If you have accumulated the Full Retirement Sum (FRS) in your CPF SA before the age of 55 years old, what does that milestone mean to you?

How should you look upon that in your planning for your financial independence?

A very common question I will get is:

“Kyith when I reach 65, how much will my CPF be then, and what will be the income I get? Is it enough for me?”

You know… this problem can be easily solved if CPF provides a calculator so that my 35-year-old friend can put in his resources today (let us be “kind” to the CPF people and not include any additional money from work) and find out what is his projected CPF LIFE Income at 65 years old.

But there isn’t such a calculator.

Sometimes I worry one of our advisers will go to the CPF office with a parang knife because they pulled a CPF LIFE calculator that works perfectly fine from the CPF website some years ago.

The best alternative is this CPF LIFE Estimator. It only works if you are an older person. If you are born younger after 1968, you cannot estimate the income you will get from CPF LIFE.

WTF.

To move forward, we have to work with what we have.

I think if the government and the environment do not change much, CPF LIFE in the future should be able to give us the income we need for our lifestyle today.

So how do we estimate that if I am 43 this year and have $80,000 in my CPF SA, if I am a 65-year-old, how much CPF LIFE Income can I get?

If we can figure out the amount of monthly income a 65 year old get today, then I can see which line item of my current expense can I fit into it.

That is what I want to share today.

A Fast Primer to CPF LIFE Income, Achieving CPF Full Retirement Sum (FRS) Today

One of the roles of our CPF is to eventually give us an annuity income to cover for our retirement. The annuity income is CPF LIFE.

The government encourages us to have enough money in our CPF so that we can have enough annuity income for our retirement.

There is this Full Retirement Sum, FRS for short, that goes up every year that gives us an idea how much to accumulate in our CPF so that we can have adequate income for retirement.

Some Singaporeans can hit this FRS in their 30s or 40s.

But like the question above, they are curious if they hit FRS today, what is the likely income they will get?

In theory, if the government controls things well, the income you will get should afford you the same lifestyle today or in the future when you are 65 (massive assumption there).

When you have accumulated until you reach the FRS, the interest on your FRS currently grows at more than 4% a year, which should outpace the annual rise in FRS limit, which is now 3% yearly.

This means that without additional money injected, the FRS today will grow to the FRS in the future.

Eventually, the monies in your CPF SA and OA will be transferred to your CPF Retirement Account (RA) at 55 years old and beyond. The monies in your CPF RA will be used as annual premium payments for your CPF LIFE annuity.

The CPF LIFE annuity income should pay you monthly for as long as you live.

The best way to look at your CPF Full Retirement Sum today is to think about how much of your lifestyle the monthly income can buy you.

The table above shows how the CPF FRS has progressed over the years. The current FRS this year is $198,800.

Here is the way I look at it:

If you managed to accumulate today’s FRS in your CPF, you have successfully secured an income stream that pays for a lifestyle in the future today. All else being equal if the government and environment result in a favorable climate, you should preserve the purchasing power and be able to have the current lifestyle in the future.

The question is what kind of lifestyle can you buy today?

The CPF LIFE estimator is currently very restrictive such that if you are younger than 55 today. it cannot estimate the income you can get. But the estimator can calculate the income for the current 55 years old when he is 65.

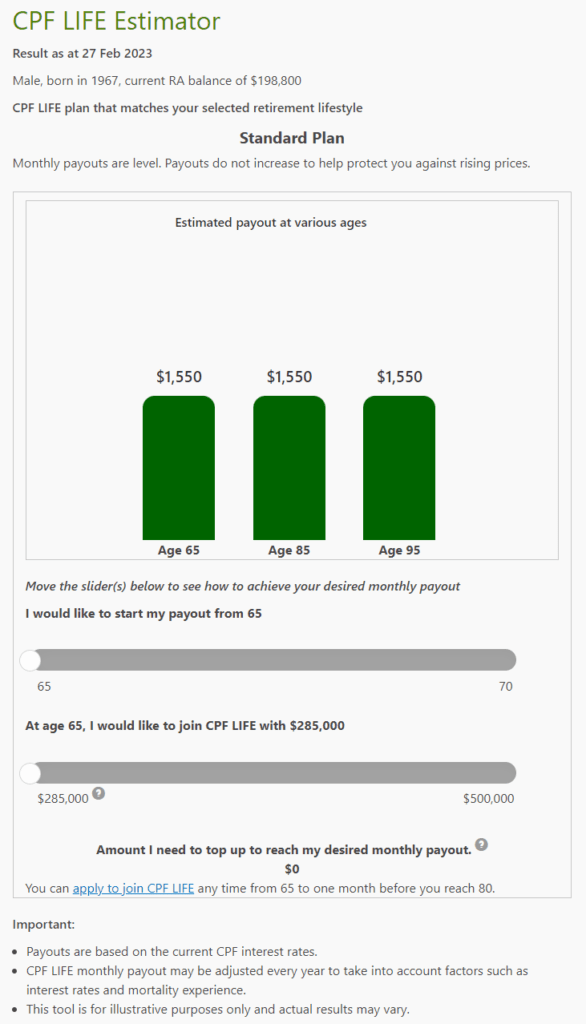

The illustration above shows that a 55-year-old today can receive an income of $1,550 a month or $18,600 from 65 years old. From the calculator, $198,800 grows to $285,000 at 65.

The ten-year growth from 55 to 65 is about 3.5% to 3.6% yearly.

Kyith is 43 currently, and he is 12 years away from 55 years old. Kyith has accumulated $198,800 in his CPF SA, so we want to see how much income he can get IF HE IS A 55-YEAR-OLD today.

Instead of the income at 65 years old for a 55-year-old, we want to see the income of a 55-year-old. This means we need to take out the growth of the monies in CPF RA from 55 to 65.

You have to play around with the CPF LIFE Estimator to figure out if you have $198,800 as a 55-year-old today, what is your income:

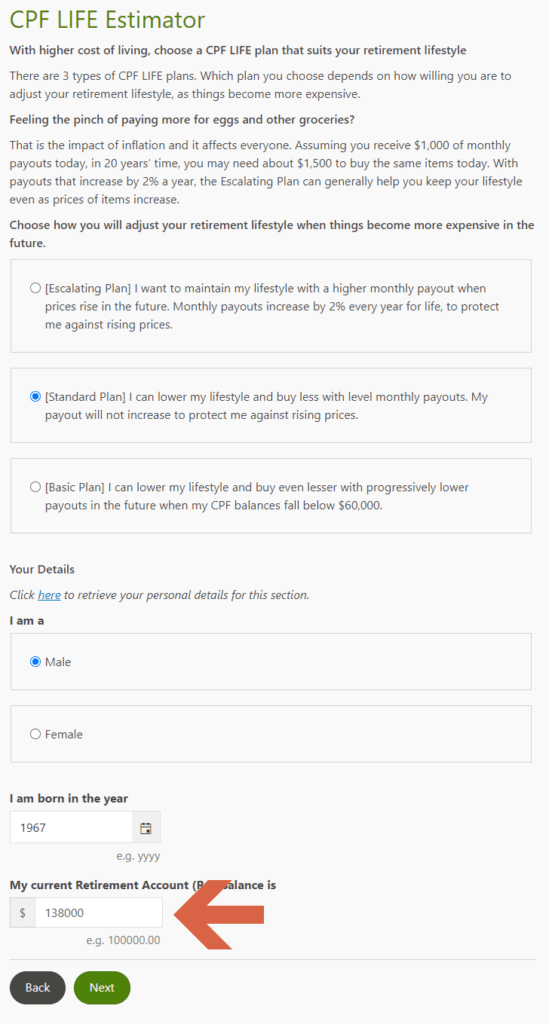

I went back and forth with the calculator and figured out that if I put in $138,000 at 55 years old, I would have roughly $200,000.

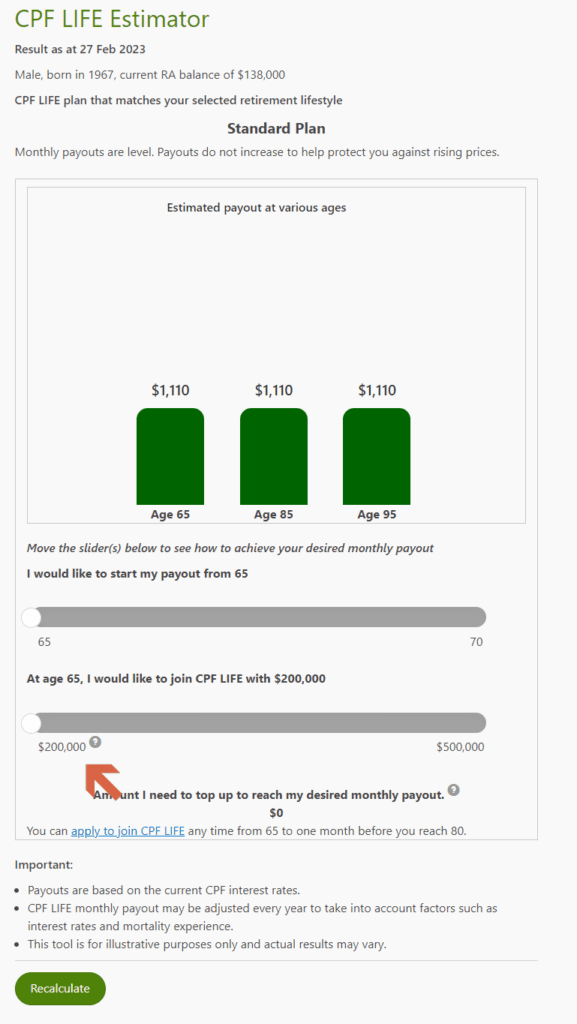

That $200,000, close to the current CPF FRS, will give an estimated income of $1,110 monthly or $13,320 yearly.

The Too Long Did not Read (TLDR)

If you reach the Full Retirement Sum in your CPF SA, you secured a real purchasing power of $1,110 monthly income.

If you have less than FRS, then your income is lesser, so instead of using Kyith and $198,800, replace with what you have currently to find out the income you can use for planning today.

How much of your desired lifestyle can you squeeze into $1,110 monthly or $13,320 yearly?

If you are very connected with the items in your current lifestyle and how much they cost, you can quickly determine what $1,110 a month buys you.

Regular readers of Investment Moats might remember not long ago, I map out the expenses that are most important for me to secure. You can read What Kind of Lifestyle Am I Buying – Part 1 of My Buying My Financial Security Series.

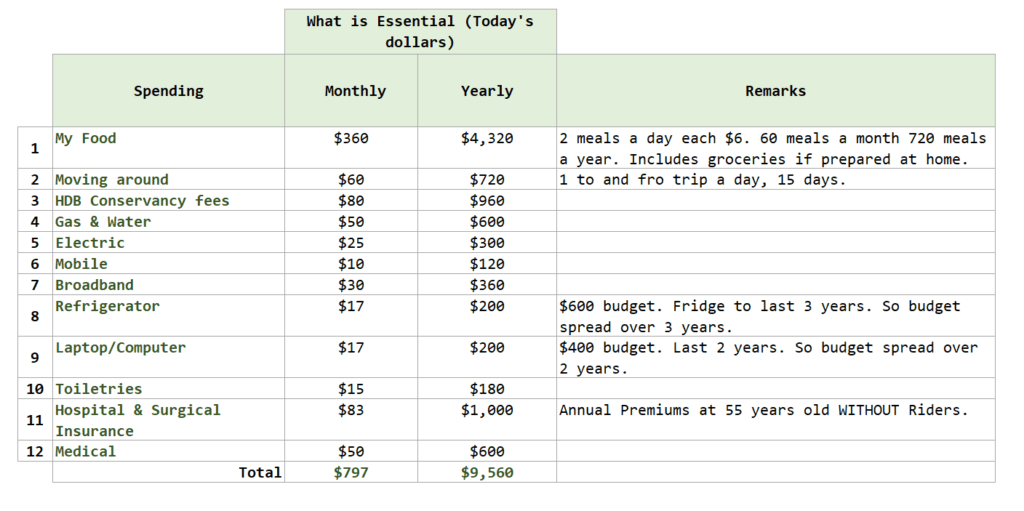

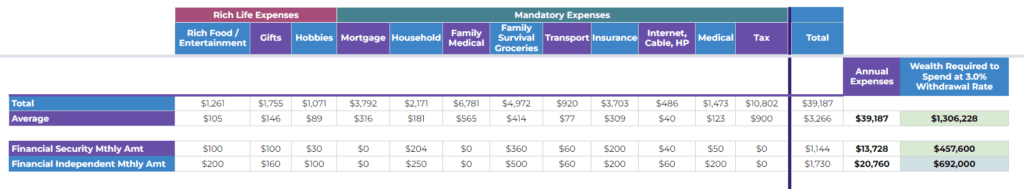

The table above shows the expenses that I worked out.

In today’s dollars, it works out to be $797 monthly, almost $800 monthly.

If I am 65 today, with $200,000 in CPF LIFE, I can more or less secure this lifestyle. This income stream, will pay for as long as I live. The only downside is that the income does not have an inflation-adjustment feature.

Still it is a pretty good feeling.

In my post about my annual expenses in 2022, I also provided the monthly income needed to be more financially secured or independent today:

The income requirement for financial security and independence is $1,144 monthly and $1,730 monthly respectively.

If we compare it against the $1,110 monthly income, my financial security figure is nearly fulfilled but I can only fit in parts of my financial independence figures.

So, of all my financial independence expenses, what lifestyles could I cover with $1,110 monthly?

You need to be able to rank your expense item, which one is more important and which one is less. You cannot treat all of them the same.

Or, out of all the line items, figure out the minimum you want to ensure you can hedge the longevity risk.

So out of my expenses, I can cover the following which is more important, that I don’t want so much surprises:

- Family survival groceries: $500 monthly

- Transport: $60

- Household: $250

- Internet, Cable, HP: $60

- Insurance: $200

All these add up to $1070 monthly. I cannot squeeze all into it and am left with medical, rich food/entertainment, gifts and hobbies.

I think that can come from other sources, but if you look at the nature of those spending, I can be more flexible. I can have a $200,000 lower volatility portfolio and spend 4% of the portfolio value at any point. While the income is volatile, the nature of the spending allows me to adjust accordingly.

Or I could increase the CPF LIFE annuity to Enhanced Retirement Sum (ERS).

Some people can only cover their food with a $1,110 monthly CPF LIFE Income.

I recently spoke to an ex-colleague whose idea about retirement food spending is $30 daily.

That works out to be $900 a month.

This means that his CPF LIFE annuity income can only cover his food, groceries and very little else.

He makes a choice, and he will need more resources:

- Contribute more to the Enhanced Retirement Sum (ERS) so that the CPF LIFE Income is higher

- Use interest income from excess CPF Monies to pay for other stuff

- Have an investment portfolio that pays for the other stuff

I am sure there are people in the same situation.

Just go through your expenses and find out how much you can cover with CPF LIFE income. What is left may need to be covered by other income sources.

What about a couple?

If both your spouse have reached CPF Full Retirement Sum, then work through how much of your retirement lifestyle can you squeeze into $1,110 x 2 = $2,220 monthly.

My friend Chris Ng says a couple spends 1.6 times of a single, so there might be more synergy there.

What if your CPF have not reached Full Retirement Sum?

This exercise will still be useful for you.

Your income is lesser, but you can still figure out with your current resources how much of your lifestyle can your CPF resources cover.

What about inflation during retirement years?

I think this is a common question.

People will have to contend with this problem and the solution may mean that you need more money on the side to buffer for inflation.

But not all the spending goes up with inflation at maddening pace.

If I were to examine my spending from the previous section:

- Family survival groceries: High inflation

- Transport: Very controlled

- Household: Goes up but still within control

- Internet, Cable, HP: Very controlled

- Insurance: Not increasing

So the overall inflation rate is not uniform.

If all your CPF Life Income is used for food, like my ex-colleague, then you might need additional resources to buffer for inflation.

$1000 monthly income at 65, at 3% inflation, will grow to $2093 at 90 years old.

The additional resources you will need go up exponentially.

I do think that in today’s money terms, having slightly more than double of the FRS or about $250,000 may be able to take care of inflation.

Some, like me, have that much in their CPF OA and SA in excess of the FRS, which could go towards providing more for inflation adjustment.

Personal Thoughts About My Situation

My needs are low, and given that needs, CPF LIFE should cover my current lifestyle.

Aside from that, the money in my OA and CPF Investment Account is more than the CPF FRS. As you see the line items of my spending, most likely not, all will go ape shit crazy during inflation times.

It feels to me my after-65 lifestyle can be basically secured with CPF monies alone.

Action Items

If you have accumulated up to CPF FRS, you can plan around $1,110 monthly.

- If you intend to pledge your home, and not need so much income and choose to only have basic retirement sum (BRS) in your CPF RA, then the income to look at is $555 monthly.

- If you are ok to go towards enhanced retirement sum (ERS), then the income to look at is $1,665 monthly

Going by the general narrative, most people think their retirement lifestyle is greater than $2,220 monthly today.

Can you answer that for sure? How do you go about doing that?

- You need to know the line items of your retirement lifestyle

- For each line item, how much it cost you

There are enough that will say it is not enough but cannot tell me in detail.

If it is not enough, you also need to figure out how many additional resources you need right???

To do that, you also need to figure out what goes in.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

J

Sunday 19th of March 2023

Hi Kyith,

This is good information. We can use the CPF Life income as the base for our retirement income say S$2k/month for both of us. Then we supplement the rest with dividend income, annuities income, bonds coupons, rental income, etc to achieve our retirement goals.

Kyith

Sunday 19th of March 2023

Hi J, the CPF income will act as the base layer for essential expenses. I do think people should need to think about their retirement lifestyle more.

Dt

Monday 27th of February 2023

This is a little confusing.

In fact I think you've already answered in the first part. If one has reached CPF SA anytime before 55, he already has purchasing power of 1550/month (today's dollar) at least. I don't get the 1110.

Kyith

Monday 27th of February 2023

HI DT, the reason i use $134k instead of $198800 is because the $1550 a month you are talking about is based on the $198,800 growing to nearly $250,000 and that $250,000 generating $1550. But if I am concern about my income as a 55 year old, then I would try to present value the $198,800 to $134,000. Hope this helps.

Sinkie

Monday 27th of February 2023

Ya, adjusting the age is what I had to do ever since CPF removed it's old calculators (2018?) and generally dumbed down its web site info.

Simple way is to pretend to be 65 this year (i.e. birth year 1958) and estimate the amount of RA you'll have at 65. Can use the 4% SA/RA interest rate to compound your current SA/RA. For those still working or topping up, need more work in Excel to estimate.

The problem for some is that the current calculator has a max cap of $300K for your projected RA amount (think it used to be capped at $500k).

Btw FRS will be increasing at 3.5% p.a. for the next 4 years till 2027 (not the 3% that you indicated). If inflation remains sticky beyond this year, there's a chance future FRS increases beyond 2027 may be higher than 3.5% per annum (4%?).

What a younger person sees when he inputs in the 1958 birth year & projected future RA amount into the CPF Life Estimator will be the projected future nominal CPF Life payouts.

If you trust CPF to be very accurate enough to adjust the future FRS increases to be inline with S'pore inflation, then the future FRS payouts will be the same as current FRS payouts in real terms. So basically keeping up with FRS increases in one's SA/RA is simply keeping up with inflation.

Kyith

Monday 27th of February 2023

i hope i interpret it correctly. thought about it for the last couple of months

retirewithfi

Monday 27th of February 2023

You need to be careful mixing up dollar values in different ages/years for comparison. The $1,110 income value is in retiree Kyith's age 65 dollars. Expenses figures are in today's dollar value (when Kyith is at age 43). So you need to present value the $1,110 using future inflation rate of your choice to today's dollar value for a fair comparison between income and expenses.

Kyith

Monday 27th of February 2023

hi retirewithfi, thanks for the warning. my thinking is that the 43 year old today, if I can spend like the 65 year old today but with a smaller amount (198k instead of 250k) then I should do ok, if singapore government help us preserve our purchasing power

Lao Kok kok

Monday 27th of February 2023

@retirewithfi, agree with your point.

Is $1110 in today’s dollars (meaning it is worth say $2220 in 18 years assuming 4% inflation)?

Will $1110 buy the same basket of goods in 18 years as it does today? If not, then cpf Monies is just over promising our current lifestyles?