Here is a higher yielding, safe way to save your money that you have no idea when you will need to use it, or your emergency fund.

The October 2018’s SSB bonds yield an interest rate of 2.48%/yr for the next 10 years. You can apply through ATM or Internet Banking via the three banks (UOB,OCBC, DBS)

However, if you only hold the SSB bonds for 1 year, with 2 semi-annual payments, your interest rate is 1.80%/yr.

$10,000 will grow to $12,501 in 10 years.

This bond is backed by the Singapore Government and its available to Singaporeans.

A single person can own not more than SG$100,000 worth of Singapore Savings Bonds.

You can find out more information about the SSB here.

Note that every month, there will be a new issue you can subscribe to via ATM. The 1 to 10 year yield you will get will differ from this month’s ladder as shown above.

Last month’s bond yields 2.42%/yr for 10 years and 1.74%/yr for 1 year.

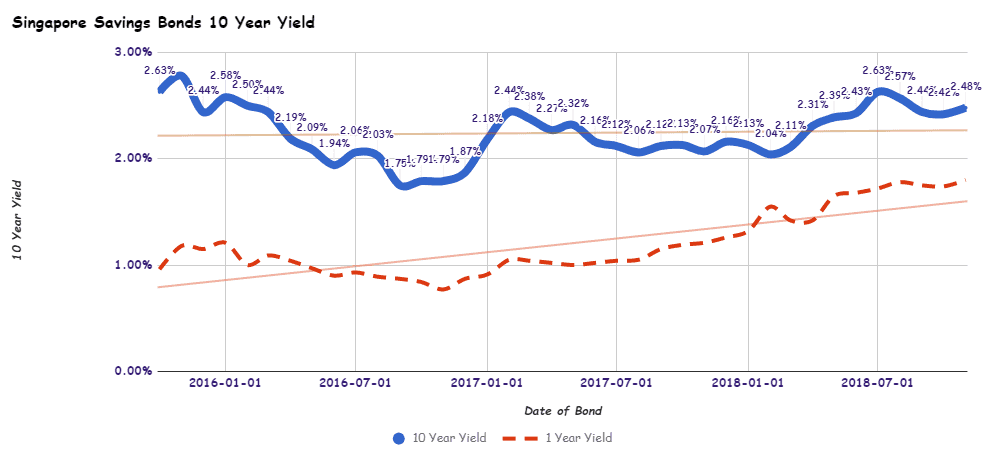

Here is the current historical SSB 10 Year Yield Curve with the 1 Year Yield Curve since Oct 2015 when SSB was started (Click on the chart, move over the line to see the actual yield for that month):

What is this Singapore Savings Bonds? Read my past write ups:

- This Singapore Savings Bonds: Liquidity, Higher Returns and Government Backing. Dream?

- More details of the Singapore Savings Bond. Looks like my Emergency Fund nIsow

- Singapore Savings Bonds Max Holding Limit is $100,000 for now. Apply via DBS, OCBC, UOB ATM

- Singapore Savings Bonds’ Inflation Protection Abilities

- Some instructions how to apply for the Singapore Savings Bonds

Past Issues of SSB and their Rates:

- 2015 Oct

- 2015 Nov

- 2015 Dec

- 2016 Jan

- 2016 Feb

- 2016 Mar

- 2016 Apr

- 2016 May

- 2016 Jun

- 2016 Jul

- 2016 Aug

- 2016 Sep

- 2016 Oct

- 2016 Nov

- 2016 Dec

- 2017 Jan

- 2017 Feb

- 2017 Mar

- 2017 Apr

- 2017 May

- 2017 Jun

- 2017 Jul

- 2017 Aug

- 2017 Sep

- 2017 Oct

- 2017 Nov

- 2018 Jan

- 2018 Feb

- 2018 Mar

- 2018 Apr

- 2018 May

- 2018 Jun

- 2018 Jul

- 2018 Aug

- 2018 Sep

- 2018 Oct

To get started with dividend investing, start by bookmarking my Dividend Stock Tracker which shows the prevailing yields of blue chip dividend stocks, utilities, REITs updated nightly

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Wil

Wednesday 10th of October 2018

Hi, Thanks for sharing. We can see some company earn interest from their free cash. Do you know if those company invest in government bond or others to earn interest? Is there any safer bond or investment choice for company with free cash instead of putting inside bank for fix deposit?

Kyith

Wednesday 10th of October 2018

bonds are usually debt instruments and is a bit different from fixed deposit. it depends on company whether they would put their spare cash into government bonds. There will be those that do that but on a shorter duration basis.