Today’s article is a continuation of my personal notes series, where I will share some honest takes on how I frame some personal financial decision-making.

Recently, I decided to tackle some of my future healthcare considerations.

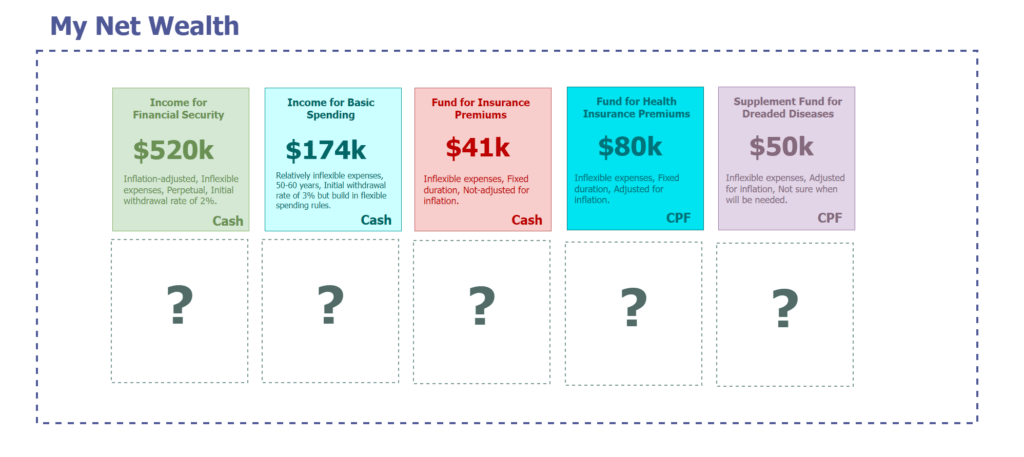

In cutting my F.I. capital needs for insurance premiums from $131,366 to $58,132, I explain that a large part of our insurance premiums do not adjust based on inflation and can be rather fixed. This means that adding our insurance premium needs to a whole retirement income figure is not very optimal.

In my calculation, I decided to leave out how much to set aside for health insurance premiums.

Health insurance is commonly known as Medishield LIFE and the private integrated shield plans and their riders are provided by Singlife, Income Insurance, AIA, Prudential, Great Eastern, HSBC and Raffles Insurance.

In this article, I will explain why I decide to set aside $80,000 of my current CPF Ordinary Savings monies to fund my future health insurance premiums.

Note: Before we continue, do be aware that what I am going to present is highly personal. This is what I decided, based on my mental model. Members of my team are focused on insurance research but these plans are my own. Part of it will be influenced by our research but my firm do not endorse my plans. In any case, you should not follow what I do blindly because your situation would likely be different from mine.

What I Wrote About Medical Sinking Fund for Health Insurance

I wrote two articles that document the ideas behind medical sinking funds specifically use to pay for health insurance.

You can read both of them here:

- Create A Fund to Pay Your Future Health Insurance Premiums – How much do you need?

- Health sinking fund to pay the premiums of your shield plan riders

Most of the ideas are valid still, except in the time between that article and today there are some adjustments:

- New MOH rules on the coverage for drugs approved on the Cancer Drug List, non-Cancer Drug List, and Cancer Services. This greatly impacts future coverage.

- Both Aviva and Axa are now known under new entities Singlife and HSBC respectively.

Most of the models are not too wrong but the challenge is coming up with a sensible portfolio implementation to fund the premiums.

The Complexity Behind Health Insurance Planning

Unlike the premiums for other coverage, health insurance premiums rise and do not rise uniformly.

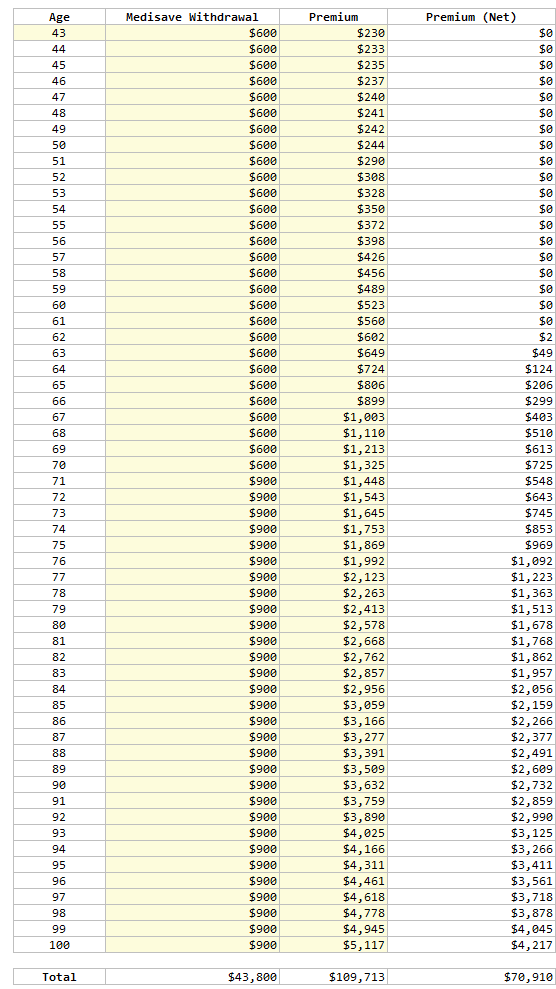

The chart below shows the prevailing premiums for Income Insurance’s Incomeshield for Restructured A hospital:

This premium is before any adjustments to the amount that can be paid with CPF Medisave.

You will observe that the bulk of the premium takes place when your health is not good and when you need hospitalization and treatment the most. When you are young, the premiums remain affordable.

Most who decide to do retirement planning when their young may miss out on planning for this because how do you estimate this?

Dual Growth Rate

The premiums that you will pay have double growth:

- Growth as you age (what we explained in the previous section.)

- Inflation growth

This means that the $4,500 annual premium in the IncomeShield chart previously will not remain at $4,500 come 99 years old.

The rate of growth varies.

In recent years, the growth for the shield plans catering to private healthcare experienced high growth rate due to systemic issues. The growth rate for government restructured A ward is more controlled.

Coverage and Cost Change Over Time

In the span of the last 18 years with a private shield plan, I have seen numerous coverage changes, some for the better, some for the worst.

With the changes, the cost of insurance also changes over time.

What used to be the cheapest plan in the market might not remain the cheapest.

This means that, if you have the cheapest plan now, in the future:

- You might not know if the coverage remains the best.

- The plan remains the cheapest.

You/I have to Decide Upon Your Philosophy towards Treatment

The challenges mean that we have tradeoffs that we need to make.

There is no ideal solution that will give the best care, with the greatest flexibility yet affordable. If you understand my article today and try and work out the amount to cover, you will realize that the portfolio value will allow Kyith to spend on the majority of his most essential expenses perpetually.

If that is your wish to have the best care, then you will need to find out how much, and then fund it accordingly.

Some decisions to make:

- What is the highest grade of care do you wish to cater for? Private, Government Restructured A, Restructured B1, B2 & C Ward?

- Do you wish to have a private shield rider to lessen the payout?

- Which insurance company to go for?

Each of us has different philosophy towards treatment, because each of our experiences are different.

For the longest time, my longer-term plan is to have a private shield plan that covers private care without the need for a rider to offset costs.

I will bear the cost of the annual deductible and the 10% co-insurance.

The default choice is not private but Restructured B1 and A ward but I wish to have the option open if I desperately need private care. Therefore, having access to Private grade care is a good to have.

As I think deeper if my goal is to pre-fund the premiums, do I want to get ready a sinking fund to fund until the best grade, or should I break it up into two levels:

- Fund the premiums for an acceptable grade of care.

- Fund the premiums for a higher grade of care if the funds allow.

I think framing how much to fund as two levels is the right way to look at it. If I continue to work, I can try to fund #2 the higher grade of care, but in the worse case, an acceptable grade of care is funded.

So here are the levels:

- Level 1: Fund the premiums for Restructured A ward care from Age 43 to 100 years old

- Level 2: Fund the premiums for Private ward care from Age 43 to 100 years old

- Level 3: Fund the premiums for lower grade rider from Age 43 to 100 years old

The S$80,000 mentioned is to cover Level 1.

The Annual Premiums for Private and Restructured A-Ward Care

Here are the total gross premiums for the private insurers for private grade care from age 43 to 100 years old:

| Insurer | Total Premiums (43-100) |

| Singlife (my current plan) | $250k |

| Income | $226k |

| AIA | $306k |

| Prudential | $286k |

| Great Eastern | $264k |

| HSBC | $256k |

| Raffles | $221k |

AIA turns out to be the most expensive, with Prudential next. But the difference is not too big. The average is $255k.

Here are the total gross premiums for Restructured A grade care from age 43 to 100 years old:

| Insurer | Total Premiums (43-100) |

| Singlife | $132k |

| Income | $97k |

| AIA | $115k |

| Prudential | $84k |

| Great Eastern | $109k |

| HSBC | $102k |

| Raffles | $102k |

The average is $106k.

If I were to downgrade to the Singlife plan that covers Restructured A ward, the premiums will be the most expensive. There might be a good reason.

Of the plans, Singlife, AIA and Great Eastern are the plans with more additional medical cover. However, this may be subject to change in the next 57 years.

I do lean towards shifting to Great Eastern’s SupremeHealth plan because Great Eastern has a decent size client pool to share the cost, and decent coverage but the cost is decent as well.

Whether I can successfully switch over from Singlife without exclusion is a big unknown. That is something to find out.

Let us look at how do we tell we need $80,000 to fund the premiums.

How much are the Net Premiums From 43 Years Old to 100 Years Old?

Part of the premiums will be paid by our Medisave. But there is a limit of how much Medisave we can use to fund the premium of our health insurance.

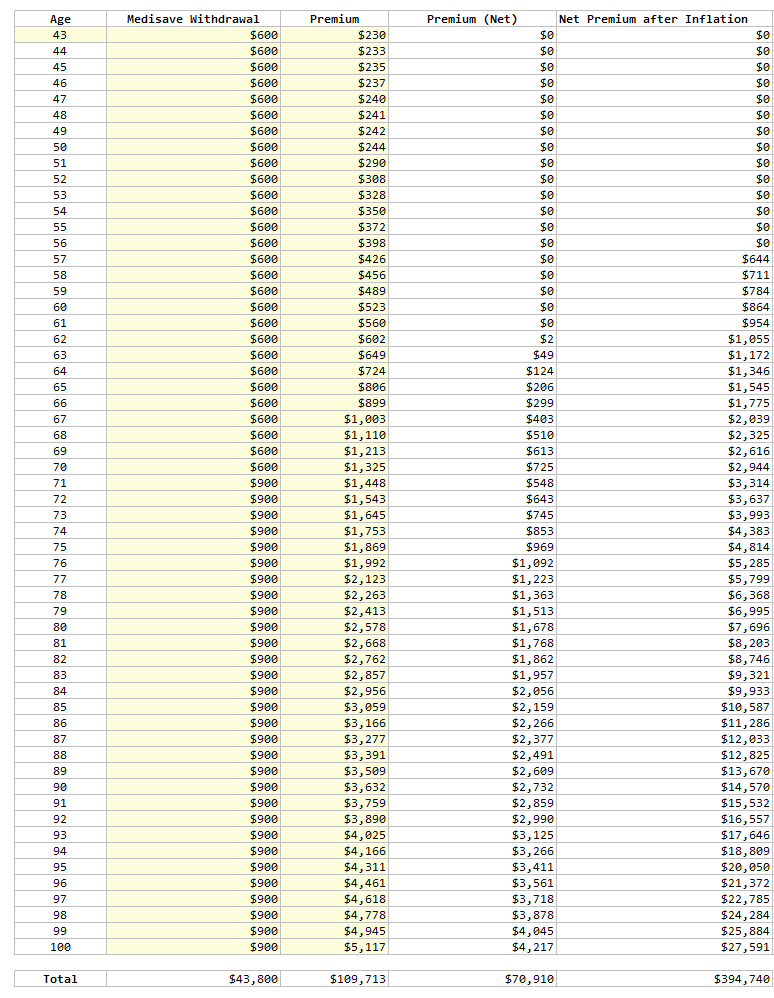

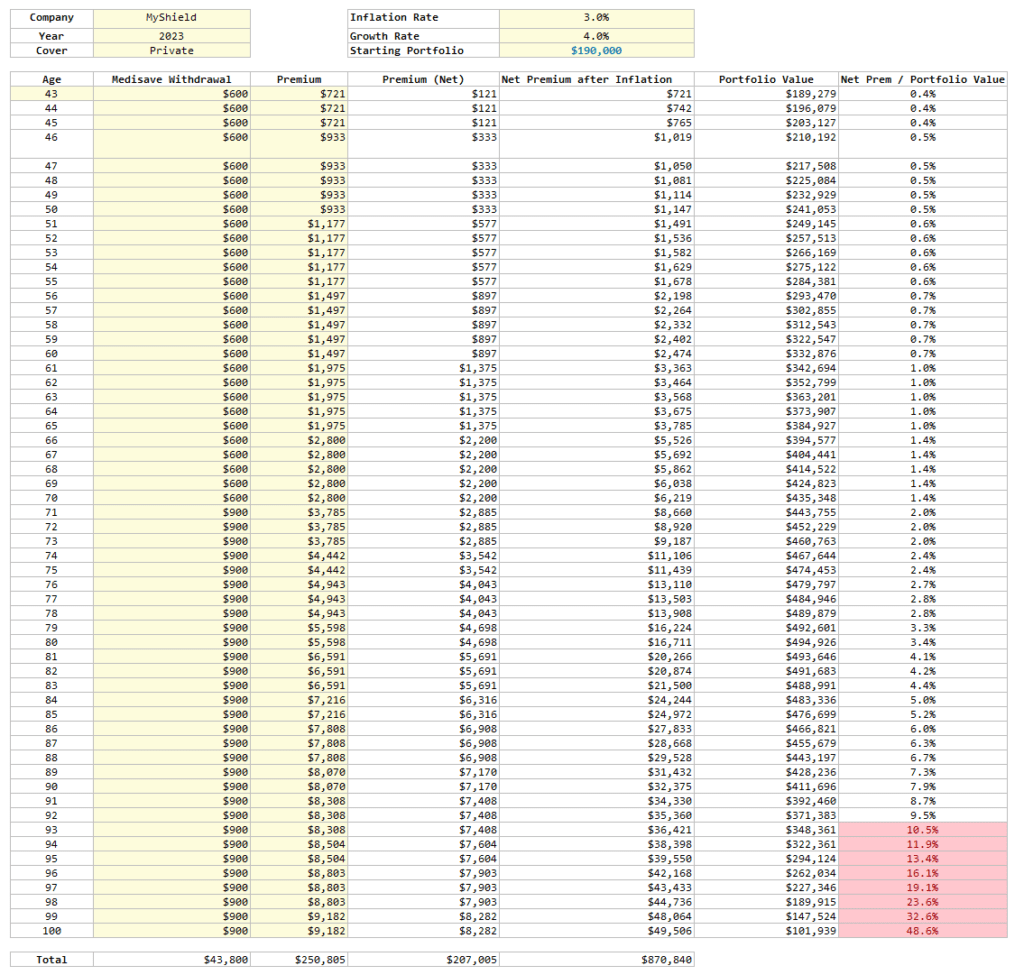

The table below shows how much we can use Medisave to fund the premiums over time, the premium for Restructured A care for Great Eastern’s plan and the net premium after the Medisave withdrawal:

Medisave will help pay $43k of the premiums. This can be provided just by Medisave’s interest alone.

Take the annual private restructured A grade care at age 99, which is $900 divide by my Medisave of $68,000 and we get 1.3%. This is below the current prevailing Medisave interest of 4%, which means that funding this should not be an issue. My Medisave will have to drop below $22,500 for funding based on interest to be an issue.

My suspicion is the annual amount we can use to pay for private shield premiums will revised up over time.

We will need to find a way to fund the other $70,910 in premiums.

Net Premiums Will Grow with Inflation Over Time.

The premiums table will not stay stagnant for the next 57 years and likely there are medical inflation.

My colleague Mike made a good observation that the bulk of recent increase comes from the Private grade of care but I will find it hard to assume the premiums not go up over time.

To give you a good idea, from 2006 to 2019, the total annual premiums of MyShield Plan 1, for age 43 to 100 years old, which caters for Private grade care, grew by 2.95% a year.

I think I am comfortable with a 3% a year growth.

We added a new column which accounts for the net premium after inflation.

Basically, I calculated the future value of the premium before Medisave withdrawal adjustment, based on the number of years away from today. Then we deduct the amount that will be paid by Medisave.

So instead of $70k, we need $394k.

The number will be higher if you are asking for Private grade care.

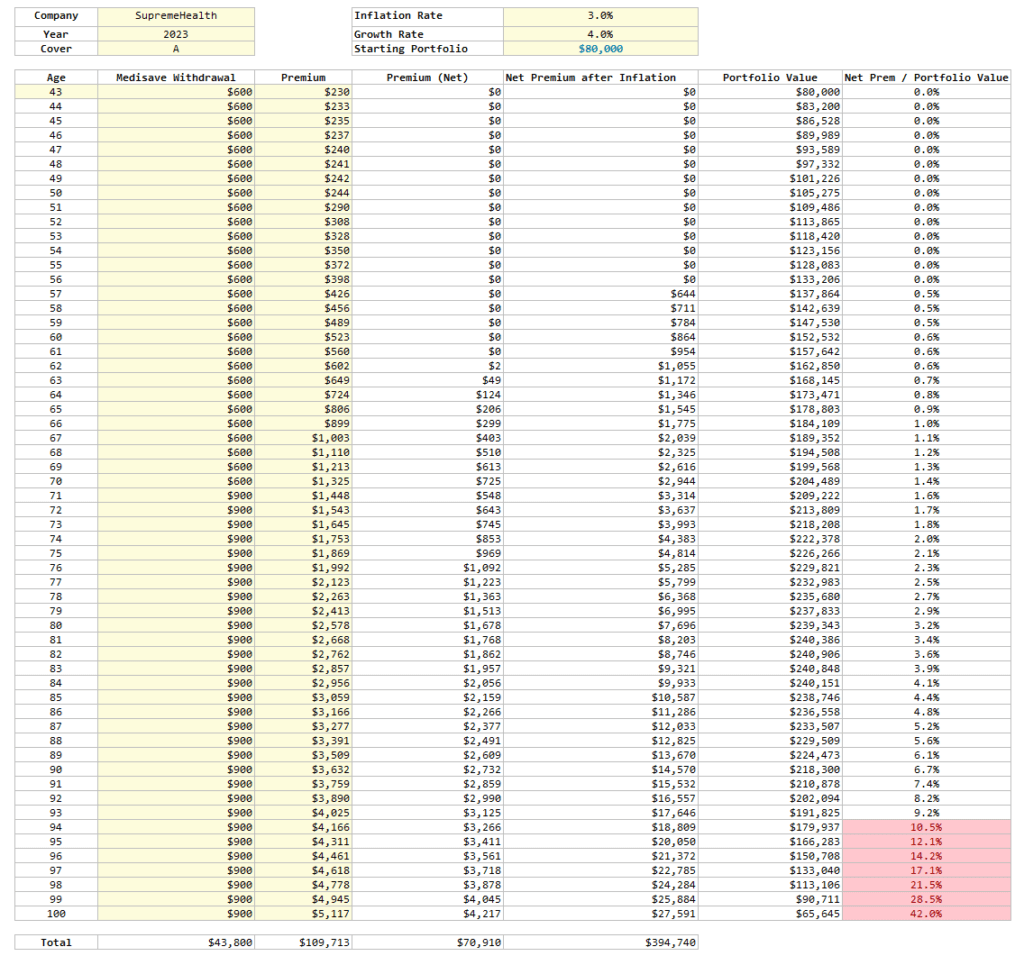

How much in Portfolio Value to Set Aside to Fund the Premiums?

We have to come up with a portfolio today, fund the portfolio so that the money last at least till 100 years old to pay for the premiums.

I will talk about the portfolio composition later but I will like be using a 75% equity and 25% bond or 80% equity and 20% bond allocation (no fxxking diff la).

The assume planning growth/return of the portfolio is 4% a year.

So how much do we need?

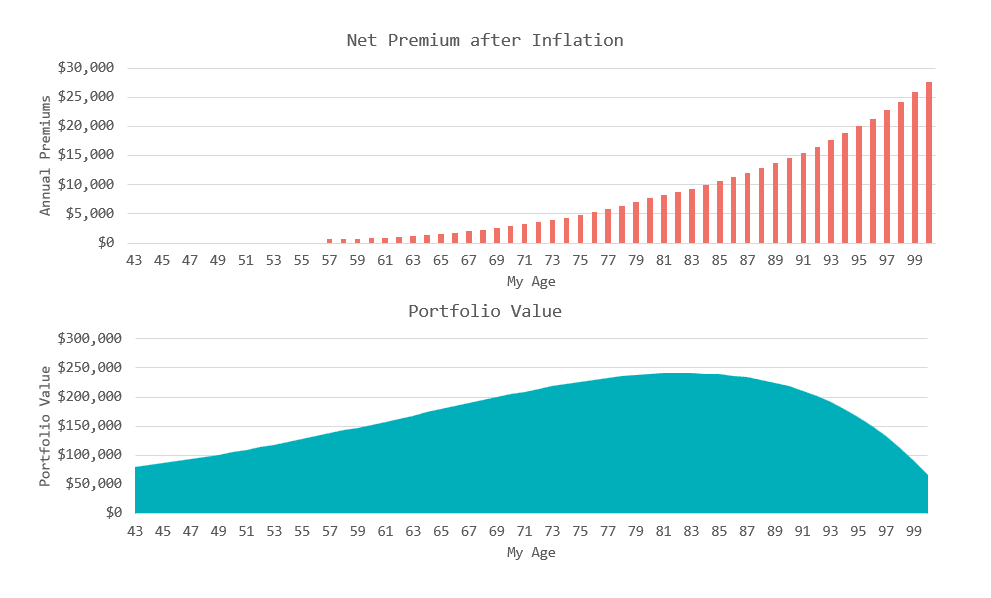

We added two more columns to the table with one of the column showing the change in portfolio value. The last column takes the prevailing net premium after inflation divide by the prevailing portfolio value. This last column allow us to gauge the current withdrawal rate of the premiums from the portfolio value.

I did a trail and error and realize that the sweet spot is to fund the portfolio with $80,000.

At age 100, I will be left with $65,645, which can probably pay for 2 more years of premium. The years denoted in red shows the current withdrawal rate above 10%, which means the money will run out in less than 10 years.

Let us move on to the risk management part.

The Historical Growth Rate of the Proposed Portfolio

Most likely, the portfolio allocation will be 75% equity and 25% bonds, funded by my CPF OA monies. The 75% equities will be invested in MSCI World index equivalent. The 25% bonds is assume to be in a mixture of CPF OA and CPF SA, depending on whether shielding is successful at 55 years old.

The blended cost could be 30 basis points, depending on the funds used.

| Financial Instrument | Allocation |

| LionGlobal Infinity Global Fund Nikko AM Shenton Global Opportunities Fund | 75% |

| CPF SA or OA | 25% |

Here are some historical returns from 1970 to 2023 April (53.4 years):

| Period | Historical Returns (USD) |

| 1970 to 2023 April | 8.1% a year |

| 2000 to 2023 April | 4.6% a year |

| 1970 to 1979 | 5.9% a year |

| 1980 to 1989 | 16.9% a year |

| 1990 to 1999 | 10.2% a year |

| 2000 to 2009 | 1.4% a year |

| 2010 to 2019 | 7.8% a year |

Here are the returns in SGD:

| Period | Historical Returns (SGD) |

| 1970 to 2023 April | 6.4% a year |

| 2000 to 2023 April | 3.6% a year |

| 1970 to 1979 | 2.2% a year |

| 1980 to 1989 | 15.4% a year |

| 1990 to 1999 | 8.7% a year |

| 2000 to 2009 | -0.34% a year |

| 2010 to 2019 | 7.3% a year |

If there is a lesson here, it is returns are uncertain.

There is a reason why I use a 4% a year planning return.

It is because we are not sure what kind of returns we are going to get for the next 57 years. The past 53 years show us a SGD return of 6.4% a year but if we talk about the past 23 years, it is 3.6% a year.

A 4% planning return does not assume that it won’t fail, but it is pessimistic enough for me.

Using a lower returns is to create a margin of safety, or being conservative, or setting a buffer.

Why I can accept flirting so close to almost running out of money is because:

- I understand that I am using a lower-than-historical return as a buffer.

- There is a tradeoff between funding for this insurance premiums and other goals.

- There are enough uncertainty with other variables such as inflation rate to deal with that we won’t be able to do perfect planning.

Working out the math allows me to know that if I can increase the funding by $10,000 or $20,000 more, my plan can be even safer. The alternative is to increase the equity allocation by 5-10% but I feel that most likely it is not going to make a difference.

My Exposure to Negative Sequence of Returns Risks and Capturing Returns

Negative sequence of returns risk is the risk that if you encounter a poor sequence due to:

- Lower portfolio return

- Higher than normal spending rate

- Combination of #1 and #2

In the earlier stages of the portfolio spending, you will run out of money faster than expected.

This is one of the challenges of retirement income planning.

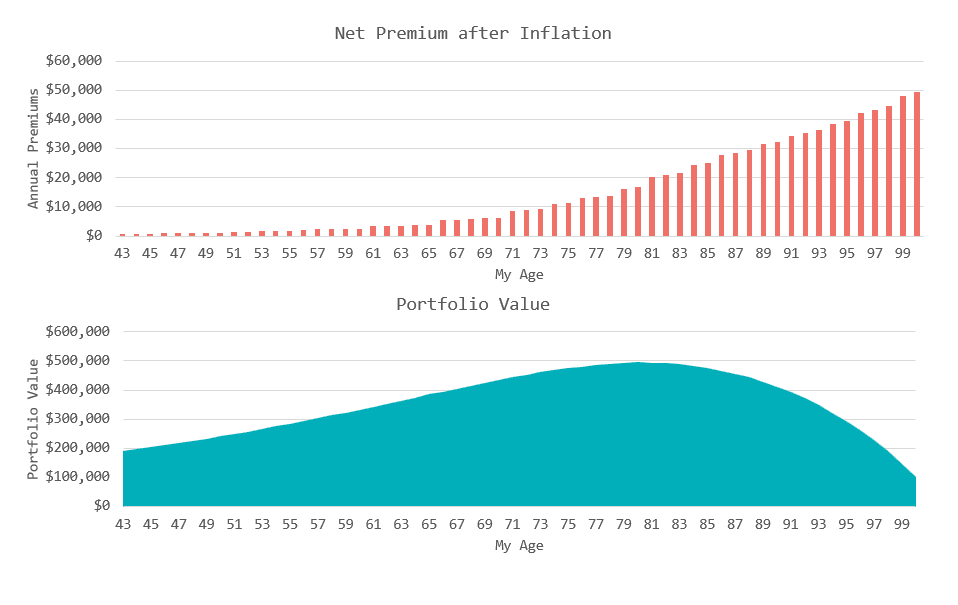

The first meaningful spend, which means the annual premiums divide by prevailing portfolio value that is more than 2%, will only occur at 73 years old.

This means that I have a 30 years runway. Within these 30 years, the portfolio drawdown is minimal. From the chart above, the portfolio value starts dropping closer to 81 years old.

The portfolio will have enough time to grow to mitigate the negative sequence of return risks. The period from 43 to 53 years old is thus important.

My data work on equity portfolio rolling returns show me that in order for very pessimistic returns (define as the 20th percentile) to hit close to average returns, you need about at least 25 to 30 years at least. Even then, your returns will still be far from the average.

A 30-years runway before the real spending increases the certainty for a volatile portfolio to work out and capture a return that is close to that 6.4% a year.

Now… if your time horizon is like five-years away from the heavy draw down, my portfolio allocation will not work so well for you.

You might want to depend on a more bond-heavy portfolio. The returns are more predictable. Even then, you still run into the issue that your returns will vary over a 20 year period, depending on the interest you will get 10 years later when bonds mature.

But most likely, it means that your capital will have to be larger.

Why Fund it with CPF OA than Cash?

Well, it has to come from somewhere right? Your CPF money eventually needs to be spent, if not you spend your cash.

If you see my graph above, the first spending comes after 55 years old.

That is when the CPF, less the monies for CPF RA, is accessible.

What if I Want to Cover for a Private Shield Plan?

Given this model, a lot of things are fixed:

- Time horizon

- Risk tolerance/capacity

- Portfolio and its cost

I can just put in the current premium for my Singlife MyShield Plan 1:

The amount that I need to fund comes up to $190,000.

Have not talked about the rider.

Here are the corresponding charts:

The nice thing is to know that, if my model is correct, I just have to find $110,000 somewhere to fund this.

The richer readers might have less of this problem.

Conclusion

For some, the future healthcare cost will come out from the discretionary spending that you cannot spend in old age.

That is okay… if you know how much to cut out in the future.

I choose to just focus on the premiums as a liability.

So with this, that is like $140k of the net wealth going to insurance premiums. This will cover critical illness, disability income, and health insurance needs.

We will cover some other areas shortly.

You can read the other parts in my notes section.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

lim

Wednesday 31st of May 2023

This is an interesting issue, because different writers have different views about setting aside sums of money in 'buckets' or 'lockboxes' for specific purposes. If you are talking about setting aside a specific sum for imminent expenditure (like university fees, buy car), thats fine. But if you are talking about a long term 'bucket' for a recurring expense I can see the there are different views.

My own view and practice is that since I have a (1) simple budget (not excessively detailed) where expenditure<income and (2) 12mths+ Emergency fund

This is sufficient and there is no need to block out a part of my investment portfolio for medical insurance premiums.

No right or wrong of course, good to share different views.

Kyith

Saturday 3rd of June 2023

Hi lim, thanks for your views.

I gyrate between whether this is excessive planning or not and I landed upon that I needed to understand this part better, partly for my work at Providend but also for readers here. I think a different takeaway is this: If you know your annual premiums could reach $30,000 a year at 98 to 99 years old, and your income by then can comfortably cover for that, and the other spending, the it is not a problem.

That is the most important thing.

LWL

Tuesday 30th of May 2023

Thanks Kyith, for sharing your thinking process and approach.

I did a review recently for my medical coverage, specifically critical illness beyond age 55 onwards as that’s when my current CI policy lapses. Long story short, my takeaway was that at current age (46 this year), it does not make sense to cover with a CI policy beyond 55. But rather, what I did was to take the quoted premium for the CI policy, and invest this amount (monthly) into Endowus. My thinking is that by age 55, when I need the CI cover, the accumulated value would be a CI sinking fund for me to draw on when needed. And if I’m lucky enough to avoid major CI, it then forms either my legacy or even retirement buffer.

Would appreciate your views on this approach, esp flaws in my thinking/approach?

FC

Sunday 4th of June 2023

@Kyith, will be looking to your post. will be interesing.. lets see if you can find middle ground... or coffee grounds.

FC

Sunday 4th of June 2023

@LWL, my first thoughts would be. will the return be sufficient for your needs? say this person sway sway tio 1x early CI @56 yo. it wipes out 100k + 50k for reccovery. means we have to start from scratch again at 61yo.. will we have the energy to continue our investments? then say, this person have a relapse at 62yo. (of coz this is worst case scenario.. and higher remote) .. then how ?

to be honest, i also like your idea of using the CI premiums to invest. at least if i am blessed to live thru the old age without major illness, at least i have a nice sum to enjoy retirement.

just playing devils advocate.

Kyith

Saturday 3rd of June 2023

HI LWL, this is something I thought about and would be writing soon. Perhaps you can let me know your thoughts after reading through mine.