In part 1 of my notes, I went through one of my highest financial priorities, explaining how much it will cost on a recurring basis and the nature of the spending.

Here is what makes up the recurring expenses that are highest in priority and how much they cost:

In this post, I will explain in my mind how much I need to set aside to provide a perpetual stream of inflation-adjusted income to fund it. I will leave the portfolio allocation ideas to the last post.

I have a sum of expenses that require an income to match. This is the income requirement. We will strip away other considerations and focus solely on identifying the key characteristics that affect success and failure.

The magic number I have in mind is approximately $520,000.

Let us see how I derived that.

Update (May 2023): This magic number was bumped up from $480,000 because I added mobile phone replacement and increase the provision for medical spending. This caused the spending need to go up from $9,560 to $10,800 yearly.

The Key Income Requirements

Perpetual – The income is meant to last more than a fixed duration, such as 20 or 30 years. It should have the resilience to last for 60 to 100 years. This is close to the requirements of foundations and university endowments, which require the money to last for generations.

Related: Could we Model Our Retirement Spending like Endowment Funds?

Adjusted to Prevailing Inflation – In other words, it should preserve your purchasing power. We do not assume a rate of return. If inflation is 15% that year, the income should allow us to pay after the inflation adjustment. The income can adjust downwards if inflation is -8% the following year. The exception is if the country (e.g. Singapore) goes hyper-inflationary, this plan may do its best to keep up but may not be able to. But the plan should have considered keeping up with inflation a vital requirement.

Inflexible Income – As decision-makers, we can choose to cut the income or spend more, but the plan should recommend an income that is predictable with low volatility. For example, if the portfolio takes a hit, the income recommended should not be reduced to be conservative. The decision maker can eventually decide to take less, but that is not up to the income solution itself.

The Key Challenges in Creating Such an Income Solution

Many would list down numerous challenges that we have to tackle. Most of the challenges are more qualitative.

Basically, the world in the future may or may not mirror the past. We can use the past as a reference because many things that will occur in the future will be similar to the past. But some things will be different.

For example, before 2020, oil futures do not go negative. The impact on many things is minimal, but there may be events in the future that alter how we fund our needs.

When it comes to providing income over a long duration, where many things can happen, here are the technical challenges (in terms of priority):

1. Persistently High Inflation

Not a single year of high inflation of 8% but over the duration, we are unlucky to experience high inflation again and again. This challenge becomes more critical if we are funding expenses that tend to adjust to higher inflation.

For example, if 50% of the income requirement is for basic food, which affects many people, the government has an interest to rein in inflation if not they would not be in the job. But if the income requirement is highly based on discretionary spending, then there is little external incentive for government to affect the cost.

Persistent inflation is tough to tackle because you cannot “be frugal and spend less”. If you look at my expenses, it is already highly optimized and there is no fat to cut and spend less. You do not have much choices but to be price takers.

Whether the portfolio is good or bad, you ramp up your spending.

Persistently high inflation in the first few years when you start spending is a more significant problem. This is partly attributed under part 1 of the problem called the sequence of return risk. Many look at the sequence of return risk and think about portfolio returns, but the most sinister part is the spending that cannot be easily cut down and you have to spend more and more.

Related: What is the Negative Sequence of Return Risk and How Does it Affect Your Retirement?

2. Volatility Drag

If your portfolio is volatile, especially in the first few years, the drawdown and your need to spend it will kill the portfolio.

This is part 2 of what is attributed under a sequence of return risk.

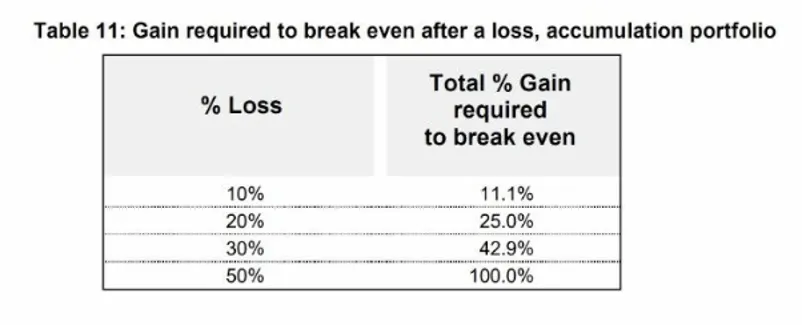

The table above shows the math of breaking even. If you have a 10% fall in portfolio value, you need 11.1% to break even. But if the loss is 30%, it requires nearly 43%.

Now think about this: On top of your losses, what if you are spending 8% of your portfolio? Then the amount taken out of your portfolio that year is 38%, which is closer to 40% then 30%.

This means the amount of gain that you need to break even is much higher. By spending a large amount, relative to the portfolio value, you place additional stress on the portfolio to generate returns. In some of the math, it just does not work out.

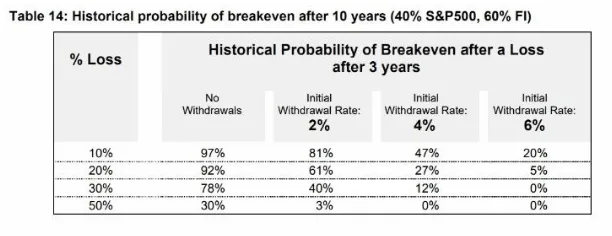

The table above shows the losses, and three different withdrawal rate or how much you spend relative to your portfolio in the first year. The four withdrawal rates are 0% (no spending), 2%, 4% and 6%.

The percentage in each cell shows the amount of gain you need to break even in 10 years (the label in the table in the image is wrong, it should be the historical probability of breakeven after a loss after 10 years).

If there is no spending, then there is a high chance of breakeven after ten years. Some sequences won’t breakeven, even after ten years. This is normal. If you spend only 2% in the initial year, you can still have a reasonable chance of breaking even, if the volatility of your portfolio is low.

But if your portfolio volatility is 50%, the chance of breakeven falls to 3%.

If your initial withdrawal rate is 6%, and the volatility is more than 30%, the chance of breakeven in 10 years is 0%.

Basically, your portfolio is in a downward mode.

Some think that portfolio returns are everything. Higher returns usually come with higher volatility. If volatility is too high and you spend too much, the portfolio may be impaired.

3. Portfolio Return

While returns are not everything, you need enough returns to ensure that your portfolio lasts for a long time. You will need to achieve a reasonable risk-adjusted return.

I will look at this piece this way:

- The world is uncertain

- Each asset class has its strength and weaknesses

- If you are heavily tilted towards one asset class for your entire portfolio, you live and die by its strength and weaknesses

You can have all your portfolio in bonds, but if you don’t realize you will live through thirty years of persistently high inflation, your portfolio will not do well, and you will need to spend it down. On the flip side, if you don’t realize you will live through thirty years of deflation and you are high in equities, that will be challenging as well.

The Most Important Thing to Get Right: Your Income-To-Asset Ratio or Your Initial Withdrawal Rate

My study into retirement, financial independence, and investments over the years have to lead me to understand that if you want to preserve a portfolio yet get income, you need :

- A large capital base

- Draw a conservative starting income

The asset allocation and that stuff are less important than this ratio. I will probably tackle why asset allocation is less important later.

This is the formula of why the rich remain rich. They have so much money that even with setbacks or occasional frivolous spending, it does not impair their portfolio.

But how much is considered rich enough to buffer for unlucky life? That is what this exercise serves to do.

We know my income requirement in the first year is $10,400, and I need the income to be adjusted for inflation.

If my portfolio is $100,000, the income-to-asset ratio is $10,400/$100,000 = 10.4%. This is also the initial safe withdrawal rate that many researchers talked about.

Related: Why the Safe Withdrawal Rate (SWR) is Essential for Your Financial Independence

Lowering this income-to-asset ratio, also means your capital base is more significant. But how much is considered significant enough so the inflation-adjusted income can last till perpetual?

I have rounded up the research I came across the topic below:

| Research | Safe Initial Withdrawal Rate | By | Source | |

| 1 | Ultimate guide to safe withdrawal rates - Part 2: Capital preservation vs Capital depletion | Less than 3% to 3.25% | Early Retirement Now | Link |

| 2 | Sustainable spending rates for Single Family Office | Less than 1.3% | Wade Pfau | Link |

| 3 | Fecuntity of Endowments and Long-duration Trusts | Less than 2.7% | James Garland, Northwood Family Office | Link |

| 4 | Perpetual Spending Rate for Foundations, Endowment and Charitable Trusts | Less than 2.3% | Jim Otar | Link |

| 5 | Income planning in the most expensive market conditions - Greater than 35 times Shiller CAPE | Less than 2.8% | Robert Shiller | |

| 6 | Rivershedge Research | Less than 2% to 2.5% | Rivers Hedge | Link |

| Average Less than 2.4% | ||||

| Generating perpetual passive income | Investment Moats | Link |

You can read into each of the research. They average somewhere close to 2.4% of the initial portfolio value.

So if my income requirement is $9,560 yearly, I will need to set aside $10,400/0.024 = $433,333.

If I create a portfolio of $434,000, it can provide a perpetual inflation-adjusted income of $10,400 yearly.

All this is very theoretical, but I take solace that all the different research triangulates to between 2-3%.

But how much would the income requirement differ?

| Income-to-Asset Ratio / Initial Withdrawal Rate | Portfolio Value |

| 2.0% | $520,000 |

| 2.1% | $495,238 |

| 2.2% | $472,727 |

| 2.3% | $452,173 |

| 2.4% | $433,333 |

| 2.5% | $416,000 |

| 2.6% | $400,000 |

| 2.7% | $385,185 |

| 2.8% | $371,428 |

| 2.9% | $358,620 |

| 3.0% | $346,666 |

If I am more conservative, I will set aside $520,000; if I am more risk-seeking, I will set aside $346,666. The difference from 2.4% is about $20,000 to $90,000.

As my income needs are more inflexible, and I have the financial resources, I will use a 2.0% income-to-asset ratio or initial withdrawal rate to be more conservative.

So the magic portfolio figure to anchor in the head is $520,000 or a 2% income-to-asset ratio.

Why Asset Allocation is Important, But Only After You Use a Conservative Income-to-Asset Ratio

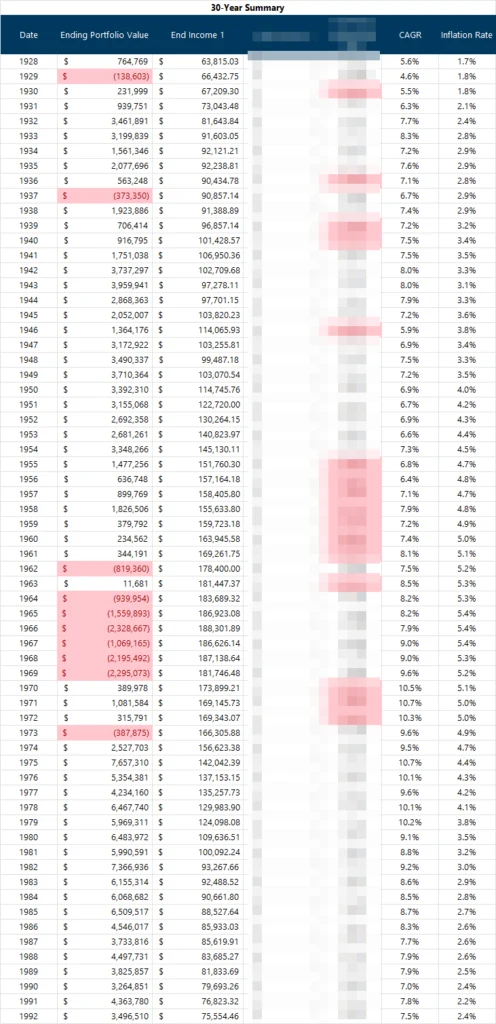

Suppose we spend $40,000 in the first year on a $1 million portfolio. The asset allocation is 60% S&P 500, 20% 1-month US Treasury Bills and 20% Long-Term US Government Bonds.

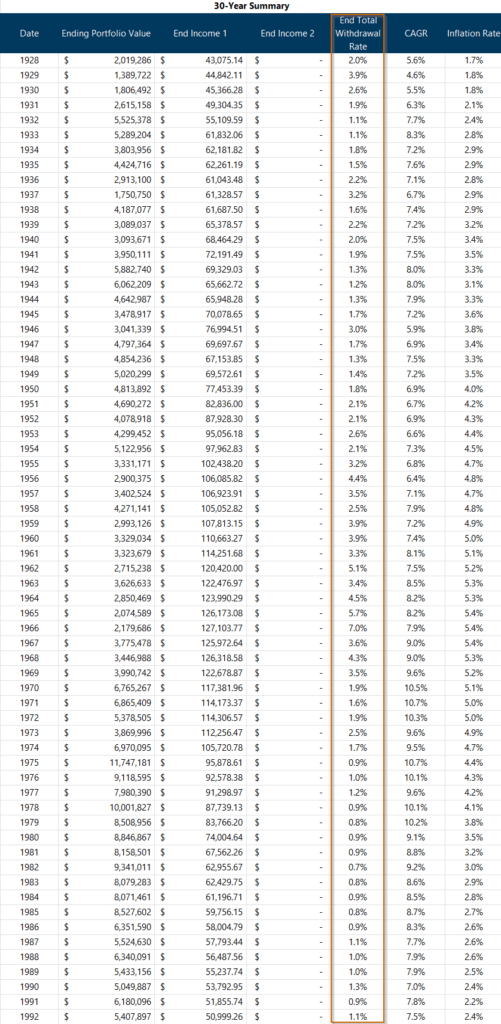

I was able to simulate whether the portfolio would last if I lived through all the different 30-year periods:

Out of the 65 thirty-year periods, I would run out of money in ten. Periods starting in 1929 and 1937 were very volatile periods, and those periods starting in the 1960s experienced, on average greater than 5% yearly inflation. You can observe the corresponding ending portfolio value (negative means run out of money pre-maturely), ending income ($40,000 grows to…) and the compounded average growth (CAGR) and inflation rate.

I can be lucky or unlucky. Luck plays a significant role in whether I run out of income.

Now, what if we boost the equity to 80%?

Out of the 65 thirty-year periods, I would STILL run out of money in ten of those years. Just for info, even if I jack the equity to 100%, I will still run out of money in seven of those sixty-five sequences.

There are just specific sequences that are challenging to deal with.

If I reduce the income requirement to $27,000 instead, if I live through any of these 65 periods, there is less chance of running out of money.

The highlighted End Total Withdrawal Rate shows me the ending income divided by the ending portfolio value. Notice that many of the ending withdrawal rates is less than 2%, which indicates that the money could still last for some time. Even periods with high inflation look better, but there are challenging sequences, such as the period starting in 1966, where the ending withdrawal rate is 7%. Inflation better go down if not… even with this inflation rate, we will also struggle.

For Income to Last A Long Time, the Rate of Return is Important, Which Means Asset Allocation Has its Role

Instead of a thirty-year income need, let us shift to a sixty-year income need. If the portfolio can give inflation-adjusted income that last for sixty-years, with a rather conservative ending withdrawal rate, the money is close to perpetual.

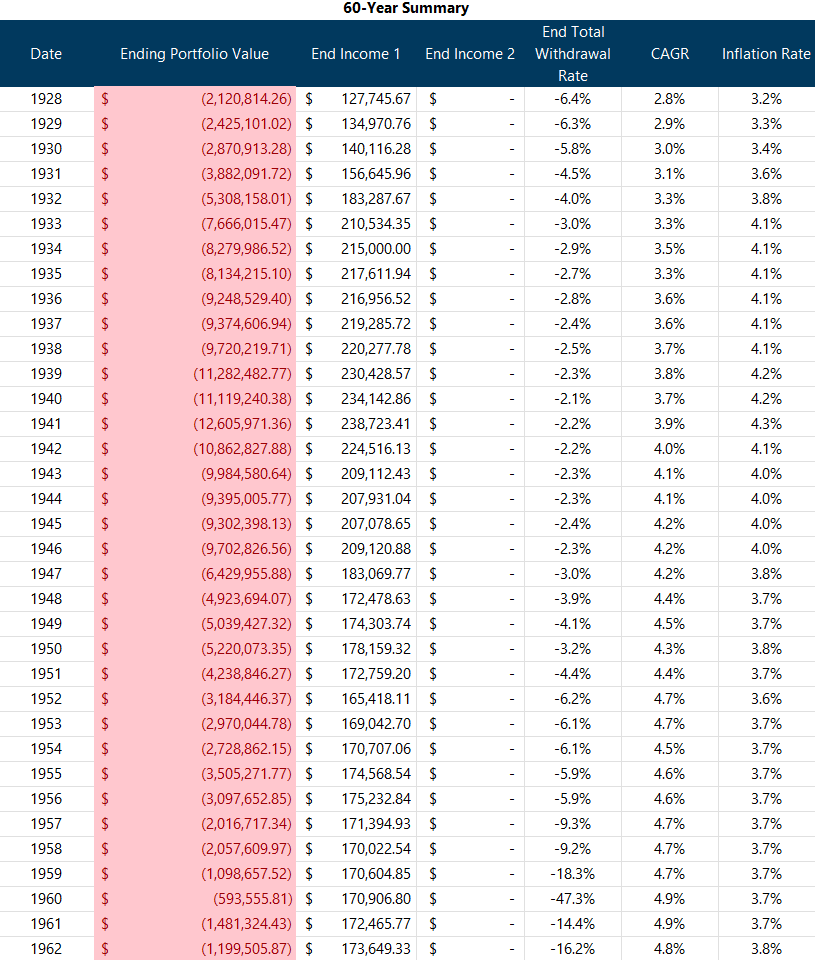

Now let us try to spend $20,000 from a $1 million portfolio with 50% in 1-month US Treasury and 50% in Long-Term Govt bonds. That is a 2% income-to-asset ratio, which should be rather conservative right?

Zero out of the 35 sixty-year sequences lasted.

This should provide some thoughts to investors with asset allocation that is bond and cash heavy.

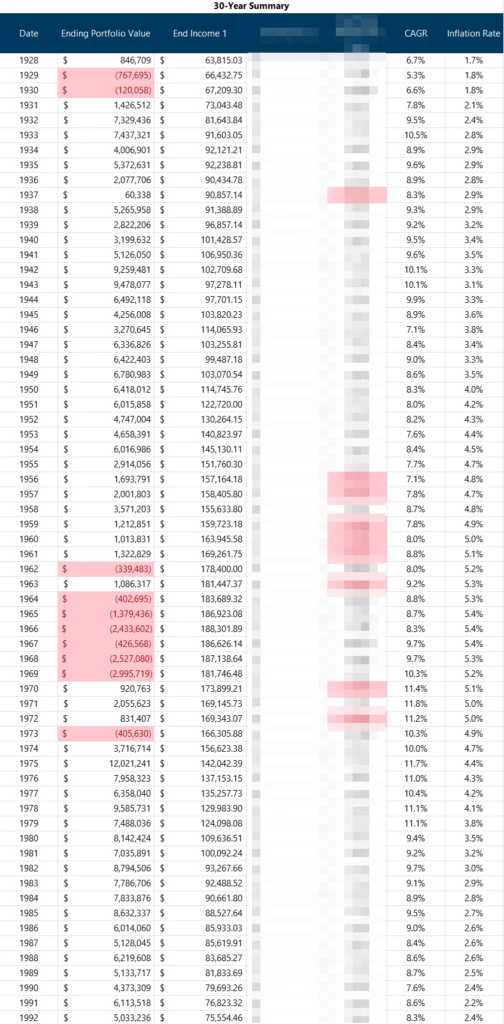

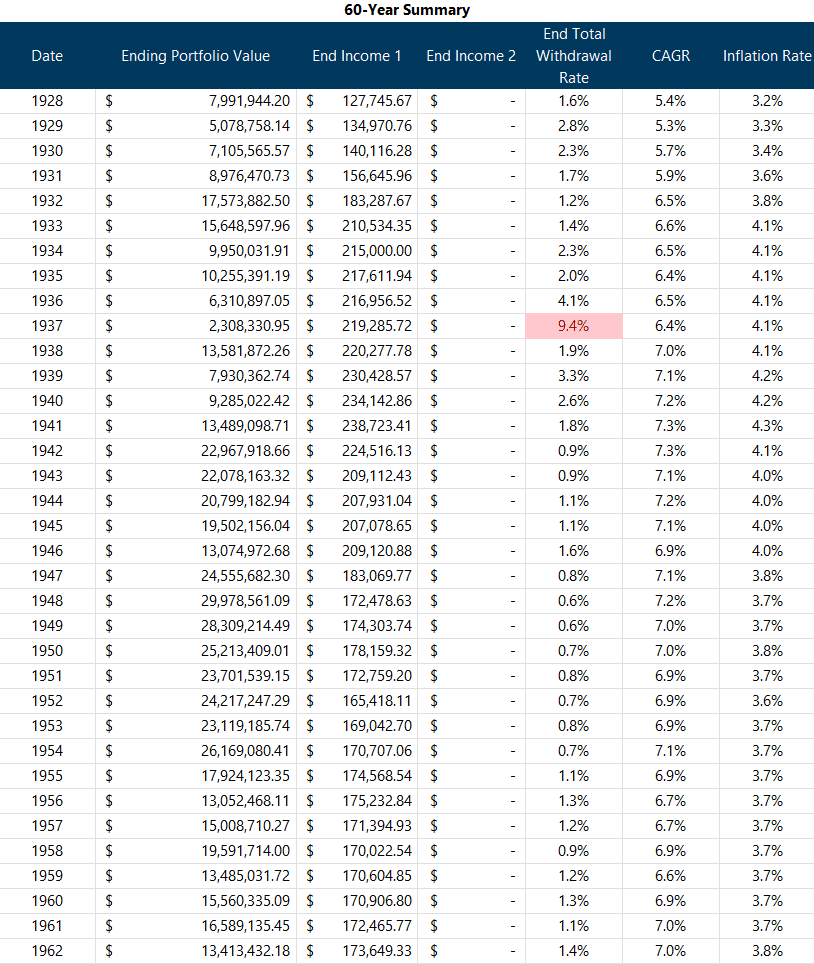

If we just allocate 40% of the bonds to equity instead:

This is a more balanced allocation. We didn’t even shift to 100% equities.

In many sequences, your $1 mil ends up more than $10 million. The sixty-year period starting in 1937 remains the most challenging. I would likely run out of money in 10 more years.

If I have taken care of the income-to-asset ratio, the ideal equity allocation is between 40% to 75% if we want the income to last a long, long time.

There are perhaps some asset allocation tweaks that we can consider. I will leave that to part 3 of the article.

Lucky or Unlucky?

I covered persistently high inflation scenarios and the lack of portfolio returns. The last one is about volatility drag. Many would equate having an active fund that gives high return to give you the retirement you want.

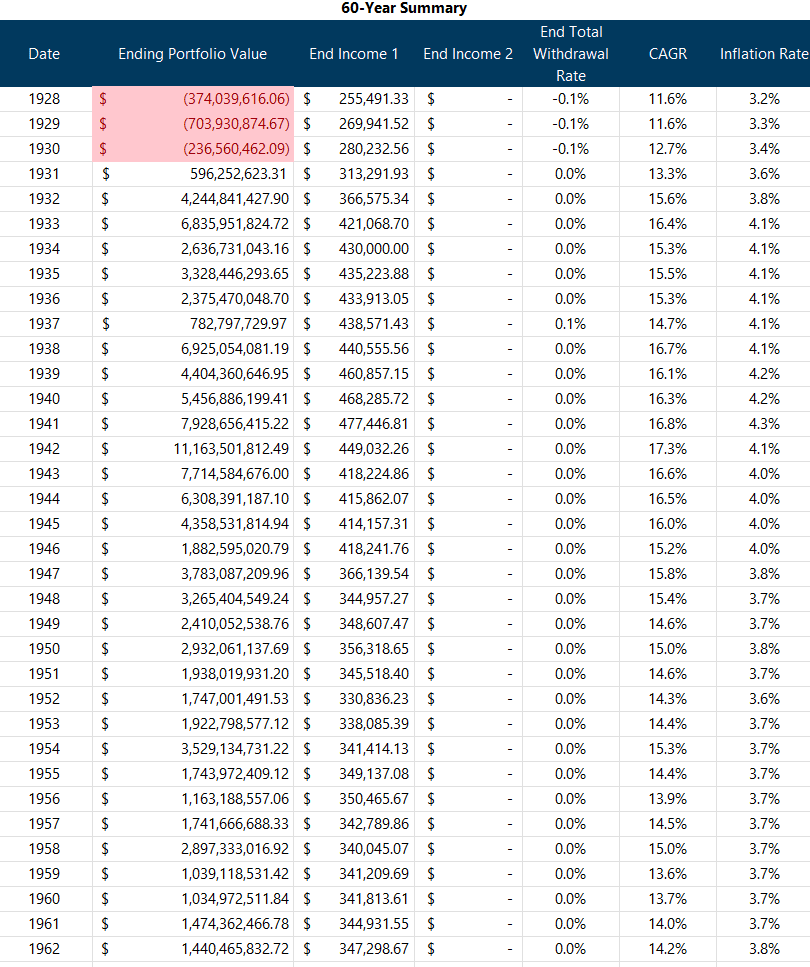

If that is the case, then just invest in smallcap value. Smallcap value have some of the outrageously high historical returns, over different 60-year period. The average 60-year return is 14.9% yearly.

Yet how would you do if you invest all your $1 million in 100% small cap value? I decide to spend only $40,000 in the initial year:

This is where I feel most will have a dilemma. A crazy portfolio like this in most cases grows $1 million into billions of dollar, even after providing the income. That is like a lot of money. Persistently high inflation is not a problem at all if you are lucky.

Yet, smallcap value lost 86% of its value during the Great Depression. The volatility drag in the initial years was so bad that portfolios will die in 15 years.

Returns is not everything and perhaps, a good risk-adjusted returns is more important.

It also begs the question: If we have not done simulations like this, we will conclude a 100% small-cap value is such a potent portfolio that it will work due to high rate of return.

So what if we have more data, and our data shows even an income-to-asset ratio of 2.4% is not conservative enough?

What is Important Is Finding Out Whether Your Strategy is Closer to Being Conservative Enough or Closer to Complete Financial Ruin

When we look at the income-to-asset ratio or the safe withdrawal rate, I think many are not looking at it the right way.

I met up with someone so that I can genuinely help him understand the withdrawal rate concept better. I left that session very disappointed with the way he gloss over its importance. One of his arguments is along the lines that it would be a futile exercise to figure out what is the exact safe rate.

What he says may be true, but there is a difference between being roughly correct and exactly wrong.

If you felt that by spending 4.5% of your initial portfolio value is safe, we know that leans closer to not true. You may be unlucky enough to live through some sequence where that strategy will:

- Run out of money.

- You have to drastically cut your income to about half by reaching year 30 of your retirement.

- Your mind will have enough anxiety that you consider going back to work.

We know from my notes returns is not everything. If you find all sorts of strategy that boost your returns but is very volatile, you may be spending too much time focusing on the wrong thing.

I think it matters less whether you start your plan spending 2%, 2.2% or 2.5% of your initial portfolio because research shows you would be leaning closer to being conservative.

But it matters a lot more if you feel that spending 5-6% of your initial portfolio is safe. That is closer to 100% wrong.

And that is why I decide to stick closer to 2%. It’s not because I am assured that it is 100% safe but that I know its closer to being safe enough.

Conclusion

Sometimes, I think back to my first post nine years ago where I tried to see if I can be financially independent with $550,000 (you can read it here).

I probably tried to force a square into a triangle hole too much by concluding that with a flexible spending plan, I can be financially independent.

- My concept of the lifestyle I want to save up towards is probably wrong.

- The spending strategy is not conservative for the lifestyle at all.

If we look at what we worked out today ($520,000), that $550,000 is enough but I think it is essential to understand what kind of lifestyle the money buys you, how conservative the plan is, and how it is implemented.

Part 3 will be tougher to put in words but let us see how. If you are interested in retirement planning articles like this, you can browse my retirement planning posts below.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

jutamind

Monday 26th of December 2022

Hi Kyith,

The asset portion of income to asset ratio that you referred to in your article is referring to liquid asset only or total asset (including non liquid assets)?

Kyith

Wednesday 28th of December 2022

hi jutamind, sorry that can be confusing. that asset can refer to your portfolio, but mainly those are the assets that go about generating that income. if its investment property then you can include the net equity value. as we often look at cpf life income separately, you do not include those assets that don't go about generating that income.

here is a good example. suppose you are thinking whether to include this amount of cash. if the cash goes about to make sure that the portfolio income is more stable, in some unlucky situation, then it is to be included. if the cash is meant more for another purpose or you consider that cash as another stream of income, then do not include.

hope that helps.

usually that asset is my portfolio la.

Reetesh

Sunday 25th of December 2022

Hi Kyith,

I have been a regular reader of your posts for a year now and I continue to be amazed at the level of details that you include. We'll your articles have been very thought-provoking and they have influenced the way I look at personal finance. Thanks for all that you do to share your knowledge and wishing you all the best for a great 2023!

Kyith

Monday 26th of December 2022

HI Reetesh, thanks for the vote of confidence. I hope you have a good year-end break and feel refresh for the new year.