If you hold a portfolio of US stocks or the US incorporated exchange-traded funds (ETF), you might want to take note of the potential estate tax implication should you suddenly passed away.

An estate tax is a tax on the net worth of an individual above an exempted amount. These taxes are usually levied when the person passed away. They are also known as Death Tax.

For example, if you are a non-US resident and have accumulated US$1 million on your portfolio of US incorporated assets, you would have to pay estate tax officially. There is usually an exempted amount and in the case of the US, the exempted amount is US$60,000. Thus, US$940,000 will be subjected to estate tax.

Currently, the tax is tiered from 18% to 40% for non-US residents (depending on the taxable amount). This would mean that the beneficiary of your estate would inherit about US$322,400 less.

Here is an extract from the U.S Internal Revenue Service (IRS) last review on 12 Apr 2021:

In the extract above, it states that stocks of corporations domiciled in US are subjected to estate tax, even though the person is not situated in the US or registered as a nominee.

Usually, investors would debate whether the 30% dividend withholding tax is something that they can live with (you can read my comprehensive guide to dividend withholding tax here) but I think this is something that you should seriously think about when structuring your wealth.

Estate tax is not limited to the assets in United States. Many countries have estate tax and inheritance tax.

Per Wikipedia, here are the countries with the highest inheritance tax or estate tax:

- Japan: 55%

- South Korea: 50%

- France: 45%

- UK: 40%

- USA: 18% to 40% (tiered)

- Ecuador: 35%

- Spain: 34%

- Ireland: 33%

- Belgium: 30%

- Germany: 30%

That said, there are some possible solutions that we can consider to circumvent this problem as well. We will explore them in this article.

Now before we begin, what you read here is based on what I understand about the subject. This topic involves taxes in different countries interacting with more countries. Each interaction is a body of work.

If you tried to find out more about this subject from your broker, Robo-adviser, fund distributor, financial planner, what is likely going to happen is that many would ask you to check with your tax accountant. The reason is that not many want to touch this domain.

This domain can get complicated pretty quickly and many of us may not know the intricate work to advise you well. So the easy solution is to tell you to go ask a tax accountant.

I do think that on a high level, there is a framework that you can use to understand these things. The right way to use what I wrote here is more as a primer to go down the right rabbit hole and not treat this as the absolute facts.

Ok, let’s get started.

Estate Taxes and Inheritance Tax are Potentially Bigger Deal than Withholding Taxes

A large segment of investors buys and hold exchange-traded funds (ETF). At this point, many of these ETFs have rather a low dividend yields.

If there is a 20-30% withholding tax on a 1.6% dividend yield, the withholding tax will shave 0.48% from your overall returns. Over time, this cost can be substantial.

We can try our best to save on this by using more tax-efficient ETF or fund solutions.

However, the estate taxes and inheritance tax will pose a bigger deal simply because the potential tax incurred by your beneficiary is much higher.

If you have accumulated US$1 million, the potential taxes that would be paid out of the estate is US$322,400.

Thus, while I can let some of these withholding tax considerations slide, you have to ask yourself whether it is wise to lose such a large amount of money to the US government.

The Difference Between Inheritance Tax and Estate Taxes

In layman terms:

- Inheritance tax – Is a tax on what your beneficiary will receive

- Estate tax – This is a tax on your estate (the stuff you are left with a net of your debts and expenses). This is charged regardless of who inherits your net wealth

Usually, gift tax is lump together with inheritance tax.

The confusing thing is that, for some countries, they call the tax inheritance tax but if you read the description of the tax, it behaves like a tax on the estate.

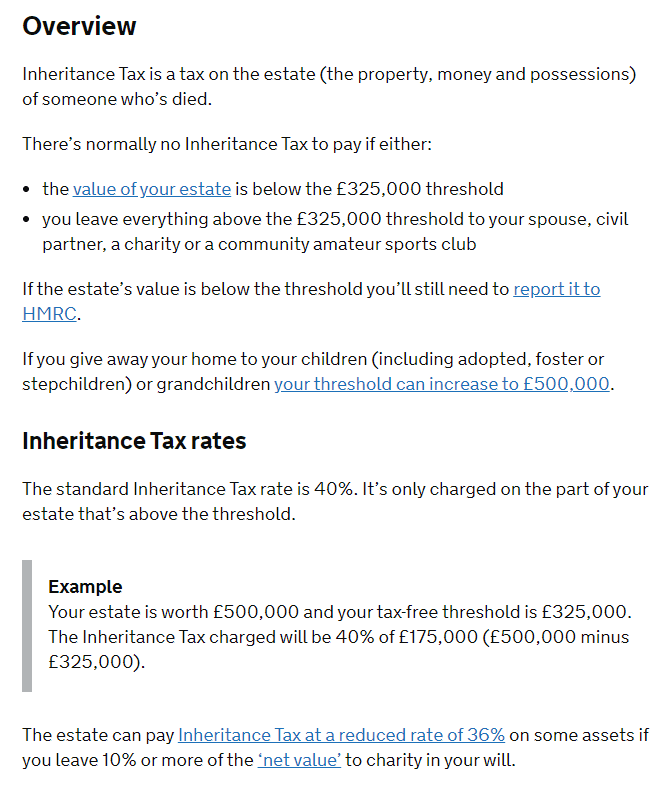

Here is an example of the United Kingdom’s inheritance tax:

If you read the description, it describes the inheritance tax as a tax on your estate.

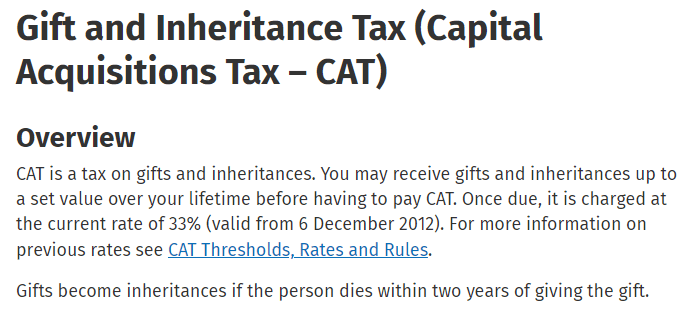

However, in the case of Ireland (for those domiciled Irish folks), it is worded more as a tax on the beneficiary:

Whether it is 33% or 40% tax, it still feels painful for the people receiving the money. They either pay more on accepting the inheritance from you or accept a lower inheritance (since the estate is smaller).

There is however a difference.

You could work in Ireland for 5 years. You never wanted Ireland to be your domicile or where you call home officially. However, while you are there, one of parent passes away and leave you with a sum of money.

Non-domiciled individuals who have been tax residents in Ireland for five consecutive years are liable to pay inheritance tax. (You are a tax resident because you work and pay taxes there).

Of course, there are nuances such as what is the amount and whether this amount is above or below the set value.

To circumvent this, you might need to do something to ensure that you do not satisfy that five consecutive year rule. It means that you need to have a certain understanding of the tax law in another country.

Which can be a real pain.

There are Exempted Amount, Set Limits that Limits the Estate Taxes and Inheritance Taxes that you have to Pay

That said, governments tend to set limits such that the tax usually falls on the people that are more well-off.

For example, the current estate tax exemption for US citizens is above US$11.5 million. If you are a non-tax resident (you the investor who invests in US-domiciled companies or ETF), the exempted amount is US$60,000 (not a lot of exemption thus it is a problem).

Based on the UK inheritance tax example before, the UK limit is pretty alright at 325,000 pounds (SG$575,000).

This means that if a person leaves behind an estate of 500,000 pounds, the tax on his estate would be (500,000-325,000) x 40% = 70,000 pounds.

Different countries will also have their own exemptions for certain groups of beneficiaries. For example, in the UK context, married couples and civil partners are allowed to pass their possessions and assets to each other tax-free in most cases.

The surviving partner is allowed to use both tax-free allowances (the 325,000-pound limit not used by your deceased partner), providing the first spouse to die did not use up their full inheritance tax allowance by giving away a big chunk of money in their will.

What are the Potential Recommendations to Address these Estate/Inheritance Tax Issues?

If you would like to have less tax slippage so that your beneficiaries can have more usable wealth to enhance their lives, maybe you can explore how you can optimize your wealth better.

Here are some recommendations. They have their pros and cons like always.

1. Invest Mainly in Markets, Companies that Are Domiciled in Estate Tax-Free Countries or Low in Estate Taxes

The first solution is to choose where you invest. If the majority of your estate is in the jurisdiction where you do not have to pay estate taxes, then you avoid a lot of these headaches.

There are a few countries that currently do not levy estate taxes and some are pretty popular investing markets for Singaporeans:

- Singapore

- Hong Kong

Companies, unit-trust, ETFs incorporated in Singapore or Hong Kong should be estate tax-free. They tend to be listed on the SGX and Hong Kong Stock Exchanges.

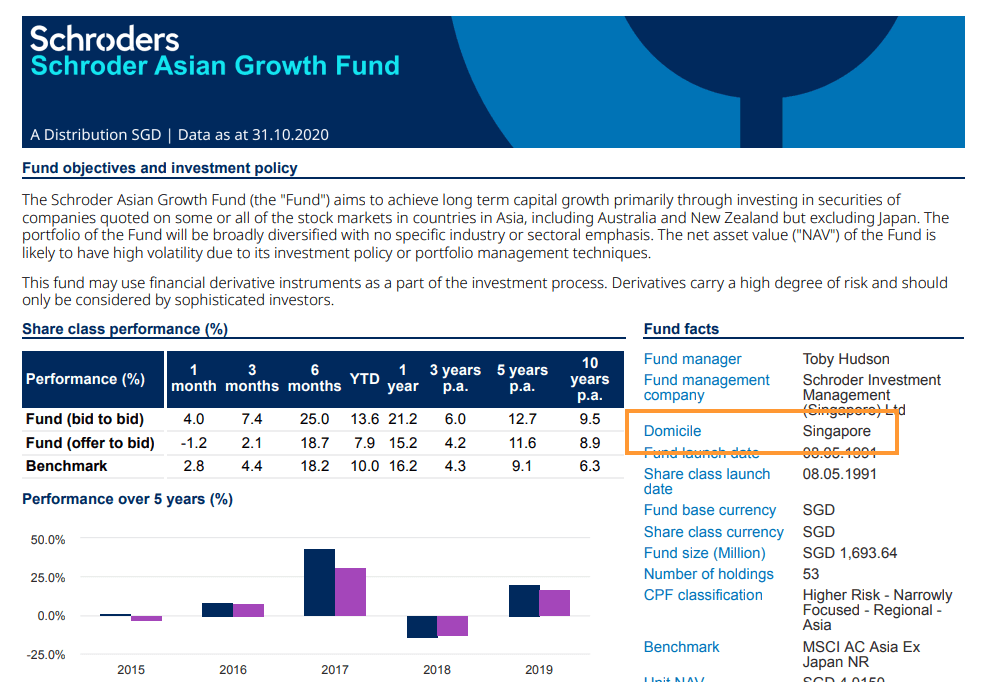

For the fund investors, most of the funds incorporated in Singapore should be free of estate taxes.

How do you check this?

You can take a look at the fact sheet. I have attached a section of the factsheet of a Singapore incorporated fund, Schroder Asian Growth:

Secondly, there are also countries that currently do not levy estate taxes. Companies, unit-trust, and ETF choose to incorporate or domicile them in these countries.

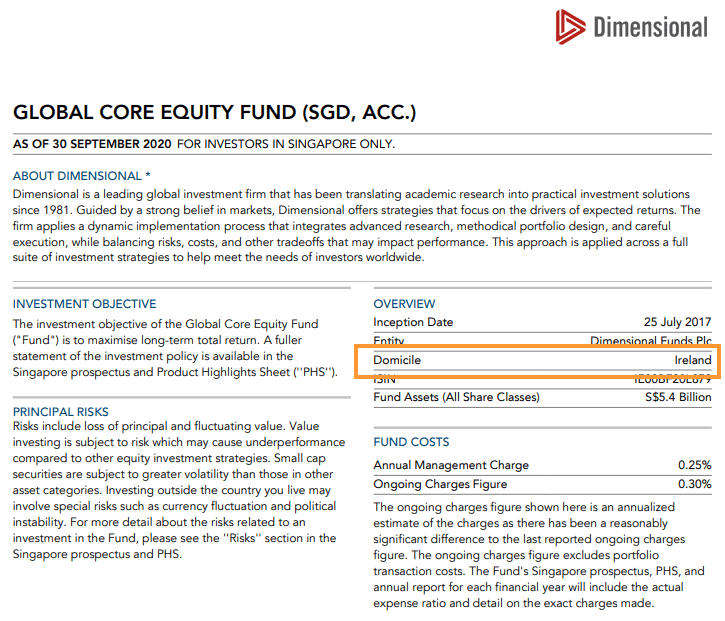

For the buy-and-hold investors who wish to invest in a low-cost unit trust or ETF, a popular option is to invest in Irish-domiciled UCITS funds.

Now, you might be spooked by the 33% inheritance tax example I have given you previously. That is for Irish citizens.

You can consider these UCITS funds a lawful permanent resident of Ireland but are afforded a different set of rules. Ireland has long been recognized as a destination of choice for investment funds due in no small part to the government’s encouragement in creating a flexible system advantageous to set up funds.

UCITS stands for Undertakings for Collective Investment in Transferable Securities and they account for the vast majority of Irish domiciled assets and are distributed worldwide to more than 60 countries (based on 2010 Lipper data).

UCITS funds’ advantage is that the investors in other European member countries can invest in them more easily.

The advantage of funds domiciled in Ireland is that Ireland does not levy any inheritance, estate taxes on these Ireland domiciled ETFs and unit trust.

23.6 Exemption of certain investment entities

– Revenue Ireland

CATCA 2003 s.75 provides an exemption from tax for gifts and inheritances of units of certain investment entities (defined in the TCA 1997, Part 27).

Units held in collective investment schemes, common contractual funds, investment limited partnerships or investment undertakings are exempt from tax in cases where neither the disponer nor the donee or successor is domiciled or ordinarily resident in the State, at the date of the disposition and at the date of the gift or inheritance, respectively. The CAT exemption applies in the case of the transfer of units in an investment limited partnership notwithstanding that this type of entity has been removed from the definition of “investment undertaking” in section 739B(1) TCA 1997.[5]

These Irish-domiciled UCTIS funds are listed on the London Stock Exchange under popular brand names such as BlackRock iShares, Vanguard, Wisdom Tree.

Some of the funds have been mentioned in previous articles such as IWDA and VWRA here, emerging market bond JPEA, High yield IHYA.

At Providend, we also advise our clients to consider managing these potential tax implications by structuring their wealth in Vanguard, Dimensional funds that are low-cost, broadly diversified, fundamentally sound that allows them to capture the returns to meet their financial goals.

By placing their wealth in these UCITS funds, they have one less tax worry on their minds.

Here is a portion is taken from the factsheet of a Dimensional fund:

Finally, there are companies that are listed in countries that you would make the estate liable to future estate taxes but are domiciled in countries that are currently free of estate taxes.

One example could be Sea Limited the Singapore company listed on the stock exchange in United States.Sea Limited is incorporated in Cayman island.

Cayman island currently does not have inheritance or estate taxes.

The caveat to this recommendation is that tax laws will potentially change. Companies can merge and change the places where they call home. Ireland could change their perspective on how they conduct this fund domicile business.

I think it is very unlikely they will change. However, even if they do, there are other countries that are tax-friendly waiting to eat their lunch.

The notable one: Singapore with its VCC structure (Singapore variable capital company).

Ireland is not the only European country with UCITS funds. Luxembourg has its own set of UCTIS funds domiciled over there as well. From what I understand they do not face estate taxes and inheritance taxes for investors as well.

I will list out some countries that do not have these kind of death taxes in a lower section in this article.

2. Setup Your Brokerage or Investment Account as a Joint Account

This is a common solution for many couples (then again you can do that with your parents as well)

If you set it up as a joint account, the surviving spouse can still manage the account. They could sell off the shares of companies incorporated in countries that have estate taxes.

By right, the demise of one spouse should trigger an estate tax event on the entire amount. The surviving spouse should submit a death cert for tax clearance.

That is the official way.

But I think the unofficial way is not to declare and just sell off your shares.

From the words of some who have checked with the brokers, they do not care so much what you do with the shares in your brokerage account.

I think most likely, if you submit the death cert, as per my experience trying to get my late mom’s money out of her account, they will force you to close the account.

But if you ask me, it is a risk that you would have to take. Officially, I would not recommend you to do this.

If you think about it, if your family is peaceful this is OK.

However, if your children are at odds with your surviving spouse, what would happen if they start suing your surviving spouse for doing something illegal. In a way, this is not very legal at all.

Back in my school days, I have a friend who told us this tale of his family. He is not on speaking terms with one of his siblings. When his dad passed away, his sibling tried to monopolize the money and tried chasing them out of their home.

This is more common than you think.

The reason we tried to set up our estate well is so that our wealth doesn’t become a divisive thing when we are not around.

This is something our client advisers try to enlighten the clients and prospects who are interested in setting up their estate. Sometimes, it is not just about the money but what you wish to communicate with the people around you, through your estate decision, when you are not around.

An alternative to the joint account is to keep a log of your brokerage accounts, their access credentials and tell someone you really trust where to find it should something happen to you.

This is so that they can log into your account and do the same thing as the surviving spouse.

The consequences are the same as well. In fact, if the family is damn messy, this is even worse if the person you trusted is not a direct line family member.

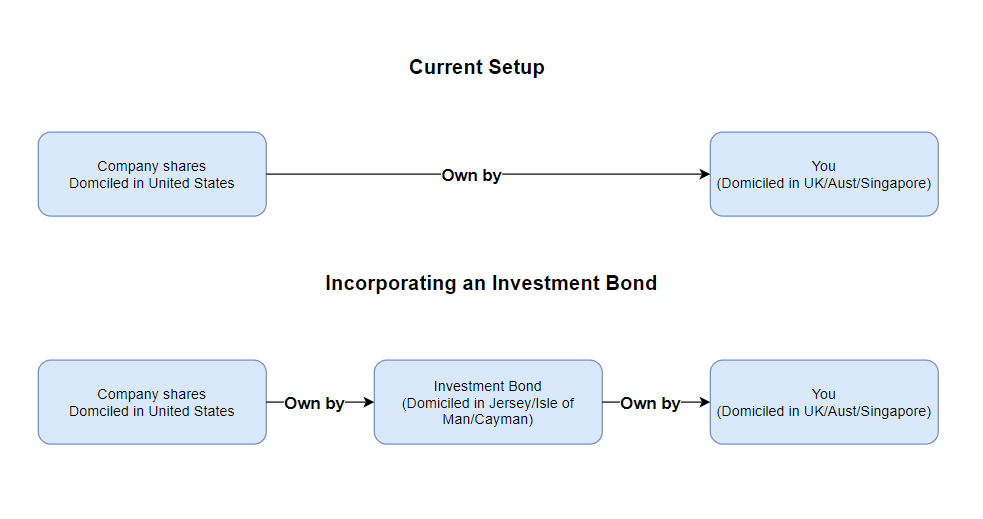

3. Setup an Investment Bond to hold the Shares and Funds

Some of our client advisers have clients with company shares of firms incorporated in countries with high estate taxes.

Depending on their situation, we may recommend they to rationalize their exposure. However, if there are grounds that they prefer to keep those shares, we could help them structure as an Investment bond.

You can think of an investment bond as a wrapper container that holds these funds and shares. Instead of the shares directly owned by you, you relinquish the ownership by transferring the shares to this investment bond.

This investment bond is like a lawful resident of a tax-free country such as Jersey, Isle of Man or Cayman islands. You would own this investment bond.

Should the person passes away, the shares are still down by this “living” investment bond, incorporated in Jersey/Isle of Man or Cayman island. It would depend on whether Jersey/Isle of Man or Cayman island levies estate taxes on the deceased.

There is currently no estate tax in Jersey, Isle of Man and Cayman Island.

There are more details about such bonds that I will not go deep into.

These bonds are popularly owned by expatriates because of their frequent deployments from country to country. They have been recommended these types of products by advisers because of the “tax savings” that they could enjoy.

Unfortunately, they might be lead around by advisers. They have saved on the taxes, but the commissions they paid to the advisers more than take away the advantages. How are we supposed to be able to compound our wealth when the cost can be more than 2% (excluding the total expense ratio of the underlying funds)

There are also some changes and restrictions to how much and when they can take out their holdings.

Our expat adviser Max have spent enough of his time helping prospects and clients make sense of whether they need products such as these or they have been lead around to focus on the wrong stuff.

The truth is, these wrapper bonds can be useful and cost-efficient under a more humane adviser fee structure. Sometimes what you need is someone with enough transparency to explain to you how these products work, what are they useful for, when you do not need it, what are the alternatives to this.

4. Use Term Insurance to Make Up for the Estate Taxes

Term insurance is a cost-effective solution to address this problem.

Suppose your portfolio is worth US$1 million. So you will potentially need to pay US$375,000 in estate taxes.

That will be an equivalent of SG$500,000.

The annual premium for a term life insurance of that amount is $500. That is about a 0.10% portfolio cost.

As your portfolio goes up, gradually buy more term insurance. Term life insurance is much cheaper today than years ago due to longer life expectancy (refer to my cheapest term life insurance article)

What will happen when you live past 65 years old?

As you get older, the cost of term life insurance would not be worth it.

If you have built your wealth, you might want to think about perhaps shifting your assets to investments that are more estate tax-efficient as recommended here.

5. Just Lived With it

This is not quite a solution but I will throw it out there.

Sometimes, you need to know whether you have enough.

If even after potentially paying the estate taxes, you will leave more than enough for the next generation, then you have done the responsible thing!

You are not gonna be around anymore and you have done all that you could to pass down the right values, principles and money to give them a good platform to live a good life.

Additionally, if the potential return of the investment, its quality is better than what you can get anywhere else, maybe the benefit will still outweigh this estate tax, inheritance tax consideration.

For example, currently, you have $1 million. The investment vehicles available to you in more estate tax or inheritance tax-friendly countries can earn you 7% a year compounded returns.

In 15 years, the $1 million would grow to $2.76 million. However, if the rate of return that you can compound is at 11% a year, the same $1 million may have grown to $4.8 million. After a 40% estate tax, you would be left with $2.88 million.

Net net, it might still be worth it.

But if we think about it, does it make sense to deploy our wealth in assets that earn a greater rate of return but end up getting shaved?

I have more of a philosophical answer.

The assets may be able to compound and give less headache to your heirs. Eventually, it might prove to be a better investment versus investing in something that is tax-efficient but is not built to last. Passing these assets to them is also a way of communicating your wealth management philosophy. They might learn a bit from that.

There is some counterpoint to this:

- The growth rate from my experience is not so cast in stone most of the time. You can try and invest in areas where potentially the growth rate is better but your result might disappoint. If the person passes away, it is a double whammy

- Your heirs might still sell off those assets for their own personal goals

- The lifespan of individual companies are getting very short (the average lifespan now is 18 years), so a good company during your lifetime might not continue to be good in their lifetime.

The Countries with No Estate Tax or Death Taxes

If you are looking for unit trust or exchange-traded funds, companies that have fewer estate tax issues, here is a list of companies that currently do not have an estate tax.

The issue is… while they might not have estate taxes, they may have other taxes that would be a deal-breaker. These may not be applicable if you do not wish to change your domicile to that country.

- Australia – there could be some capital gains tax

- New Zealand

- Canada – there could be some capital gains tax

- Estonia – gains on transfer of property as a gift or inheritance is subjected to income tax

- Hong Kong

- Macau – foreign source income is exempted as well. Stamp duty may apply with regards to real estate transfers

- Singapore

- Luxembourg

- Norway

- Portugal – family members who are not deceased’s immediate family would face a 10% stamp duty

- Serbia – there are estate tax but family members directly connected are exempted from inheritance tax.

- Slovakia – no inheritance tax but there are capital taxes on appreciation in the value of the estate assets when sold

- Sweden

- Israel – pretty heavy capital gains tax on assets sold

My Friends At Fifth Person Explains Estate Tax!

My friends Adam, Victor and Rusmin over at Fifth person covers a large part of this in a video.

It might be clearer to hear them explain compare to my wall-of-text:

Summary

I hope this article has given you some ideas to think about when it comes to addressing the estate tax, inheritance tax issue for the portfolio.

I think I have provided more ideas for the estate tax part, less for the inheritance tax. If you are going to move overseas to work, perhaps you can look up the tax laws in that country. Try to make sense of the income tax, what are the conditions that would make you a tax resident of the country, under what conditions would you need to pay gift taxes, and whether there are any outrageous taxes that might potentially be a problem.

You could also check with the liaison person in your company to see if they can provide some advice in that area.

I think we are lucky also that we lived in a country that currently do not have estate taxes, dividend withholding taxes (for individuals. There are withholding taxes for companies and partnerships), taxes on foreign source income.

But some of these might change during your lifetime. We will never know. There were enough murmurs of the return of estate taxes.

If you need some help to better structure your wealth, be more optimized in terms of the estate/inheritance tax aspect, planning your will and estate, you can look up Providend here. We work with expatriates in Singapore and around the region as well.

Disclaimer: This post is for information purposes only and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Ricardo

Monday 1st of January 2024

Hey there,

Just found your site, thanks for the article, very helpful.

I been thinking about this for a while, I am an EU citizen so subject to the “death tax” , I have account with IB (Ireland) but recently I opened a LLC and also a company/business broker account with IB (US).

I thought that using the llc would protect me for the estate tax in case of death but seem I was wrong right? I would have to put my wife and sons as owners/shareholders so they can take the full ownership without having to pay the estate taxes correct?

Another option is to own the llc via a foreign entity (for example a local company that owns the llc, so using the llc as investment vehicle)

Thanks again and happy 2024.

Kyith

Monday 1st of January 2024

'Hi Ricardo, thanks for sharing your situation. I am not a tax adviser but purely interpreting this from my vantage point. Putting another person as a joint account holder solves the problem partly if it is one of the LLC account where if one passes, the other joint account owner wholly owns the other persons half. there iss also a joint account option where this is not the case.

In that other kind of joint account, the other joint owner is seen as an executor to sell the holdings so that they can distribute in a way in accordance to the will.

All these stuff is a problem if there are disputes. without disputes among the heir, there might not be such a big problem.

having an LLC or private company are options but there are cost as well.

Aside from these two there are things like investment bond or basically insurance policy where the stock investments can be placed inside the policy and when the person passes away the heir can get the money which are usually tax free.

Remember that estate duty or inheritance tax is usually on the investments not the account. what sort of investments do you have roughly ricardo? where are they domiciled?

Cae

Thursday 24th of December 2020

Hi Kyith,

If I were to use IB, purchasing IWDA / VWRA, am I right to understand that since both are Irish-domiciled, there will not be an estate tax problem? Thanks.

Kyith

Saturday 26th of December 2020

HI Cae, your assets in IWDA and VWRA fall under the tax jurisdiction of Ireland. Whether an investor would have to pay estate duty will depend on IRish tax laws. Currently, for retail investors, they do not need to pay.

Chris

Saturday 19th of December 2020

Thanks for the article! This is an area that is not well covered in many SG blogs. I recently found out about the high US estate tax for US shares. I think this is a more important issue than the 30% withholding tax for dividends.

Just want to seek your views on the following:

1. Is it correct that all ADR shares listed on US stock exchange, say Nio, BioNtech, SEA, are not subjected to US estate tax.

2. Does the US estate tax apply to all or equal proportion of asset in a joint account? Do you know if US imposes requirements on banks and brokers to comply with the estate tax requirements. Even though you suggested the use of a joint account might circumvent this, I am wondering if a reputable broker, such as DBS or IB, would report this to the US tax authority or take action to stop/recover any payment done after the demise of a joint account holder, since the broker would be alerted by the deceased's estate administrator to establish the amount held.

3. I understand UK does not impose inheritance/estate tax on non-residents. So a Singaporean who invest in UK shares, say through LSE, will not be taxed even the vested amount is above GBP325,000.

Thanks.

Kyith

Saturday 19th of December 2020

Hi Chris, for #1 the refinement would be that each of those companies followed the tax laws of where they are domiciled. if it is the USA, it will be governed by united states tax laws. if it is UK it will be by UK tax laws. Not really where the stock is listed.

for #2 what I understand is that brokers do not enforce. Typically, joint accounts are not included in common estate assets. This means that the other joint person can take out the money and close the accounts. I am not sure of the situation if both holders are of different nationalities. #3 this is the first time i have heard that UK do not impose that on non-residents. I would have to read that up. Always know that it does affect non-residents in some ways.

This is not often covered because usually non dare to commit and even if we put this out there, not many should take the risk based on what we said haha.

Leon

Saturday 12th of December 2020

Thanks for the info. This is news to me.

I have an account with IB, setup long time ago before they have office in Singapore. If I transfer my account to be a Singapore account, would I still subject to US law? My account with them only has US listed shares.

moneysavegeek.com

Saturday 12th of December 2020

@Leon, You will still be hit by US withholding taxes on dividends on your US listed shares and you will also be hit by a 40% estate duty on US assets above USD60k (this does assume you are not US tax resident).

Wil

Thursday 3rd of December 2020

Hi Kyith,

Thx for sharing of this issue. U mentioned"gains from investments should not have corporate income tax as well". If we have own company in Sg, we can utilize the funds to invest in US stock market and the gain will not be taxed from gov? and don't need to pay estate tax if anything happen to the company holder? Thx and hope you can guide.