I finally officially took over my parent’s five-room HDB flat.

That was done yesterday in an unexpected manner (story below).

My mom and dad bought this flat in 1997 under the Joint Tenancy agreement. I think most would be under this agreement.

When my mom passed away six years ago, under the Joint Tenancy agreement, there was a right of survivorship. You can read more under HDB’s Manner of Holding. The flat would automatically be passed on to the remaining co-owners, which is my dad.

When my dad got sick last year in July, one of the things we brothers thought about was the flat. When my mom passed, we helped Dad did up a simple will where 50% of his assets will go to my elder brother and 50% will go to me.

If my dad doesn’t survive, would we have greater complications under that existing will structure? My brother has an existing HDB flat, which means either we have to sell off the HDB flat, or I have to buy over his share. After checking some stuff with HDB and thinking deeper about this, I concluded that I will have to buy over my brother’s share if it is under that existing Will structure.

Financially, it may sound problematic having to cough out almost $300,000 in the current market conditions, but in the end, it is a liquidity issue. I just need to have $300,000. It is about whether I have the cash to pay my brother and after the procedure for him to gift me back $300,000.

But fxxk, all these things can be solved with just a change in the intention of the will.

So we discussed with dad and made the change.

After my dad passed away, I kicked started the Grant of Probate application, and eventually got the Grant of Probate in April this year, I decided to start the HDB the takeover process.

Here is my experience.

Making the First Appointment to Get the Process Started

I started the process of taking over the ownership of the flat after I have successfully obtained the Grant of Probate with the will. You can read about my Grant of Probate process here: My Grant of Probate Application Experience with Yuen Law.

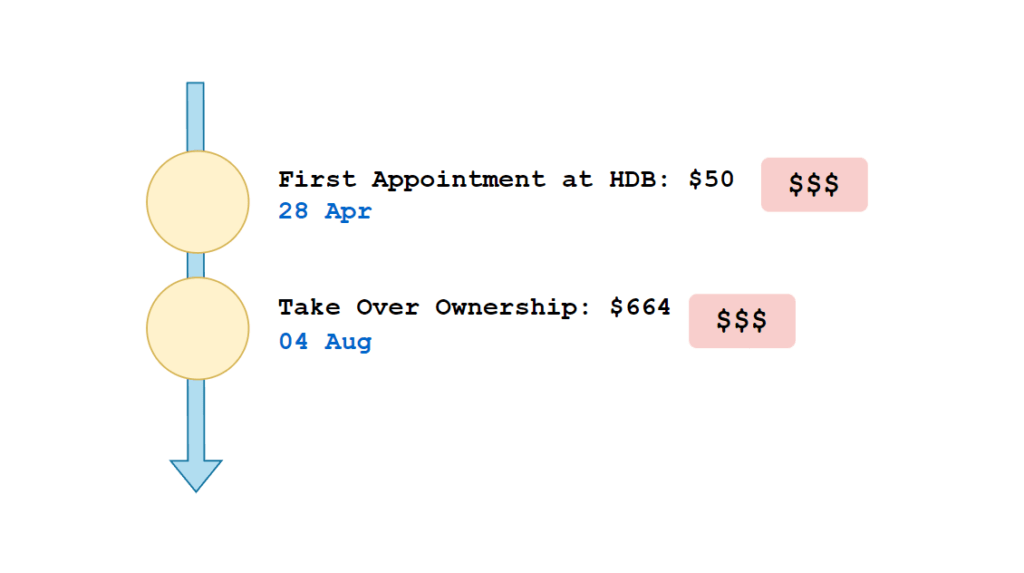

That was about 28th April 2023.

I made an appointment at the local HDB Office for Transfer of Deceased’s Property.

A day before the appointment, a person called me up to ask:

- Whether I got a will and probate.

- Whether I am the sole executioner.

After providing the info and dropping the call, I received the following SMS:

I then went down on the actual day of the appointment to start the process.

The admin person spent a fair bit of time reading my dad’s will to check up on the number of beneficiaries and executors.

The admin person asks whether I want to hold on to the flat or that I want to sell the flat off. There are a fair number of people who wish to do that.

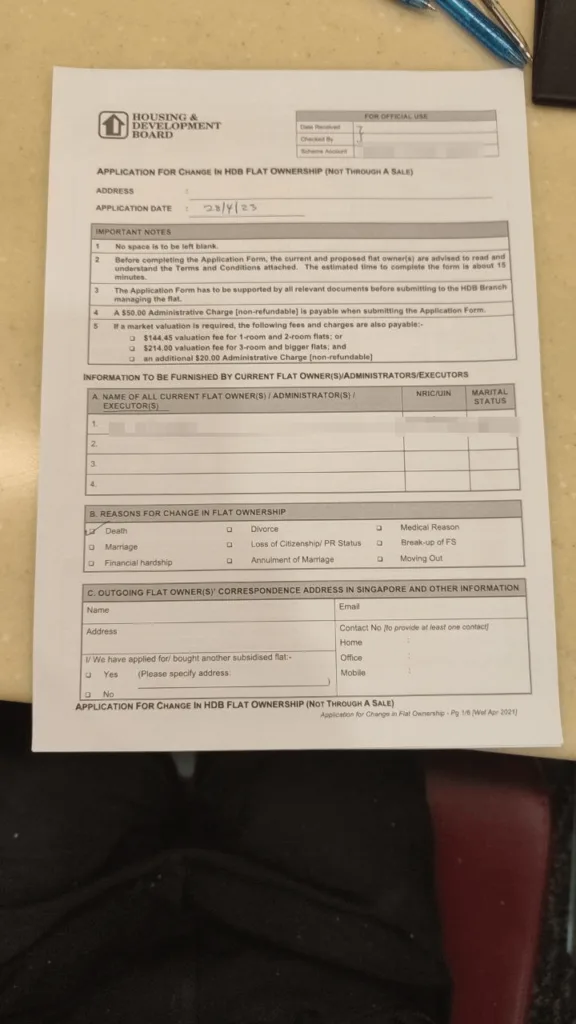

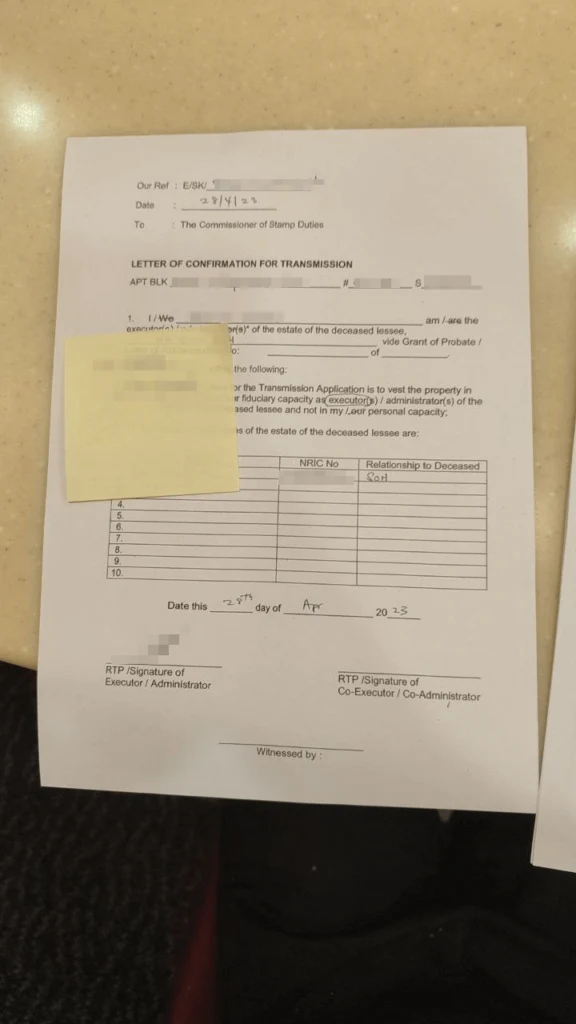

I then have to fill up the following forms:

- Purpose: Transmission and take over ownership.

- Letter of confirmation for transmission.

- Warrant to act – transmission.

Here are what a couple of those documents look like:

I was informed that if the process is successful, it will take up to three months.

I paid:

- Admin fee: $50

I was informed that when this goes through I will need to pay a conveyance and fee of about $1,000.

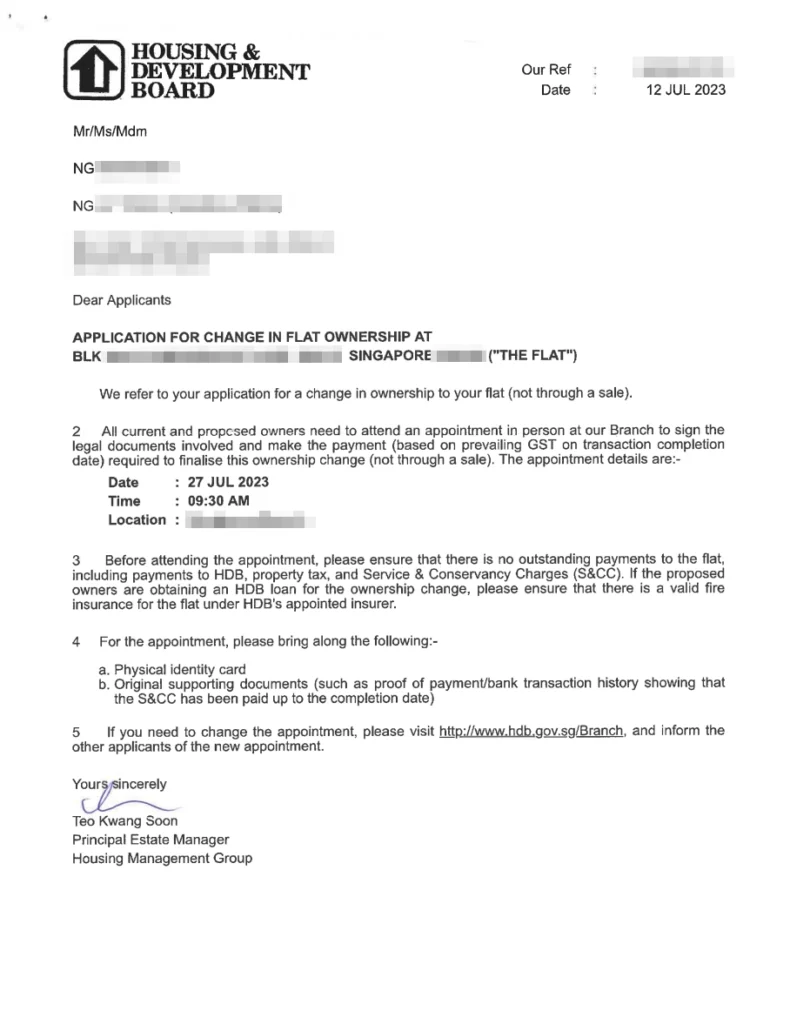

Receiving the Good News from HDB

I opened up my snail mailbox recently and found this letter:

It looks like I open up my mailbox too late (hey, I don’t open it very frequently!)

I wanted to change the appointment to another date via the Internet but as the flat is under my dad’s name, and his SingPass is dead after he passed away, I guess I will make a trip down yesterday in person to make an appointment.

The people at the HDB branch were very nice to help me process it then and there.

I signed a couple of forms, basically taking over the ownership of the lease. The admin person informed me that HDB’s lawyer will assist in most of the proceedings so I do not need my own lawyer.

The proceedings would not come up to a four-digit sum.

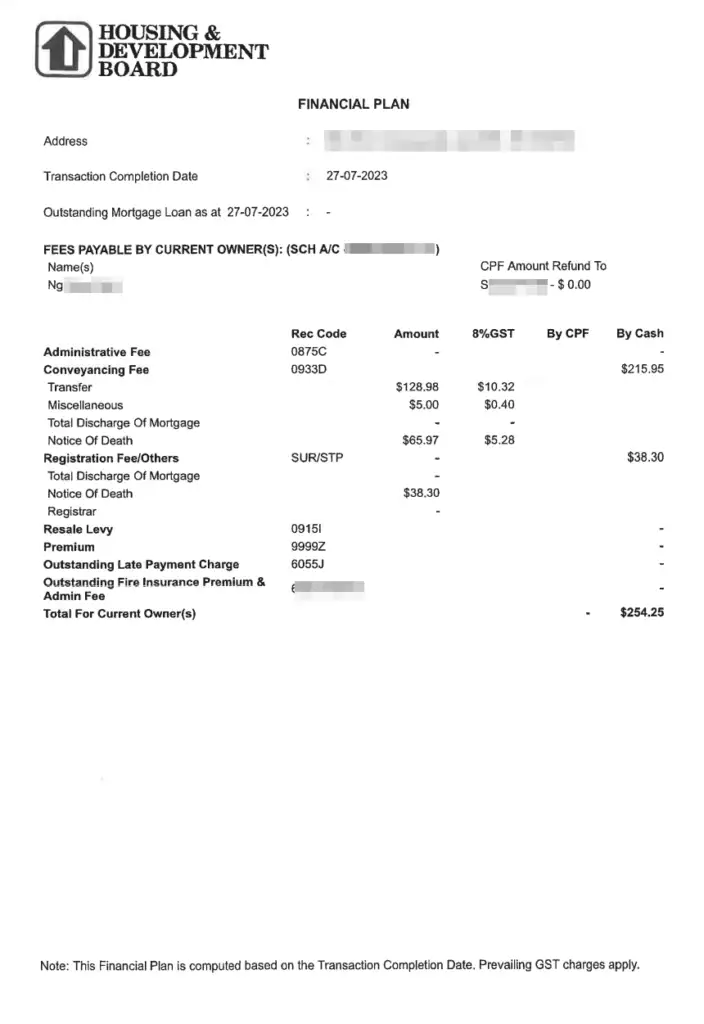

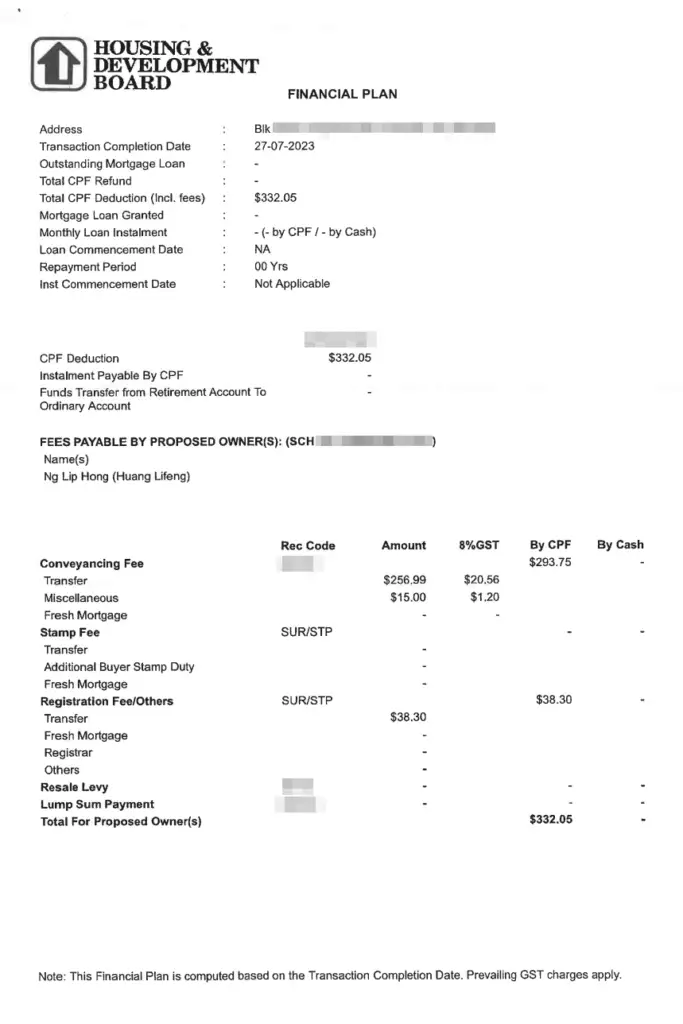

I had to pay:

- Any outstanding town council fee: $78

- The fees laid out in the letter in cash: $254.25

- The fees laid out in the letter in CPF: $332.05

The title deed of the HDB flat will be kept by CPF. If I keep it myself and I lose it, I will have to pay a few thousand for it.

I understand if you finance your mortgage through a bank before you fully own it, you would have to obtain the deed yourself.

Timeline of Events

In actual fact, the second appointment was 27 Jul, which is almost exactly three months from the first appointment like what the admin person say.

Total Payment

The total payment in all was about $714 if you add up the cost in the timeline.

This is a smaller amount than what I anticipated.

Conclusion

With that, my brother and I have what amount to a 1,300 sqft of ample storage space. While the place is under my name, in my mind, half of it belongs to him.

If you go on social media, you would see things like this:

I had like four months to adjust to living very differently from the past forty-plus years. I more or less adjusted to living alone, but it also raised some concerns that need to be risk managed.

An HDB flat can be both a property and a home. To some, it is a property, but to others is something that is filled with good or bad memories.

I will probably flush some plans and other perspectives out in future posts.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

WK

Sunday 6th of August 2023

Hi Kyith, do you mind explaining how the existing Will structure make things troublesome? And what exactly do you insert as the intention of the will and does it put your brother at a disadvantage?

thank you for your sharing. i guess i am also in a similar situation as yours

WK

Monday 28th of August 2023

@Kyith,

Hi Kyith, thanks so much for the sharing. My situation is similar in the sense that my brother owns a condo, and i do not own any property. My mother intends to pass all her assets, including a HDB, to me and my brother. Thus it makes sense that i learn from your experience and will the HDB property 100% to me to save on costs.

But i am a little confused. Since the will is set up by your father, how is it that you can set up a legal arrangement to will the property 100% to you?... Is it because as long as your brother agrees to it and then you and your brother go to a law firm to sign some documents?

It is nice to visit your blog, always learning something. Including the financial stuff that you share from time to time.. Take care

Kyith

Sunday 13th of August 2023

Hi WK, my brother at that time (And still do) own an existing HDB flat. If both of us inherit based on the old will of 50% to him and 50% to me, most likely I will officially have to buy over his share. That will entail a longer administration process, not to mention some costs. So what we did was to will the property 100% to me. In terms of percentage, financially it puts my brother in a disadvantage, but that is a personal matter in the family.

Hope this enlightens a bit and do let me know if your situation is different.

Benjamin Goh

Sunday 6th of August 2023

Hi Kyith. Are you a Singaporean or which nationality r u, n where r u domiciled n located currently?

Kyith

Sunday 13th of August 2023

Singaporean domiciled in Singapore located in Singapore?

Riley

Sunday 6th of August 2023

Hi Kyith

My condolences,and thanks for sharing your experience.

It is helpful for individuals who have not experienced such situations before.

Kyith

Sunday 13th of August 2023

Hi Riley, no issues. Just sharing the little I know.

Dannie

Sunday 6th of August 2023

Hi how do you change the intention of the will so the you take ownership of the hdb flat but your brother still retains his share in the flat?

Kyith

Sunday 6th of August 2023

Hi Dannie, the Will specify how my Dad's assets are divided. He can choose to divide the flat by giving both of us equal share or pass it to one sibling. If my dad chooses to give to both of us, both of us can inherit it but, under the HDB rules, my bro cannot keep his share.

The will doesn't consider my brothers financial setup. The human behind the will (my Dad) has to consider that. Hope this helps.

Yiew

Sunday 6th of August 2023

Hi, can advise what change u got ur dad to make in his will? Eg. Give the hdb to u only?

If u and ur bro own pte property already, and the hdb is pass downed in the 50-50 rule, u guys will have to sell the flat right?

Thanks for the info

Kyith

Sunday 6th of August 2023

Yes if both of us own the flat, we have to sell it. As a single, I did not currently own a flat so that is ok. We basically change the will to will me the property.