The charts below are not the charts of some crypto or meme coins.

They are the electricity prices in France and Germany and UK gas prices.

Let us not focus on the absolute prices, but on how many times more expensive it is than what it was for a long time.

This is something that the citizens in Europe have little control over. The governments where they lived decided upon a future energy policy in the past that resulted in the prices today. Every government would do that. However, the implemented plan has a crucial supplying country.

When the country is cut off or realizes that they have “cornered” its buyers due to the degree of supplier power it had, the buyers end up in a shitty situation that they cannot get out of easily.

The plans were set in motion many years before.

Unfortunately, the people with little control are the most affected.

The people of Europe are not handling the increase in prices very well

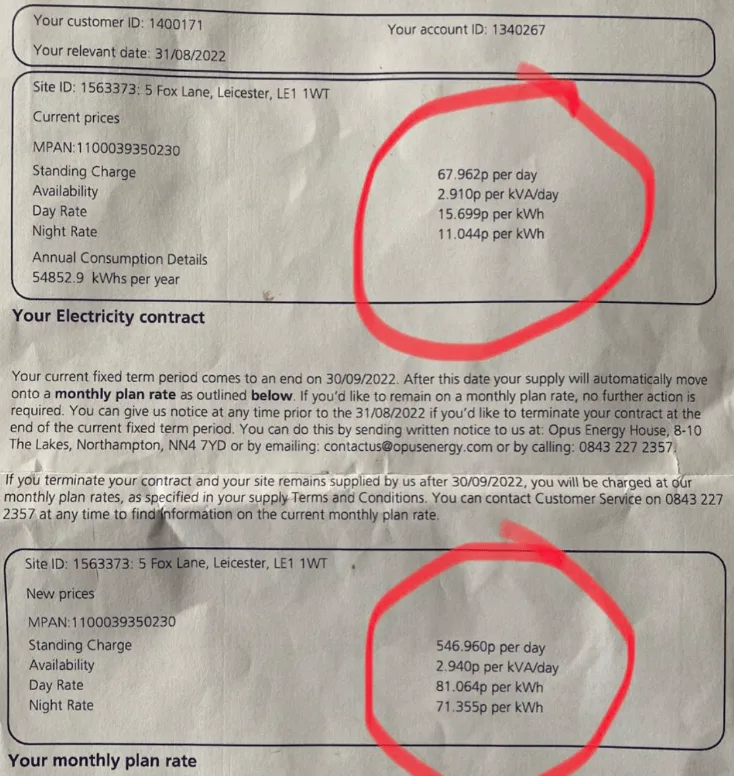

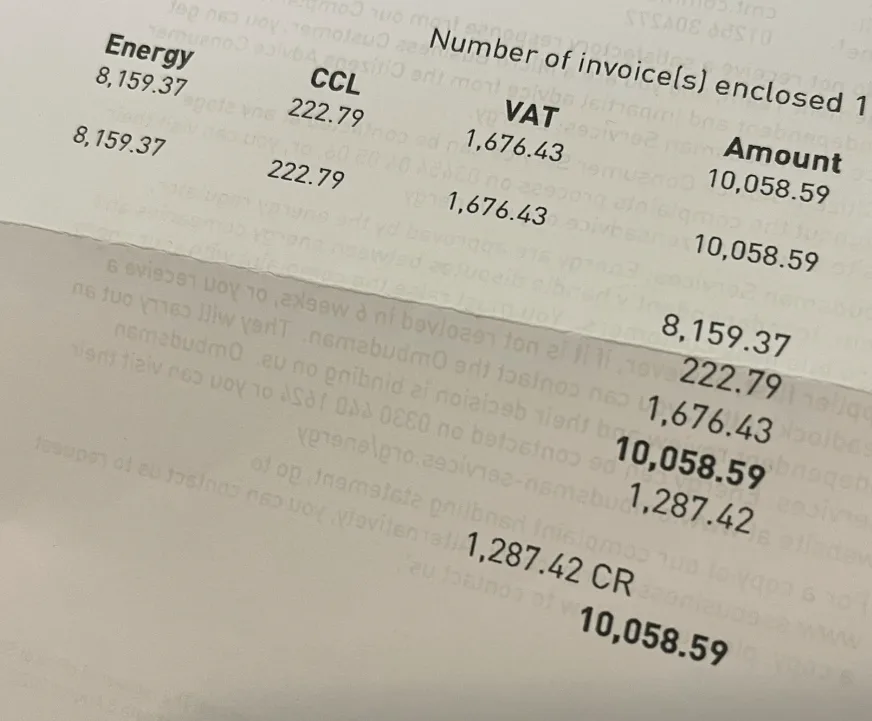

The people operating businesses are most affected by the increase in prices. Over the past weeks, we saw viral photos of shockingly high energy bills by badly affected people.

Geraldine Dolan from Ireland saw the cost of electricity to her coffee shop, Poppyfields cafe, rise to a $10,000 Euros figure and wondered if she could continue operating her 16-year-old coffee shop.

A fella on Twitter called Crab Man put together all the similar cases which contextualize the European energy situation:

Her mom’s electricity bill jumped from 10,000 to 55,000 a year. She is deliberating whether to close.

The energy bill for a small family-run business that has been operating since 1982 went from 900 pounds to 10,058 pounds.

Bournemouth’s pub cum bed & breakfast had to cease operations when the utility bill increased by 58,000 pounds.

A fish and chip shop’s monthly electricity bill went from 1,200 to 5,200 pounds, and it had to cease operations.

What could we do if this happened to us?

Singapore nearly had a moment when our important chicken supplier Malaysia stopped exporting their chickens. In the past, our water supplier indirectly threatens our supply.

The war in Russia and Ukraine will likely surface a question in government, and the people’s heads: How resilient are the supply of different items we need?

We always plan for uncommon problems that can happen to our business or ourselves. Still, I am pretty sure that before this, not many business owners would anticipate that utility bills would bring down the business that determines their livelihood.

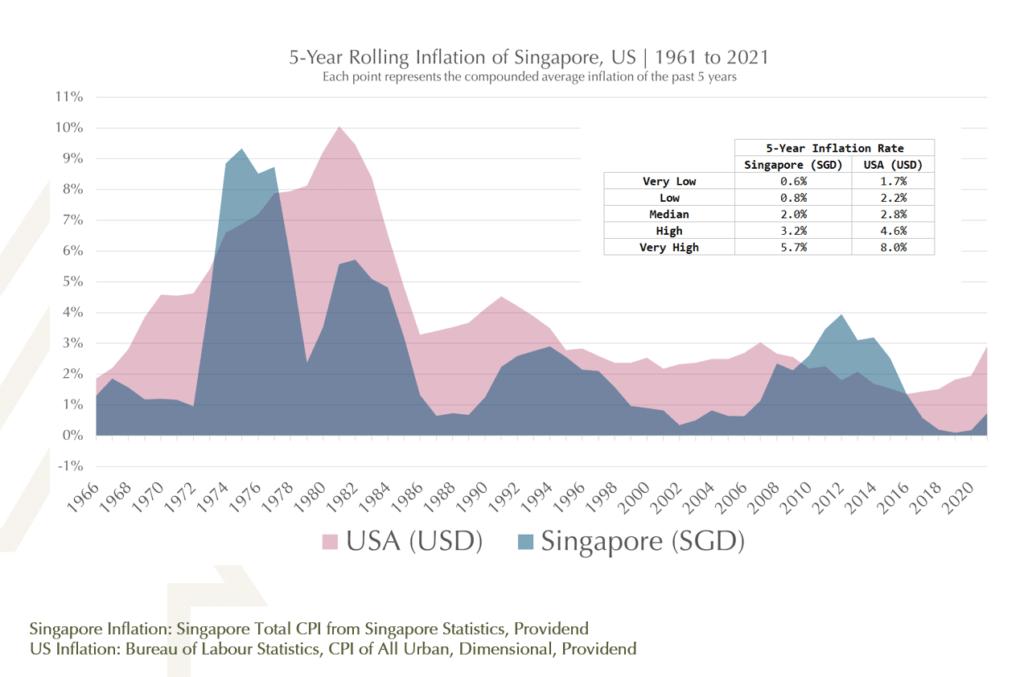

A couple of weeks ago, I provided an internal update on the historical inflation rates that may concern our clients. This is one of the slides.

It gives advisers handle on just how bad inflation could get and it also helps us reflect upon the planning norms that we use.

The challenge in planning is that it is not always right to plan for very pessimistic scenarios. But it doesn’t mean that those uncommon situations won’t happen.

When you are living through those situations, it is not a planning exercise anymore. You might not get through your retirement or have enough funds for your children’s education.

How helpful will it be if we plan with 3% inflation and I live through a period of 10% inflation for five years?

I am sure many of these business owners have buffers, which may be derived based on a common rule of thumb.

But what if a rare occurrence of great magnitude hits?

Planning can do a lot, but it does not solve everything.

Here is a roughly mental framework to look at it:

- Understand how the system works. Find out the range of possibilities the system will experience. This may be based on historical or theoretical.

- Ask yourself the magnitude of the repercussions you, your team, or your team can tolerate.

- The degree of buffer to set aside will be determined by #1 and #2. Try your best to be conservative. Conservative is determined greatly by your work in #1.

- If all else fails, you would have to rely on grit.

We might frequently question whether we had too many emergency buffers or whether we should reduce the opportunity cost of having our emergency buffers in cash. We should always remember that an emergency is something we have not thought about and, therefore, difficult to plan.

It always make sense to have an emergency fund but also recognize that it may not be enough.

Events like this will make us reflect upon the degree of our conservatism.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

- Should I Take Less Risk in My Fixed Income Allocation by Moving Away from a Global Aggregate Bond ETF? - May 5, 2024

- Singapore Savings Bonds SSB June 2024 Yield Climbs to 3.33% (SBJUN24 GX24060A) - May 3, 2024

- New 6-Month Singapore T-Bill Yield in Early-May 2024 to Stay at 3.75% (for the Singaporean Savers) - May 2, 2024

Steveark

Thursday 1st of September 2022

As an older reader I've lived through much worse inflation than current and it isn't that big a deal. Paychecks go up to cover inflation, coffee prices go up enough to keep mom and pop shops in business. Some may blame their failing business on higher energy prices but its likely they were already teetering on the brink of failure because the market corrects prices for increased costs very quickly, it's quite efficient. Any cost that applies equally to all competitors is just passed on to customers like magic.

Kyith

Tuesday 6th of September 2022

Hi Steveark, i think those retiring will find it a bigger deal.