A Singapore Treasury Bill issue (BS23106N) will be auctioned on Thursday, 30th March 2023.

If you wish to subscribe successfully, get your order via internet banking (Cash and SRS) or in person (CPF) by 29th March. You can also apply with your CPF-OA and CPF-SA funds, but you would have to go down to a bank (OCBC, UOB) and do it in person. You can also apply the same issue with your cash and SRS.

For DBS clients, you can apply for CPF via internet banking!

You can view the details at MAS here.

In the past, I have shared with you the virtues of the Singapore T-bills, their ideal uses, and how to subscribe to them here: How to Buy Singapore 6-Month Treasury Bills (T-Bills) or 1-Year SGS Bonds.

In the last issue announced two weeks ago and recently concluded, the current t-bills traded at a yield of 3.94%. In the end, the cut-off yield for the t-bill ended much lower at 3.65%.

For the second time, if you select a non-competitive bid, you may be pro-rated the amount you bid and would yield 3.65%. If you would like to ensure you secured all that you bid, it will be better to select a competitive bid, but you need to get your bid right.

A good rule of thumb is to ensure you get what you want and accept whatever the cut-off yield bid 50% of the last cut-off yield. In this case, you can bid 1.95%. Whether the final cut-off yield is 2% to 4.3%, your 1.95% bid will help secure the total allocation you need.

Gaining Insights About the Upcoming Singapore T-bill Yield from the Daily Closing Yield of Existing Singapore T-bills.

The table below shows the current interest yield the six-month Singapore T-bills is trading at:

The daily yield at closing gives us a rough indication of how much the 6-month Singapore T-bill will trade at the end of the month. From the daily yield at closing, we should expect the upcoming T-bill yield to trade close to the yield of the last issue.

Currently, the 6-month Singapore T-bills are trading close to a yield of 3.7%, which is much lower than the 3.9% yield we observed two weeks ago.

Gaining Insights About the Upcoming Singapore T-bill Yield from the Daily Closing Yield of Existing MAS Bills.

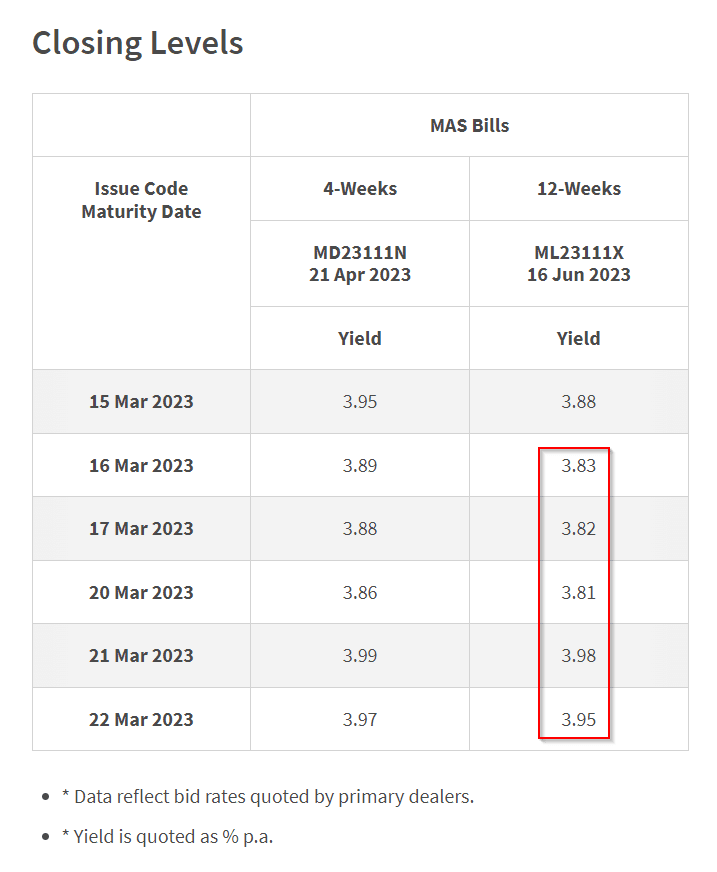

Typically, the Monetary Authority of Singapore (MAS) will issue a 4-week and a 12-week MAS Bill to institutional investors.

The credit quality or the credit risk of the MAS Bill should be very similar to Singapore T-bills since the Singapore government issues both. The 12-week MAS Bill (3 months) should be the closest term to the six-month Singapore T-bills.

Thus, we can gain insights into the yield of the upcoming T-bill from the daily closing yield of the 12-week MAS Bill.

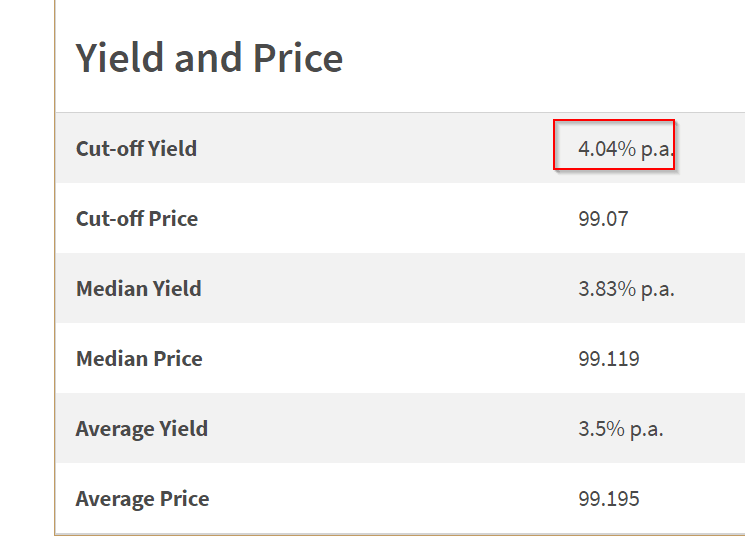

The cut-off yield for the latest MAS bill auctioned on 21st March (two days ago) is 4.04%. The MAS bill shows a slight decline from the last issue two weeks ago.

Currently, the MAS Bill trades close to 3.95%.

Given that the MAS 12-week yield is at 4.04% and the last traded 6-month T-bill yield is at 3.7%, what will likely be the T-bill yield this time round?

We are starting to see the 3-month and 6-month Treasury bill yield trade with a difference, and this may mean the yield on the 12-week MAS Bill may not be indicative of where the 6-month treasury bill eventually trades at.

Given this shift, I think the 6-month Treasury bill will trade closer to 3.70%.

Here are your other Higher Return, Safe and Short-Term Savings & Investment Options for Singaporeans in 2023

You may be wondering whether other savings & investment options give you higher returns but are still relatively safe and liquid enough.

Here are different other categories of securities to consider:

| Security Type | Range of Returns | Lock-in | Minimum | Remarks |

|---|---|---|---|---|

| Fixed & Time Deposits on Promotional Rates | 4% | 12M -24M | > $20,000 | |

| Singapore Savings Bonds (SSB) | 2.9% - 3.4% | 1M | > $1,000 | Max $200k per person. When in demand, it can be challenging to get an allocation. A good SSB Example. |

| SGS 6-month Treasury Bills | 2.5% - 4.19% | 6M | > $1,000 | Suitable if you have a lot of money to deploy. How to buy T-bills guide. |

| SGS 1-Year Bond | 3.72% | 12M | > $1,000 | Suitable if you have a lot of money to deploy. How to buy T-bills guide. |

| Short-term Insurance Endowment | 1.8-4.3% | 2Y - 3Y | > $10,000 | Make sure they are capital guaranteed. Usually, there is a maximum amount you can buy. A good example Gro Capital Ease |

| Money-Market Funds | 4.2% | 1W | > $100 | Suitable if you have a lot of money to deploy. A fund that invests in fixed deposits will actively help you capture the highest prevailing interest rates. Do read up the factsheet or prospectus to ensure the fund only invests in fixed deposits & equivalents. |

This table is updated as of 17th November 2022.

There are other securities or products that may fail to meet the criteria to give back your principal, high liquidity and good returns. Structured deposits contain derivatives that increase the degree of risk. Many cash management portfolios of Robo-advisers and banks contain short-duration bond funds. Their values may fluctuate in the short term and may not be ideal if you require a 100% return of your principal amount.

The returns provided are not cast in stone and will fluctuate based on the current short-term interest rates. You should adopt more goal-based planning and use the most suitable instruments/securities to help you accumulate or spend down your wealth instead of having all your money in short-term savings & investment options.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

revhappy

Saturday 25th of March 2023

Hi Kyith,

Since you love analysing factors, what is going on right now? It is crazy tech is up and russell 2000 is flat. Who would have thought right? With banks going down, tech is suddenly safe haven. Would love your analysis on whats going on underneath the surface in various sectors.

Kyith

Sunday 26th of March 2023

no i am not going to analyse that.

BC

Thursday 23rd of March 2023

Keith

IMO, your rule of thumb of bidding at 50% of last Cut Off Yield is a rather poor suggestion.

By bidding low, there will be real opportunity cost if the final COY turned out much lower.

eg) there is no reason to bid at 1.83% (50% of last COY 3.65%) when currently 1 year FD is at least 3.5%pa

if final COY is 2.5%, Bidder is successful but stuck with a 2.5% tbill when FD is 3.5%pa.

A better gauge would be to compare the next best available option and bid slightly above it.

eg) If using CASH, and FD is 3.5%pa, then one can shld bid at least 3.51% (for simplicity, assumed COY equals EIR)

If COY turns out to 3.5% and the bid is not successful, at least Bidder can still put his Cash in FD at 3.5%pa

eg) if using CPF, one option is OCBC's 3.55% FD. So again, no reason to put in a bid lower than that.

Bidders shld also understand there is a difference between COY vs EIR.

Kyith

Friday 24th of March 2023

Hi BC, perhaps it is poor but I am helping the readers make a financial planning decision. there can be a lot of reasons why they would need to bid and secure the treasury bills. I would not go into that. but if they die die need the bills at any cost, then I think my suggestion is valid. As you can see, my decision is regardless of the yield.