Some things will run counterintuitive to a full retirement, in my opinion.

Jack Raines over at Young Money wrote about why people that are objective rich will have financial anxiety.

Alex Lieberman made the Tweet above after securing life-changing money (high eight figures).

I never had that kind of money so I am not so sure where the financial anxiety could come from until I picked this out from what he wrote:

3) Comparison to others

When talking about money, wealth is all about your reference point.

I’m in a text group of founders who sold their businesses.

To some I’m wealthy, but when folks are worth 9-figures and talk about flying private and building their 4th billion dollar business, I don’t feel wealthy financially.

Comparison really is the enemy of contentment.

Oh.

Some of you think the problem can be easily solved if you don’t compare yourself to others.

I disagree because there is a lot of levels to this “You should not compare yourself to others”. We also run into a problem of not you, but your spouse comparing yourself to others.

He or she has aspirations, and is it wrong for the family to deny those aspirations?

Financial Independence with the Whole Damn Pyramid

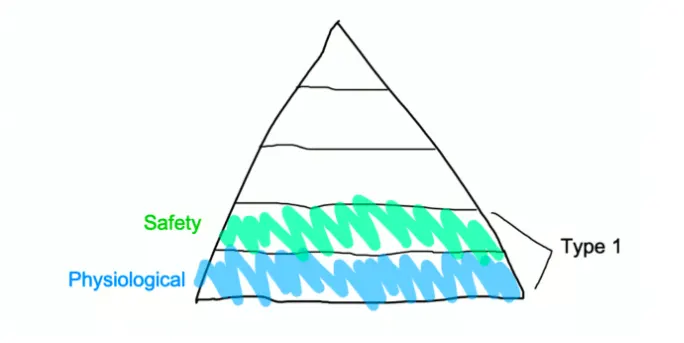

Jack thinks that Maslow’s Hierarchy of Needs help explain why these very, very well off people would still have financial anxiety:

There are a few levels to the pyramid that illustrate Maslow’s concept of what motivates our behaviour. Actually, what Maslow had in mind was not a pyramid but more of a ship but we can work with a triangle.

The hierarchy of needs shows what will make us more fulfilled. As we get higher, we will be more fulfilled.

The first two levels or first few levels, for a modern nation like Singapore, are easier to fulfil. As long as you have a roof over your head, have hot water, got light and food, you should be pretty ok.

Jack says that money usually solve these set of problems easily because they are more clear-cut.

If you ask Kyith, Kyith will not say it is clear-cut because Kan Ni Nah, everyone tries to squeeze more and more things into the first two levels!

But I do think that if you wish to secure your physiological and safety needs, and you are not doing the Kan Ni Nah things of trying to squeeze more and more into it, you can have an investment portfolio that can provide income to address that more easily.

For a modern progressive country, fulfilling safety and physiological needs is not enough.

And that is where the problem lies.

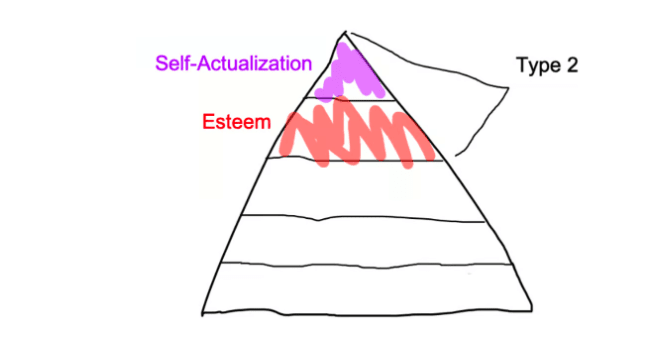

There is a set of questions you have to deal with in seeking fulfilment at the higher part of the pyramid:

Is your work fulfilling?

Are you living up to your potential?

Is everything going to come crashing down?

Can you maintain your lifestyle?

Are you underachieving in relation to your peers?

Will you lose your social status if your business fails?

There is something unique about them: They can be very personal to different people.

Some say the remedy is not to compare and keep things simple. But if that is the case, how come one cannot have a stream of income that fulfils his or her needs?

If it is a question of not having a surplus (income minus expenses) that is high enough that gets you close to it, if your needs are “not that much”, then there are more people that should be financially fulfilled.

But still many are chasing.

The reason is that to have safety, and fulfilment, to a degree that you feel satisfactory is different for each of us.

Every time I hear the comment: “We really don’t ask for much.” and then I hear what is considered not asking for much, I realize what people want is really a lot more than my own personal barometer.

But am I using a questionable barometer or are they asking for much.

It may not matter.

But if you want everything in that pyramid, especially if you want to be financially secure yet fulfilled, it will just cost a bomb.

And there are various degree to independence or security.

If you wish for high certainty, it would cost at least two bombs.

There are some things that you can’t fulfil that well if you retire fully. Most just don’t want that salary to be a strong consideration whether they should take that job or endeavor.

If so you don’t need near financial certainty for some of these spending line items.

In fact, you might appreciate it if you had to work for it.

- Save up, invest well and create a stream of income to fulfil your physiological and security needs.

- Save up well for some areas of fulfillment that is very important to you. Perhaps your children’s needs such as their future education, tuition and tertiary education cost are some.

- Work for the rest. Discover life while not having to worry about #1 and #2.

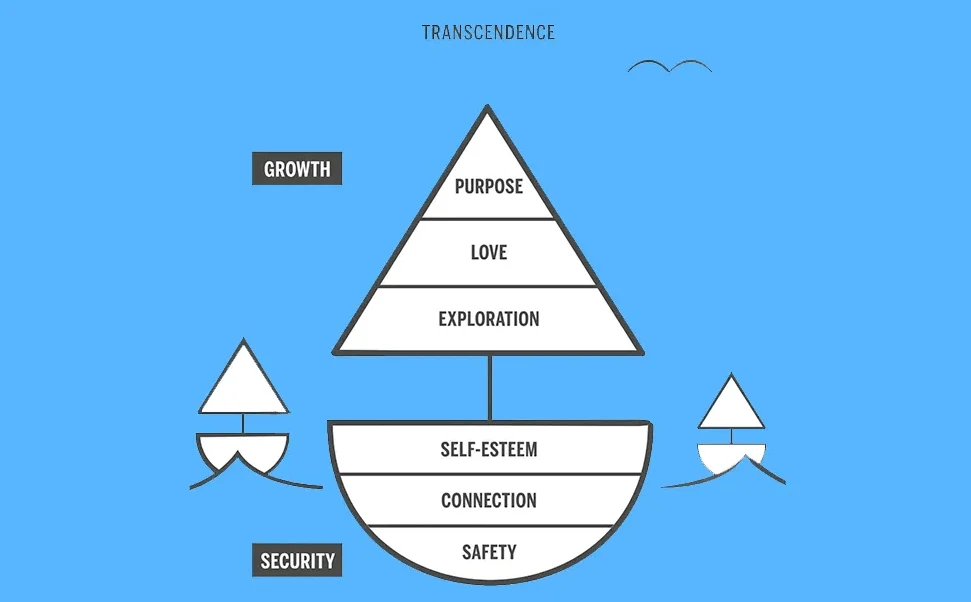

Update: Some of you may be curious how a non-pyramid Maslow Hierarchy of Needs look like.. Well it may look something like this:

I really like this illustration. Put it out clearly Security and Growth. You may find it easier to secure security but the growth part is more subjective.

You might need to do some garang paid work to reach personal fulfillment.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

lim

Sunday 15th of October 2023

Like Sinkie said, its pretty obvious what the problem is. He is in a chat group where others are showing off their private jets and luxury lifestyle.

The reference to other persons being successful with their 4th business when it appears he only had 1 successful business is that he doesn't know whether he was just lucky with the 1st business - and if he tries again with his money, is he going to lose it all because he isn't as lucky the 2nd time?

https://investmentmoats.com/money/luck-role-lives-big-fall/

Kyith

Monday 16th of October 2023

Hi Lim, even if he is not in that chat, i think by virtue that that is his cliche, he is bound to be in that groove. When I am trying to be a better investor, being with like minded people is a way to get better, but the down side is that we cannot stop the side effect of comparing performance.

Sinkie

Sunday 15th of October 2023

LOL solution for Alex L is to remove himself from social media groups & just focus on what is shiok enough for himself & family.

In terms of the psycho aspect, I prefer Equity Theory of Motivation compared to Maslow's Hierarchy of Needs. Perception of equity explains a lot of human behaviours. It was developed to focus on employee behaviour but fundamentally it applies to all aspects of socioeconomic behaviours.

https://en.wikipedia.org/wiki/Equity_theory

Kyith

Monday 16th of October 2023

Hi Sinkie, thanks for the introduction. When I read a brief description, it feels more like being more equitable in a group. Perhaps i would need to understand more.