I started noting down some key points to certain podcasts that helped me to grow as a person or a wealth builder. Since I am doing that, I thought of putting up some personal notes.

These notes might be useful for some or might be harder to comprehend for others without context, and that is ok. They are meant to serve my ever-weakening memory so that overtime I got a list of stuff that I can keep up to date frequently.

They might not have very coherent and flowery introductions, so only some readers will understand. Most likely, it will be less politically correct. There should be some vulgarities, so it might not be safe for the kids.

The notes will eventually be collated on this page: Managing Kyith – My Personal Notes

My first post today is to collect some thoughts about what kind of expenses will make up a lifestyle if I need to go into “conservatively, minimum spending” mode and how much do I need.

This will probably be part 1, which will describe the qualitative thinking behind the lifestyle.

I don’t expect people to understand my obsession with financial security. Maybe, just maybe, I am the only one growing up without much stuff, and that is why buying some sort of minimum, financially secure lifestyle ranks top of my financial goals.

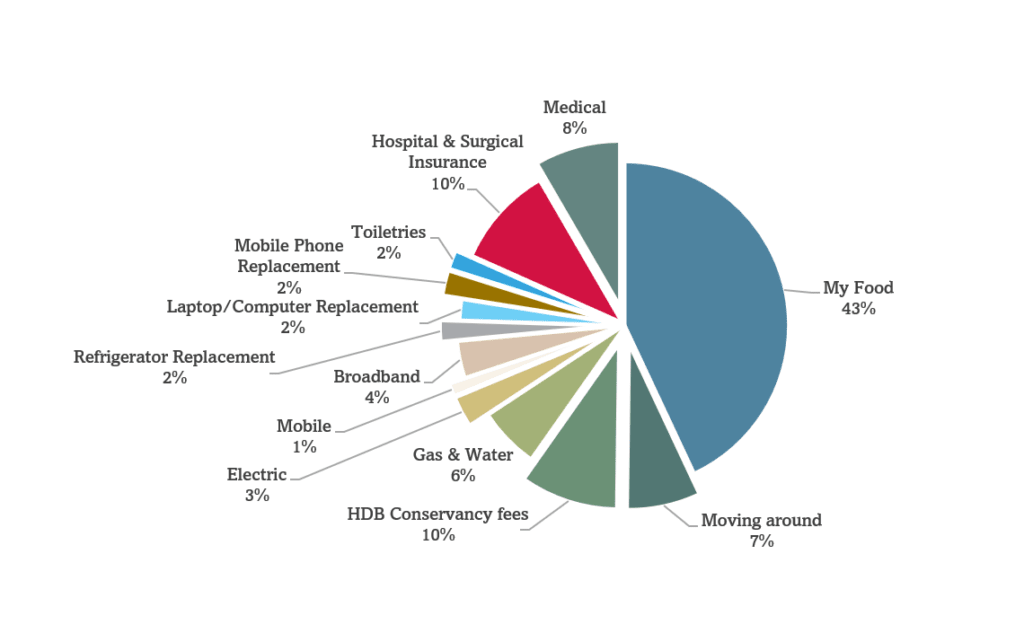

My Essential and Inflexible Spending Comes Up to $10,040 a Year

The table below shows the spending that is most essential to my life:

Note: This is not all my expenses currently. If you want to review my actual expenses, this most recent annual expense post will shed more light.

Update (May 2023): I revised my most essential expense upwards from $9,560 yearly to $10,040 yearly.

This spending is for one person and readers may feel yours will be different, which is OK. I worked out my figures if you are interested work out yours.

Living in Singapore the middle-income way for 40 years leads me to this list.

I like the breakdown of this list pretty much because it helps me think from time to time about whether the figures have moved, research up the individual inflation rates, or what to add on to the list.

If there are changes in the figures, I will just change them and update them here.

This is what the above looks like in a pie chart:

Objective Of Firming Up This Set of Spending.

I want to firm up a list of spending that I will need personally that can guarantee me a certain quality of living that is acceptable to me. This lifestyle is dear to me and I don’t wish my lifestyle to fall beneath this. I can accept and will live a better lifestyle but what is considered the floor in my lifestyle acceptance?

If I know the spending items, I can then identify how much to secure that lifestyle with different degrees of security.

It tries to answer the first part of the question in our head:

“I can accept [this minimum lifestyle standard], and I cannot accept a lower grade of lifestyle. How much money would it cost me to secure this lifestyle perpetually?”

We can then think about how much of our wealth we need to set aside to give us this lifestyle in real terms (which means inflation-adjusted) with great certainty.

If you mentally know the financial figure and the quality of your lifestyle, you can have greater peace of mind spending what is left after setting aside this magic number.

The Minimum Grade of Lifestyle Acceptable

The minimum grade of lifestyle acceptable to me is close to urban survival living but to be honest, I think even mine has some buffers.

If I live this lifestyle, I won’t have the thought: “Why is my life so shit?” but more of “last time I lived this way before, and it is a livable life that won’t deplete my morale in life if I lived this way for long periods.”

This lifestyle is not: “Things can be better, but living like this is not too bad.”

My choice rests somewhere between the first and third thoughts.

To secure this minimum, urban survival living is trying to reach a certain degree of financial security.

Most of us lived like struggling students before, and we lived on less (with a lot of parental support), so urban survival living is closer to that.

If you asked me, many Singaporean parents lived that way as well. If you look at what they spend daily, they spend more on their kids and keeping the family going than on themselves.

Related:

This is Not The Basis of a Retirement or Financial Independence Plan

If you are planning to retire or think about your own style of financial independence, you can use what I presented to help you think, but my objective is different from retirement or independence.

One reason is you don’t want to retire by planning to spend only on the essentials but a more comfortable life. And you may also be more flexible.

Thus, the figures that you come up with may be different.

Guaranteeing Our Physiological Needs with Resources

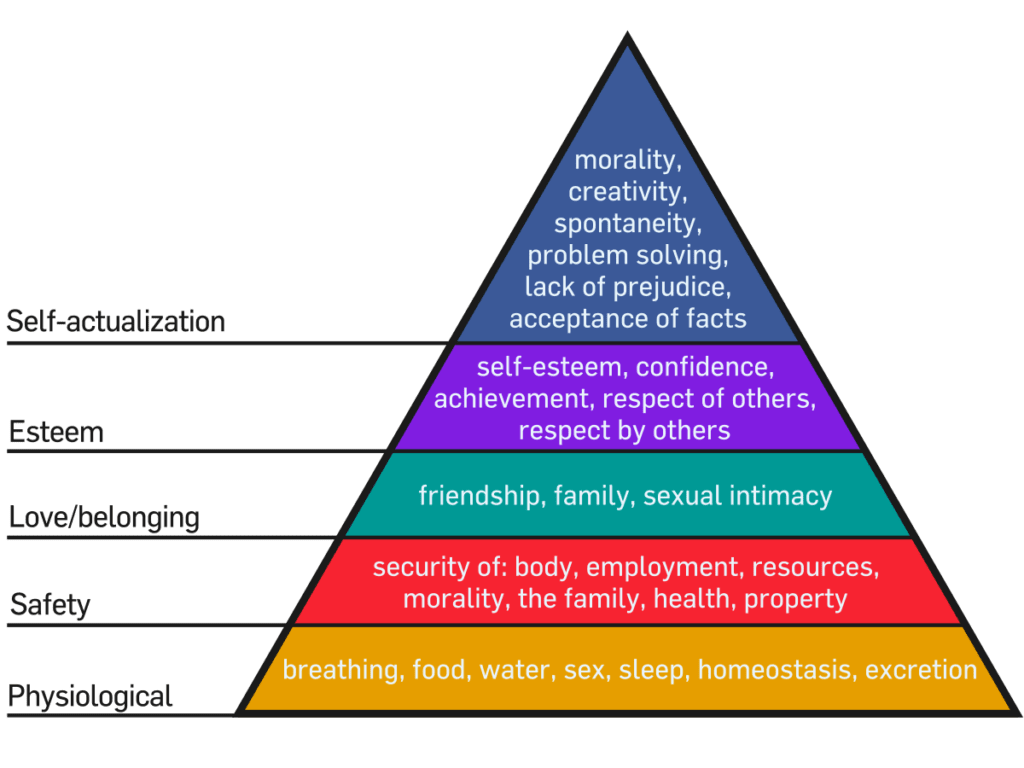

Maslow explains that most of us have a hierarchy of needs:

The layers below are the most basic and essential in the grand scheme. Once we can secure them, then it is more sensible to achieve more.

With more financial resources, we can gain more, which would be a more balanced and satisfying life.

Urban survival living is to achieve financial security in the physiological and safety layer. I am not saying what is on top is not essential, but the primary concern is certainty over the bottom layers.

Once we know that is not under threat, it gives us confidence to go out there and reach for the upper layers.

Why Do I Define Each Expense With Greater Granularity?

We should not have too many essential expenses if we define what is essential well.

If we have less, we can define them better and ask ourselves sincerely if that spending is really essential.

I want to have a list that I can stare at from time to time and ask: “Does this still stand? Is there something that I feel strong enough that should be added?”

Large categories will create a layer of abstraction in your brain. Your brain will go: “Let’s see. What do I have in my home maintenance?” That is when you realize that you do not know what is in home maintenance.

Greater granularity + Ask ourselves deeply = Truer Essential Expenses => Can identify the amount to set aside better.

Why are the Expenses Essential and Inflexible?

Without these items, I don’t think we can survive for long, which is why I think they are essential.

Others would consider some of the spendings as fixed and variable, but you have to ask, what is the use of considering them that way if you cannot vary the spending at all? Some of the fixed spendings is not necessary as well.

What we want to find out are the inflexible expenses. I need to eat X amount of calories a day. That is inflexible in general.

If the nature of expenses is essential and inflexible, then we know that:

- Our income requirements are more fixed than flexible.

- If we lived through an unlucky period, we could not cut down on these expenses. Therefore, extra thought must be put in to care for the possibility of living through unlucky periods.

Past articles on essential or survival expenses:

- Financial Security: How Much is Your Annual Survival Expenses?

- Differentiating Your Retirement Spending by the Degree of Inflexibility. What is the Solution to Address Inflexible Spending?

Expenses tend to be Sensitive to Inflation.

Honestly, I have not done enough work on this yet. Given that I have the spending items above, I should be looking at the inflation rate of these items over time (if there is one).

While most of the spending is non-discretionary, most of the costs only go up and won’t adjust downwards.

If I cook at home, then most likely certain food items that became expensive due to supply and demand dynamics may correct downwards, but if it is the food outside, they seldom go down.

Given this and the inflexible nature of spending, it also means some extra thought must be put into caring for periods when inflation will spike up.

This will not be your inflation going up by 3% a year.

The plan has to care for the situation where the Cai Png goes up 15% in one year (like this period) and stays there for a while. If there is no buffer in the spending budget, I eat one less vegetable (The vegetable for Cai Png typically costs 80 cents to $1 and so if the cost picks up, not ordering one for a $3.50 Cai Png will be a 22% savings, which should help offset the inflation in Cai Png prices)

If you plan for this, you cannot use that “my spending requirements go up by 3% a year” kind of mindset. It has to be “whatever inflation in the past throws at me, this plan must be robust enough to take it.”

The income needs to adjust for prevailing inflation.

More work to be done in this area (When there is more time.)

I Planned for Continuous, Recurring Spending But In Reality, It is Likely Not to be Spent

Most likely, this income stream will need to be activated for a few months or a couple of years.

Given this, actually, the amount of money can be minimal.

You can imagine just setting aside $10,040 x 3 years = $31,200, which would serve this purpose.

However, since I have the resources, I would like to see if I can set aside an amount so that I can live this kind of lifestyle perpetually if I need to. Even if I don’t spend it, this is a specific, inflation-adjusting income stream that can support another person within my capability.

You can imagine this to be my Wealth Machine concept that I talked about in the past.

Given that I am working, the reality is that I won’t tap upon it but mentally, I know it is there if I need to activate it.

Related:

I Feel Better Knowing A Lesser, More Certain Income Stream than a Greater, Less Certain Income Stream

There are two extremes:

- A set of expenses that gives a good lifestyle. To be conservative, you need a significant portfolio value. If you do not have a significant portfolio value, your income stream is less certain.

- A set of expenses that gives you an OK lifestyle or covers certain areas you are more concerned about. To be conservative, you need a portfolio that is much, much smaller. Because the expense is lesser, capital based on conservative estimates is also lesser, this portfolio is easier to accumulate, and your income stream is more certain.

Which one would you prefer?

I prefer number 2.

I would rather:

- Know specifically what was covered.

- Know that I have a great degree of certainty instead of more unknowns.

- Then not be consistently anxious about how resilient my income stream is in the face of market uncertainty.

Different people, different strokes.

Going Through The Different Spending

These are my thoughts on how I came up with the amount in current money terms (2022) and what it entails.

1. Food

Most of us will have to eat 1080 meals a year. That works out to be 90 meals a month and three meals daily. I think what is essential is our calorie intake to be adequate than whether we eat three meals a day. Some of your philosophies may be six small meals a day while others do intermittent fasting and would eat three meals but in a short window.

After eating on this earth for 40 years, I kinda know that as we get older, we eat less. For the past half a year, I been eating two main meals a day. If we plan for the essential, then if I am fine with two meals a day for such a duration, then that frequency is good.

This is the bare minimum amount of food that I will take.

To be honest, I have given some buffer to the budget by setting out $6 a meal. I could vary it by having 3 x $4 meals a day if I want to.

For some, the bare minimum might be three vegetables Cai Png, which typically comes up to $3 a meal. That would really cut down the amount of money to set aside.

But food is the only category that I put in more thoughts (and perhaps even further thoughts after this) because much of our survival revolves around food.

So to err on the safe side, I put $6 per meal.

There is no comfort food here. But being honest here, Cai Png is not bad.

2. Moving Around

If I am not working for some reason or looking for a job, I would likely operate around my neighbourhood which is quite sufficient for most stuff.

So I plan to travel 15 days a month with a round trip, each costing $4.

If I need to travel more, this means either the chances of employment success is higher, which would make some of the transport cost not so essential but job-related.

It should allow me to make odd trips to visit my friends, and if I were to visit them more, then it means financially, I will tap upon other pools of resources.

3. HDB Conservancy Fees

This one usually costs $78 for now (5-room HDB). I cannot stop paying this.

4. and 5: Gas, Water and Electric

My last 2-3 years of gas & water works out below $45, with the last year to be lower than $40. My electric cost doesn’t seem to dip much. In October, it is $19 a month.

Estimating about $75 a month to keep the lights, water and gas going should be fine.

6. Mobile

The mobile phone used to be good, but nowadays it might lean closer to essential.

I don’t need a lot of data if I am not moving about, but I would like a minimum no-contract plan to keep the number. The plans today gave ample data and talk time to be functional.

I will push for $20 to get more data if I do not have broadband.

Perhaps this is more efficient than getting broadband because broadband is not cheap.

7. Broadband

Honestly, I used to think this is essential, but now I keep wondering if getting more data for mobile, when it comes to survival, is more optimal.

In Singapore, broadband is still unlimited, which is one of the reasons for it above more mobile data, but understanding my usage pattern may shed more light on which is better.

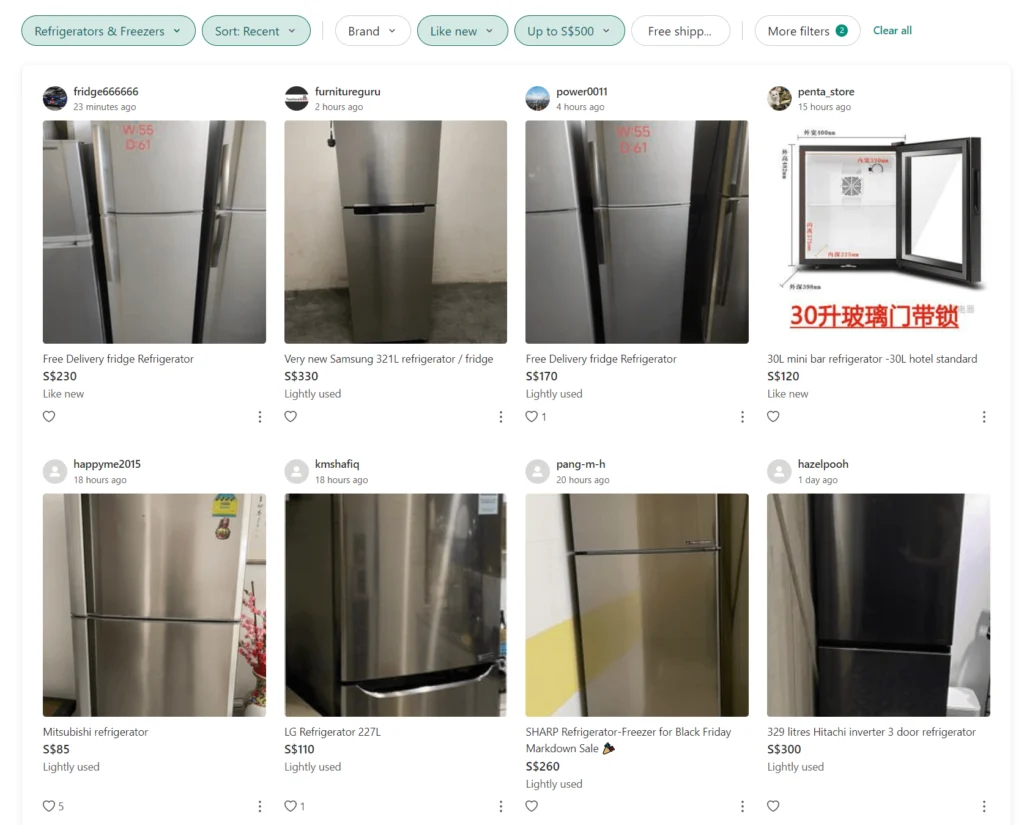

8. Refrigerator Replacement

This cost is purely set aside for preventive measures.

To survive, I can live on lesser:

- Washing machine spoil can just depend on the laundromat for more oversized items or wash me.

- I don’t need bath so often and I have gotten used to bathing without the heater.

- Don’t watch TV

- No aircon. I have like 6 to 7 fans at home (don’t ask me why I have so many)

But the one most time-sensitive thing is that if the fridge were to spoil, food would go bad, which is the most problematic. A refrigerator can cost a range of prices, and my current one cost me $980.

But if I were to get something for contingency, then $600 would do.

I looked at what kind of fridge I could get for that budget on Shopee, and it seems like I can get a two-door fridge. Good enough. The fridge has to last for three years. I don’t care about the size as long as I can dump most food in.

If I have more things, maybe I would consider getting a freezer for the time being.

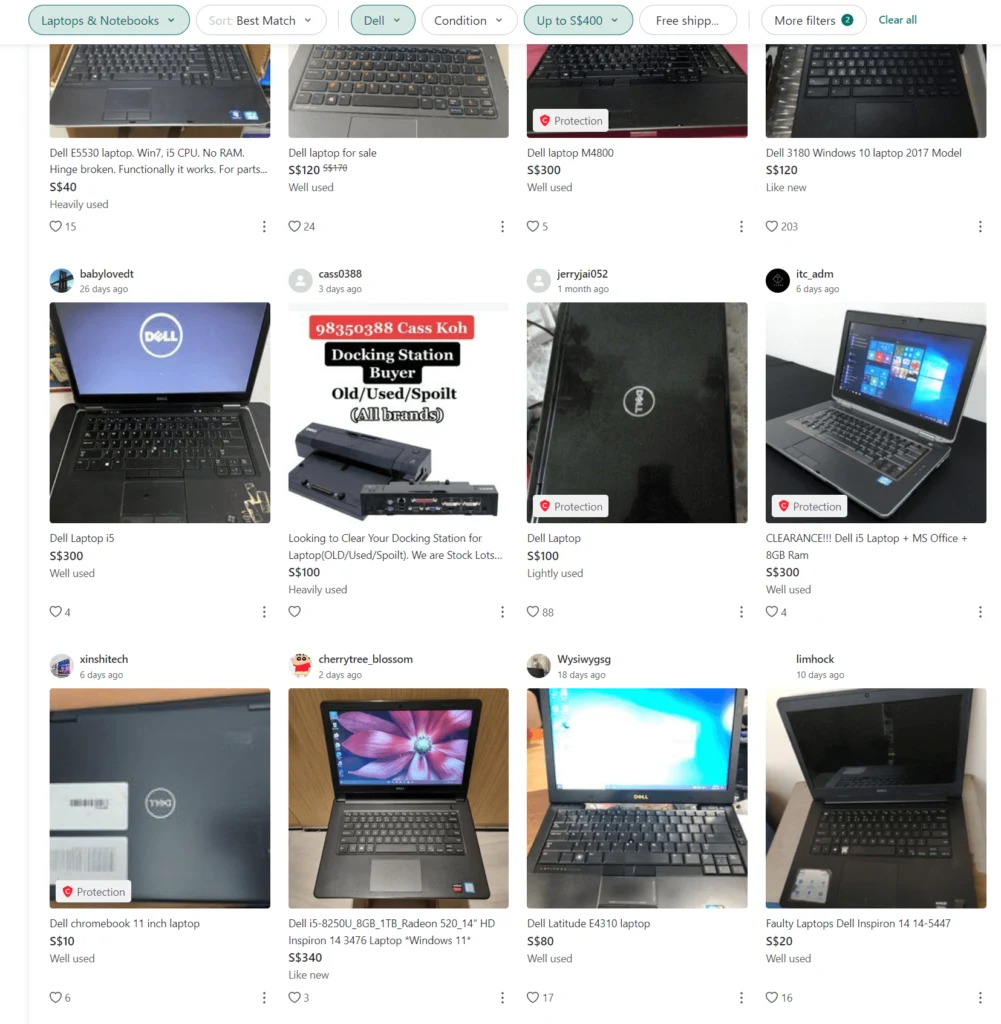

I also looked at what kind of fridge we can get on Carousell for less than $500, giving some buffer for transport costs. If I am not so fussy, my fridge costs could be lower.

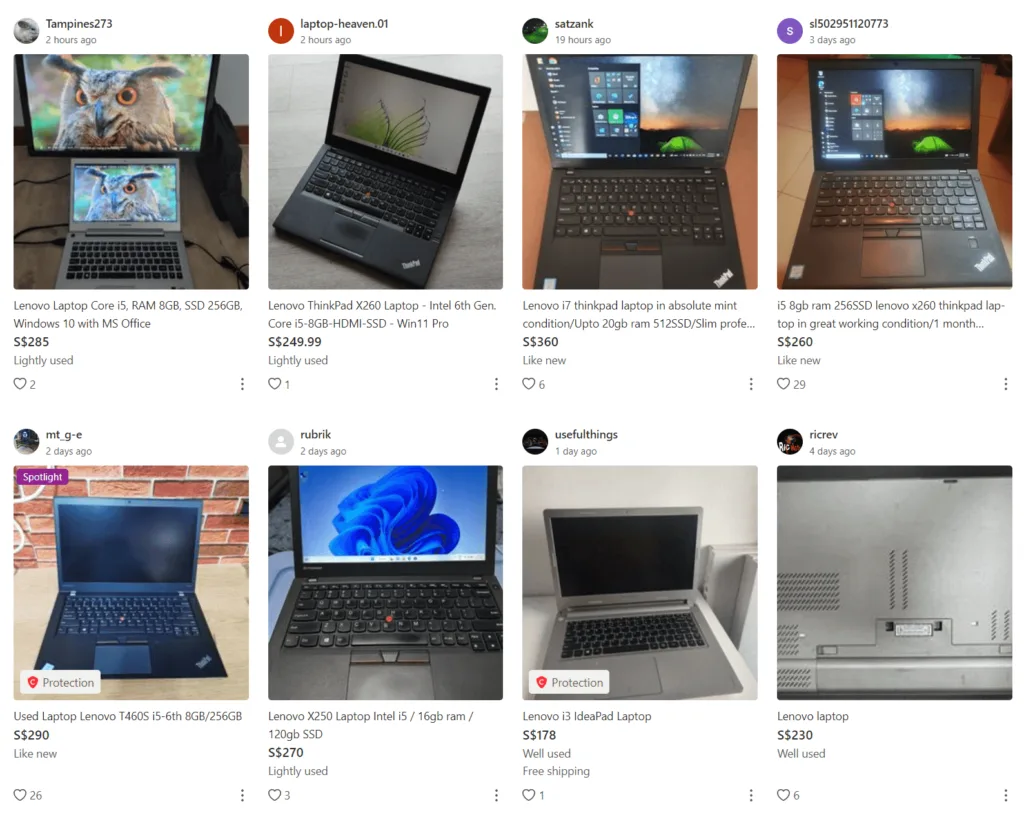

9. Laptop / Computer Replacement

This cost is also for preventive purposes.

A computer is essential for living with greater sanity. I do expect the computer to change every 2 years, with a budget of $400.

The budget looks ridiculous until you realize I have not paid for a brand-new laptop in 7-8 years. So my laptop usually costs around $350 and sadly lasted 2 to 3 years.

If I get an outstanding laptop, it is usually because I need the horsepower and smooth experience for something. Usually, that is for work and if I have work, it makes sense to get something better.

That means, if I am not, the bare minimum grade is an old one or something I can put together.

10. Mobile Phone Replacement

This is something I added in May 2023 after considering it hard.

The mobile phone usually lasts for two years and has become the most essential. Perhaps if I were to consider whether to have a computer or a phone, a phone may be most essential because it has become a computer. We may reach a point in the future where we can finally have one device but we are not there yet.

The budget is $480 over two years which means I will save up $240 a year to replace the phone where necessary.

11. Toiletries

We always need some brush, toothpaste, baking soda, vinegar and detergent to upkeep with life.

12. Hospital and Surgical Plans

This might be a bit controversial, but this is how I look at the protection side of things.

To understand things, you might want to read my insurance philosophy below. Generally, not all protection ranks equally, and some protection is more important because they protect us against more frequent and higher-cost stuff.

We got to ask ourselves what we consider genuinely essential when push comes to shove.

And I determine that our health insurance, perhaps with private insurance, is genuinely essential. My situation may be a bit special in that:

- I don’t have many dependents. If I passed on, the amount should be more than enough for the dependents left, even without the term insurance payout.

- I have a sum set aside for alternative care in case of critical illness, aside from funding this urban survival living/financial security lifestyle.

- If you lose or leave your job, your disability income insurance coverage won’t be valid anymore. The insurance payout if you cannot be gainfully employed earning an income you excel at. The reason why we are engage in this financial security planning is to set aside a stream of income perpetually so that this disability do not become a big problem.

So this leaves us with health insurance.

Our health insurance is important because be it accident, disability or terminal illness, most likely we will be hospitalized.

But the question is what grade of plan do we need or whether we need a rider or not.

My take is to plan for a health standard that you can accept, then have a flexible plan in case you need private care.

So at the minimum, cover for private but plan to be admitted most of the time to a Class A or B1 ward.

The $1,000 a year provides some buffer from private shield insurance up to 55 years old. Beyond that, private health insurance will cost more than $1000.

My strategy is to account for part of the medical cost in my annual recurring essential expenses but the rest from a medical sinking fund if I have one. You can read more about medical sinking fund in the resources below.

Related:

- My Insurance Philosophy – 2017 (I think it may be time for an update)

- Create A Fund to Pay Your Future Health Insurance Premiums – How much do you need?

- Health sinking fund to pay the premiums of your shield plan riders

13. Medical

We get sick from time to time, and we just try our best to alleviate it on our own. But there are certain issues that is better to get a professional to check out.

This amount may be more when we get older.

I have not had to touch this much, but I am cognizant that even in survival mode, it is better to plan for things like this.

Conclusion

Today, I want to quantify a lifestyle and determine how much it will cost.

This is also a “floor” lifestyle I don’t want to go below ever, and I determine the lifestyle will cost around S$10,000 a year in today’s money.

In my following notes, I will describe how much money to set aside and the portfolio configurations.

Your mileage may vary, so use this as a scaffolding to figure out the minimum lifestyle that will give you some security instead of treating this as the blueprint.

Here is Part 2 of the series where I go deeper into how much do I need to fund the financial security I need.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024