If you wish to start investing with Interactive Brokers, you will need to transfer money from your local bank account to Interactive Broker’s bank account first.

Once you have successfully funded the account, you can convert the currency and start investing.

You can read my guide on how to fund your interactive brokers account and also how you can withdraw money from your interactive accounts.

Interactive Brokers can be rather interesting because they would allow you to fund your trading account from any bank, that is under your name, and withdraw money to a lot of banks registered with your name.

Thus, it can act as an intermediate currency exchange between your local USD account and a foreign GBP account. In my Interactive Brokers currency guide, I explained that when you change from one currency to another in Interactive Brokers, the rate is very close to the spot rate.

This is potentially a great saving.

A month ago, I have the problem of having some USD in my Wise account.

I wonder if instead of transferring the USD to my DBS Multiplier USD account, could I transfer to Interactive Brokers?

Why Do We Need TransferWise to Send Money to Interactive Brokers?

As a Singaporean, I have no problem funding my Interactive Brokers account. I can use FAST Transfer to fund my account with SGD or DBS Remit to fund my account with USD. Both options are considered as a Wire transfer.

Both options are free.

Unfortunately, other international banks may charge international investors an exorbitant fee to perform a wire transfer to another country.

Wise is an international payments company with a few payment services that you can use to reduce the cost of currency exchange:

- Send money with money in one currency to another entity in another currency at an exchange rate more favourable than the rates charged by your bank

- Allows you to receive money in a different currency with their virtual bank account (this is how I receive money from a United States source in USD

- Spend with a Virtual debit card

Wise might not always have the best rates. There are also similar platforms such as Revolute and OFX.

With TransferWise, we can potentially create this use case:

- Send money from an international entity via ACH (Automated Clearing House) to your Wise virtual account in the foreign currency

- Send the money from Wise via Direct ACH into InteractiveBrokers

- Use Interactive Brokers to convert the money at near spot rates (incurring SG$2.80 of fee)

- Withdraw the money to a local bank for free (you are limited to one free withdrawal per month)

Of course, you could just use the money to trade or invest (which is what I did)

Limitation of TransferWise for Singaporeans

I want to thank a reader for pointing out some of the limitations of using TransferWise for Singaporeans.

With the Singapore Banking Payments Act, there is a limitation to how much money you can send, hold, and spend on your payments account.

You can read the banking payments act here.

The limitation is

- you can’t hold more than 5,000 SGD in your e-wallets by the end of the day Singapore time

- you can’t transfer more than 30,000 SGD from your TransferWise balance each year

With this, it becomes a real bummer for Singaporeans. However, this might be useful for our international friends.

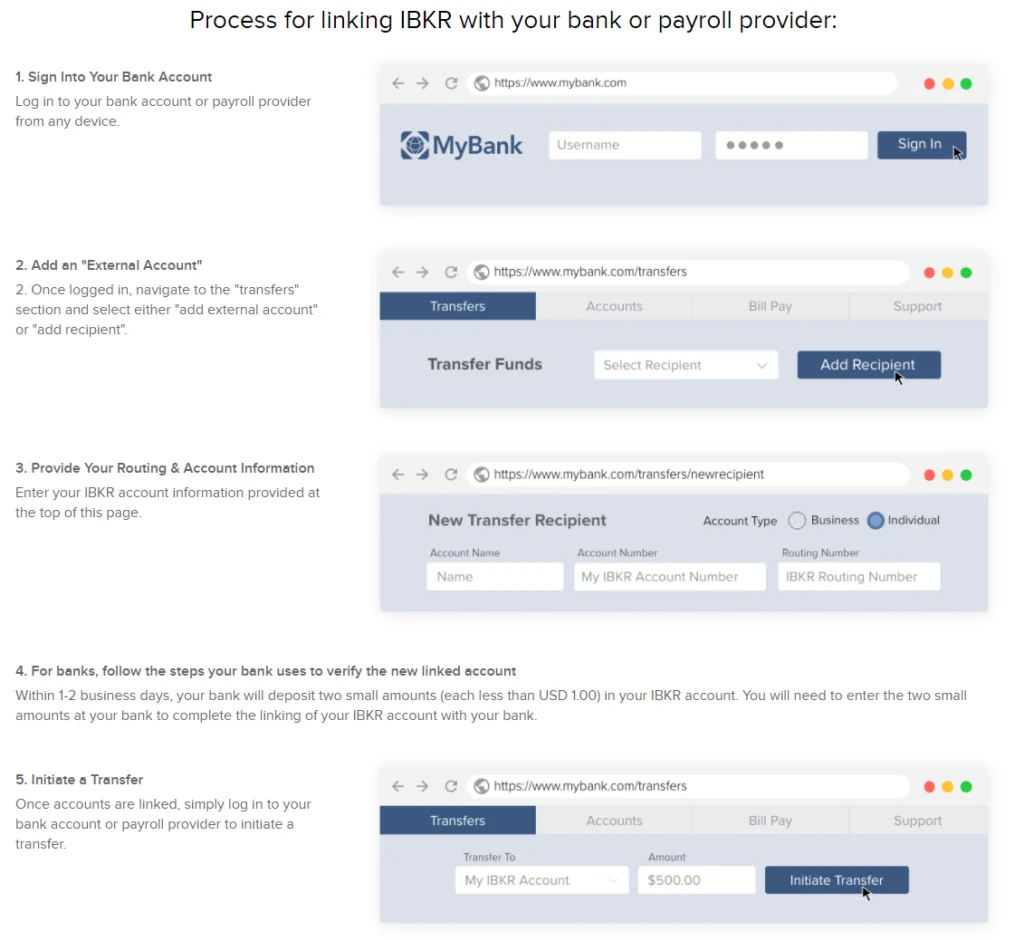

So here is how you can carry this out.

Step 1: Setup Your Direct ACH Transfer in Interactive Brokers Account

We start this by going to Transfer & Pay and selecting Deposit Funds

Out of all the options, you can choose Direct ACH Transfer from your Bank.

You will receive this notification warning that your bank account needs to be held in the United States. Click Yes.

You would need to sign this agreement by typing in your name.

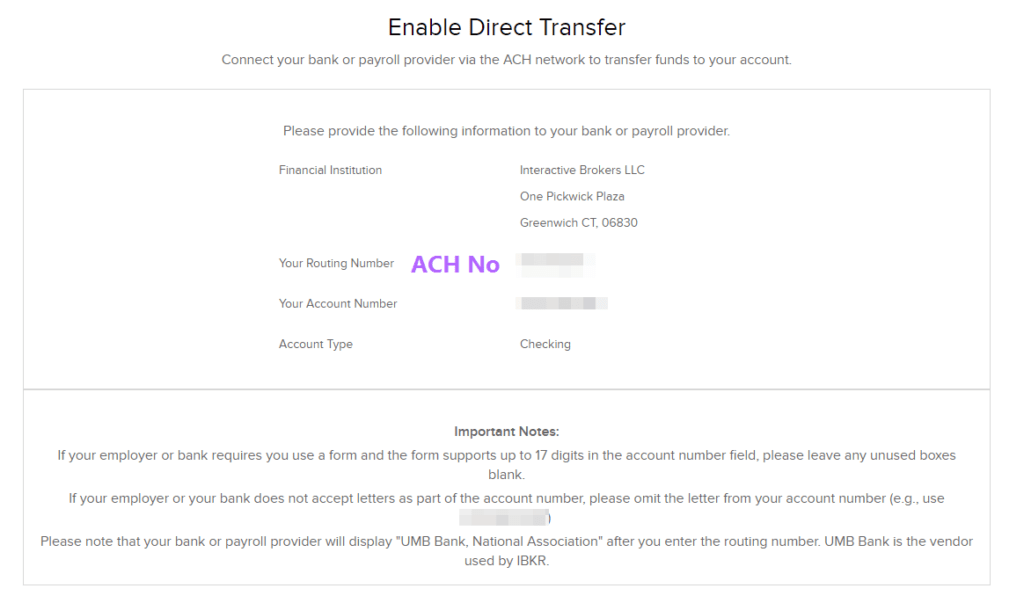

Interactive Brokers will provide you with the instructions to set up the ACH at Wise.

What you need to take note of is your Routing Number and Your Account Number. That is your ACH number to put in Wise and the account number.

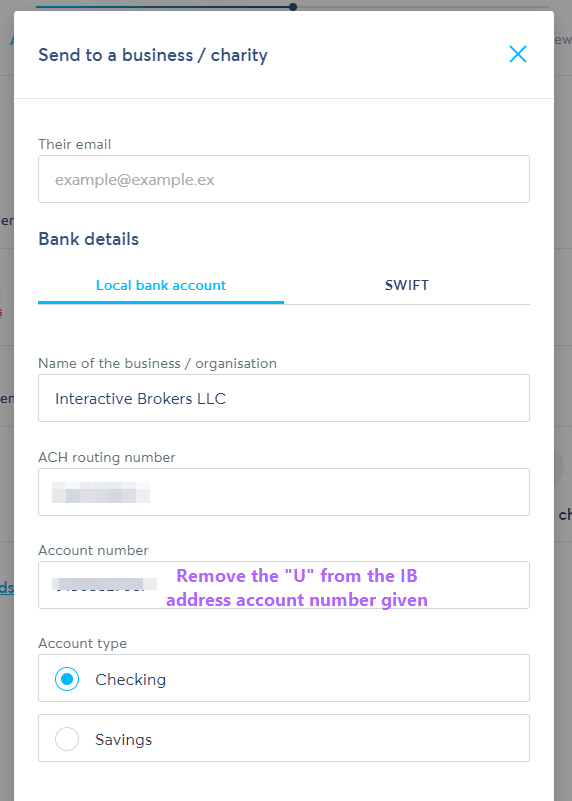

Now, the account number given by Interactive Brokers has a letter “U” in between. That will not be permissible in Wise. If you look at Important notes, it will ask you to replace “U” with “0”.

We will do this accordingly later.

Now let us go over to Wise.

Step 2: Configure TransferWise to Send Money via ACH to Interactive Brokers

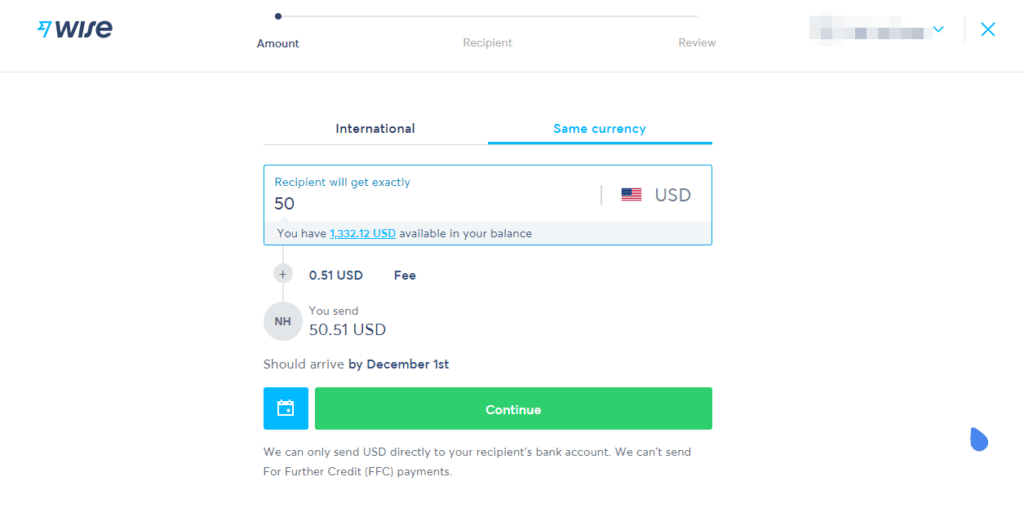

When you log in to Wise, you will see a screen like this. Select your USD account on the left panel under Balances.

Then click on Send.

You have the option to send International or the Same Currency. Choose Same Currency.

Click Continue.

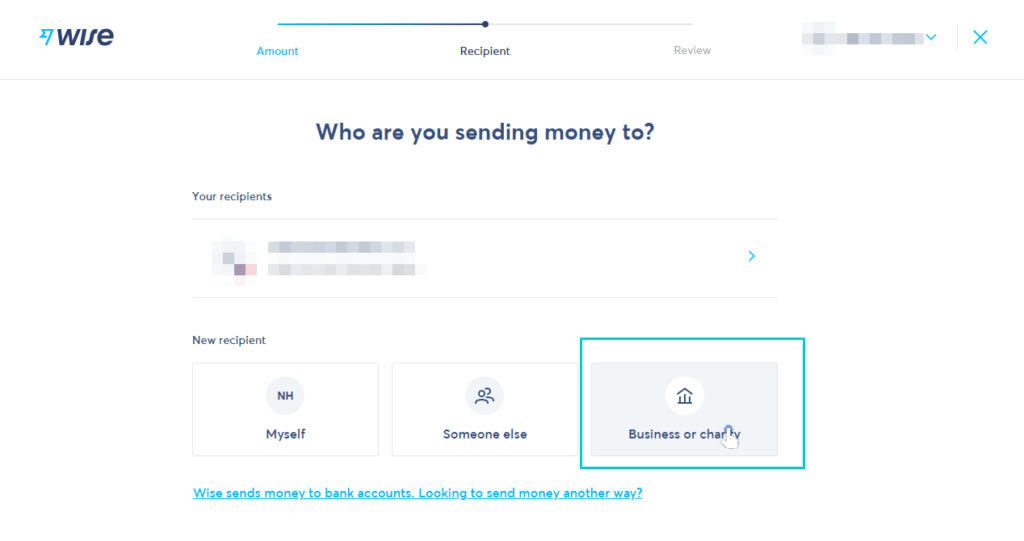

Under New recipient choose Business or charity.

I did not key in their email.

I entered Interactive Brokers LLC, the ACH routing number and Account number given by Interactive Brokers.

Account type chose Checking.

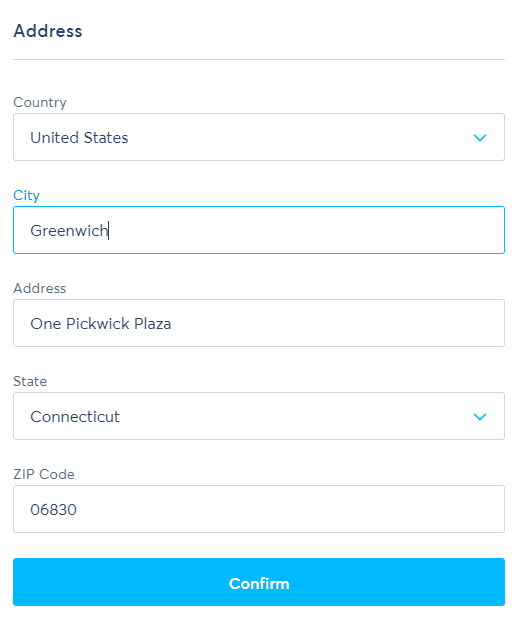

Here is how I keyed in Interactive Brokers address. Do note that your address may be different but I highly think that it should not change so much.

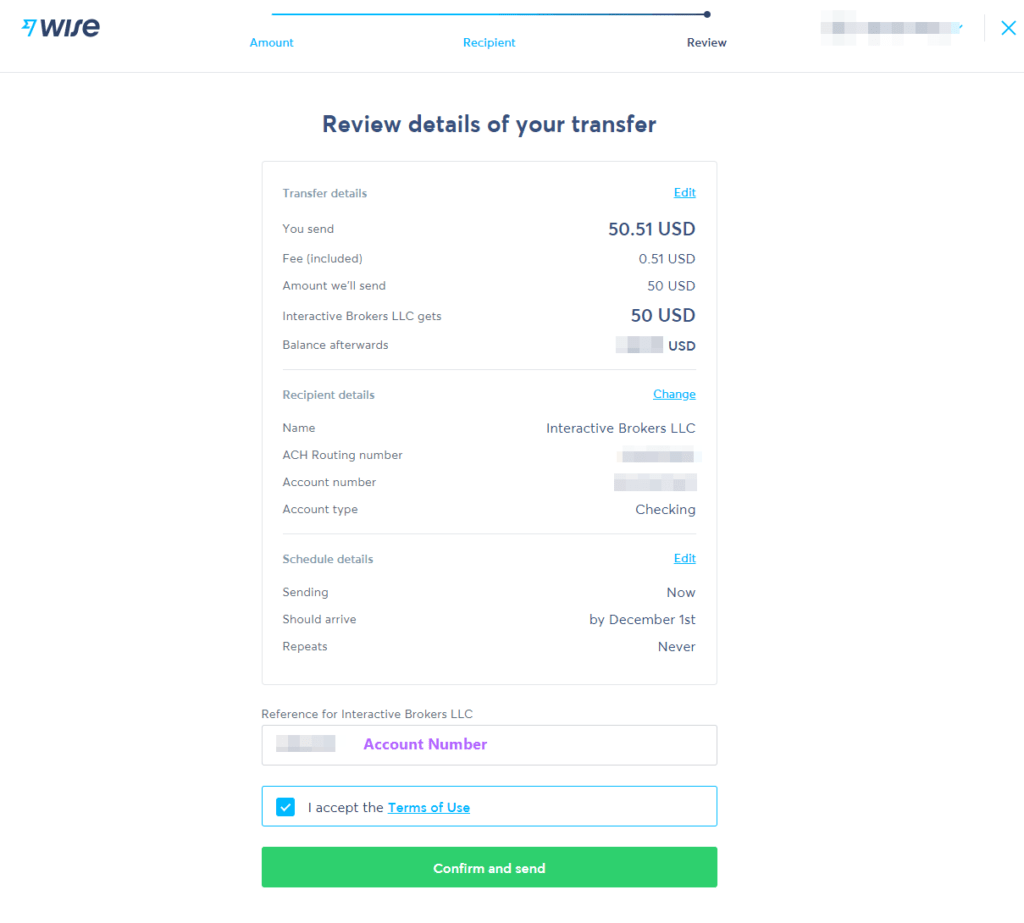

Review the details that you key in and enter your IBKR account number as a reference.

Then click Confirm and Send.

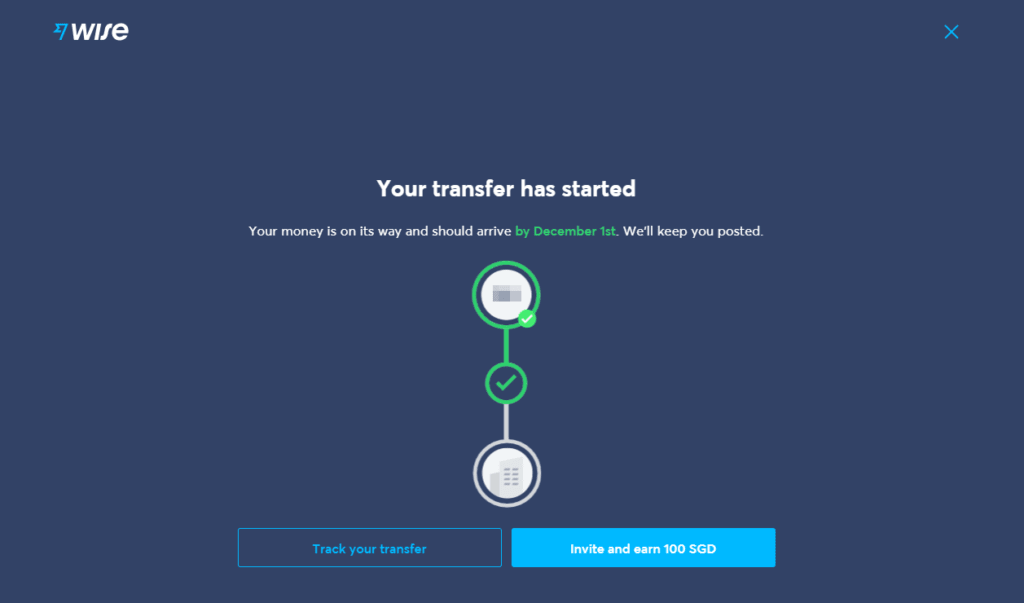

That is it! You have finished the money sending process.

Now it is time to wait!

How Long Will Your TransferWise Money Arrive and be Ready in Interactive Brokers?

Apparently, Direct ACH transfer looks pretty fast.

This is compared to the previous experience when I use Wire transfer to Interactive Brokers.

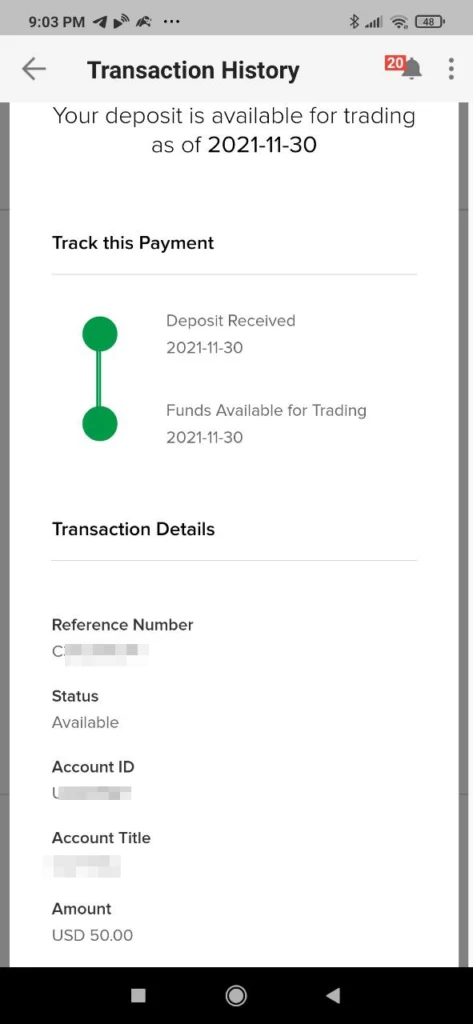

If you go to Interactive Brokers, then Transfer & Pay, then Transaction History, you can review the status of the transaction.

If you look at the timeline, I created this Direct ACH in Wise on 30th Nov and on Interactive Brokers, it shows that the funds are received and available trading on 30th Nov.

Conclusion

I hope that this method is cost-effective and will stick around for some time. We might never know if Interactive Brokers will pull a stun by prohibiting this form of transfer.

I think the most sensible thing is not to do any currency conversion. Do the currency conversion in Interactive Brokers as the rates are better there compared to a lot of other platforms.

If you have tried with OFX, revolute and it works for you, do let me know.

My Comprehensive Interactive Brokers How-to Guides

Interactive Brokers is a great low-cost, financially strong brokerage platform that can be the standard broker for holding your long-term investments. You can access 150 global exchanges, including exchanges such as Singapore, the US, Hong Kong, London, European and Canada.

You will enjoy cheap commissions and zero minimum recurring platform fees or maintenance fees. Convert your funds to different currencies at near-spot rates, paying a flat US$2 fee.

To get started or become familiar with Interactive Brokers, check out my past articles on how to invest with Interactive Brokers. I hope the guides make your life and investing experience easier and brighter.

An Easy Step-By-Step Guide to Setup Interactive Brokers (IBKR)

How to Fund & Withdraw Funds from Your Interactive Brokers Account

How to Convert Currencies in Interactive Brokers

How to Buy and Sell Stocks and Securities on Interactive Brokers

How Competitive are Interactive Brokers Commissions Pricing?

How Safe is it to Custodized Your Money at Interactive Brokers? The things they do better than other brokers.

How Safe is it to Custodized Your Money at Interactive Brokers (2)? Financial strength of IB during recent banking crisis and during Great Financial Crisis

Interactive Brokers have Eliminated the US$10 monthly inactivity fee. More details here.

How to Transfer your shares from Standard Chartered Online Trading to Interactive Brokers

How to trade after-hours and premarket

Create Customized Reports and automatically send them to your email

What is the PortfolioAnalyst Report and Automatically Send the PortfolioAnalyst Report to Your Email

Send Money from TransferWise to Interactive Brokers

Interactive Brokers’ Fluid Interest Income on Cash

Introducing IMPACT by Interactive Brokers

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Jason

Monday 24th of January 2022

Hi Kyith, I am looking into this method to fund my IBKR account, but I don't see an option to do an ACH deposit anymore and can only find the option to use bank wire transfer. Could you please advise? Also, are the rates for SGD to USD conversion in IBKR better than conversion using TransferWise? Was considering directly using IBKR to convert if the fees are not too different

Daniel

Saturday 14th of January 2023

@Kyith, I'm also facing the same issue with a newly opened IBKR account - there's only one option for Wire and not for ACH.

Kyith

Friday 28th of January 2022

Hi Jason, the rates in IBKR is definitely better than Transferwise. As to the ACH, this is strange, I revise the screen captures not too long ago as the old method doesn't work. If you go to IBKR there should be two different IBKR ACH options.

John Simons

Thursday 2nd of December 2021

I read the latest comments that IBRK wants to receive ACH transfers, so yesterday Nov 30, 2021 I sent $100 from Wise to IBRK as ACH and receive it the next day (like in 14h or so).

John Simons

Tuesday 4th of January 2022

@Kyith, How much was maximum ammount that you sent per 1 tranfer? Have you tried like $10k?

Kyith

Thursday 2nd of December 2021

yes me too. did it this month twice. the second one i received 1 day later.

Loo

Friday 19th of November 2021

First of all, why is there annoying popup that freezes entire site?

Secondly, you don't address the most important thing:

- What section to choose: "Local bank account" or "SWIFT" in Wire??? You literally just skipped over that. - You also don't mention what email to indicate, they require obligatory email indication. - Thirdly, there IS NO "ABA routing" number, there is "ACH routing number" indicated in Wire. So your information is INCORRECT. - Finally, when I enter the added U[identifier] to the account number provided by IB the WIRE site says "Please enter a valid account number of between 4 and 17 digits.".

Such a misleading article.

Kyith

Friday 19th of November 2021

Hey Loo, so sorry you do not see value in this article. I believe my screen capture is pretty intuitive.

Jack

Friday 12th of November 2021

Thanks for the post. Non-related question.

I bought one share of Starbucks and the order was filled. However, the following day the same stock was automatically sold. I'm not sure if there is something in the settings that I need to configure so that the stock won't be sold automatically.

Hope you can advise. :) Thank you.

Kyith

Friday 12th of November 2021

Huh, that should not happen!

Karol

Friday 12th of November 2021

Hi Kyith,

I'm trying to make my first deposit into IB. I'm using Wise. I've picked wire transfer on the IB page. IB provides me with ABA Routing Number to use. However in Wise, they are asking me for ACH number. I've picked "same currency transfer" in Wise.

Seems that I am not able to make the transfer?

Kyith

Wednesday 1st of December 2021

Hi Karol, I have updated the guide with instructions how to setup a Direct ACH from Wise to Interactive Brokers. You can see if this instructions help.

Victor Portillo

Tuesday 23rd of November 2021

yup, got the same message on my account... guess we might need to start using a different method. Oh well.

Kyith

Friday 12th of November 2021

Hi Karol,

the ACH routing number is the ABA routing number. However, I suggest we wait for this. This morning I received a message on IBKR:

Dear Client,

During the past year, we received a USD deposit for account U******** via the ACH network. However, the funds were sent to the IBKR bank account that is used for wire deposits rather than the account used for ACH deposits.

Starting November 30, 2021, any ACH deposits sent to the IBKR wire deposits bank account will be automatically returned to the sender.

If you would like to continue funding your account via the ACH network, please log in, select the Transfer & Pay > Transfer Funds > Make a Deposit menu, and click "Get Instructions" for Direct ACH Transfer from your Bank.

Please note that deposits made via the "Direct ACH Transfer from your Bank" method are less prone to delays and are instantly available for trading with no credit holds.

So what I teach might not work anymore. We might need to do the ACH method. I would need to update this guide.