A day ago, colocation data center company Cxytera announced that they will be filing for bankruptcy.

Cxytera is not a very commonly known company here, but the investors of two locally listed REIT might be more familiar with the data center service provider.

Cxytera is Mapletree Industrial Trust’s third-largest tenant and Digital Core Reit’s second-largest tenant.

Even before this news, the market started pricing in the uncertainty into both their share price.

When the news is out, Digital Core Reit plunged before recovering. There were no large price movement for Mapletree Industrial REIT.

I have no vested interest in both REITs but am more intrigued with the subplot of this news flow.

Mapletree is a strong REIT brand name, longer track record (both in operation and management but also in return performance) while Digital Core was listed not too long ago. I have been so out of touch that I didn’t realize HALF of Mapletree Industrial is made up of US data centers.

There is a prevalent mindshare that if you wish to invest in REITs, stick with the bigger sponsors mainly because they are better managers.

This case… kinda show you that whether they are good managers or poor managers, sometimes we have to acknowledge there are more impactful forces at play.

And good managers cannot prevent everything. I do believe some REITs have better managers, but some investors may overweight that characteristic too much, versus what has a greater impact.

During these two years, due to high interest rates and some other factors, the performance of many REITs have not been doing well.

I think that is to be expected.

But some of the comments that I see really make me shake my head.

So I would like to share some thoughts that I have.

If Your Time Horizon for Investing in a Portfolio of REITs is Long Enough, They Should be Okay.

Some investors are hurting.

Let me pick out a few REITs out randomly:

Prices are back to the prices last seen in the 2013 peak and 2017-2018.

Prices are back to the prices last seen in 2012 and the highs of 2020.

Prices are back to the prices last seen in 2011, 2015 and 2020.

Prices are back to the prices last seen at the lows of 2020 and 2018.

You should be aware that chart does not include the dividends, depending on how long you held the stock.

I picked out the REITs which are more established, with a listed longer. In the podcast I did with Providend, I mention that whenever you have a price fall like this, you are caught wondering whether this company is going to shit or this is a grand opportunity to add more.

Some of you may be facing the same situation currently and I empathize with you for being caught in two minds.

I cannot speak about individual REITs, but I think there will be a pain because of the reset in risk-free rate to something higher. We are currently at ten-year risk-free rates of the 2000s. This is also the period where property companies started listing REITs.

They can survive that risk-free rate environment, which means they can survive this current environment.

Fundamentally, there is still a demand for physical space for different purposes and REITs are part of the solution to address that demand.

But the question is always what and when is the equilibrium?

The long-term returns of REITs and equities, generally are not too different. REITs… is a sector of equities and over the past 45 years, the data kind of shows us that. This does not indicate REITs or equities are worse. It just shows that they have risk and there is a return at the end.

There is always a period when an investor, who is 60 years old, invested 90% of his net wealth into equity or a portfolio of REIT at the worse time.

What is his experience like?

Can he recover? If so how long?

We have the data from the Dow Jones US Select REIT Index, which we can compare against the S&P 500.

Here is the best, average and worst annualized return for each time frame:

| 1Y | 3Y Rolling | 5Y Rolling | 10Y Rolling | 20Y Rolling | |

| DJ US REIT | |||||

| Best | 113% | 44% p.a. | 30% p.a. | 21% p.a. | 15% p.a. |

| Average | 13% | 11% p.a. | 11% p.a. | 10% p.a. | 11% p.a. |

| Worst | -60% | -27% p.a. | -9% p.a. | 3% p.a. | 5% p.a. |

| S&P 500 | |||||

| Best | 61% | 33% p.a. | 30% p.a. | 19% p.a. | 18% p.a. |

| Average | 13% | 12% p.a. | 12% p.a. | 11% p.a. | 11% p.a. |

| Worst | -43% | -16% p.a. | -7% p.a. | -3% p.a. | 5% p.a. |

Note: Some may be asking whether I have data for local context and the truth is that we have such a short history that we don’t have as much pivotal shifts, and the returns that correspond to those pivotal shifts. I would say that if you review the data in different markets, they will show that REIT returns are as volatile as equity and less bond-like.

In these 45 years, the average return of the DJ US REIT index is 10.9% versus the S&P 500’s 11.7% p.a. The returns are not too different.

You may experience 5 years of compounded heartache, whether you invest in the S&P 500 or the REIT.

If you sink in 90% of your retirement money, you might experience a -9% p.a. 5-year REIT return or a -7% p.a. 5-year S&P 500 return.

In fact, the most unlucky S&P 500 investor within these 44 years will experience a -3% p.a. return for TEN years while the worst REIT investor experienced a 3%p.a. ten year return.

This shows that REITs are just as volatile as equities, but history does show better recovery.

An underlying message may be that there is great heartache of -27% p.a. three-year returns.

What we experienced today is quite normal.

The question may be whether your REIT portfolio is diversified enough to survive secular or pivotal shifts in the real estate market.

I can’t tell you whether that blue chip REIT or that small up-and-coming REIT will survive but I know a collective of them, that is constantly rebalanced should be able to.

If you decide to invest in 4 of them and believe in them, then your money will live and die by how well they do.

The Macro Forces Dictate Performance in the Short Run, More than what a Good Manager can Do.

As good as some REIT managers can be, generally they cannot do much if they can only buy fair value to expensive properties, are leveraged, and have to pay out income.

The price of a REIT aggregates both the fundamentals and the psychology. The market consistently reprices a stock to tell us what the underlying is worth. But since the business and its environment are constantly shifting, the repricing is constant.

If the god of luck refuses to shine on you, even if you are a capable person, you will suffer in some way.

Here is a list of factors that will affect a REIT in different ways recently:

| What we experience | More Uncommon? | |

| 1 | Repricing due to higher interest rates | No |

| 2 | Recession and how it affects occupancy and rentals | No |

| 3 | Change in supply and demand dynamics for a sub-property area | Yes |

| 4 | Recovery from a down market | No |

A US office REIT segment would experience #1, #2, and #3 together. A Singapore office REIT will experience #2 and #3.

Their performance would likely be worse than the others, who may experience higher interest rates and recession together. I will address whether this is really that uncommon.

For some others, they experienced higher interest rates, but they have also seen some recovery so their prices have held better.

Here are some truth bombs:

- If you are very diversified across the property sector and regions, you are more insulated from these sectorial shifts in areas. But you will get market-like returns. This means as a cohort you are affected by the macro-trends such as higher interest rates, recession, and recovery.

- You can be insulated from the general market if you are very concentrated in an unaffected region. However, you need to find that region. If you are less sophisticated, you can be very concentrated in an affected region. Your returns are higher because you took on more area, sector or region-specific risks and uncertainties. However, it also means that there are more pain in price volatility, income reversions, and perhaps big capital impairments.

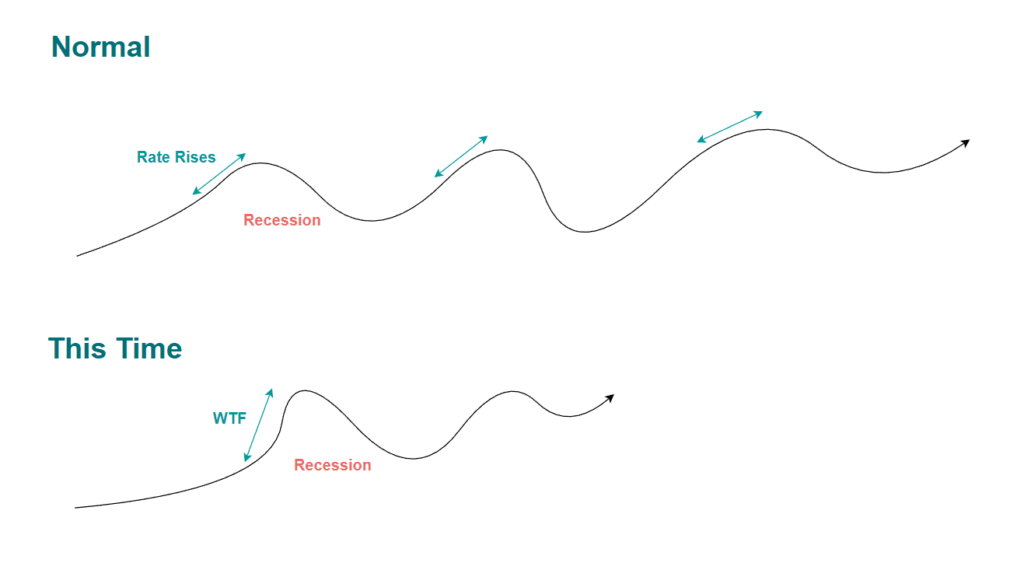

There are the Typical Rate Rises Seen in Past History. And then there is the 300% Interest Jack-up in Less than a Year

Typically, interest rate rises take place at the later stage of the normal economic cycle because they want to cool the economy from overheating. As it is quite difficult to always “cool” an economy exactly, they would overshoot. Recession is also quite a normal occurrence.

What is uncommon is for the interest rate to be so low and prices (inflation) to run so dramatically.

If you bring the interest rate from nearly 0.6% to 3.7%, that is a 500% change.

Business can take a normal rate change because that spectrum of change is within expectation but when it is so far out… something will give way.

A higher CAP rate demands -> A higher rent reversion -> For the property value to remain constant.

Some areas and REIT segments didn’t benefit from the economic pick-up.

Worse, the office sector experienced a secular demand shift that does not occur that often.

It is not about players like DBS encouraging these property owners to list the REITs here and we got swindled by property owners wishing to offload assets.

The REITs were listed before people know such a thing called COVID, which resulted in an acceleration and acceptance of the viability of work-from-home.

Without COVID, work-from-home may eventually be more prevalent but it would take longer, which spread out the office demand and supply adjustments.

Good managers can set up the REIT with well-spread out financing, a larger tenant opportunity set, a more diversified tenant base, and be more geographically diversified.

But they cannot rebel against huge shifts.

If something happens and the ten-year Singapore government bond rate is at 10%, do you think all the good REIT values won’t be affected? Hell, even all our equity markets are going to be affected!

The Singapore Government implemented TDSR and MSR, the maximum loan tenure, and the amount of downpayment. These encourage prudence.

The government typically will make the measures more stringent to discourage excessive risk-taking.

From a financial planning perspective, these measures automatically build in more margin of safety in the purchase.

If I rent out my property and only pay interest on my loans, regularly rolling my loan through interest-only refinancing, I can make sure that the rent I receive is 100% of the interest that I pay.

If the interest rises by 100%, at least my rent covers my loan. I have the opportunity to raise my rent 100% so that I can still do ok. But if I cannot raise my rent, my property value will drop because the market consistently reprices my property based on future rent, and the market assumes my future rent for the next 70 years is going to be much lower (I know it is debatable but that is how the market thinks..)

It is even worse if I have to cut my rent if the demand is so bad.

This is what the office sector is experiencing:

- Rent income is getting lower.

- #1 means not adjusting rent upwards.

- The interest rate has been the most aggressive rate of change in decades.

This is a sure-fxxk situation but it is happening now.

Five years ago, if you ask me whether this could happen, I will only be able to consider #1 and #2 and never considered #3. My sophistication considers an aggressive rate increase but in my mind, I forgot that if your base rate is low, the change is really aggressive.

If you know all this back then, would you have purchase the property?

You still would… because you consider this as a very rare event.

Is it right to make major business decisions based on the probability of rare events happening?

Most likely not.

The financially prudent way is to not buy when markets are doing “ok”.

When markets are doing “ok”, there is less focus on prudence. There are risks, but they are easily masked by a good environment.

You want to buy when all the risks are out in the open.

But in that environment majority of us will be too scared, or too indecisive to take action.

And if we are scared, it is a shitty environment to list a REIT.

Buying when the environment is poor is good because:

- The market always prices the timeframe of cash flows irrationally, and they just price the cash flow to stay low irrationally longer than expected.

- There are risks and uncertainty, but these are baked into the current low prices. There are risks and uncertainty but likely less than previously, so you are closer to the bottom than to the top.

- By evaluating a security or a property in this environment, using your standard metrics, you will on average hit more good deals than to search in an environment where only uncommon deals are good.

Going by something similar, REITs should:

- Buy properties that are under-rented.

- The property looks like shit and we pay further to do AEI.

- Leverage based on the original low valuations, then when the property is well rented out, re-value it, and you have a low-leverage property. More margin of safety debt-wise.

This is not going to happen often. There are managers that do this but most likely an unlisted property company with such a mandate.

For the original investor who stayed with them (just like the IPO subscriber of a listed REIT), they would have benefit from the price appreciation, the income receive and while prices have nose-dive recently, selling off property at market prices to pare down loans may still make the original investment decent because the fund mandate practices prudence and cautiousness.

REITs can usually only be listed when times are good.

They are leveraged so liquidity-poor events hit them particularly hard. During recession, liquidity is exceptionally poor most often because lending standards become more stringent.

As a REIT investor, it means you are buying at most fair value stuff, and need to sit through uncertainty.

This is no different from investors investing in other things.

How This May Play Out (Like it Always Does)

If I were to guess, I think most of the risks we fear are now out in the open:

- Supply and demand dynamics as a result of work from home is in the open.

- Interest rate is at a moderately high level. Even further upward adjustments is a smaller magnitude than a 500% jump.

- Recession risks are out in the open.

The question is how much of these risks have work itself into the current prices.

That I am not so sure.

We can get the sequence right but not the timing.

But I fear usually this situation ends with some fire-sale kind of situation:

- Cannot take on any more debt.

- Cannot refinance their debt.

- No one wants to buy their property at the current market price (Which is already not good or know the predicament they are in)

- People are angry with you if you dilute them more through rights issues.

What is likely to happen is deep pain….. then recovery.

Conclusion

Uncommon secular shifts can take place.

We don’t plan with extreme prudence in mind and so most often, we cannot avoid uncertainty in investing. If you plan with extreme prudence, most likely you won’t buy much at all.

Things will get better, and they always get better, but the question is how long it will take, and whether you will be there to benefit from it.

If you hold something long, usually you can get positive returns, if you are diversified enough.

But many cannot get to hold it for long because of financial imprudence:

- Excessive borrowing relative to your income.

- Not respecting the time horizon when you need the money.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.