It has been some time since I updated my notes about what I do with my money. This is partially for me to have some clarity and timeline on how my manage my money instead of advise I usually provide for people. You may be interested to take a peak at some of the inner conversations I have with myself when deliberating on my stuff.

I keep most of these notes over here if you are interested in reading them.

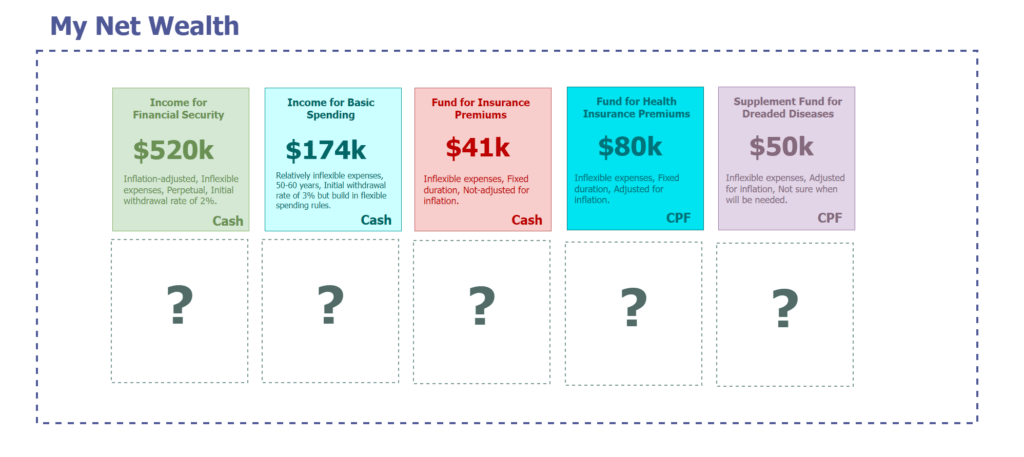

I started this current series by penning down my most essential and inflexible expenses, and how I came up with how much capital in a portfolio to generate for this set of expenses.

Aside from my most essential expenses, the reality is that to operate a household, it is likely I need more spending than that.

There is a set of basic spending that I need to take care of periodically and that would mean I need to size up the capital for this set of spending.

This article is to reflect upon this.

The Additional Basic SpendingNeeded to Supplement My Essential Spending

What is the difference between essential spending and basic spending? Aren’t they the same?

Here is where they are similar:

- They lean closer to being more inflexible than flexible.

- I need them to be there periodically.

The main difference is that if we reflect hard on it, basic expenses keep life going, and make life more livable and more satisfactory. Without basic spending, I can stay alive, but if I have the choice to save up for a decent life, I won’t just want a lifestyle, spending only on the most essential.

I want it to be more livable.

Without essential expenses and any other toolset such as practice freegan living, scavenging for food and necessities, life would be in danger.

Without basic expenses, life sucks, but I can still survive.

If I have the capability to save up for it, I don’t want life to suck so much.

Here are the additional basic spending I need:

This will not make a lot of sense unless you review the spending line items and the amount for my spending in my most essential expenses (again… it is explain in this article).

Why the Basic Spending is More Inflexible

My basic spending leans towards being more inflexible because they are made up of spending that they will come in the next 50 years, whether I like it or not.

At some point, I will be more sick that I will need more, just not sure when. I would need to eventually replace many furnishing around the house, just not sure when.

I think I have some flexibility in that for home maintenance, if the economy is not so good, and if the portfolio is in a poor shape relative to the income needed, I can cut back or postpone some major repairs if it doesn’t affect my life too badly.

But I cannot delay some of these replacements for long, so that’s why they are rather inflexible, but not as inflexible as my most essential expenses.

Rather than consider this spending an emergency, set aside a recurring income for them.

Each Spending Line Item

Residential Home Maintenance

Over the next 57 years, I do see that I would periodically need to spend on a few things annually to touch up the home.

Be it painting, minor renovation, or replacements other than my fridge, computer and mobile phone, things will break down and there are new demands which require a recurring sum of money to safely take care of.

If I don’t spend a lot of this in a year, the money accumulates eventually to $20,000 in ten years ($2,000 out of $3,000 a year over ten years), which may be necessary for some major touching-up work.

Medical

In my most essential spending, I set aside $70 monthly for some of the pressing out-of-pocket medical needs. If I don’t spend them, it gets accumulated.

As I age, the spending is likely going to increase. I am unsure when I need them. I could need the amount tomorrow or three years from now.

There is no way to anticipate other than to provision for an annual amount. The income here is to supplement that $70 monthly in case it is not enough.

Dad’s Mobile

I maintain a $10 Giga line for my late Dad’s number.

Initially, I kept the number just in case some long-lost relative called so I could let the relative know what had happened to my dad. But no one called but I wonder how long I will keep the number.

The number is sort of a remembrance but I got a feeling eventually, this line item will go away. Not a sum that will keep me up at night. I would cancel it if finances is too challenging.

Merchandise

For the clothes & accessories in my life.

These are the clothes, bedsheets and all those stuff that I need for the home. It usually does not include what I need for work. If I need work clothes, I will spend more than this (if needed) but the orientation is that I don’t need work clothes when I don’t have a job.

How Long Do I Need the Income?

I would need the income for this spending for as long as I need to maintain this household and live.

I do not need this income to last forever. It would still prove challenging for money that don’t last forever but still last for so long.

How do I Generate the Income To Provide for My Recurring Basic Spending?

Similar to my other spending needs or concerns, I would need a sum of money, to be put into a portfolio, in order to provide for this need.

The portfolio will be rather similar or likely the same portfolio that generates my most essential expenses.

The portfolio will be made up of:

- Diversified equity ETF

- Diversified bond ETF

The difference is that the capital needs are slightly lesser because:

- The spending needs are less inflexible (but still leaning more towards the inflexible side).

- Need inflation-adjustment but.

- Don’t need to be so perpetual.

- It is less of a life-and-death situation (this is because there are income meant specifically for medical needs, aside from there amount).

I can still rely on some flexible spending strategies for my basic spending needs. There are a few flexible spending strategies but by and large, they have the same characteristics:

- Make it harder for you to run out of money.

- Unfortunately reduces your purchasing power.

- Make your income more volatile.

You can read more about flexible spending strategies in this article here.

The flexible spending strategy is sensible because in truth part of the spending is adjustable.

But I would need to start with a particular Safe Withdrawal Rate.

Here is my Safe Withdrawal Rate Table again:

| Initial Safe Withdrawal Rate | How long your inflation-adjusted income will last | E.g Initial Annual Income on $1 Million Balanced Portfolio |

| Above 7% | Less than 10 Years | $70,000 |

| 7% | 10 Years | $70,000 |

| 3% | 10 to 20 years | $30,000 |

| 2.8% | 20 to 40 years | $28,000 |

| 2.8% - 2.5% | 40 to 60 years | $28k - $25k |

| Below 2.5% | Perpetual | $25,000 |

Given that I may need the income stream for 55 years or so, I should be using an initial withdrawal rate of between 2.5% to 2.8% to calculate the capital needed.

But because I can be slightly more flexible with the income stream, and I will build in some flexible spending rules, I am comfortable to start with an initial withdrawal rate of 3%.

If my annual income basic spending needs is $5,200 a year, this means my capital needs is:

$5,200 / 0.03 = $173,333.

The portfolio allocation would be similar to the portfolio allocation for my most essential spending (which is likely between 60-75% equities).

In total, my portfolio needs is $520,000 + $174,000 = $694,000.

This capital will come from cash.

Flexible Spending Rules to Employ on the Portfolio on an Ongoing Basis

I look at flexible spending rules as a more structural decision-making rules that you will also make on your spending, if you tell us that you can be flexible with your spending.

They look more mechanical to you put it has to be so that all of us are clearer.

While they are mechanical, they can be pretty clear and since we know what we can spend on very specifically for this set of spending, we can be very mechanical.

Every year, I look at how much to spend as an annual income recommendation so that I balance spending rationally and preserving portfolio longevity.

Here are some of the rules:

- Prioritizing medical spending over residential home maintenance and merchandize.

- Spend on things that need to be fixed up or replaced.

- Spend on supplement needs and ongoing medical cost needs.

- Accumulate the income for major renovation fixes or furnishing replacements.

- If markets are not doing well, and we have yet to accumulate enough income for major fixes in #2, delay the spending until a better time.

- If markets are not doing well, cut back on merchandise spending for the time being.

- If overall income, relative to the portfolio, is less than 2.5%, recommend a 10% increase in income recommendation (the portfolio is doing very well relative to current spending)

- If overall income, relative to the portfolio, is more than 4.5%, recommend a 10% decrease in income recommendation (the portfolio is doing poorly relative to current spending)

Rule #7 and #8 will systematically step the income up and down depending on the growth of the portfolio.

Are These Rules Too Unrealistic?

I have two options:

- Use these rules to be flexible with spending.

- Increase the capital needs such as 30%, 50%, or 100% more capital so as not to think about it so much.

I prefer to do a bit of both.

I think many of you, looking at what I am planning to spend on will do the same as well.

You don’t have unlimited capital and yet you want to retire at some point, so you will have to manage your resources.

If you don’t break down what makes up your income, your mind will eventually run into the same consideration.

When your portfolio is down (unless you are some investment god that your portfolio is never down), you will subconsciously ask whether you will be okay.

How much can I cut down on my spending? Where do I cut?

If I cut $200 is that enough not to kill my portfolio? Or do I have to cut more? If so, wouldn’t I have less to spend? Then, would I have enough to spend?

Even if your portfolio is not down but in very safe instruments, you would run through with the same thing. This is even so that you have buffers.

The fact is that subconsciously, you will have these conversations with yourself.

It is just that I flush them out early.

In my opinion, you can have 20% more provision but if you are unwilling to figure out what is the income for, you will have to go through these considerations one day.

Conclusion

This adds another card to how I plan my net wealth. The need for cash goes up to about $730,000.

Will see if I have the time to flush out some of the other needs.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Kelvin

Friday 20th of October 2023

Hi Kyith,

Just want to point out that the $174K in your calculation may be an error and if so has affected the rest of the numbers in your assumptions.

Kelvin

Monday 30th of October 2023

@Kyith, I guesses I might have mistaken the content. Apologies for the confusion.

Kyith

Friday 20th of October 2023

Hi Kelvin, could you point out the error?