A few months ago, I began searching to see if there is a short-term, safe alternative to our usual fixed deposits on Interactive Brokers.

Interactive Brokers is my go-to securities custodian platform, and if there is a way for most of my funds to be securely stored there, I will instead the funds be securely stored there. This is not a really pressing need because if you have more than $10,000, the cash balance in your Interactive Brokers also earn interest.

You can read my post here for more explanation: Interactive Brokers Very Liquid, High-Interest Cash Account.

If I have US$100,000 in cash and an Interactive Brokers net asset value of US$100,000, the blended rate is 4.3% p.a. If I have SG$ 135,000, the blended rate is 2.46% p.a.

These may not be the best rates but if you are not so fussy about things like me, and would prefer things to be easy, this is not too bad.

But some readers would say that the first $10,000 don’t earn any interest in IBKR.

I may also have a unique problem because I am using IBKR LLC and since IBKR LLC is incorporated in the United States, cash deposits in brokerages (not banks), by the rules may be subjected to estate taxes. The estate tax may amount to 18-40%, which can be hefty.

So it might be wiser for me to keep those liquid funds invested in something liquid. Life is always filled with challenges if you want your funds to be safe, earn more, and be liquid at the same time, but don’t get taxed potentially.

If so, do you have any options?

Very Short-Term Duration Money Market/Fixed Income ETF Options

Since Interactive Brokers mainly deal with securities, the best is to search for whether there are money market ETFs that are incorporated in tax-efficient countries.

I use the IBKR, so the natural options are those ETFs domiciled in Hong Kong and UCITS ETFs listed on the London Stock Exchange. If you are using IBSG, there may be Singapore ETF options available since you can trade in the SGX.

In Hong Kong, I found the following:

- CSOP US Dollar Money Market ETF | Hong Kong Domcile | 0.35% ongoing charges | US Dollar | US$475 mil AUM

- CSOP Hong Kong Dollar Money Market ETF | Hong Kong Domcile | 0.30% | Hong Kong Dollar | HK$5 bil AUM

- CSOP RMB Money Market ETF | Hong Kong Domcile | 0.61% | Renminbi | CNY 295 mil AUM

Those are good options if you need them but CSOP always have very high ongoing costs and it is a question whether I can go lower.

I need to be clear that I don’t have many options so I cannot just look at costs.

Over at London, there are definitely options denominated in EUR and GBP but did not fit my needs.

We have the following options:

- Vanguard U.S. Treasury 0-1 Year Bond UCITS ETF | Irish Domcile | 0.07% Ongoing costs | US$602 mil AUM

- iShares $ Treasury Bond 0-1 yr UCITS ETF | Irish Domcile | 0.07% Ongoing costs | USD$7 bil

- JPMorgan ETFs – BetaBuilders US Treasury Bond 0-1 yr UCITS ETF | Irish Domcile | 0.07% | USD$2.2 bil

- JPMorgan ETFs – BetaBuilders US Treasury Bond 0-3 Months UCITS ETF | Irish Domcile | 0.07% | US$378 mil AUM

- iShares $ Ultrashort Bond UCITS ETF | Irish Domcile | 0.09% Ongoing costs | US$1 bil

- JPMorgan ETFs – Ultra-Short Income UCITS ETF | Irish Domcile | 0.18% | USD$251 mil

Almost all the options are in USD. Of course, I have reservations about having money in another currency that is not SGD but we got to worry about that later.

Most of these ETFs have a duration closer to 0.4-0.6 years which means that the value of the bond is less affected by market interest rate fluctuations than longer duration bonds.

Out of all these, I decided to put my money in the iShares $ Ultrashort Bond UCITS ETF (ERNA ticker symbol).

What is the iShares $ Ultrashort Bond UCITS ETF | ERNA

The iShares Ultrashort Bond (ticker symbol ERNA) is a very short-term bond fund that holds a portfolio of bonds that are due to mature soon.

ERNA sits in the nice balance between:

- Accessible through IBKR, IBSG and works well with my margin account.

- Very short duration thus not much negative convex sensitivity to interest rate changes.

- Since it holds corporate bonds, there is a certain credit premium (read that as compensated risk) to earn above-risk-free government bonds.

- It is diversified enough.

What does the fund invest in?

The fund invests in a portfolio of short-term corporate bonds that will be maturing soon (we will go into how soon later). The fund tracks the Markit iBoxx USD Liquid Investment Grade Ultrashort Index (see S&P factsheet of the index here).

The bonds must be corporate credit backed by corporate issuers that are not secured by specific assets. Debt issued by governments, sovereigns, quasi-sovereigns, and government-backed or guaranteed entities is excluded.

The bonds must have a maturity of less or equal to one year.

Corporate bonds tend to be riskier than government bonds, but there is a sweet spot where you can earn a better return while not taking very, very little risk.

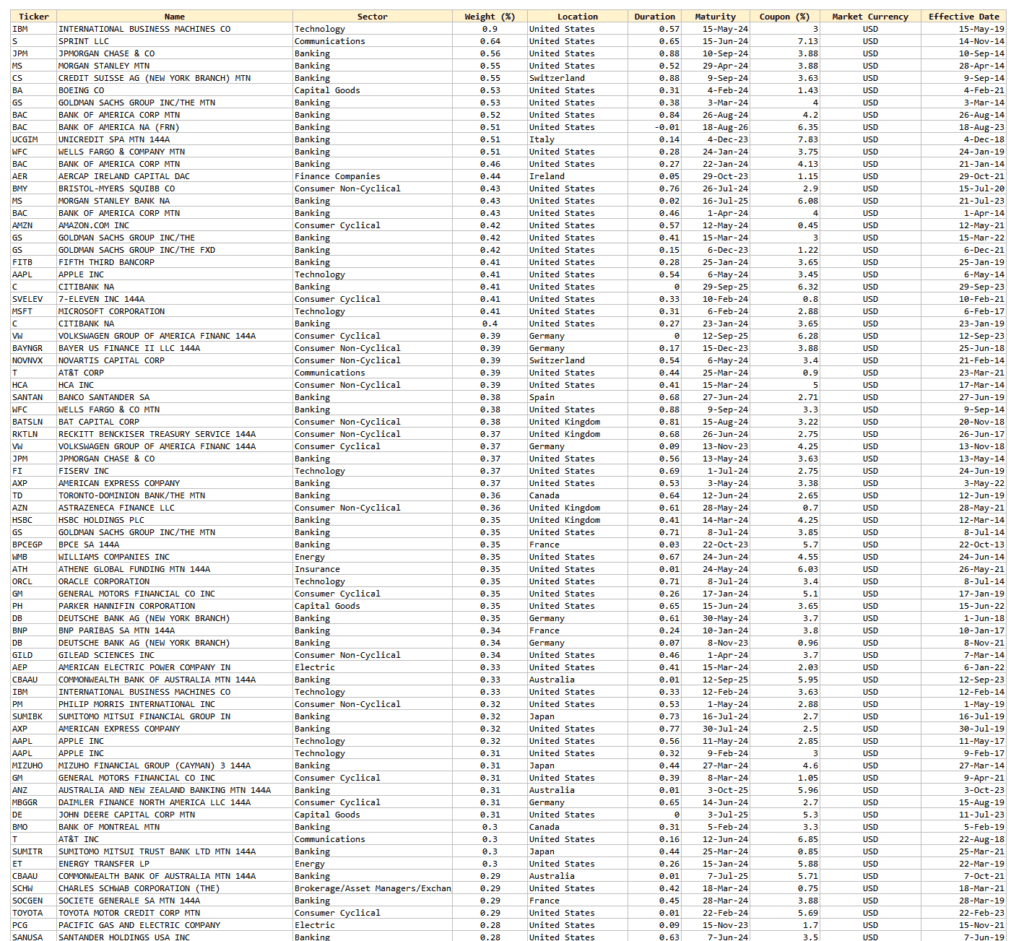

Currently, the portfolio is diversified among 582 USD maturing bonds.

The nice thing about an ETF structure is that ETFs publish what they hold and update on a daily basis. You can go to Holdings and take a look.

The top 10 issuers held 17% of the 582 bonds, with the biggest % being Goldman Sachs issuing 2.55% of the bonds.

It is important to be diversified enough in case there is a blow up in one company.

The issuers are some of the biggest MNCs.

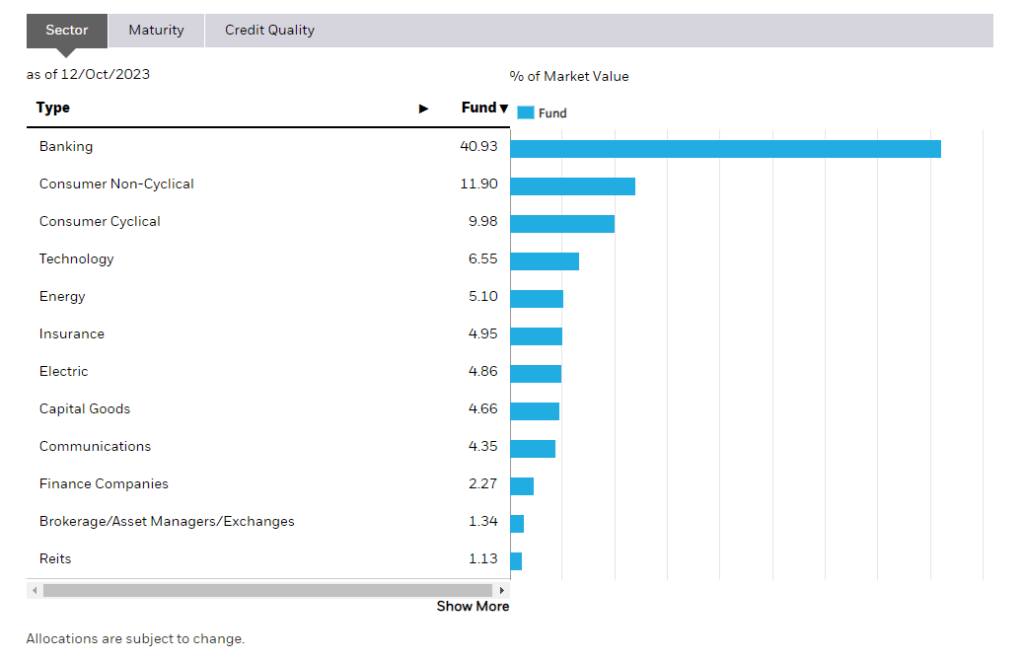

The knock on ERNA may be the number of banking issuers. My thoughts is that there will always be banking uncertainties, whichever time period and these are some of the banks that went through the Global Financial Crisis and have gone through more stringent capital requirements audits.

But if you are uncomfortable with this, then there are the non-corporate versions I listed that will still do the job for you.

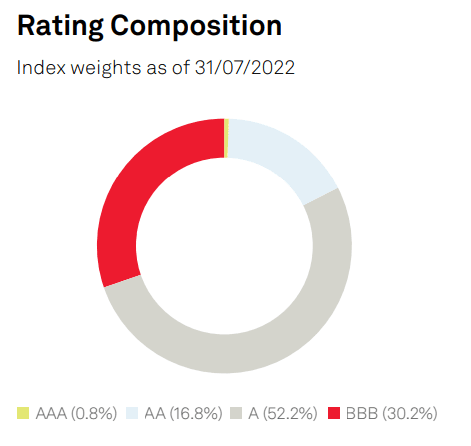

Investment Grade Bonds

As the fund do not invest in government securities, there are some credit premium to be earned.

As stated in the index factsheet, the majority of the bonds are not AAA rates but above investment grade.

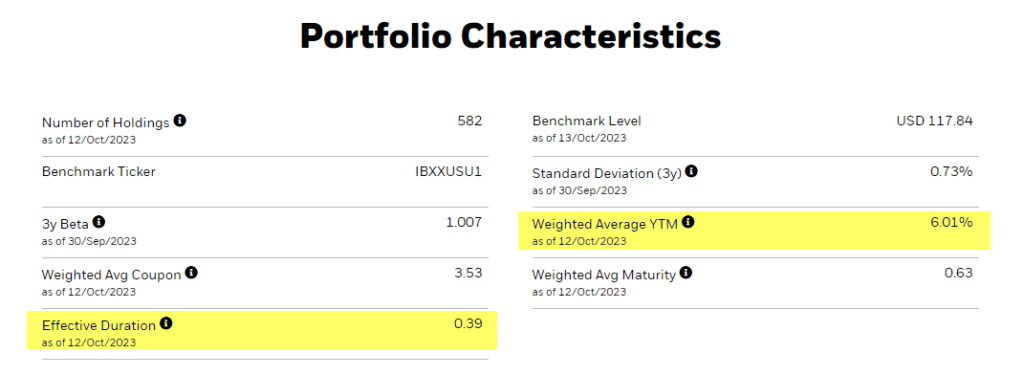

The Average Yield to Maturity and Duration

The weighted yield to maturity tells us the annualized return that you can get from the coupon payments and where the price fo the bond is traded.

The current weighted yield-to-maturity is currently at 6.01% p.a.

When I started investing in this, it was closer to 5.5% p.a. I look upon the yield more as a return that I can get in short-term bond issues that I cannot get if I were to purchase the bond myself.

I do expect the returns to move around but currently, whether it is 3% or 6%, it is a good enough return for me for the purpose. I will talk more about financial planning later.

The effective duration tells us the sensitivity of the bond price changes due to movement in the market interest rates. If market interest rates go up, prices of issued bonds go down, and the question is to what degree. If the duration is short, and ERNA is 0.4, we do expect the changes in market interest rates to less affect ERNA.

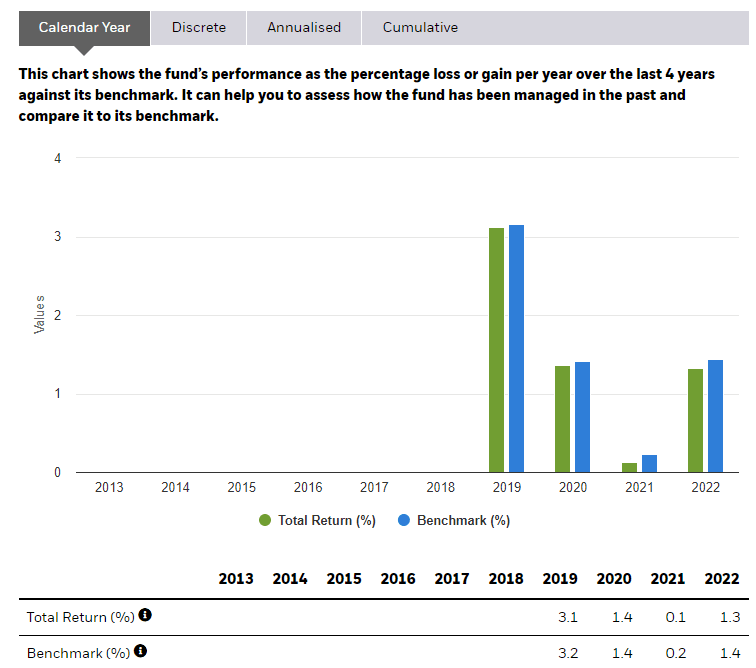

The current YTD returns of ERNA, which is an accumulating ETF, is 4.1% and here are some of the past calendar year returns:

Here is the price chart of ERNA using TradingView:

Since ERNA is an accumulating ETF, the prices reflect any of the coupons distributed to the fund as they were not paid out but reinvested instead. We can see clearly that someone in June 2022, the interest rate started to really climb.

But what may have caught your attention is the big drawdown in 2020.

During the Covid-19 period, many bond ETFs saw massive price volatility. This is because the actual bond market tends to be less liquid, and during Covid when there is greater selling (due to fear) and buying, if you want transactions to take place immediately, and there is no price discovery, the bid-ask spread wiiiiiiiiiiiidddddeeeens to a great degree.

If we discuss the net asset value of the underlying, the prices are not as wide.

When prices start stabilizing, you can see the price returns to normal. For those who unluckily requires liquidity at that period, they may be shocked by what they got.

Besides the currency risk, this is the second most unsettling thing for me. I wonder if another crisis that worries bonds will unhinge things this way. If this is a sticking point, you can always go for the non-corporate ETF version (IB01).

Currency Risk

The ETF is denominated in USD, which is the reserve currency of the world.

Everyone has different opinions about the USD. If you are living in an emerging market country that is not called Singapore, you would prefer that to your home currency (if you are not spending it). This is because the currency devaluation risk for your home country currency is bigger.

But the Singapore dollar is one of the strongest currencies in the world and that may create a problem.

In general, it is our preference to invest in a money market fund that is in SGD but if we don’t have a choice, we need to agree that there is a risk to our plan and decide if it is worth the risk.

In my mind, the yield that we can earn on the ERNA when converted to SGD is about 1% less so I am looking at a 5% return instead of a 6% return. There is a parity theorem that means it is not worthwhile to seek a higher value interest deposit because the currency effect tend to efficiently priced in the better rate.

I thought about the risk and decided to take it because in my opinion, I also don’t wish to be in ERNA forever. I would eventually rebalance it to equities or longer-maturity bond ETFs.

The Financial Decision Making

The ERNA is suitable if:

- You want a more efficient way to earn returns and not suffer volatility compared to leaving your cash monies in IBKR.

- You want a fuss-free way to capture the inverted yield curve as you see rates staying the way it is for a while.

- Aside from funds that you can deploy elsewhere for higher returns but smaller quantum, you have excess monies.

The risks are:

- Some underlying bond defaults may translate to capital losses. While I don’t think the risk is big, it is possible.

- Currency fluctuations. USD to SGD can shift by 3-6%, and this could wipe out your returns if you have short-term liquidity needs.

- Risks that even Kyith failed to see.

I think whether is the ERNA, or IB01, these are large AUM, very low ongoing cost ETFs for you to consider.

I know that the yield looks very attractive now but from a financial planning perspective, I look at the ERNA as something that I prioritize liquidity, fuss-free, and access to inaccessible bond returns than the actual returns itself.

My Comprehensive Interactive Brokers How-to Guides

Interactive Brokers is a great low-cost, financially strong brokerage platform that can be the standard broker for holding your long-term investments. You can access 150 global exchanges, including exchanges such as Singapore, the US, Hong Kong, London, European and Canada.

You will enjoy cheap commissions and zero minimum recurring platform fees or maintenance fees. Convert your funds to different currencies at near-spot rates, paying a flat US$2 fee.

To get started or become familiar with Interactive Brokers, check out my past articles on how to invest with Interactive Brokers. I hope the guides make your life and investing experience easier and brighter.

An Easy Step-By-Step Guide to Setup Interactive Brokers (IBKR)

How to Fund & Withdraw Funds from Your Interactive Brokers Account

How to Convert Currencies in Interactive Brokers

How to Buy and Sell Stocks and Securities on Interactive Brokers

How Competitive are Interactive Brokers Commissions Pricing?

How Safe is it to Custodized Your Money at Interactive Brokers? The things they do better than other brokers.

How Safe is it to Custodized Your Money at Interactive Brokers (2)? Financial strength of IB during recent banking crisis and during Great Financial Crisis

Interactive Brokers have Eliminated the US$10 monthly inactivity fee. More details here.

How to Transfer your shares from Standard Chartered Online Trading to Interactive Brokers

How to trade after-hours and premarket

Create Customized Reports and automatically send them to your email

What is the PortfolioAnalyst Report and Automatically Send the PortfolioAnalyst Report to Your Email

Send Money from TransferWise to Interactive Brokers

Interactive Brokers’ Fluid Interest Income on Cash

Introducing IMPACT by Interactive Brokers

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

J

Friday 27th of October 2023

Just some follow-up thoughts - you get about 70bps more for comparing the Ultrashort Bond UCITS ETF vs the 0-1 YEAR UCITS ETF.

That's not unsubstantial if our goal is to earn a slightly higher return than the risk free rate without taking too much risk.

That being said, if the goal is to be more of a cash replacement (especially if the idea is to deploy it in a market sell-down), than an ETF with only T-Bills would probably be more appropriate to rule out a situation like March 2020 when liquidity dried up until the Fed intervened.

Just food for thought!

Kyith

Saturday 4th of November 2023

Hi J, that thinking is not wrong there. I considered that and in another time period, I would have gone with your option. Thanks for fleshing out your thoughts.

RJS

Monday 16th of October 2023

Hi there Can you compare these shorter duration bonds to something like AGGU? Also there is SDIG but that seems to be 0-5 years.

Kyith

Monday 16th of October 2023

I think the tenor for the two are rather different. There is nothing special to both. They are just two different group of bonds and which is applicable for what purpose.

J

Sunday 15th of October 2023

Was just looking at this yesterday myself.

There'a also the JPM BetaBuilders US Treasury Bond 0-3 M UCITS ETF USD Acc.

Shorter duration than the 0-1 Year Equivalent ETF

Kyith

Sunday 15th of October 2023

HI J, thanks for pointing that out! IT is definitely good to have something even shorter term than this.