One of my F.I. Telegram group members shares with me this Graham Stephen video about why he doesn’t spend money:

My Telegram group member identified the term “Financial Minimalist”.

I think it is a nice term but I like this video because it explains a lot of things that I couldn’t do well in text.

Some will find it incredulous considering Graham Stephen is a top YouTuber and makes millions annually from links to his channel.

But what Graham is talking about is what’s going through inside his head.

I can understand that.

There are a few philosophies that Graham and I similarly shared.

Not having high overheads that weigh you down

At 1 min 45 seconds.

Graham points out that having a lot of financial overheads stresses him out. It’s like signing your life away on things you are unsure if you need them.

“What is the point of owning these things if you are obligated to work the next thirty years or eighty hours a week just to pay for it?”

That is why he prefers a minimalist financial lifestyle.

- Less financial obligation leads to

- More financial freedom, which leads to

- Less financial stress, which leads to

- More freedom to express yourself to do more creative work

Graham grew up with not much, and he identifies money with less flaunting, but it basically gives options.

Having options is bigger than anything to him.

Living life on your own terms

At 4 min 45 seconds.

Graham explains something and it is less about whether I agree with or not but more like what a twenty-year-old without father-and-mother-money thinks like.

“This was the path to eventually living life on your own terms, around your own schedule, doing the things that you want to do, when you want to do them. All of a sudden, it is not crazy to want to save all my income.”

Think this is what most want and money is an enabler.

At no point was money mentioned.

Most likely the barometer for financial independence is this.

On your own terms does not mean not work but you dictate a large part of it.

Your Investments Cover Your Overheads. If you keep your Overheads Low…

At 5 min 12 seconds.

This is the part that I have identified the most, that I tried to explain to people, but people don’t quite understand.

When Graham bought his first rental property, he made $30 a day in net rental income (that is the right way to calculate things!)

He realizes that $30 a day covers 3 x All-you-can-eat sushi over where he lives! He can have all-you-can-eat sushi for the rest of his life (provided they don’t close down!)

Then he wanted to expand his cost to cover his gym memberships.

Phone bill.

Car insurance.

Groceries.

Graham then looks at money very differently.

Phone bill, car insurance and groceries are what Graham refer to as overheads.

When he receives a property agent commission cheque of $15,000, he doesn’t see it as $15,000 but that it is $87 a month income indefinitely.

That is enough to pay for his high-speed internet bill forever.

So for each cheque that came in, his thought process is:

- How much money can I make if I invest it?

- What item can I check off the list?

Eventually, he covered all his expenses.

As you see, if Graham has less overhead, he needed less.

For every $100 a month he needed less, he needed $20,000 less capital.

This is a similar philosophy to the financial security philosophy I shared:

- What kind of lifestyle would I need to buy for myself?

- How much do I need to provide a perpetual income to fund that lifestyle?

It is not that I only spend $10,040 a year but I considered that $10,040 as the expense I wish to secure the most. The rest, I care less about.

Your expenses are basically:

- Essential and basic

- Obligations to a lot of others

But what are considered essential and basic differs from person to person and most likely Graham asks about the difference for each expense line item. He wonders if each item is more of a overhead or not that important.

The truth is… even some of your expenses can be broken up into two different sets, with one higher grade and one lower grade. Food is a big category and one that can be broken up.

Can we do something similar to what Graham do?

I think that is why the dividend investors like the income of dividends. Every stock they buy gives them some income, and eventually it will cover their expenses.

But most are unwilling to be more intentional about their expenses.

There is also a question of:

“If I save $10,000 a year, how much income can I assume I will get, to cover some of my overheads?”

Do you use 6%, 5% or 4% in long-term dividend income you get?

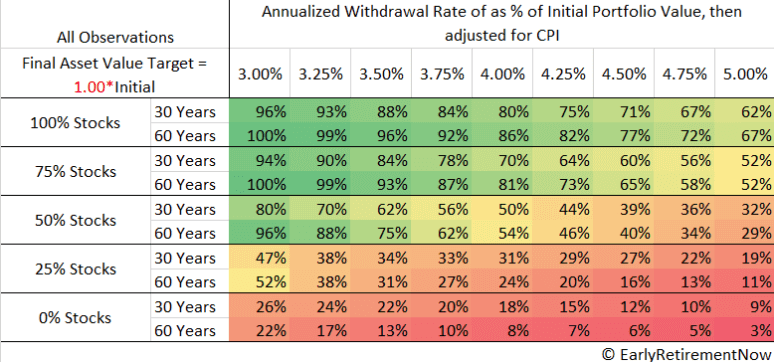

I think this is where the safe withdrawal rate study is helpful.

The research behind the safe withdrawal rate gives us an idea about a good rule of thumb of:

- What is the asset allocation (100% stocks to 0% stocks)

- How long it will last if we wish to preserve income (Final asset value target = 1 x initial means preserve 100% of your initial capital)

If we based on a 50%/50% allocation, using a 3% initial withdrawal rate is a good rule of thumb.

So if you put away $25,000 a year, a 3% initial withdrawal rate lets you know that while your money is in cash, you can eventually put in a 50% equity and 50% bond portfolio, which has historical rigor to show you can get inflation-adjusted income for a very long time.

This gives you $750 a year or $62.50 monthly.

How much of your current spending line items can $62.50 cover? Do you care about that spending line item at all?

Overtime, in my chat with people, one of the big thing people struggled with when trying to size up whether they are ready for financial independence or not is their obligations to others.

The others are to their parents, to their kids.

There is a whole host of expenses to that.

They assume those expenses go on indefinitely.

And because of those expenses, yet they wish for me to tell them a sum they need to be conservatively financially independent, it ends up with a rather large figure.

If those obligations are permanent obligations that goes on indefinitely, then it ends up like this.

Ultimately, understanding the characteristics of your spending allows you to hasten to your desired lifestyle.

Many don’t want to understand what they spend on more, or how to look at it differently.

Then, you have to be on the slow path.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024