Here is a safe way to save money that you have no idea when you will need to use or your emergency fund.

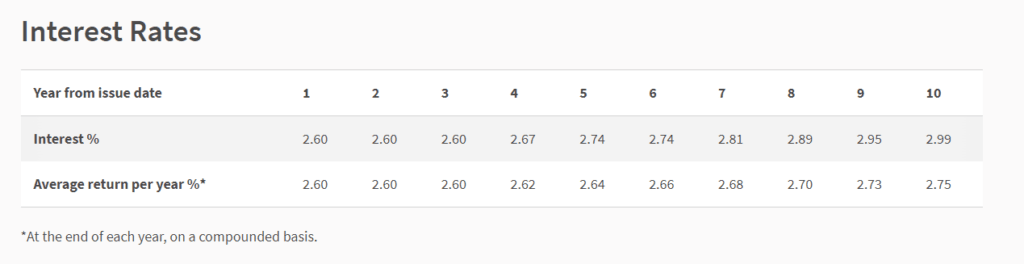

The September 2022’s SSB bonds yield an interest rate of 2.75%/yr for the next ten years. You can apply through ATM or Internet Banking via the three banks (UOB, OCBC, DBS)

However, if you only hold the SSB bonds for one year, with two semi-annual payments, your interest rate is 2.6%/yr.

$10,000 will grow to $12,757 in 10 years.

The Singapore Government backs this bond, and it’s available for you to invest if you have a CDP or SRS account (this includes Singapore Permanent Residents and Foreigners).

A single person can own not more than SG$200,000 worth of Singapore Savings Bonds. You can also use your Supplementary Retirement Scheme (SRS) account to purchase.

You can find out more information about the SSB here.

Note that every month, there will be a new issue you can subscribe to via ATM. The 1 to 10-year yield you will get will differ from this month’s ladder, as shown above.

Last month’s bond yields 2.80%/yr for ten years and 2.63%/yr for one year.

Here is the current historical SSB 10-Year Yield Curve with the 1-Year Yield Curve since Oct 2015, when SSB was started (Click on the chart, and move over the line to see the actual yield for that month):

How to Apply for the Singapore Savings Bond – Application and Redemption Schedule

You will apply for the bonds throughout the month. At the end of the month, you will know how many of the bonds you applied were successful.

Here is the schedule for application and redemption if you wish to sell:

You have from the second day of the month to about the 25th of the month (technically the 4th day from the last working day) to apply or decide to redeem the SSB you wish to redeem.

Your bond will be in your CDP on the 1st of the following month. You will see your cash in your bank account linked to your CDP account on the 1st of next month.

You May Not Get All the Singapore Savings Bonds That You Apply For

Do note that when you apply for the Singapore Savings Bonds, you may not get all that you apply for. Think of this as you are bidding for an amount which is determined by the demand and supply of Singapore Savings Bonds.

When the interest rate is low, the demand tends to be lower relative to history, and you can get a more significant amount. Still, if the interest rate is very high, demand can be so overwhelming that you may get a small portion you apply for.

For example, in the August 2022 issue, you can apply for $100,000, but the maximum allotted amount per person was $9,000 only. If you applied for $8,000, you would get your total $8,000 allocation.

To review the past allotment trend, you can take a look at SSB Allotment Results here.

How do the Singapore Savings Bonds Compare to SGS Bonds or Singapore Treasury Bills?

Singapore savings bonds are like a “unit trust” or a “fund” of SGS Bonds.

But what is the difference between buying SGS Bonds and its sister, the T-Bills, directly?

The SGS Bonds and T-Bills are also issued by the Government and are AAA rated.

Here is a MAS detailed comparison of the three:

The main advantage of the 1-year SGS Bonds and Six-month Singapore Treasury Bills is that you can get a more significant allocation currently compared to the Singapore Savings Bonds. This means that if you need to earn a good interest yield of $400,000, you get a better chance to fulfil that with 1-year SGS Bonds and Six-month Treasury Bills.

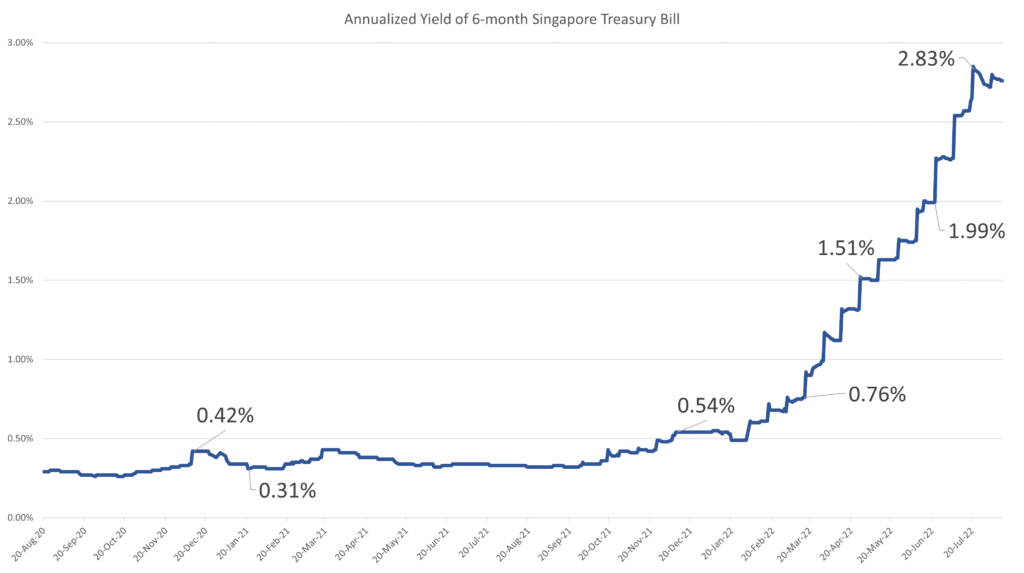

The short-term interest rates are getting rather exciting, and short-term SGS bonds and treasury bills may be applicable to supplement your Singapore Savings Bonds allocation.

I wrote a guide to show how you can easily buy the Singapore Treasury Bill and SGS Bonds here. You can read How to Buy Singapore 6-Month Treasury Bills (T-Bills) or 1-Year SGS Bonds.

My Past Value Add Articles Regarding the Singapore Savings Bonds

Read my past write-ups:

- This Singapore Savings Bonds: Liquidity, Higher Returns and Government Backing. Dream?

- More details of the Singapore Savings Bond. Looks like my Emergency Funds now

- Singapore Savings Bonds Max Holding Limit is $200,000 for now. Apply via DBS, OCBC, UOB ATM

- Singapore Savings Bonds’ Inflation Protection Abilities

- Some instructions on how to apply for the Singapore Savings Bonds

Past Issues of SSB and their Rates:

- 2015 Oct

- 2015 Nov

- 2015 Dec

- 2016 Jan

- 2016 Feb

- 2016 Mar

- 2016 Apr

- 2016 May

- 2016 Jun

- 2016 Jul

- 2016 Aug

- 2016 Sep

- 2016 Oct

- 2016 Nov

- 2016 Dec

- 2017 Jan

- 2017 Feb

- 2017 Mar

- 2017 Apr

- 2017 May

- 2017 Jun

- 2017 Jul

- 2017 Aug

- 2017 Sep

- 2017 Oct

- 2017 Nov

- 2018 Jan

- 2018 Feb

- 2018 Mar

- 2018 Apr

- 2018 May

- 2018 Jun

- 2018 Jul

- 2018 Aug

- 2018 Sep

- 2018 Oct

- 2018 Nov

- 2018 Dec

- 2019 Jan

- 2019 Feb

- 2019 Mar

- 2019 Apr

- 2019 May

- 2019 Jun

- 2019 Jul

- 2019 Aug

- 2019 Sep

- 2019 Oct

- 2019 Nov

- 2019 Dec

- 2020 Jan

- 2020 Feb

- 2020 Mar

- 2020 Apr

- 2020 May

- 2020 Jun

- 2020 Jul

- 2020 Aug

- 2020 Oct

- 2020 Nov

- 2020 Dec

- 2021 Feb

- 2021 Mar

- 2021 Apr

- 2021 May

- 2021 June

- 2021 July

- 2021 Aug

- 2021 Sep

- 2021 Oct

- 2021 Nov

- 2021 Dec

- 2022 Jan

- 2022 Feb

- 2022 Mar

- 2022 Apr

- 2022 May

- 2022 June

- 2022 July

- 2022 Aug

- 2022 Sep

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024