares in SCB?

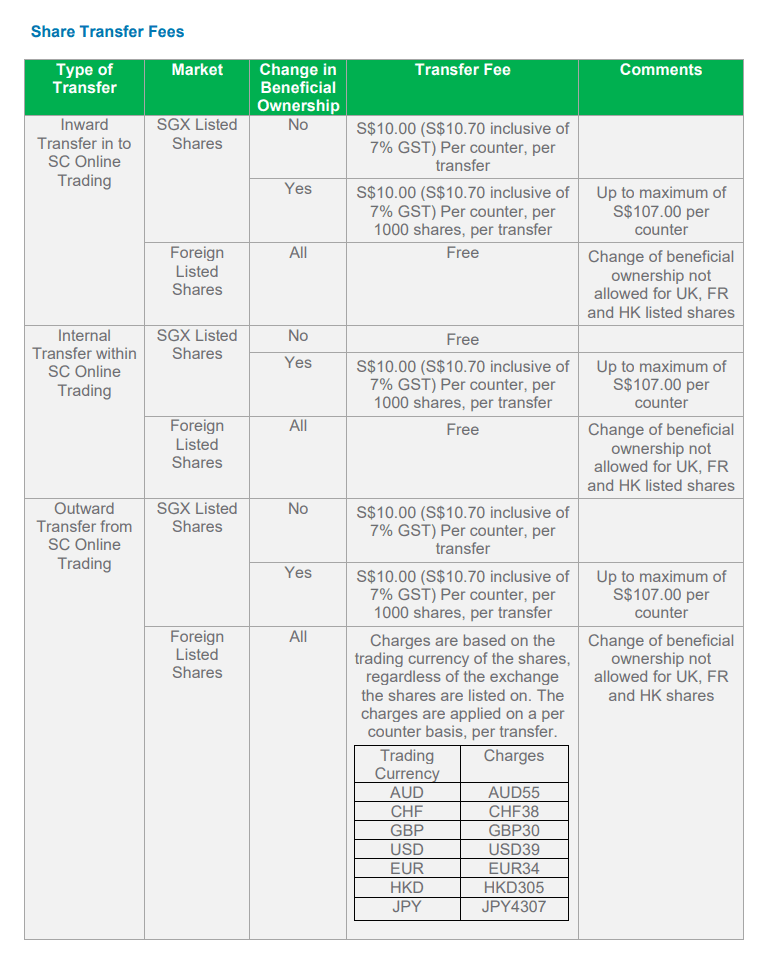

The table below shows the Outward Transfer cost:

I think your decision hinges firstly on cost and hassle.

It might be cheaper if you sell and then transfer the cash over, then you buy again. Of course, that is two transactions.

If each of your positions is too small, then the flat transfer charges would look less economical.

In my case, the cost worked out to be 0.30%. I think is OK.

Roughly a buy or sell transaction, without minimum, works out to be 0.35%. So the cost is not too bad.

After going through this process, I find transferring more convenient.

However, you will feel that you have less control as you would have to wait anxiously and wonder if you have keyed in the right things.

How to Transfer Shares from Standard Chartered Online Trading (SCB) to TD Ameritrade?

I think some of you have asked me this question.

My blogging friend Kelvin from What’s behind the numbers recently successfully transferred across.

If you wish to find out, you can read the instructions that worked for him here.

How to transfer US shares from Standard Chartered to TD Ameritrade?

Summary

I think with this knowledge, I have a viable onboarding solution for young, do-it-yourself, passive, low-cost investors.

- If you felt less confident that your annual capital injection into your portfolio would allow you to accumulate to US$100,000 in 4 to 5 years, you can start investing with Standard Chartered Online Trading first.

- Once your portfolio have grown to US$100,000, transfer over to Interactive Brokers to enjoy better currency rates, commission rates.

I would like to thank the friend of my reader who venture to transfer his funds over. As not many people did this, the staff at Standard Chartered was not familiar with the process.

But he preservered and now the transfer request that comes after him is much faster.

For those looking for a good, low-cost broker that allows you to invest in a vast number of markets, you can check out Interactive Brokers here.

My Comprehensive Interactive Brokers How-to Guides

Interactive Brokers is a great low-cost, financially strong brokerage platform that can be the standard broker for holding your long-term investments. You can access 150 global exchanges, including exchanges such as Singapore, the US, Hong Kong, London, European and Canada.

You will enjoy cheap commissions and zero minimum recurring platform fees or maintenance fees. Convert your funds to different currencies at near-spot rates, paying a flat US$2 fee.

To get started or become familiar with Interactive Brokers, check out my past articles on how to invest with Interactive Brokers. I hope the guides make your life and investing experience easier and brighter.

An Easy Step-By-Step Guide to Setup Interactive Brokers (IBKR)

How to Fund & Withdraw Funds from Your Interactive Brokers Account

How to Convert Currencies in Interactive Brokers

How to Buy and Sell Stocks and Securities on Interactive Brokers

How Competitive are Interactive Brokers Commissions Pricing?

How Safe is it to Custodized Your Money at Interactive Brokers? The things they do better than other brokers.

How Safe is it to Custodized Your Money at Interactive Brokers (2)? Financial strength of IB during recent banking crisis and during Great Financial Crisis

Interactive Brokers have Eliminated the US$10 monthly inactivity fee. More details here.

How to Transfer your shares from Standard Chartered Online Trading to Interactive Brokers

How to trade after-hours and premarket

Create Customized Reports and automatically send them to your email

What is the PortfolioAnalyst Report and Automatically Send the PortfolioAnalyst Report to Your Email

Send Money from TransferWise to Interactive Brokers

Interactive Brokers’ Fluid Interest Income on Cash

Introducing IMPACT by Interactive Brokers

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

Gemma

Wednesday 21st of June 2023

Hi Keith, why did you prefer to use IBKR LLC over IBSG? I started with IBKR LLC not knowing that it doesn’t include SG & HK stocks. So I open an IBSG account. Now planning to move all UCITS etf from LLC to IBSG. And will also transfer ucits shares from SCB to IBSG. Do you see any problem with this setup?

Kyith

Wednesday 28th of June 2023

Hi Gemma, from what you mention not much issue. IBSG should be a better platform than SCB. I am surprise you cannot trade HK stocks with IBKR LLC. I have been able to do that.

I started with IBKR LLC so that was what I am on. I actually have both. IBKR has SIPC protection but as a US entity it also has its estate tax issue with cash.

Ryan

Monday 4th of July 2022

Thanks for this write up Kyith! Can I ask how taxes are processed when you hold SG stocks in IBKR? I understand taxes are withheld for capital gains and dividends for US stocks/ETFs and wonder if SG gains/dividends will be taxed as foreign investment. A consideration might be that I currently hold tax residency in the US.

Kyith

Tuesday 5th of July 2022

Hi Ryan, I am unable to provide tax advice because it is rather complicated. But if I understand, US folks there is worldwide taxation on their investments and money. This means that if you own a Singapore stock, capital appreciation/dividends of a Singapore stock is subjected as ordinary income tax/tax losses. This was mentioned in a podcast where an American owns a local singapore REIT. That is something to take note of.

Jun Jie

Sunday 5th of September 2021

Hi Kyith, are there any promotions if I were to transfer in shares from other brokers to IBKR? Is the below promotion valid ? Thank you Referred accounts will receive $1 in IBKR shares for every $100 of value (cash or other assets) added to their account for up to $1000 worth of IBKR shares. The average balance must be maintained for at least 1 year for the shares to vest and be accessible.

Kyith

Sunday 5th of September 2021

i don't know about this one.

kid

Wednesday 25th of August 2021

Hi Kyith, Thanks for the info. I have a similar situation with DBS Vickers, and want to transfer to cheaper brokerage. DBS FAQ stated that "Fees for withdrawal of foreign securities are SGD 50 per counter + any out-of-pocket charges.". Do you have any info/ideas on how "any out of pocket charges" calculated? I just want an estimated cost so that I can decide whether it makes sense to transfer instead of paying monthly custodian fee.

Kyith

Saturday 28th of August 2021

Hi kid, unfortunately I did not have the info on the DBS side of the house.

Hazel

Thursday 19th of August 2021

Hi Kyith, I managed to transfer my stock from SCB to IB after a more than 2 weeks wait but I noticed that my average stock price information from SCB is not transferred over. IB just indicate my stock market value price at the time of transfer together with the quantity. Is this the way it should be? Having regrets of transferring my stocks over.

Kyith

Tuesday 24th of August 2021

Hi Hazel,

I think as long as the value is there it is ok. cost basis may just be some form of accounting. My reader have managed to set the cost basis. He used the information here https://www.interactivebrokers.com/en/software/am/am/reports/positiontransferbasis.htm