I met up with a friend I had not seen for some time because he was gracious enough to pass me an electronic mouse. Mine broke down unexpectedly, and it just so happened that he was giving away two.

During our conversation, he decides to pick my brain on a unique problem: “Kyith, now that I have been investing for a while and have contributed regularly to a couple of Robo-advisor platforms. What are your thoughts regarding whether I should spread them out further?”

I think what my friend is thinking is not unique. Many will have this worry about their platform collapsing. I told my friend that his degree of wealth is not substantial yet, but what will help him is to ask himself the same question if his portfolio is $1 – 2 million.

The degree of worry about financial ruin may increase dramatically, and likely that would probe him to think about whether dividing his wealth into chunks of $300,000 would be better and what would happen if he lost $300,000 overnight because the platform collapsed.

Part of his protection would be SDIC insurance, but a large part of his protection will be the strength of MAS’s regulatory framework.

The final part of due diligence would be the strength of the financial company. Our heydays, our brokers UOB KayHian and GK Goh are listed. We can see how they operate as a firm and be more assured of how well-run these brokers are. They were profitable and could dish out healthy dividends to the shareholders.

Of course, that would mean they are earning a good deal of commissions from us!

I have recommended moomoo as a brokerage platform in the past. Many have wondered how sustainable it is for a broker to keep giving so many incentives to get new clients on the platform and to trade.

I think one of the best ways is to take a look at whether moomoo is a financially well-run company.

moomoo’s parent, Futu Holdings Limited is a listed ADS company on the Nasdaq stock exchange under the ticker symbol FUTU. As a listed company, their financials are available to review and scrutinize.

In this article, I will review and explain my thoughts after reviewing Futu Holdings’ financials.

Futu Holdings is a Profitable Company

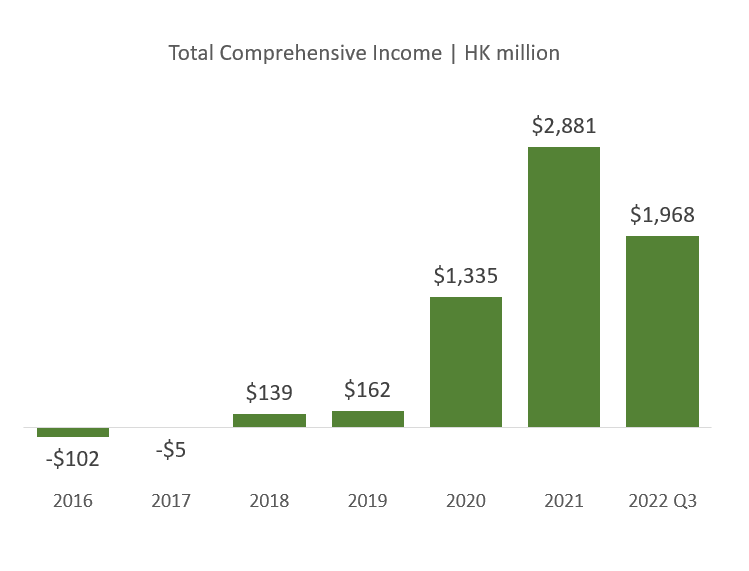

The chart below tabulates the net income (comprehensive income) of Futu holdings from pre-IPO days (FUTU IPO in 2018) till today:

Once the company could pare down its losses and become profitable, it decided to IPO. Since then, it has grown most of its profit organically without acquisitions. This is more remarkable even with the poor recent market performance, first in China and later in US stocks.

We know Futu holdings are profitable, but how does it make money?

How Futu Earns Their Money

Futu holdings were founded by Leaf Li as early as 2007. Leaf, the 18th employee at Chinese giant Tencent, saw his net wealth grow as Tencent went public in 2004. However, his early trading experience with the traditional platform at his disposal was described as crude, unstable, and difficult to use. Most importantly, he could not get customer support personnel when he most needed it.

He saw the ample opportunity because he had an inside view of what made Tencent a success: Improving the platform for customer experience and customer support.

So he left Tencent and started a tech-enabled brokerage solution.

FUTU roughly stands for Fortune for U, Treasure to U, which is the corporate values they hope to achieve.

Futu holdings revenue is broken into three segments:

- Brokerage commission income and handling charge income

- Interest income

- Other income

Brokerage commission income and handling charge income & Expenses

This consist of commissions and execution fees charged to their clients for executing and clearing. Futu generates commissions and execution fees through trading equities and equity-linked derivatives for their clients.

Handling charge income primarily consists of fees from settlement services and handling services for subscription and dividend collection.

The expenses consist of fees charged by executing brokers in the U.S as Futu transacts with them, and expenses charged by stock exchanges for providing clearing and settlement services in connection with IPO subscriptions.

Interest income & Expenses

This consist of interest income from margin financing and securities lending services, Interest income from bank deposit and interest income from IPO financing by arranging for Futu’s clients in connection with their subscriptions in initial public offerings.

The expenses primarily consist of interest expenses of borrowings from commercial banks, other licensed financial institutions and other parties to fund Futu’s margin financing and IPO financing business.

Other income & Expenses

This consists of

- Income from Enterprise public relations services by providing institutional clients with public relations services, including distributing company information and news and providing communication channels with investors.

- Underwriting fee income in their investment banking business through equity underwriting.

- IPO subscription service charges income from new share subscription services (IPO)

- Currency service income from clients (forex)

- Income from market data services

- Client referral income by referring clients to licensed A-share brokers in China

Processing and servicing cost consist of market data and information fees, data transmission fees, cloud service fees and SMS service fees paid to stock exchanges and data and other service providers.

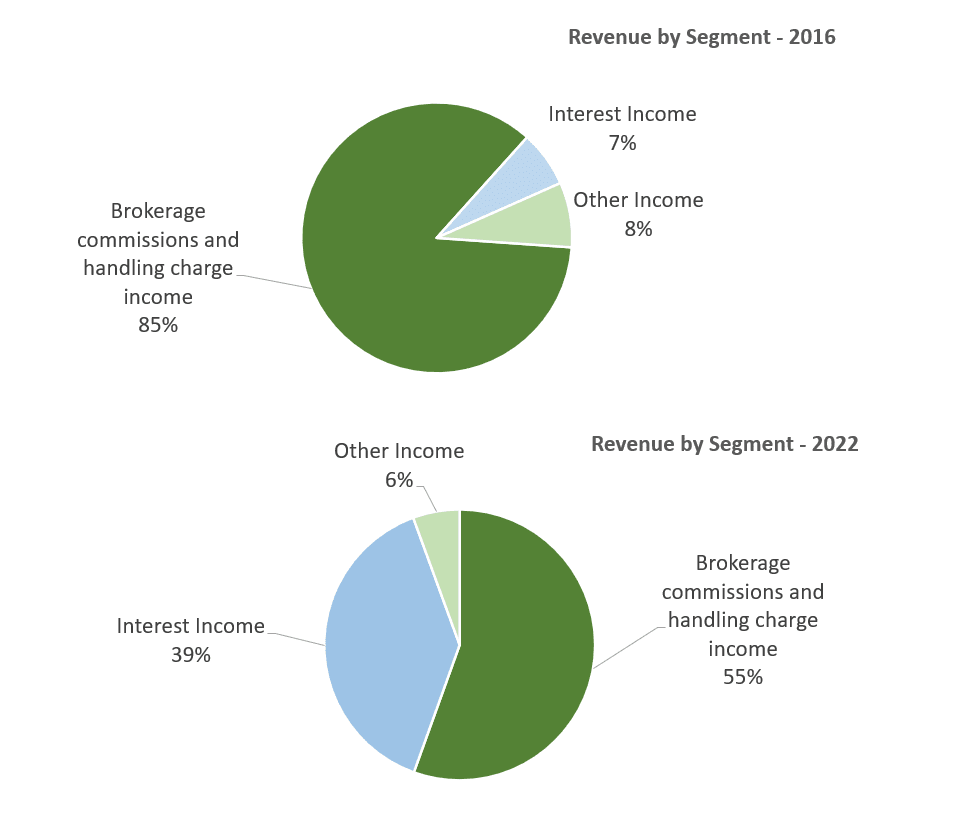

Revenue by Segment

In 2016, Futu holdings still earned most of its revenue from brokerage commissions. As with most brokerages, some of their earnings eventually come from margin interest. But also more and more, as we store more of our spare money as cash, they can earn from the spread (by investing in higher-yielding securities) to earn a spread income.

Gross Profit by Segment

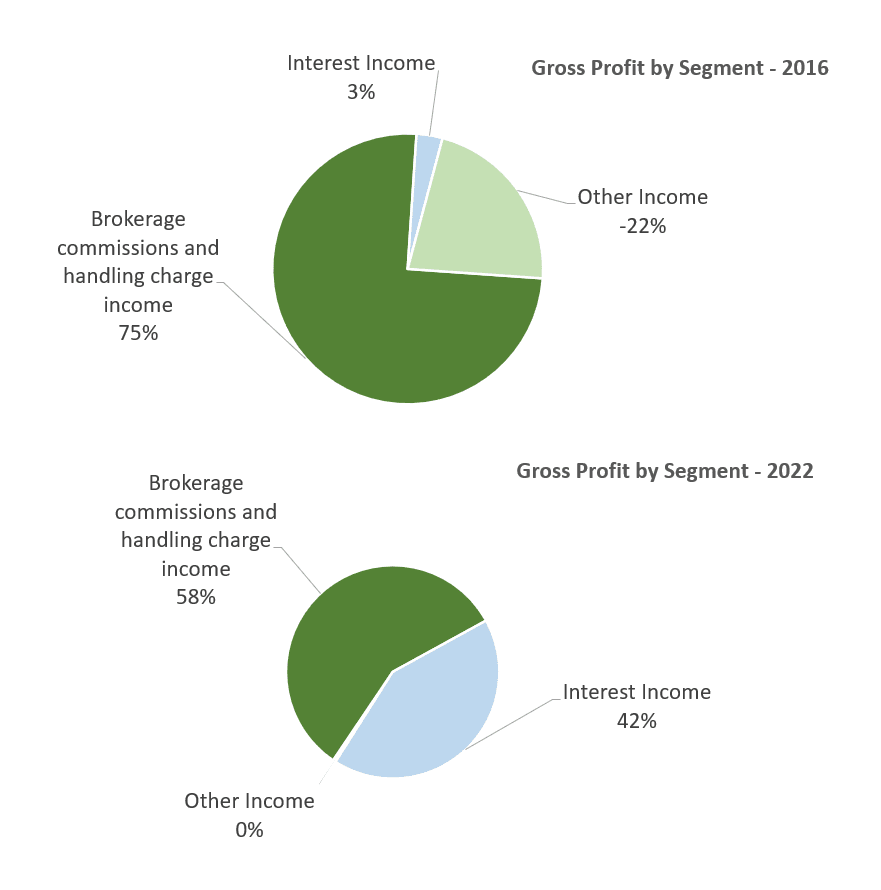

By looking at revenue, we would not be able to know how lucrative the business is. A study of Futu’s gross profit may give us some ideas:

I have lumped the processing expenses under other income, showing a fragile other income segment.

In its infant stage, the majority of the profit came from brokerage, but eventually, less the cost, interest income has become its second profit engine.

Gross Profit Margin

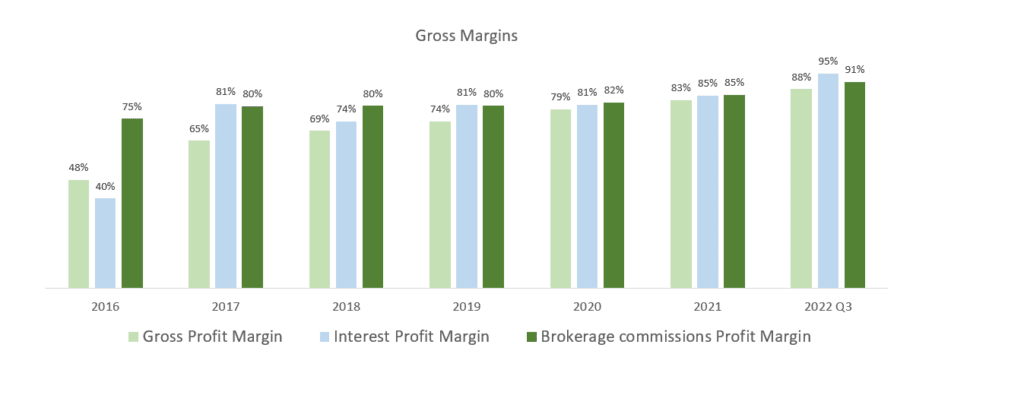

The gross profit breakdown shows the rough contribution of each segment to Futu holdings. To find out how lucrative is the brokerage business, we can look at the gross margins.

The chart above plots the overall gross profit margin, interest profit margin and brokerage commissions profit margin from pre-IPO to recent.

In its infant stage, margins were already respectable but probably not enough to cover Futu holding’s fixed cost. We can see that over time, interest and brokerage commission margins improved.

Most likely, this is due to the synergy of scope. An increase in trading and borrowing does not always lead to a proportionate cost increase.

Futu holding’s very high gross profit margin is not out of the norm. For the last quarter ending in September 2022, Interactive Brokers also spotted a gross margin of 89%.

The Cost of Building Out Futu’s Competitive Edge

The company firmly believes that investing in technology and observing the landscape would reap long-term benefits for the company. The technology will set them apart and at worst, help them keep up with the competition, which will feedback to bring in more clients.

A tech-enabled online brokerage and wealth management business should eventually have operating leverage. There were more significant investments in research and development and its people in the early days.

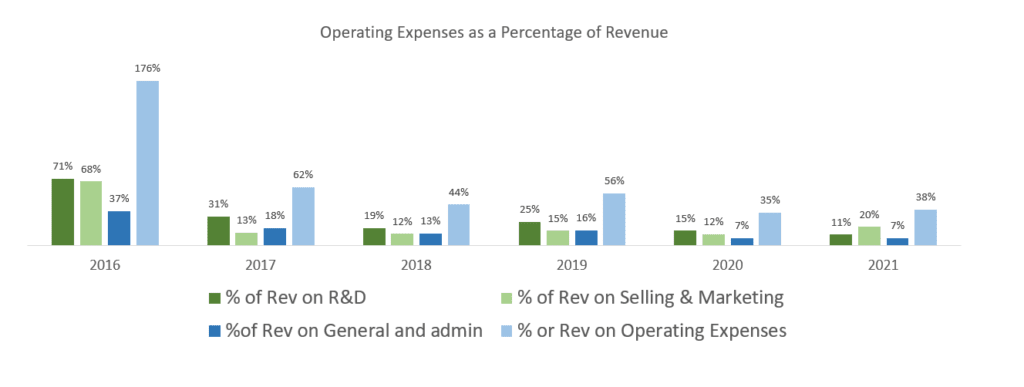

We can deduce how much investments in research and development, marketing and administration are from reviewing their operating cost.

In their earlier days, the overall operating expenses were more than the revenue generated. Over time, their revenue grew, and while the expenses rose, all the costs gradually decreased as a revenue percentage.

They may look like they spend a lot on marketing to grow new markets like Singapore and US. However, the overall spending on marketing is still very manageable, even though we can see a dramatic pickup in marketing spending in 2021.

Prudent Debt and Cash Flow Management

Whether you are looking at Futu as an investor or a client, you can tell the management’s prudence in the way they conduct their business overtime. Some management sees an opportunity and would throw caution to the wind, and lever up their balance sheet to take advantage of supposed tailwind.

If they are right, and it works out, then it is great but there are also good case study where things hasn’t work out.

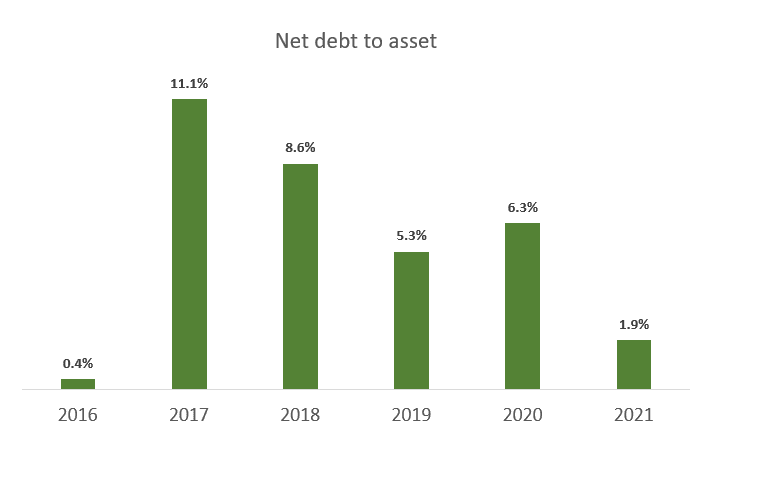

The chart below shows the net debt to asset of Futu holdings over the years:

A large part of the cost at the start has to be the fixed investments in technology. Without a sizable customer base and revenue, they will not have the capital to continuously invest in R&D as well as marketing. Futu technology started in 2007 as a technology and services business. Most likely, much of the costs were incubated and funded back then such that we don’t see that cost today.

By the time Futu went IPO in 2018, we can only observe minimal borrowings, which include convertible bonds. The net debt to asset, which already takes out the cash on balance sheet, was low and continue to go down over time.

After the initial investment in technology, much of the cost should be funded by the business. Their margin business leverages on client’s funds to earn money for Futu and therefore need additional capital from themselves.

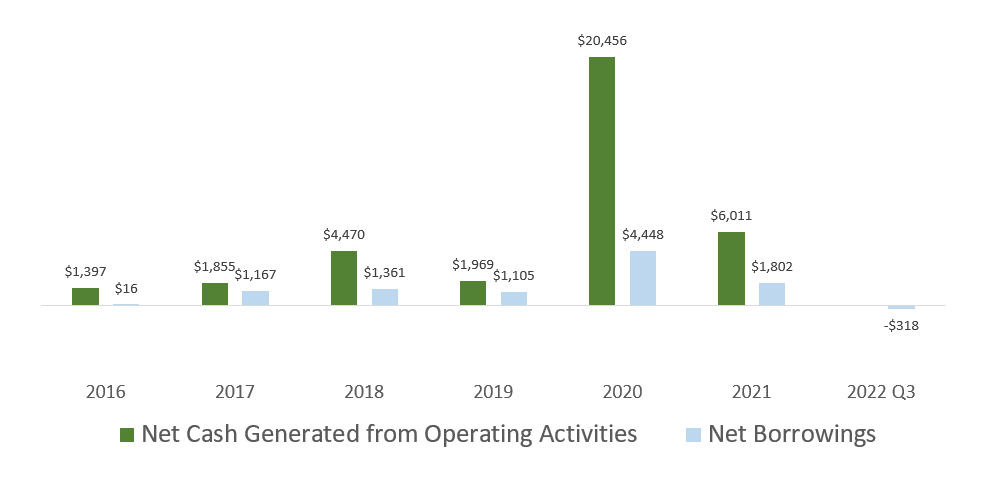

The chart below shows the net cash generated from operating activities and net borrowings over time:

Net cash generated from operating activities will show the management’s cash flow management in the short term. Normally, it is better we assess the free cash flow of the business. A healthy free cash flow shows that the business is generating meaningful cash to pay shareholders, repay debt or to reinvest. In Futu’s case, their capital expenditure is very low (most of their cost comes in the form of manpower costs, which is already factored into the net income) so I think looking at net cash generated from operating activities is rather safe.

Futu’s net operating cash flow (green bar) is volatile but has shown rapid growth since early days. The problem with looking at operating cash flow is that if management use payables to fund the business, it may give us a false sense that this business is better than it looks. Futu holdings show a lot of year-to-year receivables and payable fluctuations and up to today, they been balancing the books well.

One layer of check that we can carry out is to make sure that while cash flow is going up, it is not funded by longer term debt. The light blue bar show that while debt has increased since Futu’s 2018 IPO, the borrowings have subsequently been paid off.

Unless management does some advance cash flow manipulation that I am not competent enough to see, I think the business is generating cash.

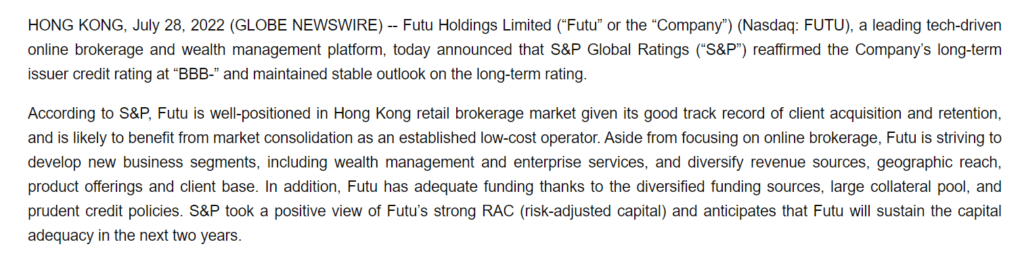

Recently, S&P Global have reaffirmed Futu’s near investment grade rating, which is a stamp of approval of how the company manage its business. This would lower its borrowing cost if needed as well.

Futu Rode the wave of Increased trading during Covid-19.

So how did Futu holdings manage to grow their profits over time?

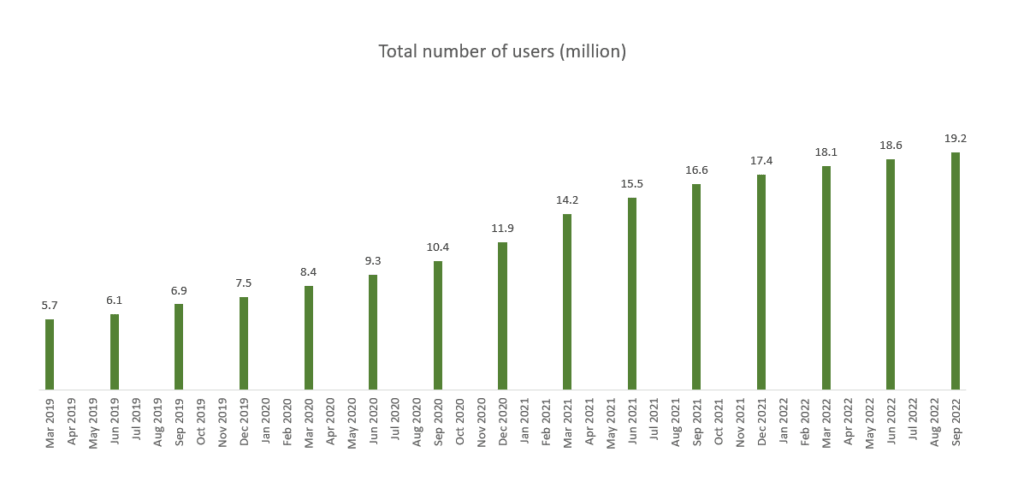

The chart above shows the growth in the number of users on a quarterly basis. Over the past 4 years, the company have gradually grow its number of users steadily. The biggest spike occur for the quarter ending March 2021. That is when the China stock market peaked as well as the launch of moomoo in Singapore.

Since then, the China market have tumbled follow by the US market, but the total number of users have continue to go up.

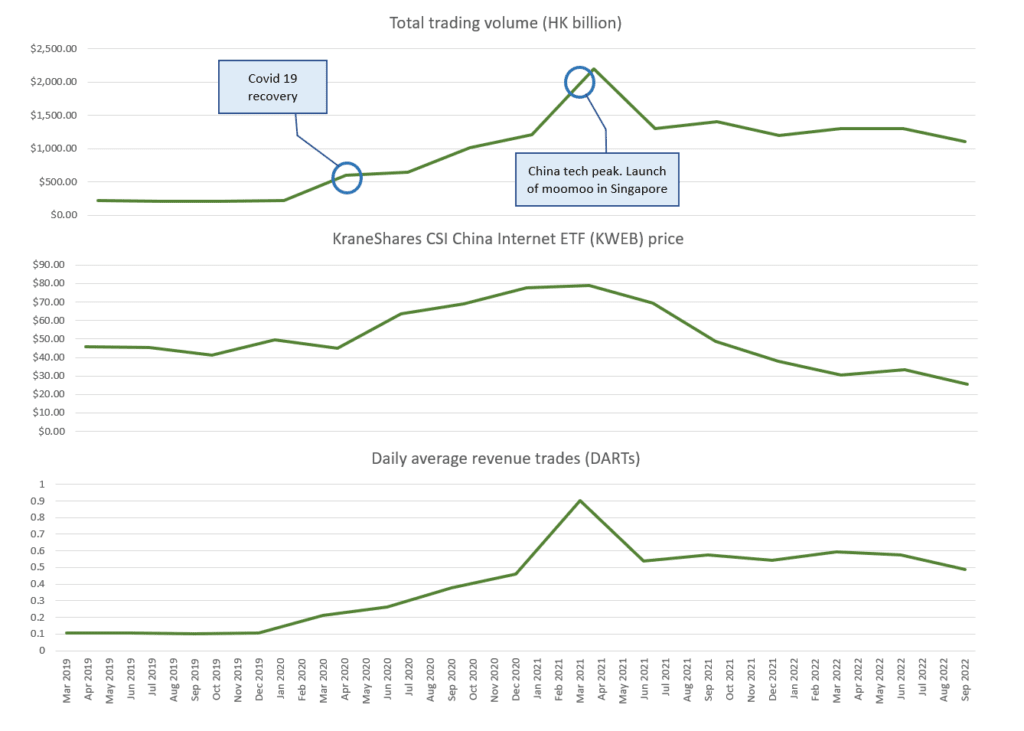

The chart below layers the total trading volume, and daily average revenue per trade with the change in price of KraneShares CSI China Internet ETF over the same period:

I believe that most of the user base is still Chinese and Hong Kong people using the Hong Kong platform to trade. With the Covid-19 lockdown, interest in stocks has picked up, which has spurred the growth in trading volume from an average of HK$224 billion to HK$595 billion in Mar 2020 to HK$2,200 billion at the peak in Mar 2021.

The trading volume subsequently died down as the China tech stocks started tumbling down, but trading volume maintained around HK$1,100 to HK$1,300 till today. This volume is still higher than pre-Covid and equivalent to Sep 2020 levels, five times the pre-Covid volume.

This still puts meaningful cash flow into the business.

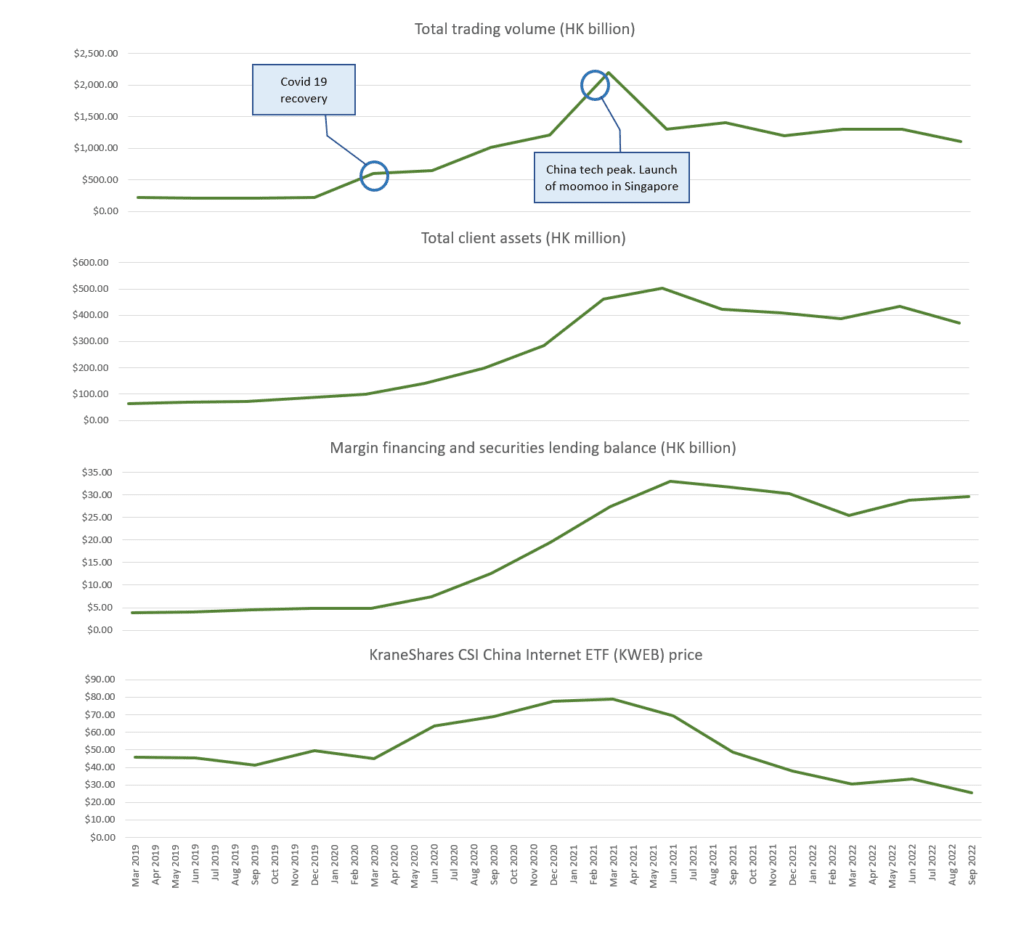

In the series of charts below, we layer the trading volume and KraneShares CSI China Internet ETF with the growth in total client assets and margin financing & securities lending balance:

Total client assets show the asset under management of Futu’s fund management platform (You can consider moomoo Cash Plus to be under this category and mainly Futu Money Plus in Hong Kong). While the trading volume peaked, client asset value declined from a high of HK$503 mil to HK$369 mil. Part of the fall is due to the fall in the value of the equity and bond funds, mitigated by inflows from HK and Singapore investors. I think fund investors tend to be more sticky.

But the most sticky part of Futu’s business should be the growth in its margin finance business. The business grew from HK$3.9 billion to a peak of HK$33 billion in Jun 2021 before stabilizing at HK$29 billion today.

In my opinion, the data show us that Futu Hong Kong is still the most significant business driver and COVID-19 was a favourable tailwind to growing its user base. But the main driver was the higher trading interest, more significant margin financing, and interest from what they can earn from the cash account spread.

Half of the client assets under management could be from its foray into Singapore but that remains a small revenue and profit driver.

Covid-19 and the boom in Interest in China stocks may have pulled forward Futu holdings’ growth and its organic growth is tied to the growth of the user base, the frequency of trades, the number of traders that uses leverage. These are further tied to the community, marketing, new ways to trade.

The future plans is to bring on options and forex trading. Trading these instruments inherently requires more leverage, which should boost margin financing and trading volume of the same user base.

There are ways to grow organically, with less need to increase cost proportionately.

Conclusion

Based on what I see, FUTU is a decently well run, tech-leveraged, brokerage and wealth management platform trying to grow. The business is profitable, generating cash flow, paying down it’s debt.

It is trying to compete through organic funding of it’s marketing, and research & development.

The devastating bear in the China stock market and later US stock market, and the higher interest rates should present a formidable challenge if Futu Holdings is built on fragile foundations but up to now, Futu have been operating well.

These are signs that you want to see if you are a moomoo user seeking assurances about where your wealth is customized.

Trade on the go at lower fees compared to other brokerages. Invest in U.S. Stocks, ADRs, and ETFs at S$0* commission forever (SG residents trading in US markets).

If you wish to sign up, you can use my moomoo referral link here.

If you sign up for a new moomoo account and deposit S$2,700/ US$2,000 / HK$16,000 into your cash account, you can still get a FREE share of a US company.

This article is written in collaboration with moomoo Singapore. All views expressed in the article are my independent opinion. Neither moomoo Singapore nor its affiliates shall be liable for the content of the information provided. The Monetary Authority of Singapore has not reviewed this advertisement.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Eugene

Tuesday 14th of March 2023

It is easy and irresponsible to throw Trumpian accusations against the author to cast doubt. Here's my take.

As a customer at Moomoo, IBKR and Tiger, I am concerned about the security of my funds and stock holdings at these brokerages. This article contains useful information which can be verified with a little work as FUTU is a public listed company. As such I do not question the veracity of this report. Kudos to the author.

All 3 brokerages are regulated by MAS (Singapore), and SEC (USA). In addition, FINRA protects deposits up to $250,000. You can check online if your brokerage is covered by FINRA. This should add another layer of security.

All the same, I am very skittish. That is why I spread my investment funds in all 3 brokerages. Most likely my cautious stance is unjustified. But each of the 3 brokerage are good in their own way, and I make use of their respective strengths.

Kyith

Saturday 18th of March 2023

hi Eugene, thanks for sharing your point of view. I think it is at least slightly better if we have public records to validate and see danger ahead rather than a private ltd broker that we cannot see at all.

G.l

Monday 2nd of January 2023

Paid article. Same as those who are paid to endorse FTX. Zero credibility.

Kyith

Wednesday 4th of January 2023

But could you tell me what is wrong with what I said about moomoo then?