When I first went down this financial independence rabbit hole, the dividend model looks pretty sound.

- Spend only the income that is paid by your portfolio of dividend stocks

- Your capital is untouched

- Since I am invested in a 100% stock portfolio, if I manage the portfolio well, stocks should give a high probability of keeping up with inflation

- Markets can go down. However, since you do not touch your capital, if your capital goes down, and you will only spend the income distributed, your capital will have the opportunity to recover back.

- Since you are not selling or drawing down your capital, the dividend income model mitigates the sequence of return risk

The capital is sacred. It cannot be touched.

I have a certain degree of confidence that the dividend income model can work for my financial independence. This is because I have been investing in stocks for a while and have lived with managing a dividend income portfolio.

So based on this model, computing how much we need is pretty simple. What is a conservative average dividend yield that we can get in Singapore?

Probably around 4-5%. In truth, you could find stocks that give more but let us be a bit conservative. 5%. If your annual expense requirement comes up to $24,000 a year, then I would need to accumulate $24,000 / 0.05 = $480,000. Sounds doable! If I wish to be conservative, I would use 4% and I would need $600,000. Tougher but still looks doable.

As a risk-averse person, I saw the appeal of this structure because if I have the capital, I have greater flexibility whether to leave it as a bequest or choose to pivot in life in different ways.

As I went deeper into this area of research, I realize there are certain flaws in using such a strategy for your financial independence. I came across this research piece and I thought it is a good time to put out my thoughts on this.

The Evolution of Providing Income for Retirement

In order to compartmentalize our options for retirement income, perhaps we can recap how we got to this place.

The most obvious form of retirement income comes from our government. That is something not within our control. Humans realize that depending on the government might not be enough.

So they started to build wealth themselves.

This is how it is evolved:

- Spend interest on bonds. Then inflation reared its ugly head so…

- Spend dividend income from stocks. This is during the period where dividend yield on United States stocks was 4%

- #2 + Spend down capital gains. They found that you could spend more if you spend dividend and capital gains (our GIC model!)

- #3 + Spend down principal. Dividend yield became so low that it became a problem just by depending on dividend income

The dividend retirement income model thus existed for quite some time. It is not something new and I believe there were seniors who used it extensively.

What is the Requirement for Retirement Income

There are a few criteria we looked for in our retirement solution:

- Provides a stable cash flow

- We must have a certain level of purchasing power protection of the retirement cash flow

- It needs to last for the entire period you need it

- Optional: Some of you would wish for the capital to be relatively intact so that you can pass it to the next generation

That is largely it. Notice I didn’t mention about the return on investment or compounded average growth. It is not they are unimportant. They are.

However, if we look from a utility perspective, in order to provide 1 to 4, your compounded growth rate needs to be there. If you find a solution that gives you 1 to 4, most likely, the compounded growth rate is there.

I also tend to think a lot of people scrutinize the investment performance portion too much during the financial independence phase and there was less emphasis on the above.

The Problem: Volatile Inflation-adjusted Income

I find the main issue with the dividend retirement income model is that most of us think the inflation-adjusted income is more stable than the reality.

I have profiled a retirement risk management software called Timeline this year and last week they did some data crunching in this area.

It is quite difficult to model the dividend retirement income model because we do not have enough data. However, Timeline allows you to model whether your retirement strategy can stand the test of historical sequences and Monte Carlo simulations. They definitely have some data.

So they sought to model only spending the dividend income in the United States and United Kingdom context.

They have historical monthly data for the United States and United Kingdom equities and also the CPI data to model inflation (Jan 1924 to May 2019 for UK and 1900 to 2019 for US). That is almost 95 and 119 years respectively.

The portfolio is made up of 100% UK or US equities.

If we have those data we can find out how the monthly dividend income, capital value will look in a total of 792 30-year periods.

Fees were ignored. This benefits the portfolio to survive better.

The United Kingdom Results

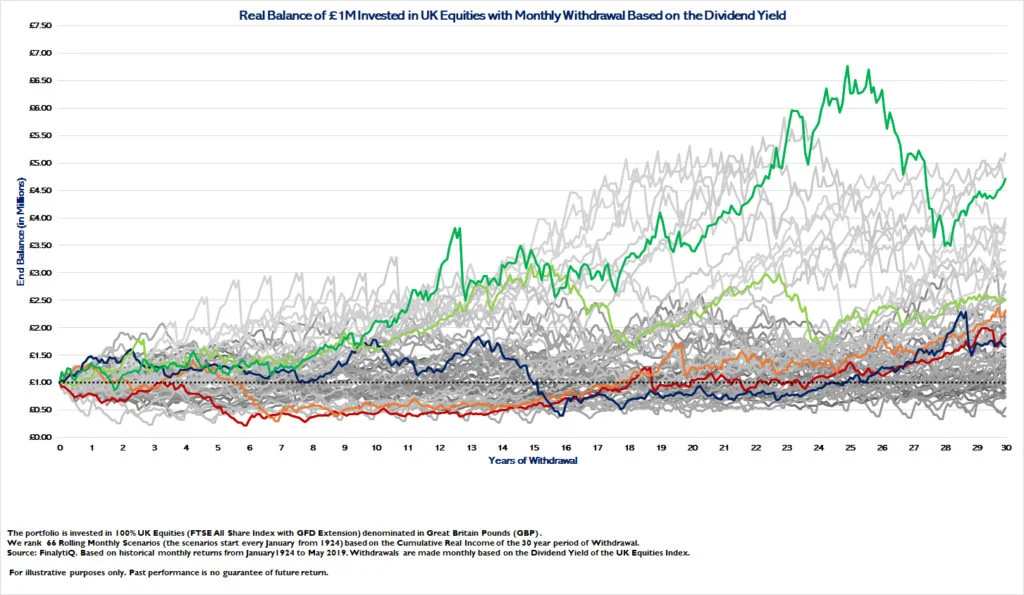

The chart below shows the monthly inflation-adjusted dividend received by a retiree invested in 100% UK Equity for every 30-year rolling period since 1924:

Do note that when we say inflation-adjusted it means that if the income is below the starting point, you are losing purchasing power.

Think of each of these lines as a clone of Kyith. So, in this case, there are 66 Kyith. Each of these Kyith lives off a 1 million pound UK dividend portfolio.

The first thing you will notice is that the starting dividend income is different. In some years the dividend yield is higher so you start off in a brighter note. In some years the dividend is lower, so you start off lower.

Going strictly by this, it means the starting income you get to spend will vary, and you have to retire in a period where the dividend yield matches your retirement.

Your dividend income for retirement is very very volatile. And in some years you lose purchasing power, in some years you do better.

The above chart shows the capital for all 66 30-year instances. You would realize that your capital value is never zero. However, there are some sequences wherein the end, the real value is less than the starting. This does not mean that it is lower than the starting. You could end up still having $1 million after 30 years but this $1 million is very different from the $1 million 30 years ago.

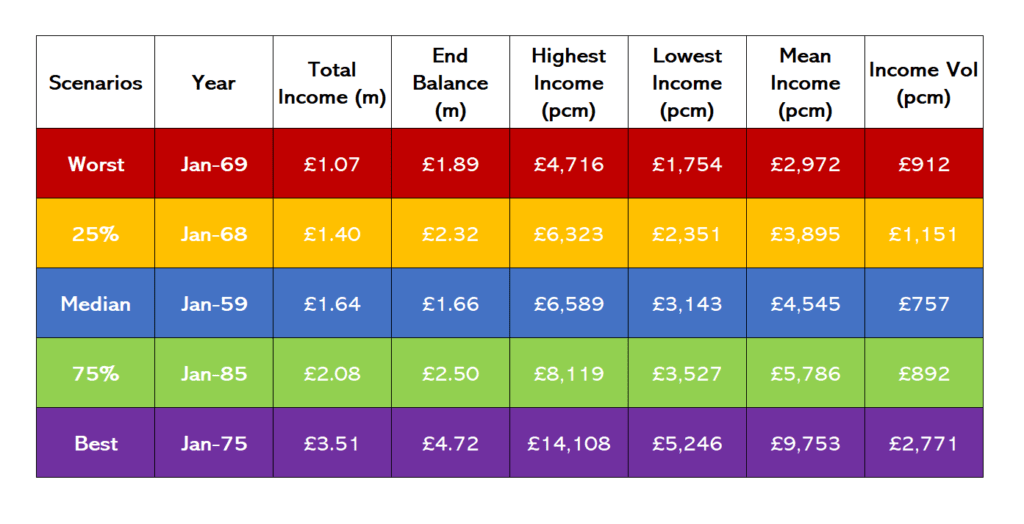

This table shows the result ranked by cumulative income provided. In the worst case, the total income provided was $1 mil, which is about the capital amount. The ending balance is $1.89 mil, which is almost double the initial amount.

The worst year is again one of those 1965 to 1970 years. Those high inflationary years are the toughest.

The income is volatile. There are some months you spend $4716 a month, some months $1754 a month and a lot of month $2972 a month.

Of course, in the median, you end up spending more, but nevertheless there is volatility in the income.

A median income of $2972 a month in the worst case is about $36,000 a year which is almost a 3.6% yield. That is a pretty good initial yield if you asked me.

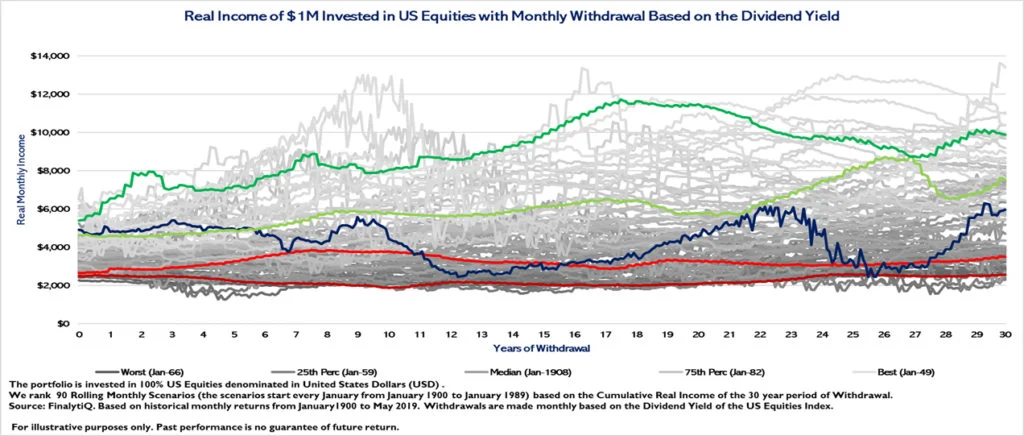

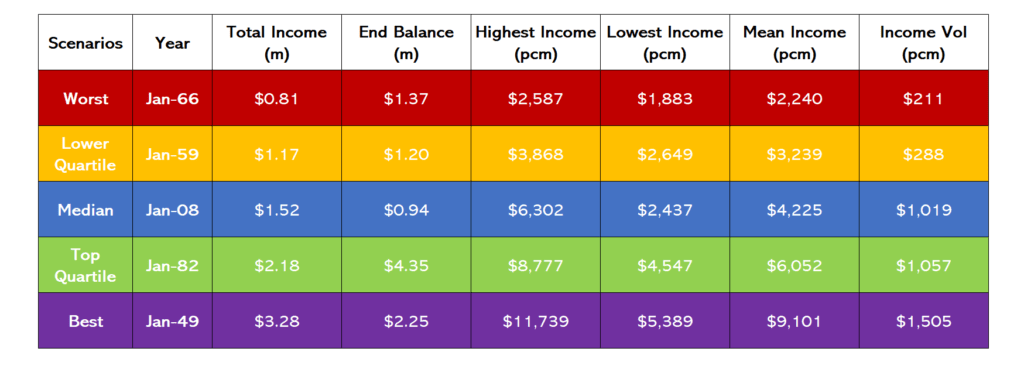

Now let us take a look at United States data

The United States Results

Same story here. The blue line is especially interesting. It shows us that for that retiree the real income can really fluctuate.

Again the tough year was the 1965 to 1970 years.

The volatility for the worst years looked lower. However, in the worst year, the median income that you could spend is around a 2.4% dividend yield. I wonder if that is acceptable for a lot of people.

Timeline’s Thoughts

You can read the Timeline’s piece here.

The writer summarizes the following points:

- Relying on dividend for a stable retirement income is a fallacy. It is an optical illusion

- The income is less stable than a retiree can tolerate

- If you adjust for inflation, it is even tougher to tolerate

- If you implement this strategy, you have to tolerate volatile inflation-adjusted income

- In 25th percentile scenario (1968), a $3500 a month income fell for 7 years, reached a low of $2400 a month

- In median scenario, a 4466 a month scenario meandered for 15 years making budgeting hard

- Because the investor refuses to draw upon the capital, they have little flexibility

- The Investor leaves a significant legacy, but it is pointless when the income needs cannot be matched.

- Under the Safe Withdrawal Rate method, the investor makes no distinction between dividend or capital growth. The income drawn is consistent. If the income is less than the amount needed, capital is sold. If the income is more than the amount needed, income is banked.

- In some countries, dividends are taxed heavily. This makes it not very efficient. Very much so if you are thinking of early retirement.

How do we make the Dividend Retirement Model Work?

The overall conclusion is that the dividend model does not give a stable inflation-adjusted income.

Timeline contrast this model with the Safe Withdrawal Rate model, which gives a more stable income.

The weakness of the Safe Withdrawal Rate model is that you might run out of money if your withdrawal rate is too high. If it is too low, you will need more money.

Those who wish to make the dividend model work would say… I will spend less.

But “I will spend less” is not a solution. How much less?

If you have $1 million and your dividend yield is 5%, your first-year dividend income is $50,000. Then, if the results are poor and you spend $15,000 the next year that is workable for some. But for others, that is a drastic cut.

A more quantifiable way of implementing is “I will spend X% or $X less”.

The problem with that is that… it is pretty difficult to help you plan how much you need to save up.

A more sensible way is to use my best rule of thumb retirement planning model:

- Split your expenses to Essential and Less Essential Expenses

- Aim to build up your wealth so that it is able to generate an income that covers the essential expenses in a conservative manner. This would be about 3.0% of your initial wealth. However, you should aim to make a portfolio of dividend stocks that gives you a conservative dividend yield of 5%.

So suppose your portfolio is $1 mil. The starting year, the portfolio produces $50,000 in dividend income. Of this, $30,000 is spent on essential expenses. The other $20,000 you can choose to spend part of it, all of it. The rest you reinvest it.

If the portfolio does not do well, it should still distribute $30,000 worth of dividend income. You should still be able to cover the essential expenses.

If you implement well, your dividend income may be volatile, but in the worst case, it should still at least give you the initial 3% worth of dividend income.

This dividend income is more… stable.

Does this Modified Dividend Retirement Income Model Sound Pretty Familiar?

If you look at my conservative dividend retirement income model, it is not so different from a Safe Withdrawal Rate of 3%.

By planning with a more conservative dividend yield for the essential expenses, it is the same as choose to spend a conservative starting sum of money.

I realize if you understand the withdrawal rate, it explains a lot of things pretty well.

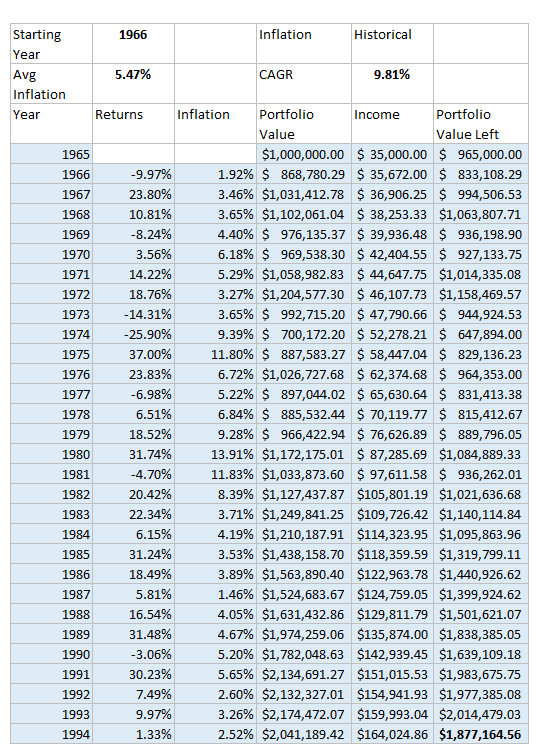

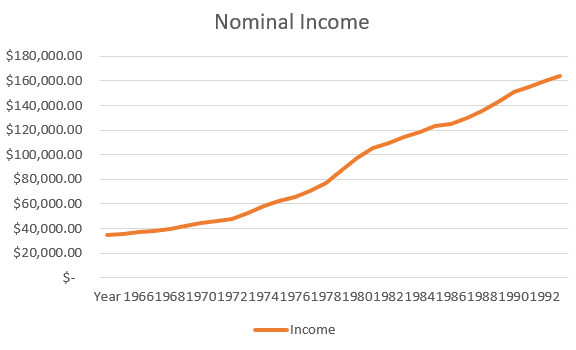

To value add, we take the worst United States Scenario of 1966 and see what will happen if we spend a safe $35,000 in expenses on the initial year.

The CAGR for the period is 9.81%. The average inflation is 5.47%.

Income is adjusted for inflation and starts from $35,000 a year. At the end in 1994, your income would have been $164,024. You end up with a capital of $1.88 million at the end of 30 years.

The income is more stable and inflation-adjusted.

The trick to make a lot of retirement planning work is really to split the expenses to 2 layers and be more accommodating to live with a more variable layer 2.

The solution of many people to make the dividend retirement income model work ends up being a very close cousin of the withdrawal rate system.

Conclusion

What a wealth builder wishes for, when planning for his or her financial independence, is a reliable, inflation-adjusted income that lasts long enough, yet able to retain capital after that duration.

This is tough.

And you realize there ain’t many products out there that has all these characteristics. Especially the reliable + inflation adjustment.

If you wish to replace the management of a dividend portfolio, you can use a good performing exchange-traded fund that is dividend focus, or a unit trust that is distributing.

The STI ETF gives out dividends, the Hong Kong Tracker Fund, which tracks the Hang Seng Index gives out dividends. There are the favorites like Schroder Asian Growth and First State Dividend Advantage.

But it is likely their dividends are volatile as well (something for me to expand next time)

The reason is… not many firms have the compliance to guarantee that.

It is only our friends at Aggregate Asset Management have the balls to put out a piece showing a high withdrawal rate is possible because they trusted their long term returns projections. Even then, they are not guaranteeing it.

Bottom line is this:

- To earn a higher expected return, you have to take on market risk. You have to put your capital in a position that the capital may go down. This means you need to live with volatility

- Cash flow only from fund, stock, bonds payout only is going to be volatile

- You can make it work if you are OK with volatile income

One last thing, remember I have started this thinking this dividend model is the right framework to think about the money part of financial independence. And I realize there are certain flaws to it.

I want you to know that this is how reality will be for most of us. You try to be as great of a critical thinker as you could and come up with a good solution or implement the best solution you could find out there. However, the reality is that you would realize something doesn’t work so well and you have to adjust it.

It is the same for a lot of things in life. And this think, execute, review, think, execute loop is what is needed for life (not just in financial independence). Can’t always chase after the perfect solution.

Articles on Getting Passive Income

Here are a set of articles focus on leveling you up on the topic of getting passive income from your investments:

- How to get Passive Income from Funds that don’t distribute Income

- Why Living Off Dividend Income in Retirement is Not Perfect

- Why Your Income Fund Pays the 3-7% Income partly from Capital

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

FIhopeful

Monday 28th of October 2019

Hi

Does your analysis include the Cpf life payout portion?

Personally I think it's not possible to live on dividends if u retire early like 30s or 40s, if you got kids.

More realistic scenario would be somewhere in 50s or 60s, where you can tap on Cpf life or partial withdrawal at 55 if necessary.

Kyith

Monday 28th of October 2019

HI FIhopeful, why would it be not impossible? Lets say your dividend portfolio is such that you can spend 2% of your 4% dividends on your expenses. that portfolio have an average payout ratio of less than 50% of its earnings yield. i think it is reasonably safe. of course, that would mean your portfolio is large enough. if we wish for safety, we can achieve it by using conservative measures. it would usually mean we neeed to accumulate more.

this analysis is independent of CPF life.

there is a reason for that.

Suppose your expenses is only $8000 a year. You wish for an inflation-adjusted income of that. Your capital is $400,000. the average payout is 4% because you choose some rock solid mature growers. the dividend may start at $16,000 a year, but you needed only $8000 and the rest, you save it for next year or reinvest it. The dividend sometimes go up and down. In this scenario, even during a poor year, when the 16,000 div gets cut to 10,000, it could still work. you probably don't need CPF life.

The math of this showed that the capital does not go to zero in almost all US and UK 30-year history.

I would say one thing... i have not go deep into it, but i came across studies that say these pension income later does not impact these withdrawal scenarios. their impact is less than what we think. I have not look into it, but it may be a rabbit hole you wish to jump into.

lim

Monday 28th of October 2019

The inflation rate is a weighted basket of items which includes medical costs (6.1%) and housing costs (26.3% housing & utilities), and those two have been spiralling out of control. post secondary Education (6.1%) is also increasing. Transport is a mix of public and private I presume (15.8%)

The inflation rate of some of these items actually do not affect a retiree who has planned properly that much (eg: education inflation is irrelevant). The retiree still has to content with inflation for food, haircuts, etc, but these are not increasing as fast as medical/housing.

(1) Housing inflation: If I have my fully-paid modest 999 or freehold condo, I'm not bothered by housing inflation (2) Medical inflation: Crucial to have my incomeshield and rider to deal with hospitalisation. As for general health, look at the price of panadol 30 years ago and generic paracetamol now - when patents expire, medicine actually becomes cheaper. (3) Transport: Isn't public transport for seniors subsidised. My parents prefer to take public transport instead of taxi/grab for the exercise/to remain active.

Kyith

Monday 28th of October 2019

Hi Lim, thanks for raising this point. You are not wrong. My expense reports would show something like this. But you got to take some assumptions lah. I can say inflation in recent years very low, then i will have people telling me Kyith you are being very bias. You can already see it in this comment thread.

lim the shield plan does help but note the premium of the shield plan is inflating as well.

as a thought experiment i am testing out this financial planning software at work. so I cheekily put my cable tv bill and another expense that is $40 dollar inflating at 10%.

after a while i realize the very far age numbers 90 to 100 years old the portfolio value started declining very rapidly. i do not know why. it is only later that i realize those 40 bucks inflate like mad until they form the 2nd and 3rd largest expense behind food!

Steveark

Sunday 27th of October 2019

Very well presented information. I got the impression that while you showed US data because it was available that in fact you invest entirely in Singapore dividend stocks? I would think investing is a relatively tiny economy compared to the global economy adds a disproportionate risk to the strategy. Just the fact that there is no long term data available would back that up. Wouldn’t a global investment strategy with a large percentage of US and European dividend stocks be wiser or perhaps I misunderstood that part.

Kyith

Monday 28th of October 2019

HI Steveark, you are not wrong there. globally diversified is important.

Chris

Sunday 27th of October 2019

Fantastic piece of analysis Kyith. Always enjoyed reading your articles. On this piece, my thinking is that if you build your capital to a large enough AUM , then all this worry becomes far less.

Kyith

Sunday 27th of October 2019

HI Chris, that is correct. The trick is always to figure out how much is large enough

Tacomob

Sunday 27th of October 2019

Great insights supported with thorough analysis. As usual.

Andy congratulations on that wonderful feature in the Straits Times today, Kyith. Well deserved to be featured there.

Kyith

Sunday 27th of October 2019

Hi Andy! thanks a lot!