Today’s article is a continuation of my personal notes series, where I will share some honest takes on how I frame some personal financial decision-making.

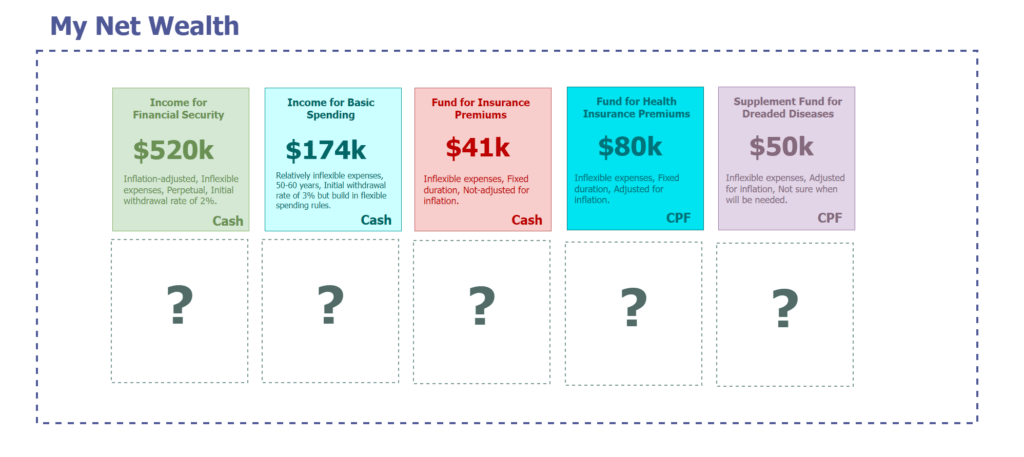

I identified a lump sum set aside to pay for my health insurance premiums (for Restructured A hospital) in my last post.

The next area to think about is this:

A lump sum payment for a severe dreaded disease that can occur at any point from 43 years onwards.

Some readers have thought about this topic, and it is not new. One of my readers requests to see if I have a view on an idea he has:

What my reader is looking for is to self-insure his or her critical illness needs but the question is whether is it viable, and if so, what is a viable plan?

Note: Before we continue, do be aware that what I am going to present is highly personal. This is what I decided, based on my mental model. Members of my team are focused on insurance research but these plans are my own. Part of it will be influenced by our research but my firm do not endorse my plans. In any case, you should not follow what I do blindly because your situation would likely be different from mine.

The Financial Problem we are Trying to Solve

We want to:

- Set aside a lump sum so that in the event of a significant dreaded disease event, we can activate this sum of money.

- We don’t know when it will happen, but it is likely it will happen somewhere.

- Most likely, the chances of survival are less than 50%

In insurance, this is known as critical illness protection.

Traditionally, critical illness protection is to cover what internally in Providend is known as advanced-stage illness. Generally, the chances of survival are up in the air.

When I was younger, I used to think that the chances of survival were high. As a guy who has seen both his parents diagnose and pass away with cancer, and greater education tells me that this is more like… if you survive… hope to live 10 more years. If not, I will live in terms of weeks or months.

Since the early days, we have advanced in medical coverage.

We now have coverage for:

- Early critical illness

- Multipay critical illness

- Term till 99 coverage for death and critical illness

I added #3 in because I think when I went down this path (2006), the term till 99 is less prevalent.

Early critical illness provides a lump sum payment if you are diagnosed with an illness that fits the early critical illness criteria. Typically, that is a cancer that is in its early stages.

From what I understood, the chances of survival are high, the majority of the cost can be covered by health insurance, does not deplete your savings and you can go back to work fast.

My ex-colleague’s dad was diagnosed with something like that and was back up pretty fast. We have other cases of similar experiences. Some doctors we talked to wonder why the fuss over covering for early critical illness.

Multipay critical illness is getting popular because of the advertised flexibility. You can get three times or six times the sum assured, depending on what you suffer from in a lifetime.

I think the appeal is in the coverage for relapse and a different kind of critical illness event. We are afraid that in such an event, we would not have the monies when we most needed it.

The question is whether someone will survive and then live to have to tackle another event.

One of my good friends told me the story of an acquaintance of his who is currently battling his THIRD cancer. Each time in a different area.

Is that a rare case or a common case? I am not really sure.

But it gives us an idea of what could happen.

What does Critical Illness protection suppose to cover?

Critical illness protection, in general, is to cover :

- Replacement income for the period where you recuperate from your illness. Most likely, you cannot work or have to focus on recuperation.

- Lump sum to help in the healing. If you require alternative medication to aid your healing, you have to cater for it.

Typically, we would say 3 to 5 years of your income or expenses plus alternative treatment costs.

This is so subjective, but I think you understand why. Each of us has different healthcare philosophy and lives different lives.

Is it better to cover income or just the expenses?

For most, I lean towards covering the income because you may still wish to set aside money so that your future financial goals will remain unaffected.

If you survive, there is still work to be done.

How much lump sum to cover for alternative medication?

Coming up with a sum is challenging because it depends on your healthcare philosophy. If you do not trust western medicine and wish to seek alternative care, then your cost may be higher.

My friend Chris Tan used to tell me the story that someone spend $400,000 on alternative care years ago.

That is possible but it is difficult to judge.

Doesn’t your income opportunity cost and alternative medication cost go up over time?

Realistically they do go up over time.

If so do we need additional CI coverage as our income increases and the alternative cost of medication increases?

Personally, it should.

I think it is less talked about. You may be suspicious that your financial planner wants to increase your coverage but I think there is a valid case for that.

I said it should, unless you are an outlier like the folks in the financial independence community who has built up their net wealth to provide income independent of their job.

Most are not actively pursuing these activities and are reliant on their income from work to fulfill their traditional financial goals and so naturally, the CI needs should go up over time.

So perhaps from time to time, a review of whether you are adequately covered is good.

How do I think about this problem?

Critical illness is more than just cancer. Kidney failure, stroke and heart disease that is severe enough are some of the problems that can hit us.

To tackle this, we need a combination of:

- Long-term health insurance.

- Long-term care.

- Lump-sum cash payout.

I have covered #1 but have not talked about #2.

I think that is something to ponder about and discuss in due time.

Lump-sum cash payout, the main topic today, is part of the solution to tackle this problem.

My philosophy is that we need to survive the first year. If you cannot survive the first year, we don’t have much else to talk about.

My budget is to make sure that I considered enough for the first year of care.

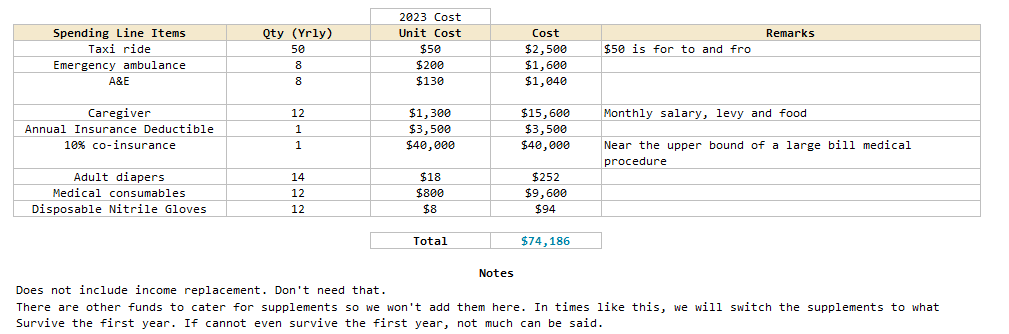

Here are my lump-sum budget consideration:

The expense line items are in today’s cost. It works out to a total of $74,186.

Perhaps they lean more towards my experiences dealing with two cancer cases and I am open to better refinement if there are readers with other experiences willing to share.

I catered for a $400,000 inpatient major surgery and the need to pay a 10% co-insurance and a $3,500 deductible (because I am not getting a rider). If it is less severe, I have more budget to work with.

I am still on the fence if something like cancer were to hit me, whether I will go ahead with the traditional western treatment. You gain a fxxking different perspective after dealing with it not just twice but dunno how many times if you include relatives.

If I don’t, that $40k is about $3,333 a month, which adds to the $800 in medical consumables. Is that enough? I don’t know. Against this is not even close to the $400,000 my boss Chris talks about.

I also cater budget for a caregiver, but in truth if I activate the budget for my discretionary spending for this, I don’t need this $1,300 a month and thus that budget can go to something else.

Do I need to cover for income replacement?

I am financially independent. The majority of the costs are planned for in a conservative manner. If we add the income for essential, basic and those flexible lifestyle expenses, it should be enough. Especially with the reduction in activity.

There are also no dependents on the income except for myself.

Would my spending be higher due to the illness? Yes, it would, which is why part of this budget caters for higher costs.

Can we use our CPF Medisave to pay for this?

My experience tells me no.

We have to rely on out-of-pocket costs.

Adjusting this budget for inflation

The $74,186 budget will need to grow over time with inflation.

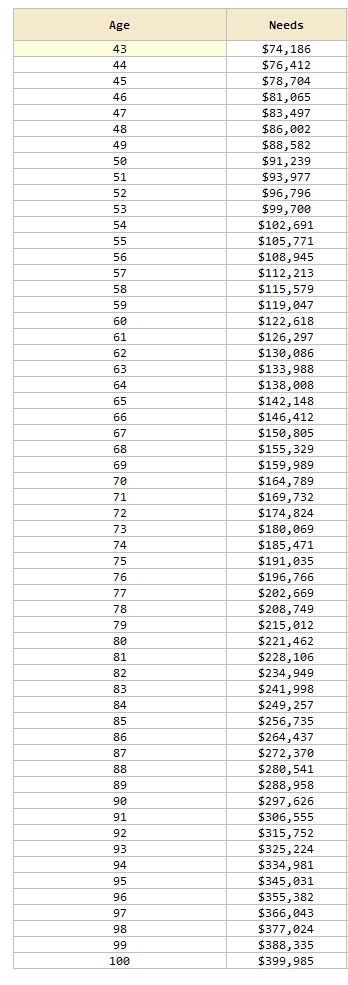

The table below shows the budget needed to grow at 3% a year:

We do not know when we will need it, but it is likely the needs will go up as medical and lifestyle cost goes up over time. You may even debate with me whether using 3% a year is conservative enough!

Part of the future financial risk is covered by advanced-stage critical illness insurance.

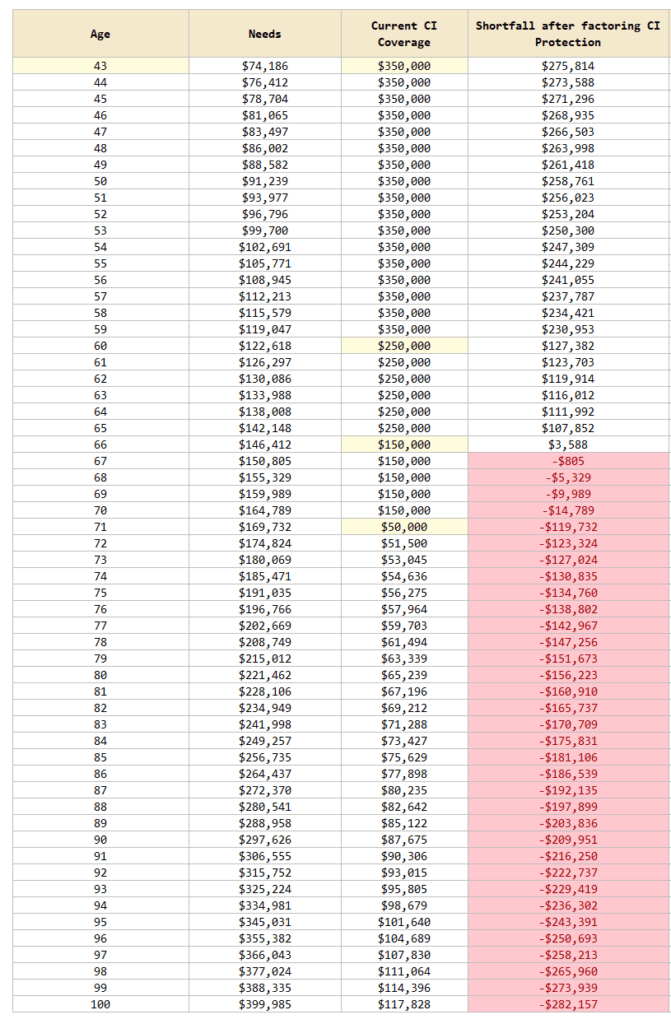

I have advanced-stage critical illness coverage in the form of term insurance and a limited whole life insurance.

There is $300,000 worth of term life insurance coverage, which will cover till 55, 60, and 65 years old respectively. I have $50,000 worth of limited whole-life coverage which should cover for life. The coverage for limited whole life should go up over time in the later years.

The coverage was purchased originally to cover the 3 to 5 years of income replacement needs but as I do not need it now, I can leverage them to cover for the lump sum medical needs.

I added a column that shows my evolving critical illness coverage (Current CI Coverage) and the furthest column shows the shortfall after we factor in CI Protection coverage, which is Current CI Coverage minus my Needs:

If the last column is positive, it means there are excess funds and no shortfall and if it is negative, there is a meaningful shortfall.

By and large, I should be well covered before the age of 67.

Beyond 67 years old, there will be a shortfall in coverage.

So we would need a way to cover the shortfall.

A Portfolio to Supplement the Shortfall in Critical Illness Coverage after 67 Years Old

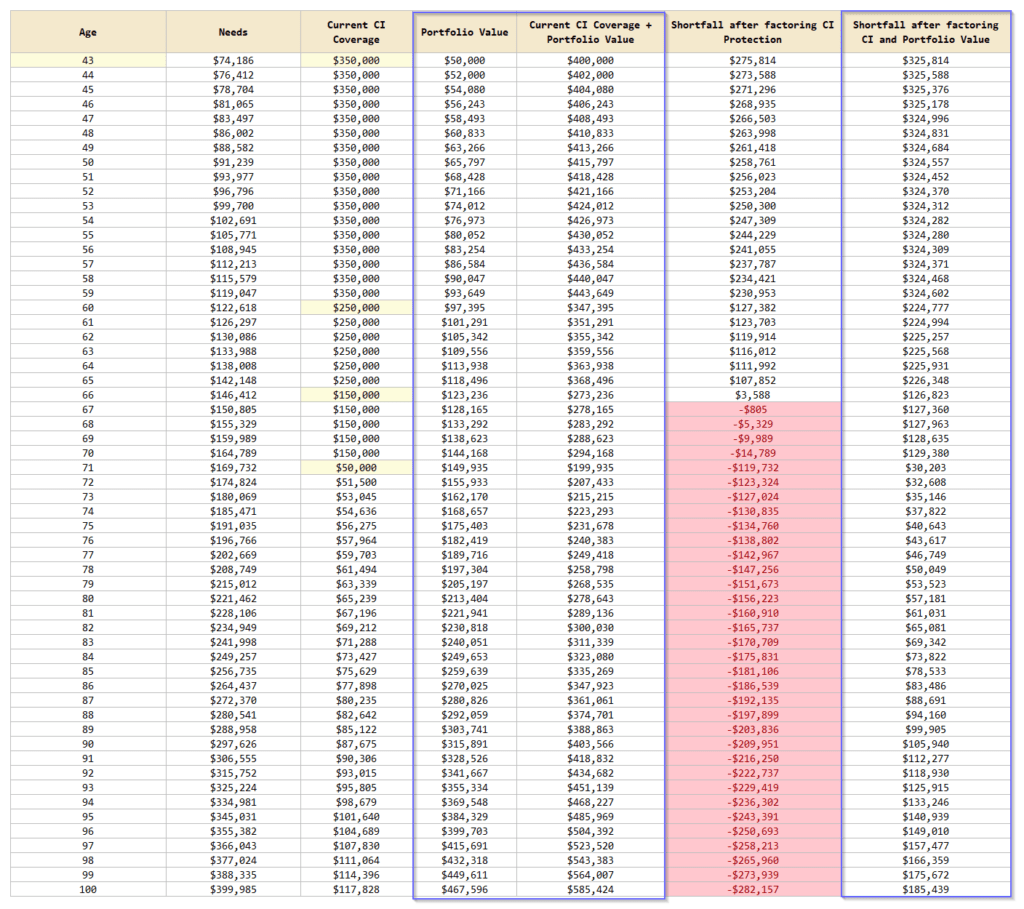

My main plan is to use the same concept as funding for my health insurance premiums for the shortfall in this lump sum needed.

- The funding will come from my CPF OA/SA monies.

- The allocation is a 75% equity and 25% bond allocation.

- The funds and instruments chosen will be similar.

- We will use a planning return of 4% a year, which leans towards a more pessimistic return compared to the long-term return of 6.4%. This is to ensure that in the event I am unlucky, my plan will be more intact than out of wack.

I added three columns to show the portfolio to supplement the critical illness protection and whether the combination of CI coverage & portfolio covers the shortfall. This column is taking Needs minus (Current CI coverage + Portfolio Value):

A negative value in the last column means the portfolio plus CI protection could not cater to the CI Needs and a positive value shows that the portfolio plus CI protection is able to pay out in the event that we need the money.

If we fund it with a lump sum of $50,000, the portfolio value will grow over time.

The last column shows a positive value in all years with the lowest excess to be $30,000 when age is 71 years old.

How did I arrive at a lumpsum initial portfolio value of $50,000?

I adjust the portfolio so that the coverage from 67 years old to 100 years old is positive, yet not excessively positive.

We have built in a margin of safety in the planning returns, and therefore there is no need to have an excessive buffer.

There should be an excess in funding if things go according to plan -We may be able to cancel one C.I policy.

We observe that from age 43 to age 63, there are like $200,000 to $300,000 in excess coverage.

This is because aggregating the portfolio and CI protection is much more than our needs.

From 67 to 100, if investment performance is not too pessimistic, there should also be excess funding.

The good news here is that I have the option to possibly do away with two advanced-stage critical illness policies.

The ideal candidates would be the policies that will expire at the earliest. Given that I am trying to set aside money to fund the policies, this would potentially save me $19,000 in premiums.

This means net-net, I would need to set aside just $30,000 more instead of $50,000.

My Exposure to Negative Sequence of Returns Risks and Capturing Returns

Negative sequence of returns risk is the risk that if you encounter a poor sequence due to:

- Lower portfolio return

- Higher than normal spending rate

- Combination of #1 and #2

This portfolio will have 23 years before we need the money.

This should be a long enough runway to not only break even. My data work does show that we may need 25 to 30 years to fully capture the average return but I don’t need average historical returns for the plan to work out.

Could a CI Term till 99 Be a Viable Solution?

A term policy does not grow in value over time.

This means that to cover for roughly a $300,000 shortfall at 100 years old, I may need to buy a term and cover to 99 years old.

I have not run the premiums but to give you a gauge, a year ago we generated a term till 99 for a 45-year-old male to cover for life with $1 million coverage. This is without an accelerated CI rider.

The premiums came up to about $5,810 a year. Higher coverage is cheaper so if we were to only cover $300,000 it might work out to be $3,000 a year. But to cover CI, which typically is the costly one it could bring the premiums back above $6,000 a year.

Now if I get it today, I would need to pay ongoing premiums for 57 years. If I am diagnosed with critical illness earlier then it would be more worth it than setting aside $50,000 more.

But if it doesn’t how should I fund this $6,000 a year in premium?

I might need a portfolio to conservatively pay for the premiums. Since this spending is rather inflexible, and with such a long runway we need to go with an initial safe withdrawal rate lower than 3% (perhaps 2.8%).

This will mean I need an additional capital of $215,000 to generate $6,000 a year, based on a 2.8% initial safe withdrawal rate.

This looks more costly than my original plan.

What about Other Insurance Plans? Would they fit the Requirement?

For those who are sharper, you might be able to deduce that my plan is basically:

- CI insurance will eventually fall off, but the term policies have no cash value.

- I have both financial resources and enough time horizon.

- Grow a portfolio that will eventually be able to assure the CI in the later years.

A possible solution is to sell off my existing term plans, or in a less drastic manner, take the money set aside for future CI premiums ($36,225 in total) and add some more capital in a cash-value insurance plan, with a CI rider attached.

The cash value plan will cover my CI needs for my whole life. It also has legacy appeal as well.

The key criteria are:

- The cost structure of the insurance plan must make sense.

- The CI coverage is based on the sum-at-risk model.

The sum-at-risk is the difference between the benefit paid out and the value accumulated of the policy. The insurance premiums charged is based upon this sum-at-risk or this difference.

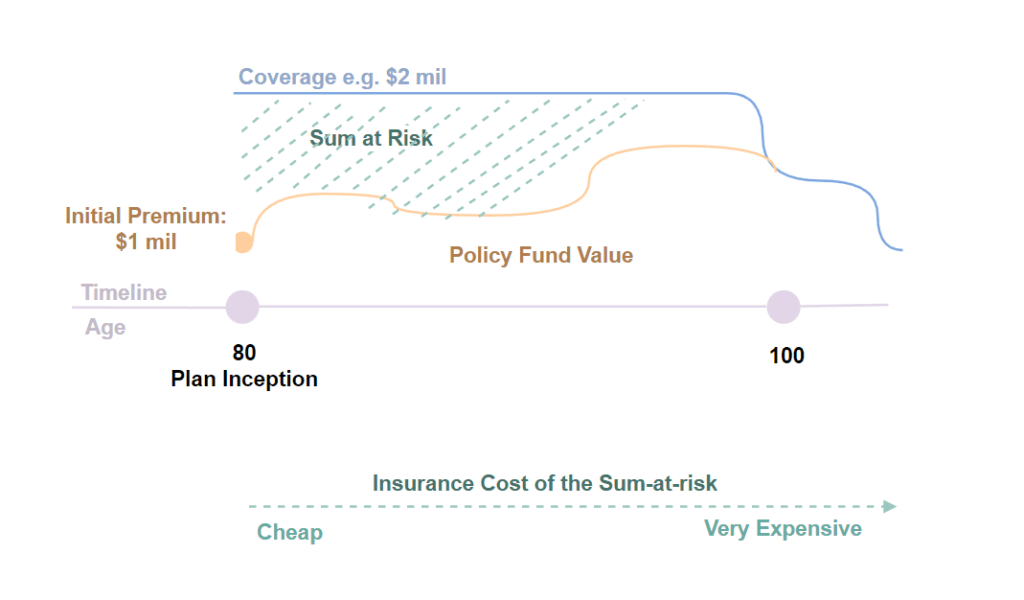

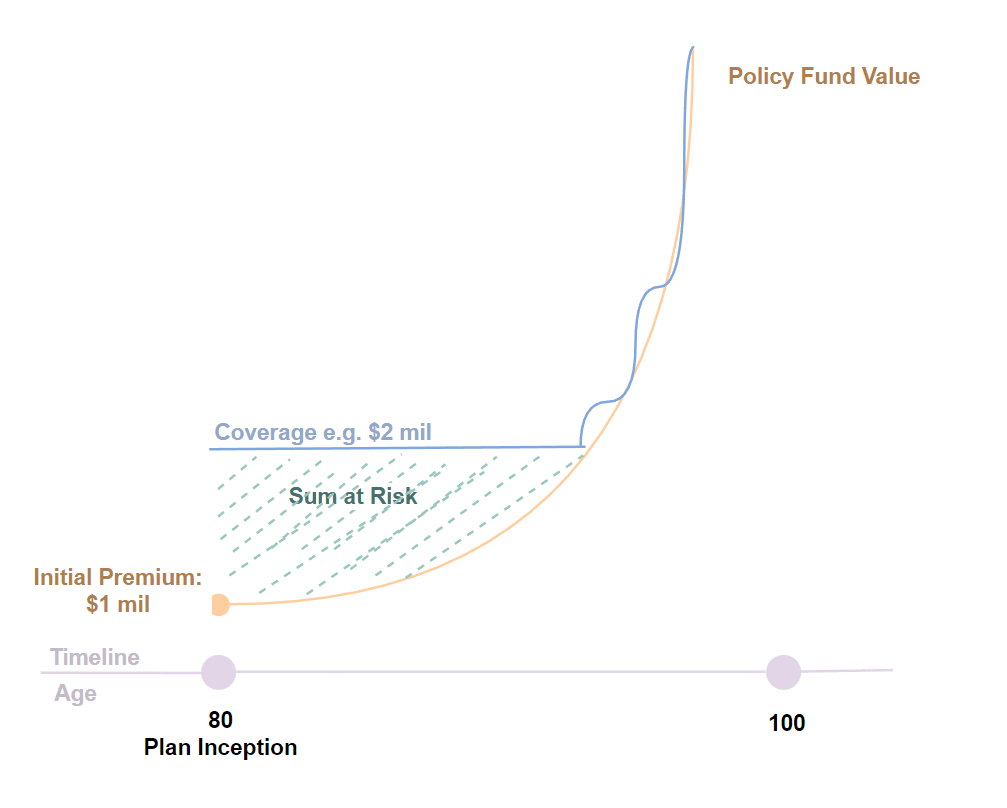

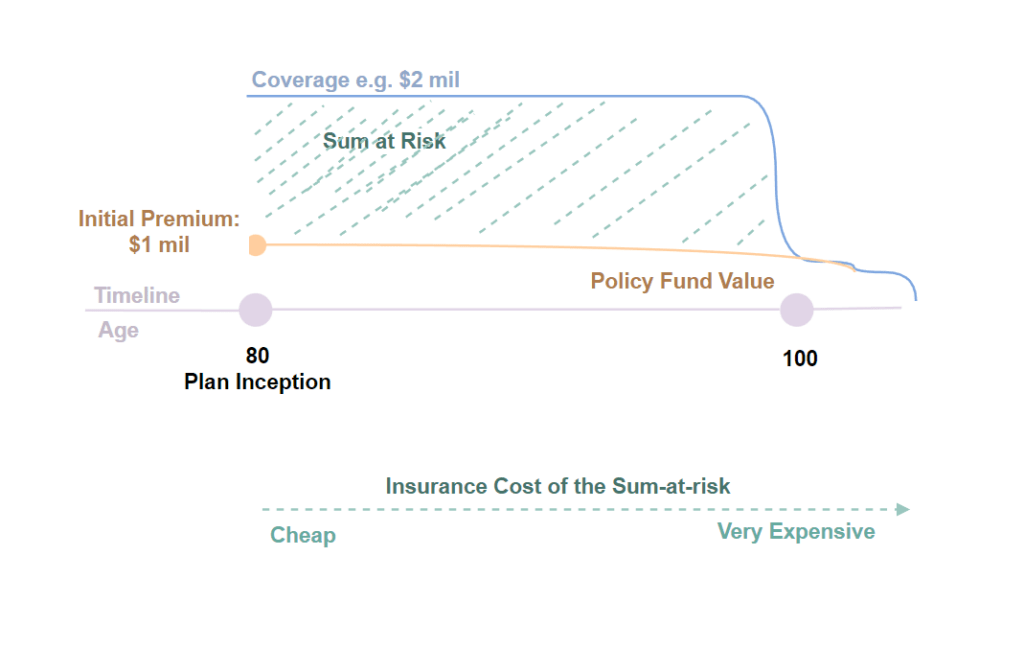

This diagram might help you make sense:

Suppose you are at 80 years old and purchase a plan with an initial premium, or value of $1 million. The plan has a coverage benefit of $2 million. This means that anytime you passed away, you get $2 million.

Now, the $1 mil either can be put in a fund that returns based on crediting rate (universal life policy), or in unit trust investments (variable universal life or investment-linked policy). The value will grow over time.

If the value of the policy don’t grow until more than the coverage by a certain time (in this case 100 years old), then the coverage will fall to the value of the policy which is may be less than $2 million.

The sum-at-risk is the difference in that shaded area, and the cost of insurance depends on how big that area is.

Now suppose in the extreme case your policy invests in a fund that moons to this degree. The value of your policy far exceeds the coverage earlier than expected. The sum-at-risk is reduced and the cost of insurance also goes down.

But what if it doesn’t? Then your cost of insurance is going to be very high.

This model will work very well if you invest in fundamentally sound financial securities, that is low cost, that in the long run can deliver good outcome with high probability.

However, from what I understand, variable universal life and investment-linked policies cannot cover critical illness in this way.

So this promising area gets thrown out of the plan. (Hat-tip to my colleague Mike for clearing this part up).

Conclusion

I can choose to fund this $50,000 portfolio the same way as the portfolio to pay for the health insurance premium with CPF monies, but that would mean that before 55, I cannot get access to the money.

That is fine if I still have enough CI coverage. This plan, however, allows me to cancel two of my CI policies if I wish to and cancelling those policies will create the accessibility problem I mentioned.

I think what I will do is to fund those two life insurance with CI with my salary as long as I can be employed and if I am not employed, I will set aside the amount to pay for premiums till 55 years old. I will not have those policies after 55 years old, provided I check that my portfolio plans (explained in this article) is progressing as planned.

I think too much morbid discussions for the last three pot of money. The next one likely will go back to normal expenses.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

- The Cheapest Way to Extend Your Laptop to TWODisplay that I Can Find. - April 29, 2024

- My Quick Thoughts on the Net Cash, 4% Yielding Boustead. - April 28, 2024

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

revhappy

Wednesday 7th of June 2023

I see that your patience in SCV is finally paying off! All the best!