A few months ago, securities broker Interactive Brokers came up with three mobile applications that cater to specific target segments.

I have been using their main mobile application on my Android phone for the past couple of years and greatly appreciate the package they deliver. I get a listed, financially sound, well-backed, profitable custodian with a history of delivering good, low-cost trade execution across various financial markets for many electronic securities.

Although I am pretty satisfied with their default Android mobile application, I was intrigued about the different things I can perform with the new Interactive Brokers applications.

This article explores the most intriguing one, in my opinion, which is IMPACT by Interactive Brokers.

What is IMPACT by Interactive Brokers?

IMPACT is a niche investment application explicitly designed for socially responsible investing (SRI), also known as environmental, social and corporate governance (ESG) investing.

If you have an existing Interactive Brokers account, you can download IMPACT from the Apple and Google application store and experience IMPACT today.

You can use your existing Interactive Brokers account to sign into the IMPACT app and do not need to create a new Interactive Brokers account.

If you are new to Interactive Brokers, you can always sign up today.

The existing Interactive Brokers mobile application is quite comprehensive, but for some, your ideal platform may not be one that throws a zoo of functionalities at your fingertips. What you are looking for is an application that has enough functionalities but helps you to decide what to invest in.

Some of your priorities are not only on returns but achieving returns by investing in funds & companies that operate based upon principles that you agree with. You do not wish to invest in companies that derive a large part of their income from weapons, tobacco, or unethical business practices. You would prefer to invest in companies with a high focus on mindful business models, ethical leadership and LGBTQ inclusions.

This is what IMPACT is explicitly created for.

A Native Application Design from the Ground Up

Some users felt that the interface feels ancient if we compare the existing Interactive Brokers mobile application to the mobile application of new brokerage firms.

For example, the mobile application will take us to a webpage if we need to change or review some account management settings. Instinctively, you know this application feels like a patchwork.

Perhaps that is why Interactive Brokers created a new interface for these three applications. They all spot the same user interface, with some modifications because each application has a different focus area.

If you cannot stand how old fashion the current mobile application is, you might want to explore IMPACT by Interactive Brokers.

Who are Interactive Brokers?

Interactive Brokers (IBKR) is a 46-year-old US-listed international brokerage platform. IBKR (Ticker: IBKR) has captivated the hearts of international investors by allowing us to trade a wide variety of products in many different markets at a low cost compared to the competition.

IBKR give you access to 150 global markets in the world, across stocks, options, futures, currencies, bonds, funds, crypto and more. You can fund your account in 24 currencies and trade access denominated in multiple currencies.

Other than retail, IBKR is also used by institutions, aspiring hedge fund managers, US-registered investment advisers, family offices, and small businesses through various account structures.

For conservative investors, IBKR is listed on the Nasdaq. You can review its annual and quarterly financial reports to assess its financial standing. IBKR is 76% privately held by its founder, billionaire Thomas Peterffy (72nd richest person in the world and the wealthiest Hungarian).

You can review IBKR’s strengths and security information, investor & account protection and how they handle clients’ money here.

I have a whole series of articles to explain the benefits and negatives of using Interactive Brokers and how to get started at the end of this article. You might want to check out that section.

Review Your Portfolio Through IMPACT’s Socially Responsible Investing Lens

Now, I will jump straight in and take you through the distinct feature of IMPACT.

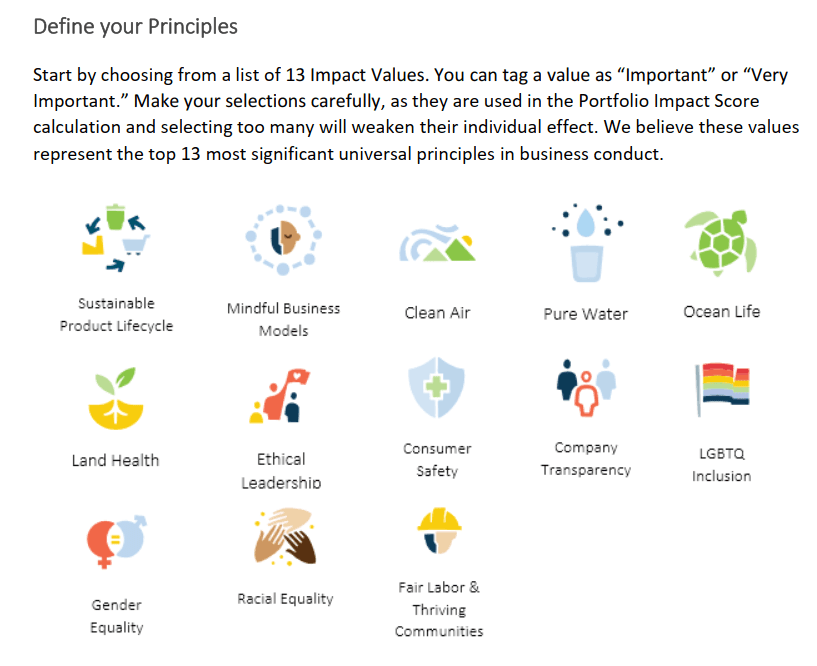

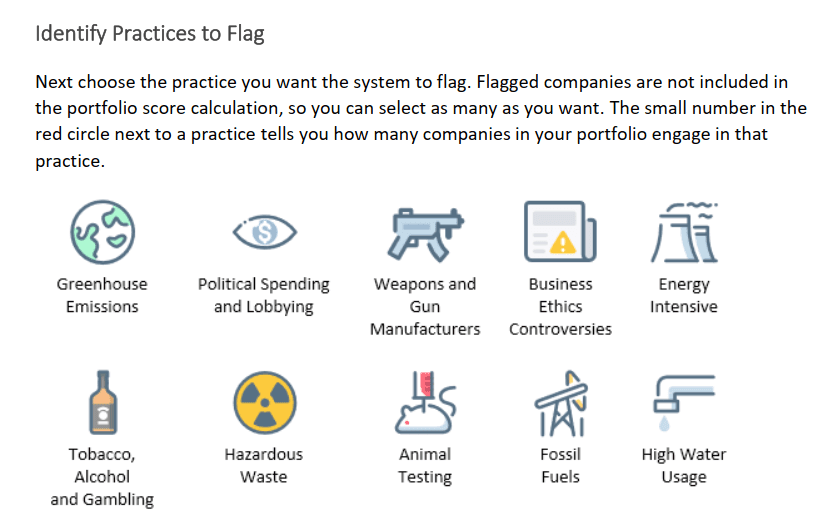

IMPACT by Interactive Brokers allows you to select principles you identify with, such as those presented above. Defining these principles will help IMPACT advise you throughout the application whether your current and prospective investments are aligned with your principles.

Next, you can identify certain business practices you are concerned about so that IMPACT can advise whether your current and prospective investments have significant levels of these practices.

Making these two sections of choices will help IMPACT understand your preferences, and you can review your investments through your own SRI lens.

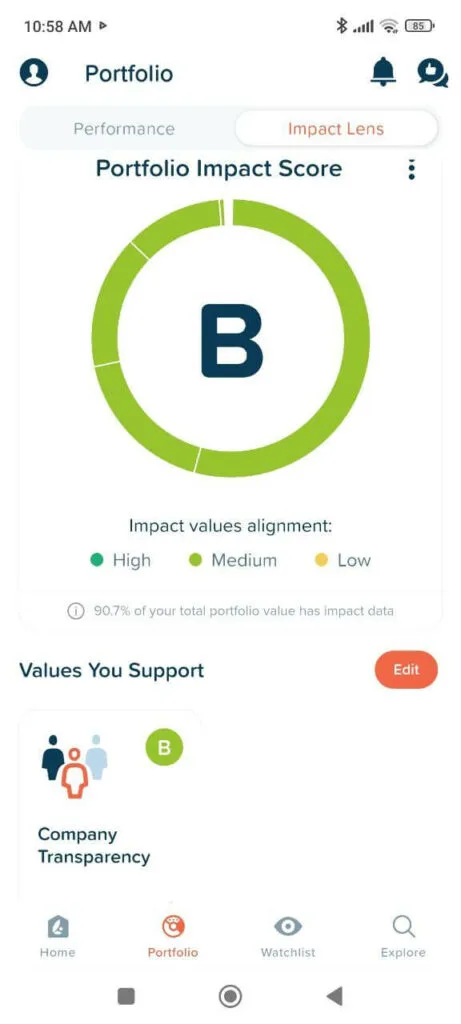

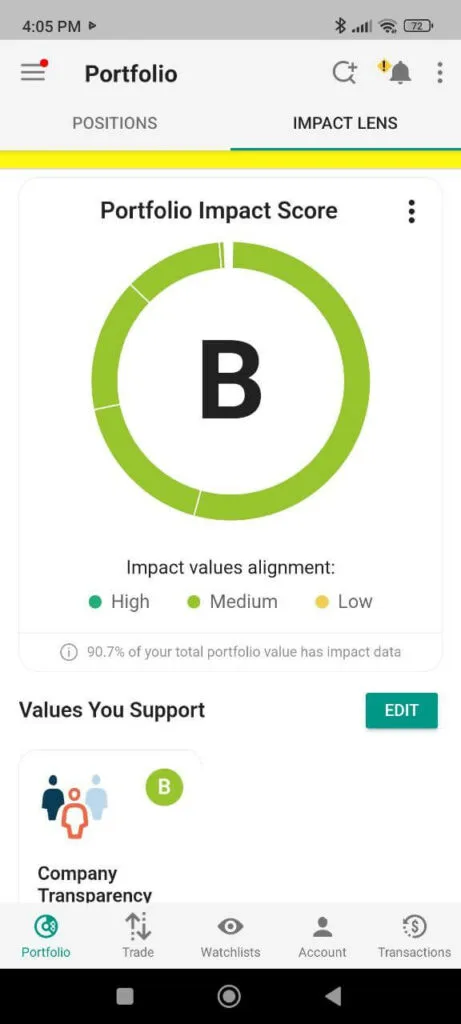

The diagram below shows the overall portfolio impact score for my portfolio:

We observe that 90.7% of my total portfolio has impact data. Some minor positions did not have data, so they were excluded from this scoring. The portfolio impact score is the weighted average (weighted by dollar value) of your Impact Effect score for each position in your portfolio for which the position has a score.

If this weighted score exceeds the benchmark score derived from your preferences, your portfolio receives an “A” grade. If the weighted score is lower, the portfolio receives either a B or C, depending on how low the score is compared to the preference benchmark.

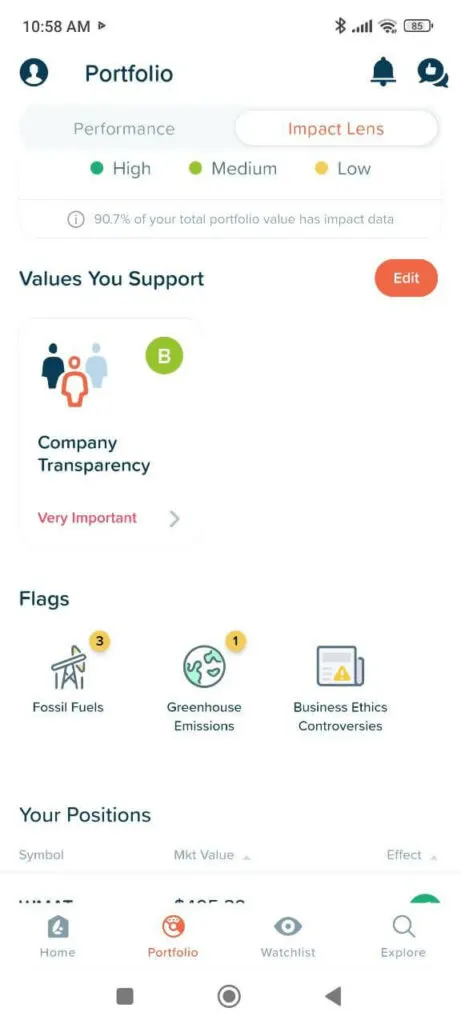

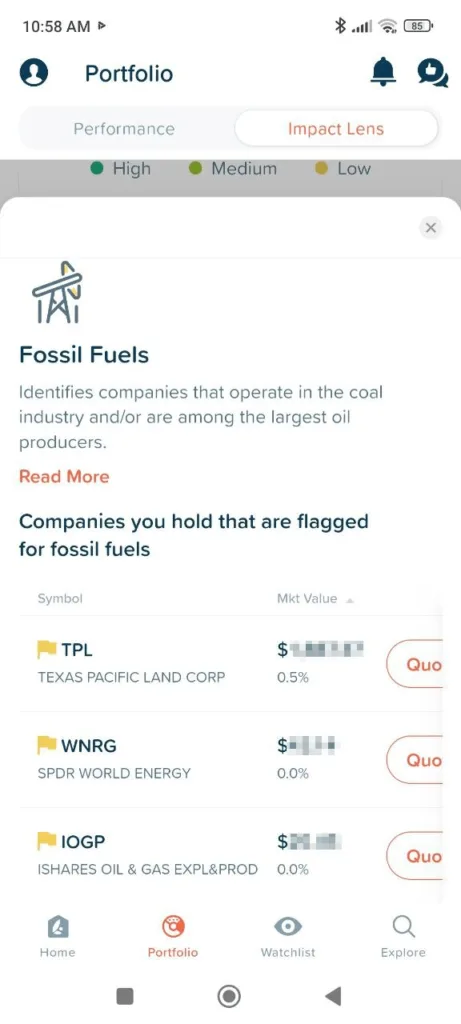

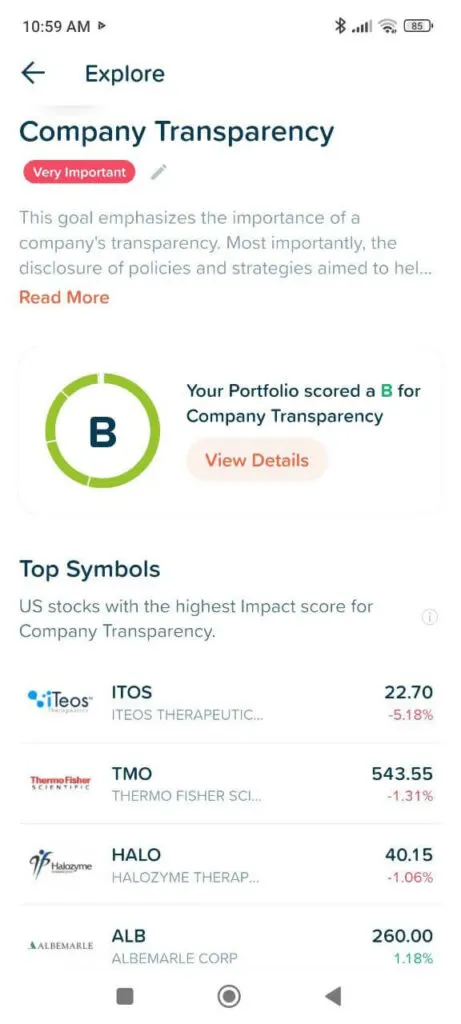

If we scroll down further, we can see the values I support (Company Transparency) and areas that concern me (Fossil Fuels, Greenhouse Emissions and Business Ethics Controversies).

In the Impact tab of my portfolio, there is a “3” at the top right corner of Fossil Fuels. Impact flag that 3 of my companies operate in practices that may be something that I am concerned about. This might be something that I should review and evaluate whether I should replace them with other stocks in my portfolio.

The impact will introduce companies that score high in the principles I am aligned with.

Case Study: The Impact Score of Vanguard FTSE All-World ETF ( VWRA)

VWRA, the ticker symbol for Vanguard FTSE All-World UCITS ETF Fund, is one of the more popular ETFs used by Singaporeans for passive investing.

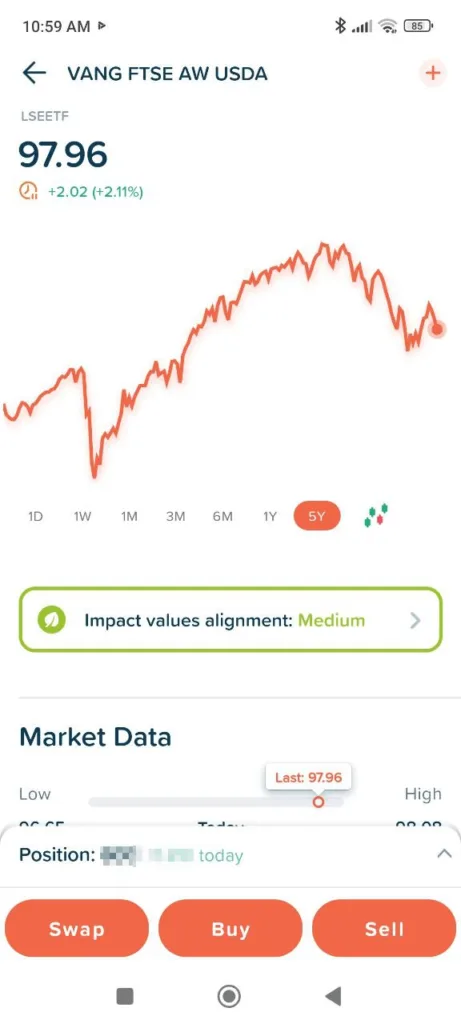

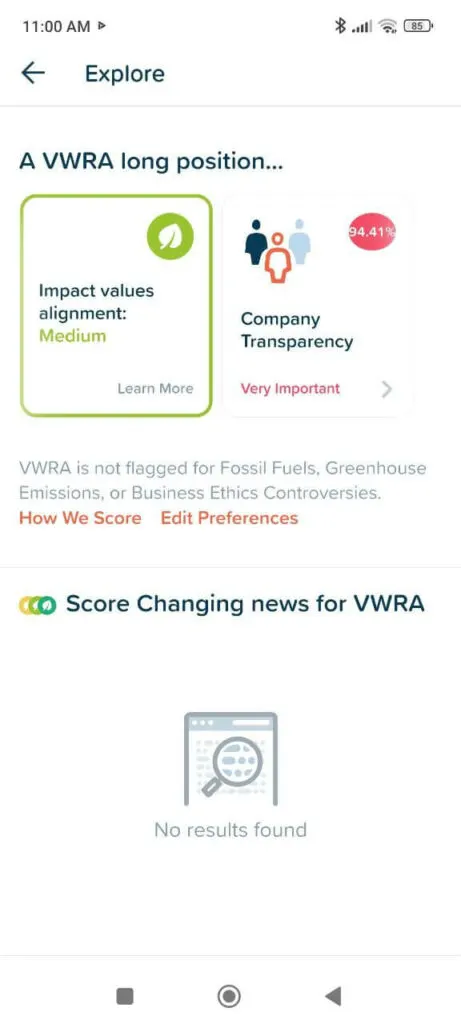

If we review VWRA in impact, we observe that the impact values alignment is medium.

There is a number at the top right corner of Company transparency. Based on the data, 94.4% of the companies in VWRA are transparent enough. VWRA did not flag anything for fossil fuels, greenhouse emissions or business ethics controversies.

This is quite a good screen, especially for investors of high-quality companies. These are potential flags that may impact the company’s intrinsic value and would trigger further research to see whether there is any truth to the practices you disagree with.

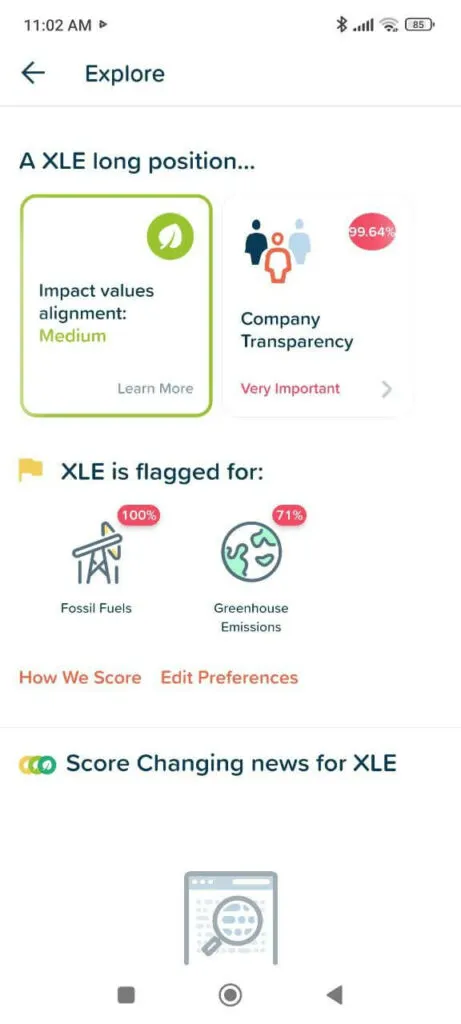

Case Study: State Street’s Energy Select ETF (XLE)

In contrast, XLE, the ticker symbol for US-listed ETF, the energy select SPDR ETF. Impact flagged that 100% of the companies in XLE deal with Fossil Fuels and 70% deal with greenhouse emissions. If this two concern me enough, XLE may not be an excellent ETF to invest in.

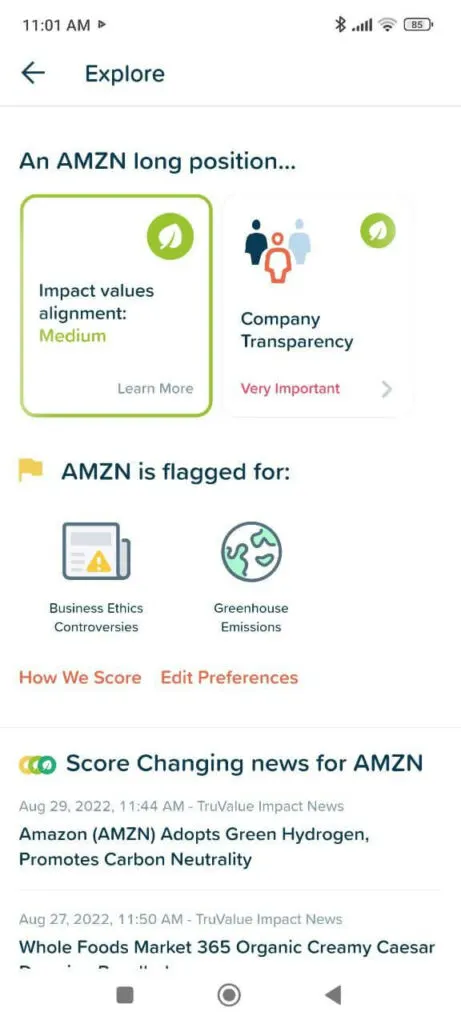

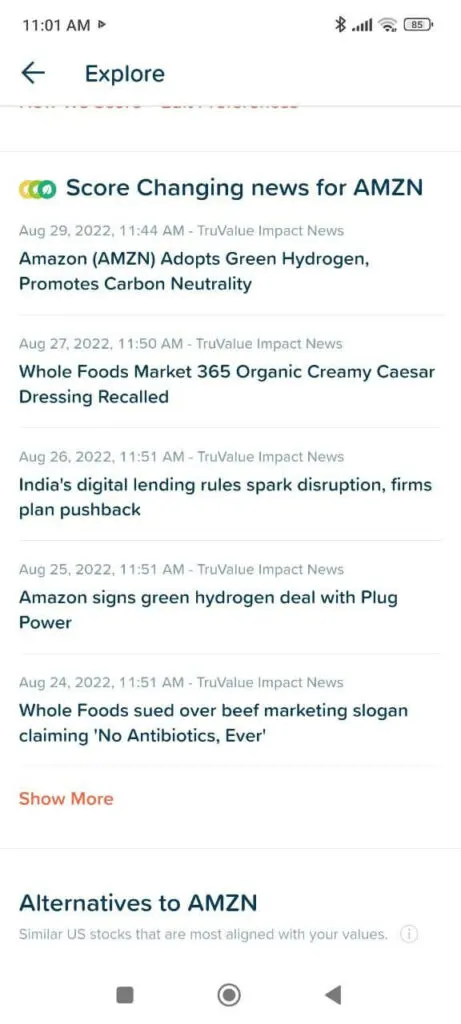

Case Study of an Individual Stock: Amazon

How different would the Impact Score of an individual stock be?

If you browse Amazon’s ESG profile, you will observe that Amazon is flagged for higher-than-average greenhouse emissions and controversial business ethics. You would have to dive deep into what caused Refinitive to rate them this way.

Impact helps you by collating the related news articles to this area to give you some handles to go deeper into your research.

Where Can You Access or Review Each Security’s Impact Details?

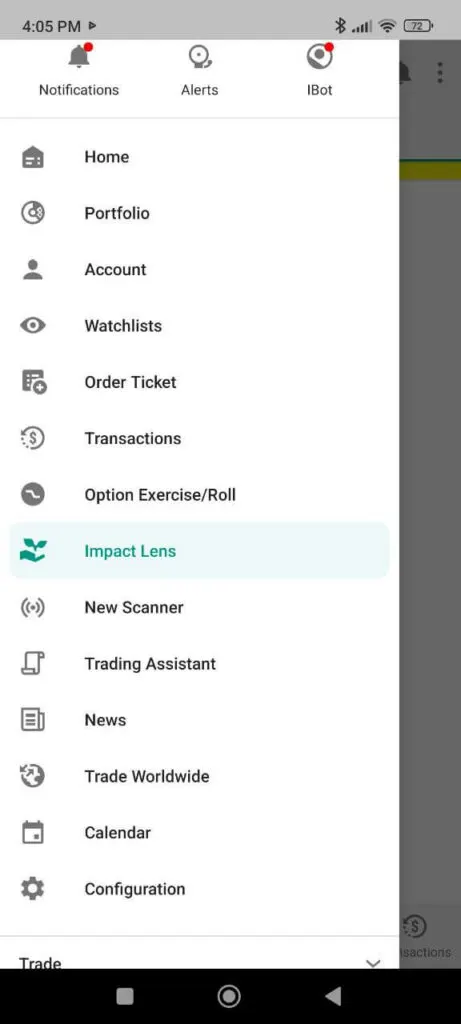

You can also access the Impact information in your existing Interactive Brokers mobile application and IB Trader Workstation (TWS).

You can go to Impact Lens on the left side panel of your mobile application to access the Impact profile of your portfolio.

You can access the same information on TWS on its Impact Dashboard.

What Else Can You Do in IMPACT?

Interactive Brokers created IMPACT to be more focused on your ESG trading experience. The application does not have all the functionality you can access in the Interactive Brokers mobile application.

Here are the things that you can do in the app:

- Review your transactions

- Buy and sell securities, including options

- Check your account value and margin levels

- Initiate fund deposits and withdrawals

- Convert between currencies

- Review your watchlist

- Review your holdings

- Access your Interactive Brokers account settings

With these functions, it pretty much allows you to make the day-to-day investment/trading.

How Does Impact Rate The ESG Impact of Each Security?

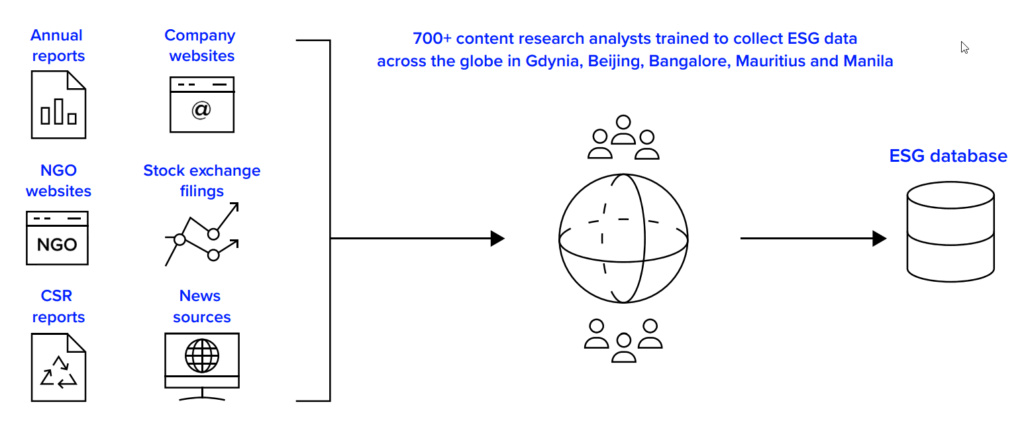

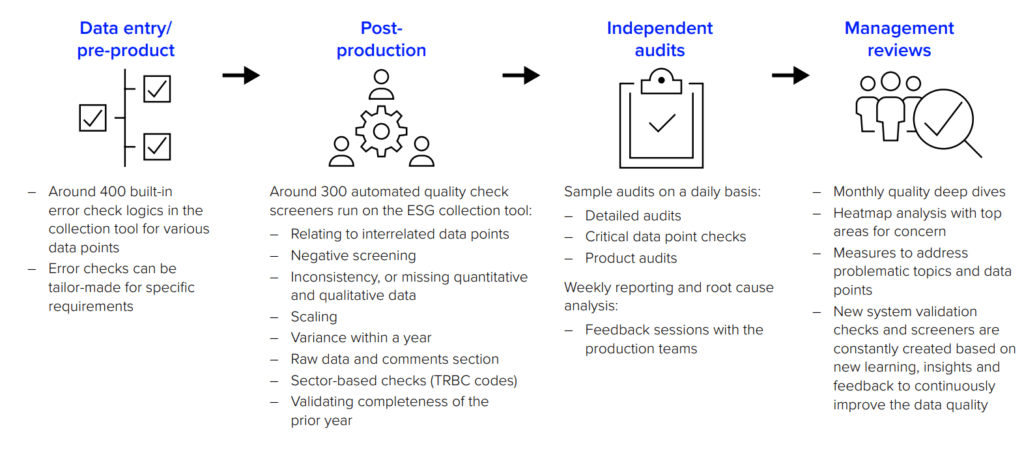

They must be scored first to assess the ESG characteristics of a security or a fund.

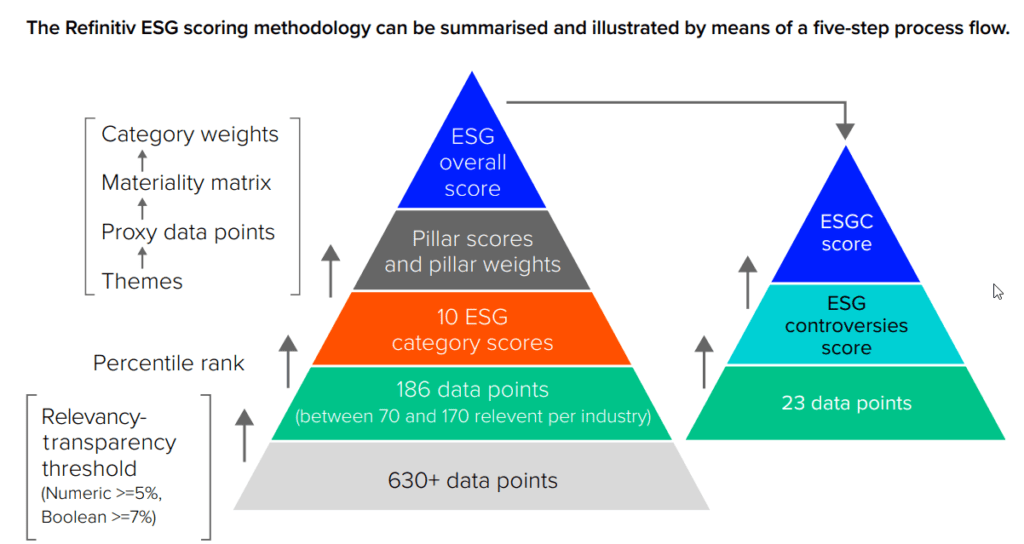

IMPACT uses the socially responsible investing (SRI) data from data providers Refinitiv and Factset’s Truvalue Labs. Refinitiv and Truvalue collect the unstructured data and compute scores within common frameworks such as ESG and SASB.

These scores are then aggregated into IMPACT’s portfolio grades, which are curated based on the impact values that you have chosen.

If you are interested, here are the resources to understand better how Refinitiv and Truevalue score the individual securities:

- Refinitiv ESG Score Overview

- ESG Scores from Refinitiv – 2022 May

- At a glance: FactSet Truevalue Insight360 Datafeed

Many here are investors in individual securities and managed investments such as unit trusts or exchange-traded funds (ETF), and you might wonder how do they derive the ESG scores for a fund.

In layman speak, if you know what the fund holds and have scored each security in the fund, then you can aggregate the score systematically.

Refinitiv’s guide can help us understand this better.

For each underlying stock, you will need to identify various ESG-related characteristics. These characteristics can come from annual reports, but more and more, they come from other sources. Data companies like Refinitiv and Truevalue use machine learning and other technology to speed up the arduous task of data extraction and processing.

These raw data must be processed further and validated in their own way. Some prefer to put it through a human qualitative lens.

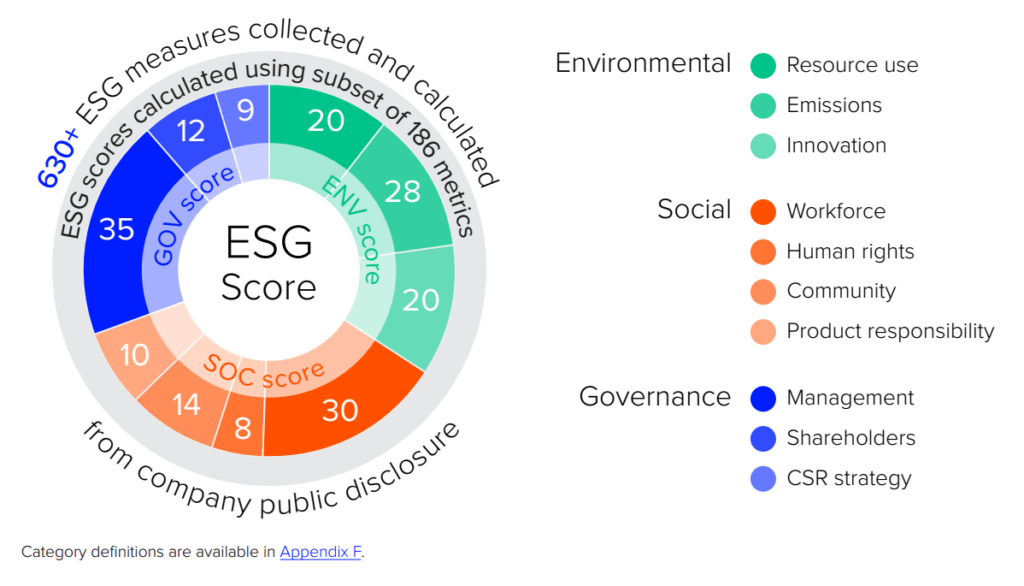

Each ESG data providers create its ESG framework for scoring companies. Refinitiv distils the data points into 186 data points, split into three different pillars.

Each data provider has its way of weighing the groups of data points based on its ESG framework. Eventually, each company will have an ESG score.

The ESG score, and flags of each holding is aggregated into the fund’s overall score, weighted by its weight in the portfolio.

How You Should Use Interactive Broker’s IMPACT Scores to Drive Your Investment Strategy?

Based on the research from where I work (you can look up my bio below to find out where), there is a lack of clear empirical evidence that there are long-term premiums to be harvested by investing in companies with high ESG scores, Impact investing, and low carbon emission companies.

The data available is two decades old, which might not be enough for us to conclude that there is an ESG premium confidently.

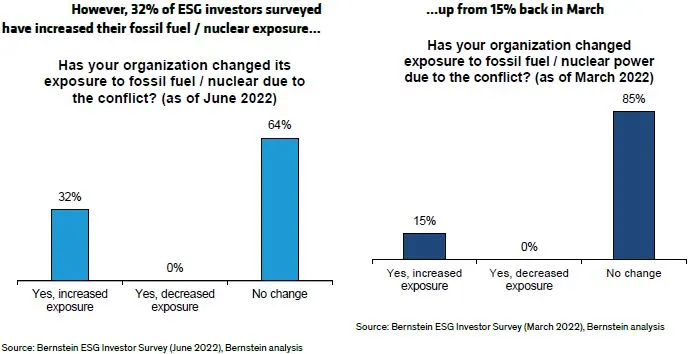

Currently, we may be observing a funny phenomenon where ESG funds are more receptive to adding old-school energy companies into their funds:

There is a thin line between shifting your holdings due to positive change in your ESG philosophy and fighting for your fund’s survival.

I am not sure myself. Suppose I am looking to build wealth and evaluate strictly based on returns. In that case, I don’t evaluate ESG except for governance, which may change my view on the quality of individual companies.

But you are not me.

There are some areas you feel deeply about, regardless of how well your investment does.

And with IMPACT, you can form a portfolio you would not be conflicted about owning. Select the principles you feel strongly about and flag the areas you are more concerned about. Eventually, your portfolio will reflect closer to your principles.

And if there are conflicts, you should be more at ease knowing that you know that some of your stocks are less aligned with your principles and why you are still invested in them.

Download IMPACT by Interactive Brokers on Apple App Store and Google Play Today

IMPACT is available on both Apple and Google’s mobile stores today. Give them a try and let me know what you think.

You can download them respectively here:

My Comprehensive Interactive Brokers How-to Guides

Interactive Brokers is a great low-cost, financially strong brokerage platform that can be the standard broker for holding your long-term investments. You can access 150 global exchanges, including exchanges such as Singapore, the US, Hong Kong, London, European and Canada.

You will enjoy cheap commissions and zero minimum recurring platform fees or maintenance fees. Convert your funds to different currencies at near-spot rates, paying a flat US$2 fee.

To get started or become familiar with Interactive Brokers, check out my past articles on how to invest with Interactive Brokers. I hope the guides make your life and investing experience easier and brighter.

An Easy Step-By-Step Guide to Setup Interactive Brokers (IBKR)

How to Fund & Withdraw Funds from Your Interactive Brokers Account

How to Convert Currencies in Interactive Brokers

How to Buy and Sell Stocks and Securities on Interactive Brokers

How Competitive are Interactive Brokers Commissions Pricing?

How Safe is it to Custodized Your Money at Interactive Brokers? The things they do better than other brokers.

How Safe is it to Custodized Your Money at Interactive Brokers (2)? Financial strength of IB during recent banking crisis and during Great Financial Crisis

Interactive Brokers have Eliminated the US$10 monthly inactivity fee. More details here.

How to Transfer your shares from Standard Chartered Online Trading to Interactive Brokers

How to trade after-hours and premarket

Create Customized Reports and automatically send them to your email

What is the PortfolioAnalyst Report and Automatically Send the PortfolioAnalyst Report to Your Email

Send Money from TransferWise to Interactive Brokers

Interactive Brokers’ Fluid Interest Income on Cash

Introducing IMPACT by Interactive Brokers

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024