A Singapore Treasury Bill issue (BS23100Z) will be auctioned on Thursday, 5th January 2023.

If you wish to subscribe successfully, get your order via internet banking (Cash and SRS) or in person (CPF) by 4th January. You can also apply with your CPF-OA and CPF-SA funds, but you would have to go down to a bank (OCBC, UOB and DBS) and do it in person. You can also apply the same issue with your cash and SRS.

You can view the details at MAS here.

In the past, I have shared with you the virtues of the Singapore T-bills, their ideal uses, and how to subscribe to them here: How to Buy Singapore 6-Month Treasury Bills (T-Bills) or 1-Year SGS Bonds.

In the last issue announced two weeks ago and recently concluded, the current t-bills traded at a yield of 4.23%. In the end, the cut-off yield for the t-bill ended quite close to that at 4.28%.

For the second time, if you select a non-competitive bid, you may be pro-rated the amount you bid and would yield 4.28%. If you would like to ensure you secured all that you bid, it will be better to select a competitive bid, but you need to get your bid right.

A good rule of thumb is to ensure you get what you want and accept whatever the cut-off yield bid 50% of the last cut-off yield. In this case, you can bid 1.95%. Whether the final cut-off yield is 2% to 4.3%, your 1.95% bid will help secure the total allocation you need.

Now, I have feedback from readers that I should not ask people to bid low because if everyone does that, it will eventually lower the eventual cut-off yield. I want to call out for most to submit the yield they wish to get. However, I believe some need to secure the total allocation for what they bid for a specific purpose. This can be for SA Shielding. If that is the case, by bidding lower, you may risk earning a lower interest versus the market, and you accept that risk because the bills serve a specific purpose.

If the majority of the people are doing it for SA shielding and bid low, that means that the yield reflects the will of enough majority (60% of the auction participants). This is the risk we all take. I want to think Investment Moats have some influence over the auction outcome, but likely it is so tiny. Even if Kyith recommends not doing it, you will still bid lower if you understand it and your intention differs from what was recommended.

Gaining Insights About the Upcoming Singapore T-bill Yield from the Daily Closing Yield of Existing Singapore T-bills.

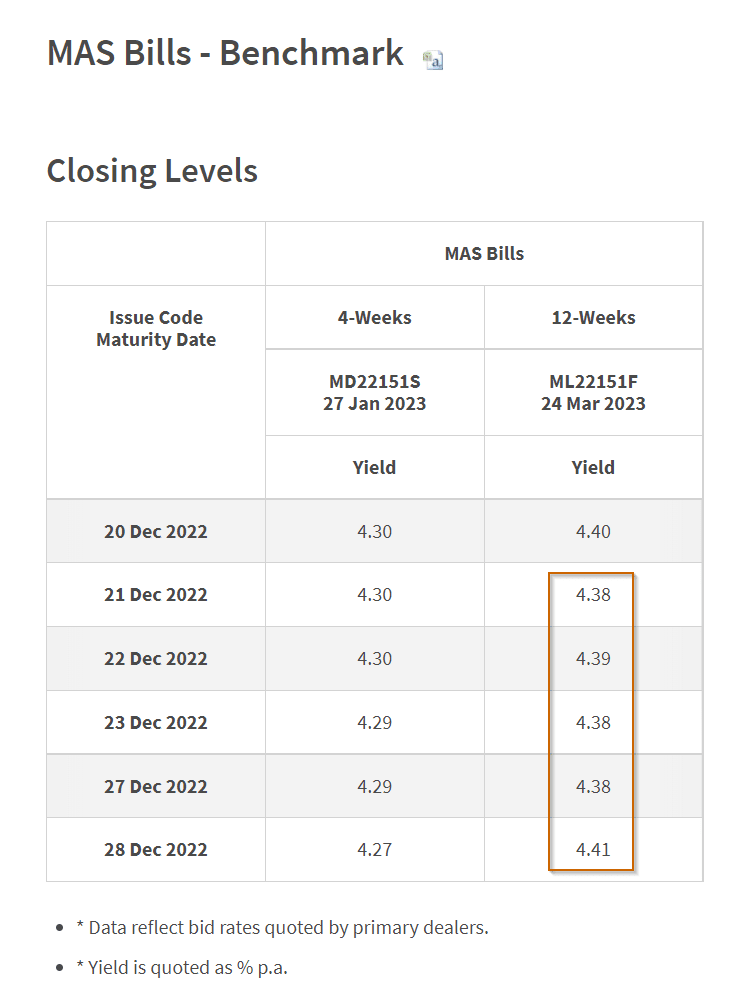

The table below shows the current interest yield the six-month Singapore T-bills is trading at:

The daily yield at closing gives us a rough indication of how much the 6-month Singapore T-bill will trade at the end of the month. From the daily yield at closing, we should expect the upcoming T-bill yield to trade close to the yield of the last issue.

Currently, the 6-month Singapore T-bills are trading close to a yield of 4.3% in the last few days, which is close to the yield of the T-bills 2 weeks ago.

Gaining Insights About the Upcoming Singapore T-bill Yield from the Daily Closing Yield of Existing MAS Bills.

Typically, the Monetary Authority of Singapore (MAS) will issue a 4-week and a 12-week MAS Bill to institutional investors.

The credit quality or the credit risk of the MAS Bill should be very similar to the Singapore T-bills since the Singapore government issues both. The 12-week MAS Bill (3 months) should be the closest term to the six-month Singapore T-bills.

Thus, we can gain insights into the yield of the upcoming T-bill from the daily closing yield of the 12-week MAS Bill.

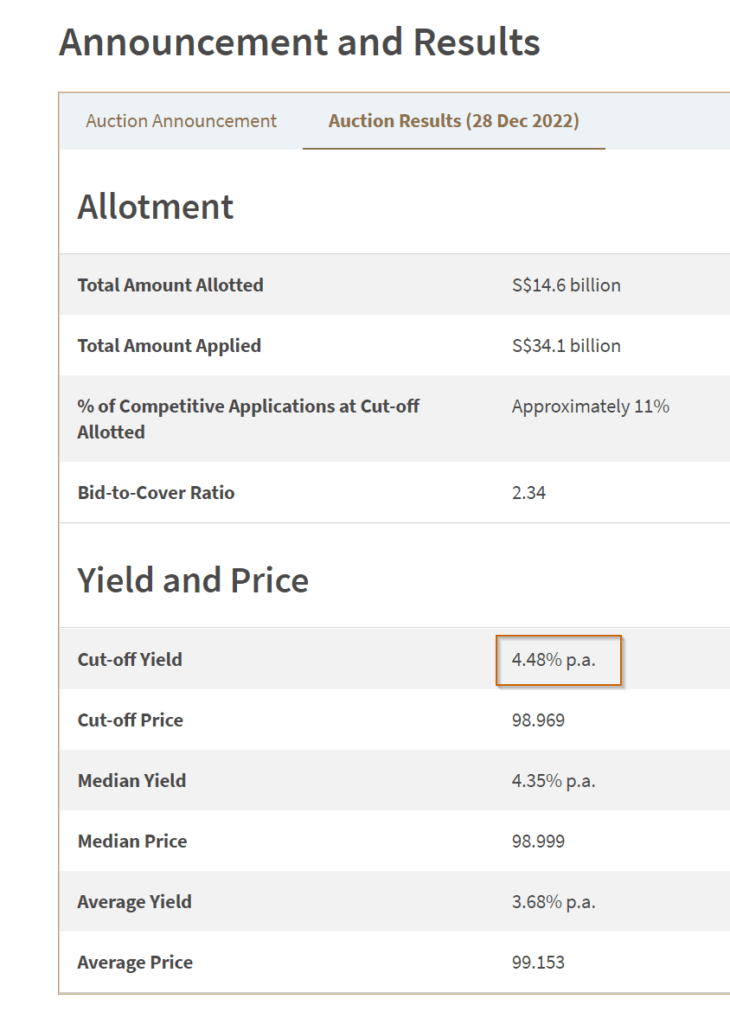

The cut-off yield for the latest MAS bill auctioned on 28th Dec (yesterday) is 4.48%. This is higher than the last MAS bill issue a week ago.

Currently, the MAS Bill trades close to 4.40%.

Given that the MAS 12-week yield is at 4.48% and the last traded 6-month T-bill yield is at 4.4%, what is likely to be the T-bill yield this time round?

Based on what happens in the market at the start of the year (it might be volatile), we could see some upside to the stock market and the risk-free bond yield moderating. If there are higher recession risks and the yield curve starts reflecting some steepness, we could see the yield curve shifting down and that would mean a lower short-term market yield.

As a shorter-maturity government bond, I felt the eventual demand would not be too far from the current 4.2%. If there is a greater inflation risk, we might see the yield closer to 4.4%.

Here are your other Higher Return, Safe and Short-Term Savings & Investment Options for Singaporeans in 2023

You may be wondering whether other savings & investment options give you higher returns but are still relatively safe and liquid enough.

Here are different other categories of securities to consider:

| Security Type | Range of Returns | Lock-in | Minimum | Remarks |

|---|---|---|---|---|

| Fixed & Time Deposits on Promotional Rates | 4% | 12M -24M | > $20,000 | |

| Singapore Savings Bonds (SSB) | 2.9% - 3.4% | 1M | > $1,000 | Max $200k per person. When in demand, it can be challenging to get an allocation. A good SSB Example. |

| SGS 6-month Treasury Bills | 2.5% - 4.19% | 6M | > $1,000 | Suitable if you have a lot of money to deploy. How to buy T-bills guide. |

| SGS 1-Year Bond | 3.72% | 12M | > $1,000 | Suitable if you have a lot of money to deploy. How to buy T-bills guide. |

| Short-term Insurance Endowment | 1.8-4.3% | 2Y - 3Y | > $10,000 | Make sure they are capital guaranteed. Usually, there is a maximum amount you can buy. A good example Gro Capital Ease |

| Money-Market Funds | 4.2% | 1W | > $100 | Suitable if you have a lot of money to deploy. A fund that invests in fixed deposits will actively help you capture the highest prevailing interest rates. Do read up the factsheet or prospectus to ensure the fund only invests in fixed deposits & equivalents. |

This table is updated as of 17th November 2022.

There are other securities or products that may fail to meet the criteria to give back your principal, high liquidity and good returns. Structured deposits contain derivatives that increase the degree of risk. Many cash management portfolios of Robo-advisers and banks contain short-duration bond funds. Their values may fluctuate in the short term and may not be ideal if you require a 100% return of your principal amount.

The returns provided are not cast in stone and will fluctuate based on the current short-term interest rates. You should adopt more goal-based planning and use the most suitable instruments/securities to help you accumulate or spend down your wealth instead of having all your money in short-term savings & investment options.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Tom

Thursday 29th of December 2022

For SA shielding, assuming it happen on a certain date, I think it may be better to do non-competitive for 5 month before that cutoff date. If after 5 months there are still money left, as a last resort then execute your strategy of bidding 50% of the last cut-off yield. This way, you can "try" to get higher rates if possible.

Kyith

Thursday 29th of December 2022

Hi Tom, that is quite a sound plan. I would usually suggest people to at least do it about 2 issues between their birthday and when they decided to do it. This is so that if they cannot get it in the first tranche, they have at least one backup.

Nick

Thursday 29th of December 2022

Also, assuming your strategy is correct, isn't doing SA shielding on the 12 month t-bill coming up next year be better?

Kyith

Thursday 29th of December 2022

hi Nick, if there is a 12-month one and you need it then you are right. but for some, there is a balance of the opportunity cost of earning lower interest for longer. This is if the tbills interest is lower than the CPF SA interest. at this point, it is quite comparable so it is not an issue.

regarding why not non-competitive bid, i am trying to cover some less likely possibility. In one of the issues a couple of months ago, the non-competitive bids were so much that those who bid non-competitive didn't get the full allocation. So if you are doing SA-shielding, you only manage to shield part of what you wanted. hope this helps.

Nick

Thursday 29th of December 2022

Actually I don't get one part, if you want to bid at 1.9% to ensure you get full allocation, why not just go for non competitive and you definitely get full allocation? The interest rate that you would lose for CPF is 2.5% for 7 month and above too, so again, might as well go for non-competitive since there is very slim chance that it would get below 1.9%.

Jane

Thursday 29th of December 2022

Thank you!

Jack Sparrow

Thursday 29th of December 2022

BS23100Z auction date is 5th Jan, not 10 Jan.

Kyith

Thursday 29th of December 2022

hi Jack, thanks I hope I corrected that. I dunno what I was thinking looking at the 10 Jan and thinking that is the auction date. Thanks.