It’s the last day of the year.

Many are contemplating whether there are other ways to lower your taxable income that you need to successfully complete by today.

You can do a voluntary top-up to your CPF SA/RA and Medisave or your spouse’s CPF SA/RA and Medisave if the accounts are still below their respective limits. (Take a look at point 3 in this article). You can potentially reduce your taxable income by $16,000 ($8k each for yourself and your spouse).

The other action you can take is to contribute up to $15,300 to your SRS account. The taxes in the account would be tax-deferred, which means currently, you will lower your taxable income by $15,300.

I never had an SRS Account until four years ago. I decided to open the SRS account by funding it with just $1 so that to lock in the current statutory retirement age. The process to create an SRS account is very easy currently.

Why do we need to lock in the statutory retirement age? Is it always better to contribute to the SRS or there are downsides to it?

In this article, we will try to go through this briefly.

I will also share a FREE Google Spreadsheet that you can use to see if it is a good idea to consider contributing to your SRS account.

What is the SRS Account, and How is it Useful for You?

The SRS Account stands for Supplementary Retirement Scheme, a voluntary scheme encouraging people to save for retirement. The SRS Account is basically our private retirement plan that supplements the government-defined contribution plan, the CPF.

By channelling some of your money annually to your SRS account, you can defer your income tax so that your annual income tax payable can be lowered.

Let me explain.

When you contribute to your SRS account, you defer paying taxes till the designated withdrawal time.

This contribution amount will be a deduction from your total income to derive a lower taxable income.

During withdrawal time, after your statutory retirement age, only 50% of your withdrawal is subject to income tax. How much tax you will pay at withdrawal will depend on your tax bracket. The idea is that when you retire, you should not earn any ordinary income, so the income tax that you pay on 50% of your withdrawal should be lower than the tax you pay on your current tax bracket.

The designated withdrawal time is tied to the current statutory retirement age. The statutory retirement age currently is 63 years old.

SRS account is not only available to Singaporeans and permanent residents but also to foreigners. For foreigners, after ten years, they can withdraw in one lump sum, and 50% of the value is subjected to tax without penalty.

Thus for both Singaporeans & PR and foreigners, this is the second primary way that they can use to reduce their taxable income. The main one, advocated by financial bloggers, is to transfer $8,000/yr to your CPF Special Account / Retirement account & Medisave account and another $7,000 to your family member’s CPF Special account / Retirement account & Medisave account.

Currently, the maximum you can contribute to your SRS is S$15,300/yr for Singaporeans and $35,700/yr for foreigners.

In terms of what you can purchase with your SRS account, you can purchase all sorts of financial assets from stocks, unit trusts, even Robo advisors, insurance savings plans, and annuities.

Can you withdraw your money from your SRS before the statutory retirement age?

Yes, you can but…

If you withdraw before 62 years old, you have to pay a 5% penalty on your withdrawal, and the withdrawal is entirely subjected to ordinary income tax. If you withdraw after the designated withdrawal period, there will be no penalty.

You will have to withdraw finish your wealth within ten years. If you purchase an annuity with your SRS, this 10-year restriction is not imposed.

Taking Action Today by Creating Our SRS Account to Hedge Our Withdrawal Age Risk

I never felt the need to open an SRS account because due to my income level and the tax relief that I had in the past, the tax that I eventually pay is a tiny percentage of my total income.

However, recently, I started to get very uneasy with the number of articles in mainstream publications, and on TV regarding working longer, discussion on retirement and the retirement age.

I got a freaking feeling that they will extend the statutory retirement age.

When that happens, so will the penalty-free SRS withdrawal age.

So why not spend $1 to fix that penalty withdrawal age?

I did some research and seems that I cannot find any noticeable difference in the offering of UOB, OCBC and DBS.

So I go with the most accessible option which is to open an SRS account with DBS.

It is easiest because opening many accounts with DBS is just a few clicking processes.

If you navigate accordingly and follow the instructions, all it takes is to transfer $1 to open it.

I didn’t even bother that opening an account and transferring money will net you a cash reward. However, if you are interested in this stuff, here it is.

Opening an account does not require much effort, why not open one to give you some administrative flexibility next time?

Some of My Deeper Thoughts about SRS and Paying Taxes

Four years ago, I just want to ensure that I can lock in that penalty-free withdrawal age, just in case I need it.

However, I thought about it and decided to do some quick calculations on my projected income tax for next year.

And then I realize maybe I should contribute to my SRS account.

When my mom passed away a year before, I lost some large tax deductions. When I ROD in 2017, I also lost some small tax deductions. My tax deduction is quite bare.

That, together with higher total income, would mean that my taxable income will significantly increase my income tax expense.

So SRS became a viable consideration.

I really, really, really, really don’t like to have my money locked up. So that means no CPF SA top-ups and previously no SRS contribution.

The SRS contribution is perhaps the lesser evil between the two of them.

This is because you can withdraw SRS early and pay the 5% penalty, but you cannot do that with your CPF.

I compute that there is a possibility that I could be unemployed in the future and take an early withdrawal, and I won’t be taxed at an ordinary income level. The difference between the 5% penalty and my marginal income tax bracket is still worth it.

But in the end, in the grand scheme of things, perhaps I should pay the tax increase and be done with it.

I forecast this will be the highest total income I will have for some time, so perhaps this will be the last time I will pay in such an income bracket.

I am not going to make a big deal out of it as I am fortunate I can pay a higher tax because it would mean I earned more while others struggled to get employed.

Contributing to an SRS Account May Not be That Useful Mathematically if You Invest Your Money Decently

Some of the older folks who did the math tell me the SRS system is broken (which I will explain later)

But in truth, the savings on taxes today, deferring the tax payment so that you will only be taxed 50% of what you have in the future, may not result in a significant difference.

Some more numbers focus people have worked this out.

In my Financial Independence Telegram Group, I have seen two discussions on this.

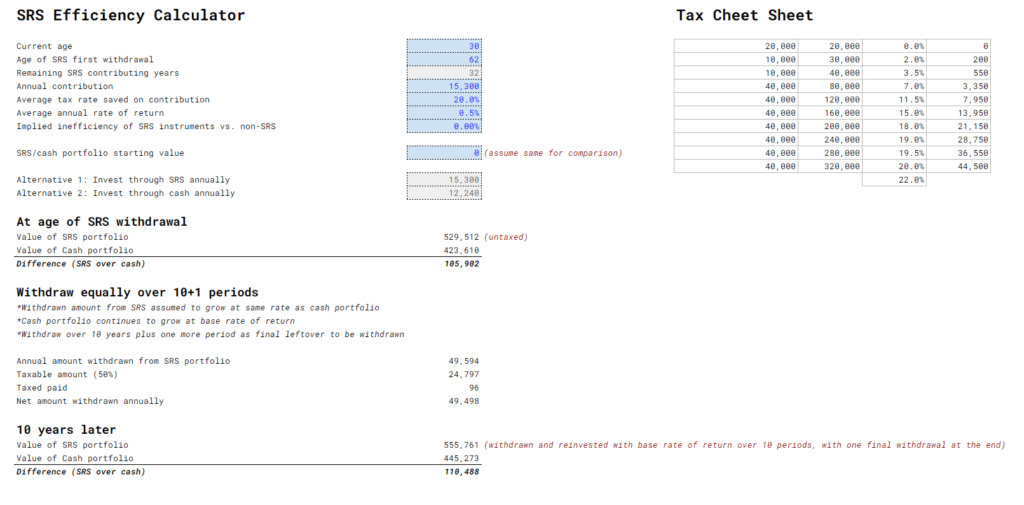

One of our members, Lincoln, created a Google Spreadsheet to compare the trade-off between putting your money in SRS versus if you are paying the taxes and investing the rest.

You can view Lincoln’s SRS Efficiency Calculator spreadsheet here. You can make a copy of the spreadsheet here.

The suitable model is to compare the final value of what you will have if you put your money in SRS and, if you do not, at different milestones.

In this case, it measures:

- At the age of SRS Withdrawal

- Ten years after SRS Withdrawal

You can see there is a difference, and if the difference is positive, there is some usefulness of using SRS versus not using SRS.

In the case study above, this 30-year-old is 32 years away from 62-years-old where he can take out his money. He is in the 20% income tax bracket and does not invest at all, so his rate of return is only 0.5%.

There is an improvement of $105,902 and $110,448 if he uses the SRS account versus if he does not.

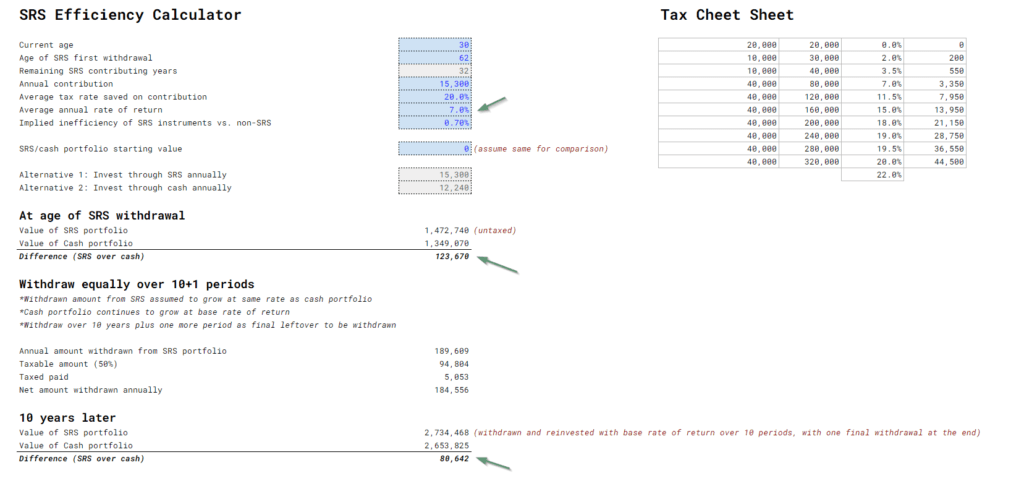

What if he invests with an expected rate of return at 7% and with some investment costs of about 0.7% a year?

His value from using SRS is still higher than cash ($123,670, and $80,620, respectively).

But, respective to his portfolio value, the amount is more insignificant.

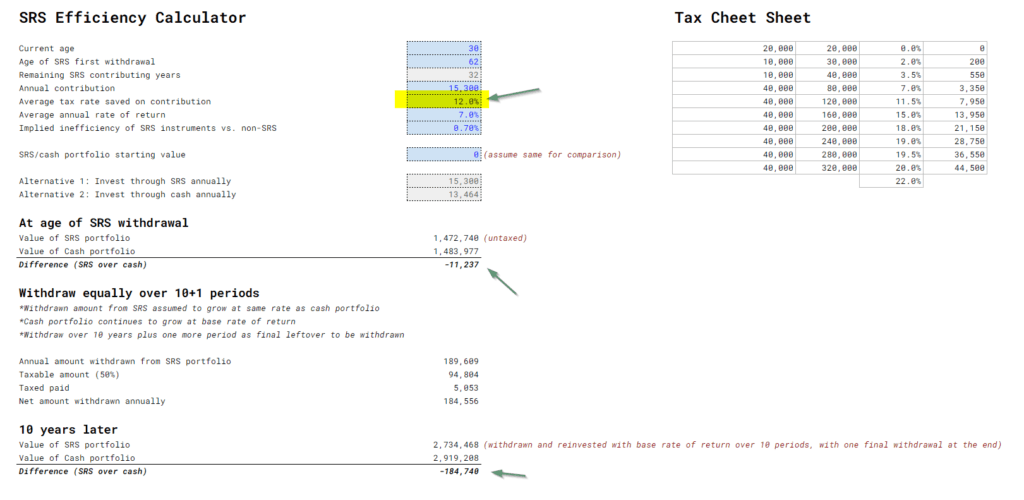

But if you are in a lower tax bracket today, the savings, if you are an investor that can invest at a greater rate of return, is lesser.

If a person invests, but his income tax is less than 13%, you can see that the difference is insignificant.

I tested that even if your rate of return is 2-3% a year, there is not a lot of monetary advantage to using SRS.

So this is not because the rate of return is a high 7%, but if your returns are decent, and you belong to a relatively lower tax bracket, the difference is minimal.

It might be beneficial not to defer the taxes.

The future has a lot of uncertainty, but hopefully, the calculator can help you model the savings or lack of savings.

I should tell you that your future is uncertain. The eventual rate of return is uncertain, whether you continue to contribute every year is uncertain, the future income tax rate is also uncertain.

Why the SRS is a bit Broken

The math in the previous section will show that generally, we can say the tax deference and tax deduction works in our favour, but you lose a lot of the optionality of your wealth by semi-locking your money in SRS.

One of the main reasons it’s broken is because relatively speaking, our ordinary taxes paid in Singapore is relatively low, versus other countries.

In other countries, the effective taxes paid could be 20% upwards of your total income.

Unlike other countries, on a personal basis, we do not have

- long term equity capital gains taxes

- short term equity capital gains taxes

- taxes on dividends (unless from a partnership)

- taxes on interest income (unless from a partnership)

What this means is that if we build wealth through our normal cash, brokerage and investment accounts, there is no tax penalty to it.

We thus do not need to make use of private deferred contribution accounts such as the SRS to optimize our taxes. For example, in the USA, there are taxes on capital gains and dividends, thus optimization with traditional IRA, Roth IRA, 529, 401k, HSA and Roth 401k accounts is a must. Some of these accounts will lock your money till 59.5 years old. There is a whole discipline of Roth conversion ladders and contribution optimization that a wealth builder has to contend with.

Overall, we are already paying very low taxes relative to the net worth.

This is advantageous to individuals and families that are financially unfettered and conscientious.

If we look at the impact of the tax savings on three different groups of people, the lower-income, middle income and higher income:

- if the lower-income contributes to SRS, it will take up a large proportion of their annual income. It is a challenging way to save money and likely they won’t have that high of a tax burden as well

- the high income can contribute to SRS, and enjoy the tax savings. However, in the grand scheme of things, the tax savings during withdrawal versus after-tax withdrawal will be rather minute versus their net worth

- the middle income would enjoy this the most, but a lot will depend on the rate of return of the SRS portfolio, and your current tax bracket. I haven’t done the math, but in the grand scheme of things, it might matter much less than we think

If you have contributed or choose not to contribute to the SRS, do let me know your thought process and whether you have a different take on my personal situation.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Amit

Tuesday 2nd of January 2024

Nice write up as always Kyith. Question for you and/or the community here..are there direct options to invest SRS funds in US/International ETFs? I haven’t come across any and therefore reluctantly use Robo advisor platforms. The closest that I see for US exposure that can be bought directly is SPDR S&P 500 ETF S27 as that’s listed in SG. For reference, my SRS account is with DBS

Kyith

Monday 12th of February 2024

Hi Amit for the late post, endowus allow you to invest your SRS money in the Amundi PRime USA

JC

Saturday 31st of December 2022

Dear Kyith , since you put in the effort to come up with this article, let me share with you the perspective of someone who has been contributing to SRS since its first inception in 2001.So this is a practitioner's real life experience.

1. I contributed to SRS because i had no other tax shelter and paid more than 15% tax rate yearly. 2.i contributed the max annually and invested it in low risk instruments like 5 year insurance plans that in 2001 paid around 3-4%'pas. So the only effort was seeing an insurance agent once a year. 3. once the returns on the 5 year plans fell below 3%, i started putting the annual contribution into blue chip reits and high dividend stocks .Average yield of 4-5% pa. All dividends reinvested. Probably looked at the returns once a month and made investment actions 1-2 times a year. 4.total amount invested- $250k, nov 2022 valuation $600k.This despite the reits falling 15-20% on average in a truly horrible year of 2022. 5.Now here are the relevant considerations about SRS after 20 years of contribution. These cover the emotional aspects and investor behavior rather than financial simulations.

a. SRS is a retirement scheme- it forces you to save in a disciplined manner and because of the 5% penalty, you will not withdraw unnecessarily. Discipline is the key here.

b. it allows the power of compounding to work fully which you are less like to do so if you are buffeted by market crashes and full of fear, uncertainty and doubt, leading to suboptimal outcomes like withdrawals. The 2008 market crash and all others in the past 20 years were easier to bear when you can't withdraw the money anyway and have to leave it there until you turn 62.

c. The 7% simulation above is flawed bec it assumes you will pay tax on more than $100 000 per year. You are more likely to have done your tax planning once you hit your 50s and start buying annuities which aren't taxed the same way. Based on your chart, the optimal withdrawal amount seems to be 60k a year where you withdraw $20k more than the 40k tax free a year, yet pay less than $1000 in taxes.

d. ultimately SRS is a retirement scheme. it is meant to supplement your FRS and ERS. with inflation at 5%, every bit of savings count and as i have shown, the $2000-$3000 you save yearly from not paying taxes can compound to a large amount which is not to be sniffed at.

i hope this practical review helps .

SalivaChan

Sunday 2nd of January 2022

Great insights, Kyith!

While the potential tax savings is always attractive, my biggest bugbear with SRS is the lack of effective good low-cost options available versus the usual cash investment accounts.

DFA funds come the closest imho, but even that comes with “access fees” which is a drag on returns.

Kyith

Tuesday 4th of January 2022

Hi SalivaChan, no choice that is the world we live in. I think there are those unit trust platform with no advisory or access fee. But you pay trailer charges. These are the Poems and Dollardex. For a long time, people use SRS to invest in individual stocks.

Chan Mali Chan

Monday 27th of December 2021

Not sure why one should assume that one can get a higher rate of return with cash vs SRS investments.

The SRS scheme is perfect for long term investments like index ETF. Just buy and keep till retirement and benefit from the tax savings. The aim of the scheme is certainly not for one to simply transfer and keep in cash to save on tax. As its name states, it is a retirement scheme meant to encourage long term investing for retirement.

It is a no brainer, especially at higher tax brackets.

Garudadri

Friday 31st of December 2021

@Kyith, Hi Nice discussion What happens if a foreigner contributes full 10 years and then withdraws after ten full years AFTER leaving SG? What will be the rate of taxation on the amount? Will tax apply to 50% of the corpus only ? Any idea? Thanks in advance

Kyith

Tuesday 28th of December 2021

One can get a higher rate of return in cash because the lowest cost investment in SRS, comes at a higher cost. It is not a no brainer because you have less flexibility with the money.

Ht

Tuesday 5th of March 2019

Can we do it via ocbc srs Application ? No difference right ?