There are some deals that you have to treat as homework.

Going through some of these deals are both a mental exercise but also whether we are able to identify whether any part of the deal is attractive enough.

Sembcorp Industries(SCI) and Sembcorp Marine (SMM) were halted a few days ago. There were speculations of privatizations and rights issue but yesterday we get a better picture of it.

There are 2 parts to this deal:

- Sembcorp Marine will issue a renounceable rights issue of 5 rights shares for every 1 existing Sembcorp Marine share at S$0.20. This is not to acquire some assets but to re-capitalize SMM.

- The proceeds will be mainly used to replace existing debt that was mainly issued by parent Sembcorp Industries

- After the rights issue, Sembcorp Industries will distribute the 100% Sembcorp Marine shares they own to existing shareholders. Roughly each SCI shareholders would receive between 427 and 491 SMM shares for every 100 SCI shares they owned.

- If you are a current SCI shareholder, now you own SCI and SMM separately and you can decide what you want to do with it

There are two parts of this deal so let me talk about the rights issue first.

The 5-for-1 rights issue of Sembcorp Marine

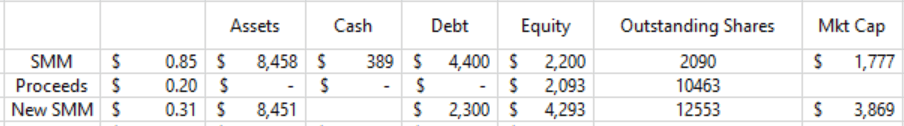

The existing balance sheet of SMM looks like this:

- Assets: 8.4 billion

- Cash: 389 million

- Debt: 4.4 billion

- Equity on book: 2.2 billion

- Number of outstanding shares: 2090 million shares

- Last traded share price: $0.85

- Market Capitalization: $1.78 billion

Sembcorp Marine’s debt to asset is at 52%.

This debt to asset is high but not bothering dangerous levels. This rights issue will bring in $2.1 billion in funding.

Management have stated that this $2.1 billion is to replace the debts. One of the main debt is a $1.5 billion loan from Sembcorp Industries to Sembcorp Marine.

Since Sembcorp Industries currently own 61% of Sembcorp Marine, this action effectively turned SCI’s shareholders from bondholders to equity holders (for a short duration of time heh)

This deal… is dilutive to existing shareholders.

SMM is not doing any groundbreaking acquisition and the effect of replacing debt tends to mean that existing profits and cash flows are shared among a bigger pool of shareholders.

SMM shareholders should feel horrendous about this.

SCI will subscribe up to an amount worth S$1.5 billion out of the S$2.1 billion in rights shares.

What about the other 39% minority SMM shareholders?

The trick is that if these 39% SMM shareholders do not subscribe to their rights, Temasek will subscribe to the remaining S$0.6 billion worth of rights.

So if you look at the right side, SMM ownership will change to a mixture of Temasek, SembCorp Industries, and minority public shareholders.

Because it is so dilutive, most likely the minority public shareholders will not subscribe to the rights issue (this is a renounceable rights issue which means you can renounce your right to subscribe by selling your rights when it is listed to others)

So eventually the ownership structure should be 6.5% SMM public shareholders, 23.6% Temasek and 69.9% Sembcorp Indistries.

Note: Temasek does not own any share in SembCorp Marine directly at this point.

If we piece the conversion of SCI’s loan to SMM and the structure of this rights issue, we can see that the deal was structured to plan for the dis-association of SCI from SMM.

How SMM Would Look Like Post-Rights Issue

The debt of SMM will be reduced but equity will increase. There will be dilution of earnings but it seems the new shareholders Temasek is not that concerned.

The rights issue will bring on 10 billion in shares and post-rights issue the number of shares will increase to 12.5 billion.

The rights were issued at nearly 75% discount of last traded price. Massive discount.

The theoractical ex-rights price (TERP for short) after the rights issue will be around $0.31.

SembCorp Industries Distribution of SembCorp Marine Shares Post-Rights Issue

After the rights issue, Sembcorp Industries will pay out the shares they own of SMM to all their shareholders.

You can think of this as SCI giving stock dividends.

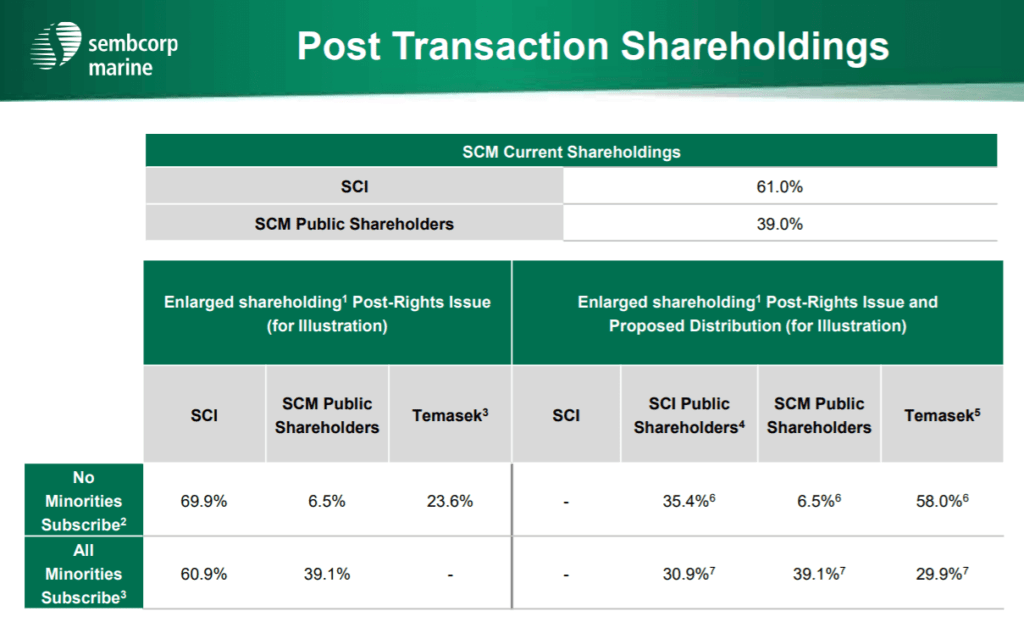

Before we go into this, this is how the ownership structure is like:

- Temasek owns 49% of SCI. They do not own SMM.

- SCI owns 61% of SMM.

With this SMM stock distribution, this means Temasek, through SCI, will now own directly 29% of SMM.

If we mesh this together with the ownership structure of SMM, Temasek will now own 23.5% + 29% = 52.5% of SMM.

This makes Temasek effectively the direct parent of Sembcorp Marine.

The slide above was put out by the companies.

There are 2 rows, with the top row if no minorities subscribe to the rights issue and the bottom row if all minorities subscribe.

The placing of no minorities subscribe in the top row seem to indicate that this is the outcome that they are expecting.

In that scenario, Sembcorp Industries ceased to be a shareholder in SMM. Temasek becomes the majority owner as well as existing SCI and SMM shareholders. (Notice that the Temasek ownership % and my 52% is different, obviously, some of my math might be wrong.)

The alternative scenario is that all minorities subscribe and there are no majority shareholders of SMM.

This I think is unlikely the scenario (hence the ultra discounted rights-issue that is so dilutive to force your hand)

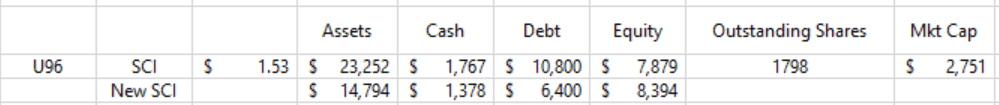

A Cleaner SembCorp Industries Emerges

The most appealing part of this deal might be that without the baggage of SMM, SCI might be re-rated better as a utilities and urban development business.

Since SCI owns 61% of SMM, they consolidate SMM’s full income and balance sheet into SCI.

If we backed it out we have a leaner SCI. This SCI has a net debt to asset of 34%. (I am not sure if I have double-counted the $1.5 billion SCI lend to SMM so do be wary of my math here.)

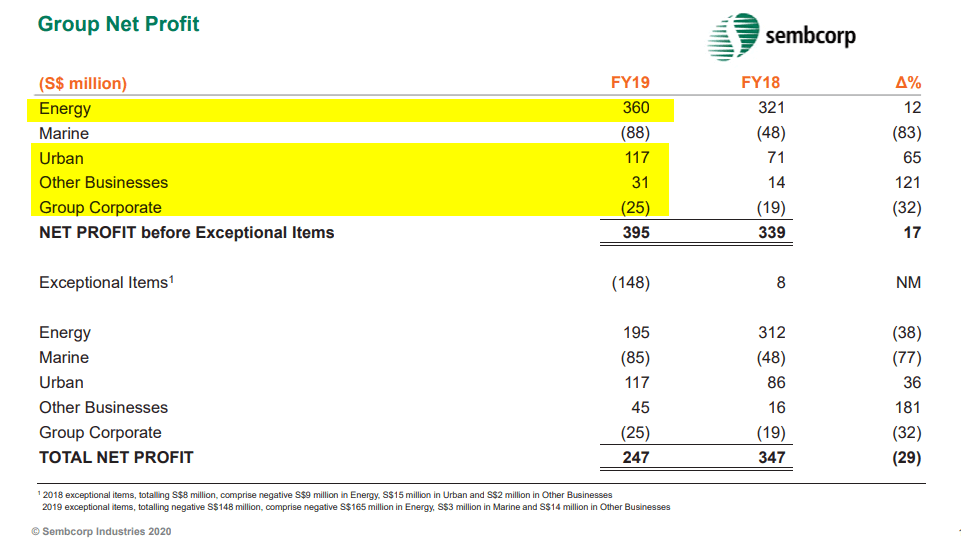

The above slide was extracted from SCI’s full year results.

If we remove the marine business, SCI does not look so bad. The energy business, made up of mainly local and overseas utilities ventures tend to be recurring in nature. The Urban business not so much.

A business like this should be valued based on cash flow. We can use a conservative Price Earnings to value SCI.

But how much is conservative? A well operated utility business such as Cheung Kong Infrastructure (1038) (CKI) is trading at 10 times PE.

I don’t think SCI is as superior as CKI.

If we backed out the marine losses, the net profit could be $450 million. A PE of 8 times would bring the market capitalization to $3.6 billion or $2.00 per share.

However, if you buy SCI today, you get the SMM stock dividend as well. So you have to include that in.

However, how much would the SMM share eventually trade at?

Conservatively, if the rights is priced at $0.20 then maybe that is a conservative price to assume. If you want, you can use $0.15 or $0.10.

If you own a share of SCI this would entitle you to maybe 4.27 shares of SMM:

- $0.20: $0.85

- $0.15: $0.64

- $0.10: $0.43

This sort of bring the intrinsic value of SCI to between $2.43 to $2.85.

Think the share price will shoot up.

As with all things valuation, there are assumptions and I might have make mistakes here and there. So do not treat this as the truth.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Paul

Wednesday 10th of June 2020

Great insight to demerger. Looks like SCI shareholders are benefiting at the expense of SMM shareholders.

There may be shareholders of SMM who cannot cough out cash for their rights issue. What I feel is that if they want to still remain exposed to SMM, they can switch-sell their SMM shares into SCI shares to retain exposure without having to subscribe for the rights. But then again, it's my own opinion.

I got a fair value of $2.53 based on SCI and SMM prices ($2.09 and $0.62 respectively) yesterday. It's within your intrinsic value range. I hope my calculations are right too!

https://thefatherwhorambles.blogspot.com/2020/06/demerger-and-rights-issue-sembcorp.html

Kyith

Wednesday 10th of June 2020

Hi Paul, interestingly, one of our advisers (where i work) send us a Whatsapp on the switch sell as well!. A valuation can be quite wrong when their Indian business turns out worse than expected. After this article, a few people highlighted to me the risk there.

BlackCat

Tuesday 9th of June 2020

Hi Kyith,

I think SM becomes part of Keppel. No idea what price.

Off topic, have you looked at CKI? The numbers look good: high yield, ok payout ratio, low debt. Only some of their future seems uncertain, with the UK regulator lowering prices. And future acquisitions may be limited, with UK/Aust stopping them from buying certain certain assets as a China company.

I'm always looking for sustainable dividend stocks. SCI may be in that category now.

Kyith

Wednesday 10th of June 2020

Hi BlackCat, i cannot fault your analysis. I agree with most of it. I suppose i need some time to piece together the UK part. The problem for CKI is that with the geopolitical tension, it might be difficult for them to secured new acquisition. CK have recently lost a bid for an Isreali water project when US ask them to be wary of China linked firms like CK

Lionel

Tuesday 9th of June 2020

Thanks for your great analysis, Kyith.

As a Sembcorp Marine shareholder, I'll definitely vote "no" in the whitewash resolution, because it is extremely disadvantageous to Sembcorp Marine shareholders. Also, if the demerger fails to materialise, Temasek Holdings will need to come up with a much better deal for us if it wants to acquire a controlling stake in Sembcorp Marine in order to force a demerger.

Kyith

Tuesday 9th of June 2020

Hi Lionel, true that. It is only after I put out that one of my peer asked me how many will choose not to subscribe to the rights issue. Then I realize that if you do not subscribe to it, it is even worse for the existing shareholders.

Jason

Tuesday 9th of June 2020

good analysis Kyith. my calculation early today before market open show if one were to buy SCI at $2.0/share today, and then sell all new SMM share at $0.25 given by SCI later, the net cost of new SCI share will be at $0.875. And use earning per share of $0.25 your calculation implied, that give us PE of <4. super cheap for a utility and urban development company.

Kyith

Tuesday 9th of June 2020

Hi Jason, good work there. Of course, I could also be wrong that actually the utility business is not worth much.

Rahim

Tuesday 9th of June 2020

As now sci had increased 30%. I've no idea whether to hold to to add more. Anyway I just sold all my holding on sci @$2.00 a piece and make profit around 1.5k. Question, now reach 2.19. Are they going north or south? Can still buy at even reached 2.20? Please comment any one?