How do we know whether these political and government policies have an impact on the businesses you invest in?

Perhaps a review of a slew of companies will tell you something. That is lots of work. But if you want your money to be safe, you got to do it. If this is not for you, there are always index funds.

Shangri-la Asia Limited (Stock code: 69) is a hotel operator listed in the Hong Kong Stock exchange. It is owned by Robert Kuok, His Daughter is the executive chair person.

Yesterday, Shangri-la Asia released its interim results.

It’s business involves

- Owning and operating the hotels it owns. This can be directly or with joint venture partners Kerry Properties Limited (KPL) which is also affiliated with Robert Kuok

- Owning and operating investment properties

- Development of hotels

- Management of hotels

The main bulk of its profits or EBITDA have come from owning and operating the hotels.

In total they operate around 102 hotels around the world.

Like a lot of property stocks in Hong Kong, there is a big discount to NAV. At the share price of HK$8.65 the market capitalization is about US$3.86 bil. Dividend yield is about 2.6%. Share price was as high at HK$18 at one point in the last 2 years.

If we take the annual report and value it, your RNAV could be US$6.8 bil if you use the historical cost minus depreciation for hotels or US$8 bil if I roughly estimate based on their EBITDA and Cap Rate.

You can see the upside.

Perhaps there is a need to look at the results more. These firms in HK all trade at a large discount but the unique thing about Shangri-la is that 10% of their EBITDA is in Hong Kong. Not too much but also not too little.

This period of protest brings out a learning lesson about the benefits of adequate diversification. You will notice that some of these service residence and hotel players are pretty diversified around the world.

A single protest event in HK affects Shangri-la but it could have been worst if its very concentrated. It would take a global slow down, or a secular shift in travel and hotel dynamics to really affect them.

Sometimes looking at the results of these companies gives you an assessment of just how bad or good things are in certain regions you are interested in.

China is one. How were they impacted by trade war, or for the matter are things slowing down?

And how was the protests affecting business.

A large amount of the properties owned by Shangri-la or under the associates is in China. They have hotels in Hong Kong as well.

So it is great that they provide some color on the Hong Kong and China situation.

The interim results show the results for the first 6 months.

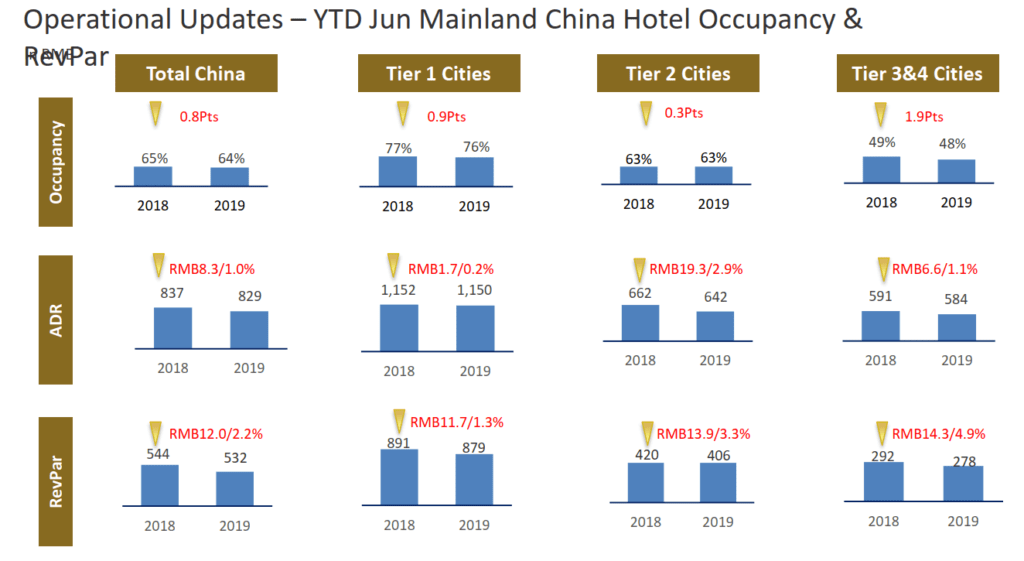

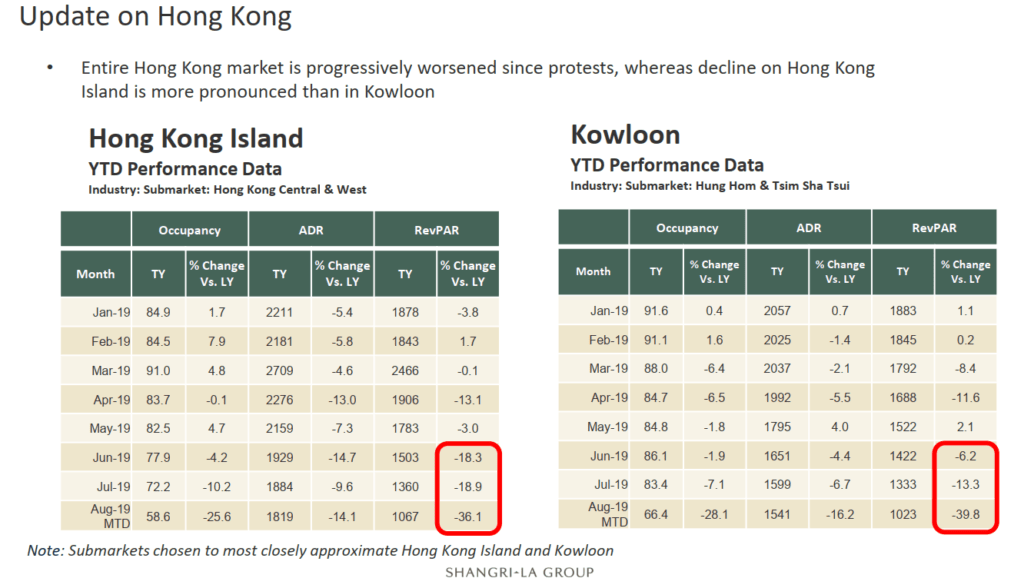

Occupancy for both HK and China in the first half of the year was pretty good. The average daily rate (ADR) for China have weakened yer on year while the average daily rate for HK was better.

When we put occupancy together with ADR, it shows that the charge rate and quality for the HK hotels were doing better. China worse off.

RevPar for both declined, with China being more significant.

Here is the data, broken down by different cities in China.

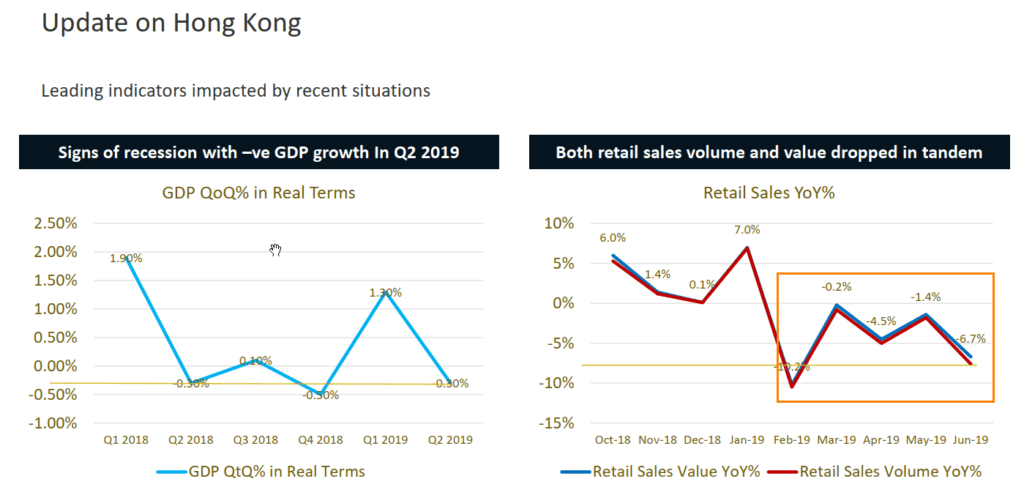

Shangri-la Asia also furnish some general Hong Kong GDP and retail sales figures. I am more interested with the retail sales figures for the past 6 months. Not very optimistic about it.

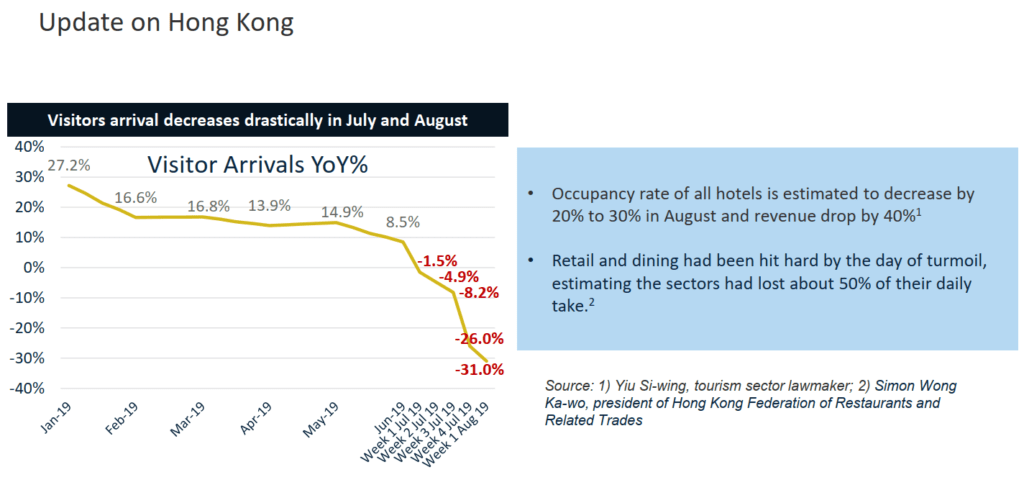

According to the general tourism and restaurant data the 1.5 month’s protests really affected the visitor arrivals.

In the slide above, we can really appreciate the difference between the RevPar, ADR and Occupancy for the first 5 months of the year in 2 different sub-market in Hong Kong and the past 3 months.

If your business operates in an environment where it is dependent on good relations, tourism, these data does show that these protests will caused an impact of a larger degree.

Shangri-la’s China data gives me some glimpse of the situation there. Together with some other companies, it seems the slowdown is pretty evident.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024