In this post, I will explain further about the main portfolio which makes up the majority of my net wealth.

The bulk of this portfolio was published on Investment Moats for quite a while because I wanted a way to show people how to use my FREE Google Spreadsheet, which many have said is a pretty good way to track your portfolio by transactions ( You can read more and get the spreadsheet here).

However, many have also explained that my spreadsheet looks like a zoo. This is because the spreadsheet is not just about tracking what we currently have but what we used to have. So many of the line items would be what I own last time.

Anyway, as part of my notes series, I wanted a way to consolidate my thoughts about the portfolio.

I don’t really have a name for the portfolio, but I name my two portfolio spreadsheet (one which is still private) Daedalus and Crystalys, and I am lazy to change the name so the name of this portfolio is Daedalus. (I could have called the two portfolios Sange and Yasha in another parallel universe).

Okay let us not waste too much time.

Note: Before we start, do note that I use my notes section to explain my plan for my own personal situation or for those people I am planning for. Your own situation may differ from me so you should read this more as a contrast to your own personal situation, and find similarities or differences. You can treat similarities as some sort of validation another person is doing the same thing, and should ponder about why I do some things differently from you. Don’t treat this as the blueprint to financial Nirvana.

The Goal of the Portfolio

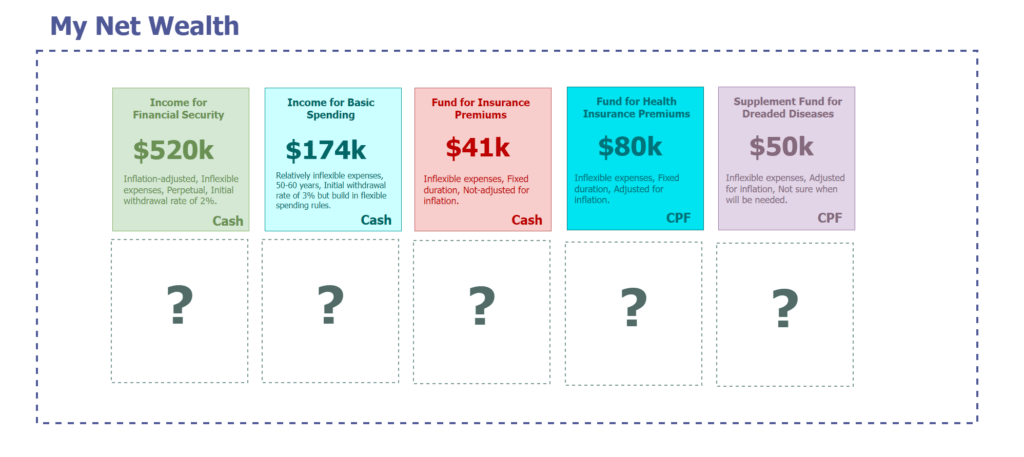

In my early notes, I mapped out the life goals that I have and financially how I matched up with those goals. They are illustrated in the diagram below:

I have not mapped out all the goals and how much to fund them with (this is a first world problem), but what you see above is what I have thought of at this point.

Daedalus’ goal is to provide income for Financial Security and Basic Spending if I were to leave my job. From the illustration, we can see that what I need is about $694,000 in total.

You can read more about these two goals if you go to my notes section:

I would keep repeating to my readers and Telegram group members: The characteristics of the goal drives how you shape the portfolio.

So before you even think about the portfolio, it is good to think about the characteristics of the goal.

My most essential spending is more demanding because the income stream I prefer it to be

- Perpetual,

- inflation-adjusting (even more than 3% p.a. if required),

- and consistent enough.

There can be more leeway for my basic spending in reality. For example, if the portfolio is not doing well, can I delay the purchase of a vacuum cleaner or some service appointments a few months? Sure. But that spending will have to be carried out, but there is some flexibility.

However, given the degree of my wealth, I think I can group these two goals together, and they will eventually be provided by Daedalus.

Current Value of the Portfolio and Projected Income

This portfolio was painstakingly accumulated since I started working. No cash flow has been extracted from the portfolio. Since end 2021, I have not added money from my salary into the portfolio except for SRS contribution if I am working to reduce the taxes.

As of 7th April 2024 the value of the portfolio is $1,371,000 (rounded to the nearest thousands).

The current portfolio value is much more than the need that I explain in the previous section ($694k) which means that I have provided for more than enough. I could extract almost half of it for other financial goals but at this moment, there isn’t a lot of other goals to carve out for and to make things simple, I would leave this as it is.

In both these notes:

- How much do I need to provide a perpetual income to fund that lifestyle?

- Aside from my most essential spending needs, I need $5,160 yearly for my basic needs. I would set aside $174,000 to provide income for it.

I explain my plan to safely provide a consistent, inflation-adjusted income stream perpetually and most of my ideas is based around the amount of income we start drawing out from the portfolio, relative to the portfolio value.

This is also called the Safe Withdrawal Rate framework. (Comprehensive article, and my YouTube explanation)

I don’t want to go too deep into this and if you are interested you can read more in the two links above.

My experience tells that whether you can have a safe or less safe income stream is less about your investment portfolio (still important) but more about the financial planning part of things.

Given the overall cost of my portfolio, if I were to start spending from Daedalus, I am comfortable if we start with 2% to 2.4% of the portfolio, the income stream can last a long time and should be rather conservative.

So the projected inflation-adjusted income will be between:

- 2%: $1,371,000 x 2% = $27,420 yearly ($2,285 monthly)

- 2.4%: $1,371,000 x 2.4% = $32,904 yearly ($2,742 monthly)

This is a conservative income stream that should withstand some challenging scenarios that will normally make your minds anxious if your income strategy can withstand such scenarios.

My Portfolio Allocation

Over the years, I realize that we all have different framing how we divide our portfolio or our strategy. I have some weird stuff over the years as well.

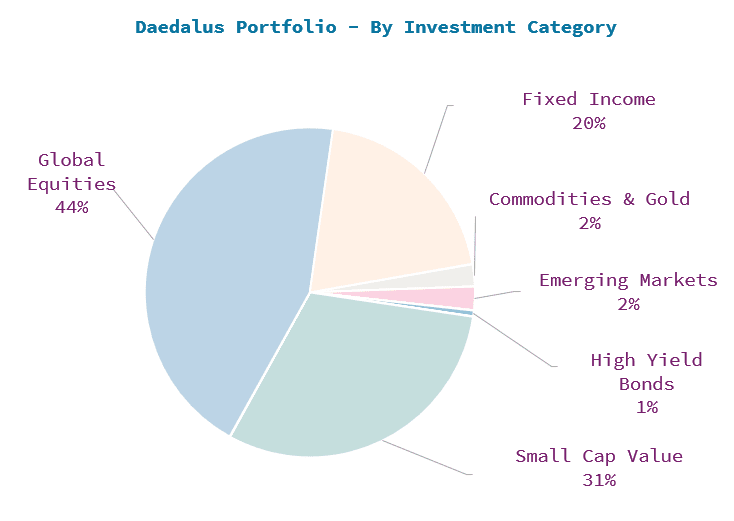

I broke down Daedalus in a simple manner as below:

These will be broad categories. Global equities, Small Cap Value and Fixed Income, dominate most of the portfolio. There is no “this is an income portion”, or “this is a buffer portion”, or “this is for growth”.

Those are framing more inline with financial planning (the first section we talked about above).

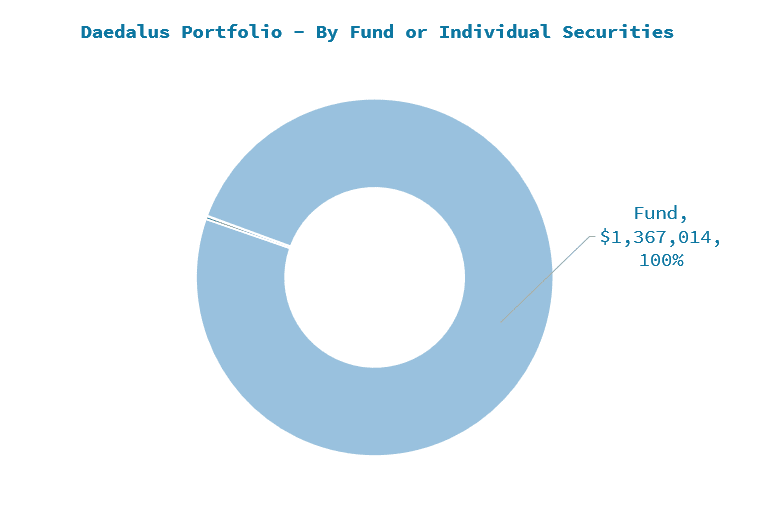

The chart below breaks down how much of Daedalus is made up of fund or individual securities:

I will explain more about the portfolio in the subsequent sections.

Daedalus is a Very Passive, Strategic, Systematic Investment Portfolio Strategy

What does this even mean?

- Strategic: Set an asset, regional allocation for the long-term and don’t change it. The opposite of strategic is to be tactical. In tactical allocation, you have an opinion about how the market will do in a certain timeframe, and you re-allocate your portfolio based on this opinion. Some folks can have a mix of X% Strategic then (1-X% Tactical).

- Systematic: The decision to buy, sell or hold the underlying securities takes place in a rules-based manner. These rules are backed by enough empirical evidence that allows us to evaluate the spectrum of possible outcome. The opposite of being non-systematic or non rules-based is to very much invest based on opinion. Investors can implement systematic investing at their wealth management layer or through funds that make their decisions in a rules-based manner. Investing in index-tracking funds, factor or Smart beta funds, and some quant hedged funds are examples of systematic investing.

- Passive: Due to the decision to be Strategic and Systematic, the portfolio should not require the owner to intervene. There is very little “should I sell away this fund to buy another fund” or “should I take profit on this individual stock”. Or “I need to investigate and analyse this opportunity”. A passive strategy should be one where you make very little actions or have very little of your mental capacity occupied by it.

I don’t expect to change the asset allocation much.

The decision to be tactical is often more link to needing a return that is higher than what the market portfolio can provide, adjusted for the risk.

Daedalus doesn’t need to chase returns anymore and the volatility of the portfolio or the income that is needed is managed through the financial planning layer through the very low safe withdrawal rate.

I will explain in sections below what I would change to the portfolio.

I prefer the portfolio to be strategic and passive going forward, but I understand that coming from a background where I have been operating as a retail portfolio manager for a while, this may be challenging. I would rather say I aspire for the portfolio to be strategic instead of saying it will definitely be strategic.

Daedalus can be passive, and systematic because the portfolio manage (Kyith) delegates almost all the work to the underlying funds.

What Will Drive the Portfolio Returns

The returns of our portfolio will be driven by the degree of risk we take in our portfolio.

- If we want the returns of a biotech sector, you got to be exposed to the risks of investing in the biotech sector. Similarily, if you wish to be ready for the return of growth in China, you need enough exposure. You cannot only have the returns but also be expose to some sort of risk there.

- However, there are some risk, as a result of your own/family situation that you cannot take so much risk so you have to reduce the risk exposure, which may reduce the potential returns you can earn. There is a trade-off.

I will not explain too much here but what will drive my portfolio returns explain this in detail.

Let’s review the portfolio through various framing.

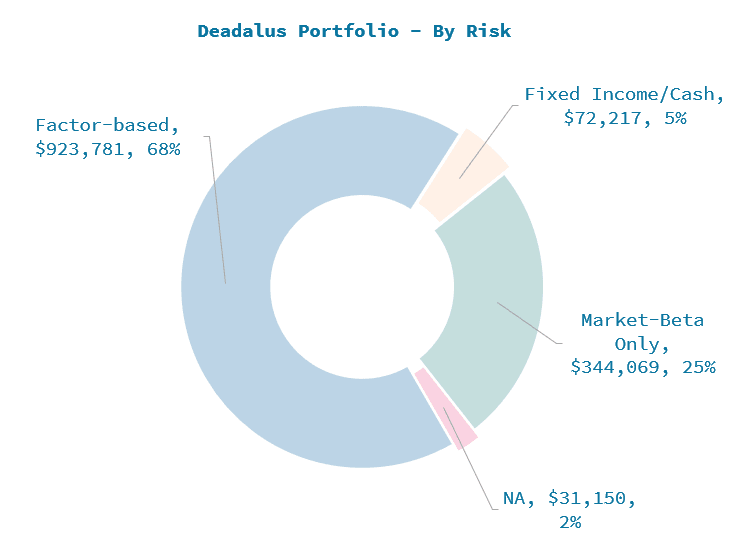

The chart above breaks down the portfolio based on it’s risk exposure.

The majority of the returns will be driven by taking on market risks above the risk-free rate (market-beta) and other independent risks (factor-based). Future returns will depend on the risk exposure.

The fixed income portion happens to be in market-beta.

If we add the cash and fixed income, that comes up to 20% of the portfolio. I am more comfortable with less than 100% equities due to my studies over the safe withdrawal rate.

The success rate of an 80% equity 20% fixed income portfolio is better if not equal to a 100% equity portfolio. At a certain point, the volatility drag from a high equity allocation will adversely affect an income portfolio.

The Main Funds that Make Up Daedalus

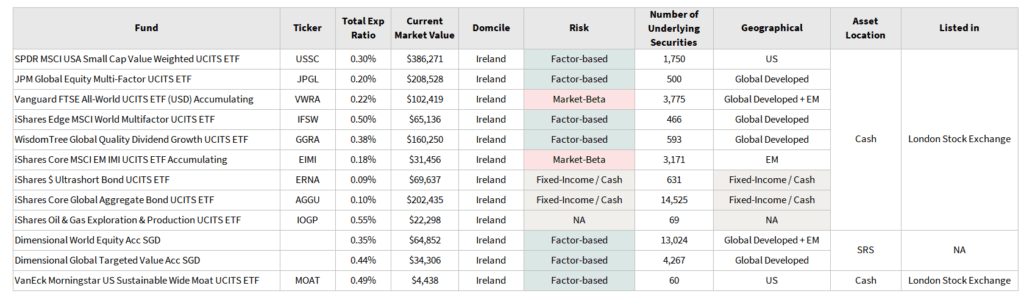

Daedalus is mainly made up of the following funds:

I have provided most of the info that is commonly asked. These are mainly exchange-traded funds (ETFs) listed on the London Stock Exchange (LSE) or unit trusts that can be bought locally.

We can then continue.

The Independent Risk Exposure of the Funds in the Portfolio

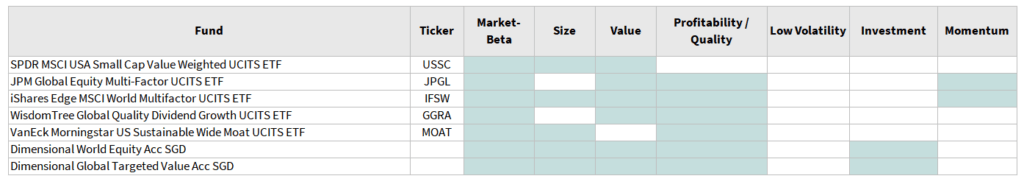

The table below list the main funds used and their exposure to other risks that is not market risk-based:

Most of these funds can be considered as dual or multi-factor funds with exposure to not just one factors. This will help smooth out the returns when one factor remains dormant for an extended period.

In a way, I just want to take systematic risks that are evidence-based.

I don’t really want to be too bothered which one works over the long term. In the short term, some of these factors may not compensate me but I have time to wait. While some of the factors remain dormant, other factors show up to make it more livable.

For example, the common story is how value didn’t show up in the last decade but funds with exposure to the high profitability and quality factor did well.

If we have exposure to that independent risks, it makes the experience more livable while waiting.

Geographical Diversification

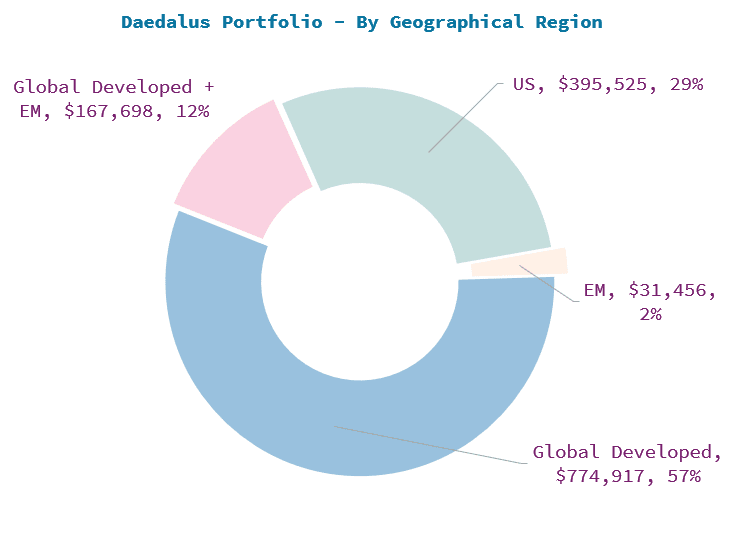

The chart below shows the geographical breakdown of Daedalus:

The returns will be driven by the allocation. A large part of the allocation will be driven by developed markets. The large US exposure is primarily due to the SPDR US Small Cap Value-weighted ETF and US Wide Moat Sustainable ETF.

In comparison, I have probably 2-3% exposure to emerging markets. The risk of emerging markets is higher, and therefore we hope that the returns compensate for it. But if you are comfortable with the returns from developed markets, you can leave emerging markets out.

I felt that my allocation is smaller and I struggle with it. Most likely, I will allocate part of the existing 5% cash allocation to Emerging Markets because having some exposure is better psychologically if we live through another 1997 to 2007 again.

Average Dividend Yield of the Portfolio

I don’t focus on the dividend yield of the portfolio primarily. I look at the returns that we will get as a mixture of long-term capital gains + dividend yield.

Still, it is good to stock-take and look at how much dividends the underlying securities are yielding.

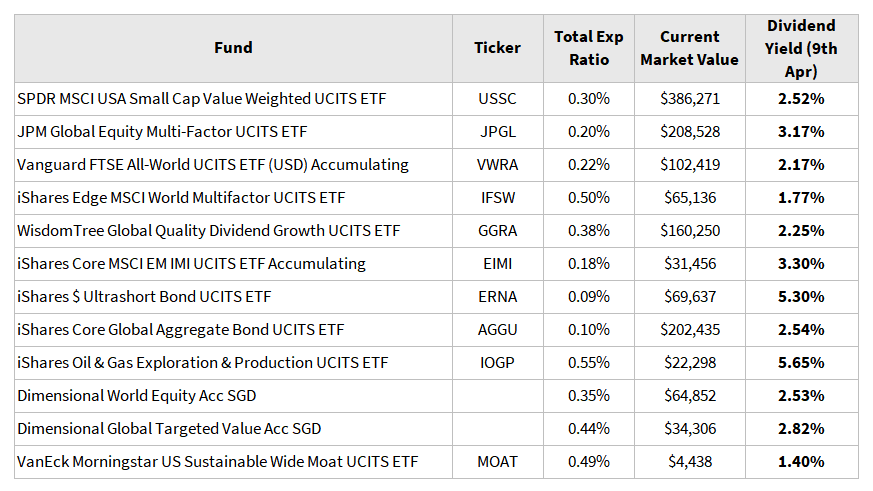

In the last column of the table below, I have listed the average dividend yield of the fund, as per Morningstar (9th April 2024) of each of the main funds:

Most would acknowledge the average dividend yield leans closer to being low. I do think if the composition doesn’t change, from a total returns perspective, most of the returns will come from the growth of the dividends.

Based on market value, the average dividend yield of Daedalus is 2.75%.

We can frame this 2.75% differently.

Some of you can view it as: “Oh, Daedalus’ value is $1.37 million, and so 2.75% of that will give $37,675 yearly or $3,139 monthly. Since the average dividend payout ratio of the underlying securities is low, and many are tilted towards quality, we should expect the 2.75% dividend to grow with inflation, so this $3,139 monthly income is very safe!”

The other framing is: “Okay, Kyith’s plan is to start spending an initial income of 2-2.4% of Daedalus’ value then adjust for inflation annually. Since the average dividend yield is 2.75%, his plan is actually very conservative.”

I wouldn’t push both framings to the extreme, but we can look at things both ways as well.

The High Exposure to US Small-Cap Value

Most readers would be familiar with my preference to be globally diversified but would notice the larger-than-normal allocation to US small-cap value.

This is probably my most risky exposure and what I struggle with the most. Because of the risk taken here, I can afford to have a larger fixed-income allocation, or a smaller emerging markets allocation.

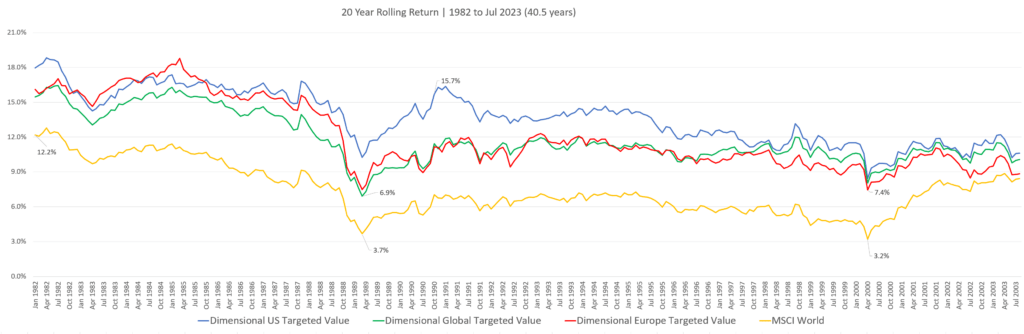

This is a purely data-driven decision. In the past, I published the returns of global small-cap value:

I shall not elaborate much on this you can review the data here: Comparing the Crazy Historical Compounded Returns of Dimensional Global Targeted Value Versus US Targeted Value (and MSCI World)

For those who wish to implement, note that the tracking error against an MSCI World or S&P 500 is big. It has one of the highest historical returns but it is not for everyone.

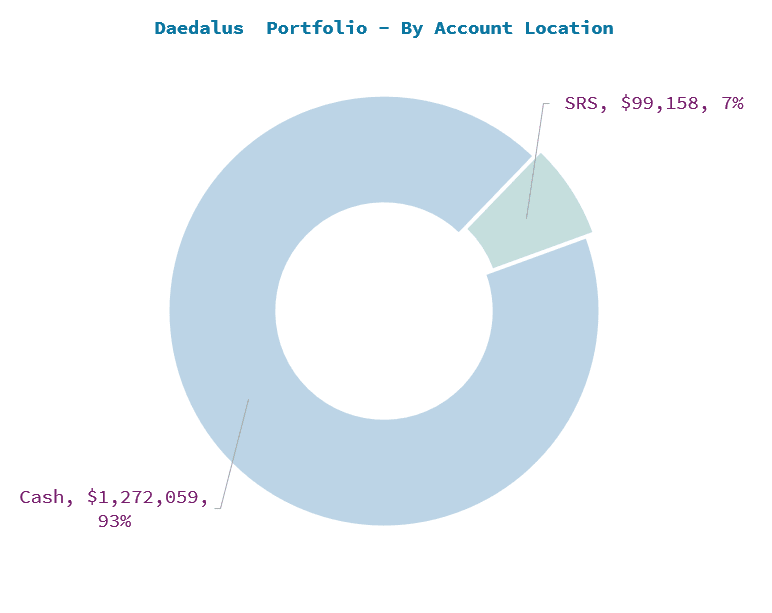

Asset Location

The majority of the portfolio is in cash accounts or liquid accounts that I can assess to:

I made the stupid decision to allocate my SRS monies partly as this portfolio and so that is why we have like $100,000 in the portfolio.

Now, it feels troublesome to separate the SRS into two groups because I don’t really want to inject new capital into the portfolio.

The portfolio is custodized under:

- Cash: Interactive Brokers LLC.

- SRS: iFAST.

I invest my SRS money through Providend but I have the option to switch the custodian if I wish to, to an alternative one. I will think about the decision next time.

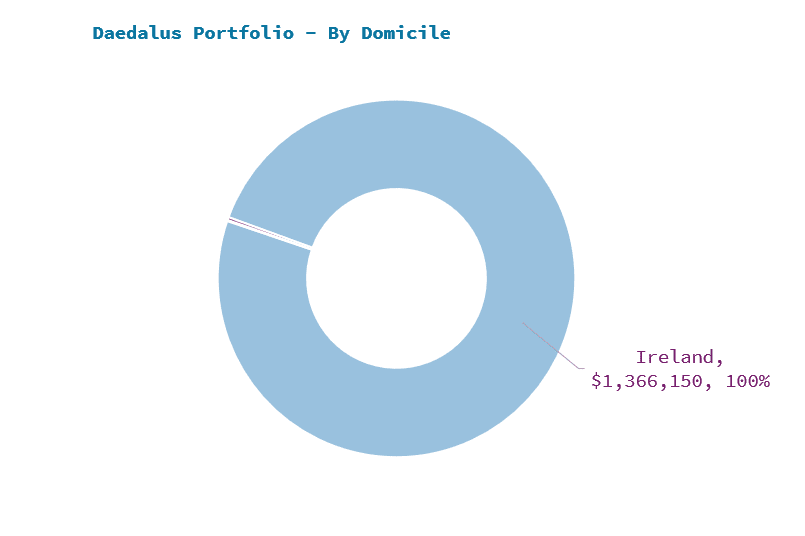

Domicile and Estate Tax, Withholding Tax Considerations

Almost 100% of the portfolio is domiciled in Ireland:

The main reason is to maintain estate tax and withholding tax efficient.

You can read more about these two here:

- Guide to Withholding Taxes for Singaporean Investors

- Guide to Estate Taxes for Singaporean Investors with Overseas Investment

Many have mistaken that the decision point lies in how much withholding tax we can save when thinking about whether to invest our money in areas that are less tax efficient. But the main consideration is the #2 one, which is not having to think about after-life estate tax considerations.

The amount can potentially be significant.

Now, there are much debate upon whether we will eventually be taxed or not, how brokerage will treat these stuff if we passed away.

I don’t know everything, but I would hazard to guess I know more than a lot of other people.

You know what, I choose to avoid any risks here if I can. I would rather take risk on the portfolio level and not taking risks at this level. I don’t have to push my portfolio so hard by taking on these “what-if” risks and have a clearer peace of mind that if I passed away, the beneficiary of my estate have less ambiguity.

I choose to simplify things here. Being passive means being bothered about fewer things.

Daedalus Overall Recurring Ongoing Costs

The recurring ongoing costs usually depend on:

- Advisory/wrap account fees

- Platform fees

- Ongoing fees from underlying funds

Since I am managing this portfolio, I don’t have to pay advisory/wrap account fees. I have to thank Providend for not charging employees here.

There are no platform or custodian charges with Interactive Brokers. Under iFAST, as a custodian, there is a 0.15% p.a. platform fee that I have to pay. This is one of the reasons I consider switching to another custodian where I would likely be charge 0.10% p.a. instead.

Factoring all these costs, the recurring ongoing cost works out to be 0.28% p.a.

In most of my safe withdrawal rate study, I embedded an ongoing cost of 0.50% p.a, so it is good that I was able to keep the cost lower than that.

Daedalus is Crafted Structurally to be More Resilient

I recently got a comment about certain aspects of the portfolio along the following lines:

“Given the low income of your portfolio, you might as well put the money in an HDB flat which can yield 5%”

I could have made a deeper rebuttal of the comment but I wonder which plan is more resilient:

- 100% of your portfolio value in a property, subject to government policy, with a lease that can run down to zero in a single country.

- A portfolio made up of a few funds, which individually is like a trust structure/incorporated companies, diversified globally, over many sectors, with different independent risks holding numerous companies.

I would rather go with the latter.

If you ask most people, they would admit they cannot forecast the future exactly:

- Will Emerging markets and international markets continue to do poorly versus the US?

- How would AI change the world?

- Will property prices continue to remain high?

- Which companies today will be the best performers in the next 20 years, and which companies will fade away?

- Will the value, high profitability, size, and momentum premium continue to show up?

- Will passive flows adversely affect the markets?

I also won’t know, and admittedly, these are risks we face. However, the opportunity is that if we take on these risks systematically by being diversified enough, we may be able to capture the returns brought about by the risk exposure.

Yet, there are some risks we are unwilling to take.

Concentration in a country or region is also a risk in that, you live and die by that concentration. Do you need to take on the risk to that degree?

Personally, that may be the risk that I do not wish to take on, and so my preference is to step away from the returns and risk profile of concentration.

Daedalus is Not the Most Returns-Optimized Portfolio

By virtue of my previous point, it also means that Daedalus is not going to be the most optimized portfolio that will get the highest return.

I do think it has a decent chance to get a high return but in truth, I value other things aside from return:

- I don’t wish to keep second guess and wonder if I should add this or that to the portfolio.

- We cannot have the perfect timing, and I would prefer a portfolio to be in the risk region before the run takes place.

- In order to earn that high return, we got to be able to sit with the portfolio.

- Diversification that makes a portfolio more livable is a portfolio that is less well optimized.

What is the Expected Return of the Portfolio?

This might be a question in your mind.

The truth is I don’t know.

I should qualify when I say I don’t know.

The returns in the future is always difficult to know. A whole history of returns gives us an idea the range of returns we may get but the future may not always play out like the past, or will play out slightly differently.

I have seen enough history of returns compared to many others, so when I say I don’t know… you may wish to consider why I say that.

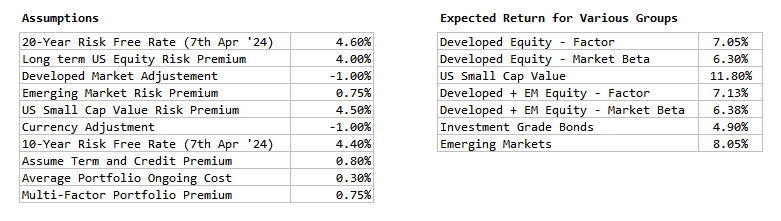

If you put a gun to my head, I could probably give you an academic guess. Back at Providend, our investment team took some time to formulate how we think about future returns for planning going forward.

The guess is very much on prevailing risk-free rates and long-term risk premiums and a bunch of long-term economic and returns data:

I made some currency adjustments to the data for the Singapore context and with all these… the expected returns worked out to be 7.92% p.a.

But what is the point of computing a future expected return?

That 7.92% p.a. represents a spectrum of out come which may go as low as 2-4% p.a. and as high as 12-14% p.a.

What Daedalus will get in the future (and most likely your portfolio as well) will be in the range between those.

If Future Returns are Such a Wide Spectrum, How Does Daedalus Engineer Consistent Income?

Generating income that is passive, reliable, consistent, inflation-adjusting and last for long is like fighting a Chimera or a multi-head monster.

Most people think they are slaying a one-headed monster until they realize that the deal is bigger than they imagine.

My philosophy is to take the income management out of the investment portfolio management and think about it separately.

How I manage the income (in the early section about spending an initial 2% to 2.4% of the initial value of Daedalus) is a way of crafting an income strategy outside of the investment portfolio portion.

Can Daedalus keep up with Inflation?

To keep up with inflation, you need elements of the portfolio that did well in inflationary environment in the past.

While the portfolio does not have much commodities, as parts of the portfolio is equal-weighted, the portfolio have more equities exposed to commodities.

More so, historically, equities have kept up with inflation in the long run. Read kept up, not hedge inflation. Having almost 75% equities will help with that.

But if the Portfolio is Crafted to Keep Up with Inflation, What about the Short-Term when My Spending is Higher, and Equities & Fixed Income Does Not Do as Well?

This is why I feel it is better to manage the spending strategy outside of the investment portfolio (Daedalus)

We rely on a conservative safe withdrawal rate to estimate the capital we need. That Safe Withdrawal Rate embeds the knowledge of portfolios that survived historically high inflation 30, 40, 50 year periods.

So, the capital we set aside allows us to still draw higher income during periods where equities may experience higher volatility (to the downside).

Investors will always have to contend with this challenging problem of getting reliable income, but having income that keeps up with inflation. Bonds make the income reliable but may struggle to be there in the long term. Dividend income tend to keep up with inflation if done right with adequate income growth but if you need $55,000 yearly instead of $50,000 yearly, would the dividend income match up exactly as needed? May not be.

This income, return and inflation uncertainty is something all of us have to contend with.

Potential Changes to the Portfolio Allocation

Since configuring the portfolio to its current manner, I have not made significant changes.

I want to make some changes if we have more UCITS options.

- I want to switch from a UCITS US Small Cap Value-weighted ETF to a UCITS Global Small Cap Value if it is available. Dimensional Global Targeted Value is a good choice but I am apprehensive to pay the 0.30% p.a. fees under Endowus FundSmart. That and, having most of portfolio located in Interactive Brokers is one of the main reasons for me not to take the Global Targeted Value route.

- Would likely deploy much of the 5% allocation in Ultra Short Fixed Income bond ETF to Equity-based portfolio. That will leave my fixed income / cash allocation to be 15%.

Aside from that, not much other allocation changes thoughts.

Conclusion

I hope that is not too long to read.

I guess I have the same ideals as many: A passive portfolio that serves to grow and provide income.

Daedalus tries to express the investment part of this ideal through this portfolio allocation. A Strategic and Systematic portfolio, being less returns-optimized and more diversified will create a more passive portfolio.

To make a portfolio more resilient, we need to make the portfolio less fragile, and therefore, diversification plays a big role.

I think for many, they may have similar questions about their own portfolio and hopefully by contrast against Daedalus, it helps strengthen your conviction you have about your portfolio. If not, it is time to make some tweaks.

I will add this to my personal notes. You can read the notes here.

You can implement something similar through some of my recommended platforms such as Endowus and Interactive Brokers. Enjoy $20 off your Endowus Fee when you sign up with the code INVESTMOAT_97WUPRC54E.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

- The Cheapest Way to Extend Your Laptop to TWODisplay that I Can Find. - April 29, 2024

- My Quick Thoughts on the Net Cash, 4% Yielding Boustead. - April 28, 2024

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

Goh

Friday 12th of April 2024

Hi Kyith

Thanks for the detailed write-up! May I know why you prefer IBKR LLC over IBKR SG?

YM

Tuesday 9th of April 2024

Also, it's interesting that the non-market-factor portion of your portfolio is about 2.7 times your market beta portion. From what I've seen online, most people would do it the other way round. Could I ask how you decided on that percentage / ratio? (Not saying it's wrong or whatever; I'm just asking because it's a question that, er, many people interested in factor investing wrestle with :)

YM

Wednesday 10th of April 2024

I think the basic question many of us have is: how much of one's equity allocation should be put in (i) a market-cap-weighted index fund (eg VWRA or IMID) vs. (ii) some Avantis / DFA etc thing that's supposed to help get at non-market-beta factors too. (What makes things even more complicated, as you know, is that (ii)-funds tend to come with higher fees.)

Judging from reddit and the rational reminder forum, most people tend to put somewhere between 10% - 40% of their equity allocation in (ii). That's why I found it striking that you seem to have put a lot more in (ii) --- though I might have misunderstood your breakdown.

Kyith

Wednesday 10th of April 2024

Hi YM, the market beta should be a large proportion of what drives the returns, from a lot of research, the factors amount to a small different (like Rational reminder podcast). not sure if that answer the questions.

YM

Tuesday 9th of April 2024

Am curious about how you arrived at the following figures, if you don't mind sharing! Did you run simulations?

> That 7.92% p.a. represents a spectrum of out come which may go as low as 2-4% p.a. and as high as 12-14% p.a.

Kyith

Wednesday 10th of April 2024

Hi YM, expected returns is a way of finding out for a given time frame (usually long) if we invest what returns we are going to get. I didn't want to go into details because that is one topic by itself. It is using say a historical equity risk premium (which is the average of 50 years of data) and the current 20-year treasury yield. most of the data and adjustment is based on some long term data.

I am famous for using historical rolling simulation. This is not. This is purely average.

Hence i say... it shows 7.9% p.a., but average don't mean much really because what you and i may eventually get is one draw out of a range of 2% to 14% p.a.