My friend STE advise me that a better way to earn high returns and maintain relatively good short-term liquidity is to invest in Singapore treasury bills with six-month or one-year tenor.

I think the Singapore treasury bills are pretty good if you have money that you have no idea what to do with but want to earn more interest than the measly interest given by Singapore local banks.

The best thing is that it is straightforward to apply, not much hassle at all and I will show you how.

What Are Singapore Treasury Bills (T-Bills) and 1-Year SGS Bonds?

Treasury bills, or T-bills in short, are short-term securities that the Government of Singapore issues.

They have a very short tenor, typically six months to one year, and they do not give you a coupon. They are issued at a discount to their face value. For example, if you apply for $1000 worth of T-bills and successfully get it, your cost will be $985, and when it matures, the government of Singapore will give you back $1000.

So it is like you are buying something at a discount.

When you buy a Singapore treasury bill or SGS bonds, you are lending money to the Singapore government on a short-term basis. The Singapore government have an obligation to pay you interest and your principal back.

The Singapore government can default or not pay you back the interest and principal. There is that risk there.

Why Buy Six Month Singapore Treasury Bills (T-Bills) or One Year SGS Bonds?

In the past, many people didn’t bother with Singapore Treasury Bills but started bothering about it when the returns started climbing to a meaningful amount.

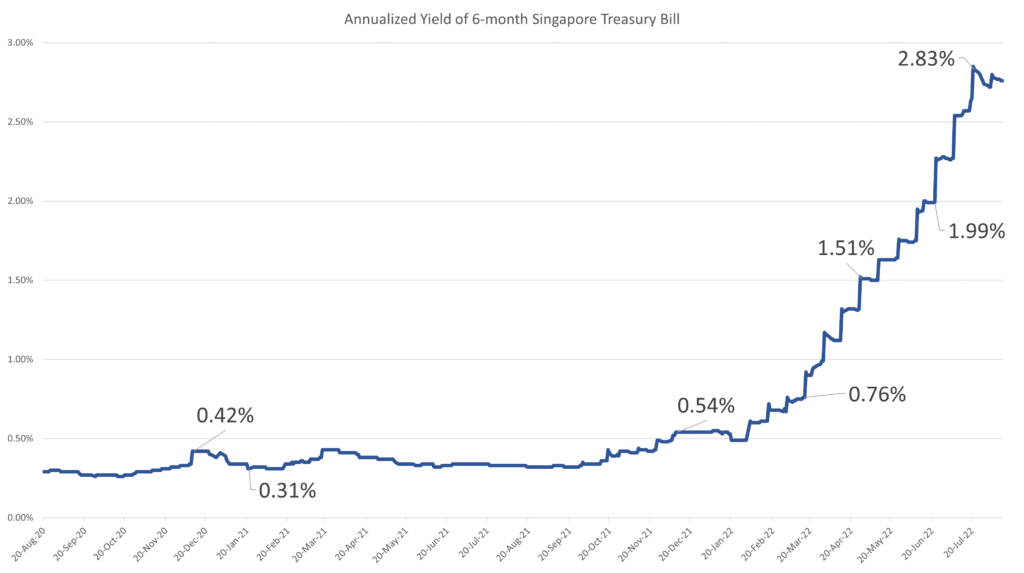

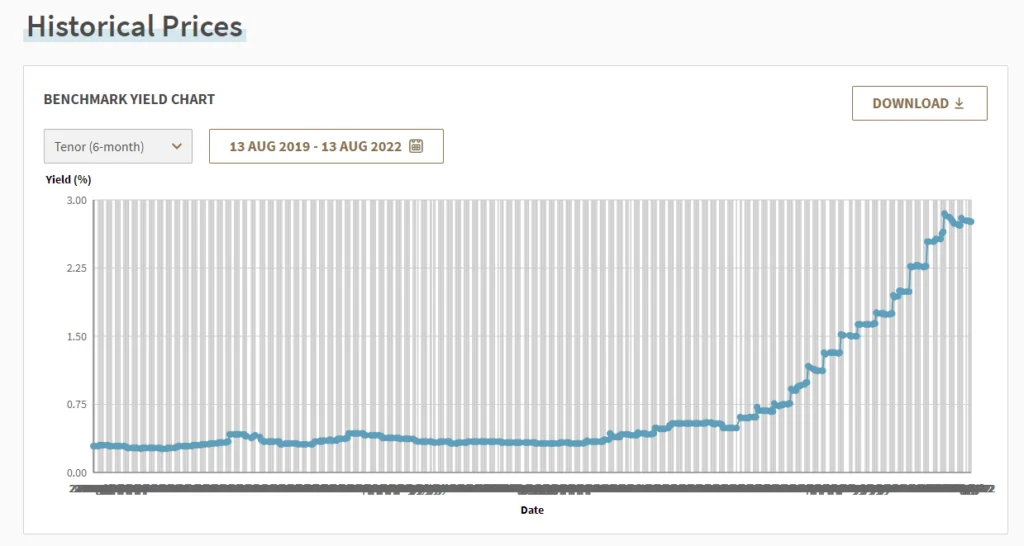

The chart below shows the annualized yield that you can earn from buying the six-month Singapore treasury bill issued for the past three years:

The past yield is less meaningful if it starts shooting to 2.8%, then people start taking notice.

The yield of the bonds issued periodically is not fixed and very much depends on Singapore’s short-term government interest rate movements, which are influenced pretty much by the demand and supply of the Singapore dollar, economic growth, and inflation.

So this good yield might not stick around for long, and perhaps in the future, you might think it is worth too much of a hassle.

The appeal of buying a Singapore Treasury bill is not only the yield but the whole package that comes with it:

- The interest yield is better than the interest rate provided by your savings deposit (and even some other short-term instrument)

- You can apply a large amount and can get a large amount (the limit for a non-competitive bid at the Treasury bill auction is $1 million, which means the cap of how much you can apply and possibly get is around $1 million. You could, of course, submit a competitive bid)

- The minimum amount that you need to apply is a manageable S$1,000.

- Very, very high credit quality. When you buy a Singapore Treasury bill or SGS bond, you are effectively lending to the Singapore government, which is AAA rated in the world (very rare)

- Bonds and treasury bills protect your principal (unless the Singapore government defaults)

- Six-month treasury bills and One-year SGS bonds are issued frequently enough for you to reinvest the proceeds as they mature.

- The auction process is easy over internet banking (for cash & SRS. For CPF, it is more complex).

- The crediting process of your principal upon maturing is also automatic.

- Foreigners can also buy.

So as a package, the Singapore Treasury bill rest in a very sweet spot that is not easy to replicate.

What are the downsides?

- It is challenging to sell bonds and treasury bills on the secondary market. If you face a short-term liquidity crunch, you may be stuck.

You are exchanging liquidity for higher returns.

How Can Singapore Treasury Bills (T-Bills) and 1-Year SGS Bonds Fit into Your Financial Plan?

Given the bill or bond’s unique characteristics, I can think of a few ideal uses:

- Earn higher interest for the money you need in the short-term but not immediate. You will need to seriously ponder your liquidity needs and not underestimate them, as it might not be so easy to sell your bonds and bills on the secondary market.

- SA Shielding for your CPF SA Monies. For those who are about to turn 55 and would like to prevent their CPF SA and OA monies from going into their CPF retirement account but instead fund the CPF retirement account with cash, usually, they will make use of CPF SA-approved unit trusts available on platforms such as Dollardex, Poems and iFast Fundsupermart. You can also invest in Treasury Bills with your CPF SA monies, so you have a safer way to do SA shielding while protecting the principal amount of your CPF monies better than CPF SA-approved unit trusts. The downside is that the procedure may crumble some (I have not tried it, but if you have, do let me know your experience)

I think it is less ideal as an investment war chest because if an opportunity arises, you might not be able to take advantage of it as your money is locked up in the Treasury securities.

How to Apply for Singapore Treasury Bills (T-Bills) and SGS Bonds (Cash and SRS)?

The process to apply for treasury bills is pretty simple.

Before all this, one pre-requisite is that you need a CDP Account. The CDP is the central depository where you can store your Singapore-centered securities, such as your Singapore shares, Singapore savings bonds, and SGS bonds.

You need to set up an account to apply for the Singapore bonds or treasury bills successfully.

To open your CDP Account, you can do it here.

Another pre-requisite is that you need to bank with one of the three major local banks (DBS/POSB, OCBC, or UOB). The main reason is that you will be applying through them.

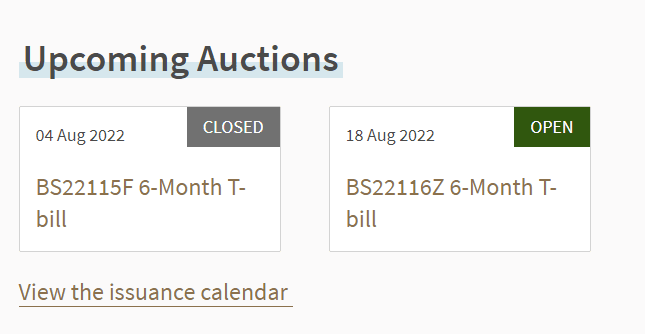

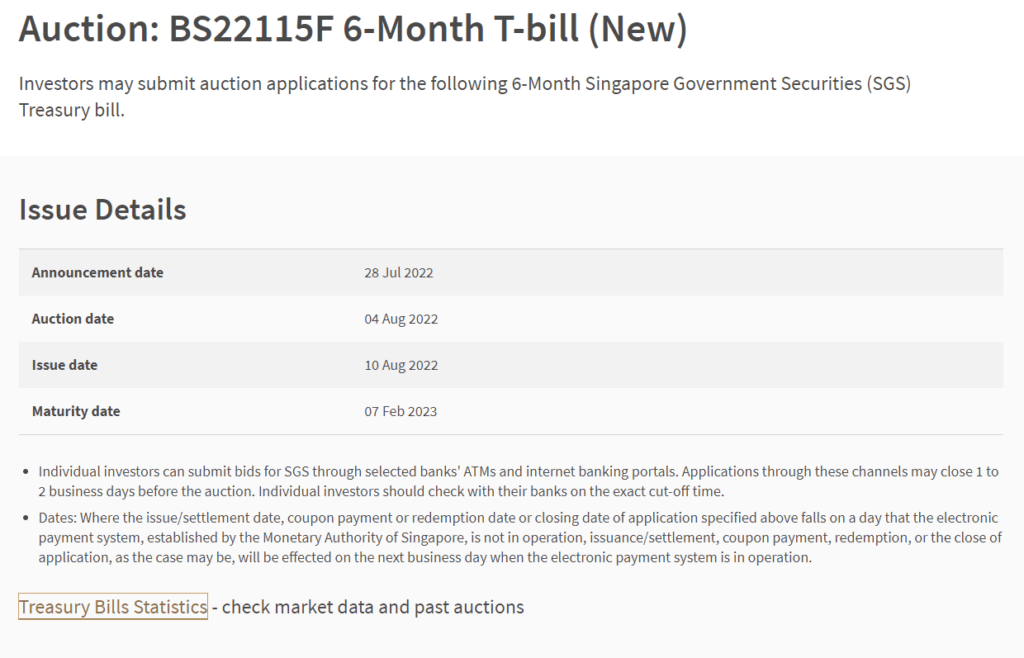

You first need to know whether a treasury bill is currently available for auction.

By going to the Upcoming Auctions tab under the MAS T-bills website, you can see what is available for auction, when it will take place and the timeline. If you are interested in SGS Bonds instead, the Auction updates over here will provide the information on upcoming SGS Bond auctions.

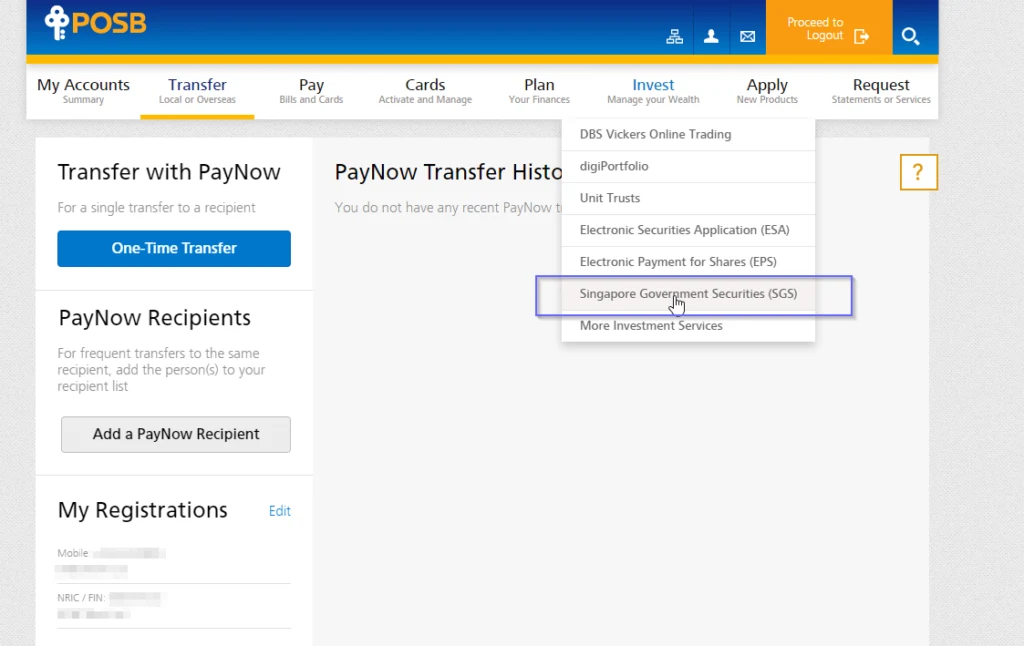

Next, log in to your bank account.

You can apply easily in the comfort of your own home via internet banking. You can apply through the ATM as well.

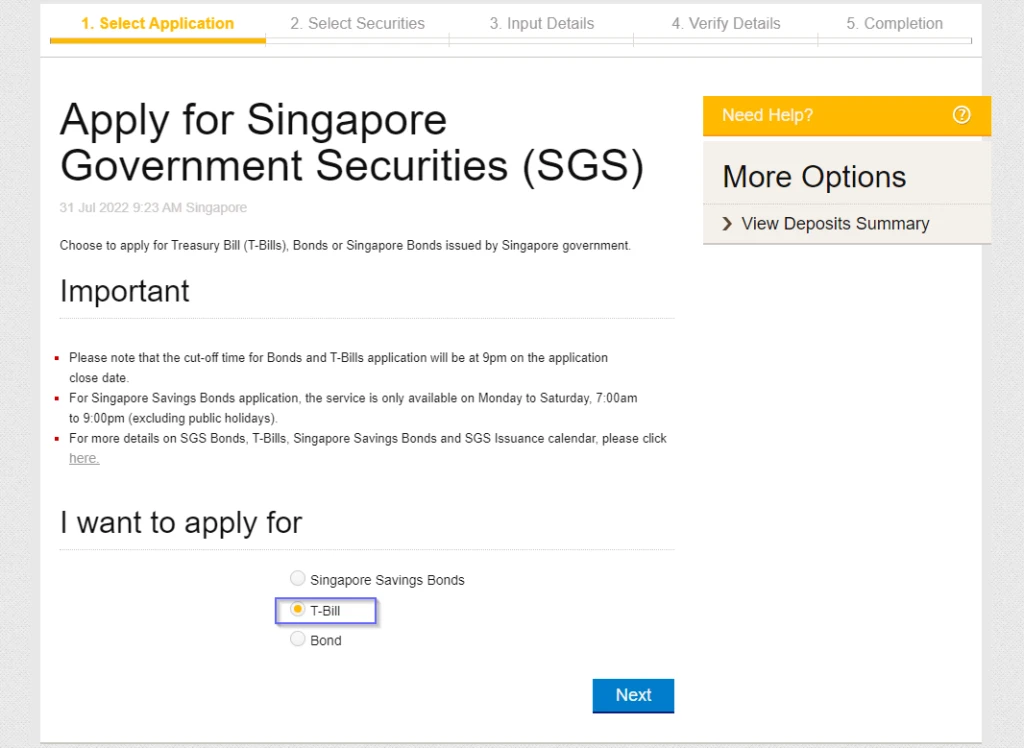

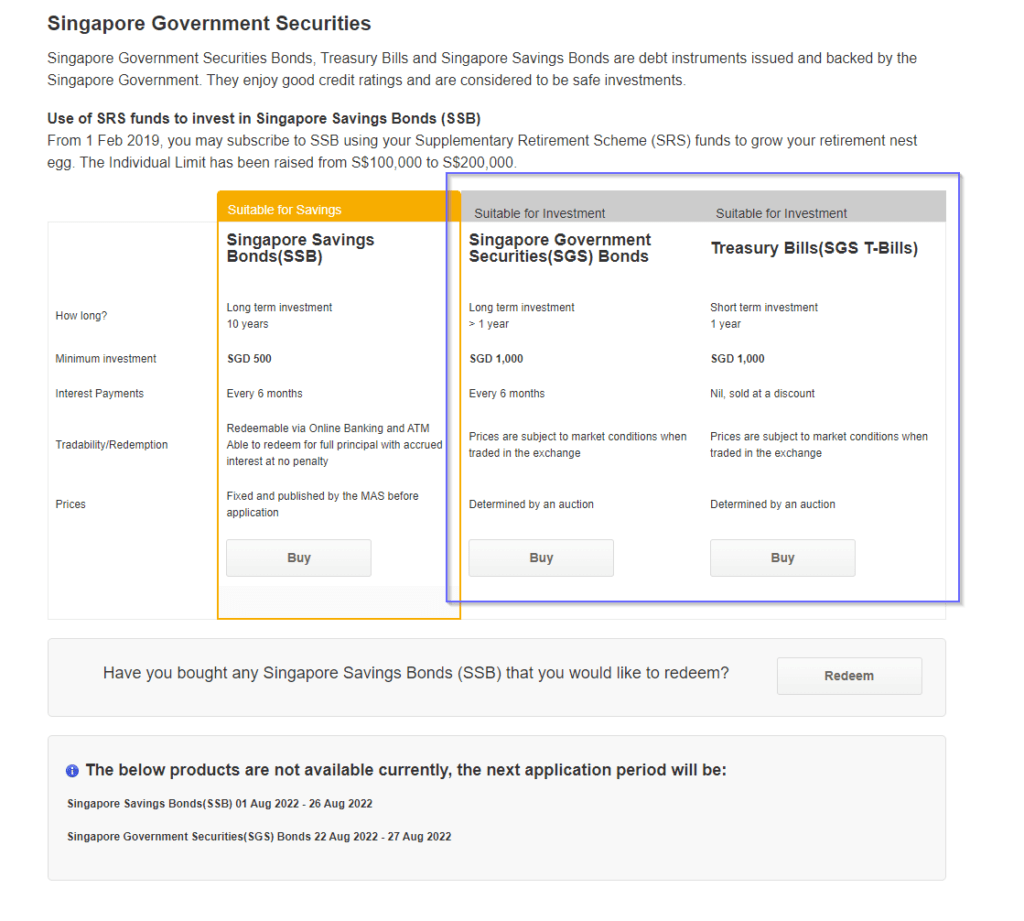

In the case of DBS, that will be under Invest > Singapore Government Securities.

Select either T-Bill or Bond, based upon what you are applying for.

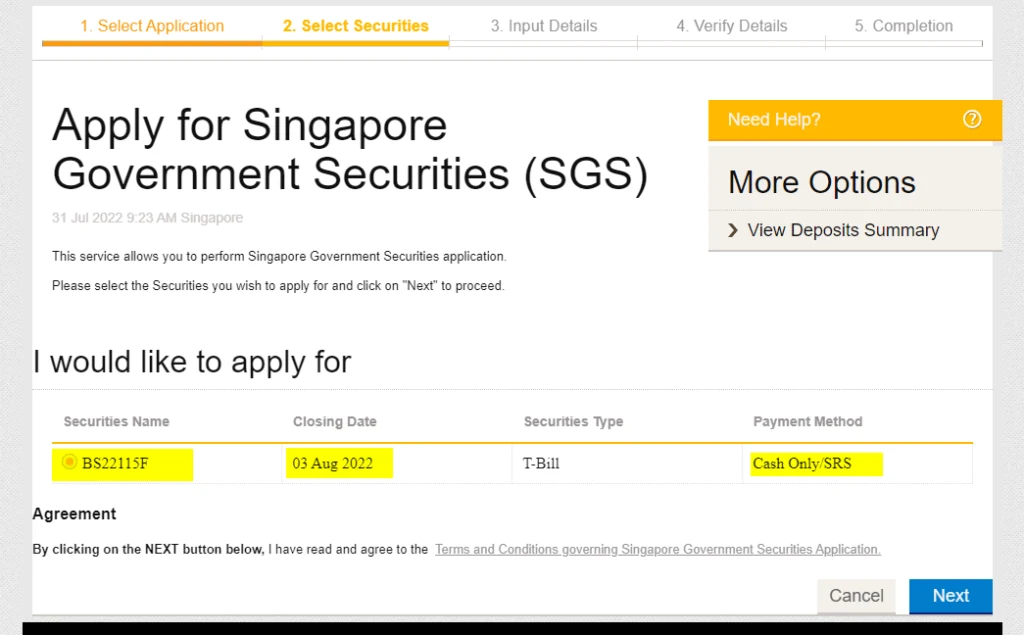

The security available for the auction should be shown, and you can proceed after selecting it.

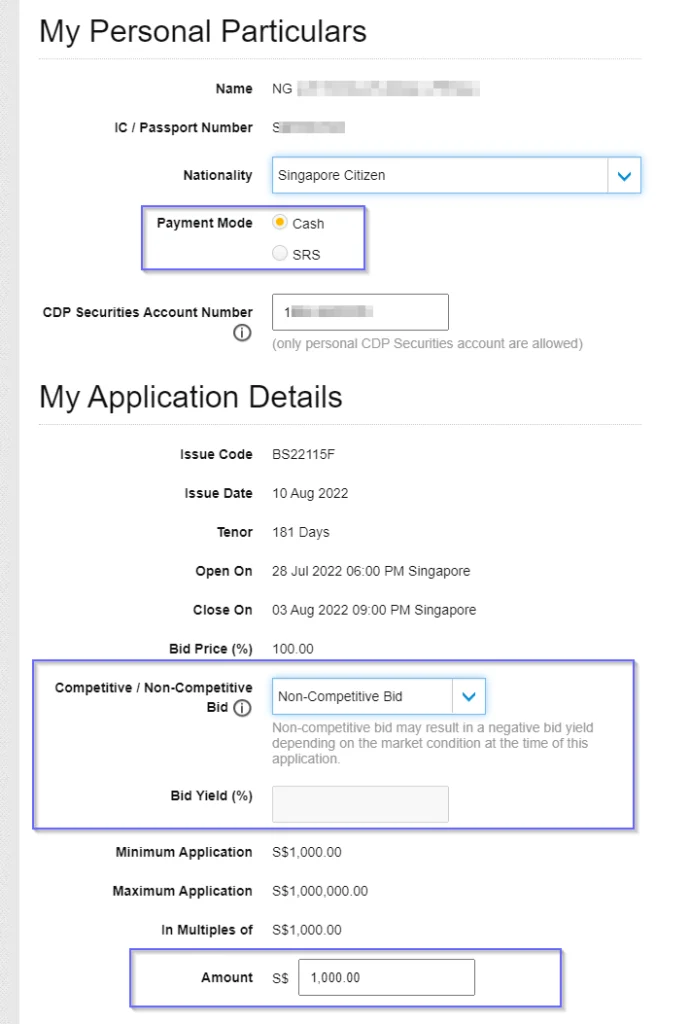

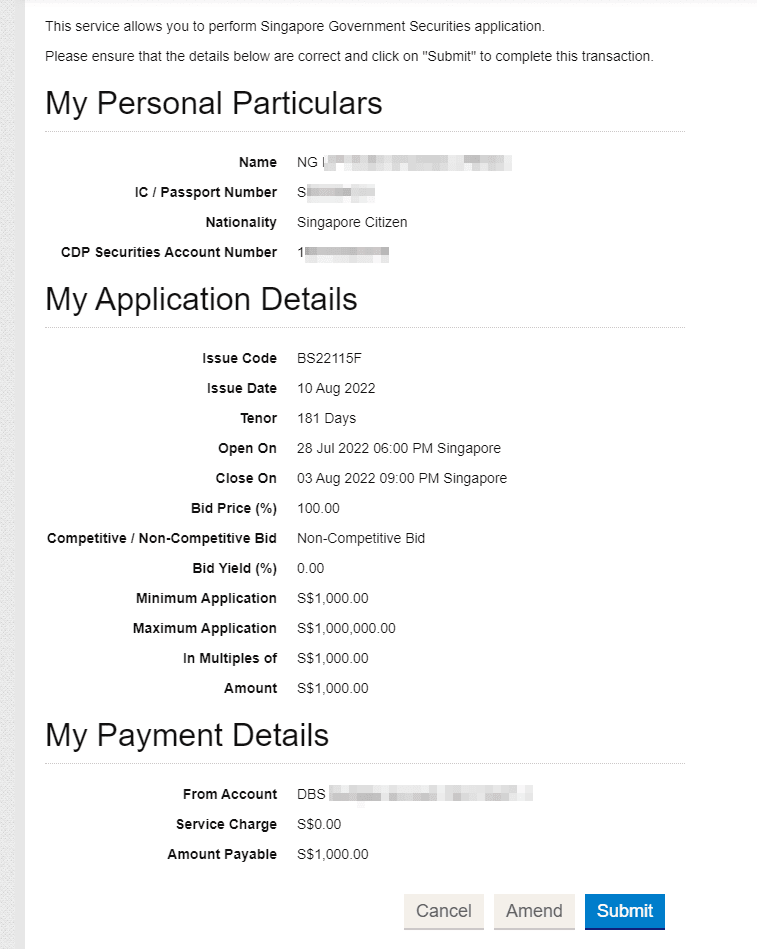

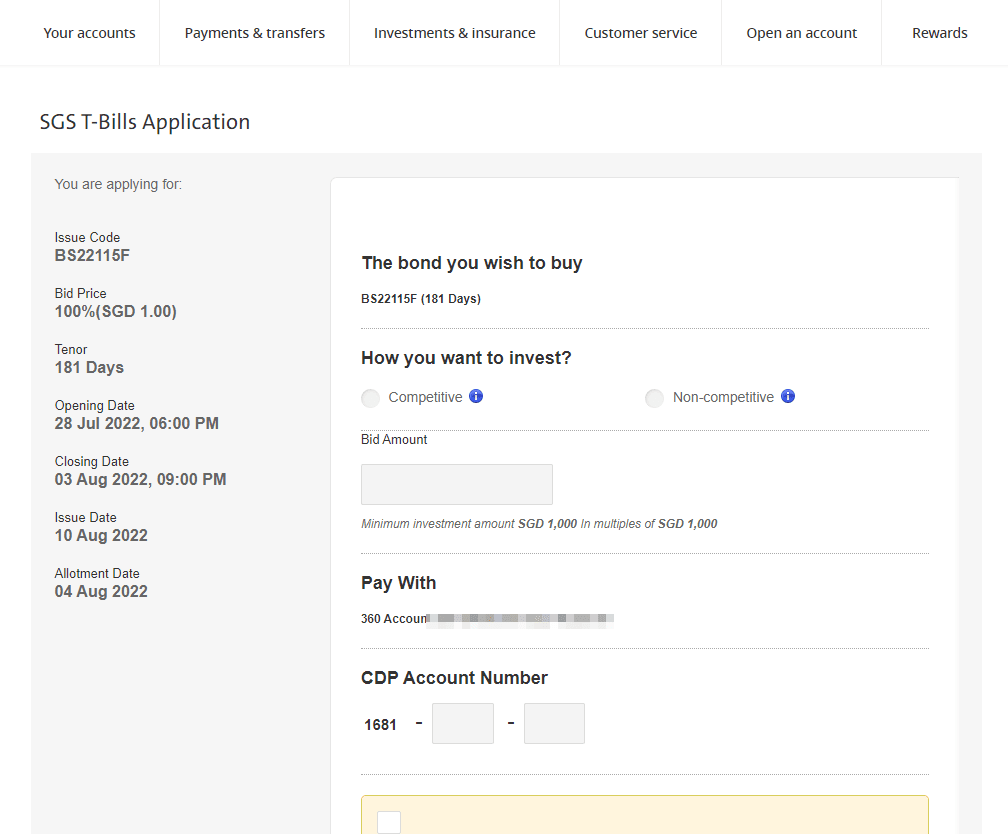

Check your details and change them accordingly if you need to. Select your payment mode between cash and SRS. Under application details, select Non-Competitive Bid unless you have an ideal yield that you would bid for. For most people, non-competitive is enough.

Fill up the amount to apply for (in this case, it is $1,000).

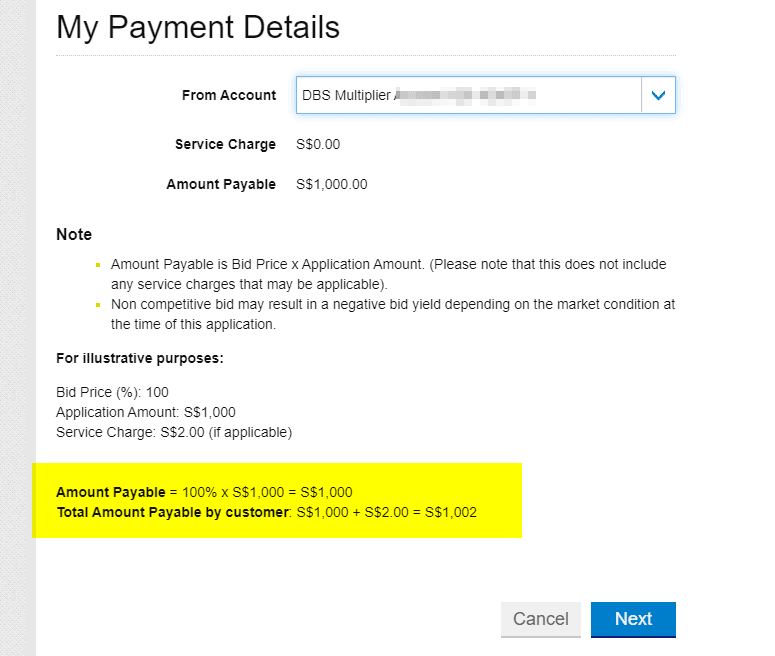

The rest is more about checking whether you are submitting the right stuff and upon submit, you are good to go.

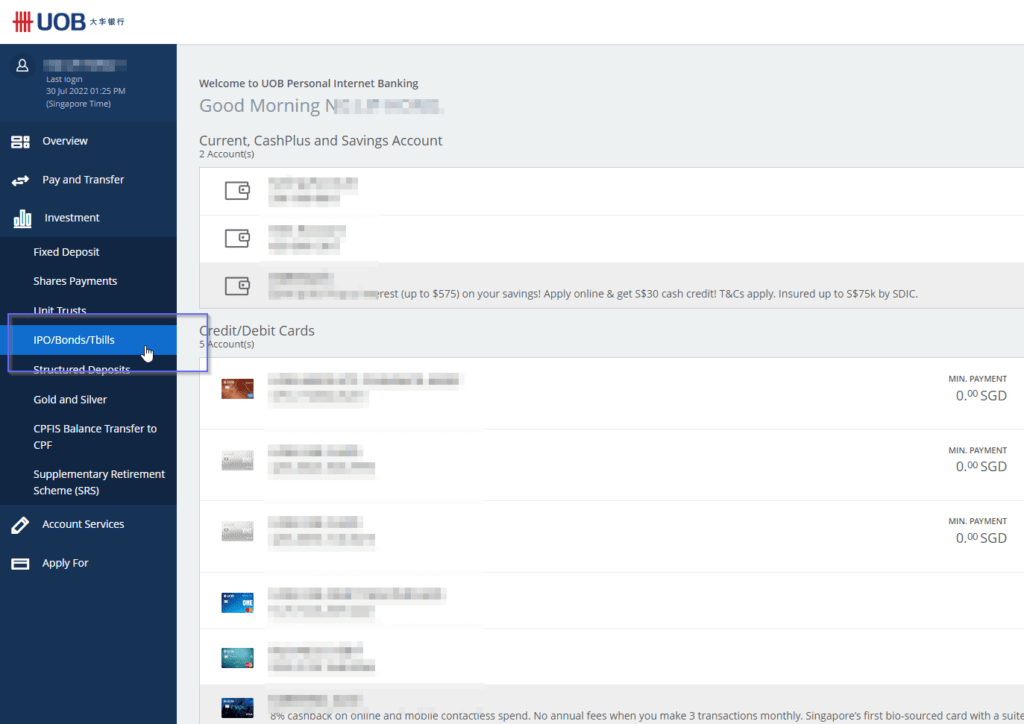

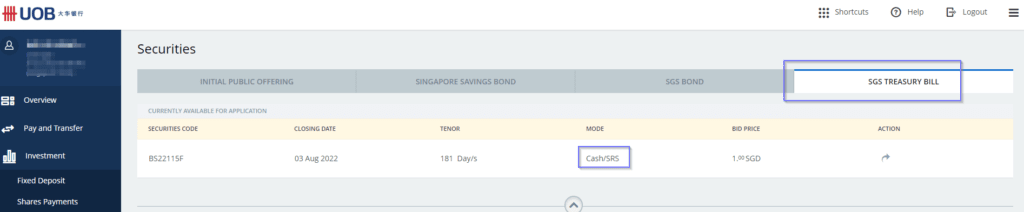

For UOB bank, this will be under IPO/Bonds/Tbills.

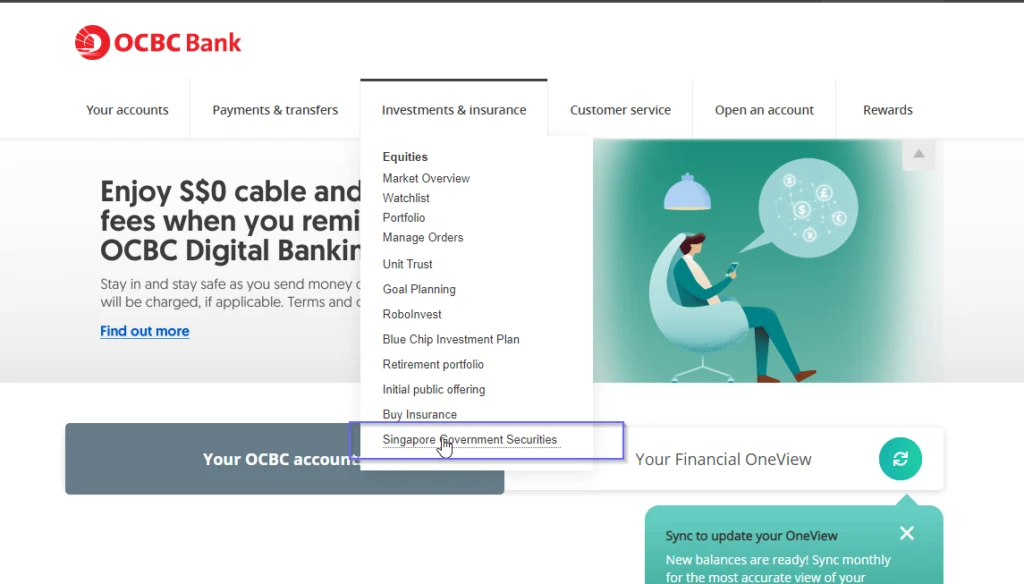

Here is what OCBC’s way will look like.

How to Check if You are Successful in Your Treasury Bill or SGS Bond Application?

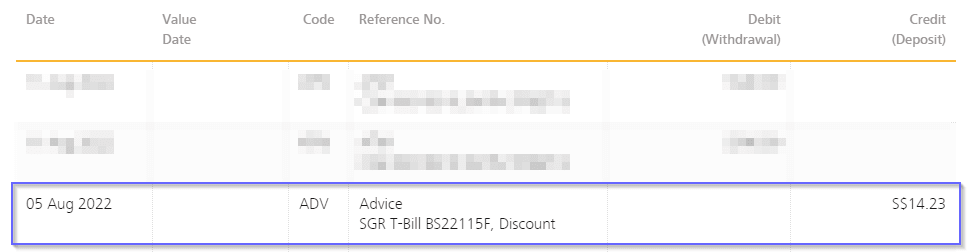

A day after the closing of the auction, you should see a discount refund in your bank statement for roughly the amount you applied for. In this case, this small amount means I applied for a small amount as well.

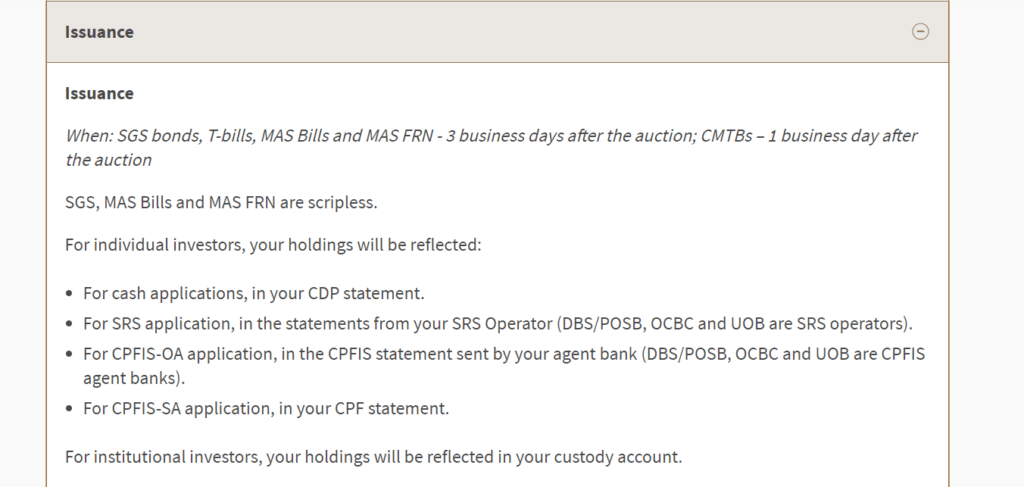

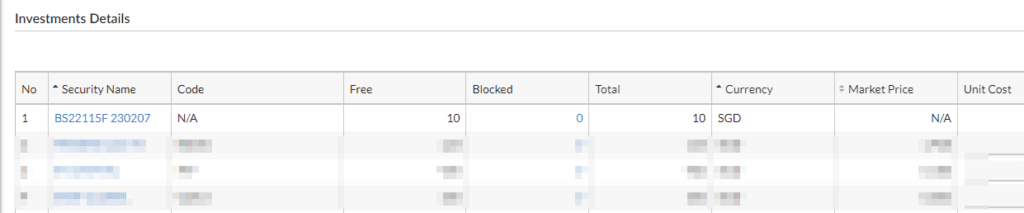

You should see the SGS bond or Treasury bill in your CDP account a few days later.

You can check through SGX Portfolio here.

Do Not Over Apply for Treasury Bill or SGS Bonds Like How You do for Singapore Savings Bonds!

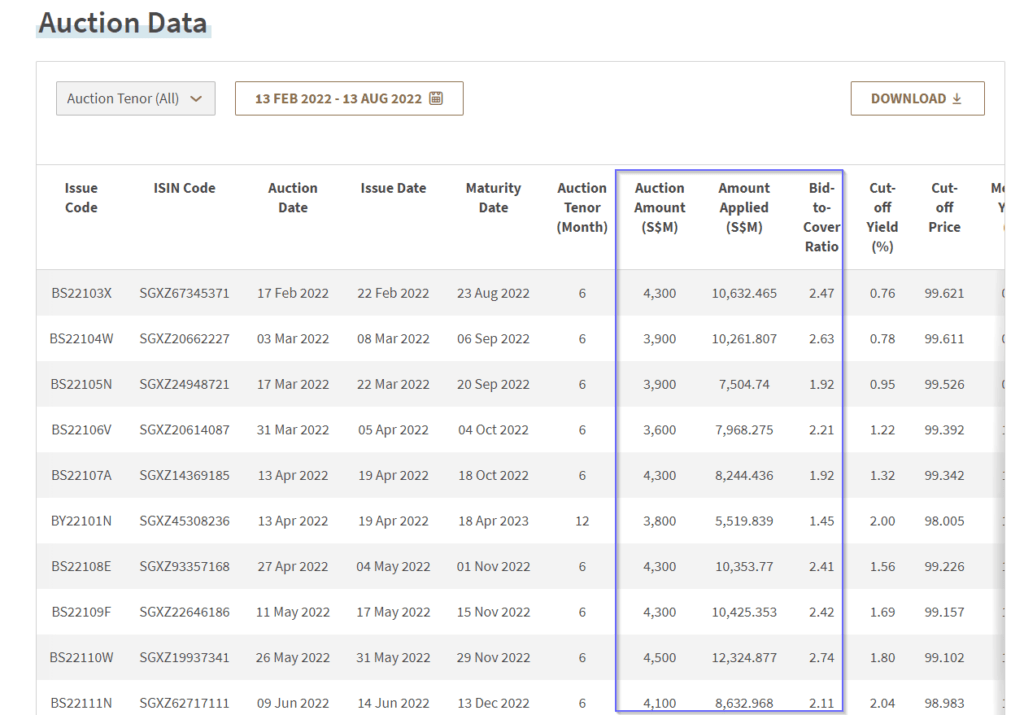

If we look at the statistics for the SGS bonds and Singapore Treasury bill applications versus the amount eventually issued, it’s about 2.5 to one.

For most of us who applied, we are going to get a full application.

So don’t go crazy in trying to apply $400,000 when you only want to secure $40,000 worth of treasury bills haha!

How to Apply for Treasury Bill with Your CPF Monies

You will need to submit an application in person at the main branch of your respective CPF Investment Scheme (CPFIS) agent bank (DBS/POSB, OCBC, or UOB)

Before investing your CPF Ordinary Account (OA) monies, you will need to open the CPFIS account with one of the agent banks first, and in this case, you need to go to not just any branch to apply for the T-bill but the main branch.

You do not need to open a CPFIS account if you wish to invest your CPF Special Account (SA) funds in Singapore Treasury Bills. If you go down to one of the banks, they will open a safe-keeping custodian bank account to keep the treasury bills.

I wrote a guide to share how you can use Singapore Treasury Bills to shield your CPF-SA monies here. The guide will also share more insights on the Treasury bill buying process with CPF SA.

Can You Apply for the Same Singapore T-bill Issue with both Your Cash and SRS?

The short answer is yes, you can.

Can You Apply for the Same Singapore T-bill Issue with Funds from Different Banks?

I have not tried this, but readers have shared this is possible. Do update me if you tried and it didn’t work.

Finding Out Useful Statistics about 1-Year SGS Bonds and Singapore Treasury Bills

You can go to Treasury Bills Statistics to get a lot of helpful information about the past auction, yield and all:

- Auction data

- Daily Treasury Bill Prices

- Outstanding SGS

- Historical Prices

- Historical Turnover

For example, here is some useful information:

This chart shows a history of the yield of the six-month Singapore Treasury Bill over a three-year history.

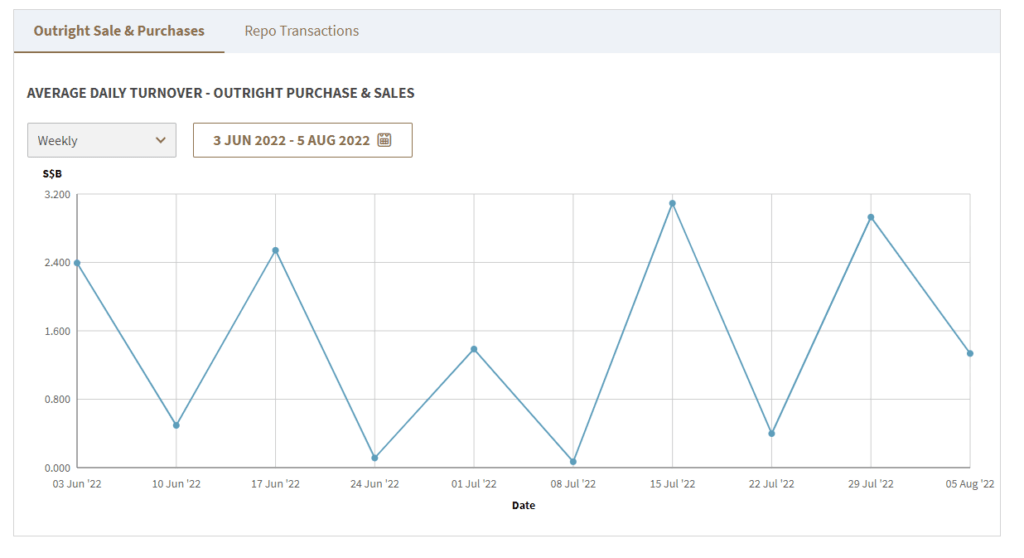

This chart shows the daily traded volume of the treasury bills.

Here are your other Higher Return, Safe and Short-Term Savings & Investment Options for Singaporeans in 2023

You may be wondering whether other savings & investment options give you higher returns but are still relatively safe and liquid enough.

Here are different other categories of securities to consider:

| Security Type | Range of Returns | Lock-in | Minimum | Remarks |

|---|---|---|---|---|

| Fixed & Time Deposits on Promotional Rates | 4% | 12M -24M | > $20,000 | |

| Singapore Savings Bonds (SSB) | 2.9% - 3.4% | 1M | > $1,000 | Max $200k per person. When in demand, it can be challenging to get an allocation. A good SSB Example. |

| SGS 6-month Treasury Bills | 2.5% - 4.19% | 6M | > $1,000 | Suitable if you have a lot of money to deploy. How to buy T-bills guide. |

| SGS 1-Year Bond | 3.72% | 12M | > $1,000 | Suitable if you have a lot of money to deploy. How to buy T-bills guide. |

| Short-term Insurance Endowment | 1.8-4.3% | 2Y - 3Y | > $10,000 | Make sure they are capital guaranteed. Usually, there is a maximum amount you can buy. A good example Gro Capital Ease |

| Money-Market Funds | 4.2% | 1W | > $100 | Suitable if you have a lot of money to deploy. A fund that invests in fixed deposits will actively help you capture the highest prevailing interest rates. Do read up the factsheet or prospectus to ensure the fund only invests in fixed deposits & equivalents. |

This table is updated as of 17th November 2022.

There are other securities or products that may fail to meet the criteria to give back your principal, high liquidity and good returns. Structured deposits contain derivatives that increase the degree of risk. Many cash management portfolios of Robo-advisers and banks contain short-duration bond funds. Their values may fluctuate in the short term and may not be ideal if you require a 100% return of your principal amount.

The returns provided are not cast in stone and will fluctuate based on the current short-term interest rates. You should adopt more goal-based planning and use the most suitable instruments/securities to help you accumulate or spend down your wealth instead of having all your money in short-term savings & investment options.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Jasmine

Tuesday 9th of January 2024

Hi Kyith,

I recently applied for T-Bills of $10,000 through CPF, the CPF statement shows OA -$ 9,816.23. What does this number mean? This is my first time applying T-bills and I have no idea of how much I earn.

Kyith

Thursday 11th of January 2024

Hi Jasmine, usually when we buy tbills that is six months, they will give us the amount we will invest less the future interest we are going to get. so say for example in six months we are suppose to get $200, your account will show $9800. In six months time when you get back the money, you will get back $10,000. So basically you got the interest upfront.

Wang

Monday 3rd of October 2022

Sorry, please ignore my question. I have found it on CDP statement. I was expecting a $ value instead of number of shares.

Wang

Monday 3rd of October 2022

Hi Kyith, after I bought the t-bill last month using cash, where would it appear? I can't find it listed in online banking nor cpf account.

Kyith

Monday 3rd of October 2022

it should appear 4 days later in the CDP account

H. Choon

Saturday 24th of September 2022

This is very useful and informative!

Leon

Wednesday 31st of August 2022

May I know how can I sell this in the open market? In the same way as shares via SGX?

Kyith

Tuesday 6th of September 2022

usually you will have to go through a dealer. the 1 year SGS bonds is more traded on the SGX and you would need a broker to sell it. However, for retail, there may be a liquidity issue.