The Rational Reminder podcast pointed me to this paper called Sustainable Withdrawal Rates from Retirement Portfolios – The Historical Evidence on Buffer Zone Strategies.

What the hell is a buffer zone?

I think many of you retirement planners like to have cash in your retirement like a cash bucket. If the stock market is not so good, instead of spending from the more volatile part of your portfolio, spend from the cash allocation. In this way, you can avoid the negative sequence of return risk. (Read here about the sequence of return risk). But on top of that, when times are good, you replenish the cash buffer as well.

So, how good is having this cash buffer?

According to this paper, it is not so good. The conclusion is that it is better to just stick with a plain old equity and bond portfolio.

But Kyith, shouldn’t having cash be safer?

Kyith tells you a lot of time already. Repeat after me for the 1000th time: For your portfolio to be safe mathematically, so that your income last the duration you need, respect the initial income-to-your-portfolio ratio or the initial safe withdrawal rate!

The cash buffer provides psychological comfort, but generally, I think there are many historical sequences that is so challenging NOT BECAUSE OF MARKET DOWNTURN but of very high inflation.

And so cash buffers don’t do much in those scenarios.

Another factor that may prove challenging is the part of always replenishing the cash buffer. If cash is a return drag, the act of replenishing is shifting from a higher-return asset to a very low-return one.

I think the big differentiating part of why this is a problem is the replenishing part.

But there are some data (which i flesh out below) that may be useful for you. Now we can understand better why very experienced former actuary Don Ezra, who sits on a few pension planning board, structured his personal retirement plan as 5 years’ worth of cash and the rest 100% equities (read this note on my blog).

So I have shared the conclusion.

From this point on, it is my interpretation of the paper (for those that bother about such things).

What is a Buffer Zone Strategy?

Suppose you have a $100,000 portfolio and you want to withdraw 5% of the amount or $5,000 yearly.

If I use a 3-year buffer zone, I will put 3 years’ worth of spending or $15,000 into cash. The rest, $85,000 goes into an investment portfolio made up of risky assets such as equities and bonds.

Here are the rules:

- If end of the year, if the year’s return is up, I withdraw $5,000 from the investment portfolio.

- If the year’s return is down, then I will take money from the cash holdings.

- In the second year, if the portfolio is up, then I will spend from the investment portfolio and also liquidate enough fo the investment portfolio to bring the cash position back up to its original value.

So basically, there is a cash replenishment at work here.

Testing the Buffer Zone with Historical Data

The researchers tested this Buffer Zone in this way.

One portfolio is made up of:

- 100% equity 0% bonds

- 75% equity 25% bonds

- 50% equity 50% bonds

- 25% equity 75% bonds

- 0% equity 100% bonds

The other is based on:

- Money Market Fund portfolio

- What you see above from 1 to 5

The allocation between the money market and #2 depends on how many years of spending we wish to buffer from 1 Year to 4 years.

Why 1 to 4 years?

This is because if we look at US data from 1926 to 2009:

- There is only 1 time the market went down exactly 4 years in a row

- There are only 2 times when the market went down exactly 3 years in a row

- There is only 1 time the market went down two years in a row

- There is one time the bond market is down two years in a row (now it may be two times if we include the current instance!)

The researchers run through these two kind of portfolios and see which one do better over 84 years of US data. By doing better, it means that the percentage of success of 15, 20, 25 and 30-year retirement periods is higher. Success means the money lasts for that tenor.

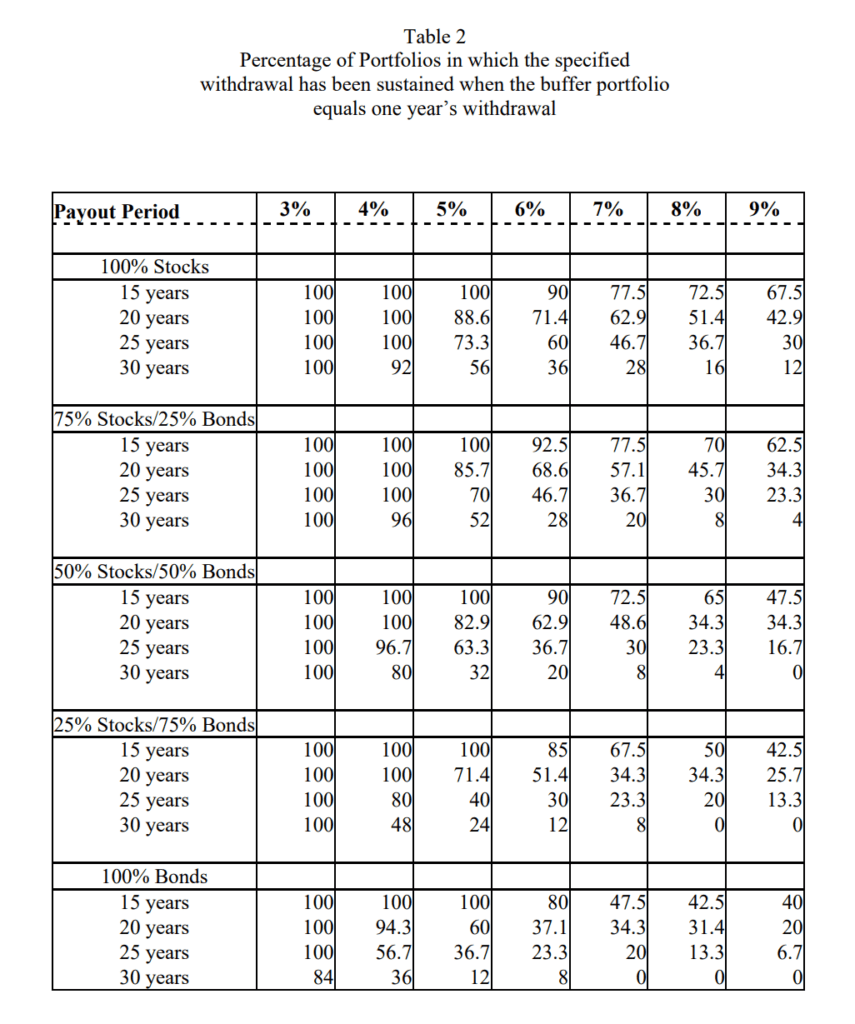

The first table below shows the success rate of the typical safe withdrawal spending:

The researchers denote this as CHW based on the starting alphabet of the researchers behind the Trinity study paper. There are various allocation of equity and bonds, various tenor of retirement and various safe withdrawal rates from 3% to 9%.

The result of this is not surprising. If the initial withdrawal rate is 3%, most allocation and time period will be ok except if it is 100% in bonds. 3% is low enough such that even the most pessimistic historical inflation and market sequence will work.

As you increase the withdrawal rate to 4%, 5%, 6%, the success rates start dropping. At 5%, perhaps 50% of the time, the retiree may get a good outcome, and 50% they do not.

The next table shows the portfolio simulation if they have one year of buffer:

What you will notice is that… the success rate didn’t improve much! Just scroll up and down and do a comparison. A higher success percentage should be observe in this table IF the buffer zone works.

But what about 2, 3, 4 year of buffer zones?

Let us take a look at the next table:

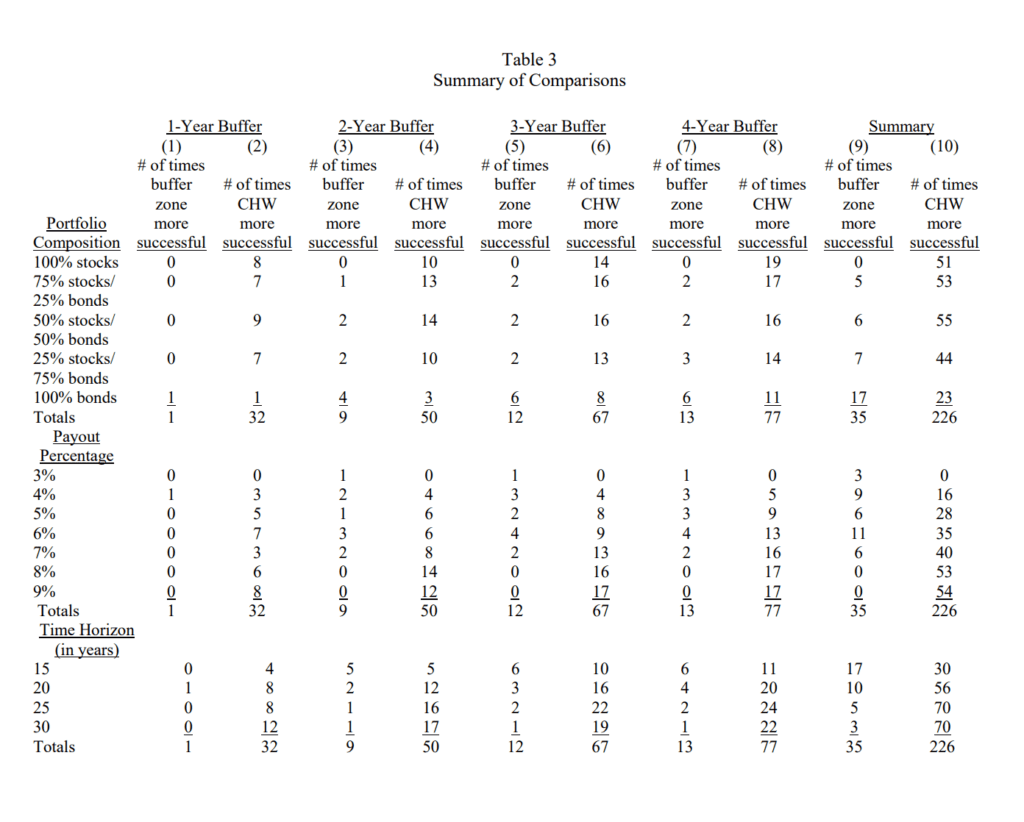

Okay, this table is a bit busy, but you can focus on the first group titled 1-Year Buffer. That group is comparing the buffer zone success against the CHW, which is the traditional safe withdrawal rate. It shows which strategy ends up being more successful. They do this against different stock and bond allocation, different time horizon, and different initial withdrawal rate.

We observe for the 1-year buffer the CHW has more success than the buffer zone, which indicates that mathematically, the outcome is better without the buffer zone.

This is consistent for the other 2, 3, 4 year buffers.

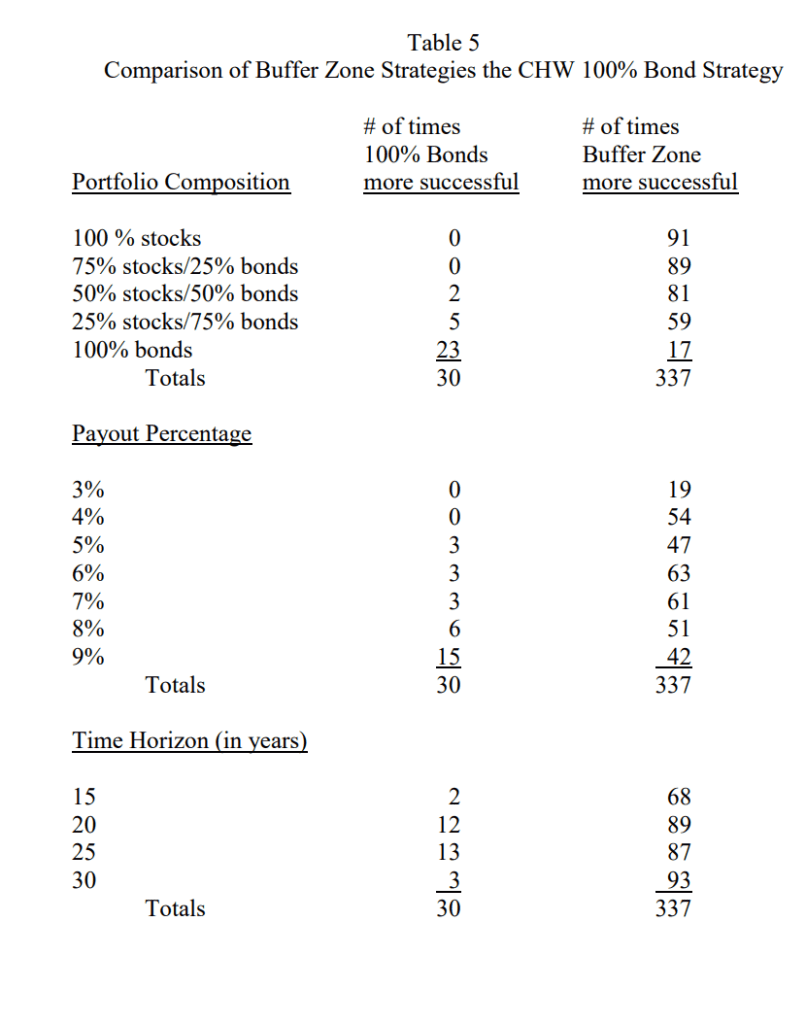

The researchers also tried to answer a question: If we have a 100% bonds portfolio and one with Buffer zone, which is better?

The odd thing is why if the portfolio is 100% bonds, we have data that have equity allocations.

In any case, A diverse portfolio with a buffer zone is better than a 100% bond portfolio allocation.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

klee

Tuesday 14th of November 2023

Is "cash buffer" the same as "emergency fund"? If so, emergency fund is a bad idea?

Or, there is a difference in duration, eg years of cash buffer means much higher cash drag than months of emergency fund?

Kyith

Tuesday 14th of November 2023

It depends on how you frame the problem. The cash buffer is not an emergency fund because it has a very specific role. We know that if we live through a period that may be similar to one 30 or 40 year period in the past, we may live through a period where the first 5-7 years is very challenging and this cash buffer is to tackle that.

This is not meant for expenses you do not foresee, that is an overspending problem that we tackle separately. In these kind of retirement research, we usually fix things like, i just want a fund for my caifan and it solely serve this purpose.

hope this helps.

Sinkie

Tuesday 14th of November 2023

I thought the cash shield method is more common, whereby the retiree builds up 3-5 yrs of cash before retirement & then spends down this cash first to negate any initial SOR risk before starting the 4% withdrawal from his balanced portfolio.

Think you covered it in 1 or 2 of your safe withdrawal articles before. Basically another way of saying "build a bigger portfolio" and/or "use a 2.5 or 3% initial withdrawal" lol.

Kyith

Tuesday 14th of November 2023

I think this is me digesting this research. Quite likely, the more you harvest into cash, there is greater opportunity cost. It doesnt just buffer for the early SOR, it tries to prevent spending from equity in further downturns.

My research is... usually the cash is quite useless for future downturns.