A Singapore Treasury Bill issue (BS22125T) will be auctioned on Thursday,21st December 2022.

If you wish to subscribe successfully, get your order via internet banking (Cash and SRS) or in person (CPF) by 20th December. You can also apply with your CPF-OA and CPF-SA funds, but you would have to go down to a bank (OCBC, UOB and DBS) and do it in person. You can also apply the same issue with your cash and SRS.

You can view the details at MAS here.

In the past, I have shared with you the virtues of the Singapore T-bills, their ideal uses, and how to subscribe to them here: How to Buy Singapore 6-Month Treasury Bills (T-Bills) or 1-Year SGS Bonds.

In the last issue announced two weeks ago and recently concluded, the current t-bills traded at a yield of 3.95%. In the end, the cut-off yield for the t-bill ended at 4.40%!

For the second time, if you select a non-competitive bid, you may be pro-rated the amount you bid and would yield 4.40%. If you would like to ensure you secured all that you bid, it will be better to select a competitive bid, but you need to get your bid right.

A good rule of thumb to ensure you get what you want and accept whatever the cut-off yield bid 50% of the last cut-off yield. In this case, you can bid 1.95%. Whether the final cut-off yield is at 2% to 4.3%, your 1.95% bid will help secure the full allocation you need.

Gaining Insights About the Upcoming Singapore T-bill Yield from the Daily Closing Yield of Existing Singapore T-bills.

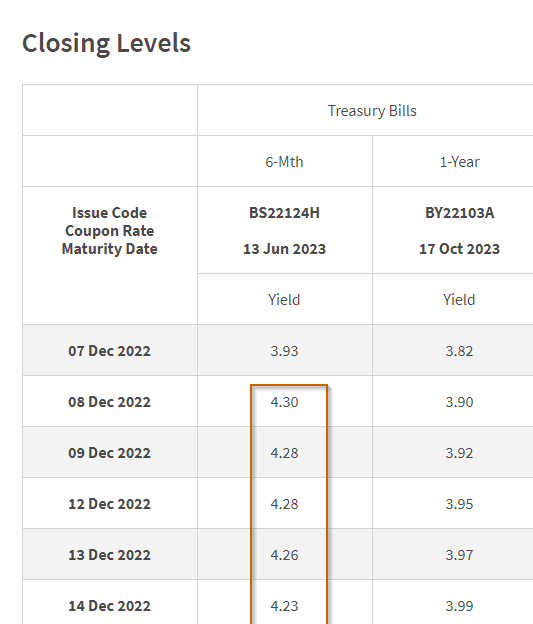

The table below shows the current interest yield the six-month Singapore T-bills is trading at:

The daily yield at closing gives us a rough indication of how much the 6-month Singapore T-bill will trade at the end of the month. From the daily yield at closing, we should expect the upcoming T-bill yield to trade close to the yield of the last issue.

Currently, the 6-month Singapore T-bills are trading close to a yield of 4.2% in the last few days, which is close to the yield of the T-bills 2 weeks ago.

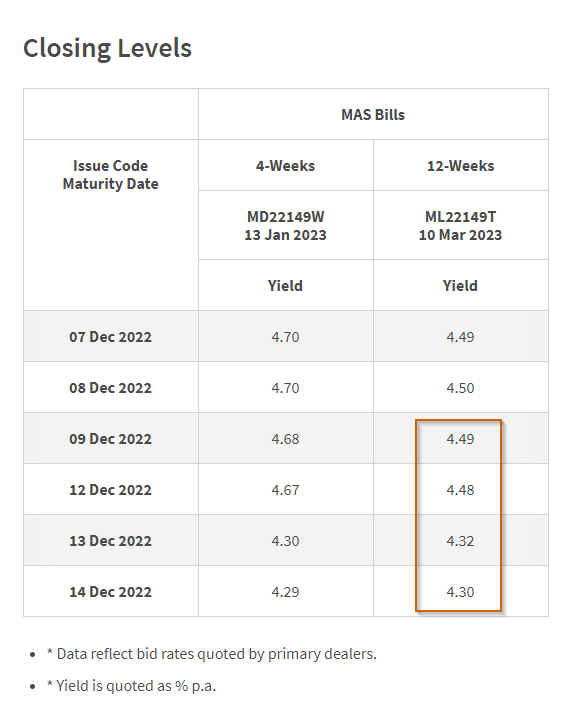

Gaining Insights About the Upcoming Singapore T-bill Yield from the Daily Closing Yield of Existing MAS Bills.

Typically, the Monetary Authority of Singapore (MAS) will issue a 4-week and a 12-week MAS Bill to institutional investors.

The credit quality or the credit risk of the MAS Bill should be very similar to the Singapore T-bills since the Singapore government issues both. The 12-week MAS Bill (3 months) should be the closest term to the six-month Singapore T-bills.

Thus, we can gain insights into the yield of the upcoming T-bill from the daily closing yield of the 12-week MAS Bill.

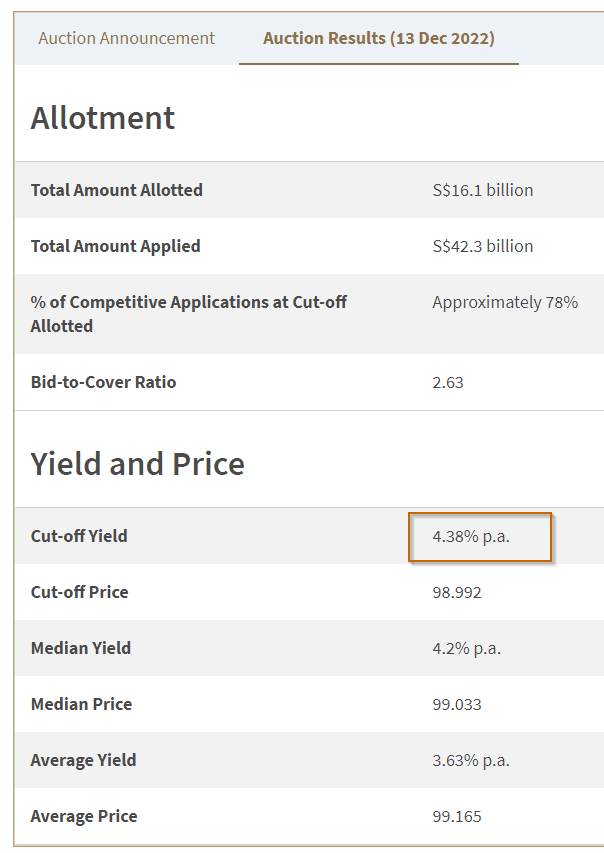

The cut-off yield for the latest MAS bill auctioned on 13th Dec (a couple of days ago) is 4.38%. This is higher than the last MAS bill issue a week ago.

Currently, the MAS Bill trades close to 4.30%.

Given that the MAS 12-week yield is at 4.3% and the last traded 6-month T-bill yield is at 4.2%, what is likely to be the T-bill yield this time round?

In the last auction, those who made lower competitive bids to bring down the eventual cut-off yield seem to disappear. Many were pleasantly surprised to enjoy a healthy 4.4% yield.

The beauty of an auction system is the demand and supply will gravitate the cut-off yield closer to what the aggregate people want. If the majority choose to bid competitively and do not care about what yield they will eventually get, the yield will be lower.

Also, with the recent market yield compression, I am sensing that we should see a lower 6-month Treasury bill yield of around 4.2% instead of a higher yield.

Here are your other Higher Return, Safe and Short-Term Savings & Investment Options for Singaporeans in 2023

You may be wondering whether other savings & investment options give you higher returns but are still relatively safe and liquid enough.

Here are different other categories of securities to consider:

| Security Type | Range of Returns | Lock-in | Minimum | Remarks |

|---|---|---|---|---|

| Fixed & Time Deposits on Promotional Rates | 4% | 12M -24M | > $20,000 | |

| Singapore Savings Bonds (SSB) | 2.9% - 3.4% | 1M | > $1,000 | Max $200k per person. When in demand, it can be challenging to get an allocation. A good SSB Example. |

| SGS 6-month Treasury Bills | 2.5% - 4.19% | 6M | > $1,000 | Suitable if you have a lot of money to deploy. How to buy T-bills guide. |

| SGS 1-Year Bond | 3.72% | 12M | > $1,000 | Suitable if you have a lot of money to deploy. How to buy T-bills guide. |

| Short-term Insurance Endowment | 1.8-4.3% | 2Y - 3Y | > $10,000 | Make sure they are capital guaranteed. Usually, there is a maximum amount you can buy. A good example Gro Capital Ease |

| Money-Market Funds | 4.2% | 1W | > $100 | Suitable if you have a lot of money to deploy. A fund that invests in fixed deposits will actively help you capture the highest prevailing interest rates. Do read up the factsheet or prospectus to ensure the fund only invests in fixed deposits & equivalents. |

This table is updated as of 17th November 2022.

There are other securities or products that may fail to meet the criteria to give back your principal, high liquidity and good returns. Structured deposits contain derivatives that increase the degree of risk. Many cash management portfolios of Robo-advisers and banks contain short-duration bond funds. Their values may fluctuate in the short term and may not be ideal if you require a 100% return of your principal amount.

The returns provided are not cast in stone and will fluctuate based on the current short-term interest rates. You should adopt more goal-based planning and use the most suitable instruments/securities to help you accumulate or spend down your wealth instead of having all your money in short-term savings & investment options.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

Morris

Wednesday 28th of December 2022

Hi Kyith, dont mind sharing with me the link. How you manage to get the Treasury Bill table that shows both the 6-moth and 12months Yield% on a daily basis?

Kyith

Thursday 29th of December 2022

Hi Morris, here you are: https://eservices.mas.gov.sg/statistics/fdanet/SgsBenchmarkIssuePrices.aspx

Revhappy

Tuesday 20th of December 2022

"The beauty of an auction system is the demand and supply will gravitate the cut-off yield closer to what the aggregate people want. If the majority choose to bid competitively and do not care about what yield they will eventually get, the yield will be lower."

The above statement is not true. The cut off as the name suggests is the maximum yield that just makes it within the 60% allocation. So if majority make a competitive bid at 1%, but there is the last 1k or 10k who bid at 5% but just fall under the 60% allocation, everybody gets 5%.

Kyith

Wednesday 21st of December 2022

thanks for clarifying.

Ab

Monday 19th of December 2022

For curiousity If I apply for t-bill succesfully using CPF but have insufficient fund in CPF. What will happens? Thanks

VO

Tuesday 20th of December 2022

@Ab, When you visit the bank branch to put in your bid, the bank staff has to check that you put aside $20k in OA account before you can invest. There is also a limit set for the amount you can invest with your CPF OA funds.

Fluff

Friday 16th of December 2022

Please don't suggest low balling the bid. This will only cause the rates to go down. If you want the best chance of full allocation, just bid non-competitively.

Revhappy

Thursday 22nd of December 2022

This is a bit like market order vs limit order :) Sometimes we want to buy the stock at anyprice, but still we would like to put a limit order, just so that we dont get a freak trade with very low price. So I think if people are indeed using CPF as source of funds, they should put something like 3%, and if they are doing with cash, there are so many FD options with 4% now, so they should put 4%. This will prevent any freak results so it if for their own safety as well as it helps bring the average yield higher and not lower :)

Kyith

Saturday 17th of December 2022

HI Fluff, i think different people have different motivations. Imagine all of us bid competitively then one institution who has a lot of money really wants this tranche for some reason. and this institution bidded 2% for it.

What can we do about it? The institution probably is not doing it for SA shielding but for some other purpose.

If you look at the MAS Bill auction... they are subjected to such dynamics as well.

I suggest the lower bid as an illustration of getting a full allocation. I also don't want to give people the impression that if you put in a non-competitive bid, you will forever get the full allocation. If you wish to get the full allocation with high certainty, what is your course of action? It is to put in a lower bid with higher degree of confidence.

Max

Friday 16th of December 2022

Why do you suggest to lowball the bid for T-bills. You do know how the interest rate is being calculated? Your suggestion to lowball it at 50% only brings the interest down and making it less attractive. Also, why would you even suggest to offer lower then what you can get in time deposits? Does make no sense at all…

Pete

Friday 16th of December 2022

@Kyith, say for some strange reasons, everyone bid at 0.1% because they wanted full allotment, what would the cut-off yield be? I think that is Max's point. IMO, it is not wise to low ball; there has to be a minimum yield that a bidder wanted and in today's market, must match what high yield or FD are offering.

Kyith

Friday 16th of December 2022

Putting in a low offer increases the chance you get a full allocation. The interest rate that you get is the cut-off interest, which is the interest every one will get. So its not like you will lose out. e.g. you put in 0.1% and if the cut-off yield is 4.2%, you get 4.2%.