Today’s article is a continuation of my personal notes series where I share some real takes on how I frame some personal financial decision making.

I wanted to write part 3 and 4 about the investment and portfolio allocation, but decided to slow down a bit.

An easier article is on the unique set of attributes for a particular set of your personal expenses that might have slipped your mind.

Not all of your expenses that you want to find a recurring income stream, need to be inflation-adjusted.

We will lump all our expenses into one bowl and decide how to create an income stream to fulfill that bowl of expenses. You will think that hiding your insecurities of showing how much you spend on specific thing and throwing this problem to your financial planner to solve your problem is better.

So they will give you an income stream but the capital will likely to be larger.

If you are less specific, most often, your plan has buffers. Then you add on more buffers on top of buffers.

Aside from our health insurance, we buy level insurance-premium plans. Level premiums mean that the premiums we pay do not go up over the tenor. We have the option to choose insurance plans with premiums that change upon renewal or rising premiums but most of us prefer plans with predictable expenses, so we get sold those by the insurance agents.

I have more financial resources, or I am of the idea that I have.

So I can frame the insurance premiums that I currently pay annually in a different way:

Out of the wealth that I have accumulated, how much do I need to set aside to “pre-pay” for the insurance premiums today, so that I don’t have to account for the premiums in my recurring expenses?

My Current Insurance Protection Expenses (Sans the Health Insurance)

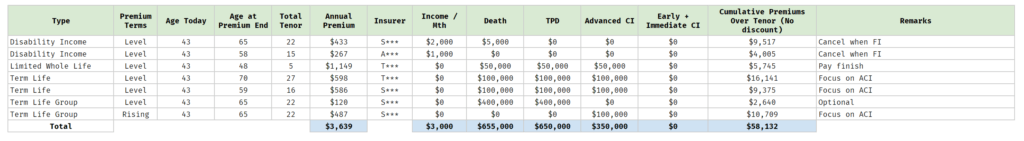

The table below roughly shows the type of insurance I am currently servicing, how long I will be servicing them, the coverage:

My total coverage:

- Disability income till age 58-65: $3,000 a month

- Income for dependents (death coverage): $653,663

- Advanced critical illness coverage: $350,000

- Early + Intermediate critical illness coverage (note the spelling error in the table): $0

At this stage, you may have questions about what I think about my coverage, or you may have opinions about my coverage.

I will not go into much but if you are interested, do leave comments in my various Telegram chats or in the comments below. (SG FI chat, Investment Moats Channel)

Insurance is part of your personal finance. My personal situation is different from yours. You can ponder about why I do it this way and reflect upon how it contrast to your own situation but implementing what I do may sometimes be detrimental to your own situations.

The premiums for almost all my insurance, other than the Mindef group term critical illness and health insurance are levelled.

I pay a cheap premium for my Mindfe group term critical illness currently, but that will rise as I grow older. I plan to cover that until age 65, so I add up the premiums I have to pay from today, till 65 and average them out and that comes up to $487 a year or about $40 a month.

The total annual premiums that I have to pay is $3,941 a year.

The premium tenor for each of these policy is different. I will have to pay five more years of premiums before I fully own my $50,000 limited whole life plan but for one term life, I had to pay for 27 years more.

If I add up the premiums, it comes up to $63,062.

This means if I am able to set aside a lump sum of $63,062 today, I don’t have to worry about this aspect of my insurance premiums. If I get retrench or something, I don’t have to worry about my ability to service the premiums.

It also means if I wish to calculate how much capital I need to create a recurring, inflation-adjusted income stream, I can deduct $3,941 a year out of this.

How Much Capital Do I Need if I Were to Consider This Annual Insurance Premium as a Recurring Stream?

If you consider that my annual expenses averages $24,000 a year, deducting this means reducing the recurring, inflation-adjusted income needs by 16%.

What does considering this annual insurance premium “normally” for most folks mean?

- This stream of expenses need to be inflation-adjusted, just like your other expenses.

- You would need this for the entire duration of your “retirement” or how long you need the income stream.

If we use the income-to-asset ratio or initial safe withdrawal rate to estimate how much I need, I would use 2%. 2% is what I used to determine how much capital in my portfolio to provide a stream of inflation-adjusted income for my most important set of expenses (you can read How Much to have Perpetual Income to Fund My Security? – Part 2 of my Building My Financial Security Series)

But Kyith, why use such a low ratio? Do you really need your insurance premiums to last till perpetuality? Aren’t you gonna stop paying for your premiums at some point?

That is precisely why I consider this group of expenses separately!

If we treat all our expenses with equal importance, then if I use such a conservative way to estimate my income stream for all my expenses then, I have to use 2% for this as well.

That would mean I need a capital of $3,941/0.02 = $197,050 in my wealth, to generate a stream of inflation-adjusted income, to be able to pay for my insurance premiums to perpetuity.

If you compare setting aside $63,062 versus $197,050, that is almost 70% less or a six-figure sum less.

But honestly, I hope you get how flawed the traditional way of lumping expenses together is.

Even I feel stupid writing that I will use 2% as a way of estimating how much I need.

But in a way, if you lump all your expenses together, and you want your plan to be more certain, you cannot use a initial safe withdrawal rate that will only give optimistic outcomes only.

If we respect that your overall plan needs to have some conservativeness, then an initial withdrawal rate of 3% gives the right balance for someone needing a 30-40 year retirement.

That means I need a capital of $3,941/0.03 = $131,366 in my wealth to take out this set of insurance premiums as part of my recurring expense.

This is a smaller sum but still 100% larger than if I set aside a lump sum of $63,062.

There are some cost savings, but I also recognize that if my annual surplus/savings from work is $25,000, then the difference might be working for 2.5 more years. This might be tolerable for some.

My Immediate Insurance Tweaks

Having said that I would not talk too much about why I plan this way, I do think I will change something, which will affect how I snapshot how much I need.

I own two plans from M*** so as to fulfill my DBS Multipler requirements. Both plans have fulfil the needs but I have not cut them. Recently, my colleague Mike (our Providend Insurance Specialist) alerted to me that the Mindef and MHA pure death coverage premiums are even lower after Singlife has re-secured their contract.

So most likely, I will cust both those lose and up my Mindef coverage (if underwriting is not an issue) to $400,000.

The revamp table will look like this:

The cumulative premiums that I have to set aside today is now lower at $58,132. If I round up, that will be around $60,000. Nice round figure to set aside and be worry-free about servicing premiums.

Given where life is, I think

- the death coverage is a good-to-have

- the disability income insurance look expensive. That may not be very necessary if I stop work at some point.

- the most necessary part of the plan is the advanced CI

Considering the most necessary, I think about $42,000 out of $58,132 is anchored in my mind. As I have enough financial resources, I think having $18,000 more is a good middle ground.

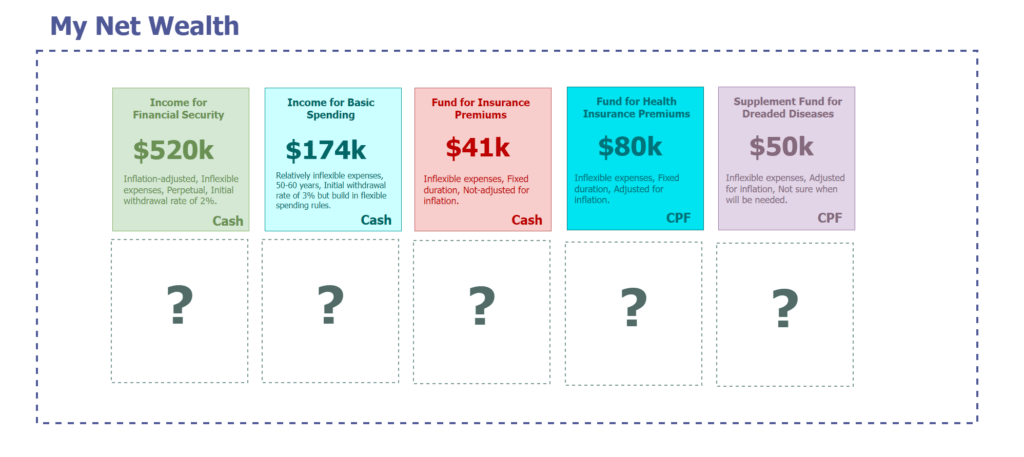

The Plans Revealed, Up till Now

I wrote about two aspects of how I viewed my wealth currently and so there are still a few things to map out. So here is how things are. If you are new, you could check this page out to see each of the “cards”.

You may have expenses of similar nature to insurance premiums

There are other expenses of similar nature that you can consider this way.

Their nature seem to be:

- Inflexible expenses. You die die need to service them.

- Does not adjust for inflation.

- Ends somewhere.

A common one used to be your mortgage.

As I am paying off my mortgage with HDB, I noted that my mortgage doesn’t change much. But nowadays, how much you pay depends on whether you take fixed rate or flexible rate loans, and it does shift about.

So it is challenging to set aside a sum.

But you could estimate that, out of your entire net wealth, a fixed sum has to be used to pay off your mortgage. The challenge is the interest.

You could always estimate that you will pay close to a long term interest of 4% and that interest amount is what you set aside.

We can probably have an interesting discussion on this in the future.

Another one that you might scold me would be the allowance you give your parents:

- Inflexible. You got to give.

- Non-inflation-adjusting. This is what many would scold me for haha.

- Ends somewhere. This one is a bit morbid to discuss about.

Honestly, there are not a lot of expenses of this nature. If you have some that you consider, do let me know.

You will need to be able to separate insurance for your protection goals and insurance for other goals

Okay, a very crucial reason I can plan this way is due to how I am able to clearly see insurance as protection.

What bugs me is that for some reason, many cannot clearly separate what they have into what is for protection and what they buy for don’t know what fxxk reason at that time.

If you have insurance that are endowments, ILPs and some whole life or universal life, you might consider them as investment vehicles and it might not always make so much sense to visualize them this way.

If you look at each of the “cards” under my net wealth, they are geared towards fulfilling a certain need. If you have endowments, ILPs and these cash-value products, they are vehicles, but they don’t tell you where you want to go (in finance case, what are you saving up for?).

Insurance for Protection is very clear.

They are meant to hedge health risks that are high impact, that you felt are important enough. Can you define what are those ILPs and endowments for you?

That may help you think about whether you should consider them in this card or another card.

What if you are paying insurance premiums for your kids?

At some point, your kids would have to take over.

If not, you have resigned your fate to pay over the long term for them. Have you made up your mind? It cannot be the case you are still paying for their premiums even in your retirement, and you assign part of your income for it, right?

Whichever way, if the insurance has a tenor and a fixed premium, you can size it up and have a rough idea of how much that would cost you.

If you choose to pay for it for them, that insurance can also be seen as a “gift” or legacy provided to them when you are still alive.

But it is better to size it up separately for two reasons:

- You may be interested to know how much you have helped them.

- That may be a sum to help frame them how much they have to take over.

- You may look at the insurance for them with different priorities than your own, and therefore it make sense to look at them separately.

If you have questions, ask away. I may append them to the article.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Aaron

Monday 23rd of January 2023

Hi Kyith,

Big reader of your blog. You mind sharing your portfolio performance so far, USD exposure (its a problem if it keeps declining, and messes up the asset liability matching projections), and how you plan to change asset allocation for future?

Thanks

Kyith

Tuesday 7th of February 2023

Which time period are you talking about? Cause it is only recently my portfolio is more ETF based.