After my post exploring if I managed to successfully secure a $1,110 monthly, inflation-adjusted income stream today when I reached CPF FRS, I was informed that there is a new CPF Retirement Income calculator for younger CPF members.

This calculator allows you to assess your current CPF SA monies and your future income contributions, how much income you can have at 65 years old, and what is the shortfall you need to top-up to reach your desired income.

How helpful is this calculator?

It greatly help what I was trying to do in the last article.

It can also help if you are a financial planner trying to calculate how much retirement income your client can have with CPF LIFE.

Let us go through the calculator.

CPF Retirement Income Planner

To create a personalized retirement income plan, go to this CPF Site.

You will need to log in to CPF using your SingPass.

You can only use this calculator if you are younger than 55. My colleague Choong Hwee, who is older than 60, logged in but cannot use it.

Navigating the Retirement Income Planner

Firstly, I have about $208,000 currently in my CPF SA. You will realize later that the calculator provides the figure based on your CPF SA.

You can start thinking about your desired retirement lifestyle and how much that lifestyle will cost today.

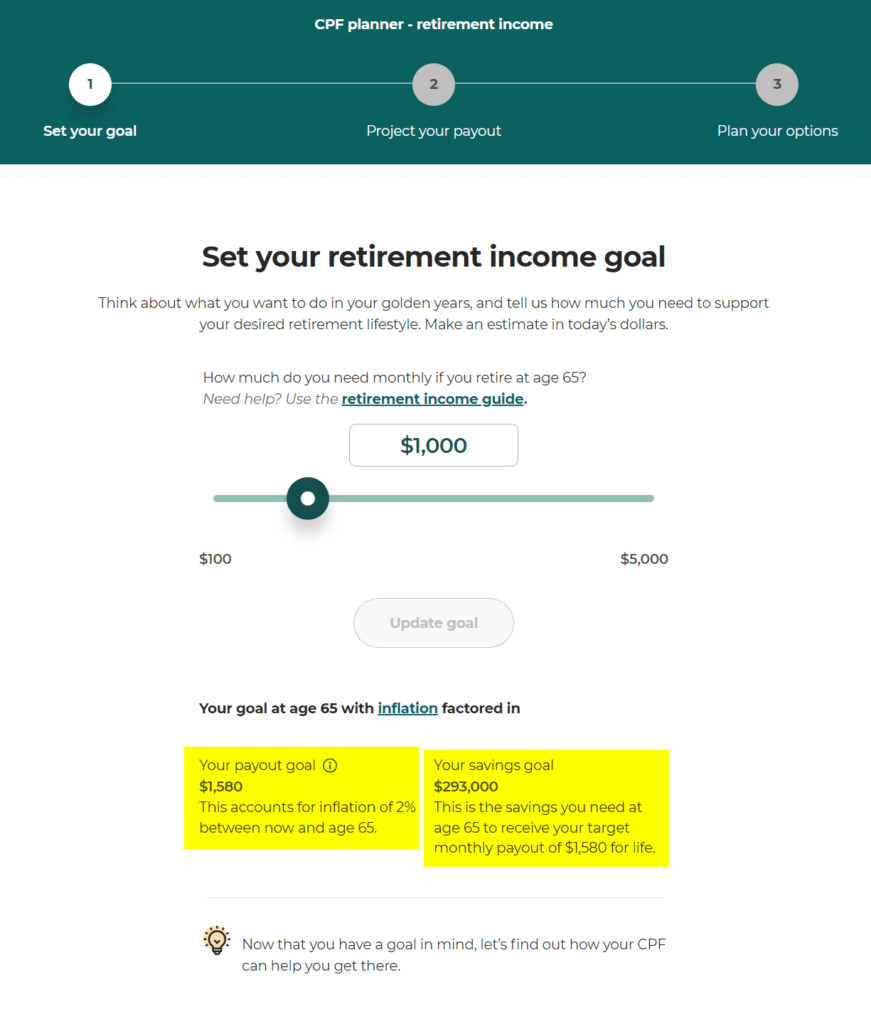

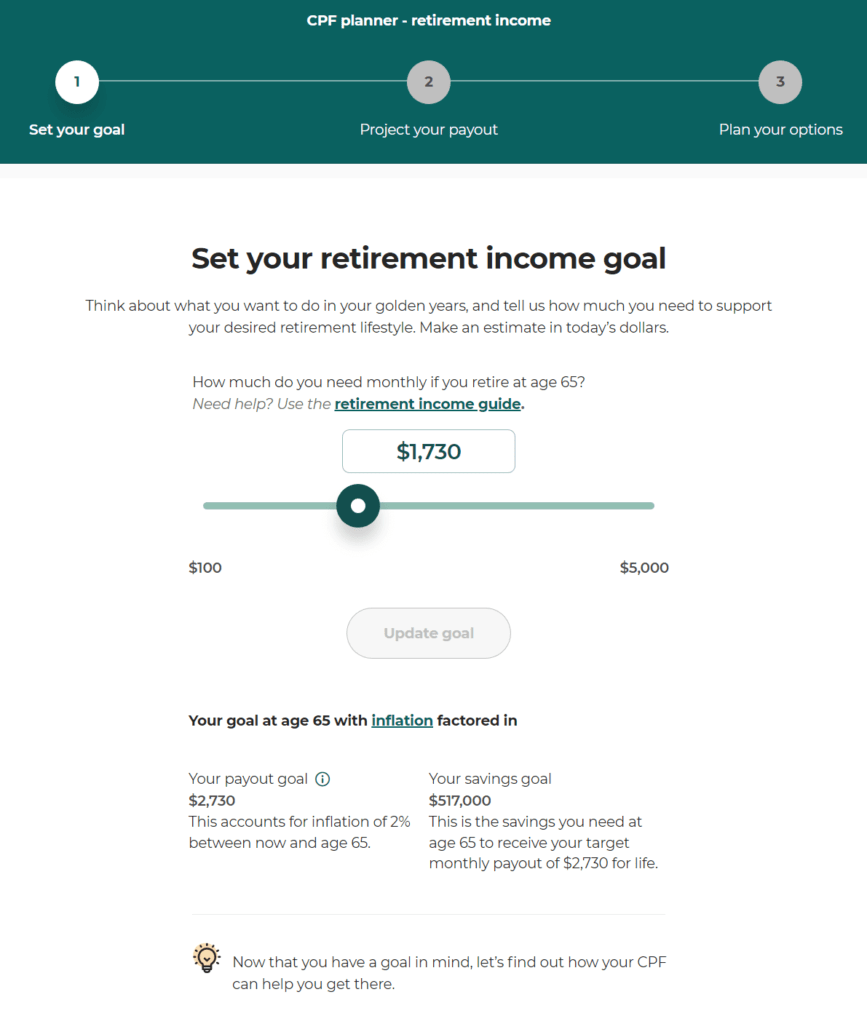

In this example, I put $1000 a month. The slider doesn’t work well, so I key in. The notes tell us that the average core inflation rate over 20 years is below 2%.

The 2% inflation is the rate the retirement calculator assumes. You cannot have the option of using a higher but more conservative inflation rate.

If you click on Factor in inflation button, you will see the following:

The calculator immediately tells me that at 65 years old, $1,580 a month is equivalent to $1,000 a month today, with inflation at 2% yearly.

I need $293,000 in my CPF Retirement Account at 65 years old to receive $1,580 a month for life, or $293,000 to retain my $1,000 monthly purchasing power today.

Click Next.

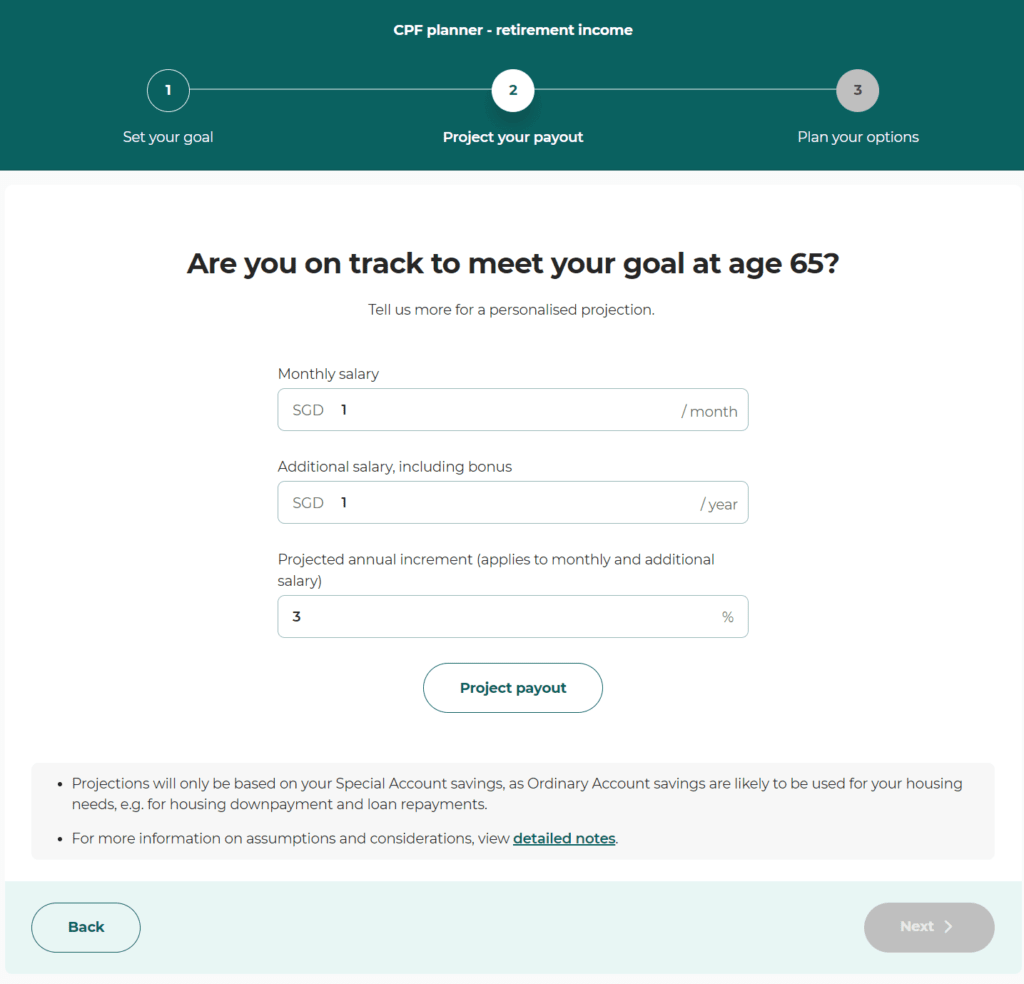

On the next screen, you can specify your monthly salary, bonus and the projected salary increment:

I don’t want to specify additional salary because I am interested to know the purchasing power of my current CPF SA account.

There is no way to not put any monthly salary. I have to put $1 so that I can click Project payout. There is also no way to specify how long you decide to work.

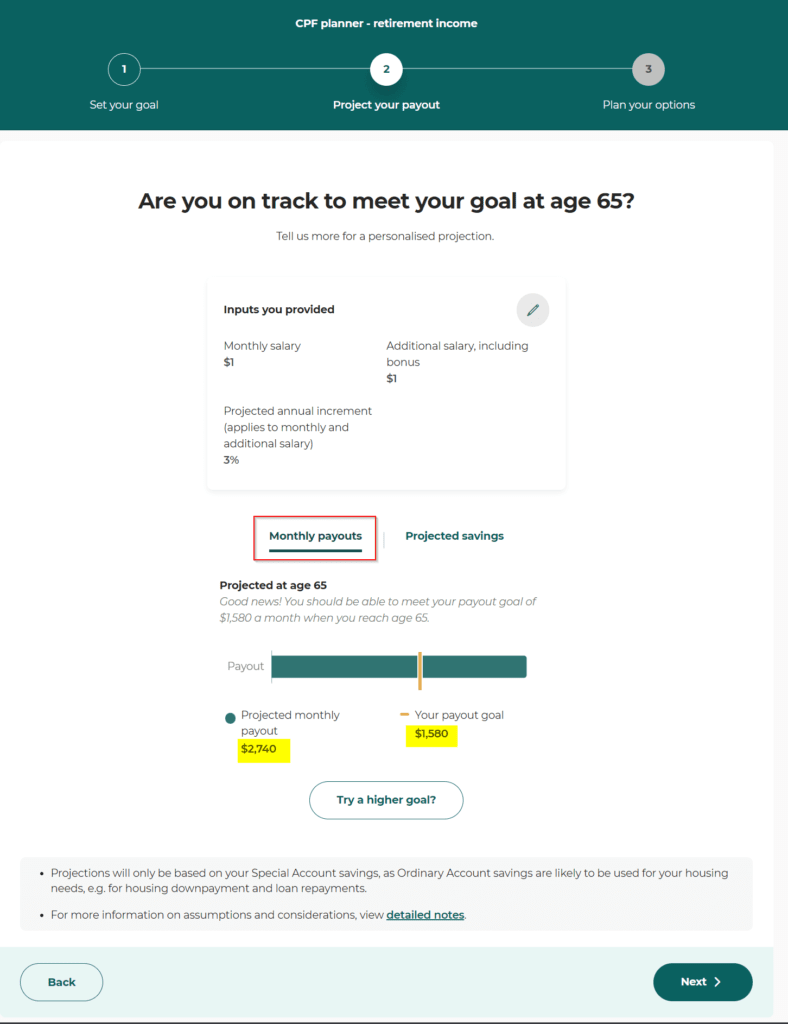

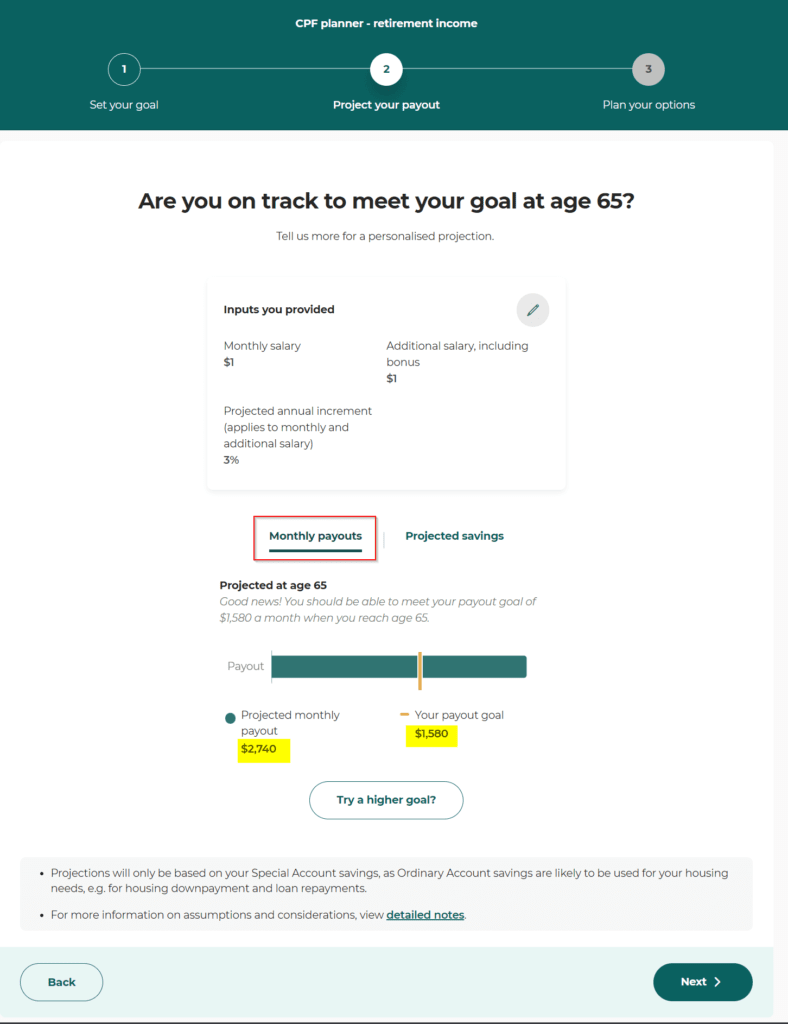

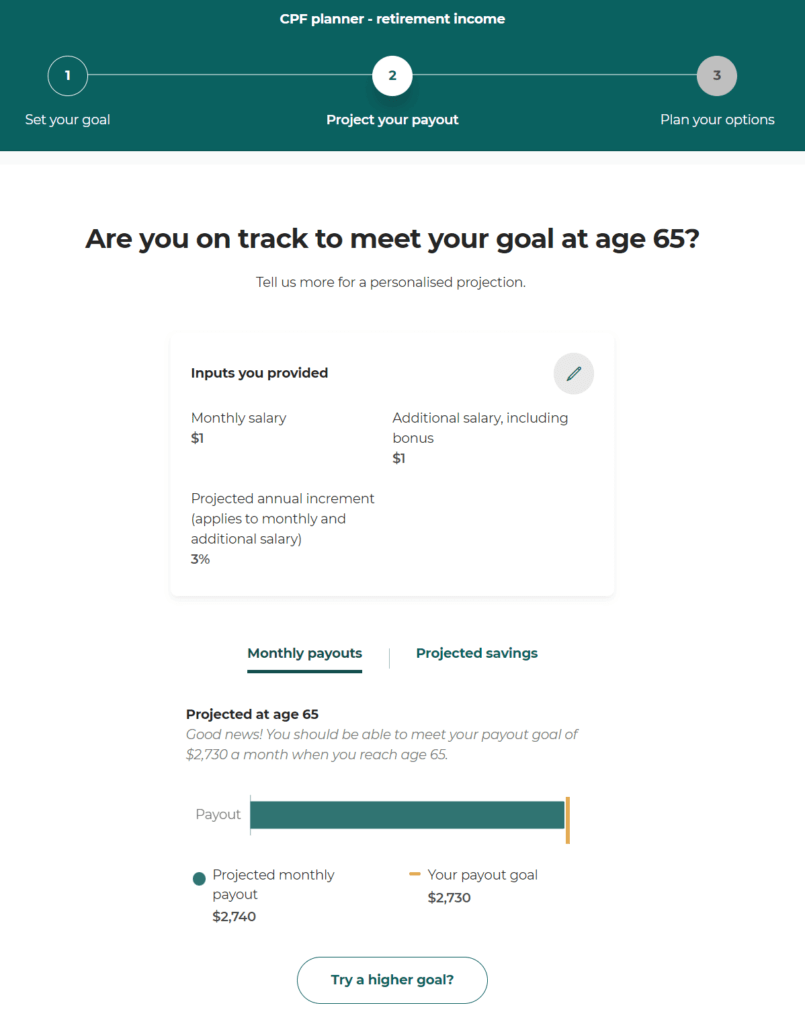

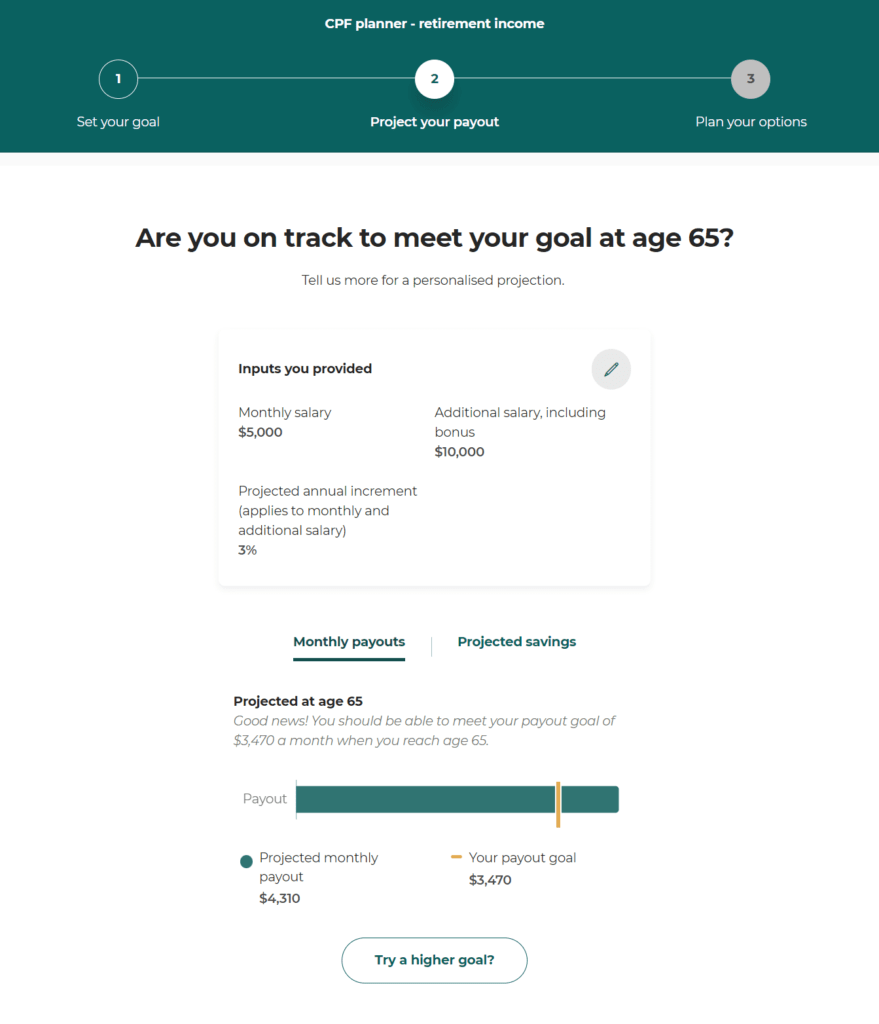

When you click on Project payout, you will get the following:

Monthly payouts tell me that the maximum projected payout at 65 years old for me is $2,740 monthly. It exceeds my target of $1,580 monthly.

This means that my CPF SA currently allows me a higher real income today at 43 years old.

I must choose CPF LIFE Standard Plan for this $2,740 monthly income (see assumptions below).

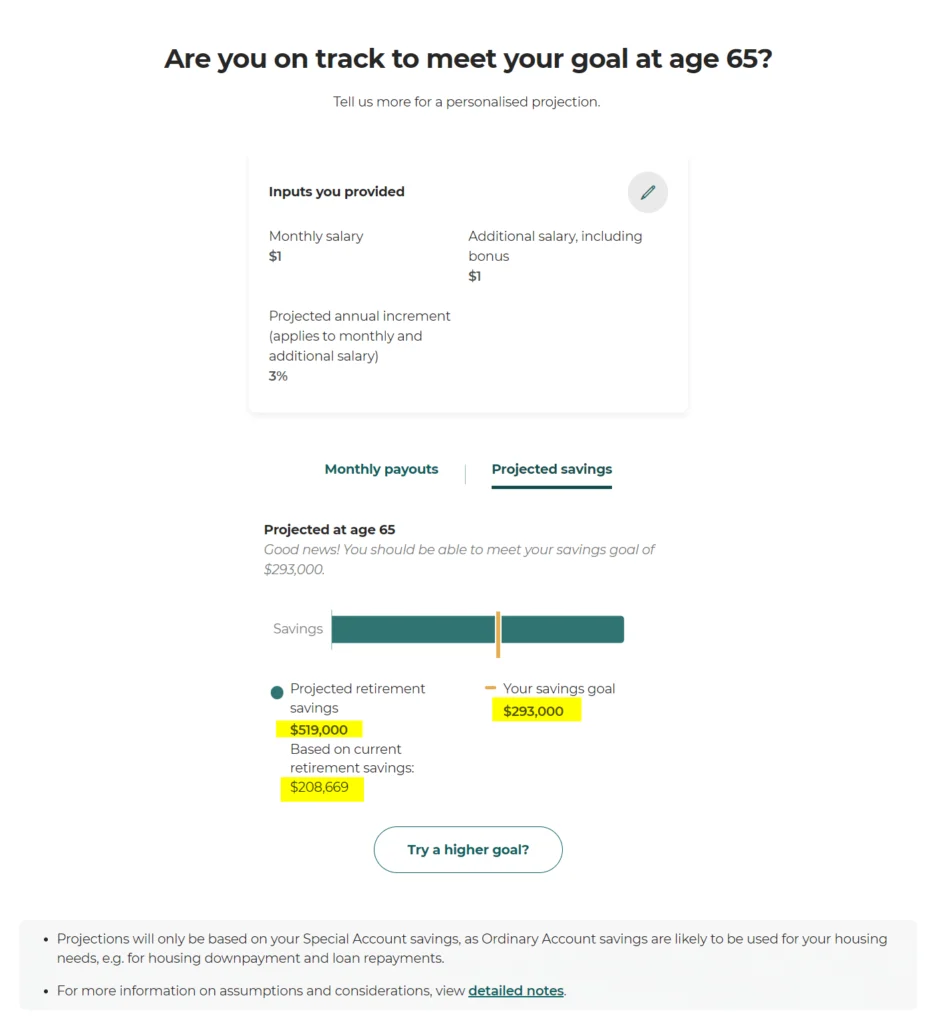

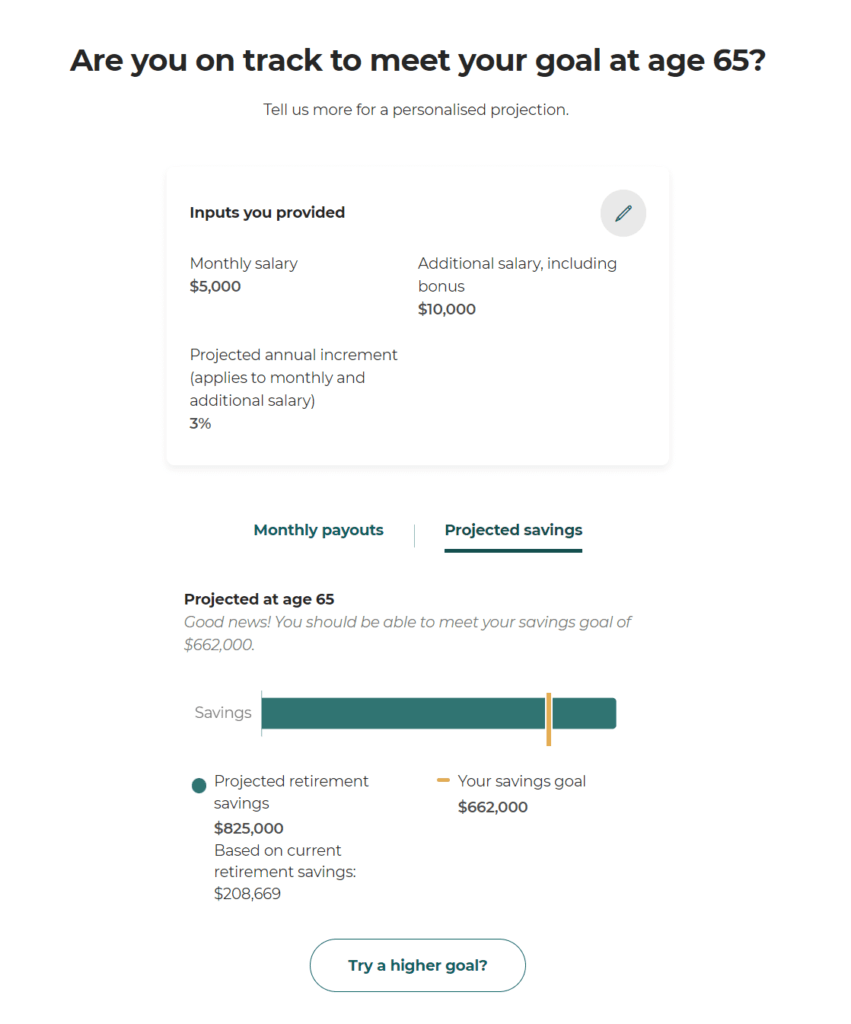

If you click on Projected savings, it tells me that my current $208,669 will become $519,000 in my CPF Retirement Income at 65 years old. The rate of return is strangely only 2.63% yearly.

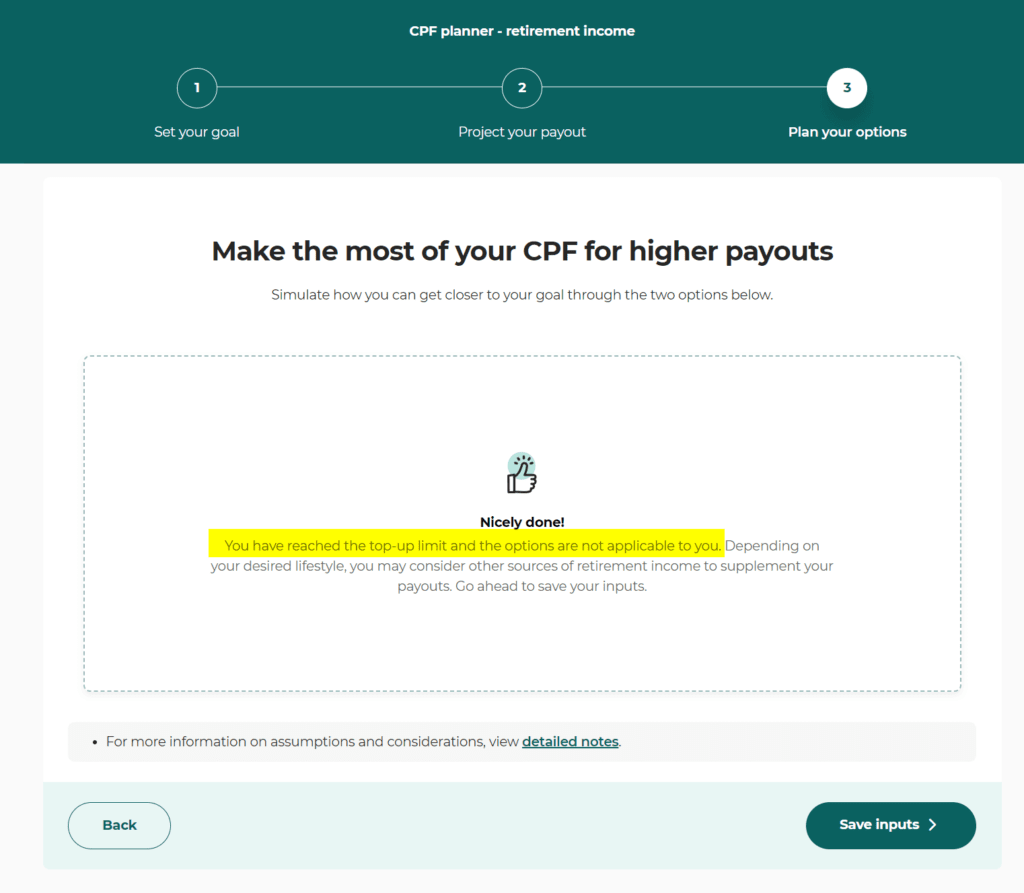

The last page shows you how much you can top-up your CPF SA to reach your goal. This is not too useful.

Here are the assumptions and explanations CPF build into the calculator:

Setting Retirement Income Goal

- The initial retirement income goal selected by you is expressed in today’s dollars.

- A 2% inflation rate is applied to the initial retirement income goal to compute your payout goal at age 65.

- Based on the assumption that the full savings amount can be committed to CPF LIFE, your savings goal at age 65 is computed by deriving the amount of annuitised savings needed to achieve your payout goal at age 65 through a CPF LIFE Standard Plan policy.

- In the retirement income guide, retirement lifestyle choices provided are based on expenditure items from the Household Expenditure Survey 2017/18.

Projections

- Projections are based on the salary-related details you provided. These details will be stored for future projections, and will remain unchanged until you edit them through the planner. If you do not provide current and accurate information, the projections may not be suitable for your use.

- Projections will start from the current month, and end when you are projected to reach age 65.

- Projections assume that you remain employed throughout the projection period.

- Only Special Account (SA) and Retirement Account (RA) balances are projected. The RA is created from SA balances only when you are projected to reach age 55.

- Initial SA balances used for projections are based on your latest available SA balances.

- SA contribution rates are based on those for private sector employees and government non-pensionable employees.

- Contributions on monthly salary are capped at a salary ceiling of $6,000.

- Contributions on additional salary (e.g. bonus) are paid once a year every December, and are capped at the Additional Wage Ceiling based on the assumption that you only have one employer.

- Annual increments are assumed to be constant over the projection period, and applied at the end of every December.

- SA and RA balances earn 4% per annum interest over the projection period. The first $60,000 of balances earn an extra 1% per annum interest. After age 55, the first $30,000 of balances earn an additional extra 1% per annum interest.

- CPF interest is calculated monthly, but credited and compounded annually at the end of December.

- Projected savings are based on total SA and RA balances you are projected to have at age 65.

- Projected payouts are based on the assumption that all projected savings can be committed to CPF LIFE.

Simulating Top-ups or Transfers

- Simulations of top-ups or transfers are subject to CPF top-up limits. To project top-up limits, a 3.5% growth rate is applied to the Current Full Retirement Sum and Current Enhanced Retirement Sum.

- Top-ups and transfers simulated will take effect one month after the projections begin.

- Simulating a recurring top-up will take the place of any existing recurring top-up you have. Simulated recurring top-ups will continue until you are projected to reach age 65.

If My CPF SA Has $208,000, How Much Real Income Have I Secured Today?

This was the question I wished to solve when I wrote my blog post here.

To find that out, we will need to do some reverse engineering.

We know that at 65, the highest monthly projected payout is $2,740. We can use 2% a year inflation rate and work out to be $1,770 monthly.

My $208k today will grow to $519k to produce an actual income of $1,770 monthly.

You can validate this by redoing the CPF retirement calculator again:

I key in a figure $1,730 a month, which is close to $1,770 a month and gets close to $2,730 a month.

You can see that the payout goal is almost close to the projected monthly payout.

If the inflation rate is 2% a year, the inflation-adjusted lifestyle I manage to secure today is $1,770 a month.

What if I Wish to be more Conservative With My Present Real Income Estimation?

We know that at 65, my $208,000 today will give me an income of about $2,740 monthly.

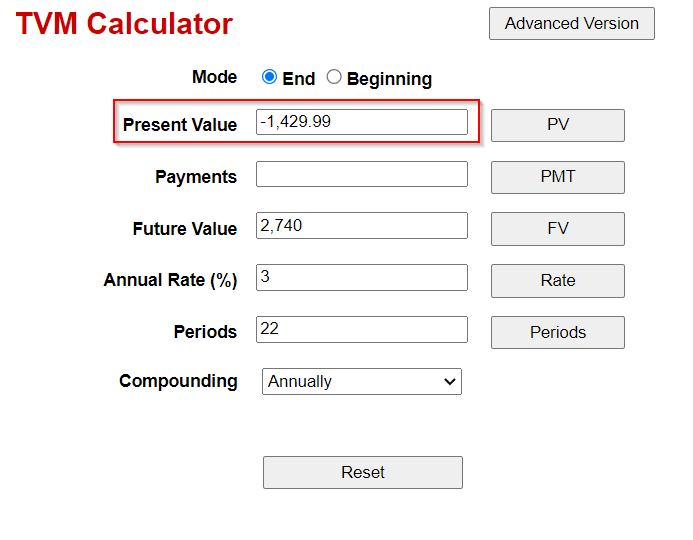

We can use a Time Value of Money Calculator such as this to calculate the real income if we use a more conservative 3% yearly inflation.

With 3% yearly inflation, the real income that my $208,000 CPF SA managed to secure is $1,430 monthly instead of $1,770 monthly.

If my spouse (if I have one) has roughly the same in CPF SA, I will manage to secure an income of $2,860 monthly.

$1,430 monthly is higher than the $1,110 monthly estimated in my previous article.

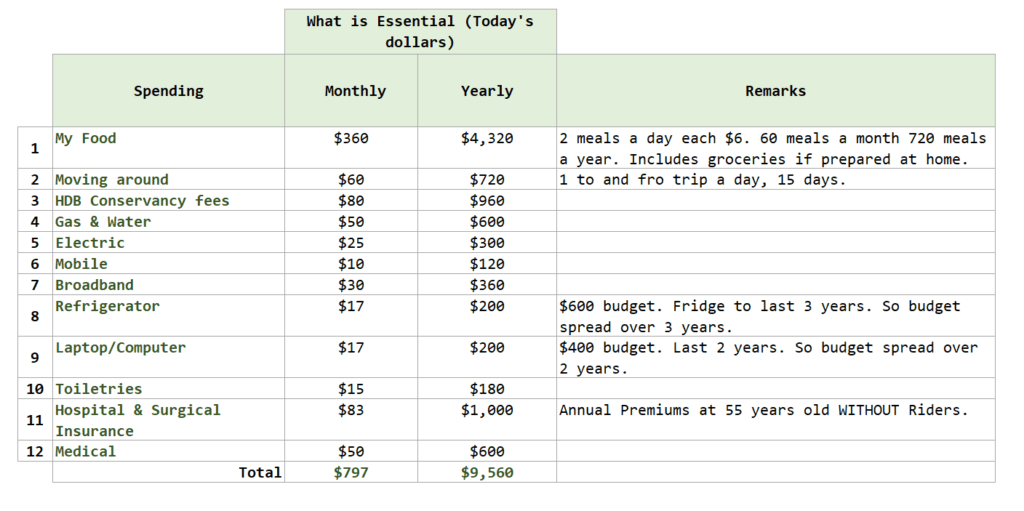

How Much of My Desired Lifestyle Can be Squeezed into $1,430 a month?

Regular readers of Investment Moats might remember not long ago, I map out the expenses that are most important for me to secure. You can read What Kind of Lifestyle Am I Buying – Part 1 of My Buying My Financial Security Series.

In today’s dollars, I need $797 monthly to give me a mentally satisfactory lifestyle and this can be covered by $1,430 monthly.

We can frame the excess CPF LIFE income above $797 monthly in two ways:

- The CPF LIFE income can pay for more line items of expenses.

- I can have inflation-adjusted income from 65 till about 90 years old.

Both framings is useful and it gives assurance that I might have secured my most essential, and inflexible lifestyle.

Estimating the Maximum Retirement Income of Your Clients at 65 Years Old

This calculator can help a financial planner determine how much retirement income can come from CPF LIFE.

You can ask your prospect or clients to click on the link above, login with their SingPass and enter their salary.

You can ask them to ignore the Set your goal. Enter anything to proceed to Project your payout.

Enter their salary, and the calculator will calculate, with the income, what is their projected monthly payout at 65. In this case, the income is $4,310 a month.

He or she will have accumulated $825,000.

You can then see how much more income over $4,310 a month your client needs that has to be supported by their investment portfolio.

Conclusion

If you are in your accumulation phase, do put in your income and see what kind of retirement income you can get when you are 65 years old.

I think this calculator while not perfect, can help you and client advisers estimate their retirement income.

What do you think of the calculator?

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

- The Cheapest Way to Extend Your Laptop to TWODisplay that I Can Find. - April 29, 2024

- My Quick Thoughts on the Net Cash, 4% Yielding Boustead. - April 28, 2024

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

Dumbpappy

Sunday 19th of March 2023

What kind of idiot are you?

Kyith

Sunday 19th of March 2023

Probably a smarter idiot then you.

Chow C M

Saturday 18th of March 2023

If you’re 60 years old now and have S$150,000 in RA account, is it good to join the CPF Life scheme? Thanks.

Kiki

Sunday 19th of March 2023

@Kyith, maybe also need to factor in the increment of the retirement age to 70-75 by 2040-2050.

Kyith

Saturday 18th of March 2023

Hi Chow, the answer may not be so easy unless we know about the person's situation better. This is because we have to look into the income requirements, whether the person wishes to leave a bequest for the next generation all those sort of stuff. In general taking up CPF LIFE is to hedge your longevity risks so that you have an income stream to cover your most important expenses.

retirewithfi

Saturday 18th of March 2023

Assuming $208,669 in SA at 43 is transferred to RA at 55 and continues to grow in RA until 65 when LIFE premium is deducted, the rate of return computed by Excel's RRI = rri(65-43,208669,519000)=4.23%. Curious how did you derive the 2.63% figure?

Kyith

Saturday 18th of March 2023

hi retirewithfi, i use a time value of money calculator and that is what I derive. Strange now that I calculated it, it is 4.23%