“Kyith, you should give yourself a budget for food if you are planning your finances. This will give you more leeway on food choices because if you eat Cai Png every day it can be very stale and boring very soon!”

We are currently on a company retreat and this was one of the little discussions that came about as we are interacting with each other.

Recently, my colleague Chee Kian, Isaac, and I accidentally got into a weird lunch discussion about financial planning around food. These conversations become weird because traditionally, planning for your financial independence is more than just food:

- There are more expense line items.

- How much you use, or the frequency, the grade of the expenses changes over time, sometimes within your control or not within your control.

- You are assumed to be able to vary your spending especially when financial resources are constrained.

- Some specific financial solutions were assigned to target such a problem e.g. our RetireWell solution for reliable retirement income planning.

We don’t just constrain it to one item but as everyone knows I like to constrain for one item. The primary reason to do that is when you focus on just one single item you will start seeing the real challenges that make people addicted to your income.

This is especially so for food.

If you strip away all the spending line items and solely focus on food, then the real shit rears its ugly head:

- You do not wish to cut down on the frequency of your meals (usually three times a day, which means 90 meals a month, 1080 meals a year). You will have unhappy children. This limits your flexibility.

- Inflation does not go up 3% a year. You have spurts of 20% inflation and then it plateaus. Sometimes you have shrinkflation (same price but the quality and quantity go down).

If you are planning to solely secure an income to provide for food:

- How would you go about doing it?

- How much is your income requirement in planning? (As in your expenses currently is $X for the year, $Y on average for the last Z number of years, which figure would you use?)

- How much of an inflation-adjustment do you estimate? (Remember inflation in reality is in spurts but traditional planning is you assume 3% yearly change in inflation)

- What kind of investment strategy do you assign to this?

It is something for you to ponder about.

I have shared my view in the personal financial planning notes when managing my own money:

- What kind of lifestyle would I need to buy for myself?

- How much do I need to provide a perpetual income to fund that lifestyle?

And so I won’t go into them today but want to focus the post on one specific area.

Chee Kian made the opening comment when he reflected upon our conversation and that a comfortable buffer is better.

I do agree a more comfortable buffer is better but what is considered a more comfortable buffer?

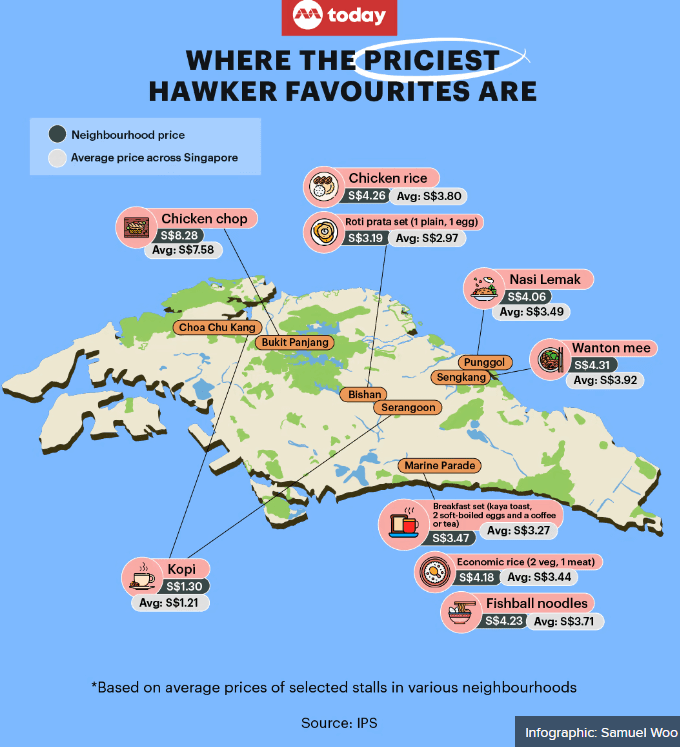

He reviewed this article from Today titled Study finds eating out cheapest in Toa Payoh, most expensive in Bishan; many food stalls didn’t raise prices following GST hike.

In this article, the researchers at the Institute of Policy Studies (IPS) create a blueprint to measure some common breakfast, lunch, and dinner meal items, and see the most expensive, cheapest, and average around Singapore.

The meal assumptions are decent in that each meal involves a meal and a drink.

Here are the places where the different types of dishes are the cheapest:

And dearest:

Okay, I am a Cai Png guy and can tell you the average $3.44 a meal cost for 2 vegetables and 1 meat is roughly on point.

- Vegetables cost $0.70 a dish

- Meat (if not the expensive one) cost $1.40-$1.50. If it is more expensive it ranges from $2 and more. For some stalls in Sengkang will KNN charge $2.00 for one meat

- Rice is usually $0.50-$0.60

Here is the dearest and cheapest regions of Singapore:

Basically eating in my area is more expensive than eating in town. This is quite true for my case for some stuff.

Chee Kian feels like this can be the basis of how much to plan for.

I sort of feel rather uneasy about this.

If I am planning for myself, I can use this as a template but you will slowly realize the flaws.

If I plan for today, I can just use the most expensive which is $18 a day or $6570 a year. Suppose we use a conservative 2.5% safe initial withdrawal rate, and that would mean I need to set aside $6570 / 0.025 = $262,800.

But what about that retiree who decides to retire in 2019 pre-COVID, pre-inflation, four years ago? That $18 a day might be much lower, perhaps $14 a day. The amount in the portfolio to set aside would be $5110/0.025 = $204,400.

Imagine that retiree decides to really stop work, have no work income, and when they come in for the annual review to revisit this specific area, you tell them $204,400 is not enough, you need 28.5% more ($262,800) in your portfolio, after spending down for four years.

The client and the client adviser better hope the portfolio performs well like an Energizer Bunny.

If we want to plan for a buffer, how many buffers does that 2019 pre-COVID retiree should set?

- 1.2 times their $14 a day cost?

- 1.5 times their $14 a day cost?

- 2 times their $14 a day cost?

- 3 times?

- 4 times?

If that 2019 pre-Covid retiree uses 1.3 times their $14 a day cost, in 2023, he or she will have hit the max buffer, so today when the retiree comes in, do you increase the buffer and ask to put more into the portfolio to give more peace of mind?

When you fix the spending to a spending item that is inflexible in frequency and grade, you start seeing the challenging problems.

In this case, the magnitude of the buffers you set during planning might matter more than you think.

On this note, using a lower safe withdrawal rate, or a higher income requirement are ways to build greater buffers into your plan so that there is less stress on the portfolio.

I do find that many of us plan and think from an accumulator’s mindset.

If you always have income coming in, you might not see the challenges when planning not to have income coming in.

You will rely on the most powerful planning tool in your arsenal: Flexibility.

Every shit is solved by the ability to be flexible.

So flexibility is that assumption that you have to consistently ponder about. Can you really be always flexible?

The Realities of the Frequency and Grade of Food Spending

I am 43 years old and I have probably been eating for 43 years of my life to know a little about eating.

There is a reason why sometimes my nickname is “trash bin” when I was younger I can really stretch and shrink my stomach. If we don’t want to waste food, we know where to dump it into.

But even nowadays, I started to see the limits as I grow older.

You just don’t eat so much anymore.

As I observe our older colleagues, they also commented they don’t eat as much as last time.

But because they have more financial resources and can eat less, they focus on the higher-quality grade of food.

My 90-plus-year-old Ah Ma doesn’t eat as much as me.

During the dying days of both my parents, they also ate much lesser.

The reality is that if we fix the grade of food we eat, it is plausible to be deflationary in your food expense.

The Kyith five years ago would have planned for 3 x $4 a day meals = $12. Today, he plans for 2 x $6 a day meals = $12.

So Kyith experienced no inflation in his food expenses.

If I remain true to myself, planning for myself is easier.

But the challenge is always planning for others:

Are they willing to have a conversation about their true spending flexibility? Are they willing to be flexible?

A young 30-year-old pursuing financial independence can never see himself eating 2 meals a day in the future, or even one egg a day at hundred years old.

If he cannot see it, he might not be able to relate.

As older adults, we can share our experiences with them on how physiologically we change over time and some of these variabilities in spending might reduce in a much more manageable food income requirement.

But it is also important to recognize that these physiological changes might take place far longer. That same 30-year-old might have the same appetite till 42 years old. Would food spending deflation set in?

Most likely not. An early retiree will still need to compromise.

And if that 30-year-old is unwilling to compromise, it presents a challenging situation if we are solely planning for an income fund for food.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- The Cheapest Way to Extend Your Laptop to TWODisplay that I Can Find. - April 29, 2024

- My Quick Thoughts on the Net Cash, 4% Yielding Boustead. - April 28, 2024

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

KY

Tuesday 28th of March 2023

Haha, I like how serious you are when it comes to what most people would think is a very subjective and vague part of financial independence planning (myself included). Yet food is usually the biggest part of that equation. Just share some thoughts when I try to apply my mind more seriously to this 😄 For me, the issue about buffers is that it is difficult to have a good guide. Too low and it’s risky, too high and it’s wasteful. And for me, sorry to be blunt but using the word flexibility during planning kind of feels like an excuse not to plan well 😅 (though it’s very different to bring in flexibility during execution, that’s one of the most important traits IMO to successful retirement / financial independence)

One really technical way is to do a probability distribution chart of food fluctuations across retirement horizons. Across 100 years, what were the fluctuations like for each 20-year period? Then set some figure that you’re comfortable with (eg 95% of outcomes for conservative estimate). Then plan according to that for the inflation part. I believe this is actually similar to how we gauge probable investment returns. But having said the above, I feel like laughing for suggesting this method 😂 Shouldn’t financial independence planning be more fun and enjoyable? 🙂 Just my two cents haha.. But still want to say I enjoy your very interesting articles and unique thoughts, keep them coming!

Kyith

Sunday 2nd of April 2023

HI KY, thanks for the idea. I like your suggestion and perhaps that is what we can value add to the people. Yet, there is this part about knowing roughly the pattern but also buffering a little. IF we layer both together we can reach a more reasonable measure. Upon reflection, I feel that our food consumption also goes down as we age. not sure if you agree. so that naturally dampens inflation.

I might sound like I talk about food a lot, but food is really a big part of the expenses for those with a lesser financial resources.

If you look at my post about the part of my expenses that I am most concern with, its $750 a month the food takes up 50% of it. if I don't gauge it well, that $750 becomes $1000. The need might went up $200,000.

ron

Thursday 23rd of March 2023

Living the 'good' life is having options. Options, choice in almost anything, from food, travelling modes, clothes, housing.

The only way is to accumulate wealth to have such options. Allocating for food, it would be better to have a wider price range. From "cai-png" to 8 course meals regardless western or chinese menus.

Off course, 8 course meals is not every day but perhaps once a month, or 2 months. I set aside ang pow money, 'white-gold' money too... on a monthly basis. Any excess at the end of the year is accounted for as 'bonus'...

Ron

Friday 24th of March 2023

@Kyith, Yes, indeed!. As a guide, the price for an 8 course Chinese meal at Spring Court Restaurant starts from $688++ for 10 pax.

That is about $70 per pax. Having that kind of meal 4 times a year as a retiree is highly possible. Set aside $400 per annum. And one's eating option widens tremendously. Birthdays, clan gatherings, schoolmates, ex colleagues, etc all covered.

French, Italian, Chinese, Japanese, Korean, Indian, Indonesian, cuisines all within reach. We are in Singapore.

It does not mean every retiree should have such meals, even if its a special occasion. Yet, having the option is what retirement means for me.

Kyith

Friday 24th of March 2023

Hi Ron, I get that there is a wide spectrum for food. do you mean we should cater our budget to take in even 8 course meal or have I misunderstood?

YAP

Tuesday 21st of March 2023

Wah... count until like that is really 活得很辛苦 leh...

Kyith

Friday 24th of March 2023

Hi Yap, you choose not to count until like that. I think we need that mental agileness to navigate tough financial planning topics like this. Most of my friends chooses not to count until like that. Then again, most of my friends didn't get to a state where they felt they are financially independent.